Brokers Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BANCA SELLA S.P.A. (Incorporated with Limited Liability Under the Laws of the Republic of Italy) €1,000,000,000 Euro Medium Term Note Programme

Base Prospectus BANCA SELLA S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) €1,000,000,000 Euro Medium Term Note Programme This document has been approved as a base prospectus (the “Base Prospectus”) issued in compliance with Directive 2003/71/EC (as amended, to the extent such amendments have been implemented in the relevant Member State of the European Economic Area, the “Prospectus Directive”) by the Commission de Surveillance du Secteur Financier (the “CSSF”) in its capacity as competent authority under the Loi relative aux prospectus pour valeurs mobilières dated 10 July 2005 which implements the Prospectus Directive in Luxembourg (the “Luxembourg Prospectus Law”). Application has been made by Banca Sella S.p.A. (the “Issuer”) for notes (“Notes”) issued under the €1,000,000,000 Euro Medium Term Note Programme (the “Programme”) described in this Base Prospectus during the period of twelve months after the date hereof, being the approval date of this Base Prospectus, to be listed on the official list and admitted to trading on the regulated market of the Luxembourg Stock Exchange, which is a regulated market for the purposes of the Markets in Financial Instruments Directive 2004/39/EC (each such regulated market being a “Regulated Market”). The Programme also allows for Notes to be unlisted or to be admitted to listing, trading and/or quotation by such other or further competent authorities, stock exchanges and/or quotation systems as may be agreed with the Issuer. There are certain risks relating to the Issuer and the Notes which potential investors should ensure they fully understand. -

Annual Report

ANNUAL REPORT 2007 121st FINANCIAL YEAR SELLA HOLDING BANCA) SELLA ER M FOR ( Joint Stock Company Head Office in Biella – Share Capital and Reserves € 448.757.834 Member of the Deposit Guarantee Scheme Registered on the Banks and Banking Groups Roll Tax and VAT number 01709430027 13900 Biella (Italy) – via Italia, 2 Tel. 015.35011 – Telefax 015.351767 – Swift SELB IT 22 Web site www.gruppobancasella.it This volume has been printed on ecological recycled paper This volume has been printed on ecological recycled Insert: photographs from the Fondazione Sella archive Vittorio Sella, A crevasse on the Gabelhorn glacier, August 1, 1887 Vittorio Sella, Mischabelhörner seen from the North summit of Alphubel, August 3, 1887 Vittorio Sella, Lower summit of Monte Rosa in the direction of Macugnaga from the summit of Dufourspitze, August 11, 1887 Vittorio Sella, Cervino and Monte Rosa seen from somewhere near the Colle delle Grandes Murailles, September 18, 1887 CONTENTS BOARD OF DIRECTORS 7 BOARD OF STATUTORY AUDITORS 7 CHart OF BANCA SELLA GROUP 8 TERRITORIAL ORGANISATION OF BANCA SELLA GROUP 10 CORRESPONDENT BANKS FOR BANCA SELLA HOLDING 21 SHAREHOLDERS’ MEETING – NOTICE OF MEETING 23 BOARD OF DIRECTORS’ ANNUAL REPORT 25 Rating . 27 Financial highlights . 28 Alternative performance indicators follows . 29 Macroeconomic scenario . 30 Strategic issues and state of progress of three-year strategic plan . 33 Operating result . 34 Trade policies . 38 Operating performance in main areas of activity . 42 Operating structure . 47 Outlook . 50 Significant events occurred after the close of the financial year . 52 Own shares and shares of the parent company . 52 Equity investments and dealings with Group companies . -

Digital Transformation of the Retail Payments Ecosystem European Central Bank and Banca D’Italia Joint Conference

