Software Sector Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

FCC-06-11A1.Pdf

Federal Communications Commission FCC 06-11 Before the FEDERAL COMMUNICATIONS COMMISSION WASHINGTON, D.C. 20554 In the Matter of ) ) Annual Assessment of the Status of Competition ) MB Docket No. 05-255 in the Market for the Delivery of Video ) Programming ) TWELFTH ANNUAL REPORT Adopted: February 10, 2006 Released: March 3, 2006 Comment Date: April 3, 2006 Reply Comment Date: April 18, 2006 By the Commission: Chairman Martin, Commissioners Copps, Adelstein, and Tate issuing separate statements. TABLE OF CONTENTS Heading Paragraph # I. INTRODUCTION.................................................................................................................................. 1 A. Scope of this Report......................................................................................................................... 2 B. Summary.......................................................................................................................................... 4 1. The Current State of Competition: 2005 ................................................................................... 4 2. General Findings ....................................................................................................................... 6 3. Specific Findings....................................................................................................................... 8 II. COMPETITORS IN THE MARKET FOR THE DELIVERY OF VIDEO PROGRAMMING ......... 27 A. Cable Television Service .............................................................................................................. -

TPG Telecom Limited and Its Controlled Entities ABN 46 093 058 069

TPG Telecom Limited and its controlled entities ABN 46 093 058 069 Annual Report Year ended 31 July 2016 2 TPG Telecom Limited and its controlled entities Annual report For the year ended 31 July 2016 Contents Page Chairman’s letter 3 Directors’ report 5 Lead auditor’s independence declaration 34 Consolidated income statement 35 Consolidated statement of comprehensive income 36 Consolidated statement of financial position 37 Consolidated statement of changes in equity 38 Consolidated statement of cash flows 39 Notes to the consolidated financial statements 40 Directors’ declaration 91 Independent auditor’s report 92 ASX additional information 94 3 TPG Telecom Limited and its controlled entities Chairman’s letter For the year ended 31 July 2016 Dear Shareholders On behalf of the Board of Directors, I am pleased to present to you the TPG Telecom Limited Annual Report for the financial year ended 31 July 2016 (“FY16”). Financial Performance FY16 was another successful year for the Group. Continued organic growth and the integration of iiNet into the business have resulted in further increases in revenue, profits and dividends for shareholders. FY16 represents the eighth consecutive year that this has been the case. A detailed review of the Group’s operating and financial performance for the year is provided in the Operating and Financial Review section of the Directors’ Report starting on page 7 of this Annual Report, and set out below are some of the key financial highlights and earnings attributable to shareholders from the year. FY16 FY15 Movement Revenue ($m) 2,387.8 1,270.6 +88% EBITDA ($m) 849.4 484.5 +75% NPAT ($m) 379.6 224.1 +69% EPS (cents/share) 45.3 28.2 +61% Dividends (cents/share) 14.5 11.5 +26% iiNet Acquisition At the beginning of FY16 we completed the acquisition of iiNet and consequently there has been significant focus during the year on integrating the businesses to improve the efficiency of the combined organisation. -

JMP Securities Elite 80 Report (Formerly Super 70)

Cybersecurity, Data Management & ,7 Infrastructure FEBRUARY 201 ELITE 80 THE HOTTEST PRIVATELY HELD &<%(5SECURITY, '$7$0$1$*(0(17 AND ,7,1)5$6758&785( COMPANIES &RS\ULJKWWLWLSRQJSZO6KXWWHUVWRFNFRP Erik Suppiger Patrick Walravens Michael Berg [email protected] [email protected] [email protected] (415) 835-3918 (415) 835-8943 (415)-835-3914 FOR DISCLOSURE AND FOOTNOTE INFORMATION, REFER TO JMP FACTS AND DISCLOSURES SECTION. Cybersecurity, Data Management & IT Infrastructure TABLE OF CONTENTS Executive Summary ............................................................................................................................ 4 Top Trends and Technological Changes ............................................................................................ 5 Funding Trends ................................................................................................................................ 11 Index by Venture Capital Firm .......................................................................................................... 17 Actifio ................................................................................................................................................ 22 Alert Logic ......................................................................................................................................... 23 AlgoSec ............................................................................................................................................ 24 AnchorFree ...................................................................................................................................... -

