WA Iron Ore Profile – June.2018 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Welcome to Cloudbreak

Welcome to Cloudbreak This booklet provides you with the information needed to help make your stay at Cloudbreak more pleasant. Please take the time to read through the information before arriving on site. FEBRUARY 2009 Table of Contents Welcome Message ........................................................................................... 1 Foreword ..................................................................................................... 1 PART ONE: Before you depart ......................................................................... 2 The Pilbara ....................................................................................................... 3 Fortescue Metals Group Limited ...................................................................... 3 Cloudbreak....................................................................................................... 3 Packed and ready to go .................................................................................... 4 At the departure lounge ............................................................................... 4 Parking at Perth Airport ............................................................................... 5 Staying in touch ............................................................................................... 5 On Arrival ......................................................................................................... 5 At the Airstrip .............................................................................................. -

UGL Limited, Roy Hill – Western Australia

FACT SHEET UGL Limited, Roy Hill – Western Australia Roy Hill Iron Ore mine, the only independent iron ore project with CUSTOMER UGL Limited West Australian majority ownership, is a 655 million tonne per LOCATION Roy Hill, Western Australia annum iron ore mining, rail and port development in the Pilbara DESCRIPTION Penske Australia has supplied, region. Situated approximately 115 kilometres north of Newman, commissioned and managed the Roy Hill is a world-class, low phosphorus iron ore deposit. installation of three diesel-powered containerised gensets from MTU for The operation consists of a conventional open pit mine and wet the diesel power station, as part of processing plant. There is a single rail line for heavy haul cartage Alinta Energy’s power supply to the and a purpose built two-berth iron ore port facility at Port Hedland Roy Hill Iron Ore mine that is capable of stockpiling, screening and exporting mined product. OPERATIONAL DATE August 2015 Roy Hill enlisted the services of Alinta on the two-phase construction project to provide a 121 km 220 kV transmission line and substation with 6 MW diesel back-up power. Alinta partnered with Penske Australia customer UGL Engineering, under a turnkey design and construction contract. CONFIGURATION As part of the project with UGL, Penske Australia has installed and commissioned three state-of-the-art containerised gensets from MTU to deliver critical power solutions for the mine infrastructure. The generators are configured to run in various operational modes including blackstart operation, island operation and grid parallel mode. FEATURES The DP 2870 D5C diesel gensets feature the 20V 4000 G63 engine and deliver 2.5 MW prime power at 50 degrees ambient, critical for the harsh heat and aridity of the Pilbara. -

Our Company Annual Report 2011 a Disciplined Approach a Proven Strategy We Are BHP Billiton, a Leading Global Resources Company

For personal use only Our Company Annual Report 2011 A disciplined approach A proven strategy We are BHP Billiton, a leading global resources company. Our purpose is to create long-term shareholder value through the discovery, acquisition, development and marketing of natural resources. For personal use only BHP Billiton Limited. ABN 49 004 028 077. Registered in Australia. Registered office: 180 Lonsdale Street, Melbourne, Victoria 3000, Australia. BHP Billiton Plc. Registration number 3196209. Registered in England and Wales. Registered office: Neathouse Place, London SW1V 1BH, UK. Each of BHP Billiton Limited and BHP Billiton Plc are members of the BHP Billiton Group, which is headquartered in Australia. Contents 1 Key information 3 4 Board of Directors and information Key 1 1.1 Our business 3 Group Management Committee 104 1.2 Chairman’s Review 4 4.1 Board of Directors 104 1.3 Chief Executive Offi cer’s Report 5 4.2 Group Management Committee 107 1.4 Selected key measures 6 5 Corporate Governance Statement 108 1.5 Risk factors 7 5.1 Governance at BHP Billiton 108 1.6 Forward looking statements 11 5.2 Shareholder engagement 109 2 Information on the Company 12 5.3 Board of Directors 109 2.1 BHP Billiton locations 12 5.4 Board of Directors – Review, Information on the Company 2 2.2 Business overview 14 re-election and renewal 115 2.2.1 History and development 14 5.5 Board Committees 117 2.2.2 Petroleum Customer Sector Group 14 5.6 Risk management 124 2.2.3 Aluminium Customer Sector Group 21 5.7 Management 125 2.2.4 Base Metals Customer -