Digital transformation of the retail payments ecosystem European Central Bank and Banca d’Italia joint conference 30 November and 1 December 2017 Rome, Italy programme Thursday, 30 November 2017 08:00 Registration and coffee 09:00 Welcome remarks Ignazio Visco, Banca d’Italia Introductory speech Yves Mersch, European Central Bank Topic I – Digital evolution of retail payments 09:45 Panel discussion: Digital evolution of retail payments – a global scan from a central bank perspective Panellists: Veerathai Santiprabhob, Bank of Thailand Reinaldo Le Grazie, Banco Central do Brasil Denis Beau, Banque de France Francois E. Groepe, South African Reserve Bank Moderator: Yves Mersch, European Central Bank 11:00 Coffee break 2 11:30 Keynote speech: The impact of digital innovation on banking and payments Chris Skinner, Fintech commentator and author 12:00 Panel discussion: How to foster innovation and integration in retail payments Panellists: Massimo Cirasino, World Bank Group Luisa Crisigiovanni, Altroconsumo Elie Beyrouthy, American Express Pierre Petit, European Central Bank Javier Santamaría, European Payments Council Moderator: Paolo Marullo Reedtz, Banca d’Italia 13:15 Lunch break 14:30 Academic session: On the way to a digital retail payments ecosystem – drivers and inhibitors Are instant retail payments becoming the new normal? Lola Hernández (co-authors Monika E. Hartmann, Mirjam Plooij and Quentin Vandeweyer), European Central Bank 3 The future of digital retail payments in Europe: a role for central bank issued crypto cash? Ruth Wandhöfer, -

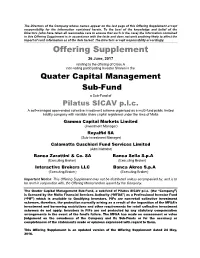

Offering Supplement Accept Responsibility for the Information Contained Herein

The Directors of the Company whose names appear on the last page of this Offering Supplement accept responsibility for the information contained herein. To the best of the knowledge and belief of the Directors (who have taken all reasonable care to ensure that such is the case) the information contained in this Offering Supplement is in accordance with the facts and does not omit anything likely to affect the import of such information as of the date hereof. The Directors accept responsibility accordingly. Offering Supplement 26 June, 2017 relating to the offering of Class A non-voting participating Investor Shares in the Quater Capital Management Sub-Fund a Sub-Fund of Pilatus SICAV p.l.c. A self-managed open-ended collective investment scheme organised as a multi-fund public limited liability company with variable share capital registered under the laws of Malta Gamma Capital Markets Limited (Investment Manager) Royalfid SA (Sub-Investment Manager) Calamatta Cuschieri Fund Services Limited (Administrator) Banca Zarattini & Co. SA Banca Sella S.p.A (Executing Broker) (Executing Broker) Interactive Brokers LLC Banca Akros S.p.A (Executing Broker) (Executing Broker) Important Notice: This Offering Supplement may not be distributed unless accompanied by, and is to be read in conjunction with, the Offering Memorandum issued by the Company. The Quater Capital Management Sub-Fund, a sub-fund of Pilatus SICAV p.l.c. (the “Company”) is licensed by the Malta Financial Services Authority (“MFSA”) as a Professional Investor Fund (“PIF”) which is available to Qualifying Investors. PIFs are non-retail collective investment schemes, therefore, the protection normally arising as a result of the imposition of the MFSA’s investment and borrowing restrictions and other requirements for retail collective investment schemes do not apply. -

View Annual Report

ANNUAL REPORT 2019 Buzzi Unicem is an international multiregional, “heavy-side“ group, focused on cement, ready-mix concrete and aggregates. The company’s dedicated management has a long-term view of the business and commitment towards a sustainable development, supported by high quality assets. Buzzi Unicem pursues value creation through lasting, experienced know-how and operating eff iciency of its industrial operations. Vision Contents Letter to the Shareholders 4 Group profile Directors and statutory auditors 8 The group at a glance 10 Regional overview 16 Review of operations Shares, Shareholders and Performance indicators 24 Business review 27 Human Resources 50 Research and development 52 Ecology, Environment and Safety 56 Non-financial statements 57 Internal control and risk management system 58 Related-party transactions 59 Outlook 60 Financial Information Consolidated financial statements 64 Notes to consolidated financial statements 70 Appendixes 144 Certification of the consolidated financial statements 151 Auditors’ report 152 4 Dear Shareholders, as our usual practice, the Chairman of the company is tasked with presenting the Annual Report for the year that has just ended (I am referring to 2019, of course). Before I embark on last year’s results, it is incumbent upon me to draw your attention to what has been happening in Italy and around the world since March 2020. It goes without saying that I am referring to the COVID-19 outbreak that, over the past month, has been impacting the economic outlook not only in Italy but also globally. This is a completely unexpected and extraordinary event whose evolution is full of uncertainties. How long this will last and how severely it will aff ect people’s health and the national and global economy is still unknown. -

