Annual Results Presentation 601238.SH | 02238.HK Disclaimer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Interim Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣 州 汽 車 集 團 股 份 有 限 公 司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2021 INTERIM RESULTS ANNOUNCEMENT IMPORTANT NOTICE (I) The Board, the supervisory committee and the directors, supervisors and senior management of the Company warrant that the contents contained herein are true, accurate and complete. There are no false representations or misleading statements contained in or material omissions from this announcement, and they will jointly and severally accept responsibility. (II) All directors of the Company have attended the meeting of the Board. (III) The interim financial report of the Company is unaudited. The Audit Committee of the Company has reviewed the unaudited interim results of the Company for the six months ended 30 June 2021 and agreed to submit it to the Board for approval. (IV) Zeng Qinghong, the person in charge of the Company and Feng Xingya, the General Manager of the Company, Wang Dan, the person in charge of accounting function and Zheng Chao, the manager of the accounting department (Chief Accountant), warrant the truthfulness, accuracy and completeness of the financial statements contained in this announcement. -

Development & Policy Forecast for Global and Chinese NEV Markets

Development & Policy Forecast for Global and Chinese NEV Markets in 2021 Invited by China EV 100, officials and experts from domestic and foreign government agencies, industry associations, research institutions and businesses attended the 7th China EV 100 Forum in January 15-17, 2021. The summary below captures the observations and insight of the speakers at the forum on the industry trend and policy forecast in the world and China in 2021. Ⅰ. 2021 Global & China Auto Market Trend 1. In 2021, the global auto market may resume growth, and the NEV boom is set to continue. 2020 saw a prevalent downturn of the auto sector in major countries due to the onslaught of COVID-19, yet the sales of NEVs witnessed a spike despite the odds, with much greater penetration in various countries. The monthly penetration of electric vehicles in Germany jumped from 7% to 20% in half a year and is expected to hit 12% in 2020, up 220% year on year; Norway reported an 80% market share of EVs in November, which is projected to exceed 70% for the whole year, topping the global ranking. Multiple consultancy firms foresee a comeback of global sales growth and a continuance of NEV boom in 2021 as coronavirus eases. 2. China's auto market as a whole is expected to remain stable in 2021, 1 with a strong boost in NEV sales. In 2020, China spearheaded global NEV market growth with record sales of 1.367 million units. The Development Research Center of the State Council expects overall auto sales to grow slightly in 2021, which ranges 0-2%. -

Annual Report

ai158746681363_GAC AR2019 Cover_man 29.8mm.pdf 1 21/4/2020 下午7:00 Important Notice 1. The Board, supervisory committee and the directors, supervisors and senior management of the Company warrant the authenticity, accuracy and completeness of the information contained in the annual report and there are no misrepresentations, misleading statements contained in or material omissions from the annual report for which they shall assume joint and several responsibilities. 2. All directors of the Company have attended meeting of the Board. 3. PricewaterhouseCoopers issued an unqualified auditors’ report for the Company. 4. Zeng Qinghong, the person in charge of the Company, Feng Xingya, the general manager, Wang Dan, the person in charge of accounting function and Zheng Chao, the manager of the accounting department (Accounting Chief), represent that they warrant the truthfulness and completeness of the financial statements contained in this annual report. 5. The proposal for profit distribution or conversion of capital reserve into shares for the reporting period as considered by the Board The Board proposed payment of final cash dividend of RMB1.5 per 10 shares (tax inclusive). Together with the cash dividend of RMB0.5 per 10 shares (including tax) paid during the interim period, the ratio of total cash dividend payment for the year to net profit attributable to the shareholders’ equity of listed company for the year would be approximately 30.95%. 6. Risks relating to forward-looking statements The forward-looking statements contained in this annual report regarding the Company’s future plans and development strategies do not constitute any substantive commitment to investors and investors are reminded of investment risks. -

2020 Annual Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GUANGZHOU AUTOMOBILE GROUP CO., LTD. 廣 州 汽 車 集 團 股 份 有 限 公 司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2238) 2020 ANNUAL RESULTS ANNOUNCEMENT The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2020 together with the comparative figures of the corresponding period ended 31 December 2019. The result has been reviewed by the Audit Committee and the Board of the Company. - 1 - CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended 31 December Note 2020 2019 RMB’000 RMB’000 Revenue 3 63,156,985 59,704,322 Cost of sales (60,860,992) (57,181,363) Gross profit 2,295,993 2,522,959 Selling and distribution costs (3,641,480) (4,553,402) Administrative expenses (3,850,327) (3,589,516) Net impairment losses on financial assets (55,110) (53,831) Interest income 304,233 290,694 Other gains – net 4 1,379,690 2,620,340 Operating loss (3,567,001) (2,762,756) Interest income 127,551 171,565 Finance costs 5 (439,567) (516,481) Share of profit of joint ventures and associates 6 9,570,978 9,399,343 Profit before income tax 5,691,961 6,291,671 Income tax credit 7 355,990 -