Feature Feature Major Wa Mining Projects

FEATURE FEATURE MINING OUTLOOK Construction workers needed for major Major WA mining projects MINING OUTLOOK 27,000 WA resources projects 2014-15 Source: Pitcrew Port Hedland Pardoo Rio Tinto rail MAJOR WA MINING PROJECTS Dampier Cape Lambert Iron Bridge Mt Dove Rio Tinto mine Completed in past year Balla Balla Abydos (Forge Resources) BHP rail Karara Mining Karara project $2.6bn Mid West Production ramp-up proceeding Sino Iron Wodgina Rio Tinto Hope Downs 4 mine $2.1bn Pilbara First production in H1 2013, ramping up to 15mtpa BHP mine Rio Tinto Marandoo mine expansion $1.1bn Pilbara Production will be sustained at 15mtpa for 16 further years Mt Webber McPhee Creek FMG rail Fortescue Metals Christmas Creek 2 expansion $US1.0bn Pilbara Completed in June 2013 quarter Fortescue Metals Port Hedland port expansion $US2.4bn Pilbara Fourth berth and support infrastructure opened in Aug 2013 Pannawonica FMG mine Atlas Iron Mt Dove mine development n/a Pilbara Production commenced in Dec 2012 Hancock proposed rail Atlas Iron Abydos mine development n/a Pilbara First haulage in Aug 2013, ramping up to 2-3mtpa Solomon Atlas Iron Utah Point 2 stockyard n/a Pilbara Largely complete and now ready to receive ore Hancock mine Hub Christmas Creek Rio Tinto Argyle Diamonds underground mine $US2.2bn Kimberley Production commenced in H1 2013 and is ramping up Buckland (Iron Ore Holdings) Cloudbreak Mineral Resources Sandfire Resources DeGrussa copper mine $US384m Mid West Ramp-up to nameplate production nearing completion Koodaideri Roy Hill Atlas Iron Construction -

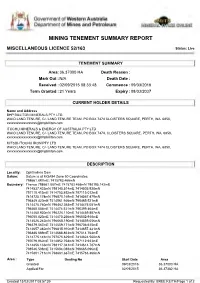

Mining Tenement Summary Report

Government of Western Australia Department of Mines and Petroleum MINING TENEMENT SUMMARY REPORT MISCELLANEOUS LICENCE 52/163 Status: Live TENEMENT SUMMARY Area: 36.37000 HA Death Reason : Mark Out : N/A Death Date : Received : 02/09/2015 08:33:48 Commence : 09/03/2016 Term Granted : 21 Years Expiry : 08/03/2037 CURRENT HOLDER DETAILS Name and Address BHP BILLITON MINERALS PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] ITOCHU MINERALS & ENERGY OF AUSTRALIA PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474, CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] MITSUI-ITOCHU IRON PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] DESCRIPTION Locality: Ophthalmia Dam Datum: Datum is at MGA94 Zone 50 Coordinates. 798661.887mE; 7415783.466mN Boundary: Thence 798661.887mE 7415783.466mN 798195.142mE 7414537.433mN 798145.514mE 7414505.938mN 797110.415mE 7414753.892mN 797115.012mE 7414725.174mN 796870.169mE 7414567.479mN 796849.420mE 7414561.946mN 796465.521mE 7414475.760mN 796462.363mE 7414475.051mN 796460.004mE 7414474.521mN 796399.464mE 7414460.930mN 796226.110mE 7414459.887mN 796050.820mE 7414470.256mN 796032.918mE 7414526.242mN 796068.190mE 7414559.056mN 796379.567mE 7414559.171mN 796736.615mE 7414657.382mN 796815.910mE 7414657.431mN 796886.689mE 7414688.863mN 797014.764mE 7414775.141mN 797075.629mE 7414824.500mN 797079.962mE 7414852.758mN 797112.933mE 7414856.133mN -

Pilbara 1 (PIL1 – Chichester Subregion)

