EV Infrastructure Corridor Development Workshop: I-5 Travel

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Transit Energy Use Reduction Plan

Lake Country Transit Energy Use Reduction Plan Energy Use Reduction, Capital Expenditure, Funding and Management/Training Plan December 2015 Prepared by ICF International 620 Folsom St, Suite 200 San Francisco, CA 94107 415.677.7100 Lake Country Transit Energy Use Reduction Plan Table of Contents Table of Contents Executive Summary ............................................................................................................................. 1 1 Energy Use Reduction Plan ............................................................................................................ 4 1.1 Introduction ................................................................................................................................ 4 1.2 Facility ......................................................................................................................................... 6 1.2.1 Review of Existing Facility and Operations .................................................................................6 1.2.2 Facility, Operations and Maintenance Strategies .......................................................................7 1.3 Vehicle Fleet and Alternative Fuels .......................................................................................... 16 1.3.1 Review of Fleet Operations ...................................................................................................... 16 1.3.2 Alternative Fuel Options ......................................................................................................... -

STAFF REPORT TO: Finance and Audit Committee AC Transit Board of Directors

Report No: 13-113 Meeting Date: April 24, 2013 Alameda-Contra Costa Transit District STAFF REPORT TO: Finance and Audit Committee AC Transit Board of Directors FROM: David J. Armijo, General Manager SUBJECT: FY 2013-14 Transportation Fund for Clean Air Program Funds ACTION ITEM RECOMMENDED ACTION(S): Consider ratifying a grant application submission to Alameda County Transportation Commission (ACTC} for FY 2013-14 Transportation Fund for Clean Air (TFCA) Program funds. EXECUTIVE SUMMARY: ACTC announced a call for projects for FY 2013-14 TFCA program funding for projects that result in the reduction of motor vehicle emissions within the Air District's jurisdiction in addition to meeting other program requirements. The applications were due by April 5, 2013 and the staff has submitted an application under the Clean Fuel Vehicle category for complete electrification of the gasoline hybrid bus. Due to a tight timeline, this is the first opportunity to inform the Board of this application. Should this project be approved for funding by ACTC, the staff will return for Board approval to enter into a funding agreement and execute necessary paperwork. BUDGETARY/FISCAL IMPACT: Staff has applied for up to $387,276 in FY 2013-14 TFCA funds. If awarded, approximately $97,000 in District capital funds would be required as matching funds as part of the FY 2013-14 capital budget. BACKGROUND/RATIONALE: TFCA is a local fund source of the Bay Area Air Quality Management District (Air District). As the TFCA program manager for Alameda County, the Alameda CTC is responsible for programming 40 percent of the $4 vehicle registration fee collected in Alameda County for this program. -

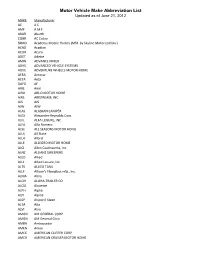

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

ACT EXPO 2013 Wednesday, JUNE 26 Welcome to ACT Expo 2013 ANGA Promotes TA & Shell for LNG Travelcenters Plan for Trucks CNG for Detailed Here

ACT EXPO 2013 WEDNESDAY, JUNE 26 Welcome to ACT Expo 2013 ANGA Promotes TA & Shell for LNG TravelCenters plan for trucks CNG for detailed here. —Page 4 Consumers Ryder for Lighter NGVs Adds 20 CNG GreenKraft and 19 Navistar TranStar for California rent and lease. —Page 8 Trillium Wins Frito War Emerges the winner under innovative RFP. —Page 9 Landi Renzo Adds Dual Fuel Stepping up their drive to bring compressed natural gas to the masses, two advocate groups unveiled six popular automobiles Starts with 12.7-liter DDC engine here converted to run on both gasoline and CNG. Marty Durbin, president & CEO of America’s Natural Gas Alliance and Kathryn Clay, executive director of the Drive Natural Gas Initiative (a collaboration between ANGA and the American Gas Association), for OUL market. —Page 10 said the campaign is aimed to convince consumers, automakers and policymakers of the benefits of CNG as an abundant, affordable clean resource. “Manufacturers are offering bi-fuel vehicles in many other countries around the world; we want Clean Energy Buys Mansfield them in showrooms here,” said Clay. —More ANGA Roadshow on Page 18 Acquisition for $20 million brings liquid fuels capability. —Page 11 Wrightspeed Opens Show Penske for Propane California’s Wrightspeed, a developer of light to medium duty plug-in hybrid Supporting Roush-powered trucks electric trucks – including a CNG-fueled demonstrator – hosted yesterday for Chicago’s Alpha Baking. evening’s ACT Expo 2013 opening reception in the Expo Hall. Seen here —Page 20 with “The Route” drive at Booth 213 is Wrightspeed’s new sales and mar- keting VP Jonathan Randall (ex-Freightliner Custom Chassis Corp). -