Foxtel Partners with Brightcove to Live Stream Mayweather-Mcgregor Main Event

August 25, 2017 Foxtel Partners With Brightcove to Live Stream Mayweather-McGregor Main Event Biggest boxing bout of the year to be available to non-Foxtel subscribers SYDNEY--(BUSINESS WIRE)-- Ahead of the biggest boxing bout of the year and one of the most anticipated fights in the history of the sport, Foxtel has partnered with Brightcove Inc. (NASDAQ: BCOV), the leading provider of cloud services for video, to livestream the Floyd Mayweather vs. Conor McGregor fight on August 27 (AEST). In addition to being able to watch the Pay-Per-View event at home, or at licensed venues, all Australian viewers can also subscribe to and stream the fight online. The offering will complement Foxtel's existing Main Event service available over cable/satellite and in licensed venues. The announcement follows a soft launch of the online offering last month, with Foxtel live streaming Jeff Horn's victory match over Manny Pacquiao to thousands of Australians. Ed Follows, Director of Product Technology Development at Foxtel, commented, "In recent years, we've focused our efforts on finding new ways to increase customer choices, and effortlessly give customers access to our content. This is another way we're doing just that. Previously, Main Event content like this has only been available to Foxtel customers. But with the dedicated online experience, anyone can sign up, buy a ticket and immediately watch the fight, with no ongoing subscription required. It means more Australians can subscribe to ground-breaking bouts like this than ever before." "Brightcove has been a fantastic partner, managing the entire process and bringing some key partners into the mix that make this all possible," Follows said. -

Software Sector Summary Report

SOFTWARE SECTOR REPORT Q1 2019 GCA: A LEADING INDEPENDENT GLOBAL INVESTMENT BANK Global investment bank providing strategic M&A and capital markets advisory services to growth companies and market leaders LEEDS PARIS FRANKFURT MANCHESTER MUNICH ZURICH NAGOYA TOKYO LONDON SHANGHAI NEW YORK MILAN NEW DELHI OSAKA TEL AVIV FUKUOKA SAN FRANCISCO TAIPEI MUMBAI SINGAPORE HO CHI MINH CITY Global platform: Sector expertise: Exceptional cross- 21 offices in key Experienced team: Expansive coverage border capabilities: markets across Over 400 employees and deep Over a third of all America, Asia and across the globe specialization transactions Europe Broad spectrum Diversified Strong reputation of clients: business model: and track record: Leading Geographically High number of conglomerates, top balanced, synergistic repeat clients and private equity firms and complementary referrals and emerging high- focus areas growth companies 2 GCA operates as GCA in America and Asia, and GCA Altium in Europe GCA OVERVIEW The GCA Software Team US Team Paul DiNardo Daniel Avrutsky Rupert Sadler Josh Wepman Managing Director Managing Director Managing Director Managing Director Software HCM Software Software, Travel & Telematics Software & Digital Media [email protected] [email protected] [email protected] [email protected] James Orozco Clark Callander Chris Gough Kevin Walsh Managing Director Managing Director Managing Director Managing Director Financial Sponsors Technology Real Estate Tech Software & Digital Media [email protected] [email protected] -