Pilbara 1 Pilbara 1 (PIL1 – Chichester subregion) PETER KENDRICK AND NORM MCKENZIE AUGUST 2001 Subregional description and biodiversity arnhemensis and other Critical Weight Range mammals, arid zone populations of Ghost Bat (Macroderma gigas), values Northwestern Long-eared Bat (Nyctophilus bifax daedalus) and Little Northwestern Free-tailed Bat Description and area (Mormopterus loriae cobourgensis) are also significant in the subregion. The Chichester subregion (PIL 1) comprises the northern section of the Pilbara Craton. Undulating Rare Flora: Archaean granite and basalt plains include significant Species of subregional significance include Livistona areas of basaltic ranges. Plains support a shrub steppe alfredii populations in the Chichester escarpment characterised by Acacia inaequilatera over Triodia (Sherlock River drainage). wiseana (formerly Triodia pungens) hummock grasslands, while Eucalyptus leucophloia tree steppes occur on ranges. Centres of endemism: The climate is Semi-desert-tropical and receives 300mm Bioregional endemics include Ningaui timealeyi, an of rainfall annually. Drainage occurs to the north via undescribed Planigale, Dasykaluta rosamondae, numerous rivers (e.g. De Grey, Oakover, Nullagine, Pseudomys chapmani, Pseudantechinus roryi, Diplodactylus Shaw, Yule, Sherlock). Subregional area is 9,044,560ha. savagei, Diplodactylus wombeyi, Delma elegans, Delma pax, Ctenotus rubicundus, Ctenotus affin. robustus, Egernia pilbarensis, Lerista zietzi, Lerista flammicauda, Dominant land use Lerista neander, two or three undescribed taxa within Lerista muelleri, Notoscincus butleri, Varanus pilbarensis, Grazing – native pastures (see Appendix B, key b), Acanthophis wellsi, Demansia rufescens, Ramphotyphlops Aboriginal lands and Reserves, UCL & Crown Reserves, pilbarensis, and Ramphotyphlops ganei. Conservation, and Mining leases. Refugia: Continental Stress Class There are no known true Refugia in PIL1, however it is possible that calcrete aquifers in the upper Oakover Continental Stress Class for PIL1 is 4. -

Iron Ore Briefing and Western Australia Iron Ore Site Tour

BHP Billiton Limited BHP Billiton Plc 171 Collins Street Neathouse Place Melbourne Victoria 3000 Australia London SW1V 1LH UK GPO BOX 86 Tel +44 20 7802 4000 Melbourne Victoria 3001 Australia Fax + 44 20 7802 4111 Tel +61 1300 55 47 57 Fax +61 3 9609 3015 bhpbilliton.com bhpbilliton.com 6 October 2014 To: Australian Securities Exchange cc: London Stock Exchange New York Stock Exchange JSE Limited IRON ORE BRIEFING AND WESTERN AUSTRALIA IRON ORE SITE TOUR Jimmy Wilson, President, Iron Ore will host an Iron Ore briefing and a Western Australia Iron Ore (WAIO) site tour on Monday 6 October 2014, Tuesday 7 October 2014 and Wednesday 8 October 2014. A copy of the materials to be presented is attached. Further information on BHP Billiton can be found at: www.bhpbilliton.com. Nicole Duncan Company Secretary For personal use only NEWS RELEASE Release Time IMMEDIATE Date 6 October 2014 Number 17/14 COST REDUCTIONS AND CAPITAL EFFICIENT GROWTH AT WAIO BHP Billiton President Iron Ore, Jimmy Wilson, today announced plans to cut unit costs at Western Australia Iron Ore (WAIO) by at least 25 per cent and the potential to increase capacity there by 65 million tonnes per year at a very low capital cost. Mr Wilson outlined BHP Billiton’s view of the long-term supply and demand trends in the iron ore market. “We continue to see healthy demand growth for iron ore in the mid-term as Chinese steel production is expected to increase by approximately 25 per cent to between 1.0 and 1.1 billion tonnes in the early to mid-2020s,” he said. -

