CMA CGM Unveils Guarantee Solution with Upto

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cargo November 2020.Pdf

THE COMPLETE RESOUrcE FOR THE CARGO INDUStrY CARGO AiRPORTS | AiRLinES | FREIGHT FORWARDERS | SHIPPERS | TECHNOLOGY | BusinEss Volume 11 | Issue 02 | November 2020 | ì250 / $8 US A Profiles Media Network Publication www.cargonewswire.com Turkish Cargo The Preferred Business Partner of the Air Cargo Industry Finnair Cargo CargoAi facilities ready digitalization for distribution made easy of Covid -19 vaccines Lufthansa Cargo Welcomes ninth B777F in Frankfurt Emirates SkyCargo Marks 18 years of Cargo Flights to Shanghai CARGONEWSWIRE.COM world’s leading air cargo publication Engage with the website and its social media platform through Display Ads, web banners, job posts, carousels, jobs, native stories, micro-sites... For advertising queries please contact: [email protected] cargonewswire1 cargonewswire1 cargonewswire1 cargonewswire1 | BUSINESS T H E C O M P L E T E R E S O U R C E F O R T H E C A R G| OSHIPPERS I N D US | T TECHNOLOGY R Y | FREIGHT FORWARDERS CARGO AIRPORTS | AIRLINES Global Air Cargo market ì250 / $8 US Volume 11 | Issue 02 | November 2020 | A Profiles Media Network Publication www.cargonewswire.com takes steps to Recovery Turkish Cargo The Preferred Business Partner of the Air Cargo Industry Finnair A record ‘dynamic load factor’ and high gains. The elevated load factor for Cargo CargoAi facilities ready digitalization for distribution airfreight rates on the world’s premier westbound volumes rose to 84% in made easy of Covid -19 vaccines Lufthansa trade lanes in September showed the September – up 18 percentage points Cargo Welcomes ninth B777F in Frankfurt global air cargo market edging towards versus September 2019 – while the Emirates SkyCargo a sustainable recovery at the start of eastbound ‘dynamic load factor’ was Marks 18 years of Cargo Flights to Shanghai the traditional peak season, say leading 67%. -

Issue 4 - Year 2020

ISSN 2667-8624 VOLUME 1 - ISSUE 4 - YEAR 2020 VOLUME 1 - YEAR 2020 - ISSUE 4 contents ISSN 2667-8624 Publisher & Editor in Chief Managing Editor Ayşe Akalın Cem Akalın [email protected] cem.akalin@aviationturkey. com International Relations & Advertisement Director Administrative Şebnem Akalın Coordinator sebnem.akalin@ Yeşim Bilginoğlu Yörük aviationturkey.com y.bilginoglu@ aviationturkey.com Chief Advisor to Editorial Board Editors Can Erel / Aeronautical Muhammed Yılmaz/ Engineer Aeronautical Engineer Translation İbrahim Sünnetçi Tanyel Akman Şebnem Akalin Saffet Uyanık 18 Proof Reading & Editing Mona Melleberg Yükseltürk Photographer Sinan Niyazi Kutsal Graphic Design Mehmet Gülsemin Bolat İmtiyaz Sahibi Nane: “We Görkem Elmas Hatice Ayşe Evers will Look Advisory Board Basım Yeri Aslıhan Aydemir Demir Ofis Kırtasiye Towards Serdar Çora Perpa Ticaret Merkezi B Blok 8 Renan Gökyay Kat:8 No:936 Şişli / İstanbul a Brighter Lale Selamoğlu Kaplan Tel: +90 212 222 26 36 Assoc. Prof. Ferhan Kuyucak Turkey’s Tomorrow demirofiskirtasiye@hotmail. Şengür com International with Hearts Adress www.demirofiskirtasiye.com Full of Hope Administrative Office Cooperation, Basım Tarihi DT Medya LTD.STI Nisan-2020 Expertise and İlkbahar Mahallesi Galip Erdem Caddesi Sinpaş Yayın Türü Forward Vision Altınoran Kule 3 No:142 Süreli in Aviation Çankaya Ankara/Turkey Tel: +90 (312) 557 9020 [email protected] www.aviationturkey.com © All rights reserved. No part of publication may be ONUR VCS/VRS reproduced by any means without written permission. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