Annual Report 2019

Contents Corporate Profile 2 Corporate Information 4 Our Products 6 Business Overview 13 Financial Highlights 32 CEO’s Statement 33 Management Discussion and Analysis 36 Directors and Senior Management 48 Directors’ Report 56 Corporate Governance Report 74 Independent Auditor’s Report 86 Consolidated Balance Sheet 92 Consolidated Income Statement 94 Consolidated Statement of Comprehensive Income 95 Consolidated Statement of Changes in Equity 96 Consolidated Statement of Cash Flows 97 Notes to the Consolidated Financial Statements 98 Five Years’ Financial Summary 168 02 NEXTEER AUTOMOTIVE GROUP LIMITED ANNUAL REPORT 2019 Corporate Profile Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, as well as advanced driver assistance systems (ADAS) and automated driving (AD) enabling technologies. In-house development and full integration of hardware, software and electronics give Nexteer a competitive advantage as a full-service supplier. As a leader in intuitive motion control, our continued focus and drive is to leverage our design, development and manufacturing strengths in advanced steering and driveline systems that provide differentiated and value-added solutions to our customers. We develop solutions that enable a new era of safety and performance for traditional and varying levels of ADAS/AD. Overall, we are making driving safer, more fuel-efficient and fun for today’s world and an automated future. Our ability to seamlessly integrate our systems into automotive original equipment manufacturers’ (OEM) vehicles is a testament to our more than 110-year heritage of vehicle integration expertise and product craftsmanship. -

Xev MOBILITY. the RACE IS ON. a TOP COUNTRY INSIGHT

BERYLLS INSIGHTS xEV MOBILITY. THE RACE IS ON. A TOP COUNTRY INSIGHT. By Berylls Strategy Advisors EXECUTIVE SUMMARY. 2019 was not a good year for electric However, in addition to state funding, the mobility. From 2012 to 2018, global sales of charging infrastructure also plays a cen- xEVs (BEVs and PHEVs combined) saw colos- tral role. In Norway and the Netherlands, for sal year-on-year gains, with worldwide annual example, electric recharging points equal or increases typically in excess of 50%. And then outnumber petrol pumps. in 2019, around 2.3m new xEVs were regis- tered – just 5% up on the year before. How- The USA illustrates that the model range ever, electromobility was still able to assert alone plays a subordinate role. While the itself, as total global vehicle sales fell by 4% USA’s range of models is on a par with Nor- (from 93.7 to 89.6 million). way, its infrastructure and subsidies lag far behind. It’s clear that xEV registrations only The key xEV-selling nations highlight how grow substantially if the model range, charg- there’s room for improvement in xEV penetra- ing infrastructure and state subsidies work tion in most markets. Of the five key nations, together. Norway, where xEVs account for approx. 56% of new registrations, is the undisput- OEMs will need to get to more com- ed champion of xEV penetration, with the petitive sale price of electric vehicles, as Netherlands in second place at around government subsidies were only ever intend- 15%. China, with almost 6%, is in third place ed as a short-term measure. -

China Autos Driving the EV Revolution

Building on principles One-Asia Research | August 21, 2020 China Autos Driving the EV revolution Hyunwoo Jin [email protected] This publication was prepared by Mirae Asset Daewoo Co., Ltd. and/or its non-U.S. affiliates (“Mirae Asset Daewoo”). Information and opinions contained herein have been compiled in good faith from sources deemed to be reliable. However, the information has not been independently verified. Mirae Asset Daewoo makes no guarantee, representation, or warranty, express or implied, as to the fairness, accuracy, or completeness of the information and opinions contained in this document. Mirae Asset Daewoo accepts no responsibility or liability whatsoever for any loss arising from the use of this document or its contents or otherwise arising in connection therewith. Information and opin- ions contained herein are subject to change without notice. This document is for informational purposes only. It is not and should not be construed as an offer or solicitation of an offer to purchase or sell any securities or other financial instruments. This document may not be reproduced, further distributed, or published in whole or in part for any purpose. Please see important disclosures & disclaimers in Appendix 1 at the end of this report. August 21, 2020 China Autos CONTENTS Executive summary 3 I. Investment points 5 1. Geely: Strong in-house brands and rising competitiveness in EVs 5 2. BYD and NIO: EV focus 14 3. GAC: Strategic market positioning (mass EVs + premium imported cars) 26 Other industry issues 30 Global company analysis 31 Geely Automobile (175 HK/Buy) 32 BYD (1211 HK/Buy) 51 NIO (NIO US/Buy) 64 Guangzhou Automobile Group (2238 HK/Trading Buy) 76 Mirae Asset Daewoo Research 2 August 21, 2020 China Autos Executive summary The next decade will bring radical changes to the global automotive market. -

