June 2021 Sales and Special Taxes Newsletter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State Board of Equalization June 4, 2020 the State Board Of

State Board of Equalization June 4, 2020 The State Board of Equalization met virtually through Microsoft TEAMS, June 4, 2020 at 10:30 a.m. The following members were present: Lieutenant Governor Brent Sanford, Chairperson Kelly Schmidt, State Treasurer Josh Gallion, State Auditor Doug Goehring, Commissioner of Agriculture Ryan Rauschenberger, State Tax Commissioner and Secretary of the State Board of Equalization Lieutenant Governor Sanford called the meeting to order at 10:36 a.m. It was moved by Commissioner Goehring and seconded Treasurer Schmidt to approve the minutes of the December 5, 2019 meeting. Upon voice vote, all participating members voted “aye.” Motion carried. The second item of business was the review of the application for tax exemption, submitted by WCCO Belting Inc. Commissioner Rauschenberger provided information about the business plan, employment, and projections. Rauschenberger noted WCCO Belting Inc. has met all requirements and notices for competitors, and has been designated primary sector by the Department of Commerce. Rauschenberger introduced and announced the representative for WCCO Belting Inc. was in attendance, should the board have had any questions. With no questions, Commissioner Goehring moved for approval for a five year, 100 percent income tax exemption. The motion was seconded by Auditor Gallion. Upon role call, all voting members voted “aye.” Motion carried. Rauschenberger continued with the late filing of the supplemental telecommunications report for NEC Cloud Communications America Inc. Rauschenberger moved for approval of $336.52. The motion was seconded by Treasurer Schmidt. Upon role call, all members voted “aye.” Motion carried. At 10:56 a.m. Lieutenant Governor Sanford announced the next item on the agenda was a discussion with the State Board Legal Staff and the State Supervisor of Assessments to obtain legal advice regarding the Griggs County Board of Commissioners failure to hold a Board of Equalization meeting and the county’s failure to complete a sales ratio study. -

2014 Primary Abstract

Unofficial Results 2014 Primary Election Page 1 of 13 Official Results 2014 Primary Election June 10, 2014 Candidates TOTALS 1101 Olivet Lutheran 1102 Doublewood Inn 1301 Westside School Elem 1302 West Fargo City Hall 1303 Veterans Mem. Arena 1601 Meadowridge Chapel 1602 Holy Cross Church 1603 Scheels Arena 2001 Northern Cass School 2101 Robert D.Johnson Ctr 2102 Fargo Library Public Senior Center2201 Page 2202 Arthur Comm. Hall Comm. 2203 Buffalo Center 2204 Day''s Inn Casselton Comm.2205 Mapleton Ctr Evangelical 2206 Shiloh 2207 Davenport Comm. Cntr 2208 Horace Senior Center 2401 Tower City Comm. Ctr 2402 NU Tech Offices 2501 Hickson Comm. Center 2502 Kindred City Hall 2701 West Acres Cntr Shop 2702 Living Waters Church 2703 Calvary Methodist Evangelical4101 Bethel 4102 First AssemblyGod Zagal Shrine 4401 El 4402 Knollbrook Covenant 4501 FargoDome 4502 Reiles Acres Comm. 4503 Harwood Comm. Center 4504 Argusville Comm. Ctr 4601 The Bowler Lutheran4602 Atonement 4603 Riverview Place Voters Election Day 14034 962 596 271 193 504 205 224 147 85 701 293 51 72 83 276 181 237 96 237 66 37 140 114 105 358 607 1056 771 1076 1103 821 135 170 104 539 954 464 Voters Early Voting 3105 235 311 29 25 91 44 40 16 0 207 119 0 7 4 28 4 31 8 14 2 7 0 2 39 95 141 301 197 178 221 197 15 18 1 133 223 122 Voters Absentee 681 47 36 14 2 22 12 2 1 3 66 29 0 0 3 7 4 1 5 3 0 1 5 1 11 56 10 27 45 62 66 38 3 5 0 13 61 20 Voters Canvassing 15 2 0 0 1 0 0 0 0 0 3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 4 0 1 0 0 0 2 2 0 BALLOTS CAST - TOTAL BALLOTS CAST - TOTAL 17835 -

