Overbury-And-The-Grasshopper.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cleveland Naturalists' Field Club and a Valued Contributor, After First Accepting the British

1 CLEVELAND NATURALISTS’ FIELD CLUB RECORD OF PROCEEDINGS 1920 - 1925 VOL.III. Part IV. Edited by Ernest W. Jackson F.I.C., F.G.S. PRICE THREE SHILLINGS (FREE TO MEMBERS) MIDDLESBROUGH; JORDISON AND CO., LTD, PRINTERS AND PUBLISHERS 1926 CONTENTS MEMOIR OF W.H. THOMAS - J.W.R. PUNCH 187 ROSEBERRY TOPPING IN FACT AND FICTION - J.J. BURTON, F.G.S. 190 WHITE FLINT NEAR LEALHOLME - EARNEST W. JACKSON, F.I.C. 206 THE MOUND BREAKERS OF CLEVELAND - WILLIAM HORNSBY, B.A 209 PEAT DEPOSITS AT HARTLEPOOL - J INGRAM, B. SC 217 COLEOPTERA OBSERVED IN CLEVELAND - M LAWSON THOMPSON, F.E.S. 222 ORIGIN OF THE FIELD CLUB - THE LATE J.S. CALVERT 226 MEMOIRS OF J.S. CALVERT - J.J. BURTON 229 MEMOIR OF BAKER HUDSON - F ELGEE 233 OFFICERS 1926 President Ernest W Jackson F.I.C., F.G.S Vice-Presidents F Elgee Miss Calvert J J Burton F.G.S. M.L.Thompson F.E.S. J W R Punch T A Lofthouse A.R.I.B.A., F.E.S H Frankland Committee Mrs Hood Miss Cotton C Postgate Miss Vero Dr Robinson P Hood Hon Treasurer H Frankland, Argyle Villa, Whitby Sectional Secretaries Archaeology – P Hood Geology – J J Burton, F.G.S. Botany – Miss Calvert Ornithology ) Conchology ) and ) - T A Lofthouse And )- T A Lofthouse Mammalogy ) F.E.S. Entomology ) F.E.S. Microscopy – Mrs Hood Hon. Secretaries G Knight, 16 Hawthorne Terrace, Eston M Odling, M.A., B.Sc.,”Cherwell,” the Grove, Marton-in-Cleveland Past Presidents 1881 - Dr W Y Veitch M.R.C.S. -

Connection Issue 70.Pdf

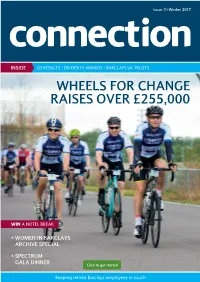

Issue 70 Winter 2017 connection INSIDE Q3 RESULTS • DIVERSITY AWARDS • BARCLAYS UK TRUSTS WHEELS FOR CHANGE RAISES OVER £255,000 WIN A HOTEL BREAK + WOMEN IN BARCLAYS ARCHIVE SPECIAL + SPECTRUM GALA DINNER Click to get started Keeping retired Barclays employees in touch Inside this issue... EDITOR’S WORD FEATURES REGULARS 5 10 Page 6 Page 4 Barclays news Barclays news Q3 2016 Results, The new £5 note, Barclays Diversity Wheels for Change, Spectrum’s Gala Business Awards 2016 Dinner and Pension Fund newsletter Page 8 Pensioners’ clubs & contacts Happy New Year to you all and welcome Page 12 Bournemouth and District Pensioners’ to the first edition of connection for Archive article 2017. We hope you’ve enjoyed the festive Club, Cornwall Pensioners’ Club, Women in Barclays season and are ready to embrace the Liverpool Retired Staff Club, East New Year. Midlands Pensioners’ Club and Many of you will be reading connection Ipswich District Pensioners’ Club on your computer or tablet screens for the Page 14 first time. To help you move through the Page 16 magazine more easily, we’ve added arrows Life beyond Your letters Barclays to the bottom of the pdf, and we’ve also Page 20 made the clickable links bold to make it The end of an era clear when you can click through to Retirements & obituaries other websites. Please let the Barclays Page 26 Team at Willis Towers Watson know if you Useful contacts no longer wish to receive a printed copy. If you’re thinking of embarking on a new Page 28 adventure this year, turn to pages 14 Competition & crossword and 15 for some Life beyond Barclays inspiration. -