European Airlines: Brace for More Turbulence

7 September 2020 Corporates European airlines: brace for more turbulence What’s next after demand shock, bailouts? European airlines: brace for more turbulence What’s next after demand shock, bailouts? Government support has helped large European network carriers avert a liquidity crisis, with air traffic to fall at least 50% in 2020. Deleveraging after the Covid-19 Analysts crisis will be a challenge for a sector not known for rich free cash flow generation. Werner Stäblein European airlines secured direct financial government support of more than EUR 25bn +49 69 667738912 after the onset of the coronavirus crisis earlier this year. The liquidity buffers most airlines [email protected] had in place were insufficient to cope with a crisis of the magnitude brought on by the pandemic which led to the grounding of almost all aircraft in April and May. Sebastian Zank, CFA +49 30 27891 225 The funding situation is now stabilised due to state aid. However, future deleveraging and [email protected] operational restructuring - including the downsizing of operations - will prove challenging Azza Chammem for some industry players. Visibility on traffic recovery is low. Customers for long-haul and +49 30 27891 240 short-haul traffic continue to book on very short notice. Business travel is recovering only [email protected] slowly. Air freight is one sector that has done comparably well, but with gradually rising passenger traffic comes increased freight capacity on passenger aircraft. Such an Media increase will compress elevated cargo yields. The air freight business is also too small to offset shortfalls in revenue from passenger travel. -

16325/09 ADD 1 GW/Ay 1 DG C III COUNCIL of the EUROPEAN

COUNCIL OF Brussels, 19 November 2009 THE EUROPEAN UNION 16325/09 ADD 1 AVIATION 191 COVER NOTE from: Secretary-General of the European Commission, signed by Mr Jordi AYET PUIGARNAU, Director date of receipt: 18 November 2009 to: Mr Javier SOLANA, Secretary-General/High Representative Subject: Commission staff working document accompanying the report from the Commission to the European Parliament and the Council European Community SAFA Programme Aggregated information report (01 january 2008 to 31 december 2008) Delegations will find attached Commission document SEC(2009) 1576 final. ________________________ Encl.: SEC(2009) 1576 final 16325/09 ADD 1 GW/ay 1 DG C III EN COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 18.11.2009 SEC(2009) 1576 final COMMISSION STAFF WORKING DOCUMENT accompanying the REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT AND THE COUNCIL EUROPEAN COMMUNITY SAFA PROGRAMME AGGREGATED INFORMATION REPORT (01 January 2008 to 31 December 2008) [COM(2009) 627 final] EN EN COMMISSION STAFF WORKING DOCUMENT AGGREGATED INFORMATION REPORT (01 January 2008 to 31 December 2008) Appendix A – Data Collection by SAFA Programme Participating States (January-December 2008) EU Member States No. No. Average no. of inspected No. Member State Inspections Findings items/inspection 1 Austria 310 429 41.37 2 Belgium 113 125 28.25 29.60 3 Bulgaria 10 18 4 Cyprus 20 11 42.50 5 Czech Republic 29 19 32.00 6 Denmark 60 16 39.60 7 Estonia 0 0 0 8 Finland 120 95 41.93 9 France 2,594 3,572 33.61 10 Germany 1,152 1,012 40.80 11 Greece 974 103 18.85 12 Hungary 7 9 26.57 13 Ireland 25 10 48.80 14 Italy 873 820 31.42 15 Latvia 30 34 30.20 16 Lithuania 12 9 48.08 17 Luxembourg 26 24 29.08 18 Malta 13 6 36.54 19 Netherlands 258 819 36.91 EN 2 EN 20 Poland 227 34 39.59 21 Portugal 53 98 46.51 22 Romania 171 80 28.37 23 Slovak Republic 13 5 23.69 24 Slovenia 19 8 27.00 25 Spain 1,230 2,227 39.51 26 Sweden 91 120 44.81 27 United Kingdom 610 445 39.65 Total 9,040 10,148 34.63 Non-EU ECAC SAFA Participating States No. -