Sample General Election Ballot

SAMPLE GENERAL ELECTION BALLOT D STATE OF NORTH DAKOTA E RAMSEY F Precinct 01 To vote for the candidate of your choice, you must darken the oval next to the name of that State Representative Agriculture Commissioner candidate. District 15 Vote for no more than ONE name Vote for no more than TWO names To vote for a person whose name is not printed Jim Dotzenrod on the ballot, you must darken the oval next to Dennis Johnson the blank line provided and write that person's Democratic-NPL Party Republican Party name on the blank line. Bill Mertens Doug Goehring Republican Party PARTY BALLOT Democratic-NPL Party Greg Westlind Write-in United States Senator Republican Party Vote for no more than ONE name Heidi Heitkamp Write-in Public Service Commissioner Democratic-NPL Party Vote for no more than ONE name Write-in Kevin Cramer Randy Christmann Republican Party Republican Party Secretary of State Jean (Jeannie) Brandt Vote for no more than ONE name Write-in Democratic-NPL Party Alvin A (Al) Jaeger independent nomination Write-in Representative in Congress Vote for no more than ONE name Michael (Coach) Coachman independent nomination Public Service Commissioner Kelly Armstrong Unexpired 2-Year Term Republican Party Josh Boschee Vote for no more than ONE name Democratic-NPL Party Casey Buchmann Charles Tuttle Democratic-NPL Party independent nomination Write-in Brian K Kroshus Mac Schneider Republican Party Democratic-NPL Party Attorney General Write-in Write-in Vote for no more than ONE name Wayne Stenehjem Republican Party Tax Commissioner State -

House of Rep Daily Journal

Page 37 1st DAY TUESDAY, JANUARY 5, 2021 37 JOURNAL OF THE HOUSE Sixty-seventh Legislative Assembly * * * * * Bismarck, January 5, 2021 The House convened at 10:00 a.m., with Speaker K. Koppelman presiding. An invocation was offered by Mr. Driver of the Mandan, Hidatsa and Arikara Nation. THE HOUSE RECOGNIZED THE PRESENCE OF: Governor Doug Burgum, First Lady Kathryn Helgaas Burgum, and Lt. Governor Brent Sanford MOTION REP. LOUSER MOVED that a committee of four be appointed to escort Mark Fox, Tribal Business Council Chairman for the Mandan, Hidatsa and Arikara Nation, to the podium, and his son Elijah to a special reserved seat in the assembly, which motion prevailed. THE SPEAKER APPOINTED Reps. Jones and Buffalo, and Sens. Kannianen and Marcellais to the escort committee. TRIBAL AND STATE RELATIONSHIP ADDRESS January 5, 2021 Mark Fox Tribal Business Council Chairman, Mandan, Hidatsa, and Arikara Nation Good morning and good to see all of you. My traditional name is Sage Man from the Hidatsa language of my adopted relatives. My father was full blooded Arikara. I just want to say it's good to see everybody here. Many of you I know. I want to acknowledge everybody, of course the Governor and First Lady. Thank you for your presence here. And thank you for being here. It makes my heart feel very good. To all of legislative leadership, thank you for being here. Too many obviously to name, but I know many of you and work with many of you. Other tribal chairman are here as well. We have tribal chairman that have come as well. -

With Sincere Thanks

Renville County Farmer Wednesday, November 21,2018 )(W Page 6 Notice to Creditors 1331 9th Avenue NW - 2nd Floor pointed to help finalize plans. PUBLIC NOTICES POBox 1206 b. Bus Barn: Supt. Voigt recom- PROBATE NO. 38-2018-PR-00019 Williston, ND 58802-1206 mends to install rain gutters on the north ESTATE OF PATSY M. (701) 572-2200· side of the building. Motion made by Abstract of Votes Cast at the HARDMAN 4-6c Mr. Vance U ndlin, second by Mr. IN THE DISTRICT COURT OF Steeves, to approve the installation of General Election November 6, 2018 RENVILLE COUNTY, STATE OF rain gutters. Motion carried. NORTH DAKOTA In the Matter of the MLS School c. Projects: Supt. Voigt updated the by the Voters of Renville County, North Dakota Estate ofPATSYM. HARDMAN, De- Board on the status of the repairs in the ceased. District Greenhouse, and the parking area proj- I hereby certity. that the within an~ following Abstract of Votes cast by the Voters of Renville County, North Dakota, NOTICE IS HEREBY GIVEN MOHALL LANSFORD ect. Supt. Voigt requested to put out bids at the General Election h~ld at the vanous election precincts of said County on the 6th day of November, 2018, is a true that the undersigned has been appoint- SHERWOOD BOARD OF for the removal of the old boiler. It was and copy of the original Abstract thereof made by the regularly organized Board of Canvassers as required by law. == ment Personal Representative of the EDUCATION PROCEEDINGS the consensus of the Board to put bids WItness my hand and seal this 13th day of November, 2018. -

