Western Australian Mineral and Petroleum Statistics Digest 2014-15

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254)

Table1.—Attribute data for the map "Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254). [The United States Geological Survey (USGS) surveys international mineral industries to generate statistics on the global production, distribution, and resources of industrial minerals. This directory highlights the economically significant mineral facilities of Asia and the Pacific. Distribution of these facilities is shown on the accompanying map. Each record represents one commodity and one facility type for a single location. Facility types include mines, oil and gas fields, and processing plants such as refineries, smelters, and mills. Facility identification numbers (“Position”) are ordered alphabetically by country, followed by commodity, and then by capacity (descending). The “Year” field establishes the year for which the data were reported in Minerals Yearbook, Volume III – Area Reports: Mineral Industries of Asia and the Pacific. In the “DMS Latitiude” and “DMS Longitude” fields, coordinates are provided in degree-minute-second (DMS) format; “DD Latitude” and “DD Longitude” provide coordinates in decimal degrees (DD). Data were converted from DMS to DD. Coordinates reflect the most precise data available. Where necessary, coordinates are estimated using the nearest city or other administrative district.“Status” indicates the most recent operating status of the facility. Closed facilities are excluded from this report. In the “Notes” field, combined annual capacity represents the total of more facilities, plus additional -

Statistics Digest 2006-07

WESTERN AUSTRALIAN MINERAL AND PETROLEUM STATISTICS DIGEST 2006–07 This publication is available on our website www.doir.wa.gov.au Head Office: Mineral House 100 Plain Street East Perth WA 6004 Telephone: +61 8 9222 3333 Facsimile: +61 8 9222 3568 Email: [email protected] For specific enquiries, please email: [email protected] DoIRAUG07_1259 Disclaimer Information provided in this Digest is made available without charge, as a public service, in good faith. The information provided is derived from sources believed to be reliable and accurate at the time of publication. However, use of the information in the Digest is at your own risk. The Digest is provided solely on the basis that users will be responsible for making their own assessment of the information provided therein and users are advised to verify all representations, statements and information for decisions that concern the conduct of business that involves monetary or operational consequences. Each user waives and releases the Department of Industry and Resources and the State of Western Australia and its servants to the full extent permitted by law from all and any claims relating to the use of the material in the Digest. In no event shall the Department of Industry and Resources or the State of Western Australia be liable for any incidental or consequential damages arising from any use or reliance on any material in the Digest. Copyright © 2007 Copyright in this document is reserved to the State of Western Australia. Reproduction except in accordance with copyright law is prohibited. CONTENTS FOREWORD 1 1. -

Our Company Annual Report 2011 a Disciplined Approach a Proven Strategy We Are BHP Billiton, a Leading Global Resources Company

For personal use only Our Company Annual Report 2011 A disciplined approach A proven strategy We are BHP Billiton, a leading global resources company. Our purpose is to create long-term shareholder value through the discovery, acquisition, development and marketing of natural resources. For personal use only BHP Billiton Limited. ABN 49 004 028 077. Registered in Australia. Registered office: 180 Lonsdale Street, Melbourne, Victoria 3000, Australia. BHP Billiton Plc. Registration number 3196209. Registered in England and Wales. Registered office: Neathouse Place, London SW1V 1BH, UK. Each of BHP Billiton Limited and BHP Billiton Plc are members of the BHP Billiton Group, which is headquartered in Australia. Contents 1 Key information 3 4 Board of Directors and information Key 1 1.1 Our business 3 Group Management Committee 104 1.2 Chairman’s Review 4 4.1 Board of Directors 104 1.3 Chief Executive Offi cer’s Report 5 4.2 Group Management Committee 107 1.4 Selected key measures 6 5 Corporate Governance Statement 108 1.5 Risk factors 7 5.1 Governance at BHP Billiton 108 1.6 Forward looking statements 11 5.2 Shareholder engagement 109 2 Information on the Company 12 5.3 Board of Directors 109 2.1 BHP Billiton locations 12 5.4 Board of Directors – Review, Information on the Company 2 2.2 Business overview 14 re-election and renewal 115 2.2.1 History and development 14 5.5 Board Committees 117 2.2.2 Petroleum Customer Sector Group 14 5.6 Risk management 124 2.2.3 Aluminium Customer Sector Group 21 5.7 Management 125 2.2.4 Base Metals Customer -