Key Barriers Affecting E-Truck Adoption, Industry and Policy Implications, and Recommendations to Move the Market Forward

World Electric Vehicle Journal Vol. 8 - ISSN 2032-6653 - ©2016 WEVA Page WEVJ8-0657 EVS29 Symposium Montréal, Québec, Canada, June 19-22, 2016 2015 E-Truck Task Force: Key Barriers Affecting E-Truck Adoption, Industry and Policy Implications, and Recommendations to Move the Market Forward Tom Brotherton1, Alycia Gilde, Jasna Tomic 1CALSTART, 48 S Chester Ave, Pasadena, CA 91106, [email protected] Summary CALSTART’s E-Truck Task Force (ETTF) produced a report outlining the markets for electric drive trucks (E-Trucks), the prime barriers facing their success and provided key findings and recommendations to support expanding E-Truck adoption. Four key findings have been identified by the E-Truck Task Force as barriers currently affecting the growth and viability of E-Truck sales; 1) high incremental cost, 2) poor vehicle quality and support from supplier(s), 3) unexpected costs and energy planning with infrastructure, and 4) reduced operation in extreme climates. The E-Truck Task Force developed a set of action-oriented recommendations for overcoming each barrier. 1. E-Truck Task Force Background 1.1 Key Findings from 2012 E-TTF Report CALSTART’s E-Truck Task Force (E-TTF) was originally created in 2011 to help understand, support and expand the production and successful deployment and use of plug-in electric trucks and buses. CALSTART published E-Truck Task Force Findings and Recommendations in 2012 based on a year-long research and industry engagement process. In that report CALSTART outlined the best use profiles for successful E-Truck deployment, provided a business case calculator for fleets, highlighted early adopter user experience, developed an infrastructure planning guide, and then established industry recommendations of actions required to speed market success. -

Alabama Power

Alabama Power – PEV & Charging Infrastructure Use, Installation Costs & Issues, & the Importance of Work Place Charging Jim Francfort Birmingham, Alabama www.inl.gov August 2015 This presentation does not contain any proprietary, confidential, or otherwise restricted information INL/CON-15-36178 Table of Contents • Background • Plug-in Electric Vehicle (PEV) battery research and development • EV Project - National PEV Usage Profiles • EV Project - National Charging Infrastructure Usage Profiles • Public Venue Charging Use & Installation Costs • Charging Fee Impact on DCFC Use Rates • Workplace Charging & Installation Costs • Other Stuff I Think is Interesting • What to Install? • If I was in charge….. 2 Background 3 Idaho National Laboratory Bio-mass Nuclear Hydropower Wind • U.S. Department of Energy (DOE) laboratory • 890 square mile site with 4,000 staff • Support DOE’s strategic goal: – Increase U.S. energy security and reduce the nation’s dependence on foreign oil • Multi-program DOE laboratory – Nuclear Energy – Fossil, Biomass, Wind, Geothermal and Hydropower Energy – Advanced Vehicle Testing Activity & Battery Testing – Homeland Security and Cyber Security 4 Vehicle / Infrastructure Testing Experience • Since 1994, INL staff have benchmarked PEVs with data loggers in the field, and on closed test tracks and dynamometers • INL has accumulated 250 million PEV miles from 27,000 electric drive vehicles and 16,600 charging units – EV Project: 8,228 Leafs, Volts and Smarts, 12,363 EVSE and DCFC • 4.2 million charge events, 124 million -