The Headquarters of National Provincial Bank of England

Symbolism in bank marketing and architecture: the headquarters of National Provincial Bank of England Article Published Version Creative Commons: Attribution 4.0 (CC-BY) Open Access Barnes, V. and Newton, L. (2019) Symbolism in bank marketing and architecture: the headquarters of National Provincial Bank of England. Management and Organizational History, 14 (3). pp. 213-244. ISSN 1744-9359 doi: https://doi.org/10.1080/17449359.2019.1683038 Available at http://centaur.reading.ac.uk/86938/ It is advisable to refer to the publisher’s version if you intend to cite from the work. See Guidance on citing . To link to this article DOI: http://dx.doi.org/10.1080/17449359.2019.1683038 Publisher: Taylor and Francis All outputs in CentAUR are protected by Intellectual Property Rights law, including copyright law. Copyright and IPR is retained by the creators or other copyright holders. Terms and conditions for use of this material are defined in the End User Agreement . www.reading.ac.uk/centaur CentAUR Central Archive at the University of Reading Reading’s research outputs online Management & Organizational History ISSN: 1744-9359 (Print) 1744-9367 (Online) Journal homepage: https://www.tandfonline.com/loi/rmor20 Symbolism in bank marketing and architecture: the headquarters of National Provincial Bank of England Victoria Barnes & Lucy Newton To cite this article: Victoria Barnes & Lucy Newton (2019) Symbolism in bank marketing and architecture: the headquarters of National Provincial Bank of England, Management & Organizational History, 14:3, 213-244, DOI: 10.1080/17449359.2019.1683038 To link to this article: https://doi.org/10.1080/17449359.2019.1683038 © 2019 The Author(s). -

Special Collections Online

MEX-MIL BANKING DIRECTORY. 2476 . !PLACE. BANKERS. DR.A. W ON IN LmmoN • Mexico • ...........•...... I ••••• I ••• 0 •••••• I ••••• I •••• I ••••••••••• I I ••• I I •••••• ;:;;;.:umel Montagu & Co • Banco Internacionale & Hipotecario ......••••. , ' 0 0 o o o o 0 0 o o 0 0 0 0 0 I o o Banco de Londres y Mexico .......................................... I I ••••••••• I •••••••••••••••••• Lazard Brothers & Co , ' 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 I 0 0 Banco Mcxicano de Corr1mercio e Industria .•. o •••••• I •••••• 0 ••••• o •••• I •••••••••• I •••••••••• I ••••••• Deutsche Bank (Berlin) London Agency, , o o o o o o o o I o o I I o o I o o Banco N acional de Mexico .. o o ••••••• o ••••••••••• I ••••• I ••••• I ••••••••••••••••• I •••••••••••••••••• Lazard Brothers & Co , I I I I I I 0 0 I I I I o o o o o o Bank of Montreal .........................•............. I I ••••• I •••••••••••••••••••••••••••••••••• o London Office, 46 Threadneedle street F r , •••••••••••••••••• Branch of International Banking Corporation ................................................•..... London Off .31 Bishopsgate st. wn E C & National Provincial Bk.of Eng,r_tl! , I I 0 I I I I I 0 I I I I I 0 I I I London Commercial Banking Co. Sociedad .A.nonima ............................................... London Office, 12 A bchurch lane E C , 0 I I I I 0 I 0 I 0 I 0 I I I I I I Mexico City Banking Oo ....•.. I ••••••••••••••••• I ••••• I ••••• I •••••••••• I I •••••••••• I •••• I •••••••• Briti~h Linen Bank & London City & Midland Bank Ltd 0 I 0 I 0 0 0 I 0 0 0 I 0 I I 0 I I National Bank of Mexico ...... -