The Mineral Industry of Australia in 2012

2012 Minerals Yearbook AUSTRALIA U.S. Department of the Interior February 2015 U.S. Geological Survey THE MINERAL INDUSTRY OF AUSTRALIA By Pui-Kwan Tse Australia was subject to volatile weather in recent years Government Policies and Programs that included heavy rains and droughts. The inclement weather conditions affected companies’ abilities to expand The powers of Australia’s Commonwealth Government are their activities, such as port, rail, and road construction and defined in the Australian Constitution; powers not defined in the repair, as well as to mine, process, manufacture, and transport Constitution belong to the States and Territories. Except for the their materials. Slow growth in the economies of the Western Australian Capital Territory (that is, the capital city of Canberra developed countries in 2012 affected economic growth and its environs), all Australian States and Territories have negatively in many counties of the Asia and the Pacific region. identified mineral resources and established mineral industries. China, which was a destination point for many Australian Each State has a mining act and mining regulations that mineral exports, continued to grow its economy in 2012, regulate the ownership of minerals and the operation of mining although the rate of growth was slower than in previous years. activities in that State. The States have other laws that deal with As a result, Australia’s gross domestic product (GDP) increased occupational health and safety, environment, and planning. at a rate of 3.1% during 2012, which was higher than the All minerals in the land are reserved to the Crown; however, 2.3% rate of growth recorded in 2011. -

Government of Western Australia Department of Environment Regulation

Government of Western Australia Department of Environment Regulation NOTIFICATION OF APPLICATIONS RECEIVED FOR WORKS APPROVALS, LICENCES AND AMENDMENTS AND AVAILABLE FOR PUBLIC SUBMISSIONS AND/OR REGISTRATIONS OF INTEREST APPLICATIONS FOR WORKS APPROVALS AND NEW LICENCES Processing or bene ciation of metallic or non metallic ore: BHP Billiton Iron Ore Pty Ltd, Wilson St, PORT HEDLAND (W5792/2015/1) [*1] Sewage facility: Roy Hill Station Pty Ltd, Lot 2 on Plan 144017, NEWMAN (W5803/2015/1) [*1] Mine dewatering: Cliffs Asia Paci c Iron Ore Pty Ltd (Mt Jackson), M77/994, MT JACKSON (L8873/2015/1) [*3] Mine dewatering: Brightsun Enterprises Pty Ltd (Radio Gold Mine), M77/63, BULLFINCH (W5793/2015/1) [*3] Processing or bene ciation of metallic or non metallic ore: Saracen Metals (Thunderbox Gold Mine), L36/155, LEONORA, (W5794/2015/1) [*3] Processing or bene ciation of metallic or non metallic ore: St Ives Gold Mining Company Pty Ltd, M15/1565-1570, Kambalda, (W5795/2015/1) [*3] Sewage Facility: Polaris Metals Pty Ltd (J4), L77/274, SOUTHERN CROSS (W5798/2015/1) [*3] Metal Coating: Nagrom Technologies Pty Ltd (Line-X Australia Headquarters), Brant Road, KELMSCOTT (W5801/2015/1) [*4] Livestock saleyard or holding pen: Wellard Animal Production Pty Ltd (Beaufort River Meats), Leggoe Rd, BEAUFORT RIVER (W5788/2015/1) [*5] Class II or III putrescible land ll site: Opal Vale Pty Ltd (Salt Valley Road Class II Land ll), Chitty Rd, HODDY’S WELL (W5800/2015/1) [*4] APPLICATIONS FOR LICENCE RENEWALS Liquid waste facility: Tox Free Australia Pty Ltd (Karratha), Lot 126 on Plan 183297, COOYA POOYA (L8332/2009/3) [*1] Class II or III putrescible land ll site: City of Cockburn (Henderson Waste Recovery Park), Lot 202 on Plan 60443, HENDERSON (L6965/1997/14) [*4] Chemical manufacturing: Upper Great Southern Regional Renewable Energy Group Pty Ltd (CBH Facility), Marconi St, PINGELLY (L8416/2010/2) [*4] Submissions may be forwarded to the Department of Environment Regulation Regional Of ce (address speci ed below) within 21 days of this advertisement. -