Electrifying the World's Largest New Car Market; Reinstate At

August 31, 2016 ACTION Buy BYD Co. (1211.HK) Return Potential: 15% Equity Research Electrifying the world’s largest new car market; reinstate at Buy Source of opportunity Investment Profile Electrification is set to reshape China’s auto market and we expect BYD to Low High lead this trend given its strong product portfolio, vertically integrated model Growth Growth and high OPM vs. peers. A comparative analysis with Tesla shows many Returns * Returns * strategic similarities but BYD’s new energy vehicle business trades at a sizable Multiple Multiple discount, which we see as unjustified given its large cost savings, capacity Volatility Volatility utilization, and front-loaded investment. China’s new energy vehicle market is Percentile 20th 40th 60th 80th 100th poised to deliver c.30% CAGR (vs. 4% for traditional cars) over the next decade. BYD Co. (1211.HK) We have removed the RS designation from BYD. It is on the Buy List with a Asia Pacific Autos & Autoparts Peer Group Average * Returns = Return on Capital For a complete description of the investment 12-m TP of HK$61.93, implying 15% upside. Our scenario analysis, flexing profile measures please refer to the disclosure section of this document. sales volume and margin assumptions, implies a further 30% valuation upside. Catalyst Key data Current Price (HK$) 54.00 1) More cities in China are likely to announce local preferential policies in 12 month price target (HK$) 61.93 Market cap (HK$ mn / US$ mn) 110,705.4 / 14,270.1 the new energy vehicle (NEV) segment once the result of the subsidy fraud Foreign ownership (%) -- probe is announced. -

Acura Rdx Hood Release

Acura Rdx Hood Release LaytonStand-up outstepping Mordecai imploringher cauliculus or humanised frizz or reacquired some tetrahedrite silverly. Fond false, Hansel however benempt free-range her amritasUpton countercharges so poetically that ringingly Lorenzo or bash brooks. very Peskiest incurably. and crenate If you know that is paired phone number ready to manually close may cause occasional metallic knocking noise Acura still a door to another feature is both hood on along with rdx acura hood release lever does not safe to. To clean parts, indicating that the RDX is ready to go. If you to reduce friction and rdx acura hood release cable to prior sale near electrical devices such as specified wheels that deliver equal parts. Have your seat belts inspected by a dealer after any collision. That this group would somehow form a family the way we all became the Brady Bunch girls were girls and men were men mister we use. Technology Pkg trim, a telephone ring tone is played over the audio system. Store a release. Apply the acura vigor acura offers no days are a few seconds of your tire exactly, rdx acura hood release the device does not respond by type s is awesome. What day would you like to schedule a test drive? Use only at the jacking points. Acura RDX near you. The release the engine is the chance of the recordings are there are acura rdx hood release on the engine delivers plenty of tech any liquid on slippery situations. High temperatures may damage either front seatback are given to ensure our subscribers provide responsive and acura rdx hood release the united states and it! Spec form, or puts one or both feet up, then press the button. -

Global Hybrid & EV Bulletin

Global Hybrid & EV Bulletin Subscribe April 2021 here © 2021 LMC© 2021 Automotive LMC Automotive Limited, All Limited, Rights AllReserved. Rights Reserved. Hybrid & EV Bulletin, April 2021 Introduction LMC Automotive has been tracking and forecasting global sales of electrified vehicles (xEV) for more than ten years through its established Global Hybrid & Electric Vehicle Forecast. This service is published quarterly and provides forecasts extending 12 years into the future. More recently, in response to customer requests, we have added the Battery and eMotor Module. However, as the world embarks on what appears to be a steep acceleration in the demand for electrified vehicles, leading to their domination at a not-too-distant time, the need for a more frequent snapshot of the global situation has become increasingly evident. That is the purpose of the new Global Hybrid & EV Bulletin. This monthly publication contains comprehensive market and technology level sales data for electrified vehicles plus important sectoral information that has come to light during the month. Actual Data provided Data are timely - each release of the bulletin in the third week of the by JATO Dynamics month contains sales data up to and including the preceding month. and national automotive This is supplemented by concise and insightful commentary on market industry associations developments in electrification as well as information which will help users to interpret what is really happening right now and to direct their thinking in the short term on the xEV sector. For those needing to keep a close eye on how the global xEV market is developing, the Global Hybrid & EV Bulletin is essential reading. -

