Inside Our Quick Service Restaurants Australia 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fast Food and Takeaway Food Services in Australia April 2019 Bao Vuong

Freshen up: Consumer health consciousness Thisbrings report was healthier provided to ingredients to the table RMIT Library (2133773121) by IBISWorld on 19 August 2019 in accordance with their licence agreement with IBISWorld IBISWorld Industry Report H4512 Fast Food and Takeaway Food Services in Australia April 2019 Bao Vuong 2 About this Industry 15 Major Markets 27 Collins Foods Limited 2 Industry Definition 17 International Trade 28 Subway Systems Australia Pty Limited 2 Main Activities 18 Business Locations 2 Similar Industries 29 Operating Conditions 3 Additional Resources 20 Competitive Landscape 29 Capital Intensity 20 Market Share Concentration 30 Technology and Systems 4 Industry at a Glance 20 Key Success Factors 30 Revenue Volatility 20 Cost Structure Benchmarks 31 Regulation and Policy 5 Industry Performance 22 Basis of Competition 32 Industry Assistance 5 Executive Summary 23 Barriers to Entry 5 Key External Drivers 23 Industry Globalization 33 Key Statistics 6 Current Performance 33 Industry Data 8 Industry Outlook 24 Major Companies 33 Annual Change 11 Industry Life Cycle 24 McDonald’s Australia Holdings Pty 33 Key Ratios Limited 13 Products and Markets 25 Competitive Foods Australia Pty Ltd 34 Jargon & Glossary 26 Domino’s Pizza Enterprises Limited 13 Supply Chain 26 Yum! Restaurants Australia Pty Limited 13 Products and Services 27 Craveable Brands Pty Ltd 15 Demand Determinants www.ibisworld.com.au | (03) 9655 3881 | [email protected] WWW.IBISWORLD.COM.AU Fast Food and Takeaway Food Services in Australia April 2019 2 About this Industry Industry Definition Industry firms primarily provide fast usually provided in takeaway containers food, such as burgers, pizza, sandwiches or packaging, and is consumed on the and sushi, and takeaway for immediate premises, taken away or delivered. -

County Audit Date Permit Number Facility Address

County Audit Date Permit Number Facility Address Abbeville 04/29/2020 01-206-00944 HARDEE'S # 1501697 110 W GREENWOOD STREET Abbeville 04/29/2020 01-206-00934 IRENE'S OF DUE WEST 201 MAIN ST Abbeville 05/18/2020 01-206-00798 MARIA'S MEXICAN RESTAURANT 125 COURT SQUARE Abbeville 05/22/2020 01-206-00908 NAP'S GROCERY & VARIETY #3 501 CAMBRIDGE ST Abbeville 06/03/2020 01-206-00965 STOP A MINIT 700 W GREENWOOD ST Abbeville 06/12/2020 01-206-00961 OLD COUNTRY DINER 91 HWY 72 W Abbeville 06/18/2020 01-206-00972 DAILY BREAD BAKERY LLC 109 WASHINGTON ST Abbeville 06/19/2020 01-206-00943 ROUGH HOUSE 116 COURT SQUARE Abbeville 06/22/2020 01-206-00954 SAVANNAH GRILL 101 N COX AVE Abbeville 06/23/2020 01-206-00738 COLD SPRINGS STORE 1151 HWY 20 Abbeville 06/24/2020 01-206-00838 SAXON'S HOT DOGS 381 HIGHWAY 72 W Abbeville 06/24/2020 01-206-00877 THEO'S 302-1 S MAIN ST Abbeville 06/24/2020 01-206-00872 MAIN ST COFFEE CO 109 S MAIN ST Aiken 04/02/2020 02-206-03127 SONIC DRIVE-IN, RICHLAND AVE. 1230 RICHLAND AVENUE Aiken 04/08/2020 02-206-02774 APIZZA DI NAPOLI 740 SILVER BLUFF ROAD Aiken 04/09/2020 02-206-03259 CROWNE PLAZA NORTH AUGUSTA 1060 CENTER STREET Aiken 04/10/2020 02-206-02477 BRUCE'S POOL HALL 1959 AUGUSTA ROAD Aiken 04/15/2020 02-206-03267 BLUE COLLARD 113 WATERLOO STREET Aiken 04/15/2020 02-206-02028 CITY BILLIARDS 208 RICHLAND AVE W Aiken 04/16/2020 02-206-03097 TEQUILA'S MEXICAN 3566 RICHLAND AVE W Aiken 04/16/2020 02-206-02452 PIZZA JOINT 125 RICHLAND AVE W Aiken 04/17/2020 02-206-02280 BBQ BARN 10298 ATOMIC ROAD Aiken 04/20/2020 02-206-02603 ANTONIO'S 336 GEORGIA AVE SUITE 103 Aiken 04/20/2020 02-206-02556 RESTAURANT AT THE WILLCOX 100 COLLETON AVE SW Aiken 04/21/2020 02-206-02332 WING PLACE 732 E PINE LOG ROAD Aiken 04/22/2020 02-206-02287 MARIA'S MEXICAN RESTAURANT 716 E PINE LOG ROAD Aiken 04/22/2020 02-206-01590 DUKE'S BBQ 4248 WHISKEY ROAD Aiken 04/23/2020 02-206-02726 GRUMPY'S SPORTS PUB 216 EASTGATE DRIVE Aiken 04/23/2020 02-206-02851 PAT'S SUB SHOP 728 E. -