Report on Corporate Governance 2016

Report on Corporate Governance and ownership structure pursuant to article 123 bis of Legislative Decree 24 February 1998 no. 58 as amended referring to the year ended December 31, 2016 MARCH 30, 2017 Buzzi Unicem SpA Registered Office: Casale Monferrato (AL) - via Luigi Buzzi n. 6 Share capital: euro 123,636,658.80 fully paid up Chamber of Commerce of Alessandria: 00930290044 Website: www.buzziunicem.it REPORT ON CORPORATE GOVERNANCE AND OWNERSHIP STRUCTURE Introduction This report contains the information on the corporate governance and ownership structure of Buzzi Unicem SpA (hereinafter referred to as Buzzi Unicem) pursuant to article 123 bis of Legislative Decree 24 February 1988 no. 58 as amended (hereinafter referred to as TUF), also in compliance with the Code of Conduct of listed companies approved in July 2015 by the Corporate Governance Committee and promoted by Borsa Italiana S.p.A, Ania, Assogestioni, Assonime and Confindustria (hereinafter referred to as “Code of Conduct” or simply “Code”) to which Buzzi Unicem adheres under the terms reported in this report. The above Code of Conduct to which Buzzi Unicem adheres is available to the public on the Corporate Governance Committee’s website (http://www.borsaitaliana.it/comitato-corporate- governance/codice/2015clean.pdf). Part I – General description of Buzzi Unicem SpA organizational structure Buzzi Unicem SpA’s organizational structure consists of the following main corporate bodies: - Shareholders’ meeting; - Board of directors; - Chairman of the board of directors; - One Vice Chairman of the board of directors; - Two Managing Directors; - Statutory auditors’ committee. This structure corresponds to the “traditional management and control model” issuing from the rules provided by the corporate law reform implemented by Legislative Decree no. -

Horn Sounding on the Future of Freight Delivery

X-BORDER PAYMENTS OPTIMIZATION TRACKER JUNE 2016 A MONTHLY UPDATE ON THE TRENDS AND PLAYERS DRIVING CROSS-BORDER PAYMENTS Horn Sounding On The Future Of Freight Delivery Paysafe’s payment technology can now process more than 100 currencies 57 percent of gamers are using PayPal or credit cards to make Alibaba reported a their online purchases year-on-year mobile growth of 192 percent X-Border Payments Optimization TrackerTM Table of Contents 03 What’s Inside 04 Cover Story 08 Methodology 09 Top 20 Rankings 14 Watch List – New Additions 15 X-Border Payments Optimization LandscapeTM 16 News & Trends 20 Scorecard 68 About © 2016 PYMNTS.com all rights reserved 2 What’s Inside By all but eliminating physical boundaries, cross-border solutions are giving a whole new meaning to the phrase “it’s a small world.” In an age where the fiscal distance from the U.S. to Europe to China has been reduced to a few swipes on a smartphone, international economies are increasing their digital dependence on each other. This month, a number of countries embraced this global shrinkage, while others attempted to rebuild borders through the tightening of trade policies. With a more interactive international market comes new hurdles for the freight industry. For June’s cover story, PYMNTS sat down with Andrew Fine, CFO of Freightos, a sales automation platform for the shipping industry, to discuss these challenges and the technological future of cross-border trade. Also included in this month’s Tracker are news highlights from throughout the cross-border payments movement. Here’s a peek at some recent headlines that showcase the global scope of cross-border initiatives. -

Ethical and Non-Ethical Italian Funds: a Comparison of Investment Policies, Costs and Returns

