30 May 2014 Global Developments the Australian

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DIAA Victorian Dairy Product Competition

Dairy Industry Association of Australia DIAA Victorian Dairy Product Competition 2017 Results DUCT C ODUCT C RO ROM OM P P P P Y Y E E R T IR I T I I A A T T D D I I O O N N N N A A 2 2 I I 0 0 R R 1 1 O O 7 7 T T C C I I V V R E L D V GO SIL RESULTS – 2017 Results Booklet 2017 DIAA Victorian Dairy Product Competition n n Butter ................................................................................. 4 n n Cheese ............................................................................... 5 n n Dips ...................................................................................11 n n Powder .............................................................................11 n n Yoghurt ............................................................................12 n n Milk ...................................................................................15 n n Cream ...............................................................................18 n n Dairy desserts ................................................................19 n n Innovation ......................................................................19 n n Ice-cream, gelati, frozen yoghurt ...........................19 n n Non-bovine product ...................................................23 n n Organic products .........................................................24 n n Other ................................................................................24 The DIAA thanks its National Partners DIAA VICTORIAN DAIRY PRODUCT COMPETITION INDUSTRY-SPONSORED -

Annual 2017— 2018

FOODBANK VICTORIA ANNUAL SNAPSHOT 2017— 2018 2 CEO’S MESSAGE DID YOU STRUGGLE TO PUT FOOD ON THE TABLE IN LAST 12 MONTHS? IF YOU DID, YOU WERE FAR FROM ALONE. Our 2017 Hunger Report found 3.6 In the last year, food insecurity – and million Australians had experienced food food waste – came into the public insecurity at least once in the previous consciousness at a level I’ve not seen 12 months. For 60 per cent, it was a during my decade at Foodbank. IN THE LAST YEAR, monthly occurrence. Over a quarter of It started in July with the ABC series FOOD INSECURITY these individuals said it was happening War on Waste, which shocked the nation at least weekly. AND FOOD WASTE by exposing us to the realities of our ““ CAME INTO THE PUBLIC How can this be? In a developed country consumer culture. A segment on Foodbank CONSCIOUSNESS AT rich with resources, a healthy economy and resulted in a flood of enquiries – individuals progressive culture, how is this happening? wanting to volunteer and donate food or A LEVEL I’VE NOT SEEN funds to help. DURING MY DECADE Look a little closer and you’ll see the In October, our Hunger Report gained AT FOODBANK. disparities. We grow more than enough traction in the media. The high cost of food – in fact we export about 65% of DAVE MCNAMARA living and bill shock were identified as farm produce – yet people are going CEO FOODBANK VICTORIA the main causes of food insecurity. As the hungry. Our economy is strong, yet report found, everyday working Australians household debt levels are among the are now going without food in order to highest in the world. -

Sight + Sound NEWS | WINTER 2020

Sight + Sound NEWS | WINTER 2020 Emil Chalhoub Finding the bard in Bardet-Biedl Syndrome Emil Chalhoub humbly describes himself as describes: “I can’t count on my eyes to get me “a pretty normal guy.” Except he isn’t at all. places, but ask any one of my 20 first cousins He’s rather exceptional. This isn’t because he is and they’ll tell you that I can get anywhere with just one in over 140,000 people diagnosed with my mouth … One of the advantages of vision loss Bardet-Biedl Syndrome. It’s his attitude and is that it enhances your other senses because, approach to living with this genetic condition naturally, you have to rely on them more. I like to that makes Emil stand out. think that my ability to talk is my sixth sense.” Emil has been diagnosed since the age of three. Even when confronting the years of depression he Bardet-Biedl Syndrome affects multiple parts experienced as a teenager, he tries to outline the of the body. A major feature is vision loss, often things that ultimately helped him pull through – caused by retinitis pigmentosa, a worsening of faith and support from his family and community. peripheral vision and night vision sometimes “Talking to someone made the difference,” he said. described as “tunnel vision.” Emil has experienced “My brothers, my family in general.” vision loss since his teenage years. He is treated When the black dog reared its ugly head again for this at the Eye and Ear where he receives in 2019 it was landing an accessible job in a call regular check-ups to assess how his eyes are centre that pulled Emil through. -

