Morning Research Focus Table of Contents 目录

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2017

(a joint stock company Incorporated in the People's Republic of China with limited liability) H Share Stock Code: 2333 A Share Stock Code: 601633 Annual Report 2017 * For identification purpose only IMPORTANT NOTICE I. The Board, the Supervisory Committee and the directors, supervisors and senior management of the Company warrant that the content set out in this annual report is true, accurate and complete and does not contain any false representations, misleading statements or material omissions, and jointly and severally take legal liability for its contents. II. All the directors of the Company attended the Board meeting. III. Deloitte Touche Tohmatsu Certified Public Accountants LLP has issued the standard audited report for the Company without qualified opinion. The financial information in the annual report was prepared in accordance with China Accounting Standards for Business Enterprises and the relevant laws and regulations. IV. Wei Jian Jun, person-in-charge of the Company, Li Feng Zhen, person-in-charge of the accounting affairs and Lu Cai Juan, person-in-charge of the accounting department (head of the accounting department), declare that they warrant the truthfulness, accuracy and completeness of the financial report in this annual report. V. Proposal of profit distribution or capitalization of capital reserve during the Reporting Period reviewed by the Board As audited by Deloitte Touche Tohmatsu Certified Public Accountants LLP, the net profit of the Group and net profit attributable to shareholders of the Company in 2017 amounted to RMB5,043,386.53 and RMB5,027,297,997.74 respectively. The Company proposed to declare a cash dividend of RMB1,551,635,730.00 (representing RMB0.17 per share) (tax inclusive) to the shareholders of the Company for the year ended 31 December 2017. -

Inventory Reduction Led to Considerable Sales Decline in The

EQUITY RESEARCH GWM (2333 HK) Inventory Reduction Led to Considerable Sales Decline in the End Month 22 January 2020 Hong Kong | Automobile | Update Report Investment Summary Accumulate (Upgrade) Inventory Reduction Led to Considerable Sales Decline in the End Month CMP HKD 5.97 GWM (Great Wall Motor) released the sales data of December, with wholesale sales of (Closing price as at 20 January) 106,000 vehicles, decreasing 21% yoy and 8% mom. The total annual sales volume was 1.06 TARGET HKD 6.45 (+8%) million vehicles, up 0.7% yoy. The main reasons for the yoy decline in sales in December: 1) according to the usual practice, COMPANY DATA the company needs create a more favourable inventory environment for the coming year O/S SHARES (MN): 3100 and actively control the pace of wholesale; 2) at the same time, as the spring festival comes MARKET CAP (HKD MN): 18504 52 - WK HI/LO (HKD): 7.26 /4.64 earlier this year, the timing for inventory reduction will also be moved up. Seeing from the terminal retail, the demand for the company's products is still relatively strong, with retail sales of about 112,000 vehicles in December, up 7.5% yoy and a strong mom growth of 47.7%, which is far better than the decrease of 5.4% yoy and 35% mom growth of the industry as a whole. SHARE HOLDING PATTERN, % Baoding Innovation Great Wall Asset 56.04 Management Key Models Remained Robust Blackrock 6.52 Key models continued to maintain steady growth, with sales of H6/M6/F7 of about 42,000/19,000/10,000, respectively, up -17%/26%/-6.4% yoy. -

Automotive Industry Weekly Digest

Automotive Industry Weekly Digest 25-29 January 2021 IHS Markit Automotive Industry Weekly Digest - Jan 2021 WeChat Auto VIP Contents [OEM Highlights] Great Wall to reshape brand image with new models 3 [OEM Highlights] VW begins sales of ID.4 CROZZ in China 4 [Sales Highlights] Chinese new vehicle sales contract 2% during 2020; demand rebound expected in 2021 6 [Sales Highlights] VW Group reports sales decline of 9.1% in China during 2020 8 [Technology and Mobility Highlights] Huawei develops smart roads in Wuxi that communicate with driverless vehicles 10 [Technology and Mobility Highlights] Geely teams up with Tencent to develop smart car technologies 10 [Supplier Trends and Highlights] DENSO collaborate with AEVA to develop next-generation FMCW lidar system 12 [Supplier Trends and Highlights] Freudenberg Sealing Technologies develops new DIAvent valves for safer lithium-ion batteries 12 [GSP] India/Pakistan Sales and Production Commentary -2020.12 14 [VIP ASSET] Stellantis: Scale Creates Opportunity 16 [VIP ASSET] Stellantis expects scale to support strong brand stable, investment into new tech 17 Confidential. ©2021 IHS Markit. All rights reserved. 2 IHS Markit Automotive Industry Weekly Digest - Jan 2021 WeChat Auto VIP [OEM Highlights] Great Wall to reshape brand image with new models IHS Markit perspective Implications Great Wall has delivered satisfactory sales results during 2020 despite the disruption from the coronavirus disease 2019 (COVID-19) pandemic. The automaker's sales rose by 5% to more than 1.11 million vehicles during 2020 on the back of strong demand for its new models, including the Haval H6 and the Pao pickup. The sales volumes of 1.11 million units exceeded the company’s target set for the year, which was 1.02 million units. -