C RSIA Carbon Offsetting and Reduction Scheme for International Aviation

INTERNATIONAL CIVIL AVIATION ORGANIZATION ICAO document CORSIA Aeroplane Operator to State Attributions December 2020 C RSIA Carbon Offsetting and Reduction Scheme for International Aviation This ICAO document is referenced in Annex 16 — Environmental Protection, Volume IV — Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). This ICAO document is material approved by the ICAO Council for publication by ICAO to support Annex 16, Volume IV and is essential for the implementation of the CORSIA. This ICAO document is available on the ICAO CORSIA website and may only be amended by the Council. Disclaimer: The designations employed and the presentation of the material presented in this ICAO document do not imply the expression of any opinion whatsoever on the part of ICAO concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. The table below shows the amendments to this ICAO document over time, together with the dates on which the amendments were approved by the Council. Amendments to the ICAO document “CORSIA Aeroplane Operator to State Attributions” Edition Amendment Approved Information on 670 aeroplane operators from 117 States. Belarus, Belize, Iceland, Iran (Islamic Republic of), Maldives, Mozambique, Solomon Islands, South Africa, and Turkmenistan 2nd Edition 20 Sep 2019 provided information for the first time. Comoros, Egypt, Lebanon, Mongolia, Philippines, San Marino, Saudi Arabia and Turkey updated the information previously submitted. Information on 690 aeroplane operators from 122 States. Cambodia, Guatemala, Nicaragua, Republic of Korea, and United 3rd Edition 24 Dec 2019 Republic of Tanzania provided information for the first time. -

Kenya Airways Annual Report & Financial Statements 2020

1 KENYA AIRWAYS | ANNUAL REPORT AND FINANCIAL STATEMENTS 2021 KENYA AIRWAYS ANNUAL REPORT & FINANCIAL STATEMENTS 2020 2 KENYA AIRWAYS | ANNUAL REPORT AND FINANCIAL STATEMENTS 2020 3 KENYA AIRWAYS | ANNUAL REPORT AND FINANCIAL STATEMENTS 2020 Table Of Contents Corporate Information 4 Board of Directors & Profiles 8 Management Team & Profiles 16 Chairman’s Statement 22 Taarifa ya Mwenyekiti 24 Chief Executive Officer’s Statement 29 Taarifa ya Afisa Mkuu Mtendaji 33 Statement of Corporate Governance 39 Performance Highlights 53 Report of the Directors 55 Directors’ Remuneration Report 61 Statement of Directors’ Responsibilities 64 Independent Auditors’ Report 65 Consolidated Statement of Profit or Loss and other Comprehensive Income 72 Company Statement of Profit or Loss and other Comprehensive Income 74 Consolidated Statement of Financial Position 75 Company Statement of Financial Position 77 Consolidated Statement of Changes in Equity 79 Company Statement of Changes in Equity 80 Consolidated Statement of Cash flows 81 Company Statement of Cash flows 82 Notes to the Financial Statements 85 Principal Shareholders and Share Distribution 175 AGM Notice 178 Proxy Forms 179 4 KENYA AIRWAYS | ANNUAL REPORT AND FINANCIAL STATEMENTS 2020 Corporate Information EXECUTIVE DIRECTORS Allan Kilavuka - (Appointed 1st January 2020) NON-EXECUTIVE DIRECTORS Mr. Michael Joseph - Chairman Mr. Jozef Veenstra * Ms. Caroline Armstrong Major Gen (rtd) Michael Gichangi Mrs. Esther Koimett Dr. Martin Oduor-Otieno Ms. Carol Musyoka Mr. John Ngumi Dr. Haron Sirima Mr. Solomon Kitungu (Appointed w.e.f 23rd April 2020) Mr. Nicholas Bodo (Alternate to Mr. Solomon Kitungu) * Dutch COMPANY SECRETARY Habil A. Waswani Certified Secretary Kenya Airways Headquarters and Base Airport North Road, Embakasi P.O. -

RASMAG/21−WP25 14-17/06/2016 International Civil Aviation Organization the Twenty-First Meeting of the Regional Airspace Safet

