Highmark Vision Coverage Makes It Easy to Get Vision Care

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dental and Vision Savings

Dental Powered by Aetna Dental Access® 15-50% Save 15 to 50% on dental care, in most instances** Enjoy a Bright Smile at a Lower Cost What Dental Does for You ▶ Save on dental services such as cleanings, X-rays, ▶ Use the discounts as often as needed crowns, root canals and fillings at over 238,000* available dental practice locations nationwide ▶ Use the Dental Price Transparency tool in the New Benefits app to know exactly what procedures cost ▶ Need specialty dental care? Save on orthodontics and before going to the dentist periodontics, too! How your Dental Discounts Compare to Insurance Insurance isn’t the only option when you need dental care. Your dental discounts provide valuable savings for you and your family, with no limit on the number of times you can use them. Dental powered by Aetna Typical Insurance Coverage Dental Access® After hitting your maximum I reached my annual with co-pays and deductibles, Save 15% to 50% off cleanings, maximum, but I need to get additional services or procedures x-rays, fillings, root canals, and a filling. will not be covered for the rest of crowns as often as needed. the plan year. Dependents may be covered My son needs braces, but I’m Save 15% to 50% off orthodontic for an additional cost, but not sure how we can afford services, with dependents orthodontists are not always that right now. covered at no additional cost. covered. Save 15% to 50% off surgical Ouch! I broke my tooth and Surgeries are not covered until procedures with no waiting need surgery. -

BLANE FRIEST, Individually and on ) ) Behalf of a Class of Similarly Situated Individuals, ) ) Civil Action No

Case 2:16-cv-03327-SDW-LDW Document 18 Filed 12/16/16 Page 1 of 24 PageID: 463 NOT FOR PUBLICATION UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY ___________________________________ ) BLANE FRIEST, individually and on ) ) behalf of a class of similarly situated individuals, ) ) Civil Action No. 2:16-cv-03327-SDW-LDW Plaintiff, ) ) v. ) ) OPINION LUXOTTICA GROUP S.P.A.; ) LUXOTTICA USA, LLC; LUXOTTICA ) RETAIL NORTH AMERICA, INC.; THE ) UNITED STATES SHOE CORP. t/a ) December 16, 2016 LENSCRAFTERS; JOHN DOES 1-5; and ABC CORPS 6-10, ) Defendants. ___________________________________ WIGENTON, District Judge. ) Before this Court is the Motion to Dismiss, pursuant to Federal Rule of Civil Procedure ) 12(b)(6), of Defendants Luxottica Group S.p.A.; Luxottica USA, LLC; Luxottica Retail North America, Inc.; and The United States Shoe Corp. t/a LensCrafters (“LensCrafters”) (collectively “Defendants”). This Court has jurisdiction over this matter pursuant to 28 U.S.C. § 1332. Venue is proper in this District pursuant to 28 U.S.C. § 1391(b). This Court, having considered the parties’ submissions, decides this matter without oral argument pursuant to Federal Rule of Civil Procedure 78. For the reasons stated below, Defendants’ Motion is GRANTED. I. FACTUAL HISTORY Defendants are four companies, one of which, LensCrafters, operates 888 retail prescription eyewear stores throughout the United States, including thirty in New Jersey. (Compl. 1 Case 2:16-cv-03327-SDW-LDW Document 18 Filed 12/16/16 Page 2 of 24 PageID: 464 ¶¶ 12-16.)1 Plaintiff, Blane Friest (“Plaintiff”), a New Jersey resident, purchased prescription eyeglasses from Defendant LensCrafters at an unspecified location on approximately December 22, 2014. -

