Entain Plc Annual Report 2020 Start Here

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Monthly Professional Factsheet Uk Opportunities Fund a Income Shares 31 August 2021

pro.en.xx.20210831.GB00BGV1T511.pdf UK Opportunities Fund A Income Shares For Investment Professionals Only FIDELITY INVESTMENT FUNDS 2 MONTHLY PROFESSIONAL FACTSHEET UK OPPORTUNITIES FUND A INCOME SHARES 31 AUGUST 2021 Strategy Fund Facts Leigh Himsworth identifies specific areas of the market that he believes are capable of Launch date: 01.09.11** delivering consistent growth. Within these themes, he employs disciplined cash flow Portfolio manager: Leigh Himsworth analysis to seek out companies capable of delivering earnings growth without Appointed to fund: 01.09.11 materially increasing their risk profile. On this basis, Leigh builds a high conviction Years at Fidelity: 7 portfolio of quality growth companies. Each holding in the portfolio has a weighting that Fund size: £602m allows it to make a meaningful contribution to performance. Risk management takes Number of positions in fund*: 55 into account factors that could impact a number of companies in the portfolio. Fund reference currency: UK Sterling (GBP) Fund domicile: United Kingdom Fund legal structure: OEIC Management company: FIL Investment Services (UK) Limited Capital guarantee: No Portfolio Turnover Cost (PTC): 0.48% Portfolio Turnover Rate (PTR): 182.08% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to increase the value of your investment over a period of 5 years or Other share classes may be available. Please refer to the prospectus for more details. more. • The fund will invest at least 70% in shares (and their related securities) of a blend of Launch date: 15.05.19 different sized UK companies. -

Restoring Trust in Corporate Governance: the Six Essential Tasks of Boards of Directors and Business Leaders

Restoring Trust in Corporate Governance: The Six Essential Tasks of Boards of Directors and Business Leaders Policy Brief January 2010 Policy and Impact Committee of the Committee for Economic Development Restoring Trust in Corporate Governance: The Six Essential Tasks of Boards of Directors and Business Leaders POLICY BRIEF Policy and Impact Committee of the Committee for Economic Development Contents EXECUTIVE SUMMARY . xi I . INTRODUCTION . 1 II . RESTORING TRUST WITH SIX ESSENTIAL GOVERNANCE TASKS . 3 1) Redefining the Mission of the Corporation—and the Roles of the Board of Directors and the CEO . 3 2) Revamping the Leadership Development Process . 4 3) Refocusing the Process for CEO Selection—and for Other Promotions into High Corporate Positions . 4 4) Reformulating Operational Objectives for Performance, Risk and Integrity . 5 5) Revising Compensation for the CEO, Senior Executives and Other Key Employees . 9 6) Re-aligning the Board’s Oversight Function . 10 III .OBSTACLES . 13 1) Labor Markets . 13 2) Differing International Standards . 13 3) Changing Board Compensation Advisors . 14 4) Short-Termism of Institutional Investors . 14 5) Manipulating the Numbers . 15 6) The Reduction of Pressure for Change . 15 IV . ACCOUNTABILITY AND LEADERSHIP . 17 1) The Market . 17 2) Shareholder Involvement . 17 3) Government Regulation . 17 4) Back to the Future: The Duties of Boards of Directors and Top Business Leadership . 18 ENDNOTES . 19 iii iv Policy and Impact Committee Chairmen PATRICK FORD LAURENCE G. O’NEIL President and Chief Executive Officer, U.S. President and Chief Executive Officer PATRICK W. GROSS Burson-Marsteller Society for Human Resource Chairman Management The Lovell Group CONO R. -