The Mineral Industry of Australia in 2008

2008 Minerals Yearbook AUSTRALIA U.S. Department of the Interior August 2010 U.S. Geological Survey THE MINERAL INDUS T RY OF AUS T RALIA By Pui-Kwan Tse Australia was one of the world’s leading mineral producing and the Brockman iron project in the Pilbara region of Western countries and ranked among the top 10 countries in the world Australia (Australian Bureau of Agricultural and Resource in the production of bauxite, coal, cobalt, copper, gem and Economics, 2009a). near-gem diamond, gold, iron ore, lithium, manganese ore, tantalum, and uranium. Since mid-2008, the global financial Minerals in the National Economy crisis had sharply weakened world economic activities, and the slowdown had been particularly pronounced in the developed Australia’s mining sector contributed more than $105 billion countries in the West. Emerging Asian economies were also to the country’s gross domestic product (GDP), or 7.7% of the adversely affected by the sharply weaker demand for exports GDP during fiscal year 2007-08. In 2008, the mining sector and tighter credit conditions. After a period of strong expansion, employed 173,900 people who worked directly in mining and an Australia’s economic growth decreased by 0.5% in the final additional 200,000 who were involved in supporting the mining quarter of 2008. Overall, Australia’s economy grew at a rate activities. Expectations of sustained levels of global demand for of 2.4% during 2008. During the past several years, owing to minerals led to increased production of minerals and metals in anticipated higher prices of mineral commodities in the world Australia, and the mineral industry was expected to continue markets, Australia’s mineral commodity output capacities to be a major contributor to the Australian economy in the next expanded rapidly. -

The Mineral Industry of Australia in 2007

2007 Minerals Yearbook AUSTRALIA U.S. Department of the Interior December 2009 U.S. Geological Survey THE MINERAL INDUS T RY OF AUS T RALIA By Pui-Kwan Tse Australia was one of the world’s leading mineral producing Constitution belong to the States and Territories. All powers that countries and ranked among the top 10 countries in the world in relate to mineral resources and their production belong to the the production of bauxite, coal, cobalt, copper, gem and near- States and Territories. Except for the Australian Capital Territory gem diamond, gold, iron ore, lithium, manganese ore, tantalum, (that is, the capital city Canberra and its environs), all Australian and uranium. Reflecting an increase in world demand for States and Territories have identified mineral resources and mineral commodities, the Australian economy grew at a rate of established mineral industries. 3.9% during 2007. Owing to anticipated higher prices of mineral The Mineral Council of Australia (MCA) urged the Federal commodities in the world markets, the Australian economy Government to establish a nationwide project approval process continued expanding and, as a result, surplus productive that would be consistent across all jurisdictions to reduce capacity was expected in the future. Owing to an increase in regulatory burdens that were affecting the mineral sector. In domestic demand and a tightening in the labor market, the addition, 10 principal statutes govern occupational health and consumer price index increased by 4.2% in 2007. safety in Australia, and, according to the MCA, this multilayer Australia’s total mineral exploration spending, excluding regulatory regime imposes a significant administrative burden petroleum, was $1,751.9 million (A$2,061.1 million) in 2007. -

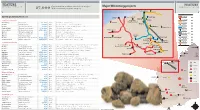

Feature Feature Major Wa Mining Projects

FEATURE FEATURE MINING OUTLOOK Construction workers needed for major Major WA mining projects MINING OUTLOOK 27,000 WA resources projects 2014-15 Source: Pitcrew Port Hedland Pardoo Rio Tinto rail MAJOR WA MINING PROJECTS Dampier Cape Lambert Iron Bridge Mt Dove Rio Tinto mine Completed in past year Balla Balla Abydos (Forge Resources) BHP rail Karara Mining Karara project $2.6bn Mid West Production ramp-up proceeding Sino Iron Wodgina Rio Tinto Hope Downs 4 mine $2.1bn Pilbara First production in H1 2013, ramping up to 15mtpa BHP mine Rio Tinto Marandoo mine expansion $1.1bn Pilbara Production will be sustained at 15mtpa for 16 further years Mt Webber McPhee Creek FMG rail Fortescue Metals Christmas Creek 2 expansion $US1.0bn Pilbara Completed in June 2013 quarter Fortescue Metals Port Hedland port expansion $US2.4bn Pilbara Fourth berth and support infrastructure opened in Aug 2013 Pannawonica FMG mine Atlas Iron Mt Dove mine development n/a Pilbara Production commenced in Dec 2012 Hancock proposed rail Atlas Iron Abydos mine development n/a Pilbara First haulage in Aug 2013, ramping up to 2-3mtpa Solomon Atlas Iron Utah Point 2 stockyard n/a Pilbara Largely complete and now ready to receive ore Hancock mine Hub Christmas Creek Rio Tinto Argyle Diamonds underground mine $US2.2bn Kimberley Production commenced in H1 2013 and is ramping up Buckland (Iron Ore Holdings) Cloudbreak Mineral Resources Sandfire Resources DeGrussa copper mine $US384m Mid West Ramp-up to nameplate production nearing completion Koodaideri Roy Hill Atlas Iron Construction -