A Study in Comparative Economic History

PRINCETON STUDIES IN INTERNATIONAL FINANCE NO. 36 The Formation of Financial Centers: A Study in Comparative Economic History Charles P. Kindlebergei INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY • 1974 PRINCETON STUDIES IN INTERNATIONAL FINANCE This is the thirty-sixth number in the series PRINCETON STUDIES IN INTERNATIONAL FINANCE, published from time to time by the Inter- national Finance Section of the Department of Economics at Princeton University. The author, Charles P. Kindleberger, is Ford Professor of Economics at the Massachusetts Institute of Technology. His work in economic history includes The World in Depression, 1929-1939 (1973) and Eco- nomic Growth in France and Britain, 1851-1950 (1964). He is the author of two Essays in International Finance, The Politics of Inter- national Money and World Language (No. 61, 1967) and Balance- of-Payments Deficits and the International Market for Liquidity (No. 46, 1965). This series is intended to be restricted to meritorious research stud- ies in the general field of international financial problems which are too technical, too specialized, or too long to qualify as ESSAYS. The Sec- tion welcomes the submission of manuscripts for this series. While the Section sponsors the studies, the writers are free to de- velop their topics as they will. Their ideas and treatment may.or may not be shared by the editorial committee of the Section or the mem- bers of the Department. PETER B. KENEN Director Princeton University PRINCETON STUDIES IN INTERNATIONAL FINANCE NO. 36 The Formation of Financial Centers: A Study in Comparative Economic History Charles P. Kindleberger INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY PRINCETON, NEW JERSEY November 1974 Copyright 0 1974, by International Finance Section Department of Economics, Princeton University Library of Congress Cataloging in Publication Data Kindleberger, Charles Poor, 1910- The formation of financial centers. -

Wealthy Business Families in Glasgow and Liverpool, 1870-1930 a DISSERTATION SUBMITTED TO

NORTHWESTERN UNIVERSITY In Trade: Wealthy Business Families in Glasgow and Liverpool, 1870-1930 A DISSERTATION SUBMITTED TO THE GRADUATE SCHOOL IN PARTIAL FULFILLMENT OF THE REQUIREMENTS for the degree DOCTOR OF PHILOSOPHY Field of History By Emma Goldsmith EVANSTON, ILLINOIS December 2017 2 Abstract This dissertation provides an account of the richest people in Glasgow and Liverpool at the end of the nineteenth and beginning of the twentieth centuries. It focuses on those in shipping, trade, and shipbuilding, who had global interests and amassed large fortunes. It examines the transition away from family business as managers took over, family successions altered, office spaces changed, and new business trips took hold. At the same time, the family itself underwent a shift away from endogamy as young people, particularly women, rebelled against the old way of arranging marriages. This dissertation addresses questions about gentrification, suburbanization, and the decline of civic leadership. It challenges the notion that businessmen aspired to become aristocrats. It follows family businessmen through the First World War, which upset their notions of efficiency, businesslike behaviour, and free trade, to the painful interwar years. This group, once proud leaders of Liverpool and Glasgow, assimilated into the national upper-middle class. This dissertation is rooted in the family papers left behind by these families, and follows their experiences of these turbulent and eventful years. 3 Acknowledgements This work would not have been possible without the advising of Deborah Cohen. Her inexhaustible willingness to comment on my writing and improve my ideas has shaped every part of this dissertation, and I owe her many thanks. -

![Here Could Be a Recognition Only of What I Have Called External Goods […]](https://docslib.b-cdn.net/cover/5187/here-could-be-a-recognition-only-of-what-i-have-called-external-goods-1425187.webp)

Here Could Be a Recognition Only of What I Have Called External Goods […]

Competition and the London Clearing Banks, 1946-1979 Linda Arch © [email protected] The Court Room, The Bank of England https://www.flickr.com/photos/ba nkofengland/6220545302, accessed 3 May, 2015 1 Should Nation States Compete? 25-26 June 2015 Structure 1. Introduction 2. Context 3. Attitudes towards competition in clearing banking - ambivalence 4. Attitudes towards competition in clearing banking - embracing competition 5. Discussion and questions 2 Should Nation States Compete? 25-26 June 2015 1. INTRODUCTION 3 Should Nation States Compete? 25-26 June 2015 Alasdair MacIntyre Credit: Sean. https://www.flickr.com/p hotos/seanoconnor365/33 51618688 4 Should Nation States Compete? 25-26 June 2015 Introduction • “without the virtues there could be a recognition only of what I have called external goods […]. And in any society which recognised only external goods competitiveness would be the dominant and even exclusive feature.” • Alasdair MacIntyre, After Virtue: A Study in Moral Theory, Third Edition, (Notre Dame, IND: University of Notre Dame Press, 2007), 196. 5 Should Nation States Compete? 25-26 June 2015 Introduction External goods: • ‘goods of effectiveness’ • profit, money, share price, status, prestige … • property or possession of an individual Internal goods: • ‘goods of excellence’ • achieved in the context of ‘practices’ • benefit the whole community who take part in that practice • Eg. an internal good in clearing banking might be the good of ‘trustworthiness’ 6 Should Nation States Compete? 25-26 June 2015 Introduction -