RASMAG/21−WP25 14-17/06/2016 International Civil Aviation Organization The Twenty-First Meeting of the Regional Airspace Safety Monitoring Advisory Group (RASMAG/21) Bangkok, Thailand, 14-17 June 2016 Agenda Item 5: Airspace Safety Monitoring Activities/Requirements in Asia/Pacific Region ESTIMATE OF RVSM LONG TERM HEIGHT MONITORING BURDEN FOR THE AUSTRALIAN AIRSPACE MONITORING AGENCY (AAMA) (Presented by Australia) SUMMARY This paper presents the current monitoring burden for aircraft registered and operated by Australia, Indonesia, the Solomon Islands and Papua New Guinea to meet Annex 6 requirements. 1. Introduction 1.1. The Long Term Height Monitoring Impact Statement developed by RASMAG was endorsed by APANPIRG/20 in September 2009. That statement included a determination by each of the Asia/Pacific Regional Monitoring Agencies (RMAs) of the anticipated monitoring burden for each State within the region. RASMAG/12 tasked the RMAs to review and update that data and subsequent meetings have seen RMAs report accordingly. The Australian Airspace Monitoring Agency (AAMA) last provided anticipated monitoring burden data at RASMAG/20. This current paper provides an update to that data. 2. Discussion 2.1 The AAMA has previously supplied data on its anticipated monitoring burden following the implementation of long term height monitoring in November 2010. The data was based on a review of the current RVSM approvals data for the State airspaces that the AAMA is responsible for, taking into account completed successful monitoring activity. 2.2 A review of the most recent RVSM approvals databases maintained by the AAMA on behalf of ICAO determined that the total number of RVSM approved aircraft totalled 1135 as at 8 June 2016. -

CHANGE FEDERAL AVIATION ADMINISTRATION CHG 2 Air Traffic Organization Policy Effective Date: November 8, 2018

U.S. DEPARTMENT OF TRANSPORTATION JO 7340.2H CHANGE FEDERAL AVIATION ADMINISTRATION CHG 2 Air Traffic Organization Policy Effective Date: November 8, 2018 SUBJ: Contractions 1. Purpose of This Change. This change transmits revised pages to Federal Aviation Administration Order JO 7340.2H, Contractions. 2. Audience. This change applies to all Air Traffic Organization (ATO) personnel and anyone using ATO directives. 3. Where Can I Find This Change? This change is available on the FAA website at http://faa.gov/air_traffic/publications and https://employees.faa.gov/tools_resources/orders_notices. 4. Distribution. This change is available online and will be distributed electronically to all offices that subscribe to receive email notification/access to it through the FAA website at http://faa.gov/air_traffic/publications. 5. Disposition of Transmittal. Retain this transmittal until superseded by a new basic order. 6. Page Control Chart. See the page control chart attachment. Original Signed By: Sharon Kurywchak Sharon Kurywchak Acting Director, Air Traffic Procedures Mission Support Services Air Traffic Organization Date: October 19, 2018 Distribution: Electronic Initiated By: AJV-0 Vice President, Mission Support Services 11/8/18 JO 7340.2H CHG 2 PAGE CONTROL CHART Change 2 REMOVE PAGES DATED INSERT PAGES DATED CAM 1−1 through CAM 1−38............ 7/19/18 CAM 1−1 through CAM 1−18........... 11/8/18 3−1−1 through 3−4−1................... 7/19/18 3−1−1 through 3−4−1.................. 11/8/18 Page Control Chart i 11/8/18 JO 7340.2H CHG 2 CHANGES, ADDITIONS, AND MODIFICATIONS Chapter 3. ICAO AIRCRAFT COMPANY/TELEPHONY/THREE-LETTER DESIGNATOR AND U.S. -