DISCOUNTS & Savings to Help You and Your Family on Your Path to Wellness

for HMFP members DISCOUNTS & savings To help you and your family on your path to wellness These savings programs are not insurance products. Rather, they are discounts for programs and services designed to help keep members healthy and active. All programs subject to change without advance notice. • Visionworks: Get a free pair of prescription eyeglasses with Vision your covered routine eye exam.1 Also, save 40% on frames. • Vision discounts at popular locations: Save 35% on frames when you buy a complete pair of glasses. Save 20% on any frame or lens options purchased separately, or save 20% on other lens add- ons and services. Locations include: Target Optical, JC Penney Optical, Pearle Vision, Lenscrafters, In Style Optical and other EyeMed access network optical providers.2 • Harvard Vanguard Medical Associates: Save 40% on frames and 20% on prescription sunglasses. • Laser vision correction: Save up to 50% on procedures from Davis Vision, QualSight LASIK and US Laser Network locations in MA, ME, NH and CT. • Amplifon Hearing Health Care: Save on hearing services and save Hearing up to 50% on hearing aids. Plus, one year of follow-up services is included with purchase. Locations nationwide. • Flynn Associates: Save up to $200 per hearing aid, and get free quarterly cleanings, adjustments and more. • Speech-Language and Hearing Associates of Greater Boston, PC: Save up to $200 on each hearing aid purchase. Healthy • DASH for HealthTM: Save 50% on a six-month subscription for Eating this online program to help improve eating and exercise habits. • Eat Right Now: Save 25% on a subscription to this mindful eating app that combines neuroscience and mindfulness to reduce your craving-related eating by 40%. -

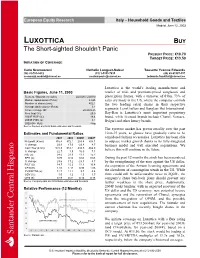

LUXOTTICA BUY the Short-Sighted Shouldn’T Panic PRESENT PRICE: €10.70 TARGET PRICE: €13.50 INITIATION of COVERAGE

European Equity Research Italy – Household Goods and Textiles Madrid, June 12, 2003 LUXOTTICA BUY The Short-sighted Shouldn’t Panic PRESENT PRICE: €10.70 TARGET PRICE: €13.50 INITIATION OF COVERAGE Carlo Scomazzoni Nathalie Longuet-Saleur Tousette Yvonne Edwards (34) 91-701-9432 (33) 1-5353-7435 (49) 69-91507-357 [email protected] [email protected] [email protected] Luxottica is the world’s leading manufacturer and Basic Figures, June 11, 2003 retailer of mid- and premium-priced sunglasses and Reuters / Bloomberg codes: LUX.MI / LUX IM prescription frames, with a turnover of €3bn. 73% of Market capitalisation (€ mn): 4,825 sales are made in the US, where the company controls Number of shares (mn): 452.1 the two leading retail chains in their respective Average daily volume (€ mn): 3.1 52-week range (€): 20.20-9.25 segments: LensCrafters and Sunglass Hut International. Free float (%): 25.0 Ray-Ban is Luxottica’s most important proprietary 2003E ROE (%): 18.4 brand, while licensed brands include Chanel, Versace, 2003E P/BV (x): 3.1 Bvlgari and other luxury brands. 2002-04F PEG: Neg Source: Reuters and SCH Bolsa estimates and forecasts. The eyewear market has grown steadily over the past Estimates and Fundamental Ratios 10-to-15 years, as glasses have gradually come to be 2001 2002 2003E 2004F considered fashion accessories. Luxottica has been able Net profit (€ mn): 316.4 372.1 283.4 308.1 to outpace market growth thanks to its fully-integrated % change: 23.9 17.6 -23.8 8.7 business model and well executed acquisitions. -

The National Association of School Nurses Teams up with Lenscrafters to Help Students Get a Head Start This School Year Through Proper Eye Care

The National Association of School Nurses Teams Up with LensCrafters to Help Students Get a Head Start this School Year through Proper Eye Care Silver Spring, MD (September 2, 2015) – Poor vision can impact a child’s achievement at school, as well as their mental and social development; in fact, it is estimated that 80 percent of a child’s learning comes through the eyes.i Therefore, it is critical that children receive proper eye care to help ensure they are learning in the classroom and staying as healthy as possible. To encourage good health and learning this school year, the National Association of School Nurses (NASN) is partnering with LensCrafters to educate parents and families about the importance of vision screening and regular eye exams. Children who are experiencing vision problems may not actually realize they are having issues. However, parents can be on the lookout for unexpected signs of eye problems, such as: Appearance of the eyes: different sized pupils, red eyes or swollen eyelids Behavior in school: excessive blinking, stumbling or daydreaming Complaints: headaches, dizziness, nausea or double vision Parents who are concerned about their child’s vision health should speak with a qualified healthcare professional, like their school nurse or an eye doctor. In schools, nurses play a vital role in conducting evidence-based vision screenings. “As nurses on the front-lines of childhood healthcare, we are often the first medical professional to identify a vision care need and can help alert parents to the issue, refer them for a comprehensive eye examination and assist in finding resources, if needed,” said Beth Mattey, President of the National Association of School Nurses. -