Banking' and Currency. 231

Banking' and Currency. 231 The following is a copyof the totals under gives more minute details of the operations each heading of the new form of statement of the Banks than the previous form of which the Banks are now by law obliged statement did. Its use commenced with to render, from the last published returns the present fiscal year. It shows in another (Sept. 30, 1871) in the Canada Gazette. It way the position of the chartered Banks :— STATEMENT of Chartered Banks of Dominion Sept. 30, 1871. Capital. Assets. $ Capital authorized 50,166.666 Specie.. 6,126,430 Capital subscribed 40,593,826 Provincial or Dominion Notes. 5,270,340 Capital paid up 38,340,131 Notes of and Cheques on other Banks 3,323,605 Balances due from other Banks in Canada 1,845,461 LIABILITIES. Do from other do or Agents not in Canada - 12,853,305 Notes in circulation 22,301,519 Govt. Debentures or Stock— 1,559,537 Govt* Deposits payable on de Loans to the Governments— 1,219,891 mand. f - 3,517,199 Loans, &c. to Corporations 1,224,611 Other do 25,911,276 Notes and Bills discounted and Govt, do do after notice 5,945,667 current 89,083,348 Other do do do .... 20,307,255 Notes, Ac. overdue and not Due other Banks in Canada... 1,055,108 specially secured 1,034,855 Do do or Agents not do 3,064,480 Overdue debts secured 1,181,206 Liabilities net included above. 1,100,766 Real Estate (other than the Bank Premises). -

Architecture & Finance

bulletin Architecture & Finance 2019/20 eabh (The European Association for Banking and Financial History e.V.) Image: Bank of Canada and Museum entrance. 29 Sept 2017. Photo: doublespace bulletin Architecture & Finance 2019/20 www.bankinghistory.org ISSN 2219-0643 bulletin | 2019/20 3 CONTENTS contents Athens to New York 6 The barriers of banking 24 Societe Generale’s architecture in Africa 32 Caixa Geral Depósitos in Brazil: Agência Financial in Rio de Janeiro 35 Bank of Canada: An architectural heritage 39 The Masonry of capitalism 45 L’Hôtel de la Monnaie de Paris: A royal architecture to the service of the monetary process 48 The house of Commerzbank at Pariser Platz in Berlin 56 Deutsche Bundesbank: Regional office in Hesse 60 KfW Group Westarkade: An energy efficient office building 65 Athenian neoclassical residence in the 19th century: A photography collection 68 Dutch functionalism in the tropics: The factory of the Netherlands Trading Society 73 BNP Paribas Asia Pacific campus 79 Headquarters of Banco Santander: The buildings of Buenos Aires, Santiago de Chile and São Paulo 87 Martins Bank head office: Liverpool 1927-32 92 Intended for magnificent business: The enduring legacy of New Court 102 Locations of the Royal Mint 107 Schroders plc 112 The New York Stock Exchange’s 11 Wall Street building 115 KEY TITLE EDITORS SUBMISSIONS bulletin (eabh - The European Carmen Hofmann, eabh All submissions by email Association for Banking and Gabriella Massaglia, eabh EMAIL Financial History) Hanauer Landstrasse 126-128, D-60314 [email protected] Frankfurt am Main, Germany DESIGN TEL Richard McBurney, Grand Creative, LANGUAGE EDITOR +49(0)69 36 50 84 650 www.grand-creative.com Jonathan Ercanbrack, SOAS University Chloe Colchester, Oxford University WEBSITE www.bankinghistory.org bulletin | 2019/20 5 ATHENS TO NEW YORK Athens to New York Carmen Hofmann his article provides the long view of financial architecture reaching from T antiquity to the present day, and focussing on the most important neo-classi- cal financial buildings in New York. -