Consolidated Primary Election Ballot Primary Election, June 12, 2018 Republican Democratic-Npl Libertarian

CONSOLIDATED PRIMARY ELECTION BALLOT PRIMARY ELECTION, JUNE 12, 2018 A STATE OF NORTH DAKOTAB BOWMAN COUNTYC Bowman City ATTENTION! READ BEFORE VOTING POLITICAL PARTY BALLOT 11 In a Political Party Primary Election, you may only vote for the candidates of one political party. This ballot contains three political parties; one in each section. If you vote in more than one political party's section, your Political Party Ballot will be rejected; however, all votes on the No Party and Measures Ballots will still be counted. To vote for the candidate of your choice, you must darken the oval ( R ) next to the name of that candidate. To vote for a person whose name is not printed on the ballot, you must darken the oval ( R ) next to the blank line provided and write that person's name on the blank line. REPUBLICAN DEMOCRATIC-NPL LIBERTARIAN 21 United States Senator United States Senator United States Senator Vote for no more than ONE name Vote for no more than ONE name Vote for no more than ONE name Thomas E O'Neill Heidi Heitkamp Kevin Cramer Representative in Congress Vote for no more than ONE name Representative in Congress Vote for no more than ONE name Representative in Congress Vote for no more than ONE name Mac Schneider State Senator District 39 Paul J Schaffner Vote for no more than ONE name Kelly Armstrong State Senator District 39 40 Tom Campbell Vote for no more than ONE name State Representative District 39 41 Tiffany Abentroth Vote for no more than TWO names 42 State Representative District 39 43 State Senator Vote for no more than -

Election Results

MCLEAN COUNTY ABSTRACT OF BALLOTS CAST NORTH DAKOTA PRIMARY ELECTION ‐ JUNE 10, 2014 District Precinct Ballots Cast LG04 LEGISLATIVE 4‐McLEAN LESS 0402 337 WHITE SHIELD/ZIEGLER RURAL 64 Subtotal 401 LG08 LEGISLATIVE 8‐McLEAN COUNTY 2,347 Subtotal 2,347 Total 2,748 LEGISLATIVE 4 ‐ LEGISLATIVE 8 ‐ WHITE Total McLEAN LESS McLEAN SHIELD/ZIEGLER 0402 COUNTY RURAL REPUBLICAN Representative in Congress Kevin Cramer 1577 167 1390 20 write‐in ‐ scattered 2 02 0 Total 1579 167 1392 20 Secretary of State Alvin A (Al) Jaeger 1565 161 1385 19 write‐in ‐ scattered 1 01 0 Total 1566 161 1386 19 Attorney General Wayne Stenehjem 1570 161 1390 19 write‐in ‐ scattered 0 00 0 Total 1570 161 1390 19 Agriculture Commissioner Doug Goehring 1540 159 1362 19 write‐in ‐ scattered 0 00 0 Total 1540 159 1362 19 Public Service Commissioner Brian P Kalk 1521 159 1343 19 write‐in ‐ scattered 0 00 0 Total 1521 159 1343 19 Public Service Commissioner Unexpired Julie Fedorchak 1527 159 1349 19 2‐Year Term write‐in ‐ scattered 0 00 0 Total 1527 159 1349 19 Tax Commissioner Ryan Rauschenberger 1527 157 1351 19 write‐in ‐ scattered 2 02 0 Total 1529 157 1353 19 DEMOCRATIC‐NPL Representative in Congress George Sinner 745 98 608 39 write‐in ‐ scattered 1 10 0 Total 746 99 608 39 Secretary of State April Fairfield 702 94 573 35 write‐in ‐ scattered 1 01 0 Total 703 94 574 35 Attorney General Kiara Kraus‐Parr 687 93 558 36 write‐in ‐ scattered 2 02 0 Total 689 93 560 36 Agriculture Commissioner Ryan Taylor 761 105 621 35 write‐in ‐ scattered 1 01 0 Total 762 105 622 35 Public -