Initial Public Offering (“IPO”) of Ordinary Shares in Mcaleese

McAleese Group Prospectus For personal use only Prospectus JOINT LEAD MANAGERS McAleese Limited ACN 156 354 068 Important Notices Offer and unknown risks, including the risks set out in The Shares have not been, and will not be, The Offer contained in this Prospectus is an Section 5, many of which are beyond the control registered under the US Securities Act or the invitation to acquire fully paid ordinary shares in of McAleese Group and the Directors. McAleese securities laws of any state or other jurisdiction in McAleese Limited (ACN 156 354 068) (“McAleese Group and the Directors cannot and do not give the United States and may not be offered or sold, Group”) (“Shares”). any assurance that the results, performance or directly or indirectly, in the United States unless the achievements expressed or implied by the forward Shares are registered under the US Securities Act, Lodgement and Listing looking statements contained in this Prospectus or an exemption from the registration requirements This Prospectus is dated 12 November 2013 and will actually occur and investors are cautioned of the US Securities Act and any other applicable was lodged with the Australian Securities and not to place undue reliance on these forward securities laws is available. Investment Commission (“ASIC”) on that date. looking statements. Except where required by law, See Section 7.7 for more detail on selling Neither ASIC nor the Australian Securities Exchange McAleese Group has no intention of updating or (“ASX”) takes any responsibility for the contents restrictions that apply to the offer and sale revising forward looking statements, or publishing of Shares in jurisdictions outside of Australia. -

WA Iron Ore Profile – January 2019 1

Western Australia Iron Ore Profile January 2019 THE WORLD IRON ORE MARKET Major global iron ore producers: 2017 Western Australia is the largest iron ore producer and exporter in the world, Western Australia accounting for 38% of global production Brazil and 56% of global seaborne exports in China 2017. Brazil is the second largest iron ore India producer and exporter in the world, Russia accounting for 17% of global production South Africa and 23% of global seaborne exports in 2017. Ukraine China (14%), India (7%) and Russia (5%) Iran are major global iron ore producers, but USA retain most of their production for Canada domestic steel production. China’s iron ore production rose 1% to 0Mt 200Mt 400Mt 600Mt 800Mt 1000Mt 302 million tonnes in 2017, following three Exported Consumed domestically/stockpiled successive years of decline since peaking Source: CRU, Iron Ore Market Outlook Statistical Review. at 506 million tonnes in 2013. China’s iron ore demand 1200Mt China accounted for 72% of global iron ore seaborne imports and 50% of global crude steel production in 2017. 1000Mt China’s iron ore imports rose 5% to 1,061 million tonnes in 2017. 800Mt China’s crude steel production fell 3% to 846 million tonnes in 2017. Around 1.4 600Mt tonnes of iron ore is used to make one tonne of crude steel. 400Mt CRU forecasts China’s iron ore imports to fall gradually over the next few years to 200Mt 1,022 million tonnes in 2022. Japan and South Korea were the next 0Mt 2005 2008 2011 2014 2017 2020 largest global iron ore importers in 2017. -

Roy Hill, Western Australia (1:250 000 Geological Series Explanatory Notes)

WESTERN AUSTRALIA SECOND EDITION A s. , . -. GEOLOGICAL SURVEY OF WESTERN AUSTRALIA 1:250 000 GEOLOGICAL SERIES-EXPLANATORY NOTES ROY HILL WESTERN AUSTRAL SECOND EDITION SHEET SF50-12 INTERNATIONAL INDEX by A. M. THORNE AND I. M. TYLER Perth. Western Australia 1997 MINISTER FOR MINES The Hon. Norman Moore, MLC ACTING DIRECTOR GENERAL L. C. Ranford DIRECTOR, GEOLOGICAL SURVEY OF WESTERN AUSTRALIA Pietro Guj Copy editor: A. George REFERENCE The recommended reference for this publication is: THORNE, A. M., and TYLER, I. M., 1997, Roy Hill, W.A. (2nd Edition): 1:250 000 Geological Series Explanatory Notes, 22p. ISSN 0729-3720 National Library of Australia Card Number and ISBN 0 7309 6556 2 CONTENTS INTRODUCTION ............................................................................................................... 1 PILBARA CRATON GRANITE-GREENSTONE ROCKS .............................................. 2 Serpentinite and tremolite-chlorite schist (ALL)............................................................... 2 Metamorphosed basalt (Ah) and pyroxene spinifex-textured basalt (Abnz) .................... 3 Metagabbro and hornblende schist (Aog) ....................................................................... 4 Schist derived from igneous rocks (AE) ........................................................................... 4 Banded iron-formation (Aci) ........................................................................................... 5 Metamorphosed granitoid rocks 5 Kurrana Granitoid Complex ( ........................................................................ -