The Grasshopper Pensioners' Club Just As We Have For

THE GRASSHOPPER PENSIONERS’ CLUB Website: www.martinsbank.co.uk © gut informiert! SECRETARY: David Baldwin, Lower Windle, Windle Royd Lane, Warley, HX2 7LY. 'Phone: 01422 832734. email: [email protected] CHAIRMAN: Bernard Lovewell TREASURER: Robert Bunn WELFARE OFFICER: Susan Sutcliffe New Year Edition 2021 JUST AS WE HAVE MORE MEMORIES On this occasion from 1951 when our two best- FOR BEEN 458 YEARS, represented Districts in our membership met in WE’RE STILL HERE WITH their annual match, where the following photograph and comments were cut from their magazine by Joan and Gordon Anthony: The annual match between Liverpool and London Districts took place on Monday 8th October on the ground of the Odyssey WE WILL REMEMBER THEM THE MARTINS BANK WAR MEMORIAL In our last edition we mentioned the rededication of our War Memorial in 54 Lombard Street we are now attempting to identify its current location. Club in Liverpool, the kick-off being taken by Mr. J.A. Banks, the Liverpool District Manager. Fog, which persisted all day, lifted just before the match began and the game took place in brilliant sunshine but with a rather strong breeze across the pitch. Liverpool pressed strongly from the beginning and after fifteen minutes they were rewarded with a goal by Smith, the left winger, from an opening made by Bass, who had headed across the goal mouth. Play was fairly even for the next twenty minutes and then London broke away and Anthony, the centre forward, scored for the visitors. Both goal-keepers had more to do in the second half and had it not been the good work of Ford, the keeper for London, who made two excellent saves, the visitors would probably have been defeated, whereas the match ended in a draw. -

Analysing Risk Management in Banks: Evidence of Bank Efficiency

British Journal of Economics, Finance and Management Sciences 1 March 2017, Vol. 13 (2) The Nature and Extent of the Reciprocal Obligations Involved in the Banker/Customer Relationship Stanyo Dinov Abstract The current paper explores the banker/customer relationship and its historical development. Based on statuary and case law, it outlines the definitions of banker and customer, the duration of their relationship and their individual rights and obligations. Recent changes of the relationship and the differences, resulting from court decisions in England and Scotland regarding their obligations, are also presented. The article also trays to predict the possible changes to the banker/customer relationship in the near future. The most important conclusions, as well as possible further developments, are outlined at the end. Keywords: BEA, CCA, JCR, BPS, ATM systems I. Introduction The relationship between the banker and the customer has changed over time, so it is not easy to predict the nature of this relationship in the near future. Recent rapid technological development has raised many questions about customers‟ privacy and protection. Therefore, there is still a need to closely examine the legal aspects of this relationship from the past to the present, in order to find the best approach to its future context. II. Definition, nature and formation of reciprocal obligation 1. Definition The banker/customer relationship consists of two sides. A banker, according to the Bills of Exchange Act (BEA) 1882 s 2, „includes a body of persons whether -

Barclays PLC Rights Issue Prospectus

THIS PROSPECTUS AND ANY ACCOMPANYING DOCUMENTS ARE IMPORTANT AND REQUIRE YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you are recommended to seek immediately your own personal financial advice from your stockbroker, bank manager, solicitor, accountant, fund manager or other appropriate independent financial adviser, who is authorised under the Financial Services and Markets Act 2000 (the “FSMA”) if you are in the UK or, if not, from another appropriately authorised independent financial adviser. If you sell or have sold or otherwise transferred all of your Existing Ordinary Shares (other than ex-rights) held in certificated form before 18 September 2013 (the “Ex-Rights Date”) please send this Prospectus, together with any Provisional Allotment Letter, duly renounced, if and when received, at once to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee except that such documents should not be sent to any jurisdiction where to do so might constitute a violation of local securities laws or regulations. If you sell or have sold or otherwise transferred all or some of your Existing Ordinary Shares (other than ex-rights) held in uncertificated form before the Ex-Rights Date, a claim transaction will automatically be generated by Euroclear UK which, on settlement, will transfer the appropriate number of Nil Paid Rights to the purchaser or transferee. If you sell or have sold or otherwise transferred only part of your holding of Existing Ordinary Shares (other than ex-rights) held in certificated form before the Ex-Rights Date, you should refer to the instruction regarding split applications in Part II “Terms and Conditions of the Rights Issue” of this Prospectus and in the Provisional Allotment Letter, if and when received.