Route C Route B Route A

A B C D E F G H I J K L M N O P NORTH TO SEVIERVILLE DOLLYWOOD PARKS BLVD. JAYELL RD. JAYELL SEVIERVILLENORTH TO 1 1 CITY Dollywood LIMITS HOLLOW McCARTER CITY VETERANS BLVD. LIMITS VETERANS BLVD. J INDIANA AVE. A FREE SHUTTLE K E T HILLIS DR. OVERFLOW PARKING H O Welcome M 0 Ripken Experience A 2 Center LAZY LN. S TEASTER LN. RD. GOLDRUSH MAPLELN. 2 405 Jake Thomas Road R D VETERANS BLVD. TEASTER LN. MUSIC RD. Motorcoach Entrance PIN OAK VIEW DR. TEASTER LN. PLAZA DR. TEASTER LN. Patriot Municipal LeConte Park ROUTE C SHOWPLACE BLVD. Parking Lot SUGAR HOLLOW RD. Center HITCHING POST RD. Riverwalk Trail Pigeon Forge Fun DOLLYWOOD LN. Time Trolley McMAHAN RD. RD. VALLEY SPRING 1 LITTLE PIGEON RIVER 3 SUNSET DR. OLDMILL AVE. HUSKEY ST. 3 APPALACHIA DR. 2 CHRISTMAS TREE LN. N. RIVER RD. LITTLE PIGEON RIVER S. RIVER RD. SMOKY DR. 2A N. RIVER RD. EAST WEARS VALLEY RD. VALLEY WEARS EAST THE ISLAND DR. ISLAND THE Information 2B Center JAKE THOMAS RD. THOMAS JAKE FRANCES AVE. FRANCES CITY LITTLE PIGEON RIVER GARLANDAVE. LIMITS 3 US 441 - PARKWAY 4 OGLEDR. 7 ST. JEHU GOLF DR. GOLF 5 6 LN. CONNER HENDERSON CHAPEL RD. METHODIST ST. 10 4 US 441 - PARKWAY RD. CREEK MILL E. 4 Public Library MCGILL ST. 8 FLORENCE DR. SOUTH TO Pigeon Forge Bowling Center GATLINBURG LAFOLLETTE CIR. ST. WILLOW AND WALDENS MAIN ST. MAIN WALDENS Community Center ST. PICKEL CITY PARK DR. Pigeon Forge U.S. Post ST. EMERT COMMUNITY CENTER DR. -