An Evolution in Gambling

Gaming plc Realms Annual ReportAnnual 2014 & Accounts An Evolution in Gambling Gaming Realms plc Annual Report & Accounts 2014 Strategic Report The Group hopes to 01 Highlights 02 Gaming Realms at a Glance 04 Chairman’s Statement become a market leader 06 Market Positioning 08 Our Strategy in the mobile-led casual 10 Chief Executive’s Review 12 Principal Risks and Uncertainties gambling market forecast Corporate Governance 14 Board and Executive to be worth $100bn Management 16 Directors’ Report 17 Statement of Directors’ worldwide in 2 years. Responsibilities 18 Corporate Governance Financial Statements 19 Independent Auditors’ Report 20 Consolidated Statement of Profit and Loss and Other Comprehensive Income 21 Consolidated Statement of Financial Position 22 Consolidated Statement of Cash Flows 23 Consolidated Statement of Changes in Equity 24 Notes to the Consolidated Financial Statements 47 Parent Company Balance Sheet 48 Notes to Parent Company Financial Statements 52 Company Information www.gamingrealms.com Highlights Strategic Report Strategic Operational highlights › Increase of 635% in new real money › Completion of new in-house scalable gambling depositors compared to the platform which includes a feature set previous financial period. to enhance conversion, retention and › Increase of 338% in average daily players monetisation of real money gambling compared to previous financial period. players. › Acquisition of QuickThink Media Limited › Obtained licences from the Alderney and Blueburra Holdings Limited. Gambling Control Commission -

Entain Plc ("Entain" Or the “Group”)

12 August 2021 – Strictly embargoed until 1.30pm BST Entain plc ("Entain" or the “Group”) Total addressable market expected to grow more than three-fold to c.$160bn Extension into interactive entertainment with move into esports Entain plc (LSE: ENT), the global sports-betting, gaming and interactive entertainment group, is hosting an investor event today to outline the exciting growth opportunities ahead for the business. Entain’s two strategic pillars of growth and sustainability are the core drivers of our success. Sustainability is a strategic imperative and we are making significant progress with our sustainability charter that we will provide an update on in more detail later in the year. Today’s event will focus on the four key growth opportunities available to the Group: • Leadership in the US ($32bn market, from $6bn today) We are making significant progress in the growing US sports betting and iGaming market. BetMGM is firmly established as the number two operator in the market and is targeting a long-term market share of 20% to 25% of the North American online market, that we expect will grow from around $6bn today to around $32bn over the long term. • Grow our presence in core markets ($70bn market, from $40bn today) We are licenced in 27 countries today as well as operating in a number that are in the process of regulating. We have leadership positions in a significant number of these with an average market share currently of around 13% to 15%. We have a strong track record of driving organic growth and our markets have in-built growth as online betting and gaming extends its appeal and scale. -

Bwin.Party Digital Entertainment Annual Report & Accounts 2012

Annual report &accounts 2012 focused innovation Contents 02 Overview 68 Governance 02 Chairman’s statement 72 Audit Committee report 04 A year in transition 74 Ethics Committee report 05 Our business verticals 74 Integration Committee report 06 Investment case 75 Nominations Committee report 10 Our business model 76 Directors’ Remuneration report 12 CEO’s review 90 Other governance and statutory disclosures 20 Strategy 92 2013 Annual General Meeting 28 Focus on our technology 94 Statement of Directors’ responsibilities 30 Focus on social gaming 32 Focus on PartyPoker 95 Financial statements 95 Independent Auditors’ report 34 Review of 2012 96 Consolidated statement of 44 Markets and risks comprehensive income 97 Consolidated statement 46 Sports betting of fi nancial position 48 Casino & games 98 Consolidated statement of changes 50 Poker in equity 52 Bingo 99 Consolidated statement of cashfl ows 54 Social gaming 100 Notes to the consolidated 56 Key risks fi nancial statements 58 Responsibility & relationships 139 Company statement of fi nancial position 58 Focus on responsibility 140 Company statement of changes in equity 60 Customers and responsible gaming 141 Company statement of cashfl ows 62 Environment and community 142 Share information 63 Employees, suppliers and shareholders 146 Notice of 2013 Annual General Meeting 66 Board of Directors 150 Glossary Sahin Gorur Bingo Community Relations See our online report at www.bwinparty.com Overview Strategy Review Markets Responsibility & Board of Governance Financial Share Notice of Annual Glossary 01 of 2012 and risks relationships Directors statements information General Meeting Introduction 02 Chairman’s statement real progress We made signifi cant progress in 2012 and remain Our attentions are now turning to the on course to deliver all of the Merger synergies as next step in our evolution, one centred on innovation that will be triggered by Annual report & accounts 2012 originally planned. -

