The Structuring of Rail Concessions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

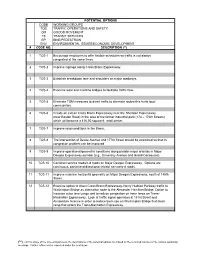

Potential Options Table

POTENTIAL OPTIONS CODE WORKING GROUPS TOS TRAFFIC OPERATIONS AND SAFETY GM GOODS MOVEMENT TS TRANSIT SERVICES BP BIKE/PEDESTRIAN ENV ENVIRONMENTAL ISSUES/ECONOMIC DEVELOPMENT # CODE NO. DESCRIPTION (**) 1 TOS-1 Encourage employers to offer flexible schedules so traffic is not always congested at the same times. 2 TOS-2 Improve signage along Cross Bronx Expressway. 3 TOS-3 Establish breakdown lane and shoulders on major roadways. 4 TOS-4 Examine local and mainline bridges to facilitate traffic flow. 5 TOS-5 Eliminate TDM measures to divert traffic to alternate routes-this hurts local communities. 6 TOS-6 Create an exit on Cross Bronx Expressway near the Sheridan Expressway (near Boston Road) in the area of the former industrial park (174 – 176th Streets) which will become a 136,00 square ft. retail center. 7 TOS-7 Improve road conditions in the Bronx. 8 TOS-8 The intersection of Devoe Avenue and 177th Street should be examined so that its congestion problem can be improved. 9 TOS-9 Improve operational/geometric conditions along parallel major arterials in Major Deegan Expressway corridor (e.g., University Avenue and Grand Concourse). 10 TOS-10 Construct service roads/c-d roads on Major Deegan Expressway. Options are continuous, partial and directional (nb/sb) service/c-d roads. 11 TOS-11 Improve mainline horizontal geometry on Major Deegan Expressway, south of 145th Street. 12 TOS-12 Examine option to divert Cross Bronx Expressway-Henry Hudson Parkway traffic to Washington Bridge as alternative route to the Alexander Hamilton Bridge. Option to increase outer lane usage and to reduce congestion on inner lanes on Trans- Manhattan Expressway. -

NYSDOT "Rail Program-Report 1985"

~.. ~~\ . , t····_, & NEW YORK STATE RAIL PROGRAM REPORT ·1985 . Prepared by the Rail Division November 1985 NEW YORK STATE DEPARTMENT OF TRANSPORTATION MARIO M. CUOMO, Governor FRANKLIN E. WHITE, Commissioner NEW YORK STATE RAIL PROGRAM REPORT 1985 Prepared in compliance with the rules and regulations for the: State Rail Pian, per Section 5 (j) of the Department of Transportation Act; and Annual Report to the State legislature, per Chapter 257, Section 8, of the Laws of 1975 and Chapter 369, Section 2 of the laws of 1979. TABLE OF CONTENTS ITEM PAGE INTRODUCTION iv CHAPTER 1: NEW YORK STATE'S RAIL PROGRAM 1 A. PROGRAM ELEMENTS 1 B. ACHIEVEMENTS 3 CHAPTER 2: NEW YORK STATE'S RAIL POLICY 6 A. AUTHORITY 6 B. POLICY 6 C. PLANNING PROCESS 9 CHAPTER 3: NEW YORK STATE'S RAIL SYSTEM 12 A. NEW YORK STATE'S RAIL FREIGHT SYSTEM 12 B. INTERCITY RAIL PASSENGER SERVICE 13 CHAPTER 4: RAIL ISSUES 18 CHAPTER 5: PROGRAM OF PROJECTS 29 A. PROJECT SELECTION PROCESS 29 B. CURRENT PROGRAM OF RAIL PROJECTS 30 C. PROJECTS UNDER REVIEW FOR FUTURE FUNDING 33 MAP 1 - NEW YORK STATE'S RAIL/HIGm~AY SYSTEM M.l MAP 2 - NEW YORK STATE'S RAIL SYSTEM M.2 APPENDIX I - PROJECTS COMPLETED UNDER NEW YORK STATE'S Al.1 RAIL PROGRAM A. 1974 BOND ISSUE Al.1 B. 1979 BOND ISSUE A1.3 C. FEDERAL LOCAL RAIL ASSISTANCE PROGRAM A1.4 D. STATE RAILASSISTANCE PROGRAM Al.5 E. RAILROAD BRIDGE RECONSTRUCTION PROGRAM Al.6 APPENDIX II - RAIL ABANDONMENTS A2.1 A. RAIL LINES ABANDONED DURING 1983-84 WITH NO A2.1 CONTINUATION OF SERVICE B. -