A80-Toothlearn-Xtooleshop.PDF (249K)

Tooth learn Function List Software Version: 5.22 Automaker method Model Engine/Type Year Chery By System Delphi electronic control system 1.5L(477F) Chery By System Delphi Electronic Control 1.6L(481F) Chery By System Delphiel ectroni ccontrol system 1.6L(451F) Chery By System Delphi 473 system Chery By System Delphi CNG engine Chery By System Liuji 465 Electronic Control System Chery By Type Type1(Delphie OBD) Chery By Type Type2 Chery By model Fengyun2 Series Delphi Electric Control System 1.5L(477F) Chery By model Cowin/Cowin2 Delphi Electronic Control System Chery By model Cowin/Cowin2 Delphi CNG engine Chery By model Cowin1 Delphi 473 EFI Chery By model Cowin3 Delphi CNG engine Chery By model Cowin5 Delphi Electronic Control Chery By model A1 Delphi 473 system Chery By model A5 Delphi CNG engine Chery By model E5 Chery By model Sonoftheeast Delphi Electronic Control System Chery By model QQ3 Liuji 465 Electronic Control System Chery By model QQ6 Delphi 473 system Chery By model Tiggo/Tiggo3 Delphi Electric Control2.0L/2.4L(4G63/4G64) Chery By model Tiggo/Tiggo3 Delphi Electronic Control1.6L(481F) Kairui By model Excellent Q22B Type1 Kairui By model Excellent Q22B Type2 Kairui By model ViewSonic Q21 Type1 Kairui By model ViewSonic Q21 Type2 Kairui By model YouSheng Q21D Type1 Kairui By model YouSheng Q21D Type2 Kairui By model elegant S22 Type1 Kairui By model elegant S122 Type2 Kairui By model elegant 2 Type1 Kairui By model elegant 2 Type2 Kairui By model QQ3 series Type1 Kairui By model QQ3 series Type2 Kairui By model K50 AUTO -

GREAT WALL MOTOR COMPANY LIMITED (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 2333)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 長 城 汽 車 股 份 有 限 公 司 * GREAT WALL MOTOR COMPANY LIMITED (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2333) ANNOUNCEMENT OF AUDITED ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2019 The board of directors (the “Board”) of Great Wall Motor Company Limited (the “Company”) is pleased to announce the audited results of the Company and its subsidiaries for the year ended 31 December 2019. This announcement, containing the full text of the 2019 Annual Report of the Company, is prepared with reference to the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to preliminary announcements of Annual Results. The Company’s 2019 Annual Report will be available for viewing on the websites of The Stock Exchange of Hong Kong Limited at www.hkexnews.hk and of the Company at www.gwm.com.cn. Printed version of the Company’s 2019 Annual Report will also be delivered to the Company’s shareholders. By order of the Board Great Wall Motor Company Limited Xu Hui Company Secretary IMPORTANT NOTICE I. The Board, the Supervisory Committee and the directors, supervisors and senior management of the Company warrant that the contents of this annual report are true, accurate and complete and do not contain any false representations, misleading statements or material omissions, and jointly and severally take legal liability for its contents. -