Master’s Degree Programme in Accounting and Finance curriculum Business Administration Second Cycle (D.M. 270/2004) Final Thesis Ethical and Non-Ethical Italian Funds: A comparison of investment policies, costs and returns Supervisor Ch. Prof. Andrea Veller Graduand Alessia Verza Matriculation Number 843687 Academic Year 2016 / 2017 INDEX INTRODUCTION pag. 1 CHAPTER 1 Socially Responsible Investments and Ethical Funds pag. 3 1.1 Ethics and Finance 3 1.2 The Socially Responsible Investment 6 1.3 The Historical Evolution of SRI Market 9 1.4 The European Market of SRI in the last years 11 1.5 SRI Categories 15 1.6 SRI Strategies and Investment Selection Processes 16 1.7 Characteristics of SRI Investors 23 CHAPTER 2 Italian Ethical Funds’ Analysis pag. 27 2.1 Overview of Italian Ethical Funds 27 2.2 Etica Sgr 29 2.3 Eurizon Capital Sgr 55 2.4 Pioneer Investments 68 2.5 Sella Gestioni Sgr 73 2.6 Ubi Pramerica Sgr 78 2.7 BNP Paribas Investment Partners Sgr 86 CHAPTER 3 The Qualitative Analysis of Italian Ethical Funds pag. 92 3.1 Subjects Involved in the Securities’ Selection Process 92 3.2 The Securities’ Selection Process 98 3.3 The Engagement Policy 127 3.4 Investment Processes in Comparison 130 CHAPTER 4 The Analysis of Ethical Funds’ Cost pag. 134 4.1 The Costs of Ethical Funds 134 4.2 The Regulation of Ongoing Charges 136 4.3 The Comparison of Ethical Funds’ and Non-Ethical Funds’ Ongoing Charges 138 CHAPTER 5 The Analysis of Ethical Funds’ Performance pag. 165 5.1 The Performance of Ethical Funds 165 5.2 The Risk-Adjusted Performance Measures 167 5.3 The Comparison of Ethical Funds’ and Non-Ethical Funds’ Returns 173 and Sharpe Ratio 5.4 Interview to Paolo Capelli 194 CONCLUSIONS pag. -

Santander Consumer Bank S.P.A

BASE PROSPECTUS SANTANDER CONSUMER BANK S.P.A. (Incorporated with limited liability in the Republic of Italy) EUR 3,000,000,000 Euro Medium Term Note Programme Guaranteed by SANTANDER CONSUMER FINANCE, S.A. (Incorporated with limited liability in the Kingdom of Spain) This base prospectus (the "Base Prospectus") has been approved by the Central Bank of Ireland (the "Central Bank"), as competent authority for the purpose of Directive 2003/71/EC and amendments thereto including Directive 2010/73/EU (the "Prospectus Directive"), as a base prospectus in accordance with the requirements imposed under EU and Irish law pursuant to the Prospectus Directive for the purpose of giving information with regard to the issue of notes ("Notes") issued under the Euro Medium Term Note Programme (the "Programme") described in this Base Prospectus by Santander Consumer Bank S.p.A. (the "Issuer") during the period of twelve months after the date hereof. Such approval relates only to Notes which are to be admitted to trading on the regulated market of the Irish Stock Exchange (the "Regulated Market") or other regulated markets for the purposes of Directive 2004/39/EC or which are offered to the public in any Relevant Member State. Applications have been made to the Irish Stock Exchange to admit Notes issued under the Programme during the period of twelve months after the date hereof to listing on the official list of the Irish Stock Exchange (the "Official List") and to trading on the Regulated Market of the Irish Stock Exchange which is a regulated market for the purposes of Directive 2004/39/EC. -

Banca Sella Group Consolidated Report And

BANCA SELLA GROUP CONSOLIDATED REPORT AND FINANCIAL STATEMENTS 2012 Drawn up by the Parent Company BANCA SELLA HOLDING S.p.A. This in an English translation of the Italian Original “GRUPPO BANCA SELLA – BILANCIO CONSOLIDATO 2012”. It contains the Consolidated Financial Statements at 31 December 2012, consisting of the balance sheet, the income statement, the statement of changes in shareholders’ equity, the cash flow report, the statement of consolidated comprehensive income and the notes to the statements, accompanied by the report on operations. In case of doubt, the Italian version prevails. Please note that the present Report and Financial Statements in displaying figures adopt the Italian system of commas instead of dots: therefore for example one thousand is displayed as 1.000, while three point four percent is displayed as 3,4%. Contents Map of the Banca Sella Group…………………………………………………………………................................3 Main corporate boards and committees of the parent company Banca Sella Holding S.p.A…..............................4 Consolidated Report on Operations at 31 December 2012 6 Main figures and indicators........................................................................................................................................7 Rating...........................................................................................................................................................................9 Macroeconomic reference scenario...........................................................................................................................9 -

