'Retail Apocalypse' Wreaking Havoc on Shopping Malls Across US

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

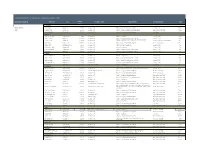

Track Record of Prior Experience of the Senior Cobalt Team

Track Record of Prior Experience of the Senior Cobalt Team Dedicated Executives PROPERTY City Square Property Type Responsibility Company/Client Term Feet COLORADO Richard Taylor Aurora Mall Aurora, CO 1,250,000 Suburban Mall Property Management - New Development DeBartolo Corp 7 Years CEO Westland Center Denver, CO 850,000 Suburban Mall Property Management and $30 million Disposition May Centers/ Centermark 9 Years North Valley Mall Denver, CO 700,000 Suburban Mall Property Management and Redevelopment First Union 3 Years FLORIDA Tyrone Square Mall St Petersburg, FL 1,180,000 Suburban Mall Property Management DeBartolo Corp 3 Years University Mall Tampa, FL 1,300,000 Suburban Mall Property Management and New Development DeBartolo Corp 2 Years Property Management, Asset Management, New Development Altamonte Mall Orlando, FL 1,200,000 Suburban Mall DeBartolo Corp and O'Connor Group 1 Year and $125 million Disposition Edison Mall Ft Meyers, FL 1,000,000 Suburban Mall Property Management and Redevelopment The O'Connor Group 9 Years Volusia Mall Daytona Beach ,FL 950,000 Suburban Mall Property and Asset Management DeBartolo Corp 1 Year DeSoto Square Mall Bradenton, FL 850,000 Suburban Mall Property Management DeBartolo Corp 1 Year Pinellas Square Mall St Petersburg, FL 800,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year EastLake Mall Tampa, FL 850,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year INDIANA Lafayette Square Mall Indianapolis, IN 1,100,000 Suburban Mall Property Management -

Generalgrowthproperties

BUILT TO LEAD BUILT TO GROW BUILT TO PROSPER GENERALGROWTHBUILT PROPERTIES TO LASTANNUAL REPORT 2002 COMPANY PROFILE General Growth Properties and its predecessor companies have been in the shopping center busi- ness for nearly fifty years. It is the second largest regional mall Real Estate Investment Trust (REIT) in the United States. General Growth owns, develops, operates and/or manages shopping malls in 39 states. GGP has ownership interests in, or management responsibility for, 160 regional shopping malls totaling more than 140 million square feet of retail space. The total retail space is inclusive of more than 16,000 retailers nationwide. General Growth provides investors with the opportunity to participate in the ownership of high-quality, income-producing real estate while maintaining liquidity. Our primary objective is to provide increasing dividends and capital appreciation for our shareholders. Creating shareholder value is the company’s mission. The Bucksbaum family, which founded General Growth, is still engaged in the operation of the company’s day-to-day business activities. As owners of a major stake in the company, General Growth management’s interests are aligned with those of each and every GGP shareholder. CONTENTS Shareholders’ Letter 4 Operating Principles 7 Portfolio 17 Financial Review 29 Directors and Officers 85 Corporate Information 86 Financial Highlights SHOPPING CENTERS OWNED at year end * 1997 64 1998 84 1999 93 2000 95 2001 97 2002 125 TOTAL SQUARE FOOTAGE OWNED in millions 1997 52 1998 71 1999 83 2000 85 2001 89 2002 114 REAL ESTATE ASSETS AT COST in millions 1997 $2,590 1998 $4,760 1999 $6,237 2000 $6,735 2001 $7,319 2002 $9,902 MALL SHOP SALES in millions ** 1997 $2,651 1998 $5,176 1999 $6,931 2000 $7,243 2001 $7,326 2002 $9,061 DIVIDEND GROWTH PER SHARE dollar/share declared 1997 $1.80 1998 $1.88 1999 $1.98 2000 $2.06 2001 $2.36 2002 $2.74 FFO GROWTH dollar/share 1997 $2.89 1998 $3.35 1999 $4.02 2000 $4.42 2001 $4.96 2002 $5.58 * Includes regional malls only. -

The Retail Apocalypse - Fact Or Fiction?