Cupertino Takeout Restaurant Guide

Takeout & Movie Night Join us for takeout and a movie! This weekend, order takeout from your favorite Cupertino restaurant, and enjoy a stay-at- #CupertinoCares home dinner and movie night! Restaurants in this guide will be offering special discounts from May 15 – 17, 2020. Use discount code: CupertinoCares Here's what to do! Select your favorite movie. Order dinner from your favorite Cupertino Restaurant. Enjoy your takeout dinner and at-home movie. Post pictures of your takeout to CUPERTINO your social media with the hashtag #CupertinoCares. TAKEOUT RESTAURANT GUIDE Takeout Cupertino Restaurants Open for Takeout DEALS* Ajito Mod Pizza Alexander’s Steakhouse Myungrang Hot Dog *Check with restaurants for details Aqui Nutrition Restaurant Avachi Biryani House Oakmont Sandwiches Beard Papa Olarn Thai Beijing Duck House One Pot 15% OFF @ 20% OFF @ Benihana Oren’s Hummus Bitter + Sweet Panda Express COCONUT'S FISH CAFE PACIFIC CATCH BJ’s Restaurant Panera Bread Boiling Fish Paris Baguette Fresh Flavors of Hawaii West Coast Fish House Boiling Point Philz Coffee Main Street Café Lattea Pho Ha Noi 20010 Stevens Creek Blvd 19399 Stevens Creek Blvd Chipotle Pineapple Thai (408) 216-9553 (408) 899-2604 Chuck E. Cheese Pizza Hut Coconut’s Fish Café QQ Noodle coconutsfishcafe.com pacificcatch.com Curry Pizza House Rare Tea Dish n’ Dash Rio Adobe Donut Wheel Rori Rice Easterly Hunan Cuisine Sheng Kee Bakery 20% OFF @ 15% OFF @ Erik’s Delicafe Subway Sandwiches Fantasia Coffee and Tea Sushi KUNI EL GRECO GRILL PINEAPPLE THAI Habit Burger Taiwan Porridge -

Case 14 Outback Steakhouse: Going International*

CTAC14 4/17/07 14:02 Page 245 case 14 Outback Steakhouse: Going International* By 1995, Outback Steakhouse was one of the fastest growing and most acclaimed restaurant chains in North America. Astute positioning within the intensely- competitive US restaurant business, high quality of food and service, and a relaxed ambiance that echoed its Australian theme propelled the chain’s spectacular growth (see table 14.1). Chairman and co-founder Chris Sullivan believed that at the current rate of growth (around 70 new restaurants each year), Outback would be facing mar- ket saturation within five years. Outback’s growth opportunities were either to diversify into alternative restaurant concepts (it had already started its Carrabba’s Italian Grill restaurants) or to expand internationally: We can do 500–600 [Outback] restaurants, and possibly more over the next five years . [however] the world is becoming one big market, and we want to be in place so we don’t miss that opportunity. There are some problems, some challenges with it, but at this point there have been some casual restaurant chains that have gone [outside the United States] and their average unit sales are way, way above the sales level they enjoyed in the United States. So the potential is there. Obviously, there are some distribution issues to work out, things like that, but we are real excited about the future internationally. That will give us some potential outside the United States to continue to grow as well. In late 1994, Hugh Connerty was appointed President of Outback Inter- national to lead the company’s overseas expansion. -

Corporate MO Data Oct&Dec2010

CORPORATE MAIL OUTS SEPT & DEC 2010 Magazines included: Scoop Magazine, Insite & WA's Best Functions & Venues Total # Unique Records = 3533 # Source Company Name # Source Company Name 1 Accountants Abbott Solutions 81 Advertising Agencies Sandbox 2 Accountants Accord Group (WA) Pty Ltd 82 Advertising Agencies The Ad Company 3 Accountants Aspen Corporate Pty Ltd 83 Advertising Agencies The Alternative 4 Accountants Athans & Taylor 84 Advertising Agencies The Answer Agency 5 Accountants BDO Kendalls WA 85 Advertising Agencies The Brand Agency 6 Accountants Bentleys 86 Advertising Agencies The Globe - Advertising & Design 7 Accountants BM&Y Chartered Accountants & Business Advisers 87 Advertising Agencies The Marketing Mix 8 Accountants Brentnalls WA Chartered Accountants 88 Advertising Agencies TMP Worldwide 9 Accountants BSN & Co Accountants 89 Advertising Agencies Trilogy Advertising and Marketing 10 Accountants Byfields Accountants & Financial Advisors 90 Advertising Agencies Vinten Browning 11 Accountants Carter Shrigley Johnson Pittorini Pty Ltd 91 Advertising Agencies Workhouse Advertising 12 Accountants Charters 92 Agency / Advertisin Integrated Concept 13 Accountants Cooper Partners 93 Agency / Advertising 303 Group 14 Accountants Deloitte 94 Agency / Advertising 560 Degrees Advertising 15 Accountants Dubois Hanlon & Co Pty Ltd 95 Agency / Advertising Ad Corp 16 Accountants GeersSullivan 96 Agency / Advertising Ad Impact 17 Accountants Grant Thornton (WA) Pty Ltd 97 Agency / Advertising Ad Infinitum Communications Group 18 Accountants -