Corporate, Social and Responsibility Report

(a joint stock company Incorporated in the People's Republic of China with limited liability) H Share Stock Code: 2333 A Share Stock Code: 601633 2 019 Corporate, Social and Responsibility Report * For identification purpose only CONTENTS About This Report 02 Message from Executives 04 A Close Look at Great Wall Motor 06 Corporate Governance 22 Responsibility Management 30 Product Responsibility 34 Responsibility for Employees 49 Social Responsibility 53 Environmental Responsibility 63 ESG Reporting Guide 72 Feedback Form 78 CSR Report 2019 1 About This Report About This Report I. REPORTING PERIOD: V. DEFINITIONS IN THE REPORT This report is the 9th annual corporate social responsibility report issued by Great Wall Motor Company “Great Wall Motor” or Great Wall Motor Company Limited Limited since 2011. This report covers the period from 1 January 2019 to 31 December 2019, with the “Company” or “we” certain information extending to the previous or subsequent years where appropriate. the “Group” the Company and its subsidiaries II. SCOPE OF REPORT: “Great Wall Holdings” Baoding Great Wall Holdings Company Limited (the indirect The scope of report covers the Company and its subsidiaries. Some contents involve Baoding Great Wall controlling shareholder of the Company) and its subsidiaries Holdings Co., Ltd and its subsidiaries. Please refer to the annual report of Great Wall Motor Company Limited for detailed corporate information. VI. NOTE TO THE REPORT III. CONTENTS OF REPORT: Data in this report are sourced from the Company’s audit report, annual report or other statistical documents. This report contains uncertainties about future plan or forecast. This report has not been This report discloses the Company’s information on economic, social and environmental performance reviewed by any independent source and investors are advised to be aware of the risks involved. -

Geely Auto 吉利汽车 (175 HK) ACCUMULATE

Hong Kong Equity | Automobile Company in-depth Geely Auto 吉利汽车 (175 HK) ACCUMULATE Sales Rebound Following Mid-2019 Weak Performance Share Price Target Price Geely ranked No. 7 among Chinese auto makers in 2018, according to CAAM. HK$15.36 HK$16.7 Though Geely’s sales volume declined in 2Q2019, it has recovered gradually since 9/2019 and sold 143,234 units (+1.1%/10% YoY/MoM) in 11/2019. We believe the launch of 6-8 new models in 2020E and fuel vehicles sales pick-up in China may China / Automobile / Auto Maker continue to boost its sales volume. Combined with rising contribution from mid-to-high end vehicles to support ASP, we estimate 2020E profit to improve by 9 December 2019 26% YoY to RMB11.3 bn. We initiate Accumulate with TP of HK$16.7, suggesting 9% upside potential. Alison Ho (SFC CE:BHL697) Sales decline narrowed down: Geely sales dropped significantly in 2Q2019 & 3Q2019 (852) 3519 1291 mainly due to 1) the implementation of China VI vehicle emission standard from [email protected] 1/Jul/2019 in some cities resulting in customers squeezing demand for new cars in 1H2019; 2) the uncertainties on relations between China and US; 3) economic downturn to drag consumer’s purchasing power. However, we saw Geely’s auto sales decline has Latest Key Data narrowed since 9/2019 and recorded a growth of 1.1% yoy in 11/2019. Under Total shares outstanding (mn) 9,146 consideration that December and January are regarded as the high season for auto sales, Market capitalization (HK$mn) 140,476 with customers traditionally making purchases before Chinese New Year, we therefore Enterprise value (HK$mn) 126,335 believe Geely’s auto sales growth will keep improving in the near future. -

Press Release

Press Release GREAT WALL MOTOR'S Q3 TOTAL OPERATING REVENUE ROSE BY 23.64% YOY TO RMB26.214 BILLION 23 October 2020 – A pick-up truck and SUV market leader in China, Great Wall Motor Company Limited (“Great Wall Motor” or the “Company”, H share stock code: 2333, A share stock code: 601633, together with its subsidiaries, the “Group”) announced that for the three months from 1 July 2020 to 30 September 2020 (the “Third Quarter”), the Group achieved an unaudited total operating revenue prepared in accordance with China Accounting Standards for Business Enterprises of RMB26,214,265,815.68, up by 23.64 per cent year-on-year; net profit attributable to shareholders of the Company increased by 2.91 per cent year-on-year to RMB1,441,071,262.11. Great Wall Motor's satisfactory business performance in the Third Quarter was mainly attributable to continued strong sales performance. The total automobile sales volume in the Third Quarter amounted to 285,593 units, up by 23.86 per cent year-on-year. For the nine months ended 30 September 2020, the Group's total operating revenue and net profit attributable to shareholders of the Company amounted to RMB62,143,459,463.53 and RMB2,587,213,985.01 respectively. According to the statistics from China Association of Automobile Manufacturers, in the first nine months of 2020, the sales volume of automobiles in China was 17.116 million units. The Group continued to strengthen its competitiveness in technology, products, brands and globalization to boost the overall sales volume. The Group’s total sales volume of automobiles in the first three quarters reached 680,690 units, further accelerating its market penetration of automobiles. -