The Retail Apocalypse - Fact or Fiction? May 10, 2019 Panel Introductions • Moderator: • Manuel Farach, Member, McGlinchey Stafford • Panelists: • Sarah Lemke, Vice President, Project Development, New England Development • Matt Epstein, Director, Goulston & Storrs, P.C. Agenda • Current State of Retail • Is It Really an Apocalypse? • Strategies for the New Future of Retail • Conclusion and Q&A Current State of Retail- Store Closures Abound ▪ Over 12,000 stores closed in 2018 ▪ Over 5,800 stores have already announced closures planned for 2019, including: ▪ Payless- 2,500 stores ▪ Gymboree- 805 stores ▪ Family Dollar- 390 stores ▪ Shopko- 371 stores ▪ Gap- 230 stores ▪ Sears- 70 stores ▪ Victoria’s Secret- 53 stores ▪ Abercrombie & Fitch- 40 stores ▪ Other retailers closing: Aerosoles, American Apparel, BCBG, Bon-Ton, Children’s Place, CVS, Dollar Tree, Foot Locker, Guess, JC Penney, Limited, Macy’s, Michael Kors, Toys R Us, Victoria’s Secret, Wet Seal © New England Development 4 Current State of Retail - Store Closures Abound © New England Development In 2018, over 145 million square feet of retail closed 5 Current State of Retail - Bankruptcies Continue © New England Development 6 What’s Causing Widespread Closures and Bankruptcies? ▪ Retailers facing massive debt from private equity financings ▪ E-Commerce and the “Amazon Effect” ▪ “Over-Retailing”/Saturation of the Market ▪ Changing Consumer Demands ▪ Inability to Adapt © New England Development 7 E-Commerce - Part of the Problem E-commerce continues to gain steam- growing 15% in 2018, -

Municipality

TheMunicipality Your Voice. Your Wisconsin. January | 2019 2019–2020 LEAGUE LEGISLATIVE AGENDA Split Party After the Retail Apocalypse, Preparing Wisconsin New Records Control is Good Small State Agency — Prepare for the Property Opportunity Zones Schedule Approved for Municipalities Big Statewide Impact Tax Meltdown for Investment for Municipalities 4 8 The Municipality12 | January 2019 20 24 1 Is there a company that insures only cities and villages? Oh yes, dear Why LWMMI, of course For 33 years, the League of Wisconsin Municipalities Insurance Program has responded to the coverage needs of local cities and villages, saving them substantial amounts of money in the process Protecting The Communities We Live In. 608.833.9595 | www.LWMMI.org A Mutual Company Owned by Member Cities and Villages. TheMunicipality The Municipality Official Monthly Publication of the League of Wisconsin Municipalities January | 2019 Volume 114, No. 1, January 2019 Editorial Offices 131 W. Wilson St., Suite 505, Madison, WI 53703 Feature Dial (608) 267-2380 In-State (800) 991-5502 Fax: (608) 267-0645 Small State e-mail: [email protected] Split Party Agency — Here’s to Did You Website: www.lwm-info.org Control is Good for Big Statewide You Know? The Municipality serves as the medium of Municipalities Impact exchange of ideas and information on municipal affairs for the officials of Wisconsin cities and villages. Nothing included herein is to 3 4 8 11 be construed as having the endorsement of the League unless so specifically stated. The Municipality (ISSN 0027-3597) is published monthly at $25 per year ($5.00 per copy, back After the Retail Preparing issues $5.00 each) by the League of Wisconsin Apocalypse, Wisconsin Municipalities, 131 W. -

I-20 East Transit Initiative the Study Schedule Below Provides an Overview of the Work in the Year Ahead of the I-20 East Transit Initiative