2019 Catalogue of Results

2019 Catalogue of Results The Royal Agricultural Society of Victoria (RASV) thanks the following partners and supporters for their involvement. A special thanks to all of the 2019 Australian Food Awards producers, judges and stewards. MAJOR SPONSOR MAJOR SPONSOR SPONSOR 2019 Catalogue of Results The Royal Agricultural Society of Victoria Limited ABN 66 006 728 785 ACN 006 728 785 Melbourne Showgrounds Epsom Road Ascot Vale VIC 3032 www.rasv.com.au List of Office Bearers As at 28/08/2018 Patron Her Excellency the Hon Linda Dessau AC — Governor of Victoria Board of Directors MJ (Matthew) Coleman (President) DS (Scott) Chapman (Deputy President) CGV (Catherine) Ainsworth D (Darrin) Grimsey NE (Noelene) King OAM PJB (Jason) Ronald OAM P (Peter) Hertan R (Robert) Millar Chief Executive Officer P. Guerra Competition Co-ordinator Danielle Burnett Email: [email protected] TABLE OF CONTENTS ENTRIES ................................................................................................................................................................................. 6 MEDALS ................................................................................................................................................................................. 6 OFFICIAL ACKNOWLEDGEMENT ........................................................................................................................................ 6 AUSTRALIAN FOOD AWARDS INDUSTRY ADVISORY GROUP ....................................................................................... -

Report DFSV Annual Report 2018 2019

Annual Report | 2018–2019 Contents About Dairy Food Safety Victoria 3 Dashboard — industry and DFSV statistics 4 Chair’s foreword 6 Chief Executive Officer’s report 7 Performance report 8 Regulation objective 8 Management of food safety incidents objective 12 Reputation objective 14 Advice and support objectives 16 Participation objective 17 Finance objective 19 Governance and business systems objective 21 People objective 23 Governance and organisational structure 25 Workforce data 29 Other disclosures 30 Financial statements 34 Independent auditors report 71 Disclosure index 73 In accordance with the Financial Management Act 1994, I am pleased to present Dairy Food Safety Victoria’s Annual Report for the year ending 30 June 2019. Dr Anne Astin Chair 27 August 2019 Published by Dairy Food Safety Victoria Copyright State of Victoria 2019 ISSN: 2204-0641 2 Annual Report 2018–2019 | Dairy Food Safety Victoria About Dairy Food Safety Victoria Dairy Food Safety Victoria (DFSV) is the statutory authority Charter and purpose responsible for regulating the Victorian dairy industry to DFSV is a statutory authority established by the Victorian safeguard public health — implementing a robust regulatory Parliament under the Dairy Act 2000. DFSV reports through framework that underpins market access and the growth of its Board to the Victorian Minister for Agriculture. the dairy industry. Ministers for Agriculture, the Hon. Jaala Pulford MP and the As a statutory authority DFSV is accountable to the Victorian Hon. Jaclyn Symes MP were the responsible ministers from Government, through the Minister for Agriculture, for fulfilling 1 July 2018 to 30 June 2019. its statutory responsibilities in line with government policy and The objectives, functions and powers of DFSV are prescribed within an appropriate governance framework. -

Bulla Dairy Foods, Colac – Victoria

CASE STUDY Bulla Dairy Foods, Colac – Victoria Bulla Dairy Foods is an iconic brand trusted and loved CUSTOMER Environmental Technology by Australian families since 1910. The family-owned Solutions (ETS) for Bulla company has been making premium quality dairy Dairy Foods products for more than a century, and its products LOCATION Colac, Victoria stand for quality and authenticity. DESCRIPTION Penske Power Systems Today Bulla offers a range of chilled and frozen dairy products partners with ETS for the installation of two – including cream, cheese, yoghurt, dairy desserts, ice cream cogeneration modules at Bulla and frozen yoghurt – renowned for the taste of country Dairy Foods’ state-of-the-art goodness and real dairy. Colac facility; supplying and commisisioning the modules, Bulla’s products include the iconic Real Dairy ice cream range, while ETS designed and full of rich creaminess, as well as the much-lauded Bulla cream managed the construction range that is the first choice of Australia’s top chefs. of the complete system With the company experiencing exponential sales growth OPERATIONAL DATE July 2014 throughout Asia-Pacific, including the discerning Japanese market, Bulla remains the biggest selling cream on the Australian market today and is one of the country’s major ice cream makers. BULLA DAIRY FOODS, COLAC – VICTORIA All of this success is underpinned by Bulla’s diversity in production and technological innovation, which has been reinforced through continuous work in sustainability and efforts to generate electricity onsite. Thanks to a significant grant from the Australian Government’s Clean Technology Food and Foundries Investment program, Bulla has installed two MTU Onsite Energy cogeneration modules to provide 80 per cent of the power requirements for its Colac frozen dairy manufacturing plant. -