Hudson Line Railroad Corridor Transportation Plan (2005)

National Railroad Passenger Corporation (Amtrak) Canadian Pacific Railway CSX Transportation MTA Metro-North Railroad New York State Department of Transportation Hudson Line Railroad Corridor Transportation Plan Final Report (Document No. M40801-11/9518/STU-137) November 2005 Prepared by: In association with: ZETA-TECH Associates, Inc. Rensselaer Polytechnic Institute TABLE OF CONTENTS Page i TABLE OF CONTENTS 1. INTRODUCTION..........................................................................................1 2. EVALUATION OF ALTERNATIVE HUDSON LINE SCENARIOS ...................2 2.1. Development and Calibration of the Simulation Model (2002 Baseline)......... 2 2.1.1. 2002 Baseline Inputs ....................................................................................................... 2 2.1.2. 2002 Baseline Simulation Results ................................................................................. 6 2.2. Future Year (2022) Baseline ........................................................................................ 7 2.2.1. 2022 Baseline Inputs ....................................................................................................... 7 2.2.2. 2022 Baseline Simulation Results ................................................................................. 8 2.3. Future Year (2022) Alternatives................................................................................10 2.3.1. 2022 Scenario 1 Inputs..................................................................................................10 -

Investing in Mobility

Investing in Mobility FREIGHT TRANSPORT IN THE HUDSON REGION THE EAST OF HUDSON RAIL FREIGHT OPERATIONS TASK FORCE Investing in Mobility FREIGHT TRANSPORT IN THE HUDSON REGION Environmental Defense and the East of Hudson Rail Freight Operations Task Force On the cover Left:Trucks exacerbate crippling congestion on the Cross-Bronx Expressway (photo by Adam Gitlin). Top right: A CSX Q116-23 intermodal train hauls double-stack containers in western New York. (photo by J. Henry Priebe Jr.). Bottom right: A New York Cross Harbor Railroad “piggypacker” transfers a low-profile container from rail to a trailer (photo by Adam Gitlin). Environmental Defense is dedicated to protecting the environmental rights of all people, including the right to clean air, clean water, healthy food and flourishing ecosystems. Guided by science, we work to create practical solutions that win lasting political, economic and social support because they are nonpartisan, cost-effective and fair. The East of Hudson Rail Freight Operations Task Force is committed to the restoration of price- and service-competitive freight rail service in the areas of the New York metropolitan region east of the Hudson River. The Task Force seeks to accomplish this objective through bringing together elected officials, carriers and public agencies at regularly scheduled meetings where any issue that hinders or can assist in the restoration of competitive rail service is discussed openly. It is expected that all participants will work toward the common goal of restoring competitive rail freight service East of the Hudson. ©2004 Environmental Defense Printed on 100% (50% post-consumer) recycled paper, 100% chlorine free. -

New York State Freight Transportation Plan Background Analysis (Deliverable 1)