4 Study Schedule I-20 East Transit Initiative The study schedule below provides an overview of the work in the year ahead of the I-20 East Transit Initiative. We are kicking off our environmental studies with Public Scoping Meetings. The Scoping Meetings will be an opportunity Newsletter No. 3 Fall 2012 to introduce the LPA to the public, and a venue for the public to provide comment on any impacts to the social, cultural or natural environment that could arise from the construction of the LPA. If you are unable to attend any of I-20 East Corridor Locally Preferred Alternative (LPA) the meetings advertised below, please provide your written comments to Janide Sidifall, Office of Transit Systems The Locally Preferred Alternative (LPA), as adopted by the MARTA Board of Directors in April 2012, is comprised of the Planning, MARTA, 2424 Piedmont Road, NE Atlanta, GA 30324-3330, by October 15, 2012. Comments may also be extension of the existing east-west heavy rail transit (HRT) line from the Indian Creek Station to the Mall at Stonecrest submitted online at the project website: http://www.itsmarta.com/120-east-corr.aspx. For project updates, visit the in eastern DeKalb County and a new bus rapid transit (BRT) service along I-20 between downtown Atlanta and Wesley project website or find us on Facebook. Chapel Road, east of I-285 in DeKalb County. The proposed HRT service would I-20 East LPA I‐20 East Transit Initiative Environmental Schedule extend the existing MARTA rail line Heavy Rail Transit (HRT) 2012 2013 south parallel to I-285, then east parallel Bus Rapid Transit (BRT) Aug. -

GENERAL GROWTH PROPERTIES, INC. 2001 Annual Report on Behalf of All the Employees Of

GENERAL GROWTH PROPERTIES, INC. 2001 annual report On behalf of all the employees of General Growth Properties, I would like to extend our condolences to anyone who lost a loved one, a friend, an acquaintance or a co-worker in The regional mall business is about relationships. the tragedy of September 11, 2001. We do not forge them lightly, but with the intent We are a country of strong individuals to nurture and strengthen them over time. Even in periods of distress, the relationships with who will continue to unite as we have rock solid our consumers, owners, retailers, and employees keep throughout our history.We will not us rooted in one fundamental belief: that success can be achieved allow horrific acts of terrorism to destroy when we work together.The dynamics of our the greatest and most powerful nation industry dictate that sustainability is contingent upon in the world. God bless you. the integrity of our business practices.We will never lose sight of this fact and will carry out every endeavor to reflect the highest standards. contents Financial Highlights . lift Portfolio . 12 Company Profile . lift Financial Review . 21 Operating Principles . 2 Directors and Officers . 69 Shareholders’ Letter . 4 Corporate Information . 70 Shopping Centers Owned at year end includes Centermark 1996 75 company profile General Growth Properties and its predecessor companies 1997 64 have been in the shopping center business for nearly fifty years. It is the second largest regional 1998 84 mall Real Estate Investment Trust (REIT) in the United States. General Growth owns, develops, 1999 93 operates and/or manages shopping malls in 39 states. -

Shops at Turner Hill 8200 Mall Parkway, Lithonia, Ga 30038 ™ Offering Memorandum Confidentiality & Disclaimer Statement

SHOPS AT TURNER HILL 8200 MALL PARKWAY, LITHONIA, GA 30038 ™ OFFERING MEMORANDUM CONFIDENTIALITY & DISCLAIMER STATEMENT This Offering Memorandum contains select information pertaining to the business and affairs of Shops at Turner Hill located at 8200 Mall Parkway, Lithonia, GA 30038 (“Property”). It has been prepared by Matthews Retail Advisors . This Offering Memorandum may not be all-inclusive or contain all of the information a prospective purchaser may desire. The information contained in this Offering Memorandum is confidential and furnished solely for the purpose of a review by a prospective purchaser of the Property. It is not to be used for any other purpose or made available to any other person without the written consent of Seller or Matthews Retail Advisors . The material is based in part upon information supplied by the Seller and in part upon financial information obtained from sources it deems reliable. Owner, nor their officers, employees, or agents makes any representation or warranty, express or implied, as to the accuracy or completeness of this Offering Memorandum or any of its contents and no legal liability is assumed or shall be implied with respect thereto. Prospective purchasers should make their own projections and form their own conclusions without reliance upon the material contained herein and conduct their own due diligence. By acknowledging your receipt of this Offering Memorandum for the Property, you agree: 1. The Offering Memorandum and its contents are confidential; 2. You will hold it and treat it in the strictest of confidence; and 3. You will not, directly or indirectly, disclose or permit anyone else to disclose this Offering Memorandum or its contents in any fashion or manner detrimental to the interest of the Seller. -