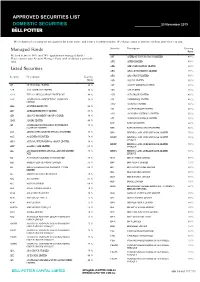

Approved Securities List

APPROVED SECURITIES LIST DOMESTIC SECURITIES 23 November 2019 The inclusion of a security on our approval list is not advice and is not a recommendation. We change ratios at any time without prior notice to you. Security Description Gearing Managed Funds Ratio We lend between 50% and 70% against most managed funds. APT AFTERPAY TOUCH GROUP LIMITED 40 % Please contact your Account Manager if you wish to discuss a particular fund. APX APPEN LIMITED 40 % Listed Securities ARB ARB CORPORATION LIMITED. 60 % ARG ARGO INVESTMENTS LIMITED 75 % Security Description Gearing ARQ ARQ GROUP LIMITED 50 % Ratio ASB AUSTAL LIMITED 50 % 3PL 3P LEARNING LIMITED.. 40 % AST AUSNET SERVICES LIMITED 65 % A2B A2B AUSTRALIA LIMITED 50 % ASX ASX LIMITED 70 % A2M THE A2 MILK COMPANY LIMITED NZ 40 % AUB AUB GROUP LIMITED 40 % AAC AUSTRALIAN AGRICULTURAL COMPANY 50 % AVJ AVJENNINGS LIMITED 40 % LIMITED. AWC ALUMINA LIMITED 70 % ABA AUSWIDE BANK LTD 40 % AX1 ACCENT GROUP LIMITED 50 % ABC ADELAIDE BRIGHTON LIMITED 65 % AYS AMAYSIM AUSTRALIA LIMITED 50 % ABP ABACUS PROPERTY GROUP STAPLED 50 % AZJ AURIZON HOLDINGS LIMITED 70 % ADH ADAIRS LIMITED 40 % BAP BAPCOR LIMITED 60 % AFI AUSTRALIAN FOUNDATION INVESTMENT 75 % COMPANY LIMITED BBN BABY BUNTING GROUP LIMITED 50 % AGI AINSWORTH GAME TECHNOLOGY LIMITED 55 % BEN BENDIGO AND ADELAIDE BANK LIMITED 70 % AGL AGL ENERGY LIMITED. 70 % BENPE BENDIGO AND ADELAIDE BANK LIMITED 70 % LPYR6UT AHG AUTOMOTIVE HOLDINGS GROUP LIMITED. 50 % BENPF BENDIGO AND ADELAIDE BANK LIMITED 70 % AHY ASALEO CARE LIMITED 65 % LPYR6UT AIA AUCKLAND INTERNATIONAL AIRPORT LIMITED 70 % BENPG BENDIGO AND ADELAIDE BANK LIMITED 70 % NZX LPYR3UT ALF AUSTRALIAN LEADERS FUND LIMITED 50 % BGA BEGA CHEESE LIMITED 60 % ALG ARDENT LEISURE GROUP LIMITED 55 % BHP BHP GROUP LIMITED 75 % ALI ARGO GLOBAL LISTED INFRASTRUCTURE 60 % BIN BINGO INDUSTRIES LIMITED 50 % LIMITED BKL BLACKMORES LIMITED 60 % ALL ARISTOCRAT LEISURE LIMITED 70 % BKW BRICKWORKS LIMITED 60 % ALQ ALS LIMITED 65 % BLD BORAL LIMITED. -