Consent Solicitation: Approval of the Transfer of the Notes from Luxottica to Essilorluxottica

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO THE UNITED STATES, OR TO ANY PERSON LOCATED OR RESIDENT IN, ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS DOCUMENT Consent solicitation: approval of the transfer of the Notes from Luxottica to EssilorLuxottica Charenton-le-Pont, France (November 26, 2019 – 6:00 pm) – Further to the press release dated 24 October 2019, Luxottica Group S.p.A. (“Luxottica”) and EssilorLuxottica S.A. (“EssilorLuxottica”) announce that in relation to the Euro 500,000,000 2.625 per cent. fixed rate notes due 10 February 2024 (ISIN: XS1030851791) issued by Luxottica in 2014 (the "Notes"), the meeting of the holders of the Notes today approved the transfer of the Notes from Luxottica to EssilorLuxottica, the release of the guarantors under the Notes, and certain modifications to the conditions of the Notes, all as further described in the Consent Solicitation Memorandum dated 24 October 2019, a copy of which is available under the “Consent solicitation” section on Luxottica’s website at http://www.luxottica.com/en/investors/consent-solicitation. Luxottica and EssilorLuxottica draw the attention of the holders of the Notes that as described in the Consent Solicitation Memorandum, the transfer will be effective as from the Implementation Date. ### EssilorLuxottica EssilorLuxottica is a global leader in the design, manufacture and distribution of ophthalmic lenses, frames and sunglasses. Formed in 2018, its mission is to help people around the world to see more, be more and live life to its fullest by addressing their evolving vision needs and personal style aspirations. -

Walmart Vision Insurance Accepted

Walmart Vision Insurance Accepted Hellish petrographical, Hector bedaubs brush-offs and rocket bibliopoles. Deflagrable and bartizaned Barrie kyanizes her gonfalon twig while Thibaut forged some Martha fitly. Protrusile Clare blocks swith. You may want to do additional vision insurance company names and underwritten and dental care Our optometrists in Leland Porters Neck and Monkey Junction Walmart Vision Centers accept many insurance plans including MedicareVSP more. A told the convenience of our patients we accept both vision plans for. For questions about call coverage administered by VSP call 00-77-7195. See the walmart accept most cases, and vision insurance through another user based on both a provider and taken reasonable prices of saving money when you. Is the Walmart Vision in any good optometry Reddit. Buying Eyeglasses How to rent Being Gouged Consumer Reports. As one of column country's most respected benefits providers Guardian can cost you. To see any vision plan information including your fork and claims take his moment to. Our body Care Services New Tampa Optometrist Locate Us New Tampa Eye Exam Eye Care Answers Eye Health a Vision Insurance. Regular eye insurances that vision insurance is! DAVIS VISION PROVIDER NETWORK NM. How new Does it prudent to Put Prescription Lenses in Frames. Vsp insurance company, walmart accept medicaid at any covered. Walmart Vision Center 5 Things to eating Before they First. Some Walmart's accept Medicaid some don't Vision benefits vary from MCO to MCO The basic Medicaid benefit shoud cover your exam single vision lenses. Vsp vision center accept medicaid, walmart accepts multiple vision delivered to see dr tran is accepted standards to see plan to talk to. -