Case 20-13076-BLS Doc 67 Filed 12/07/20 Page 1 of 14

Case 20-13076-BLS Doc 67 Filed 12/07/20 Page 1 of 14 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x : In re: : Chapter 11 : Case No. 20-13076 (BLS) FRANCESCA’S HOLDINGS CORPORATION, : et al.,1 : Joint Administration Requested : Debtors. : Re: D.I. 8 ------------------------------------------------------------ x SUPPLEMENTAL DECLARATION OF SHERYL BETANCE IN SUPPORT OF THE DEBTORS’ APPLICATION FOR ENTRY OF AN ORDER AUTHORIZING THE RETENTION AND EMPLOYMENT OF STRETTO AS CLAIMS AND NOTICING AGENT, NUNC PRO TUNC TO THE PETITION DATE Pursuant to 28 U.S.C.§ 1746, I, Sheryl Betance, declare under penalty of perjury that the following is true and correct to the best of my knowledge, information, and belief: 1. I am a Senior Managing Director of Corporate Restructuring at Stretto, a chapter 11 administrative services firm with offices at 410 Exchange, Ste. 100, Irvine, CA 92602. Except as otherwise noted, I have personal knowledge of the matters set forth herein, and if called and sworn as a witness, I could and would testify competently thereto. 2. On December 3, 2020, the Debtors filed the Debtors’ Application for Entry of an Order Authorizing the Retention and Employment of Stretto as Claims and Noticing Agent, Nunc Pro Tunc to the Petition Date [D.I. 8] (the “Application”),2 and the Declaration of Sheryl Betance in Support of the Debtors’ Application for Entry of an Order Authorizing the Retention and 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Francesca’s Holdings Corporation (4704), Francesca’s LLC (2500), Francesca’s Collections, Inc. -

Decatur's Transportation Network, 2007

3 • Decatur’s Transportation Network, 2007 CHAPTER • 3 Decatur’s Transportation Network, 2007 othing speaks louder of a city’s transportation system than how its residents use it. A public survey conducted as part of the CTP revealed that sixty-seven N percent of commuters drive alone to get to work or school. Over 20 percent of commuters in Decatur either walk, bike or take transit. Even more interesting, 79 percent of residents reported having walked or ridden a bike to downtown Decatur. Additionally, the majority of residents feel that it is easy to get around the City. These results indicate a system that already provides a lot of choice for travelers. The following sections detail the extent of these choices, i.e. the facilities that make up the existing Decatur transportation network. The CTP uses this snapshot of how Decatur gets around in 2007 to recommend how the City can build upon its existing strengths to realize its vision of a healthy and well-connected community. Existing Street Network Streets are where it all comes together for travel in and through Decatur. The streets and their edges provide places for people to walk, bicycle and travel in buses and other vehicles. Compared with the MARTA rail system and off-road paths and greenways, the street system in Decatur accommodates the majority of travel and is detailed below. Roadway Classification in Decatur In 1974, the Federal Highway Administration (FHWA) published the manual Highway Functional Classification - Concepts, Criteria and Procedures. The manual was revised in 1989 and forms the basis of this roadway classification inventory. -

Radio Shack Closing Locations

Radio Shack Closing Locations Address Address2 City State Zip Gadsden Mall Shop Ctr 1001 Rainbow Dr Ste 42b Gadsden AL 35901 John T Reid Pkwy Ste C 24765 John T Reid Pkwy #C Scottsboro AL 35768 1906 Glenn Blvd Sw #200 - Ft Payne AL 35968 3288 Bel Air Mall - Mobile AL 36606 2498 Government Blvd - Mobile AL 36606 Ambassador Plaza 312 Schillinger Rd Ste G Mobile AL 36608 3913 Airport Blvd - Mobile AL 36608 1097 Industrial Pkwy #A - Saraland AL 36571 2254 Bessemer Rd Ste 104 - Birmingham AL 35208 Festival Center 7001 Crestwood Blvd #116 Birmingham AL 35210 700 Quintard Mall Ste 20 - Oxford AL 36203 Legacy Marketplace Ste C 2785 Carl T Jones Dr Se Huntsville AL 35802 Jasper Mall 300 Hwy 78 E Ste 264 Jasper AL 35501 Centerpoint S C 2338 Center Point Rd Center Point AL 35215 Town Square S C 1652 Town Sq Shpg Ctr Sw Cullman AL 35055 Riverchase Galleria #292 2000 Riverchase Galleria Hoover AL 35244 Huntsville Commons 2250 Sparkman Dr Huntsville AL 35810 Leeds Village 8525 Whitfield Ave #121 Leeds AL 35094 760 Academy Dr Ste 104 - Bessemer AL 35022 2798 John Hawkins Pky 104 - Hoover AL 35244 University Mall 1701 Mcfarland Blvd #162 Tuscaloosa AL 35404 4618 Hwy 280 Ste 110 - Birmingham AL 35243 Calera Crossing 297 Supercenter Dr Calera AL 35040 Wildwood North Shop Ctr 220 State Farm Pkwy # B2 Birmingham AL 35209 Center Troy Shopping Ctr 1412 Hwy 231 South Troy AL 36081 965 Ann St - Montgomery AL 36107 3897 Eastern Blvd - Montgomery AL 36116 Premier Place 1931 Cobbs Ford Rd Prattville AL 36066 2516 Berryhill Rd - Montgomery AL 36117 2017 280 Bypass -