Annual Report

(a joint stock company incorporated in the People's Republic of China with limited liability) H Share Stock Code: 2333 A Share Stock Code: 601633 2 019 ANNUAL REPORT * For identification purpose only IMPORTANT NOTICE I. The Board, the Supervisory Committee and the directors, supervisors and senior management of the Company warrant that the contents of this annual report are true, accurate and complete and do not contain any false representations, misleading statements or material omissions, and jointly and severally take legal liability for its contents. II. All the directors of the Company attended the Board meeting. III. Deloitte Touche Tohmatsu Certified Public Accountants LLP has issued the standard audited report for the Company without qualified opinion. The financial information in the annual report was prepared in accordance with China Accounting Standards for Business Enterprises and the relevant laws and regulations. IV. Wei Jian Jun, person-in-charge of the Company, Liu Yu Xin, person-in-charge of the accounting affairs and Lu Cai Juan, person-in-charge of the accounting department (head of the accounting department), declare that they warrant the truthfulness, accuracy and completeness of the financial report in this annual report. V. Proposal of profit distribution or capitalization of capital reserve during the Reporting Period reviewed by the Board As audited by Deloitte Touche Tohmatsu Certified Public Accountants LLP, the net profit of the Group and net profit attributable to shareholders of the Company in 2019 amounted to RMB4,530,732,870.30 and RMB4,496,874,893.92 respectively. The Company proposed to declare a cash dividend of RMB2,281,817,250.00, (representing RMB0.25 per share) (tax inclusive) to the shareholders of the Company for the year ended 31 December 2019. -

Diagnostic List HAVAL V9.80

Diagnostic List HAVAL_v9.80 Remark: 1.√ : means that the system has this function 2. - : means that the system does not have this function 3.compared with the last version, the new added function is marked in red color Function Model Menu System Version Info. Read DTC Erase DTC Read Data Stream Actuation Test Read Freeze Frame Remarks(Other functions) read historical fault code;Oxygen sensor feedback rationality General Type Haval H3 Delphi MT20U2_EOBD electronic control system √ √ √ √ √ √ diagnosis; idle catalytic converter diagnosis; tooth learning; fault code diagnosis test General Type Haval H3 Bosch V50engine system √ √ √ √ √ √ engine test,read frozen frame General Type Haval H3 Great Wall bosch-edc16 diesel engine - √ √ √ √ - engine test,matching function General Type Haval H3 Delphi MT20U engine - √ √ √ √ - system state General Type Haval H3 Liaoning Xinfeng electronic control system √ √ √ √ - √ read frozen frame General Type Haval H3 Bosch ABS system √ √ √ √ √ - exhaust mode General Type Haval H3 Jinzhou Jinheng safety airbag √ √ √ √ - - - General Type Haval H3 BOSCH safety airbag √ √ √ √ - - - General Type Haval H3 Continental safety airbag √ √ √ - - - - network configuration; function configuration; system General Type Haval H3 Tongzhi Body control module √ √ √ √ √ - configuration network configuration; function configuration; system General Type Haval H3 Delphi Body control module √ √ √ √ √ - configuration Read network configuration information; write network configuration General Type Haval H3 safety airbag(ABM) TRW safety -

Asian Daily (Asia Edition)

Monday, 20 November 2017 (Asia Edition) Asian Daily EPS, TP and Rating changes Top of the pack ... EPS TP (% change) T+1 T+2 Chg Up/Dn Rating Guangzhou (7.5) (2.8) 0 21 O (O) China Basic Materials Sector Yang Luo (3) Automobile Group New report: Key takeaways from recent trip NetEase.com (0.9) 2 20 16 O (O) SMIC (2.2) (36.5) (1) (3) U (U) Singapore Banks Sector Danny Goh (4) ZhongAn Online P&C Initiation 1 N (NA) New report: 3Q17—setting up for a bright FY18 Insurance Co., Ltd. United Spirits Ltd. 9 9 38 16 O (O) TPK Holdings (3.3) 2 14 42 O (N) India Corporate Health Tracker Ashish Gupta (5) Muang Thai Leasing Co 2 3 7 22 O (O) New report: IBC key to NPA resolution Srisawad Power 1979 (3) 0 7 25 O (O) Public Co. ZhongAn Online P&C Insurance (6060.HK) – Initiating Coverage with N Thomas Chong (6) DBS Group 0 0 8 17 O (O) New report: Data technology makes the difference UOB 0 0 8 19 O (O) OCBC 0 0 8 10 N (N) TPK Holdings (3673.TW) – Upgrade to O Jerry Su (7) Connecting clients to corporates Back into the iPhone XY touch sensor lamination supply chain from 2H18 Thematic Trip CS pic of the day Telco Tour in Bangkok and Jakarta Date 20-23 November, Bangkok, Jakarta Taiwan AutoTech Sector: Smartphone vs Smartcar CAGR comparison (2016-2020E) Analyst Colin McCallum We believe automotive electronics will represent the next growth opportunity for the supply chain, after NagaCorp Cambodia Visit smartphones, because it has (1) a faster growth rate of 8% vs 0% for smartphones, and (2) a longer product life Date 23-24 November, Phnom Penh cycle, which in theory should translate into better profitability. -

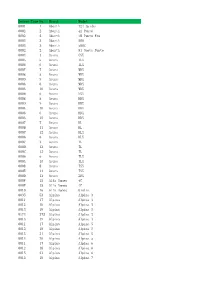

TS100 Vehicle Coverage List 20200624145351.Pdf

Sensor Type No. Brand Model 0001 1 Abarth 124 Spider 0002 2 Abarth 4A Punto 0002 2 Abarth 4B Punto Evo 0003 3 Abarth 500 0003 3 Abarth 500C 0002 2 Abarth 81 Nuova Punto 0004 4 Acura CSX 0005 5 Acura ILX 0006 6 Acura ILX 0007 7 Acura MDX 0008 8 Acura MDX 0009 9 Acura MDX 0006 6 Acura MDX 000A 10 Acura MDX 0006 6 Acura NSX 0008 8 Acura RDX 0009 9 Acura RDX 000A 10 Acura RDX 0006 6 Acura RDX 000A 10 Acura RDX 0007 7 Acura RL 000B 11 Acura RL 000C 12 Acura RLX 0006 6 Acura RLX 0007 7 Acura TL 000D 13 Acura TL 000C 12 Acura TL 0006 6 Acura TLX 000A 10 Acura TLX 0008 8 Acura TSX 000E 14 Acura TSX 000D 13 Acura ZDX 000F 15 Alfa Romeo 4C 000F 15 Alfa Romeo 4C 0010 16 Alfa Romeo Giulia 0035 53 Alpina Alpina 3 0011 17 Alpina Alpina 3 0012 18 Alpina Alpina 3 0013 19 Alpina Alpina 3 0174 372 Alpina Alpina 3 0013 19 Alpina Alpina 4 0011 17 Alpina Alpina 5 0012 18 Alpina Alpina 5 0015 21 Alpina Alpina 5 0014 20 Alpina Alpina 5 0011 17 Alpina Alpina 6 0012 18 Alpina Alpina 6 0015 21 Alpina Alpina 6 0012 18 Alpina Alpina 7 0016 22 Alpina Alpina 7 0017 23 Alpina XD3 0012 18 Alpina XD3 0018 24 Alpina XD3 0014 20 Alpina XD3 0014 20 Alpina XD4 0019 25 Aston Martin DB11 001A 26 Aston Martin DB11 001B 27 Aston Martin DB9 001C 28 Aston Martin DB9 0022 34 Aston Martin DB9 001C 28 Aston Martin DBS 001C 28 Aston Martin Lagonda 001D 29 Aston Martin One-77 001E 30 Aston Martin V8 Vantage 001C 28 Aston Martin V8 Vantage 001E 30 Aston Martin V8 Vantage S 001C 28 Aston Martin Vanquish 001B 27 Aston Martin Vantage 001C 28 Aston Martin Vantage 001C 28 Aston Martin Rapide