NSW School Canteen Buyers' Guide 2020

NSW School Canteen Buyers’ Guide 2020 Healthy Kids Association Registered Products: Everyday and Occasional Pies Flavoured milk and milk alternatives Contents Balfours Pty Ltd .................................................................20 Coca Cola Amatil Limited .......................................... 37 Earlyrise Baking Co .........................................................22 Emma & Tom Foods ...................................................... 37 How to read the NSW Buyers’ Guide .............3 Good Tucker Bakery Pty Ltd ....................................22 Freedom Foods Group ................................................ 37 The NSW School Canteen Buyers' Guide ....4 Mrs Mac’s ...............................................................................22 Lactalis Australia.......................................................37, 38 Patties Foods Pty Ltd ....................................................22 Lion Dairy & Drinks ..........................................................39 The NSW Healthy School Thompson’s Pies Pty Ltd ............................................22 Nestle Professional ........................................................39 Canteen Strategy ..............................................................5 Sausage rolls and savoury pastries Sanitarium The Health Food Company ...........39 Healthy Kids Association – who we Balfours Pty Ltd .................................................................22 Drinking yoghurts are and what we do .........................................................6 -

Basketball Victoria and Bulla Dairy Foods 'Local Heroes'

Basketball Victoria and Bulla Dairy Foods ‘Local Heroes’ Terms and Conditions Promotion Bulla Local Heroes Promoters Basketball Victoria Promotion Bulla Dairy Foods and Melbourne United Partners Promotional Start Date: 21/08/2020 at 9.00m AEST Period End Date: 9/10/2020 at 11.59pm AEST Eligible Entrance Entry is open to all Victorian residents who are 18 years and over. How to enter To enter the competition, the entrant must; Complete the entry form for as attached on the Basketball Victoria website nominating either themselves or another member of their basketball community for the work they have done to help grow the love of basketball within their community. All details filled out must be correct and true to the person completing the form. An explanation and photo or video must be attached to the entry form to be considered. A total of FOUR Bulla Local Heroes will be selected. From these four, ONE will be chosen as the overall Bulla Local Hero with a grand prize pack. Weekly Local Heroes will be determined by Basketball Victoria staff members. Our overall winner will be selected via a public vote. Prize Our FOUR WEEKLY BULLA LOCAL HERO WINNERS will receive: descriptions • a THREE MONTHS’ supply of Bulla’s Murray St Ice Cream (valued at $120). These will be redeemable via Coles gift cards • a Melbourne United cap • a carton of Bulla Hoop Time Spalding rubber balls for winner’s school, association or club of choice Our ONE OVERALL BULLA LOCAL HERO will receive: • a TWELVE MONTHS’ supply of Bulla Ice Cream (valued at $500). -