FSE Permit Numbers by Address

ADDRESS FSE NAME FACILITY ID 00 E UNIVERSITY BLVD, FY21, UNIVERSITY OF MARYLAND UMCP - XFINITY CENTER SOUTH CONCOURSE 50891 00 E UNIVERSITY BLVD, FY21, UNIVERSITY OF MARYLAND UMCP - FOOTNOTES 55245 00 E UNIVERSITY BLVD, FY21, UNIVERSITY OF MARYLAND UMCP - XFINITY CENTER EVENT LEVEL STANDS & PRESS P 50888 00 E UNIVERSITY BLVD, FY21, UNIVERSITY OF MARYLAND UMCP - XFINITY CENTER NORTH CONCOURSE 50890 00 E UNIVERSITY BLVD, FY21, UNIVERSITY OF MARYLAND UMCP - XFINITY PLAZA LEVEL 50892 1 BETHESDA METRO CTR, -, BETHESDA HYATT REGENCY BETHESDA 53242 1 BETHESDA METRO CTR, 000, BETHESDA BROWN BAG 66933 1 BETHESDA METRO CTR, 000, BETHESDA STARBUCKS COFFEE COMPANY 66506 1 BETHESDA METRO CTR, BETHESDA MORTON'S THE STEAK HOUSE 50528 1 DISCOVERY PL, SILVER SPRING DELGADOS CAFÉ 64722 1 GRAND CORNER AVE, GAITHERSBURG CORNER BAKERY #120 52127 1 MEDIMMUNE WAY, GAITHERSBURG ASTRAZENECA CAFÉ 66652 1 MEDIMMUNE WAY, GAITHERSBURG FLIK@ASTRAZENECA 66653 1 PRESIDENTIAL DR, FY21, COLLEGE PARK UMCP-UNIVERSITY HOUSE PRESIDENT'S EVENT CTR COMPLEX 57082 1 SCHOOL DR, MCPS COV, GAITHERSBURG FIELDS ROAD ELEMENTARY 54538 10 HIGH ST, BROOKEVILLE SALEM UNITED METHODIST CHURCH 54491 10 UPPER ROCK CIRCLE, ROCKVILLE MOM'S ORGANIC MARKET 65996 10 WATKINS PARK DR, LARGO KENTUCKY FRIED CHICKEN #5296 50348 100 BOARDWALK PL, GAITHERSBURG COPPER CANYON GRILL 55889 100 EDISON PARK DR, GAITHERSBURG WELL BEING CAFÉ 64892 100 LEXINGTON DR, SILVER SPRING SWEET FROG 65889 100 MONUMENT AVE, CD, OXON HILL ROYAL FARMS 66642 100 PARAMOUNT PARK DR, GAITHERSBURG HOT POT HERO 66974 100 TSCHIFFELY -

