171875 Project Hurley Prospectus Intro a 171875 Project Hurley Prospectus Intro a 25/01/2019 10:59 Page 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hinckley Le10 2Jq

WATLING STREET HINCKLEY LE10 2JQ FORECOURT & CONVENIENCE STORE INVESTMENT LOCATED IN CLOSE PROXIMITY TO M69 MOTORWAY WITH AN UNEXPIRED TERM OF 17 YEARS FORECOURT & CONVENIENCE STORE INVESTMENT LOCATED IN CLOSE WATLING STREET, HINCKLEY, LE10 2JQ PROXIMITY TO M69 MOTORWAY WITH AN UNEXPIRED TERM OF 17 YEARS INVESTMENT CONSIDERATIONS PROPOSAL ■ Strategically located Petrol Station Forecourt and foodstore, ■ Let until March 2038 with no break option - ■ We are instructed to seek offers in excess of 170 yards away from junction 1 of the M69 motorway unexpired term of 17 years £1,650,000 (One Million, Six Hundred and ■ Situated southbound on the busy A5 trunk road, being the ■ Let to Rontec Properties (No.4) Limited, Fifty Thousand Pounds) subject to contract final petrol station before the motorway guaranteed by Rontec Roadside Retail Limited and exclusive of VAT. A purchase at this level ■ Comprising of 2,342 sq ft of retail accommodation and Rontec Service Stations 1A reflects a Net Initial Yield of 5.75% rising and 8 petrol pumps, occupying a site of 0.34 acres ■ Additional guarantee by the undoubted covenant to 6.00% in June 2024 after allowing for ■ Located south of Hinckley town, 13 miles of Co-operative Group Food Limited until 2027 purchaser’s costs of 6.15%. from Leicester and Coventry ■ Estimated retail sales of £570,000 per annum and fuel volume ■ Producing an income of £100,814.76 per annum of 4.3m litres per annum subject to fixed annual uplifts of 2% ■ Freehold FORECOURT & CONVENIENCE STORE INVESTMENT LOCATED IN CLOSE WATLING STREET, HINCKLEY, LE10 2JQ PROXIMITY TO M69 MOTORWAY WITH AN UNEXPIRED TERM OF 17 YEARS Stoke-on-Trent Newcastle-under-Lyme North (M6) North (M1) Sheffield Stoke on Trent, NOTTINGHAM Manchester, Liverpool LOCATION DERBY M1 Hinckley is the second largest town in Leicestershire, located at the midpoint between Leicester and Coventry approximately 13 miles M6 (21 km) south west of Leicester town centre, 13 miles (21 km) north east of Coventry town centre and 5 miles (8km) north east of Nuneaton. -

Industrial/ Open Storage Land 2 Acres (8,100 Sq.M) to LET Haunchwood Park, Bermuda Road, Nuneaton, CV10 7QG

Industrial/ Open Storage Land 2 Acres (8,100 sq.m) TO LET Haunchwood Park, Bermuda Road, Nuneaton, CV10 7QG PROPERTY HIGHLIGHTS • 2 acres storage to let • Secure palisade fence • Sub divisible from 1 acre • Close to motorway network • Flexible lease options available • Design and build option may be available LOCATION BERMUDA CONNECTION Nuneaton oers a strategic location for distribution Bermuda Connection is a proposed scheme focused occupiers in the West Midlands being conveniently on tackling congestion in and around West Nuneaton located some four miles North of the M6 motorway. The by creating a direct 1.3mile highway link between West M6 can be accessed by the A444 at Junction 3 of the Nuneaton and Griff Roundabout.More details available M6. Alternatively, the M69 motorway at Hinckley can be at www.warwickshire.gov.uk/bermudaconnection. accessed at Junction 1 for access to the motorway At the time of publication of these particulars a final network in a northerly direction. decision has yet to be taken regarding the implementation of the Bermuda Connection scheme DESCRIPTION This 2 acre site consist of cleared open storage land with a concrete base to part and a secure palisade fence. B U L L HEATH END ROAD R IN RENT G B E R M £60,000 per annum U D A R GEORGE ELIOT O HOSPITAL A SERVICES D A444 All mains services connected. TENURE The site is available on a new lease on flexible terms as whole or from 1 acre. Alternatively design and build proposals available on request. A444 M42 A444 A38 J8 A5 Nuneaton M6 BIRMINGHAM M69 M1 J7 Bedworth M6 A5 J6 A45 J2 A34 A41 M6 Solihull COVENTRY A435 J19 A452 A45 Rugby M1 M42 A46 A45 J3a A445 M45 M40 J17 A429 Redditch A423 Leamington Spa A45 A435 Warwick Daventry J15 VAT ROAD LINKS Bromwich Hardy stipulate that prices are quoted M6 Junction 3 5.1 miles exclusive of V.A.T. -