NEW YORK STATE FREIGHT TRANSPORTATION PLAN BACKGROUND ANALYSIS (DELIVERABLE 1) JUNE 2015 PREPARED FOR: NEW YORK STATE DEPARTMENT OF TRANSPORTATION NEW YORK STATE FREIGHT TRANSPORTATION PLAN BACKGROUND ANALYSIS (DELIVERABLE 1) PREPARED FOR: NEW YORK STATE DEPARTMENT OF TRANSPORTATION CONTENTS ACRONYMS AND ABBREVIATIONS ........................................................................................................ III 1.0 INTRODUCTION............................................................................................................................... 1 2.0 COMMON GOALS AND THEMES................................................................................................... 2 2.1 | Goals Identification ........................................................................................................................ 2 2.2 | Theme Identification ...................................................................................................................... 9 2.3 | Gap Identification......................................................................................................................... 10 Gaps in Geographic Coverage......................................................................................................................................... 10 Gaps in Modal Coverage ................................................................................................................................................. 11 Gaps in Coordination ...................................................................................................................................................... -

7338-252 / I-95 Nerops Tech Memo 1

I-95 Corridor Coalition Northeast Rail Operations Study (NEROps) Phase I Final Report July 2007 Northeast Rail Operations Study (NEROps) Phase I Final Report Prepared for: I-95 Corridor Coalition Sponsored by: I-95 Corridor Coalition New York State Department of Transportation Connecticut Department of Transportation Rhode Island Department of Transportation Massachusetts Executive Office of Transportation Vermont Agency of Transportation New Hampshire Department of Transportation Maine Department of Transportation Prepared by: Cambridge Systematics, Inc. Acknowledgements: Thanks to Steve Slavick of New York State Department of Transportation for leading the project Steering Committee, and to all those from the public and private sector who contributed to the report. A full list of participants can be found in the Appendices. July 2007 This report was produced by the I-95 Corridor Coalition, a partnership of state departments of transportation, regional and local transportation agencies, toll authorities, and related organizations, including law enforcement, port, transit and rail organizations, from Maine to Florida, with affiliate members in Canada. Additional information about the Coalition, including other project reports, can be found on the Coalition’s web site at http://www.i95coalition.org. Questions about the NEROps Phase I Final Report should be directed to: Marygrace Parker I-95 Corridor Coalition Freight, Mobility, Safety & Security Coordinator Northeast Rail Operations Study (NEROps) Table of Contents 1.0 Introduction ................................................................................................................... -

View of Harlem River Looking Fig

Beile Yin, Ph.D., PE, F. ASCE 14Wcee 2008 05-02-0061 SEISMIC DESIGN OF TWO NEW YORK BRIDGES Beile Yin, Ph.D., PE, F. ASCE, Hardesty & Hanover, LLP, New York, USA ABSTRACT The Third Avenue Bridge and Willis Avenue Bridge are two adjacent bridges each carrying one directional traffic across Harlem River in New York City. The replacement of 100-year old Third Avenue Bridge is complete. The new 5-lane crossing consists of 17 approach spans and a 107-m long swing span for an overall bridge length of 457m. Including on-grade approaches, the overall project length is 1067m. Construction of the $118.8 million bridge replacement project began in 2001 and completed in 2005. The Willis Avenue Swing Bridge over the Harlem River is being replaced under a $612 million project which is massive in scope as it extends over a mile in length, passes over the Harlem River and an adjoining railyard and provides connections between two major highways as well as three major arterial streets. The new alignment not only dramatically improves the alignment from that of the 100 year old existing bridge but also facilitates maintaining 70,000 vehicles per day of roadway traffic as well as maintaining navigation on the river. The project centerpiece is a new four lane, 106 meter long swing span. This paper focuses on the seismic analysis and seismic design of the two bridges. Challenges faced by the designers of the new bridge, and solutions developed to meet these challenges will be introduced. Since similarities exist between these two bridges, more detailed description will be on one of them, i.e. -