AVEVA Worked Closely with Roy Hill to Develop a Greenfield Iron Ore Mining Site, Connecting the Entire Value Chain with Industry Leading Efficiency from Pit to Port

CUSTOMER CASE STUDY AVEVA worked closely with Roy Hill to develop a greenfield iron ore mining site, connecting the entire value chain with industry leading efficiency from pit to port. Roy Hill INDUSTRY Metals, Mining and Minerals Goals AVEVA Solution y Build a greenfield iron ore mine and mine y Demand Chain Planning and Scheduling (DCPS) process plant based on modern control y Inventory Tracking and Quality Management (ITQM) room automation principles. y Delay Accounting (DA) y Establish end-to-end visibility of the entire mining value chain from pit to port. y Capacity Simulation Model (Pre-CAPEX Analysis) y Create an organizational culture free from bureaucracy. Results y Meet mining capacity of 55 million tons y Established an ROC (Remote Operations per annum. Center) that centralizes all roles and functions linking mining operations. Challenges y Creating a fully integrated, greenfield mine- to-port operation that’s controlled remotely. y Avoid the organizational silos that many leading mining companies have evolved from. y Managing an ore reserve of 2.3 billion tons. y Realize resource-to-market potential y Mining approximately 1 million tons/day. by avoiding hidden inefficiencies. y Feeding approximately 73 million tons y Connect, automate, and control each per year into crushing facilities. component of the pit-to-port mining y Streamlining processes by facilitating site from a control center located collaboration among different functions, 1,300 km away from operations. and creating a high performance team connected by a digitized -

NYIYAPARLI CLAIM DESCRIPTION Dr Bill Day Tom Price September 3, 2003

NYIYAPARLI CLAIM DESCRIPTION Dr Bill Day Tom Price September 3, 2003 1. Introduction The Nyiyaparli claim (WAG6280/98; WC99/004) covers an area of about 40,250 square kilometres in the East Pilbara. A large area taking in a number of stations, reserves and land tenures are within the claim area: - Kumarina - Pt. Bulloo Downs - Weelarrana - Sylvania - Ethel Creek - Walagunya (ALT, held by Jigalong) - Roy Hill - Marillana - Balfour Downs - Mt. Divide - Pt. Wandanya - Robertson Range Most of these leases are held privately. The exceptions are: - Marillana, Sylvania and Ethel Creek, held by BHP; - Walagunya, held by the ALT, sub-leased to Jigalong Community; - Robertson Range, held by Jigalong Community; - Mt. Divide, held by the Irrangadji Group Association. Most of the Jigalong reserve lands (including Jigalong and Camp 61) are within the claim area, and subject to further discussions between the Nyiyaparli group and the Jigalong Council about future management in light of the State Government’s Aboriginal reserve transfer program. The Nyiyaparli claim area also includes non-exclusive tenures within the town of Newman, and three substantial parcels of UCL in the west, central and southeast parts of the area. The Nyiyaparli claim is represented by the PNTS, as are the neighbouring Palyku, Martu Idja Banyjima, and IBN claims. The Martu claim (WAG6110/98; WC96/078), represented by the Ngaanyatjarra Council NTRB, adjoins much of the eastern boundary of the Nyiyaparli claim area. The Nhanuwongka Wajarri and Ngarlawanga determination area abuts parts of the claim area in the southwest and, in the north, there is a substantial area of overlap with the Nyamal claim over the area of Mt.