Premises, Sites Etc Within 30 Miles of Harrington Museum Used for Military Purposes in the 20Th Century

Premises, Sites etc within 30 miles of Harrington Museum used for Military Purposes in the 20th Century The following listing attempts to identify those premises and sites that were used for military purposes during the 20th Century. The listing is very much a works in progress document so if you are aware of any other sites or premises within 30 miles of Harrington, Northamptonshire, then we would very much appreciate receiving details of them. Similarly if you spot any errors, or have further information on those premises/sites that are listed then we would be pleased to hear from you. Please use the reporting sheets at the end of this document and send or email to the Carpetbagger Aviation Museum, Sunnyvale Farm, Harrington, Northampton, NN6 9PF, [email protected] We hope that you find this document of interest. Village/ Town Name of Location / Address Distance to Period used Use Premises Museum Abthorpe SP 646 464 34.8 km World War 2 ANTI AIRCRAFT SEARCHLIGHT BATTERY Northamptonshire The site of a World War II searchlight battery. The site is known to have had a generator and Nissen huts. It was probably constructed between 1939 and 1945 but the site had been destroyed by the time of the Defence of Britain survey. Ailsworth Manor House Cambridgeshire World War 2 HOME GUARD STORE A Company of the 2nd (Peterborough) Battalion Northamptonshire Home Guard used two rooms and a cellar for a company store at the Manor House at Ailsworth Alconbury RAF Alconbury TL 211 767 44.3 km 1938 - 1995 AIRFIELD Huntingdonshire It was previously named 'RAF Abbots Ripton' from 1938 to 9 September 1942 while under RAF Bomber Command control. -

Jurys Inn Hinckley Island Jurys Inn Hinckley Island

JURYS INN HINCKLEY ISLAND JURYS INN HINCKLEY ISLAND 600 Free Spaces TO HINCKLEY B4109 TO M1 JCT 21 & LEICESTER SKETCHLEY HILL RUGB East Midlands (28 miles) Birmingham Intl (22.1 miles) Y ROAD TO M42 JCT 10 & TAMWORTH A5 Hinckley (2.1 miles) Nuneaton (5 miles) JCT 1 M69 Hinckley town centre WA TLING ST D B4109 M69 R A5 Y E TO M1 JCT 20 BROCHURE L K & LONDON C N TO I M6 JCT 2 H For multi location enquiries, please contact our dedicated Jurys Meeting team on: Tel: 0845 525 6338 Email: [email protected] For all other enquiries, contact the hotel directly: JURYS INN HINCKLEY ISLAND Watling Street Hinckley Leicestershire LE10 3JA Tel: 01455 631 122 Email: [email protected] Or enquire online at jurysinns.com/meetings PERFECTLY LOCATED YOUR HOME Jurys Inn Hinckley Island is located just off Junction 1 of the M69 motorway between Leicester and Coventry. The FOR BUSINESS hotel is only 2.1 miles from Hinckley railway station and offers excellent access to the M6, M69 and M1 motorways, Birmingham and East Midlands Airport, mak- Whether you want to hold a ing it a perfect base for exploring central England. Local meeting, seminar, conference, attractions include The National Space Centre, Bosworth Battlefield, Twycross Zoo & Warwick Castle. training day, workshop or event, Jurys Inn have it covered. Jurys Meetings is shorthand for excellence and reliability. Room design is stylish and light, and equipment is first class. The smooth efficiency of our highly trained, dedicated Jurys Meetings team means consistency, reliability and a completely stress-free experience. -