Experience Areas of Specialization

Theodore von Rosenvinge IV, P.E., D.GE Senior Principal EXPERIENCE GeoDesign, Inc. - 2/95 to Present Berger, Lehman Associates, P.C. - 5/92 to 1/95 GZA GeoEnvironmental, Inc. – Boston & CT 7/80 to 4/92 T.W. Lambe (MIT) 1979-80, other firms - 2 years 1975-78 co-op Composite Construction 1973-1975 EDUCATION AREAS OF SPECIALIZATION M.S., 1980, Civil Engineering (geotechnical specialization), MIT Geotechnical Engineering B.S., 1978, Civil Engineering, Northeastern University Constructibility/Peer Review M.B.A., 1993, University of Connecticut (Finance) Foundation Engineering Dispute Resolution Board Training, 2003 Soil Mechanics/Slopes Deep Foundations/Excavation PROFESSIONAL REGISTRATION Registered Professional Engineer: NY, TN, NJ, CT, MA, ME, VT, NH, RI, MI, PA, TX, FL, MD, LEED AP PROFESSIONAL EXPERIENCE: Mr. von Rosenvinge began his career as a union construction worker in Boston before engineering school for structural engineering and an advanced degree in geotechnical engineering. Geotechnical engineering experience includes field engineer to principal in the responsible charge of hundreds of projects involving foundation engineering for hi-rise buildings, major bridges, rail facilities, marine projects, earthwork/underground construction, earth retention structures and slopes, computational analysis for soil structure interaction, slope stability, soil and rock mechanics, rock engineering, blasting/vibration analysis, forensic/expert witness, field and lab testing, geotechnical instrumentation. Founding GEODesign, Inc. in 1995 the -

Rail Network and Infrastructure

TECHNICAL MEMO NYMTC Regional Freight Plan Update 2015-2040 Interim Plan Task 2.1.2 Rail Network and Infrastructure REVISED, JANUARY 2014 technical memorandum Task 2.1.2 Technical Memorandum Rail Network and Infrastructure Revised, January 30, 2014 Task 2.1.2 Technical Memorandum Table of Contents 1.0 Introduction ......................................................................................................... 1-1 2.0 Institutional Structure ........................................................................................ 2-1 2.1 Background .................................................................................................. 2-1 2.2 Class I Carriers and Affiliates ................................................................... 2-4 CSX................................................................................................................ 2-4 Norfolk Southern (NS) ............................................................................... 2-6 Conrail Shared Assets ................................................................................ 2-9 Canadian Pacific (CP) ............................................................................... 2-10 2.3 Short Line and Regional Firms ............................................................... 2-10 Housatonic Railroad ................................................................................. 2-10 New York and Atlantic Railway ............................................................. 2-10 New York New Jersey Rail ..................................................................... -

Viabilityofoakpoint

State of New York Office of the State Comptroller Division of Management Audit NEW YORK STATE DEPARTMENT OF TRANSPORTATION STAFF STUDY: THE VIABILITY OF THE OAK POINT LINK AND HARLEM RIVER YARD PROJECTS REPORT 95-D-43 H. Carl McCall Comptroller State of New York Office of the State Comptroller Division of Management Audit Report 95-D-43 Mr. John B. Daly Commissioner NYS Department of Transportation State Office Building Campus - Building #5 Albany, New York 12232 Dear Mr. Daly: The following is our staff study of the viability of the Oak Point Link and the Harlem River Yard projects. We did this study according to the State Comptroller's authority as set forth in Section 1, Article V of the State Constitution and Section 8, Article 2 of the State Finance Law. We list major contributors to this report in Appendix A. February 5, 1997 In an effort to reduce the costs of printing, if you wish your name to be deleted from our mailing list or if your address has changed, contact Raymond W. Cecot at (518) 474-3271 or at the Office of the State Comptroller, Alfred E. Smith State Office Building, 13th Floor, Albany, NY 12236. Executive Summary New York State Department Of Transportation Staff Study: The Viability Of The Oak Point Link And Harlem River Yard Projects Scope of Study In the early 1970s, the New York State Department of Transportation (DOT), the Port Authority of New York and New Jersey and the City of New York identified a series of capital improvements (that included raising rail clearances) to improve the rail freight network in the downstate region of New York. -