64-Clerks-Judgment.Pdf

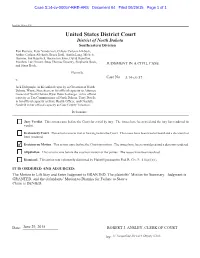

Case 3:14-cv-00057-RRE-ARS Document 64 Filed 06/29/15 Page 1 of 1 Local AO 450 (rev. 5/10) United States District Court District of North Dakota Southeastern Division Ron Ramsay, Peter Vandervort, Celeste Carlson Allebach, Amber Carlson Allebach, Brock Dahl, Austin Lang, Michele Harmon, Joy Haarstick, Bernie Erickson, David Hamilton, Matthew Lee Elmore, Beau Thomas Downey, Stephanie Bock, JUDGMENT IN A CIVIL CASE and Siana Bock, Plaintiffs, Case No. 3:14-cv-57 v. Jack Dalrymple, in his official capacity as Governor of North Dakota, Wayne Stenehjem, in his official capacity as Attorney General of North Dakota, Ryan Rauschenberger, in his official capacity as Tax Commissioner of North Dakota, Terry Dwelle in his official capacity as State Health Officer, and Charlotte Sandvik in her official capacity as Cass County Treasurer, Defendants. Jury Verdict. This action came before the Court for a trial by jury. The issues have been tried and the jury has rendered its verdict. Decision by Court. This action came to trial or hearing before the Court. The issues have been tried or heard and a decision has been rendered. ✔ Decision on Motion. This action came before the Court on motion. The issues have been considered and a decision rendered. Stipulation. This action came before the court on motion of the parties. The issues have been resolved. Dismissal. This action was voluntarily dismissed by Plaintiff pursuant to Fed. R. Civ. P. 41(a)(1)(ii). IT IS ORDERED AND ADJUDGED: The Motion to Lift Stay and Enter Judgment is GRANTED. The plaintiffs’ Motion for Summary. -

Summary Report Traill County, North Dakota Run Date:06/10/14 Primary Election Run Time:11:08 Pm June 10, 2014 Statistics

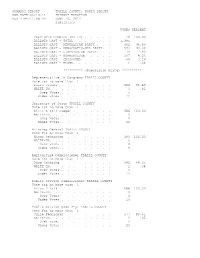

SUMMARY REPORT TRAILL COUNTY, NORTH DAKOTA RUN DATE:06/10/14 PRIMARY ELECTION RUN TIME:11:08 PM JUNE 10, 2014 STATISTICS VOTES PERCENT PRECINCTS COUNTED (OF 12) . 12 100.00 BALLOTS CAST - TOTAL. 1,295 BALLOTS CAST - REPUBLICAN PARTY . 602 46.49 BALLOTS CAST - DEMOCRATIC-NPL PARTY. 574 44.32 BALLOTS CAST - LIBERTARIAN PARTY. 12 .93 BALLOTS CAST - NONPARTISAN. 107 8.26 BALLOTS CAST - CROSSOVER . 66 5.10 BALLOTS CAST - BLANK. 1 .08 ********** (Republican Party) ********** Representative in Congress TRAILL COUNTY Vote for no more than 1 Kevin Cramer . 586 99.49 WRITE-IN. 3 .51 Over Votes . 0 Under Votes . 13 Secretary of State TRAILL COUNTY Vote for no more than 1 Alvin A (Al) Jaeger . 586 100.00 WRITE-IN. 0 Over Votes . 0 Under Votes . 16 Attorney General TRAILL COUNTY Vote for no more than 1 Wayne Stenehjem . 593 100.00 WRITE-IN. 0 Over Votes . 0 Under Votes . 9 Agriculture Commissioner TRAILL COUNTY Vote for no more than 1 Doug Goehring . 586 99.66 WRITE-IN. 2 .34 Over Votes . 0 Under Votes . 14 Public Service Commissioner TRAILL COUNTY Vote for no more than 1 Brian P Kalk . 588 100.00 WRITE-IN. 0 Over Votes . 0 Under Votes . 14 Public Service Comm 2-yr TRAILL COUNTY Vote for no more than 1 Julie Fedorchak . 577 99.65 WRITE-IN. 2 .35 Over Votes . 0 Under Votes . 23 Tax Commissioner TRAILL COUNTY Vote for no more than 1 Ryan Rauschenberger . 578 99.83 WRITE-IN. 1 .17 Over Votes . 0 Under Votes . 23 ********** (Democratic-NPL Party) ********** Representative in Congress TRAILL COUNTY Vote for no more than 1 George Sinner . -

Sales and Special Taxes Newsletter North Dakota Office of State Tax Commissioner Ryan Rauschenberger, Tax Commissioner