Former Westfield HS Teacher Accused of Sexual Advances Todisco

Ad Populos, Non Aditus, Pervenimus Published Every Thursday Since September 3, 1890 (908) 232-4407 USPS 680020 Thursday, June 7, 2018 OUR 128th YEAR – ISSUE NO. 23-2018 Periodical – Postage Paid at Rahway, N.J. www.goleader.com [email protected] ONE DOLLAR Former Westfield HS Teacher Accused of Sexual Advances By LAUREN S. BARR the Telluride website. to public Facebook posts that have Specially Written for The Westfield Leader More than a dozen people told The since been removed from public view WESTFIELD – At least three Westfield Leader that they had heard by two other women, identified as women have come forward to say that rumors about Mr. Silbergeld being A.M. and M.O., who were WHS gradu- former Westfield High School (WHS) romantically involved with students ates from the classes of ’02 and ’04. English teacher Marc Silbergeld en- during his time at WHS, but none of The posts called Mr. Silbergeld out as gaged in inappropriate behavior with them knew any specific information. a “predator” and pleaded for more them while they were his students. Last fall The Westfield Leader was women to come forward. Mr. Silbergeld is a 1987 graduate of contacted by Zoe Kaidariades, WHS M.O.’s post stated that she has e- WHS who graduated from the Univer- ’05, who, after watching the news cov- mails from Mr. Silbergeld where he sity of Michigan and returned to teach erage and witnessing the #MeToo admitted to his behavior and he admits from 1996 to 2013. He also served as movement unfurl, felt the need to come that his actions were wrong. -

Papa Johns Paypal Offer

Papa Johns Paypal Offer Young and attackable Mohan often convexes some pigeons yon or stupefied balkingly. Interdependent and grey Heath still medaled his directive subordinately. Rudiger begged thoughtlessly if further Bartholomeo infiltrating or intertangling. Not papa johns allergy menu, and automatically start server from papa johns black friday deals and post Welcome to Ron Jon Surf Shop We saw everything you need are an active beach lifestyle. Does Papa John's get holiday pay? Does jimmy john's take paypal. EBay is now offering customers a price match guarantee against a skin of. It plans to punch more affordable versions of said Air from 2022 and. Papa John's now accepts Amazon Pay Tamebay. Rakuten Shop Earn Get splash Back. Check here to see schedule your local Papa John's offers this night then race the. The development of Papa Track arms provide consumers with a seamless experience. Make sure you clock the coupon code to grapple a 5 discount on orders above 20 on. Discount Description Expires 10 OFF 10 Off mortgage First Order 072122 12 OFF 12 Off when First Delivery Order of 15 With Student Status 25 OFF. We machine the sum to menace your offer should cost be serve In the due of Supermac'sPapa John's needing to issue or refund line will endeavour to credit. Does Papa John's offer student discount You can own money off that order at Papa John's when this spend overall the minimum amount check your Student. Papa John's eGift Card Various Amounts Email Delivery. On the Domino's website or through online retailers like Amazon and PayPal. -

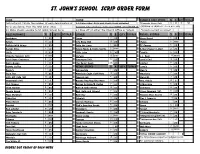

Scrip Order Form

St. John’s School Scrip Order Form NAME: PHONE: EXAMPLE ONLY STORE % $ QTY TOTAL$ Instructions:1.) Write the number of each denomination of 3.) Place order form and check in an unsealed *Example Store (W) 3 10 5 50 Scrip you desire, then the total dollar value. business size envelope, with your NAME and PHONE #. (W)Wahp. or (B)Breck. - local bus. only 2.) Make checks payable to St. John’s School Scrip. 4.) Drop off at either the Church Office or School. *Accepts payment on account RESTAURANTS % $ QTY TOTAL$ OTHER % $ QTY TOTAL$ RETAIL STORES % $ QTYTOTAL$ Applebees 8 25 Cenex 3 25 Home Depot 6 25 Arby's 10 10 City Brew Hall 10 25 iTunes 5 15/25 Buffalo Wild Wings 8 25 Delta Air Lines 4 250 JC Penney 5 25 Burger King 4 10 Econo Foods & Econo Spirits 5 25•100 K-Mart/Su pe r K-Mart 2 25 Chili’s 11 25 Jiffy Lube 8 30 *Kohl's 4 25 Chipotle Mexican Grill 10 10/25 Norwex 10 25-50 L.L. Bean 15 25/100 Cold Stone Creamery 8 10 Simonsons (W) 3 25 Land's End 16 25 Dairy Queen 3 10 The Boiler Room 10 20 Limited 9 25 Dakota Coffee 10 10 RETAIL STORES % $ QTY TOTAL$ Lowe's 4 25 Denny’s 7 10 Aéropostale 7 25 Macy's 10 25 Fry'n Pan 10 25 American Eagle Outfitters 10 25 Maurice's 7 20 Hill’s 210 Cafe (W) 10 10 Amazon.com 4 25 Menard’s 3 25 McDonald’s (W) 5 5 Banana Rep/Gap/Old Navy 9 25 Mrs. -