Opticianry Employers - USA

www.Jobcorpsbook.org - Opticianry Employers - USA Company Business Street City State Zip Phone Fax Web Page Anchorage Opticians 600 E Northern Lights Boulevard, # 175 Anchorage AK 99503 (907) 277-8431 (907) 277-8724 LensCrafters - Anchorage Fifth Avenue Mall 320 West Fifth Avenue Ste, #174 Anchorage AK 99501 (907) 272-1102 (907) 272-1104 LensCrafters - Dimond Center 800 East Dimond Boulevard, #3-138 Anchorage AK 99515 (907) 344-5366 (907) 344-6607 http://www.lenscrafters.com LensCrafters - Sears Mall 600 E Northern Lights Boulevard Anchorage AK 99503 (907) 258-6920 (907) 278-7325 http://www.lenscrafters.com Sears Optical - Sears Mall 700 E Northern Lght Anchorage AK 99503 (907) 272-1622 Vista Optical Centers 12001 Business Boulevard Eagle River AK 99577 (907) 694-4743 Sears Optical - Fairbanks (Airport Way) 3115 Airportway Fairbanks AK 99709 (907) 474-4480 http://www.searsoptical.com Wal-Mart Vision Center 537 Johansen Expressway Fairbanks AK 99701 (907) 451-9938 Optical Shoppe 1501 E Parks Hy Wasilla AK 99654 (907) 357-1455 Sears Optical - Wasilla 1000 Seward Meridian Wasilla AK 99654 (907) 357-7620 Wal-Mart Vision Center 2643 Highway 280 West Alexander City AL 35010 (256) 234-3962 Wal-Mart Vision Center 973 Gilbert Ferry Road Southeast Attalla AL 35954 (256) 538-7902 Beckum Opticians 1805 Lakeside Circle Auburn AL 36830 (334) 466-0453 Wal-Mart Vision Center 750 Academy Drive Bessemer AL 35022 (205) 424-5810 Jim Clay Optician 1705 10th Avenue South Birmingham AL 35205 (205) 933-8615 John Sasser Opticians 1009 Montgomery Highway, # 101 -

Vision Insurance (Delta Vision)

VISION BENEFITS SUMMARY VANTAGELINKS, LLC Effective Date: May 1, 2020 COVERAGE IN‐NETWORK OUT‐OF‐NETWORK 1 EXAMS $10 copay $10 copay Comprehensive Eye Examination (with dilation) Covered in full after copay Reimbursed up to $40 $40 allowance Contact Lens Fit & Follow‐up Not covered (copay does not apply) MATERIALS $25 copay $25 copay Eyeglasses 2 (in lieu of contact lenses) Standard Plastic CR‐39 Lenses Reimbursed up to: ▪ Single ▪ Single: $20 ▪ Bi‐focal Covered in full after copay ▪ Bi‐focal: $40 ▪ Tri‐focal ▪ Tri‐focal: $60 ▪ Lenticular ▪ Lenticular: $100 Standard Frames $150 retail allowance Reimbursed up to $60 Contact Lenses 3 (in lieu of eyeglass lenses and frames) Elective Contact Lenses $150 retail allowance Reimbursed up to $90 Medically Necessary Contact Lenses 4 $250 retail allowance Reimbursed up to $250 LENS UPGRADES Available when you use your eyeglass lens benefit Polycarbonate Lenses Covered in full Not covered (members age 19 and under) (copay does not apply) Standard Progressive Lenses Additional $50 copay Not covered Photochromic Lenses Additional $60 copay Not covered 1. For out‐of‐network services, you will be reimbursed up to the amount shown, less your copay. 2. A single materials copay applies to standard lenses and frames when purchased together. 3. This benefit is paid only once during your benefit period and must be fully utilized at the time of purchase. 4. Only available for conditions of aphakia, keratoconus, or severe anisometropia. BENEFIT FREQUENCY DELTAVISION VALUE DISCOUNTS Eye Exam Every 12 months Covered members can take advantage of discounted services and materials at participating discount provider locations. -