Wigston Town Centre Masterplan

Wigston Town Centre Area Action Plan 52 Baseline Report 6. Access and Movement Strategic Context 6.1. Wigston is a southern outer suburb of Leicester, lying just outside the Leicester City unitary authority area, in the Borough of Oadby and Wigston within Leicestershire County. 6.2. Wigston lies on the A5199 approximately 6km south of Leicester city centre. The A563 Leicester ring road is approximately 1.5km to the north, providing a link to the M1 via Junction 21. 6.3. The Midland Mainline Rail Network, accessed from Leicester Station, provides rail services northbound to Nottingham and Sheffield and southbound to London. South Wigston station, managed by Central Trains, lies 2.5km to the west providing services to Birmingham and Leicester. 6.4. There are several strategic transport links in the area, shown on the following figure: Figure 6.1 Strategic Transport Context Wigston Town Centre Area Action Plan 53 Baseline Report 6.5. The M1 motorway is approximately 7km to the west of Wigston, accessed via the A563 Leicester southern ring road to J21. This route is a major national artery and extremely important economically. It is due to be widened from J6A-13 (M25 London to Milton Keynes) and from J21-42 (Leicester to M62 Leeds). The widening commenced in 2006 and continues in phases until 2018. 6.6. The M69 motorway runs from M1 J21 to Coventry providing an important route linking Leicester with the West Midlands. 6.7. The A46 trunk road runs from M1 J21A to Newark and Lincoln. The route provides a northern bypass of Leicester and a second connection between Leicester and Nottingham. -

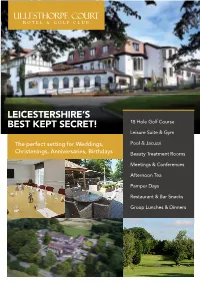

Leicestershire's Best Kept Secret!

LEICESTERSHIRE’S BEST KEPT SECRET! 18 Hole Golf Course Leisure Suite & Gym The perfect setting for Weddings, Pool & Jacuzzi Christenings, Anniversaries, Birthdays Beauty Treatment Rooms Meetings & Conferences Afternoon Tea Pamper Days Restaurant & Bar Snacks Group Lunches & Dinners BEDROOM FACILITIES 72 bedrooms including - Standard Twins & Doubles - 2 Adapted Assistance Rooms - 21 Executive Rooms (inc Family) - 9 Superior Rooms - 4 Suites 43” LCD Televisions STANDARD ROOM Iron and Ironing Boards in all Rooms Mini Safes in all Rooms Tea / Coffee Making Facilities Hairdryers HOTEL FACILITIES Free Car Parking Free High Speed Wifi Electric Car Charging Points EXECUTIVE ROOM Restaurant Hotel Bar & Golf Bar Outdoor (Summer) Terrace 4 Meeting Rooms GOLF, LEISURE & BEAUTY FACILITIES Leisure and Beauty including SUPERIOR ROOM - Swimming Pool & Jacuzzi - Sauna & Steam Room - State of the Art Fitness Room - Tennis Court - Snooker Tables - 2 Beauty Treatment Rooms 18 Hole Golf Course - Par 72, Championship length - Signature 9th & 18th holes - Excellent practice facilities - 20 golf buggies SUITE 4 CONFERENCE ROOMS Complimentary Wifi Fax / Photocopier LCD Projector & Screen HDTV Screen (Magna only) Flipchart / Whiteboard Stationery Box & Pens / Paper Water & Conference Sweets BLABY SUITE Max 90 Theatre Style ASHBY SUITE Max 50 Theatre Style BAR STORE UPPER BLABY DANCE FLOOR LOWER BLABY ASHBY SUITE TOILETS BOARDROOM Max 12 Boardroom Style MAGNA ROOM Max 16 Boardroom Style L ift & To ile t Projector Pr MAGNA ROOM KEY Socket ojector TV - HDM 64 inch -