Workiva DIR Terms and Conditions

BY SIGNING AN ORDER REFERENCING, OR BY OTHERWISE MANIFESTING AGREEMENT TO THIS END USER ACCESS AGREEMENT (THE “END USER ACCESS AGREEMENT” AND ALONG WITH ALL ORDERS, THE “AGREEMENT”) ON BEHALF OF THE ORDER ACTIVITY INDICATED BY YOU AT THE TIME OF ACCEPTANCE (“GOVERNMENT”) YOU ARE HEREBY AGREEING TO THIS END USER ACCESS AGREEMENT ON BEHALF OF GOVERNMENT. IN DOING SO THE YOU REPRESENT THAT YOU HAVE THE AUTHORITY TO BIND GOVERNMENT TO THESE END CLIENT TERMS AND CONDITIONS AND THE AGREEMENT. THE AGREEMENT IS BY AND BETWEEN GOVERNMENT AND WORKIVA INC. (“PROVIDER”). 1.0 Services. Provider agrees to provide the Subscription Services and Professional Services (collectively referred to herein as, the “Services”) as set forth in this End User Access Agreement and the applicable ordering document (an “Order”) entered into by Provider and Government. 1.1 Subscription Services. (a) Beginning on the start date set forth in the applicable Order (the “Start Date”), Provider agrees to provide Government with access to the Software set forth in the applicable Order (“Subscription Services”), and accordingly Provider hereby grants to Government and its employees or third party representatives (“Representatives”), a non-exclusive, non-transferable, worldwide right to access, use, and display the Software in connection with the Subscription Services. Users will be determined on a named user basis rather than on a concurrent user or shared user basis; provided that Government may reassign different individuals on a reasonable basis (e.g., an employee changes positions or leaves Government’s employ). Government is responsible for each of its Representative’s acts and omissions. (b) “Documentation” means the manuals, specifications, and other materials describing the functionality, features, and operating characteristics of the Software, available at https://success.wdesk.com/help, including any updates thereto. -

Including League Tables of Financial Advisors

An Acuris Company Finding the opportunities in mergers and acquisitions Global & Regional M&A Report 2019 Including League Tables of Financial Advisors mergermarket.com An Acuris Company Content Overview 03 Global 04 Global Private Equity 09 Europe 14 US 19 Latin America 24 Asia Pacific (excl. Japan) 29 Japan 34 Middle East & Africa 39 M&A and PE League Tables 44 Criteria & Contacts 81 mergermarket.com Mergermarket Global & Regional Global Overview 3 M&A Report 2019 Global Overview Regional M&A Comparison North America USD 1.69tn 1.5% vs. 2018 Inbound USD 295.8bn 24.4% Outbound USD 335.3bn -2.9% PMB USD 264.4bn 2.2x Latin America USD 85.9bn 12.5% vs. 2018 Inbound USD 56.9bn 61.5% Outbound USD 8.9bn 46.9% EMU USD 30.6bn 37.4% 23.1% Europe USD 770.5bn -21.9% vs. 2018 50.8% 2.3% Inbound USD 316.5bn -30.3% Outbound USD 272.1bn 28.3% PMB USD 163.6bn 8.9% MEA USD 141.2bn 102% vs. 2018 Inbound USD 49.2bn 29% Outbound USD 22.3bn -15.3% Ind. & Chem. USD 72.5bn 5.2x 4.2% 17% 2.6% APAC (ex. Japan) USD 565.3bn -22.5% vs. 2018 Inbound USD 105.7bn -14.8% Outbound USD 98.9bn -24.5% Ind. & Chem. USD 111.9bn -5.3% Japan USD 75.4bn 59.5% vs. 2018 Inbound USD 12.4bn 88.7% Global M&A USD 3.33tn -6.9% vs. 2018 Outbound USD 98.8bn -43.6% Technology USD 21.5bn 2.8x Cross-border USD 1.27tn -6.2% vs. -

We Envision a Digital World Powered by Intelligent Identity

WE ENVISION A DIGITAL WORLD POWERED BY INTELLIGENT IDENTITY pingidentity.com | @pingidentity IDENTITY SECURES AND CONNECTS YOUR AGILE ENTERPRISE Enterprises compete in a new digital era where user experience is paramount and security can’t be sacrificed. With data breaches on the rise and new threats emerging, organizations need strong security. At the same time, users expect to easily access all of their applications from any device. Finding the right mix of security and convenience is challenging, especially across the complex IT environments and application portfolios found in the world’s largest enterprises. At Ping Identity, we help you use identity to generate more value from your digital business initiatives by providing users with secure, seamless access to all their applications and resources from anywhere. We help you meet your security requirements while allowing you to achieve greater agility with our flexible deployment options that support all stages of cloud adoption. Our modern IAM platform spans hybrid IT and multi-cloud infrastructures to connect all users to all applications and APIs at scale. WE’RE AN IAM INDUSTRY LEADER RECOGNIZED LEADER in Access Management and Identity as a Service (IDaaS) AWARD WINNER in Identity and Access Security, Cybersecurity, Information Security and API Security OVER 50% OF THE FORTUNE 500 USE PING SOLUTIONS 12 of the 12 8 of the 10 largest U.S. banks largest bio-pharmacueticals 4 of the 5 2 of the 3 largest healtchare plans largest hospitals ENTERPRISE-GRADE FROM THE BEGINNING We’re proud to be born and raised in the enterprise. Since 2002, our standards- based platform has evolved to allow all users and devices to securely access all cloud, mobile, SaaS and on-premises applications and APIs. -