BANCA SELLA S.P.A. (Incorporated with Limited Liability Under the Laws of the Republic of Italy)

Base Prospectus BANCA SELLA S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) €1,000,000,000 Euro Medium Term Note Programme This document has been approved as a base prospectus (the “Base Prospectus”) issued in compliance with Directive 2003/71/EC (as amended, to the extent such amendments have been implemented in the relevant Member State of the European economic area (the “European Economic Area”) (the “Prospectus Directive”) by the Commission de Surveillance du Secteur Financier (the “CSSF”) in its capacity as competent authority under the Loi relative aux prospectus pour valeurs mobilières dated 10 July 2005 which implements the Prospectus Directive in Luxembourg (the “Luxembourg Prospectus Law”). Application has been made by Banca Sella S.p.A. (the “Issuer”) for notes (“Notes”) issued under the €1,000,000,000 Euro Medium Term Note Programme (the “Programme”) described in this Base Prospectus during the period of twelve months after the date hereof to be listed on the official list and admitted to trading on the regulated market of the Luxembourg Stock Exchange, which is a regulated market for the purposes of the Markets in Financial Instruments Directive 2004/39/EC (each such regulated market being a “Regulated Market”). The Programme also allows for Notes to be unlisted or to be admitted to listing, trading and/or quotation by such other or further competent authorities, stock exchanges and/or quotation systems as may be agreed with the Issuer. There are certain risks relating to the Issuer and the Notes which potential investors should ensure they fully understand. -

Gruppo Banca Sella

GRUPPO BANCA SELLA CONSOLIDATED ANNUAL REPORT 2007 Drawn up by the Parent Company BANCA SELLA HOLDING S.p.A. (formerly Sella Holding Banca S.p.A) CONSOLIDATED ANNUAL REPORT-CONTENTS BOARD OF DIRECTORS OF THE PARENT COMPANY BANCA SELLA HOLDING S.p.A. 7 BOARD OF STATUTORY AUDITORS OF THE PARENT COMPANY BANCA SELLA HOLDING S.p.A. 7 AUDIT COMMITTEE 7 BOARD OF DIRECTORS’ REPORT ON ACCOUNTS 9 Gruppo Banca Sella financial highlights . 10 Gruppo Banca Sella alternative performance indicators . 11 Strategic issues . 12 Rating . 14 Financial year result . 15 Profit distribution policy . 28 Commercial and distribution policies . 29 Human resources . 33 Research and development activities . 35 Internal controls . 37 Change in the Group structure and in equity investment . 42 Group companies . 47 Outlook . 58 Significant events occurred after the close of the financial year . 61 Own shares . 62 Reconciliation statement between shareholders’ equity and net profit of the parent company and consolidated shareholders’ equity and profit . 63 REPORT OF THE BOARD OF STATUTORY AUDITORS 65 Report of the board of statutory auditors . 66 CONSOLIDATED FINANCIAL STATEMENTS AT 31 DECEMBER 2007 69 Consolidated balance sheet . 70 Consolidated income statement . 71 Consolidated cash flow statement (direct method) . 72 Changes to consolidated shareholders’ equity . 73 EXPLANATORY NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 75 PART A – ACCOUNTING POLICIES 77 Consolidated Annual Report 2007 - PART B – INFORMATION ON THE CONSOLIDATED BALANCE SHEET 99 ASSETS Section 1 – Cash and liquidities . 100 Section 2 – Financial assets held for trading . 101 Section 3 – Financial assets evaluated at fair value . 106 Section 4 – Financial assets available for sale .