The Ultimate Logistics Location

the ultimate logistics location Industrial and Distribution Warehouse Design & Build Packages from 30,000 to 80,000 sq ft Directly off J21a of the M1 Motorway Outline planning permission for B1/B2/B8 www.optimuspoint.com the ultimate logistics location M6 M62 HULL M18 M62 M180 MANCHESTER M57 SHEFFIELD M56 Optimus Point is a prime, commercial • Industrial / warehouses from 30,000 sq ft TOWN MILES TIME Prominently located directly off J21a of the M1 Motorway development site located at the to 80,000 sq ft Coventry 25 30 mins MANSFIELD Directly off the A46 Leicester M1 Nottingham 31 33 mins STOKE- • Offices from 20,000 to 100,000 sq ft ON-TRENT strategic highway junction adjacent Derby 32 32 mins bypass with access to Newark DERBY NOTTINGHAM to Junction 21a of the M1, and A46 Northampton 38 37 mins (37 Miles) / Lincoln and the M6 • Outline planning permission for industrial, NORWICH Birmingham 44 42 mins A1 (30 miles) LEICESTER dual carriageway just to the north of M54 M42 J21a warehouse and offices uses with potential London 103 1 hr 37 mins M6Toll A46 now dualled through to Lincoln M69 Leicester which can accommodate: for alternative uses Manchester 105 1 hr 44 mins Within 20 miles of East Midlands Airport M6 A1(M) Liverpool 116 1 hr 51 mins BIRMINGHAM M42 COVENTRY Directly off B5380 Ratby Lane, NORTHAMPTON PORT MILES TIME which links to A47 Hinckley Road Hull 100 1 hr 53 mins main arterial road giving access M1 IPSWICH Liverpool 117 1 hr 53 mins M40 M50 to Leicester City Centre MILTON A1(M) Southampton 143 2 hrs 10 mins GLOUCESTER KEYNES -

M New Lubbesthorpe Dc Consultation

APPENDIX DEVELOPMENT CONTROL AND REGULATORY BOARD 21 ST JULY 2011 JOINT REPORT OF THE CHIEF EXECUTIVE AND THE DIRECTOR OF ENVIRONMENT & TRANSPORT APPLICATION UPON WHICH THE COUNTY PLANNING AUTHORITY IS CONSULTED BY THE DISTRICT COUNCIL PART A – SUMMARY REPORT APP.NO. & DATE: Application number 2011/0100/01 – Date received: th 18 March 2011. PROPOSAL: Application for outline planning permission for 4,250 dwellings, a mixed use district centre and two mixed use local centres featuring retail, commercial, employment, leisure, health, community and residential uses, non-residential institutions (including secondary school, primary schools and nurseries), a local convenience shop, a Strategic Employment Site of 21 hectares, open spaces and woodlands, new access points and associated facilities and infrastructure (comprising utilities including gas, electricity, water, sewerage and telecommunications, highway improvements and diversion to existing utilities where necessary). Detailed access proposals for two new road bridges over the M1 motorway and M69 motorway, and two road access points from Beggar’s Lane and new accesses from Meridian Way, Chapel Green/Baines Lane and Leicester Lane. LOCATION: Land north & south of the M69 motorway, west of the M1 motorway and east of Beggars Lane, Lubbesthorpe, Leicester (Blaby District). APPLICANT: Hallam Land Management Ltd, Barratt Homes, David Wilson Homes and Davidson Developments. MAIN ISSUES: The need for the development in the context of local housing and employment land requirements, and in the -

To View the Natalie Again: “Of the Various Theories Touted to Crust, a Story from the Top

5 WELCOME GLEN & CLIVEDEN MAGAZINE CHEWTON Welcome 2016 is undoubtedly set to be a milestone for many reasons - however none are more important than the two big birthdays in the family! Cliveden, home over the years to an earl, three countesses, two dukes, a Prince TAKE THE of Wales and the Viscounts Astor, will celebrate its 350th anniversary. The more observant may realise that the present house was actually only built in 1851, after the first two houses burnt down: in 1795 and 1849. Today Cliveden provides the most decadent ‘home from home’ for guests from all around the globe who appreciate the fact that they are always made PATH LESS to feel more ‘house guest’ than ‘hotel client’. The recent multi-million pound refurbishment has only added to the rich layers of history that make this iconic property completely unique in the hotel world. I would also argue that today’s house guests at Cliveden are luckier than ever when it comes to culinary delights. Although the gastronomic heart of the house is still ‘below stairs’, there is nothing old-fashioned about the state-of-the-art kitchen that André Garrett TRAVELLED now has to help him make the very most of his talents. André’s cooking style could not be more appropriate for such a salubrious venue, and like the new interior design he is not trying to be fashionable. The ‘Stop Press’ news is that Cliveden has been awarded the coveted title of AA Hotel of the Year. This is testament to the vision and deep pockets of its new owners and, of course, the team at Cliveden who have put so much energy and passion back into the house. -