Design Perspectives on Delivery Drones

C O R P O R A T I O N Design Perspectives on Delivery Drones Jia Xu For more information on this publication, visit www.rand.org/t/RR1718z2 Published by the RAND Corporation, Santa Monica, Calif. © Copyright 2017 RAND Corporation R® is a registered trademark. Limited Print and Electronic Distribution Rights This document and trademark(s) contained herein are protected by law. This representation of RAND intellectual property is provided for noncommercial use only. Unauthorized posting of this publication online is prohibited. Permission is given to duplicate this document for personal use only, as long as it is unaltered and complete. Permission is required from RAND to reproduce, or reuse in another form, any of its research documents for commercial use. For information on reprint and linking permissions, please visit www.rand.org/pubs/permissions. The RAND Corporation is a research organization that develops solutions to public policy challenges to help make communities throughout the world safer and more secure, healthier and more prosperous. RAND is nonprofit, nonpartisan, and committed to the public interest. RAND’s publications do not necessarily reflect the opinions of its research clients and sponsors. Support RAND Make a tax-deductible charitable contribution at www.rand.org/giving/contribute www.rand.org Preface Delivery drones may become widespread over the next five to ten years, particularly for what is known as the “last-mile” logistics of small, light items. Companies such as Amazon, Google, the United Parcel Service (UPS), DHL, and Alibaba have been running high-profile experiments testing drone delivery systems, and the development of such systems reached a milestone when the first commercial drone delivery approved by the Federal Aviation Administration took place on July 17, 2015. -

Private Equity & Venture Capital

VOLUME 14, ISSUE 6 ■ AUGUST 2018 PRIVATE EQUITY & VENTURE CAPITAL SPOTLIGHT THE RISE OF VENTURE AND IN THIS ISSUE GROWTH CAPITAL IN EUROPE €11bn in capital has already been secured by venture and growth capital funds focused on Europe that have closed this FEATURE 3 year; this is the highest figure seen at this stage in recent The Rise of Venture years. We put activity in the region under the microscope, examining the economic factors that have contributed to and Growth Capital in this. Europe Find out more on page 3 INDUSTRY NEWS 7 THE FACTS ■ Private Equity in the 9 PRIVATE EQUITY IN THE NORDIC Nordic Region REGION ■ Public Pension Funds 12 Investing in Private With the capital raised by managers based in the Nordic Equity region reaching record highs, we take a look at the growing private equity market in terms of fundraising activity, investor make-up and largest exits in the region. CONFERENCES 14 Find out more on page 9 RECENTLY RELEASED: THE 2018 PREQIN PRIVATE CAPITAL FUND TERMS THE 2018 PRIVATE CAPITAL All data in this newsletter ADVISOR can be downloaded to PREQIN FUND TERMS ADVISOR Excel for free Order Your Copy Download Sample Pages Sign up to Spotlight, our free monthly newsletter, providing insights into performance, investors, deals and fundraising, powered by Preqin data: Alt Credit Intelligence European and US Fund Services Awards: Best Data and Information Provider | Africa Global Funds Awards 2016: Best Research and Data Provider | The Queen’s SIGN UP Award for Enterprise: International Trade | HedgeWeek Global Awards: