Corporate Update August 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

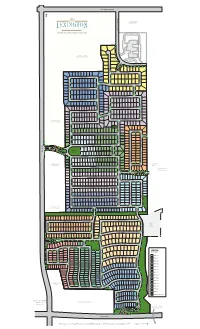

Lexington Phases Mastermap RH HR 3-24-17

ELDORADO PARKWAY MAMMOTH CAVE LANE CAVE MAMMOTH *ZONED FUTURE LIGHT RETAIL MASTER PLANNED GATED COMMUNITY *ZONED FUTURE RETAIL/MULTI-FAMILY MAJESTIC PRINCE CIRCLE MAMMOTH CAVE LANE T IN O P L I A R E N O D ORB DRIVE ARISTIDES DRIVE MACBETH AVENUE MANUEL STREETMANUEL SPOKANE WAY DARK STAR LANE STAR DARK GIACOMO LANE CARRY BACK LANE 7 8 NORTHERN DANCER WAY GALLAHADION WAY GRINDSTONE MANOR GRINDSTONE FUNNY CIDE COURT FUNNY THUNDER GULCH WAY BROKERS TIP LANE MANUEL STREETMANUEL E PLAC RAL DMI WAR A DAY STAR WAY *ZONED FUTURE 3 LIGHT COMMERCIAL BOLD FORBES STREET FERDINAND TRAIL LEONATUS LANE LEONATUS PONDER LANE SEATTLE SLEW STREET GRAHAM AVENUE WINTERGREEN DRIVE COIT ROAD COIT SECRETARIAT BOULEVARD COUNT TURF COUNT DRIVE AMENITY SMARTY JONES STREET CENTER STRIKE GOLD BOULEVARD 2 DEBONAIR LANE LUCKY 5 CAVALCADE DRIVE CAVALCADE 1 Yucca Ridge *ZONED FUTURE FLYING EBONY STREET LIGHT RETAIL Park AFFIRMED AVENUE Independence High School SUTHERLAND LANE AZRA TRAIL OMAHA DRIVE BOLD VENTURE AVENUE CONQUISTADOR COURT CONQUISTADOR LUCKY DEBONAIR LANE LUCKY OXBOW AVENUE OXBOW CAVALCADE DRIVE CAVALCADE 4 WHIRLAWAY DRIVE 9 IRON LIEGE DRIVE *ZONED FUTURE IRON LIEGE DRIVE LIGHT COMMERCIAL 6 A M EMPIRE MAKER ROAD E RISEN STAR ROAD R I BUBBLING OVER ROAD C WAR EMBLEM PLACE WAR A N Future P H City A R O Park A H D R I V E 14DUST COMMANDER COURT CIRCLE PASS FORWARD DETERMINE DRIVE SPECTACULAR BID STREET REAL QUIET RD. TIM TAM CIRCLE EASY GOER AVENUE LEGEND PILLORY DRIVE PILLORY BY PHASES HALMA HALMA TRAIL 11 PHASE 1 A PROUD CLAIRON STREET M E MIDDLEGROUND PLACE -

BANE Barn 29 Hip No

Property of Calumet Farm Hip No. Barn 682 BANE 29 Bay Colt; foaled May 8, 2005 Bold Reasoning Seattle Slew ...................... My Charmer Vindication........................ Strawberry Road (AUS) Strawberry Reason............ Pretty Reason BANE Majestic Light Wavering Monarch............ Uncommitted Whiffling........................... (1985) Bold Ruler Queen's Gambit ................ So Social By VINDICATION (2000). Champion 2-year-old colt, stakes winner of 4 races in 4 starts at 2, $680,950, Bessemer Trust Breeders' Cup Juvenile [G1] (AP, $556,400), Kentucky Cup Juvenile S. [G3] (TP, $62,750). Half-broth- er to stakes winner Scipion. His first foals are yearlings of 2006. Son of horse of the year Seattle Slew, leading sire, sire of 111 stakes winners, 8 champions, including Slew o' Gold ($3,533,534), A.P. Indy ($2,979,815, Belmont S. [G1], etc.), Surfside (8 wins, $1,852,987, Frizette S. [G1], etc.). 1st dam WHIFFLING, by Wavering Monarch. Winner at 3, $27,900. Dam of 12 other registered foals, 12 of racing age, including a 2-year-old of 2006, 8 to race, 6 winners, including-- PRAIRIE BAYOU (g. by Little Missouri). 7 wins in 12 starts at 2 and 3, $1,450,621, champion 3-year-old colt, Preakness S. [G1], Jim Beam S. [G2], Blue Grass S. [G2], Whirlaway Breeders' Cup S. [L] (AQU, $66,- 030), Count Fleet S. [L] (AQU, $41,040), 2nd Kentucky Derby [G1], Pap- pa Riccio S. [L] (AQU, $11,616), Inner Harbor S. [L] (LRL, $10,000). FLITCH (c. by Demons Begone). 8 wins, 2 to 4, $628,796, National Muse- um of Racing Hall of Fame S. -

250000 Pat Day Mile Presented by LG&E and KU

$250,000 Pat Day Mile Presented by LG&E and KU (Grade III) 92nd Running – Saturday, May 7, 2016 (Kentucky Derby Day) 3-Year-Olds at One Mile on Dirt at Churchill Downs Stakes Record – 1:34.18, Competitive Edge (2015) Top Beyer Speed Figure – 112, Richter Scale (1997) Average Winning Beyer Speed Figure (since 1992) – 99.9 (2,398/24) Name Origin: Formerly known as the Derby Trial, the one-mile race for 3-year-olds was moved from Opening Night to Kentucky Derby Day and renamed the Pat Day Mile in 2015 to honor Churchill Downs’ all-time leading jockey Pat Day. Day, enshrined in the National Museum of Racing’s Hall of Fame in 2005, won a record 2,482 races at Churchill Downs, including 156 stakes, from 1980-2005. None was more memorable than his triumph aboard W.C. Partee’s Lil E. Tee in the 1992 Kentucky Derby. He rode in a record 21 consecutive renewals of the Kentucky Derby, a streak that ended when hip surgery forced him to miss the 2005 “Run for the Roses.” Day’s Triple Crown résumé also included five wins in the Preakness Stakes – one short of Eddie Arcaro’s record – and three victories in the Belmont Stakes. His 8,803 career wins rank fourth all-time and his mounts that earned $297,914,839 rank second. During his career Day lead the nation in wins six times (1982-84, ’86, and ’90-91). His most prolific single day came on Sept. 13, 1989, when Day set a North American record by winning eight races from nine mounts at Arlington Park. -

Lex Mastermap Handout

ELDORADO PARKWAY M A MM *ZONED FUTURE O TH LIGHT RETAIL C A VE LANE MASTER PLANNED GATED COMMUNITY *ZONED FUTURE RETAIL/MULTI-FAMILY M A J E MAMMOTH CAVE LANE S T T IN I C O P P L I R A I N R E C N E O C D I R C L ORB DRIVE E A R I S T MACBETH AVENUE I D E S D R I V E M SPOKANE WAY D ANUEL STRE ARK S G I A C T O AR LANE CARRY BACK LANE 7 M O E L T A N E 8 NORTHERN DANCER WAY GALLAHADION WAY GRINDS FUN N T Y CIDE ONE THUNDER GULCH WAY M C ANOR OU BROKERS TIP LANE R T M ANUEL STRE E PLAC RAL DMI WAR A E T DAY STAR WAY *ZONED FUTURE 3 LIGHT COMMERCIAL BOLD FORBES STREET FERDINAND VIEW LEON PONDER LANE A TUS LANE SEATTLE SLEW STREET GRAHAM AVENUE WINTE R GREEN DRIVE C OIT SECRETARIAT BOULEVARD C OUNT R O TURF DRIVE AD S AMENITY M A CENTER R T Y JONES STRE STRIKE GOLD BOULEVARD E T L 5 2 UC K Y DEBONAIR LANE C 1 A Yucca Ridge *ZONED FUTURE V FLYING EBONY STREET A LIGHT RETAIL L C Park ADE DRIVE AFFIRMED AVENUE Independence High School SUTHERLAND LANE AZRA TRAIL OMAHA DRIVE BOLD VENTURE AVENUE C L ONQUIS UC O XBOW K Y DEBONAIR LANE C 4 T A ADOR V A A VENUE L C ADE DRIVE WHIRLAWAY DRIVE C OU R 9T IRON LIEGE DRIVE *ZONED FUTURE IRON LIEGE DRIVE LIGHT COMMERCIAL 6 A M EMPIRE MAKER ROAD E RISEN STAR ROAD R I BUBBLING OVER C W A AR EMBLEM PL N Future P H City A R O Park A H D R A O R CE I AD V E DUST COMMANDER COURT FO DETERMINE DRIVE R W ARD P 14 ASS CI SPECTACULAR BID STREET REAL QUI R CLE E T R TIM TAM CIRCLE D . -

Will Justify Win the Triple Crown?

Will there be a Triple Crown Winner this year? Mike E. Smith on Justify, Kentucky Derby On May 5, Justify won the Kentucky Derby. There are 2 more thoroughbred horse races that he has to enter and win in order to win the Triple Crown of thoroughbred Racing ... the Preakness and the Belmont. Can he do it? What are his chances? The three races that make up the Triple Crown are the (1) Kentucky Derby, the (2) Preakness Stakes, and the (3) Belmont Stakes. Kentucky Derby races began in 1875; Preakness races began in 1870; and the Belmont began in 1867. But in all of those years since these races began only 12 horses have won all three. Triple Crown winners Year Winner Jockey 2015 American Pharoah Victor Espinoza 1978 Affirmed Steve Cauthen 1977 Seattle Slew Jean Cruguet 1973 Secretariat Ron Turcotte 1948 Citation Eddie Arcaro 1946 Assault Warren Mehrtens 1943 Count Fleet Johnny Longden 1941 Whirlaway Eddie Arcaro 1937 War Admiral Charles Kurtsinger 1935 Omaha Willie "Smokey" Saunders 1930 Gallant Fox Earl Sande 1919 Sir Barton Johnny Loftus Even though all three races have been in existence since 1875, let's start considering our data when the first horse won all three races in 1919 ... Sir Barton won. 1. How many years have elapsed between 1919 and now? There are different ways to look at what might be the most usual gap between winners. We could figure out the gap that occurs most often (mode); or what the mean number of years of a gap is; or what is the most central measurement (median) of the various gaps. -

1930S Greats Horses/Jockeys

1930s Greats Horses/Jockeys Year Horse Gender Age Year Jockeys Rating Year Jockeys Rating 1933 Cavalcade Colt 2 1933 Arcaro, E. 1 1939 Adams, J. 2 1933 Bazaar Filly 2 1933 Bellizzi, D. 1 1939 Arcaro, E. 2 1933 Mata Hari Filly 2 1933 Coucci, S. 1 1939 Dupuy, H. 1 1933 Brokers Tip Colt 3 1933 Fisher, H. 0 1939 Fallon, L. 0 1933 Head Play Colt 3 1933 Gilbert, J. 2 1939 James, B. 3 1933 War Glory Colt 3 1933 Horvath, K. 0 1939 Longden, J. 3 1933 Barn Swallow Filly 3 1933 Humphries, L. 1 1939 Meade, D. 3 1933 Gallant Sir Colt 4 1933 Jones, R. 2 1939 Neves, R. 1 1933 Equipoise Horse 5 1933 Longden, J. 1 1939 Peters, M. 1 1933 Tambour Mare 5 1933 Meade, D. 1 1939 Richards, H. 1 1934 Balladier Colt 2 1933 Mills, H. 1 1939 Robertson, A. 1 1934 Chance Sun Colt 2 1933 Pollard, J. 1 1939 Ryan, P. 1 1934 Nellie Flag Filly 2 1933 Porter, E. 2 1939 Seabo, G. 1 1934 Cavalcade Colt 3 1933 Robertson, A. 1 1939 Smith, F. A. 2 1934 Discovery Colt 3 1933 Saunders, W. 1 1939 Smith, G. 1 1934 Bazaar Filly 3 1933 Simmons, H. 1 1939 Stout, J. 1 1934 Mata Hari Filly 3 1933 Smith, J. 1 1939 Taylor, W. L. 1 1934 Advising Anna Filly 4 1933 Westrope, J. 4 1939 Wall, N. 1 1934 Faireno Horse 5 1933 Woolf, G. 1 1939 Westrope, J. 1 1934 Equipoise Horse 6 1933 Workman, R. -

2018 Media Guide NYRA.Com 1 FIRST RUNNING the First Running of the Belmont Stakes in 1867 at Jerome Park Took Place on a Thursday

2018 Media Guide NYRA.com 1 FIRST RUNNING The first running of the Belmont Stakes in 1867 at Jerome Park took place on a Thursday. The race was 1 5/8 miles long and the conditions included “$200 each; half forfeit, and $1,500-added. The second to receive $300, and an English racing saddle, made by Merry, of St. James TABLE OF Street, London, to be presented by Mr. Duncan.” OLDEST TRIPLE CROWN EVENT CONTENTS The Belmont Stakes, first run in 1867, is the oldest of the Triple Crown events. It predates the Preakness Stakes (first run in 1873) by six years and the Kentucky Derby (first run in 1875) by eight. Aristides, the winner of the first Kentucky Derby, ran second in the 1875 Belmont behind winner Calvin. RECORDS AND TRADITIONS . 4 Preakness-Belmont Double . 9 FOURTH OLDEST IN NORTH AMERICA Oldest Triple Crown Race and Other Historical Events. 4 Belmont Stakes Tripped Up 19 Who Tried for Triple Crown . 9 The Belmont Stakes, first run in 1867, is one of the oldest stakes races in North America. The Phoenix Stakes at Keeneland was Lowest/Highest Purses . .4 How Kentucky Derby/Preakness Winners Ran in the Belmont. .10 first run in 1831, the Queens Plate in Canada had its inaugural in 1860, and the Travers started at Saratoga in 1864. However, the Belmont, Smallest Winning Margins . 5 RUNNERS . .11 which will be run for the 150th time in 2018, is third to the Phoenix (166th running in 2018) and Queen’s Plate (159th running in 2018) in Largest Winning Margins . -

Two Legs up on Triple Crown Pinch Hitter*

Griffs Frustrated fundny skt SPORTS Garden C By Mantle. 6-5 TWELVE PAGES WASHINGTON, D. C., MAY 18, 1968 By BI'ITON HAWKINS i speed, grabbed the ball on the But luff Wrlttr dead run. juggled It. but held Mickey Mantle dui deeper- on. ately acroaa Griffith Stadium's J Thue the Senator*, only • rloae-cropped turf to make a -eme end a half ahead of the superb catch of a scorching last-place Whit* Sox, lost their liner by Plnch-hltter Julio , 1fourth game in a row as Bobov Shentx hi* straight Preakness, Beequer with two base for won fourth Captures oo Tim Tam a tame-ending out that pre- still the Senator*, who have served a 6-5 victory for the lost seven of nine game*, fell Yankee* over the Senator* yes- six game* back of the dratted terday. Yankee*, who have won 17 of game*. Up point Sena- their 33 The Senator*. to that the Oriole* and tied tor* extracted amazing Athletic* are had second with .500 efficiency from four previous for record*. Two Legs Up on Triple Crown pinch hitter*. Bob Malkmu* Third Lae* far Stobbs singled a* a pinch hitter and The Yankees, threatening to Roy Sievera socked a three-run blow the American League race homer in a pinch role In the wide open with scarcely a Lincoln Road eighth inning to whittle Wash- month gone, got near-maximum fMA ington's deficit to one run. 1 mileage from their alx hits off ¦ With one down In the ninth i four pitchers a* they Inflicted Beaten Again Pinch-hitter Alble Pearson > a third straight loss on Chuek * singled off Ryne Duren. -

