Savills Elmbridge Home Truths

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Miles to Thames Ditton Station

AN IDEAL LOCATION FOR IDYLLIC LIVING INTRODUCING IRIS GARDENS. AN EXCLUSIVE TRIO OF 5-BEDROOM HOMES IN THE HEART OF THAMES The bridge over the Thames, Hampton Court DITTON – A HISTORIC VILLAGE JUST 15 MILES FROM CENTRAL LONDON. ONE OF THE MOST SOUGHT AFTER AREAS IN SURREY - FOR MORE REASONS THAN ONE THE RIVERSIDE COMMUNITY OF THAMES DITTON PROPOSES AN ENVIABLE COMBINATION OF TRADITIONAL VILLAGE COMMUNITY AND MODERN URBAN CONVENIENCES Despite being a stone’s throw from Kingston and Esher, Thames Ditton retains its traditional village character. A selection of shops, a post office, and a variety of pubs and restaurants will meet your day-to-day needs. Riverside walks along the Thames and the nearby Esher Common and Weston Green make for a relaxing and re-invigorating atmosphere. And for the more actively inclined there’s a long established health club, a golf club, and one of the oldest lawn tennis clubs in the country. GET TO KNOW THE AREA 1 Hampton Court Palace, the historical home of King Henry VIII. 1.1 miles. 2 Bushy Park, the second largest of the capital’s eight Royal Parks. 1.4 miles. 1 2 3 10 11 3 Kingston. 3.2 miles. 4 Giro Cafe, Esher, has been voted the UK’s best coffee shop for cyclists.2.1 miles. 5 Weston Green. 0.2 miles. 6 The Good Earth Restaurant, Esher, setting the standard for Chinese food in London for over 30 years. 1.8 miles. 7 Burhill Golf Club, A 36 hole club, where new members and visitors are warmly welcomed. -

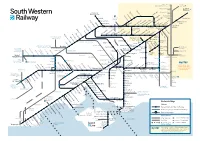

Download Network

Milton Keynes, London Birmingham and the North Victoria Watford Junction London Brentford Waterloo Syon Lane Windsor & Shepherd’s Bush Eton Riverside Isleworth Hounslow Kew Bridge Kensington (Olympia) Datchet Heathrow Chiswick Vauxhall Airport Virginia Water Sunnymeads Egham Barnes Bridge Queenstown Wraysbury Road Longcross Sunningdale Whitton TwickenhamSt. MargaretsRichmondNorth Sheen BarnesPutneyWandsworthTown Clapham Junction Staines Ashford Feltham Mortlake Wimbledon Martins Heron Strawberry Earlsfield Ascot Hill Croydon Tramlink Raynes Park Bracknell Winnersh Triangle Wokingham SheppertonUpper HallifordSunbury Kempton HamptonPark Fulwell Teddington Hampton KingstonWick Norbiton New Oxford, Birmingham Winnersh and the North Hampton Court Malden Thames Ditton Berrylands Chertsey Surbiton Malden Motspur Reading to Gatwick Airport Chessington Earley Bagshot Esher TolworthManor Park Hersham Crowthorne Addlestone Walton-on- Bath, Bristol, South Wales Reading Thames North and the West Country Camberley Hinchley Worcester Beckenham Oldfield Park Wood Park Junction South Wales, Keynsham Trowbridge Byfleet & Bradford- Westbury Brookwood Birmingham Bath Spaon-Avon Newbury Sandhurst New Haw Weybridge Stoneleigh and the North Reading West Frimley Elmers End Claygate Farnborough Chessington Ewell West Byfleet South New Bristol Mortimer Blackwater West Woking West East Addington Temple Meads Bramley (Main) Oxshott Croydon Croydon Frome Epsom Taunton, Farnborough North Exeter and the Warminster Worplesdon West Country Bristol Airport Bruton Templecombe -

A Stylish Collection of Apartments and Houses in A

A STYLISH COLLECTION OF APARTMENTS AND HOUSES IN A MAGNIFICENT TREE-LINED SETTING WELCOME TO Relax into this elegant collection LONDON SQUARE of luxury homes set amid beautifully landscaped grounds, located in Walton-on-Thames the sought-after Ashley Park neighbourhood of Walton-on-Thames. This is where you can sit back and feel truly at home. Where everything falls into place LONDON SQUARE Walton-on-Thames 02 03 Computer generated image of London Square Walton-on-Thames and is indicative only. LONDON SQUARE Walton-on-Thames SUNBURY GOLF THE PERFECT WEYBRIDGE Setting SHEPPERTON MARINA RIVER THAMES Step into a charming leafy suburb, with all amenities ASHLEY PARK close at hand WALTON CRICKET CLUB WALTON-ON-THAMES 04 05 A244 (HERSHAM ROAD) PLANNED NURSERY WALTON TENNIS CLUB The charming and historic town of Walton-on-Thames lies just 15 miles from central London. With abundant parks, excellent leisure and shopping facilities, great transport connections and the River Thames on the doorstep, it is a place to call home. The towns of Weybridge and Esher are nearby, while Kingston upon Thames and Guildford are 16 minutes* and 31 minutes* respectively by car. WALTON-ON-THAMES TRAIN STATION (0.6 MILES) *All travel times are approximate only. Sources: Google Maps. Computer enhanced image of London Square Walton-on-Thames and is indicative only. LONDON SQUARE Walton-on-Thames N 46 47 48 49 45 50 DISCOVER 36-41 44 43 51 Something new 42 75 74 76 73 52 An exclusive community with 26 53 a range of beautifully designed 25 77 72 properties offering -

Reasons-For-Closure-Weybridge

This branch is closing – but we're still here to help Our Weybridge branch is closing on Friday 18 June 2021 Reasons for closure, and alternative ways to bank. This branch is closing – but your bank is always open This first booklet will help you understand why we’ve made the decision to close this branch. It also sets out the banking services and support that will be available to you after this branch has closed. In a second booklet, which will be available from the branch prior to it closing or online at home.barclays/ukbranchclosures, we'll share concerns and feedback from the local community. We'll also detail how we are helping people transition from using the branch with alternative ways to carry out their banking requirements. Here are the main reasons why the Weybridge branch is closing: • The number of counter transactions has gone down in the previous 24 months, and additionally 89% of our branch customers also use other ways to do their banking such as online and by telephone • Cust omers using other ways to do their banking has increased by 10% since 2015 • In the past 12 months, 38% of this branch's customers have been using nearby branches • We’ve identified that only 27 customers use this branch exclusively for their banking Proposals to close any branch are made by the Barclays local leadership teams and verified at a national level ahead of any closure announcement. If you have any questions and concerns about these changes then please feel free to get in touch over the phone on 0345 7 345 345², with Graham Pannett, your Market Director for West London. -

Beverstone House

BEVERSTONE HOUSE The Crown Estate ❘ Oxshott ❘ Surrey BEVERSTONE HOUSE The Crown Estate ❘ Oxshott ❘ Surrey 55 High Street, 8 High Street Esher, Surrey KT10 9SH Cobham, Surrey KT11 3DY Tel: 01372 461900 Tel: 01932 588288 [email protected] [email protected] 10 High Street, Cobham, Grafen House, 26 High Street, Surrey KT11 3DY Esher, Surrey KT10 9RT Tel: 01932 586200 Tel: 01372 466607 [email protected] [email protected] www.savills.com www.grosvenorB.co.uk YOUR ATTENTION IS DRAWN TO THE IMPORTANT NOTICE ON THE LAST PAGE OF THE TEXT Beverstone House has been designed and built by Carrington Fox on behalf of St. Eden Homes and offers an exceptional product with the latest integrated technology throughout. The property has been designed to accord with the location and is overseen from conception by a design team, before being finished to exacting standards by our interior designer. The exceptional design offers a modern living environment that is enhanced through the use of finishes and fittings of the highest quality. Concrete floors throughout, under-floor heating, natural stone, mood lighting, bespoke joinery and the finest kitchen and bathroom furniture are utilised to provide the subtle benefits of owning a modern property. Living spaces and kitchens are large, bright and planned for optimum efficiency and appeal, while bedrooms and bathrooms are styled to be comfortable and stylish. • 10 Year LABC construction warranty • Gravel resin bonded permeable driveway with automated gates • Landscaping designed by award winning designer -

C1 Bus Time Schedule & Line Route

C1 bus time schedule & line map C1 Weybridge - Cobham - Oxshott View In Website Mode The C1 bus line (Weybridge - Cobham - Oxshott) has 6 routes. For regular weekdays, their operation hours are: (1) Brooklands: 12:51 PM (2) Cobham: 7:00 AM - 7:00 PM (3) Cobham: 7:19 AM - 7:14 PM (4) Downside: 8:15 AM - 6:46 PM (5) Oxshott: 8:05 AM - 3:39 PM (6) Weybridge: 10:02 AM - 12:51 PM Use the Moovit App to ƒnd the closest C1 bus station near you and ƒnd out when is the next C1 bus arriving. Direction: Brooklands C1 bus Time Schedule 23 stops Brooklands Route Timetable: VIEW LINE SCHEDULE Sunday Not Operational Monday Not Operational Oakshade Road, Oxshott 4 High Street, London Tuesday 12:51 PM Royal Kent School, Oxshott Wednesday Not Operational Oakshade Road, London Thursday Not Operational St Andrew's Church, Oxshott Friday Not Operational Steel's Lane, Oxshott Saturday Not Operational Clock House Mead, Oxshott Blundel Lane, Oxshott Randolph Close, Claygate Civil Parish C1 bus Info Direction: Brooklands Cobham & Stoke D'Abernon Station, Cobham Stops: 23 Trip Duration: 23 min Station Road, Stoke D'Abernon Line Summary: Oakshade Road, Oxshott, Royal Kent School, Oxshott, St Andrew's Church, Oxshott, Steel's Knowle Park, Stoke D'Abernon Lane, Oxshott, Clock House Mead, Oxshott, Blundel Lane, Oxshott, Cobham & Stoke D'Abernon Station, Oak Road, Cobham Cobham, Station Road, Stoke D'Abernon, Knowle Park, Stoke D'Abernon, Oak Road, Cobham, Tilt Road, Cobham, High Street, Cobham, Waitrose, Cobham, Tilt Road, Cobham Between Streets, Cobham, Fire Station, -

An Exceptional Country House Set in 1 Acre of Walled Garden in the Prestigious Claremont Estate

AN EXCEPTIONAL COUNTRY HOUSE SET IN 1 ACRE OF WALLED GARDEN IN THE PRESTIGI OUS CLAREMONT ESTATE BLUE JAY, CLAREMONT DRIVE, ESHER, SURREY, KT10 9LU Furnished / Part Furnished £22,000 pcm + £285 inc VAT tenancy paperwork fee and other charges apply.* Available from 01/06/2018 £22,000 pcm Furnished / Part Furnished • 6 Bedrooms • 7 Bathrooms • 5 Receptions • Exceptional opportunity • Impressive from start to finish • Significant estate • Privacy is key • Ultra- modern living space • Indoor swimming pool including sauna & gym • Cinema room • Excellent proximity to schools including ACS & Claremont • EPC Rating C • Council Tax H Description An exceptional opportunity to rent a Property that is understated in style, flexible in use and above all, a home. Every aspect of security and technology has been carefully considered to provide hassle-free liveability. With a combination of intimacy and carefully designed entertainment and relaxation space, the five-bedroom property is entirely unique and has been designed for entertaining and to reinvent country house living. Blue Jay is accessed via a 100 metre long private tree-lined driveway. Security and alarm systems have been installed with external CCTV and flood lighting. The 3 metre high, 17th-century walls were designed by architect Sir John Vanbrugh, who built Blenheim Palace in Oxfordshire and Castle Howard in North Yorkshire, two of the most significant historical country houses in England. Just 19 miles from Central London, Blue Jay is set within an acre of walled gardens, land that was formally part of Claremont House Gardens, a Royal residence designed by Sir John Vanbrugh and occupied by King George III and Queen Victoria in the late nineteenth century. -

Ebc Changes Rules on Determining Planning Applications Move Overrides Strong Public Outcry

Weybridge Society Your community association working for Weybridge Autumn 2019 Hon. Patron – Michael Aspel OBE EBC CHANGES RULES ON DETERMINING PLANNING APPLICATIONS MOVE OVERRIDES STRONG PUBLIC OUTCRY In a move that now makes it much tougher in the number of objections required to send for residents to oppose contentious planning an application automatically to committee for applications, and despite widespread local review, after an officer has recommended opposition, the Main Planning Committee of to permit. Elmbridge Borough Council (EBC) on 23rd While the Weybridge Society certainly July agreed to broadly revise its scheme for welcomes efforts to streamline performance making decisions on planning applications. and improve decision-making at EBC, the The changes, which were aimed Society, along with many other residents’ at improving the efficiency of decision- organisations, strongly objected not only making on planning applications and driven to the proposed changes to the scheme by concerns that other Surrey councils IN THIS ISSUE were outperforming EBC in deciding on Welcome to our autumn issue applications within government target featuring ARCHITECTURAL timescales, were set to take effect from TREASURES OF WEYBRIDGE! 1st September and are therefore already You might be familiar with local history, in force. but you’ll still be amazed by the wealth of A major controversial issue in the new architecture in our midst! rules is the introduction of a 28-day timescale As ever, our quarterly newsletter also from the moment the application becomes brings you news on developments in our live on the database, which will effectively area – Weybridge Society always working reduce the time residents can contact their for you! ward councillors to ask that the application 13 HIDDEN WEYBRIDGE TREASURE: not be decided by the planning officer on CHAPEL OF ST CHARLES BORROMEO his own but be debated in committee. -

Surrey County Council

InTouch Mar21_Layout 2 28/02/2021 18:33 Page 1 KEEP IN TOUCH | TELL US YOUR VIEWS l Mark Sugden | [email protected] | 07548 244422 l David Lewis | [email protected] | 07771 505567 l Alistair Mann | [email protected] | 07768 331843 l Alan Parker | [email protected] | 07917 521069 inTouch www.facebook.com/ElmbridgeConservatives WITH YOUR COBHAM, OXSHOTT & STOKE D’ABERNON CONSERVATIVES MARCH 2021 This newsletter is printed and distributed at no cost to the taxpayer and delivered in accordance with Covid rules Defending the Green light for 6th May elections Green Belt is LECTIONS to Elm- years. our top priority bridge Borough Coun- He said: “I’m keen to champion Ecil, Surrey County our local businesses and take a Council, and for the Surrey community-led approach to tack- Police and Crime Commis- ling local issues, from parking to sioner will be taking place on planning. I share residents’ de- Thursday 6th May. sire to preserve the distinctive Your Conservative candidates character of Cobham and our have been selected and are raring Green Belt.” to go - even though Covid re- Alan Parker CBE is standing to strictions mean conversations are represent Oxshott and Stoke likely to be online this year d’Abernon which includes Cob- rather than on the doorstep. ham Fairmile at Elmbridge Bor- Mark Sugden is our candidate ough Council. He is a former to represent Oxshott, Claygate Chief Executive Officer of a and Hinchley Wood at Surrey FTSE 100 company and has THE Conservative Group of County Council. After an inter- been a chairman and non-execu- councillors at Elmbridge national business career, Mark tive director for international Council is resolutely moved to Claygate in 2007, companies. -

514/515 Hersham-Esher-Thames Ditton-Kingston 514 Hersham-West

514/515 Hersham-Esher-Thames Ditton-Kingston 514 Hersham-West Molesey-Kingston Monday to Friday Service 515 515 515 515 514 515 515 515 515 515 515 514 515 515 Sch NSch NSch Sch Addlestone Tesco 0617 0701 Addlestone Station 0619 0704 514 514 Weybridge Ship 0623 0709 Sch Walton Station 0630 0721 Esher High School 1510 Field Common 1019 1119 1219 1419 1519 1625 1742 Hersham Library 0915 1520 Hersham Station 1022 1122 1222 1422 1522 EH 1628 1745 Hersham Station 0917 1523 Hersham Library 0632 0726 0824 0915 1025 1125 1225 1325 1425 1525 1520 1631 1748 Field Common 0921 1530 Esher Church Street 0638 0731 LG 0829 WM 1030 1130 1230 1330 1428 1528 WM 1638 1755 West Molesey 0928 1540 Esher Douglas Road 0639 0733 0831 0831 1033 1133 1233 1333 1435 1535 1642 1758 Beauchamp Road 0934 Esher Station 0642 0736 0834 0834 1036 1136 1236 1336 1441 1541 1647 1801 East Molesey 0940 1550 Thames Ditton Station 0647 0741 0845 0845 0946 1041 1141 1241 1341 1447 1547 1600 1655 1806 Thames Ditton Station 0946 1600 Winters Bridge 0654 0748 0854 0854 0955 1050 1150 1250 1350 1453 1553 1611 1702 1815 Winters Bridge 0955 1611 Kingston Eden Street 0704 0800 0905 0905 1005 1100 1200 1300 1400 1503 1603 1622 1713 1825 Kingston Eden Street 1005 1622 Kingston Cromwell Rd 0707 0803 0908 0908 1008 1103 1203 1303 1403 1506 1606 1625 1715 1828 Kingston Cromwell Rd 1008 1625 WM- via West and East Molesey LG- To or from Lower Green EH- to or from Esher High School 514/515 Kingston-Thames Ditton-Esher- Hersham 514 Kingston-West Molesey-Hersham Monday to Friday Service 514 515 -

Infrastructure Delivery Plan December 2018

Infrastructure Delivery Plan December 2018 IDP December 2018 Contents 1.0 Introduction ........................................................................................................ 3 2.0 Purpose of the Infrastructure Delivery Plan ....................................................... 3 3.0 Policy Context – National Guidance .................................................................. 4 4.0 Wider Regional Context .................................................................................... 5 5.0 Local Plan Update 2018-2021 ........................................................................... 5 6.0 IDP Update 2018 ............................................................................................... 6 7.0 Education .......................................................................................................... 6 8.0 Health Infrastructure ........................................................................................ 10 9.0 Transport Infrastructure ................................................................................... 12 10.0 Utilities and Waste ......................................................................................... 16 11.0 Fire, Police and Ambulance........................................................................... 19 12.0 Green Infrastructure ...................................................................................... 21 13.0 Thames Basin Heath Special Protection Area (SPA) .................................... 24 14.0 Suitable Alternative -

Sandown Park, Portsmouth Road, Esher, KT10 9AJ NTS

Listers Geotechnical Consultants Ltd www.listersgeotechnics.co.uk Tel: 01327 860060 Title: Site 1 - Indicative Layout Site: Sandown Park, Portsmouth Road, Esher, KT10 9AJ Scale: NTS Job No: 18.10.006 Drawn By: HC Listers Geotechnical Consultants Ltd www.listersgeotechnics.co.uk Tel: 01327 860060 Title: Site 2 Parameter plan Site: Sandown Park, Portsmouth Road, Esher, KT10 9AJ Scale: NTS Job No: 18.10.006 Drawn By: HC Listers Geotechnical Consultants Ltd www.listersgeotechnics.co.uk Tel: 01327 860060 Title: Site 2 - Indicative Layout Site: Sandown Park, Portsmouth Road, Esher, KT10 9AJ Scale: NTS Job No: 18.10.006 Drawn By: HC Listers Geotechnical Consultants Ltd www.listersgeotechnics.co.uk Tel: 01327 860060 Title: Site 3 Parameter plan Site: Sandown Park, Portsmouth Road, Esher, KT10 9AJ Scale: NTS Job No: 18.10.006 Drawn By: HC Listers Geotechnical Consultants Ltd www.listersgeotechnics.co.uk Tel: 01327 860060 Title: Site 3 - Indicative Layout Site: Sandown Park, Portsmouth Road, Esher, KT10 9AJ Scale: NTS Job No: 18.10.006 Drawn By: HC Listers Geotechnical Consultants Ltd www.listersgeotechnics.co.uk Tel: 01327 860060 Title: Site 4 Parameter plan Site: Sandown Park, Portsmouth Road, Esher, KT10 9AJ Scale: NTS Job No: 18.10.006 Drawn By: HC Listers Geotechnical Consultants Ltd www.listersgeotechnics.co.uk Tel: 01327 860060 Title: Site 4 - Indicative Layout Site: Sandown Park, Portsmouth Road, Esher, KT10 9AJ Scale: NTS Job No: 18.10.006 Drawn By: HC Listers Geotechnical Consultants Ltd www.listersgeotechnics.co.uk Tel: 01327 860060