London New Homes

LONDON NEW HOMES THE COLLECTION Spring/Summer 2018 WELCOME With over 120 years’ experience handling the world’s first-class properties, we are in a unique position to offer insight into key global markets, analysing trends and forecasting where the opportunities lie. This publication is designed to share with you a selection of our hand-picked new homes schemes. From striking waterfront developments to luxury apartments, I’m sure the stunning breadth we have to offer will inspire your new home or investment property. If you require any advice please do not hesitate to contact any one of our team of experts. Rupert Dawes Head of New Homes +44 20 7861 5445 ABOUT US At Knight Frank we build long-term relationships, which allow us to provide personalised, clear and considered advice on all areas of property in all key markets. We believe personal interaction is a crucial part of ensuring every client is matched to the property that suits their needs best be it commercial or residential. Operating in locations where our clients need us to be, we provide a worldwide service that’s locally expert and globally connected. ENGAGING WITH We believe that inspired teams naturally provide excellent and dedicated client service. Therefore, we’ve created a workplace where opinions are respected, where everyone is invited to contribute to the success of our business and PEOPLE & PROPERTY, where they’re rewarded for excellence. The result is that our people are more motivated, ensuring your experience PERFECTLY. with us is the best that it can be. LONG & WATERSON Computer generated images for indicative purposes only. -

Leicestershire Historian

the Leicestershire Historian 1991 7776 Leicestershire Historian, which is published annually, is the magazine of the Leicestershire Local History Council and is distributed free to members. The Council exists to bring local history to the doorstep of all interested people in Leicester and Leicestershire, to provide opportunities for them to meet from time to time, to act as a coordinating body between the various county history societies, to encourage and support local history exhibitions and generally to promote the advancement of local history studies. In particular the Council aims to provide a service to all the local history societies and groups throughout the county, by keeping in touch with them and offering advice. An Information Pack is sent to all groups who become affiliated to the Council and items are added to it from time to time. One-day Conferences are held in the spring and autumn, to which members (both individuals and groups) are invited, to meet and compare notes about their activities. An up-dated list of groups, many of them affiliated as members of the Council, is published in the magazine. There are summer outings and the AGM is held in May, kindly hosted by one of the affiliated groups. The different categories of membership and the subscriptions are set out below. If you or your group wish to become a member, please contact the Membership Secretary, who will be pleased to supply further information about membership and future activities. GROUP, Organization £5.00 DOUBLE, Husband and Wife £5.00 INDIVIDUAL £4.00 -

Estate Agencies

List of previous, present and potential Estate Agency Clients @home DC Estates Kilostate Estate Agents Purdie and Co @Home Estate Agents DDM Residential Kim Barclay Solicitors Pure Cornwall 01 Estate Agents DDS Estate Agents Kim Pullen Estate Agent Pure Estate Agency 1 Click Homes Ltd De Scotia Kimberley's Estate Agents Pure Estate Agents 1 Click Move De Vere Homes Limited Kimberley's Independent Estate Agents Pure North Norfolk 1 Stop Letting Shop Deakin-White KimberWoodward Pure Properties 1 Stop Properties Dean & Co Kimmitt and Roberts Purely Bungalows 1% OR LESS Dean Estate Agents Kinetic Estate Agents Limited Purfect Properties Ltd 1234 Property Dean Wood King & Chasemore Purple Diamond 1-4-Sale Deans Properties King & Co Purple Frog Property Limited 1st Avenue Debbie Fortune King & Partners purple property.com 1st Avenue Estate Agents Debbie Fortune Estate Agents King & Woolley Purplebricks.com 1st Call Sales & Lettings Deborah Yea Partnership King and King Purplelink Properties 1st Choice for Property Declan James Ltd King Estate Agents Purpleproperty.biz 1st Choice Properties Dedman Gray King Homes Putterills 1st Field Properties Dee Atkinson & Harrison King Residential Putts Estate Agents 1st Sales and Lettings Deeds King West Pygott & Crone 24.7 Property Del Property Estate Agents Kingbourne & Co Pymm & Co 247 Property Agent Delamere Sales & Lettings Kingdom Property Services Q Sales & Lettings 2-Move Delaney's Kingham Property Specialists Qdos Homes Ltd 2Roost Delisa Miller Kings QPC Retirement Sales 360 Properties Delmont