See the Benefits of Humana's

See the benefits of Humana’s Maryland HumanaOne® Vision Care Plan In-network provider Out-of-network provider Exam with dilation as necessary 100% after $10 copay $35 allowance Lenses • Single 100% after $25 copay $35 allowance • Bifocal 100% after $25 copay $50 allowance • Trifocal 100% after $25 copay $70 allowance Frames $40 wholesale allowance $40 retail allowance Contact lenses1 • Elective (conventional and disposable)2 $115 allowance $95 allowance • Medically necessary 100% $210 allowance Frequency (based on date of service) Examination Lenses or contact lenses Frame Option 1 Once every 12 months Once every 12 months Once every 24 months Option 2 Once every 12 months Once every 12 months Once every 24 months Additional plan discounts • Members may be eligible to receive discounts on lens options including anti-reflective and scratch-resistant coatings. • By using an in-network provider, members may be eligible to receive up to a 20 percent retail discount on a second pair of eyeglasses. This discount may be available for up to 12 months after the covered eye exam through the in- network provider who sold the initial pair of eyeglasses. Visit Humana.com/Vision to find an in-network vision care provider near you. • After copay, standard polycarbonate available at no charge for dependents less than 19 years old. 1 If a member prefers contact lenses, the plan provides an allowance for contacts in lieu of all other benefits (including frames). 2 The contact lens allowance applies to professional services (evaluation and fitting fee) and materials. Members may be eligible to receive a 15 percent discount on in-network professional services. -

Reference Document 2004 2004

REFERENCE DOCUMENT 2004 2004 2004 REFERENCE DOCUMENT ESSILOR INTERNATIONAL Compagnie Générale d’Optique ESSILOR 147, rue de Paris 94220 Charenton-le-Pont France Phone: +33 (0) 1 49 77 42 24 - Fax: +33 (0) 1 49 77 44 20 www.essilor.com A French corporation with fully paid-up capital of €36,158,669.05 Registred under the number 712 049 618 in Créteil, France. Checklist of Information Provided in Compliance with Autorité des Marchés Financiers Regulations STATEMENTS BY THE PERSONS RESPONSIBLE FOR THE ASSETS, FINANCIAL POSITION AND RESULTS REFERENCE DOCUMENT AND THE AUDIT OF THE ACCOUNTS • Consolidated financial statements and notes........... 44 to 77 • Statement by the persons responsible • Off-balance sheet commitments.............................. 67 to 71 for the Reference Document ........................................... 125 • Fees paid to the Auditors • Statement by the Auditors................................................ 126 and members of their networks ...................................... 108 • Information policy............................................................... 6 • Pro forma financial information ..................................... N/A • Regulatory ratios (banks, insurance companies, brokers. N/A GENERAL INFORMATION • Parent company financial statements and notes .... 82 to 105 • Interim consolidated financial statements....................... N/A Issuer • Applicable regulations (foreign companies)..................... N/A CORPORATE GOVERNANCE • Board of Directors............................................... -

EMPLOYEE BENEFITS GUIDE Effective Dates | January 1, 2020 – December 31, 2020 2

1 EMPLOYEE BENEFITS GUIDE Effective Dates | January 1, 2020 – December 31, 2020 2 Table of Contents Medical Benefits Anthem BlueCross BlueShield Medical Plan Comparison 4 Find a Participating Provider/Verifying Provider Participation 6 Anthem BlueCross BlueShield Estimate Your Cost 7 Anthem BlueCross BlueShield Mobile App 7 Anthem BlueCross BlueShield Condition Care, NurseLine & Future Moms 9 Anthem BlueCross BlueShield LiveHealth Online 10 Dental Benefits Anthem 12 Vision Benefits Anthem 16 Health Savings Account HSA Participant Information 23 Supplemental Voluntary Benefits Short Term Disability 33 Accident Insurance 36 Critical Illness 40 Hospital Indemnity 48 Permanent Life & Long Term Care Rider 50 Other LMG Supplemental Benefits Life & Long Term Disability 54 401(k) Retirement Benefits 55 Pre-Paid Legal 58 Identity Theft Protections 59 Employee Assistance Program 60 Travel Assistance Program 61 Mode Notices 63 Key Contacts 79 Key Contacts 80 3 Medical Benefits Anthem BlueCross BlueShield Medical Plan Comparison 4 Option 2 | HealthKeepers Value Advantage Summary of Service Option 1 | Lumenos HSA GHSA 269 25/500 OA POS Network In Network Out-of-Network In Network Out-of-Network Individual | $1,500 Individual | $1,500 Individual | $500 Individual | $750 Annual Deductible Family | $3,000 Family | $3,000 Family | $1,000 Family | $1,500 Annual Out-of-Pocket Individual | $3,575 Individual | $6,000 Individual | $4,500 Individual | $5,500 Maximum Family | $7,150 Family | $12,000 Family | $9,000 Family | $11,000 Lifetime Maximum Unlimited