222 Results Found for Your Search Criteria

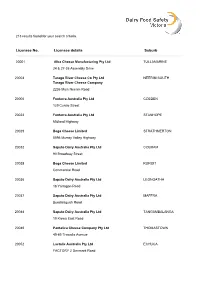

213 results found for your search criteria. Licensee No. Licensee details Suburb 20001 Alba Cheese Manufacturing Pty Ltd TULLAMARINE 24 & 27-35 Assembly Drive 20003 Tarago River Cheese Co Pty Ltd NEERIM SOUTH Tarago River Cheese Company 2236 Main Neerim Road 20006 Fonterra Australia Pty Ltd COBDEN 129 Curdie Street 20023 Fonterra Australia Pty Ltd STANHOPE Midland Highway 20029 Bega Cheese Limited STRATHMERTON 5096 Murray Valley Highway 20032 Saputo Dairy Australia Pty Ltd COBRAM 90 Broadway Street 20035 Bega Cheese Limited KOROIT Commercial Road 20036 Saputo Dairy Australia Pty Ltd LEONGATHA 18 Yarragon Road 20037 Saputo Dairy Australia Pty Ltd MAFFRA Bundalaguah Road 20044 Saputo Dairy Australia Pty Ltd TANGAMBALANGA 19 Kiewa East Road 20046 Pantalica Cheese Company Pty Ltd THOMASTOWN 49-65 Trawalla Avenue 20052 Lactalis Australia Pty Ltd ECHUCA FACTORY 2 Denmark Road Licensee No. Licensee details Suburb 20055 Regal Cream Products Pty Ltd COLAC Bulla Dairy Foods 43-49 Connor Street 20057 Tatura Milk Industries Ltd TATURA Tatura Milk Industries Pty Ltd 236 Hogan Street 20066 Warrnambool Cheese & Butter Factory Company ALLANSFORD Holdings Ltd 5330-5331 Great Ocean Road 20068 Marca Trinacria Pty Ltd HEIDELBERG WEST 32 Kylta Road 20070 Yea Brand Pty Ltd YEA Yea Brand Dairy 10 Melaleuca Street 20073 Lactalis Jindi Pty Ltd JINDIVICK Jindi Cheese Old Telegraph Road 20086 Monde Nissin (Australia) Pty Ltd CLAYTON Black Swan Foods 532-534 Clayton Road 20099 Lactalis Australia Pty Ltd BENDIGO 93 Bannister Street 20100 Lactalis Australia Pty Ltd ROWVILLE 842 Wellington Road 20108 BDD Milk Pty Ltd CHELSEA HEIGHTS 150 Wells Road 20111 Jalna Dairy Foods Pty Ltd THOMASTOWN 31 Commercial Drive Licensee No. -

Dairy Safe News

Dairy Food Safety Victoria Level 2, 969 Burke Road JUNE 2018 Camberwell, Victoria 3124 Postal address DAIRY SAFE NEWS PO Box 8221 Camberwell North, Victoria 3124 From the interim CEO Applauding excellence in dairy products Phone: + 61 3 9810 5900 I am pleased to be addressing you for In May 2018, the Dairy Industry Association of Australia (DIAA) Fax: + 61 3 9882 6860 the first time as CEO. Although only celebrated all that is good about dairy. Email: [email protected] eight weeks in, with the support of the DFSV again sponsored the 2018 DIAA Victorian Dairy Product www.dairysafe.vic.gov.au Board and staff and the warm welcome Competition awards luncheon. The awards celebrate individual from industry, my transition to the role achievements, but also recognise the high standard of quality of has been a smooth one. food produced across the entire Victorian dairy industry. DFSV After many years at FSANZ in developing congratulates all recipients of awards in the 2018 competition, and setting food safety standards with special mention of most outstanding show exhibitor, it is good to be able to see them implemented to ensure the Dooley’s Ice Cream. safety of dairy food products and to safeguard public health. Winners of the National Dairy Product Competition were It is important to me that I gain a thorough understanding of the announced that evening at the Awards of Excellence dinner. workings of the businesses DFSV licence and the environment Dooley’s Ice Cream was again successful, taking out the in which they operate. Since joining DFSV, I have taken the major award. -

Bulla Dairy Foods R&D Finished Good Specification 1011 - Bulla Vanilla Ice Cream 5L X 2