Transportation Energy Data Book: Edition 35

Transportation Energy Data Book Quick Facts Petroleum In 2015 the U.S. produced almost 13 million barrels of petroleum per day (mmbd), or almost 14% of the world’s 93.4 mmbd. The U.S. consumed 19.1 mmbd, or 21% of the world’s 92.5 mmbd in 2014. U.S. transportation petroleum use was 70% of total U.S. petroleum use in 2015. In 2015 U.S. transportation petroleum use was 107% of total U.S. petroleum production. Petroleum comprised 92% of U.S. transportation energy use in 2015. Cars and light trucks accounted for 64% of U.S. transportation petroleum use in 2014. Medium trucks (Class 3‐6) accounted for 4% of U.S. transportation petroleum use in 2014. Heavy trucks (Class 7‐8) and buses accounted for 19% of U.S. transportation petroleum use in 2014. Nonhighway modes accounted for the rest of U.S. transportation petroleum use in 2014 (12%). Energy In 2015 U.S. transportation energy use accounted for over 28% of total U.S. energy use. Cars and light trucks accounted for 59% of U.S. transportation energy use in 2014. Medium trucks accounted for 5% of U.S. transportation energy use in 2014. Heavy trucks accounted for 18% of U.S. transportation energy use in 2014. Light Vehicle Characteristics In 2014 there were 114 million cars and 125 million light trucks in the U.S. (239 million total light vehicles). U.S. cars: o 7,525,000 cars were sold in 2015. o In 2015 the average age of a U.S. -

Thank You! a T T a C H M E N T

AMERICAN PUBLIC TRANSPORTATION ASSOCIATION Bus & Paratransit Conference Planning Subcommittee Hilton Americas-Houston ● Room 340 Saturday, October 11, 2014 ● 1-3 p.m. MEETING AGENDA PLAN BUS & PARATRANSIT CONFERENCE MAY 3-6, 2015 Omni Fort Worth Hotel, 1300 Houston St., & Fort Worth Convention Center, 1201 Houston St., Fort Worth, TX 1. Welcome and host information – Paul Ballard and Nancy Amos (1 p.m.) 2. Review conference schedule overview and subcommittee’s work plan, decide on NTI courses – Lynne Morsen and Paul Larrousse (1:10) 3. Select abstracts ― breakout discussion groups organized by topics or “routes of study” to form sessions with abstracts – All (1:20 p.m.) 4. Identify invitational sessions (not having to do with abstracts) and suggest speakers for invitational / concurrent sessions and large, general sessions – All (2:30 p.m.) 5. 2016 conference in Charlotte, NC – Larry Kopf (2:45 p.m.) 6. Other business (2:50 p.m.) Attachments: 1. 2015 Bus & Paratransit Conference overview 2. Subcommittee work plan 3. Notes from May 2014 debrief meeting in Kansas City, MO 4. Subcommittee charter 5. Topics for call for papers & presentations 6. List of who receives the e-blast call for papers & presentations 7. Ideas for National Transit Institute courses to offer at the conference 8. 2014 Bus & Paratransit Conference session attendance 9. 2014 conference evaluation survey summary 10. All abstracts organized by route of study Thank you! A T T A C H M E N T 1 AMERICAN PUBLIC TRANSPORTATION ASSOCIATION MAY 3-6, 2015 BUS & PARATRANSIT CONFERENCE OVERVIEW OMNI FORT WORTH HOTEL, 1300 HOUSTON ST., FORT WORTH, TX 76102 (817) 535-6664 & FORT WORTH CONVENTION CENTER, HOUSTON ST., FORT WORTH, TX 76102 As of August 21, 2014 SAT. -

Buyers Guide for Electric and Plug-In Hybrid Cars JUNE 2012

Buyers Guide for Electric and Plug-in Hybrid Cars JUNE 2012 www.greenhighway.nu EUROPEISKA UNIONEN Europeiska regionala utvecklingsfonden Images on the frontpage; Peter Kardin from Samhall AB with their electric car in Östersund, one of the first Renault Kangoo cars in Sweden. The result of a smart charging project by Jämtkraft, ABB and Charge Storm at Jämtkraft headquarters in Östersund. Per Lundqvist and Timo Pietilä with a Mercedes Vito, one of the electric cars that Post Nord is testing in the Östersund area. Welcome to the revised 2012 Global Guide to Electric and Plug inHybrid Cars! This Buyers Guide is published by SÖT – a cooperation between the cities Sundsvall (Sweden), Östersund (Sweden) and Trondheim (Norway). The purpose of the SÖT project is to strengthen the three cities and the region through cooperation in infrastructure, sustainable communications, knowledge and competence as well as in culture and tourism. Correct and independent information about electric and plug‐in hybrid cars on the market is an important part of the infrastructure and sustainable communications section of the SÖT project. The SÖT cities present the Buyers Guide 2012 for Electric and Plug‐In Hybrid Car in cooperation with the power companies Jämtkraft, Sundsvall Energi, Trondheim Energi and Trønder Energi. This guide gives an overview of most models available for the model year 2012 and models that are expected to be available within the next year. The guide contains prices, range per charge, charging times, battery types, information about safety, links to further information and much more. The purpose of the guide is to be a reference for cities, private and public organizations and consumers that consider purchasing electric or plug‐in hybrids, or just want to know more about the market. -