Kindred Group Plc – Interim Report

“Strong business momentum and continued focus on scalability contribute to significant increase in underlying EBITDA”. Henrik Tjarnstrom, CEO KINDRED GROUP PLC INTERIM REPORT JANUARY - MARCH 2021 Financial highlights First quarter 2021 Gross winnings revenue amounted to GBP 352.6 (249.7) million, an increase of 41 per cent. Underlying EBITDA was GBP 98.0 (42.5) million. The result for the quarter was impacted by foreign currency losses on operating items of GBP 8.0 (1.8) million which are primarily unrealised losses as they relate to the retranslation of foreign currency current assets and liabilities. As the Group has significant cash balances in foreign currencies, and foreign currency rate movements were substantial, the impact was unusually large during the quarter. Profit before tax amounted to GBP 85.3 (2.4) million. Profit after tax amounted to GBP 72.6 (1.0) million. Earnings per share were GBP 0.32 (0.00). During the quarter, 1,032,500 shares/SDRs were purchased at a total price of SEK 146.0, or GBP 12.4, million. Free cash flow amounted to GBP 90.1 (22.3) million. Number of active customers was 1,818,759 (1,531,302). Key highlights The start of the year has continued to show strong business momentum across all markets and product segments with Gross winnings revenue up 41 per cent. Strict focus on scalability has led to an underlying EBITDA margin of 28 per cent, including unrealised foreign currency losses of GBP 8.0 million. Active customers reached a new all-time high of 1.8 million, which puts the Group in a strong position ahead of the big summer of sport. -

Leading Edge

leading edge Annual report & accounts 2013 Introduction Strategic report We want to ‘let the world play for real’ 01 Financial snapshot 02 Our business by improving access to our games and 04 Investment case 08 Our business model and KPIs maximising their appeal – these are 10 CEO’s review Annual report & accounts 2013 key drivers of our revenue model. 16 Strategy 26 Markets and regulatory overview bwin.party 42 Business and financial review 2013 Our proprietary eCommerce platform 52 Principal risks differentiates us from our competitors 54 Focus on responsibility and gives us a leading edge as we Governance transition to regulated markets. We 58 Chairman’s statement 60 Board of Directors deliver world-leading gaming products 62 Corporate governance 83 2013 Directors’ and brands, across multiple channels Remuneration Report and markets to an increasingly 106 Other Directors’ Report Disclosures 109 Statement of Directors’ demanding customer base. responsibilities Financial performance A richer experience online 110 Independent Auditors’ Report View our online report where you 114 Consolidated statement on can see and hear about our strategy comprehensive income in action and thoughts about our 115 Consolidated statement of future at: www.bwinparty.com financial position 116 Consolidated statement of “ Based on our performance changes in equity to-date we expect to deliver 117 Consolidated statement year-on-year revenue growth of cashflows in 2014. With further cost 118 Notes to the consolidated savings to come and the financial statements -

Kindred Goes Online in Pennsylvania

Kindred Group Press Release Malta, 15 November 2019 Kindred goes online in Pennsylvania Only a few weeks after launching the Unibet Sportsbook at Mohegan Sun Pocono, Kindred Group goes live with both online sports and casino in Pennsylvania. As of today, Unibet customers in Pennsylvania will be able to experience a full range of first-class sportsbook and casino products in a safe and secure environment. Kindred Group (previously Unibet Group) takes its next significant step in the US market with the launch of both online sports and casino in Pennsylvania. The announcement is in line with the Group’s strategy to establish a presence in what will most likely become the largest gambling market in the world. Kindred continues to adopt a local focus and global expertise wherever it operates, ensuring that customers can enjoy Unibet’s full range of first-class sportsbook and casino products in a familiar, safe and secure environment. “After a successful launch of our betting lounge, Unibet Sportsbook at Mohegan Sun Pocono, we are thrilled to take the partnership with Mohegan Sun online and bring the Pennsylvanian guests a state-of-the-art online gambling experience, including the best online casino games and an impressive online sportsbook”, says Manuel Stan, SVP Kindred US. “We’re thrilled to introduce to our customers an opportunity to place bets and game online within the state borders,” said Aviram Alroy, Vice President of Interactive Gaming at Mohegan Gaming & Entertainment. “Our sportsbook lounge is a highly engaging and joyful experience on-premises and Kindred Group are able to extend that experience online through our strategic partnership.” This is Kindred’s second state in the US, after launching online casino and sportsbook earlier this year in New Jersey in partnership with Hard Rock Hotel & Casino Atlantic City. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Kindred Group Press Release