Questions and Speeches ______

WESTERN AUSTRALIA __________ INDEX TO PARLIAMENTARY DEBATES (HANSARD) LEGISLATIVE COUNCIL and LEGISLATIVE ASSEMBLY __________ INDEX TO QUESTIONS AND SPEECHES __________ THIRTY-NINTH PARLIAMENT FIRST SESSION 11 April 2013 to 12 December 2013 __________ 62° ELIZABETH II 2013 INDEX TO QUESTIONS AND SPEECHES ABETZ, MR PETER, BAgriSci (Hons), (Southern River) (Lib) Address-in-Reply — motion, 135 Aboriginal education, 138 drugs, 138 Judaeo–Christian values, 136 post-election thankyous, 135 prostitution, 137 sport facilities, 138 transport, 137 Agriculture and Food, table grapes, importation — motion, 2939 Appropriation (Consolidated Account) Capital 2013–14 Bill 2013 — second reading — cognate debate, 3582 457 visa holders, school fees, 3584 European visit, 3582 gay marriage, 3585 government initiatives and projects, 3584 roads and agriculture, 3585 solar feed-in tariff scheme, 3583 Appropriation (Consolidated Account) Recurrent 2013–14 Bill 2013 — second reading — cognate debate, 3582 see also “Appropriation (Consolidated Account) Capital 2013–14 Bill 2013” Associations Incorporation Act, g., 341 Attorney General Classification (Publications, Films and Computer Games) Enforcement Act, g., 5486 Criminal Property Confiscation Act, g., 1485 Battle of El Alamein, gift of gratitude, s., 1532 Corrective Services Banksia Hill Detention Centre, 2913, 5517 Hakea Prison, asbestos, 1952 Wandoo Reintegration Facility, 6019 Criminal Code Amendment Bill (No. 2) 2013 — second reading, 4598 Criminal Investigation (Identifying People) Amendment Bill 2013 — second reading, 2638 Delegated Legislation, Joint Standing Committee on sixty-third report, “Information Report in relation to: Children’s Court (Fees) Amendment Regulations (No. 2) 2012, Civil Judgments Enforcement Amendment Regulations 2012, Coroners Amendment Regulations 2012, District Court (Fees) Amendment Regulations (No. 3) 2012, Evidence (Video and Audio Links Fees and Expenses) Amendment Regulations (No. -

49422 DO PROSPECT SEPT.Indd

WESTERN AUSTRALIA’S INTERNATIONAL RESOURCES DEVELOPMENT MAGAZINE September–November 2004 $3 (inc GST) Nickel Kambalda reborn Discoveries: The search takes off Kwinana’s golden anniversary DEPARTMENT OF INDUSTRY AND RESOURCES Investment Services 168 St Georges Terrace PERTH Western Australia 6000 Postal address: Box 7606 • Cloisters Square Perth Western Australia 6850 FROM THE MINISTER Tel: +61 8 9327 5555 • Fax: +61 8 9222 3862 Email: [email protected] www.doir.wa.gov.au New hi-tech airborne geological survey INTERNATIONAL OFFICES Europe European Offi ce • 5th fl oor, Australia Centre he Western Australian Government’s However, while Corner of Strand and Melbourne Place A$12million hi-tech airborne our resources sector LONDON WC2B 4LG • UNITED KINGDOM geological survey program will is vital to our State’s Tel: +44 20 7240 2881 • Fax: +44 20 7240 6637 T Email: [email protected] potentially unlock billions of dollars in economy, nothing is Clive Brown, MLA Minister for State India — Mumbai natural resources and create new jobs more important than Development Western Australian Trade Offi ce and opportunities for current and future ensuring workers return 93 Jolly Maker Chambers No 2 9th fl oor, Nariman Point • MUMBAI 400 021 INDIA generations of Western Australians. home safely. Tel: +91 22 5630 3979/74/78 • Fax: +91 22 5630 3977 The new four-year program is designed Western Australia’s resources sector has Email: [email protected] to double the area of the State covered by a strong and enviable record in protecting India — Chennai Western Australian Trade Offi ce - Advisory Offi ce base-line airborne geophysical data that the health and safety of its workers and the 1 Doshi Regency • 876 Poonamallee High Road provides an image of the rocks beneath number one priority of the industry is to Kilpauk • Chennai 600 084 • INDIA soil and sand cover. -