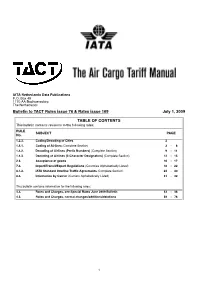

Bulletin to TACT Rules Issue 76 & Rates Issue 169 July 1, 2009

IATA Netherlands Data Publications P.O. Box 49 1170 AA Badhoevedorp The Netherlands Bulletin to TACT Rules issue 76 & Rates issue 169 July 1, 2009 TABLE OF CONTENTS This bulletin contains revisions to the following rules: RULE SUBJECT PAGE No. 1.2.3. Coding/Decoding of Cities 2 1.4.1. Coding of Airlines (Complete Section) 3- 8 1.4.2. Decoding of Airlines (Prefix Numbers) (Complete Section) 9- 11 1.4.3. Decoding of Airlines (2-Character Designators) (Complete Section) 12 - 15 2.3. Acceptance of goods 16 - 17 7.3. Import/Transit/Export Regulations (Countries Alphabetically Listed) 18 - 22 8.1.2. IATA Standard Interline Traffic Agreements (Complete Section) 23 - 30 8.3. Information by Carrier (Carriers Alphabetically Listed) 31 - 32 This bulletin contains information for the following rates: 4.3. Rates and Charges, see Special Rates June 2009 Bulletin 33 - 38 4.3. Rates and Charges, normal changes/additions/deletions 39 - 76 1 1.2.3. CODING/DECODING OF CITIES A. CODING OF CITIES In addition to the cities in alphabetical order the list below also contains: - Column 1: two-letter codes for states/provinces (See Rule 1.3.2.) - Column 2: two-letter country codes (See Rule 1.3.1.) - Column 3: three-letter city codes Additions: Cities 1 2 3 DEL CARMEN PH IAO NAJAF IQ NJF PSKOV RU PKV TEKIRDAG TR TEQ Changes: Cities 1 2 3 KANDAVU FJ KDV SANLIURFA TR SFQ B. DECODING OF CITIES In addition to the three-letter city codes (Column 1) in alphabetical order the list below also contains: - Column Cities: full name - Column 2: two-letter codes for states/provinces (See Rule 1.3.2.) - Column 3: two-letter country codes (See Rule 1.3.1.) Additions: 1 Cities 2 3 IAO DEL CARMEN PH NJF NAJAF IQ PKV PSKOV RU TEQ TEKIRDAG TR Changes: 1 Cities 2 3 KDV KANDAVU FJ SFQ SANLIURFA TR Bulletin, TACT Rules & Rates - July 2009 2 1.4.1. -

IATA Airline Designators Air Kilroe Limited T/A Eastern Airways T3 * As Avies U3 Air Koryo JS 120 Aserca Airlines, C.A

Air Italy S.p.A. I9 067 Armenia Airways Aircompany CJSC 6A Air Japan Company Ltd. NQ Arubaanse Luchtvaart Maatschappij N.V Air KBZ Ltd. K7 dba Aruba Airlines AG IATA Airline Designators Air Kilroe Limited t/a Eastern Airways T3 * As Avies U3 Air Koryo JS 120 Aserca Airlines, C.A. - Encode Air Macau Company Limited NX 675 Aserca Airlines R7 Air Madagascar MD 258 Asian Air Company Limited DM Air Malawi Limited QM 167 Asian Wings Airways Limited YJ User / Airline Designator / Numeric Air Malta p.l.c. KM 643 Asiana Airlines Inc. OZ 988 1263343 Alberta Ltd. t/a Enerjet EG * Air Manas Astar Air Cargo ER 423 40-Mile Air, Ltd. Q5 * dba Air Manas ltd. Air Company ZM 887 Astra Airlines A2 * 540 Ghana Ltd. 5G Air Mandalay Ltd. 6T Astral Aviation Ltd. 8V * 485 8165343 Canada Inc. dba Air Canada rouge RV AIR MAURITIUS LTD MK 239 Atlantic Airways, Faroe Islands, P/F RC 767 9 Air Co Ltd AQ 902 Air Mediterranee ML 853 Atlantis European Airways TD 9G Rail Limited 9G * Air Moldova 9U 572 Atlas Air, Inc. 5Y 369 Abacus International Pte. Ltd. 1B Air Namibia SW 186 Atlasjet Airlines Inc. KK 610 ABC Aerolineas S.A. de C.V. 4O * 837 Air New Zealand Limited NZ 086 Auric Air Services Limited UI * ABSA - Aerolinhas Brasileiras S.A. M3 549 Air Niamey A7 Aurigny Air Services Limited GR 924 ABX Air, Inc. GB 832 Air Niugini Pty Limited Austrian Airlines AG dba Austrian OS 257 AccesRail and Partner Railways 9B * dba Air Niugini PX 656 Auto Res S.L.U.