Airoforce Stalllion Analysis 9-9-19

STALLION ANALYSIS DATE: 9/8/19 (Colonel John - Chocolate Pop, by Cuvee) IRON MAIDENS THOROUGHBREDS [email protected] IRON MAIDENS THOROUGHBREDS Pedigree Consultant SECTION I STALLION AND IMMEDIATE FAMILY http://www.ironmaidensthoroughbreds.com ♦ 1 ♦ [email protected] ♦ 772-475-9798 IRON MAIDENS THOROUGHBREDS Pedigree Consultant AIROFORCE 2019 STALLION MATING ANALYSIS AIROFORCE (Colonel John - Chocolate Pop, by Cuvee) 2013 Gray/Roan 16.2 Hands Record: 12-3-3-0 ($679,130) Section I: STALLION AND IMMEDIATE FAMILY Airoforce is Colonel John’s most accomplished son. He has the long, lean elegance of a classic Thoroughbred, reminiscent of his sire Colonel John and second damsire, Canadian Champion With Approval, yet Airoforce received precocious speed from his damsire Cuvee. Airoforce was victorious at distances ranging between 6 1/2-furlongs and 1 1/16-miles. Although he competed mainly on turf, Airoforce won a key stake over dirt. His immediate pedigree has dirt and turf attributes. A magnificent looking $350,00 OBS April sales purchase campaigned by John Oxley, Airoforce flashed precociousness and speed in his debut, drawing away to win a six-furlong turf sprint by 3 1/4-lengths in a sharp 1:10.34, just a second off the Kentucky Downs track record. Airoforce dominated the Dixiana Bourbon Stakes (G3) by 2 1/2-lengths over a full field of fourteen over the Keeneland turf, including Camelot Kitten, Surgical Strike. Airoforce faced a full field of high-class youngsters as the favorite in the 2015 Breeders’ Cup Juvenile Turf (G1). and missed the victory by a neck, after racing in traffic and being distracted in the stretch. -

Beacon Hill Alternative Septic Systems As Provided by Loudoun County Dept of Health

Beacon Hill Alternative Septic Systems as provided by Loudoun County Dept of Health Drainfield on Golf, Equestrian Address Street or HOA Easement 1 40911 ALYSHEBA DR 2 40957 ALYSHEBA DR 3 40963 ALYSHEBA DR 4 40983 ALYSHEBA DR 5 41011 ALYSHEBA DR 6 41043 ALYSHEBA DR 7 41119 ALYSHEBA DR 8 40163 BEACON HILL DR 9 40436 BEACON HILL DR 10 40577 BLACK GOLD PL 11 40582 BLACK GOLD PL 12 40647 BLACK GOLD PL X 13 40657 BLACK GOLD PL X 14 40690 BLACK GOLD PL X 15 40714 BLACK GOLD PL 16 40728 BLACK GOLD PL X 17 40740 BLACK GOLD PL X 18 40748 BLACK GOLD PL X 19 40768 BLACK GOLD PL X 20 40771 BLACK GOLD PL 21 40777 BLACK GOLD PL X 22 16751 BOLD VENTURE DR 23 16872 BOLD VENTURE DR 24 16886 BOLD VENTURE DR 25 16889 BOLD VENTURE DR 26 16987 BOLD VENTURE DR 27 17151 BOLD VENTURE DR 28 17237 CANNONADE DR X 29 17356 CANNONADE DR X 30 17244 CANNONADE DR X 31 17247 CANNONADE DR X 32 17256 CANNONADE DR X 33 17322 CANNONADE DR X 34 17323 CANNONADE DR X 35 17334 CANNONADE DR X 36 17335 CANNONADE DR 37 17359 CANNONADE DR 38 40671 CARRY BACK LA X 39 40685 CARRY BACK LA X 40 40691 CARRY BACK LA X 41 40703 CARRY BACK LA 1 Beacon Hill Alternative Septic Systems as provided by Loudoun County Dept of Health Drainfield on Golf, Equestrian Address Street or HOA Easement 42 40717 CARRY BACK LA 43 17285 COUNT TURF PL 44 17307 COUNT TURF PL 45 17360 COUNT TURF PL 46 17397 COUNT TURF PL X 47 40578 FARM MARKET RD 48 40672 FARM MARKET RD 49 40265 IRON LIEGE CT X 50 40285 IRON LIEGE CT 51 40290 IRON LIEGE CT X 52 40307 IRON LIEGE CT X 53 40314 IRON LIEGE CT X 54 40319 IRON LIEGE -