Bulla Dairy Foods R&D Finished Good Specification 1011 - Bulla Vanilla Ice Cream 5L x 2 1. GENERAL PRODUCT INFORMATION Product Description VANILLA FLAVOURED ICE CREAM Intended Use This product is ready to eat and intended for retail sale. Intended Consumers The intended consumer is the general public. While not specifically intended for high risk consumers, it is possible that the product can be consumed by this category. Pack Size 5 L 2. NUTRITION INFORMATION PANEL Servings Per 50 Package Serving size 45g Avg. quantity per serving Avg. quantity per 100g Energy 396kJ (95Cal) 881kJ (210Cal) Protein 0.8g 1.7g - Gluten NOT DETECTED NOT DETECTED Fat - Total 4.9g 10.9g - Saturated 3.4g 7.6g Carbohydrate 11.9g 26.4g - Sugars 9.8g 21.8g Sodium 24mg 54mg 3. INGREDIENT & ALLERGEN DECLARATION INGREDIENTS: WATER, FRESH CREAM (25%), SUGAR, FRESH MILK, MILK SOLIDS, MALTODEXTRIN, EMULSIFIER (471), NATURAL FLAVOUR, THICKENERS (GUAR GUM, LOCUST BEAN GUM, PROCESSED EUCHEUMA SEAWEED, XANTHAN GUM), NATURAL COLOURS (CURCUMIN, BETA CAROTENE). CONTAINS: MILK. MAY BE PRESENT: EGG. 4. CHARACTERISING STATEMENTS CONTAINS NO LESS THAN 10% MILK FAT IN ICE CREAM. 5. ORGANOLEPTIC PROPERTIES Colour Creamy white colour. Appearance Smooth consistent texture, free from ice crystals. Odour Free from foreign or objectionable odours. Flavour True to type, free from foreign or objectionable flavours. Texture Free from extraneous matter. 6. MICROBIOLOGICAL SPECIFICATIONS Test Target Specification Test Method Coliforms <100 cfu/g Internal Laboratory Standard Plate Count <50,000 cfu/g Internal Laboratory Printed copies may not be the latest version. Approved Date: 6/7/2021 Owner: R&D Manager Page 1 of 2 Bulla Dairy Foods R&D Finished Good Specification 1011 - Bulla Vanilla Ice Cream 5L x 2 8. -

Bulla Dairy Foods R&D Finished Good Specification 1111 - Bulla Ice Cream Party Cups Light Vanilla 100Ml X 36

Bulla Dairy Foods R&D Finished Good Specification 1111 - Bulla Ice Cream Party Cups Light Vanilla 100mL x 36 1. GENERAL PRODUCT INFORMATION Product Description VANILLA FLAVOURED REDUCED FAT ICE CREAM Intended Use This product is ready to eat and intended for foodservice sale. Intended Consumers The intended consumer is the general public. While not specifically intended for high risk consumers, it is possible that the product can be consumed by this category. Pack Size 100 mL 2. NUTRITION INFORMATION PANEL Servings Per 1 Package Serving size 48g # Avg. quantity per serving %DI per serve Avg. quantity per 100g Energy 256kJ (61Cal) 3% 533kJ (127Cal) Protein 1.9g 4% 4.0g - Gluten NOT DETECTED NOT DETECTED Fat - Total <1.0g 1% 1.6g - Saturated <1.0g 2% 1.2g Carbohydrate 11.4g 4% 23.7g - Sugars 8.1g 9% 17.1g Dietary Fibre <1.0g 3% <0.1g Sodium 19mg 0.8% 40mg # PERCENTAGE DAILY INTAKES ARE BASED ON AVERAGE ADULT DIET OF 8700kJ. YOUR DAILY INTAKES MAY BE HIGHER OR LOWER DEPENDING ON YOUR ENERGY NEEDS. 3. INGREDIENT & ALLERGEN DECLARATION INGREDIENTS: WATER, MILK SOLIDS, MALTODEXTRIN, SUGAR, FRUCTOSE, FRESH CREAM (2.5%), EMULSIFIERS (477, 471), THICKENERS (GUAR GUM, PROCESSED EUCHEUMA SEAWEED), NATURAL FLAVOURS, NATURAL COLOURS (CURCUMIN, BETA CAROTENE). CONTAINS: MILK. MAY BE PRESENT: EGG. 4. CHARACTERISING STATEMENTS CONTAINS NO MORE THAN 2% MILK FAT BY WEIGHT IN LOW FAT ICE CREAM. *CONTAINS 84% LESS FAT THAN STANDARD ICE CREAM. 5. ORGANOLEPTIC PROPERTIES Colour Creamy white. Appearance Smooth, consistent texture, free from ice crystals. Odour Free from foreign or objectionable odours.