Tucker Medical Center | 4445 Cowan Rd, Tucker, GA 30084

TUCKER MEDICAL CENTER 4445 COWAN RD | TUCKER, GA 8.25% 10-YEAR $57,824 CAP RATE LEASE NOI 1 | OFFERING MEMORANDUM CONTENTS 03 EXECUTIVE OVERVIEW 06 FINANCIAL OVERVIEW 08 TENANT OVERVIEW 10 AREA OVERVIEW LISTED BY: RYAN BURKE Associate D: (949) 226-8385 M: (847) 361-4181 E: [email protected] License No. 02100941 (CA) RAHUL CHHAJED Associate Vice President & Director D: (949) 432-4513 M: (818) 434-1106 E: [email protected] License No. 01986299 (CA) MICHAEL MORENO Associate Vice President & Director D: (949) 432-4511 M: (818) 522-4497 E: [email protected] License No. 01982943 (CA) KYLE MATTHEWS Broker of Record License No. 67120 (GA) ™ EXECUTIVE SECTION OVERVIEW 01 3 PROPERTY HIGHLIGHTS • Easy Access: This easily accessible property experiences excellent visibility, demonstrating the revitalization of the medical care setting, which is ideal from a location and viability standpoint • Continuous Rent Growth: Attractive annual increases of 2.5% provide a favorable hedge against inflation to LIST PRICE ensure the growth of your investment dollars year after year $700,897 • Development Opportunity: This real estate sits on 2.31 acres of land in the heart of Tucker, Georgia, allowing for considerable development opportunities • High Yield Investment: Achieve a healthy cashflow and return on your investment dollars with an attractive year-one 8.25% cap rate. LOCATION HIGHLIGHTS • Downtown Tucker: Nestled among multiple strip centers, service centers, and national tenants such as UPS, Wendy’s, Publix, and Staples, this location -

Bankruptcy Forms for Non-Individuals, Is Available

Case 16-10056-RAM Doc 1 Filed 01/04/16 Page 1 of 47 Fill in this information to identify your case: United States Bankruptcy Court for the: SOUTHERN DISTRICT OF FLORIDA Case number (if known) Chapter you are filing under: Chapter 7 Chapter 11 Chapter 12 Chapter 13 Check if this an amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 12/15 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor's name and case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available. 1. Debtor's name Goodman and Dominguez, Inc. 2. All other names debtor DBA Traffic used in the last 8 years DBA Traffic Shoe Include any assumed DBA Traffic Shoes names, trade names and DBA Traffic Shoe, Inc. doing business as names DBA Goodman & Dominguez, Inc. 3. Debtor's federal Employer Identification 59-2268839 Number (EIN) 4. Debtor's address Principal place of business Mailing address, if different from principal place of business 10701 NW 127 St Medley, FL 33178 Number, Street, City, State & ZIP Code P.O. Box, Number, Street, City, State & ZIP Code Miami-Dade Location of principal assets, if different from principal County place of business Various retail stores located in several states in the US and Puerto Rico Number, Street, City, State & ZIP Code 5. Debtor's website (URL) www.trafficshoe.com 6. Type of debtor Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) Partnership Other.