RUNNING STYLE at Quarter Mile Decidedly 1962 9 9 ¼ Carry Back 1961 11 18

RUNNING STYLE At Quarter Mile Decidedly 1962 9 9 ¼ Carry Back 1961 11 18 Venetian Way 1960 4 3 ½ Wire-To-Wire Kentucky Derby Winners : Horse Year Call Lengths Tomy Lee 1959 2 1 ½ American Pharoah 2015 3 1 Tim Tam 1958 8 11 This listing represents 22 Kentucky Derby California Chrome 2014 3 2 Iron Liege 1957 3 1 ½ winners that have led at each point of call during the Orb 2013 16 10 Needles 1956 16 15 race. Points of call for the Kentucky Derby are a I’ll Have Another 2012 6 4 ¼ quarter-mile, half-mile, three-quarter-mile, mile, Swaps 1955 1 1 Animal Kingdom 2011 12 6 Determine 1954 3 4 ½ stretch and finish. Super Saver 2010 6 5 ½ From 1875 to 1959 a start call was given for Dark Star 1953 1 1 ½ Mine That Bird 2009 19 21 Hill Gail 1952 2 2 the race, but was discontinued in 1960. The quarter- Big Brown 2008 4 1 ½ Count Turf 1951 11 7 ¼ mile then replaced the start as the first point of call. Street Sense 2007 18 15 Middleground 1950 5 6 Barbaro 2006 5 3 ¼ Ponder 1949 14 16 Wire-to-Wire Winner Year Giacomo 2005 18 11 Citation 1948 2 6 Smarty Jones 2004 4 1 ¾ War Emblem 2002 Jet Pilot 1947 1 1 ½ Funny Cide 2003 4 2 Winning Colors-f 1988 Assault 1946 5 3 ½ War Emblem 2002 1 ½ Spend a Buck 1985 Hoop Jr. 1945 1 1 Monarchos 2001 13 13 ½ Bold Forbes 1976 Pensive 1944 13 11 Riva Ridge 1972 Fusaichi Pegasus 2000 15 12 ½ Count Fleet 1943 1 head Kauai King 1966 Charismatic 1999 7 3 ¾ Shut Out 1942 4 2 ¼ Jet Pilot 1947 Real Quiet 1998 8 6 ¾ Whirlaway 1941 8 15 ½ Silver Charm 1997 6 4 ¼ Count Fleet 1943 Gallahadion 1940 3 2 Grindstone 1996 15 16 ¾ Bubbling Over 1926 Johnstown 1939 1 2 Thunder Gulch 1995 6 3 Paul Jones 1920 Lawrin 1938 5 7 ½ Go for Gin 1994 2 head Sir Barton 1919 War Admiral 1937 1 1 ½ Sea Hero 1993 13 10 ¾ Regret-f 1915 Bold Venture 1936 8 5 ¾ Lil E. -

BAY COLT Barn 37 Hip No

Consigned by Hurstland Farm (Alfred H. Nuckols, Jr.), Agent II Barn Hip No. 37 BAY COLT 909 Foaled March 3, 2013 Forty Niner Distorted Humor ............... Danzig's Beauty Regal Ransom................... Red Ransom Kelli's Ransom.................. Musical Minister BAY COLT Fort Wood Horse Chestnut (SAF)....... London Wall Destiny's Reward .............. (2006) Doc's Leader Doc's Destiny.................... Ventured By REGAL RANSOM (2006). Hwt. in U.A.E., black-type winner of 4 races, 2 to 4, $1,894,835, Super Derby [G2] (LAD, $450,000), Saeed & Moham- med Al Naboodah Group U.A.E. Derby [G2], 2nd Alysheba S. [G3] (CD, $68,832), Gulf News U.A.E. Two Thousand Guineas [G3], Sir Shackleton H. (GP, $11,600). Half-brother to black-type winner Devil May Care. His first foals are yearlings of 2014. Son of black-type winner Distorted Humor, leading sire, sire of 114 black-type winners, 3 champions. 1st dam DESTINY'S REWARD, by Horse Chestnut (SAF). Dam of 1 other registered foal, a 2-year-old of 2014. 2nd dam Doc's Destiny, by Doc's Leader. 4 wins at 3 and 4, $152,844, 2nd Dr. James Penny Memorial H. [L] (PHA, $20,000). Dam of 4 winners, including-- Heart of Destiny (f. by Lion Heart). Winner at 2 and 3, $217,639, 2nd Dar- ley Alcibiades S. [G1] (KEE, $80,000). Brother Bobby (g. by Out of Place). 3 wins at 3 and 4, $298,213, 2nd Oaklawn H. [G2] (OP, $100,000), Philip H. Iselin Breeders' Cup H. [G3] (MTH, $60,000), Seattle Slew Breeders' Cup H.