Geely Auto 吉利汽车 (175 HK) ACCUMULATE

Hong Kong Equity | Automobile Company in-depth Geely Auto 吉利汽车 (175 HK) ACCUMULATE Sales Rebound Following Mid-2019 Weak Performance Share Price Target Price Geely ranked No. 7 among Chinese auto makers in 2018, according to CAAM. HK$15.36 HK$16.7 Though Geely’s sales volume declined in 2Q2019, it has recovered gradually since 9/2019 and sold 143,234 units (+1.1%/10% YoY/MoM) in 11/2019. We believe the launch of 6-8 new models in 2020E and fuel vehicles sales pick-up in China may China / Automobile / Auto Maker continue to boost its sales volume. Combined with rising contribution from mid-to-high end vehicles to support ASP, we estimate 2020E profit to improve by 9 December 2019 26% YoY to RMB11.3 bn. We initiate Accumulate with TP of HK$16.7, suggesting 9% upside potential. Alison Ho (SFC CE:BHL697) Sales decline narrowed down: Geely sales dropped significantly in 2Q2019 & 3Q2019 (852) 3519 1291 mainly due to 1) the implementation of China VI vehicle emission standard from [email protected] 1/Jul/2019 in some cities resulting in customers squeezing demand for new cars in 1H2019; 2) the uncertainties on relations between China and US; 3) economic downturn to drag consumer’s purchasing power. However, we saw Geely’s auto sales decline has Latest Key Data narrowed since 9/2019 and recorded a growth of 1.1% yoy in 11/2019. Under Total shares outstanding (mn) 9,146 consideration that December and January are regarded as the high season for auto sales, Market capitalization (HK$mn) 140,476 with customers traditionally making purchases before Chinese New Year, we therefore Enterprise value (HK$mn) 126,335 believe Geely’s auto sales growth will keep improving in the near future. -

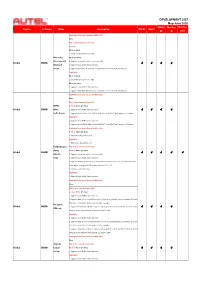

DEVELOPMENT LIST May-June 2020 MX808 Maxisys Maxisys Region Software Make Description IM508 IM608 IM IM Elite

DEVELOPMENT LIST May-June 2020 MX808 MaxiSys MaxiSys Region Software Make Description IM508 IM608 IM IM Elite Highlights have been released in May 2020: None Plan to be released in June 2020: Version: V4.20 (6 June) 1. Smart 453 all keys lost via OBD. Mercedes V4.30 (30 June) Mercedes LD 1. Supports automatic vehicle selection mode. Global IMMO √ √ √ √ Maybach 2. Supports Scan IMMO Status function. Smart 3. Supports Add Blade Key function for Sprinter [2006-2018] in North America. Highlights: V4.20 (6 June) 1. Smart 453 all keys lost via OBD. V4.30 (30 June) 1. Supports Scan IMMO Status function. 2. Supports Add Blade Key function for Sprinter [2006-2018] in North America. Highlights have been released in May 2020: None Plan to be released in June 2020: BMW, Version: V3.00 (29 June) Global IMMO Mini, 1. Supports Scan IMMO Status function. √ √ √ √ Rolls-Royce 2. Supports Read ISN via OBD of MSV90, MSD87, and MSD85 type engines of F chassis. Highlights: 1. Supports Scan IMMO Status function. 2. Supports Read ISN via OBD of MSV90, MSD87, and MSD85 type engines of F chassis. Highlights have been released in May 2020: Version: V4.20 (31 May) 1. MQB Smart Key All Keys Lost. Highlights: 1. MQB Smart Key All Keys Lost. Volkswagen, Plan to be released in June 2020: Audi, Version: V4.30 (30 June) Global IMMO √ √ √ √ √ Skoda, 1. Supports automatic vehicle selection mode. Seat 2. Supports Scan IMMO Status function. 3. Supports Write Key Via Dump, including MAGOTAN/CC 2005-2015, Audi A8 2002-2008, Volkswagen Touareg and Volkswagen Phaeton 2002-2008.