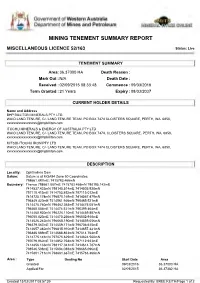

Mining Tenement Summary Report

Government of Western Australia Department of Mines and Petroleum MINING TENEMENT SUMMARY REPORT MISCELLANEOUS LICENCE 52/163 Status: Live TENEMENT SUMMARY Area: 36.37000 HA Death Reason : Mark Out : N/A Death Date : Received : 02/09/2015 08:33:48 Commence : 09/03/2016 Term Granted : 21 Years Expiry : 08/03/2037 CURRENT HOLDER DETAILS Name and Address BHP BILLITON MINERALS PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] ITOCHU MINERALS & ENERGY OF AUSTRALIA PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474, CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] MITSUI-ITOCHU IRON PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] DESCRIPTION Locality: Ophthalmia Dam Datum: Datum is at MGA94 Zone 50 Coordinates. 798661.887mE; 7415783.466mN Boundary: Thence 798661.887mE 7415783.466mN 798195.142mE 7414537.433mN 798145.514mE 7414505.938mN 797110.415mE 7414753.892mN 797115.012mE 7414725.174mN 796870.169mE 7414567.479mN 796849.420mE 7414561.946mN 796465.521mE 7414475.760mN 796462.363mE 7414475.051mN 796460.004mE 7414474.521mN 796399.464mE 7414460.930mN 796226.110mE 7414459.887mN 796050.820mE 7414470.256mN 796032.918mE 7414526.242mN 796068.190mE 7414559.056mN 796379.567mE 7414559.171mN 796736.615mE 7414657.382mN 796815.910mE 7414657.431mN 796886.689mE 7414688.863mN 797014.764mE 7414775.141mN 797075.629mE 7414824.500mN 797079.962mE 7414852.758mN 797112.933mE 7414856.133mN -

Iron Ore Briefing and Western Australia Iron Ore Site Tour

BHP Billiton Limited BHP Billiton Plc 171 Collins Street Neathouse Place Melbourne Victoria 3000 Australia London SW1V 1LH UK GPO BOX 86 Tel +44 20 7802 4000 Melbourne Victoria 3001 Australia Fax + 44 20 7802 4111 Tel +61 1300 55 47 57 Fax +61 3 9609 3015 bhpbilliton.com bhpbilliton.com 6 October 2014 To: Australian Securities Exchange cc: London Stock Exchange New York Stock Exchange JSE Limited IRON ORE BRIEFING AND WESTERN AUSTRALIA IRON ORE SITE TOUR Jimmy Wilson, President, Iron Ore will host an Iron Ore briefing and a Western Australia Iron Ore (WAIO) site tour on Monday 6 October 2014, Tuesday 7 October 2014 and Wednesday 8 October 2014. A copy of the materials to be presented is attached. Further information on BHP Billiton can be found at: www.bhpbilliton.com. Nicole Duncan Company Secretary For personal use only NEWS RELEASE Release Time IMMEDIATE Date 6 October 2014 Number 17/14 COST REDUCTIONS AND CAPITAL EFFICIENT GROWTH AT WAIO BHP Billiton President Iron Ore, Jimmy Wilson, today announced plans to cut unit costs at Western Australia Iron Ore (WAIO) by at least 25 per cent and the potential to increase capacity there by 65 million tonnes per year at a very low capital cost. Mr Wilson outlined BHP Billiton’s view of the long-term supply and demand trends in the iron ore market. “We continue to see healthy demand growth for iron ore in the mid-term as Chinese steel production is expected to increase by approximately 25 per cent to between 1.0 and 1.1 billion tonnes in the early to mid-2020s,” he said.