EMPLOYEE TIMETABLE Timetable No. 4 Effective February 5, 2006

EMPLOYEE TIMETABLE Timetable No. 4 Effective February 5, 2006 FOR EMPLOYEES ONLY R. E. Lieblong Senior Vice President – Operations GO 413 (4-10) Employee Timetable INTRODUCTION The Employee Timetable contains four parts, plus Track Charts which are provided for information only. Line Special Instructions contain Line- and Branch-specific information and rules. Each section has a prefix identifying the Line or Branch, and is numbered as shown in the table below. Hudson Line Special Instructions are separated into two sections: • GCT 41 through GCT 48 apply only to the portion of the Hudson Line between GCT and the southerly limit of CP 8 (MP 6.9). • HUD 41 through HUD 48 apply only to the portion of the Hudson Line between the southerly limit of CP 8 (MP 6.9) and Division Post/CSX (MP 75.8), inclusive. Hudson Line New Haven Line New New CP8 CP8 to Branch Branch Branch Branch Canaan Canaan Divison Divison Division Division Danbury Danbury CP 112 to to 112 CP Post/CSX LineHarlem Beacon Line Line Beacon Waterbury Waterbury GCT to CP8 GCT to CP8 Subject Post/Amtrak STATIONS HUD 40 HAR-40 NHV 40 NCN 40 DAN 40 WBY 40 BEA 40 MAX AUTH SPEEDS GCT 41 HUD 41 HAR 41 NHV 41 NCN 41 DAN 41 WBY 41 BEA 41 EQUIP. RESTR. GCT 42 HUD 42 HAR 42 NHV 42 NCN 42 DAN 42 WBY 42 BEA 42 ELECTRICAL OPER. GCT 43 HUD 43 HAR 43 NHV 43 NCN 43 DAN 43 WBY 43 BEA 43 HIGHWAY GRADE GCT 44 HUD 44 HAR 44 NHV 44 NCN 44 DAN 44 WBY 44 BEA 44 CROSSINGS LOCATION OF BULL. -

Federal Railroad Administration Office of Railroad Safety Accident and Analysis Branch Accident Investigation Report HQ-2013-18

Federal Railroad Administration Office of Railroad Safety Accident and Analysis Branch Accident Investigation Report HQ-2013-18 CSX Transportation Intermodal (CSXT) New York City, NY July 18, 2013 Note that 49 U.S.C. §20903 provides that no part of an accident or incident report, including this one, made by the Secretary of Transportation/Federal Railroad Administration under 49 U.S.C. §20902 may be used in a civil action for damages resulting from a matter mentioned in the report. U.S. Department of Transportation FRA File #HQ-2013-18 Federal Railroad Administration FRA FACTUAL RAILROAD ACCIDENT REPORT TRAIN SUMMARY 1. Name of Railroad Operating Train #1 1a. Alphabetic Code 1b. Railroad Accident/Incident No. CSX Transportation Intermodal CSXT 000118580 GENERAL INFORMATION 1. Name of Railroad or Other Entity Responsible for Track Maintenance 1a. Alphabetic Code 1b. Railroad Accident/Incident No. Metro North Commuter Railroad Company MNCW 2013071844 2. U.S. DOT Grade Crossing Identification Number 3. Date of Accident/Incident 4. Time of Accident/Incident 7/18/2013 8:29 PM 5. Type of Accident/Incident Derailment 6. Cars Carrying 7. HAZMAT Cars 8. Cars Releasing 9. People 10. Subdivision HAZMAT 0 Damaged/Derailed 0 HAZMAT 0 Evacuated 0 Hudson Line 11. Nearest City/Town 12. Milepost (to nearest tenth) 13. State Abbr. 14. County New York City 9.9 NY BRONX 15. Temperature (F) 16. Visibility 17. Weather 18. Type of Track 91 ̊ F Dusk Clear Main 19. Track Name/Number 20. FRA Track Class 21. Annual Track Density 22. Time Table Direction (gross tons in millions) 2 Freight Trains-40, Passenger Trains-60 North 10.4 U.S.