Kindred Group Press Release Malta, 6 November 2019 Kindred - winner of Sweden´s Best Looking Office Kindred Group is the proud winner of ‘Sweden´s Best Looking Office’. The competition puts the spotlight on companies that have successfully combined aesthetic and compelling environments with a smart and flexible working space adapted to fit the organisations specific needs. Kindred Group moved into its award-winning, purpose-built facility in April this year. Kindred Group (former Unibet Group) is the proud winner of Sweden´s Best Looking Office. A competition arranged annually by Fastighetssverige and Lokalnytt.se. Kindred moved into their new office at Urban Escape in central Stockholm in April after a close cooperation with the architect bureau Studio Stockholm. The process of designing a first-class international tech hub started with a survey completed by Kindred employees to get an understanding of the needs and wishes of employees. From these responses a sustainable and flexible working environment that symbolises Kindred´s culture, values and technological business, was formed. The facilities also mirror the diversity of Kindred's employees, who come from 48 different nations. “Kindred is a growing business are therefore in need of a flexible and modern office that can accommodate our future needs. Sustainability is an important component for Kindred, and this is reflected in how we chose to design our workspace. I believe that this is something that we - in cooperation with Studio Stockholm – can be very proud of”, says Kajsa Ericsson, Head of Facilities Management at Kindred Group. “Studio Stockholm has for several years worked with a line of gambling- and tech companies which gives us an understanding of the sector and suggestions on different type of solutions that can create value over time. -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

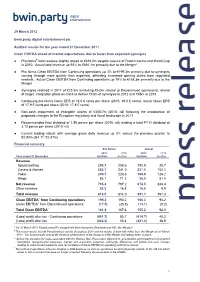

Day and Date

29 March 2012 bwin.party digital entertainment plc Audited results for the year ended 31 December 2011 Clean EBITDA ahead of market expectations due to faster than expected synergies ● Pro forma# total revenue slightly ahead at €816.0m despite closure of French casino and World Cup in 2010. Actual total revenue up 93% to €691.1m primarily due to the Merger* ● Pro forma Clean EBITDA from Continuing operations up 3% to €199.3m primarily due to synergies coming through more quickly than expected, offsetting increased gaming duties from regulated markets. Actual Clean EBITDA from Continuing operations up 79% to €168.3m primarily due to the Merger ● Synergies realised in 2011 of €23.3m (including €5.0m related to Discontinued operations), ahead of target. Integration plans on-track to deliver €40m of synergies in 2012 and €65m in 2013 ● Continuing pro forma Clean EPS of 18.5 € cents per share (2010: 19.0 € cents); actual Clean EPS of 17.9 € cents per share (2010: 17.8 € cents) ● Non-cash impairment of intangible assets of €408.7m (2010: nil) following the introduction of proposed changes to the European regulatory and fiscal landscape in 2011 ● Recommended final dividend of 1.56 pence per share (2010: nil) making a total FY11 dividend of 3.12 pence per share (2010: nil) ● Current trading robust with average gross daily revenue up 2% versus the previous quarter to €2.93m (Q4 11: €2.87m) Financial summary Pro forma# Actual 2011 2010 2011 2010 Year ended 31 December €million €million €million €million Revenue Sports betting 259.7 258.6 193.9