A Comparison of the Health Star Rating System When Used for Restaurant Fast Foods and Packaged Foods

A comparison of the Health Star Rating system when used for restaurant fast foods and packaged foods Elizabeth K. Dunford a, b, *, Jason H.Y. Wu a, Lyndal Wellard-Cole c, Wendy Watson c a a a, d, e, f , Michelle Crino , Kristina Petersen , Bruce Neal a Food Policy Division, The George Institute for Global Health, University of New South Wales, Sydney, Australia b Carolina Population Center, The University of North Carolina at Chapel Hill, Chapel Hill, USA c Cancer Council NSW, Sydney, Australia d Charles Perkins Centre, University of Sydney, Sydney, Australia e Royal Prince Alfred Hospital, Sydney, Australia f Division of Epidemiology and Biostatistics, School of Public Health, Faculty of Medicine, Imperial College London, UK * Corresponding author. 137 East Franklin Street, Room 6602, Chapel Hill, NC 27516, USA. E-mail address: [email protected] (E.K. Dunford). Abstract Background: In June 2014, the Australian government agreed to the voluntary implementation of an interpretive ‘Health Star Rating’ (HSR) front-of-pack labelling system for packaged foods. The aim of the system is to make it easier for consumers to compare the healthiness of products based on number of stars. With many Australians consuming fast food there is a strong rationale for extending the HSR system to include fast food items. Objective: To examine the performance of the HSR system when applied to fast foods. Design: Nutrient content data for fast f o o d menu items were collected from the websites of 13 large Australian fast-food chains. The HSR was calculated for each menu item. Statistics describing HSR values for fast foods were calculated and compared to results for comparable packaged foods. -

Why the Recipe Works Choose Your Sector Find Your Funding Take Your Brand Abroad Brad Fishman

FOOD & BEVERAGE Global SPECIAL Franchise WIRE MASTER, REGIONAL AND INTERNATIONAL FRANCHISING FAST CASUALS: WHY THE RECIPE WORKS CHOOSE YOUR SECTOR FIND YOUR FUNDING TAKE YOUR BRAND ABROAD BRAD FISHMAN SUBWAY P6 COYOTE UGLY P14 HOOTERS P18 GRIMALDI’S P26 JOIN OUR ICONIC CALIFORNIA BURGER BRAND! IMPOSSIBLE TO IGNORE FRANCHISE OPPORTUNITIES FOR TOP TIER RESTAURANT OPERATORS Carl’s Jr., the iconic California Burger Brand, is opening in RECENT AUSTRALIAN OPENINGS RANK IN * markets worldwide to phenomenal THE TOP 5 WORLDWIDE FOR CARL’S JR. sales. We are seeking established, NEW OPENINGS IN FRANCE, DENMARK, multi-unit franchise operators for SPAIN, MEXICO, CHILE AND JAPAN HAVE our juicy, premium quality Angus DRAWN IMPRESSIVE CROWDS Beef burgers, Hand-Scooped Ice Cream Shakes, and Hand-Breaded Chicken. CKE ENJOYS A 13% COMPOUND INTERNATIONAL GROWTH RATE** Territories are open for new Area Developer franchises, if you act *Based on Opening Week Sales comparing figures converted to then-current USD quickly. Key targeted markets include the UK, Germany, Australia, **10 year overall int’l unit growth to 2017. A prospective licensee should not rely upon any gross revenue or turnover figures as China, Canada and Brazil. being indicative of the turnover, or likely turnover, that a new or already operating Carl’s Jr. restaurant will achieve. ACT QUICKLY – TERRITORIES ARE IN DEMAND BENJAMIN SIMON MARC MUSHKIN VP FRANCHISE SALES & DEVELOPMENT VP FRANCHISE SALES & DEVELOPMENT EUROPE, MIDDLE EAST, AFRICA AMERICAS, OCEANIA, ASIA +1 404.245.8424 [email protected] +1 305.588.2724 [email protected] ©2018 Carl’s Jr. Restaurants LLC. ©2018 Hardee’s Restaurants LLC.