Equivalent Strategies for the ARB Zero Emission Bus Regulation

Equivalent Strategies for the ARB Zero Emission Bus Regulation June 2014 Edition Prepared for: Prepared by: The information contained in this report was prepared on behalf of Southern California Gas Company by the environmental consulting firm of Gladstein, Neandross & Associates. The opinions expressed herein are those of the authors and do not necessarily reflect the policies and views of Southern California Gas Company. No part of this work shall be used or reproduced by any means, electronic or mechanical, without first receiving the express written permission of Southern California Gas Company and Gladstein, Neandross & Associates. 2 Acknowledgements The development of this report was performed at This report was authored by Gladstein, Neandross the request of Southern California Gas Company. & Associates, one of the nation’s leading experts on the use of alternative fuel and electric transportation technologies. Gladstein, Neandross & Associates has offices in Santa Monica, CA, Irvine, CA, and New York City, NY. In addition to numerous contributions from staff, the primary authors of this report include: Jarrod Kohout, Project Director Ryan Erickson, Project Director Tan Grimes, Graphic Designer Cliff Gladstein, President Sean Turner, Chief Operating Officer Southern California Gas Company Gladstein, Neandross & Associates 555 W 5th Street 2525 Ocean Park Boulevard, Suite 200 Los Angeles, CA 90013 Santa Monica, CA 90405 1 Park Plaza, 6th Floor T: (213) 244-1200 Irvine, CA 92614 www.socalgas.com 1270 Broadway, Suite 1009 New York, NY 10001 T: (310) 314-1934 www.gladstein.org About the Authors Gladstein, Neandross & Associates (GNA) has extensive experience in the alternative-fuel, electric vehicle and low emission transportation technology industries. -

Peak Demand Charges and Electric Transit Buses White Paper

U.S. Department of Transportation Federal Transit Administration Peak Demand Charges and Electric Transit Buses White Paper Prepared by: Jean-Baptiste Gallo, Ted Bloch-Rubin & Jasna Tomić CALSTART (626) 744-5605 (work) (626) 744-5610 (fax) [email protected] 10/1/2014 Peak Demand Charges and Electric Transit Buses White Paper Disclaimer This report was prepared as an account of work sponsored by an agency of the United States Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States Government or any agency thereof. The views and opinions of authors expressed herein do not necessarily state or reflect those of the United States Government or any agency thereof. 1 Peak Demand Charges and Electric Transit Buses White Paper Table of Contents Table of Contents .............................................................................................................................................................. 2 List of Figures ..................................................................................................................................................................... -

Multi-Lab EV Smart Grid Integration Requirements Study Providing Guidance on Technology Development and Demonstration T

Multi-Lab EV Smart Grid Integration Requirements Study Providing Guidance on Technology Development and Demonstration T. Markel and A. Meintz National Renewable Energy Laboratory K. Hardy, B. Chen, and T. Bohn Argonne National Laboratory J. Smart, D. Scoffield, and R. Hovsapian Idaho National Laboratory S. Saxena, J. MacDonald, and S. Kiliccote Lawrence Berkeley National Laboratory K. Kahl Oak Ridge National Laboratory R. Pratt Pacific Northwest National Laboratory NREL is a national laboratory of the U.S. Department of Energy Office of Energy Efficiency & Renewable Energy Operated by the Alliance for Sustainable Energy, LLC This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications. Technical Report NREL/TP-5400-63963 May 2015 Contract No. DE-AC36-08GO28308 Multi-Lab EV Smart Grid Integration Requirements Study Providing Guidance on Technology Development and Demonstration T. Markel and A. Meintz National Renewable Energy Laboratory K. Hardy, B. Chen, and T. Bohn Argonne National Laboratory J. Smart, D. Scoffield, and R. Hovsapian Idaho National Laboratory S. Saxena, J. MacDonald, and S. Kiliccote Lawrence Berkeley National Laboratory K. Kahl Oak Ridge National Laboratory R. Pratt Pacific Northwest National Laboratory Prepared under Task No. VTP2.IN14 NREL is a national laboratory of the U.S. Department of Energy Office of Energy Efficiency & Renewable Energy Operated by the Alliance for Sustainable Energy, LLC This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications. National Renewable Energy Laboratory Technical Report 15013 Denver West Parkway NREL/TP-5400-63963 Golden, CO 80401 May 2015 303-275-3000 • www.nrel.gov Contract No.