Sales and Special Taxes Newsletter North Dakota Office of State Tax Commissioner Ryan Rauschenberger, Tax Commissioner June 2021 Photo credit: ND Tourism IN THIS ISSUE 2021 LEGISLATIVE RECAP Sales and Use Tax The following are highlights of sales and special taxes Legislation......................................2 legislation approved by the 2021 Legislative Assembly and signed into law by Governor Doug Burgum. Motor Vehicle Excise Tax The bill text and additional information for the 67th Legislation......................................4 Legislative Assembly are available at www.legis.nd.gov/ assembly/67-2021/regular. Alcohol Tax Legislation and Updates..........................................5 Contact Information.....................7 SALES AND USE TAX LEGISLATION HB 1195 – SPECIAL EVENT ORGANIZER REPORTING REQUIREMENTS House Bill 1195 amends a special event The bill also allows the special event organizer to organizer’s requirement to submit a list of vendors exclude a vendor from the form if the organizer attending an event to the Tax Commissioner. included them on a form in the previous six Previously, a special event organizer was months. All vendors at the event, new and required to submit a Special Event Vendor previously submitted, count toward the event’s Reporting Form when the event had 10 or more vendor total. vendors. Starting August 1, 2021, the number increases to 25 or more vendors. The Special Statutory change: Amended special event Event Vendor Reporting Form is on the Office organizer reporting requirements under N.D.C.C. of State Tax Commissioner’s website at www. § 57-39.2-10.1. nd.gov/tax/SpecialEvents. Effective date: August 1, 2021 HB 1206 – PREPAID WIRELESS 911 FEE RETURN COMPENSATION House Bill 1206 updates the return compensation amount. -

Party Ballot No-Party Ballot

The arrangement of candidate names appearing on ballots in your precinct may vary from the published sample ballots, depending upon the precinct and legislative district in which you reside. SAMPLE BALLOT GENERAL ELECTION BALLOT NOVEMBER 6, 2018 A STATE OF NORTH DAKOTA B BURLEIGH COUNTY C To vote for the candidate of your choice, you Public Service Commissioner must darken the oval ( R ) next to the name of Vote for no more than ONE name Judge of the District Court that candidate. South Central Judicial District To vote for a person whose name is not printed Jean (Jeannie) Brandt Judgeship No. 9 on the ballot, you must darken the oval ( ) Democratic-NPL Party Unexpired 4-Year Term R Vote for no more than ONE name next to the blank line provided and write that Randy Christmann person's name on the blank line. Republican Party PARTY BALLOT John W Grinsteiner United States Senator Public Service Commissioner Vote for no more than ONE name Unexpired 2-Year Term Kevin Cramer Vote for no more than ONE name County Commissioner Republican Party Vote for no more than THREE names Heidi Heitkamp Brian K Kroshus Kathleen Jones Democratic-NPL Party Republican Party Casey Buchmann Dennis Agnew Democratic-NPL Party Representative in Congress Vote for no more than ONE name Jim Peluso Tax Commissioner Charles Tuttle Steve Schwab independent nomination Vote for no more than ONE name Mac Schneider Kylie Oversen Leo Vetter Democratic-NPL Party Democratic-NPL Party Kelly Armstrong Ryan Rauschenberger Mark Armstrong Republican Party Republican Party Secretary of State Vote for no more than ONE name NO-PARTY BALLOT To vote for the candidate of your choice, you Josh Boschee must darken the oval ( R ) next to the name of Democratic-NPL Party that candidate. -

2018-Mayjun-Community-Banker-Newsletter

INDEPENDENT COMMUNITY BANKS OF NORTH DAKOTA C OMMUNITY B ANKER NEWSLETTER Official Newsletter of Independent Community Banks of ND May/June 2018 Issue NEW Seminar Presented by ICBND: HR Survival Kit in Today’s Challenging World Wednesday, September 12, 2018 Ramkota Hotel & Conference Center, Bismarck Who Should Attend: HR Professionals, Branch Managers, Market Presidents and anyone who wants to learn strategies on improving the workplace. Session Overview: Addressing the Basics in Hiring and Firing • Mistakes in hiring and firing • Techniques used for successful interviews • What to do before and after the interview • Legal versus illegal questions • Strategies for successful new employee orientation • The necessity of proper documentation • Avoid surprises by honest feedback before firing employees • Horror stories you’ve experienced Handling Workplace Bullies • Definition of bullies in the workplace • Reasons why they continue to bully their targets • Learn the GAP and Verbal Aikido to gain control Communicating Why Sexual Harassment and Discrimination Can’t be Tolerated • Challenges you have experienced in the workplace • Mistakes others have made handling sexual harassment and discrimination • How to stop the culture of keeping silent and letting powerful people get away with it • Successful changes experienced by your colleagues Having Tough Conversations with Mediocre Employees • How to handle performance appraisals • Discuss possible complications • Mistakes you have made • Learning how your colleagues use PA • Discover the power