2) Short Form Announcement FY2020 IFRS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DISTRICT SAFETY PLAN Overberg

DISTRICT SAFETY PLAN Overberg Civic Centre NR Arendse 15 October 2019 George Introduction – DSPs and the Western Cape Road Safety Situation Average around 1,400 people killed on Western Cape roads each year: • Average 3 to 4 people killed per day. • Estimated 17 people seriously injured per day. Estimated 57 people injured per day (CSIR estimates). • Based on CSIR cost of crashes study, approximate economic burden in WC is R26,937,398 per day. Over R9b per annum • Most of the cost is in loss of earnings – so hits local economies the hardest Caledon “District Safety Plan” (DSP) pilot launched October 2016. Twelve months after implementation: 29.7% reduction in fatalities in the region. © Western Cape Government 2012 | Background Recognizing that the existing crash levels on our roads represent a major impediment to the socio-economic development of the Western Cape, the Transport Branch of the Department of Transport & Public Works has adopted a vision of zero fatalities and serious injuries on Western Cape roads. Together with its partners in all three spheres of government, the Branch has conducted a process to develop a District Safety Plan in the Caledon Traffic Centre area of operations. © Western Cape Government 2012 | Go to Insert > Header & Footer > Enter presentation name into footer field 3 Background © Western Cape Government 2012 | Go to Insert > Header & Footer > Enter presentation name into footer field 4 Vision Zero and the Safe System Jurisdictions where “safe system” road safety strategies have been adopted which include targets of ZERO fatalities and/or serious injuries: Sweden Northern Ireland Edmonton; Canada London, Bristol, Brighton, Blackpool; UK New York, Boston, Los Angeles, Washington, Seattle, Austin etc; USA Mexico City; Mexico © Western Cape Government 2012 | Go to Insert > Header & Footer > Enter presentation name into footer field 5 Vision Zero and the Safe System No-one should be killed or seriously injured while using the road network. -

Transport Impact Assessment

INNOVATIVE TRANSPORT SOLUTIONS Transport Impact Assessment Boulders Wind Farm Vredenburg, Western Cape November 2018 5th Floor, Imperial Terraces Carl Cronje Drive Tyger Waterfront Bellville, 7530 Tel: +27 (021) 914 6211 E-mail: [email protected] Boulders Wind Farm ITS 3997 November 2018 (Rev1) Report Type Transport Impact Assessment Title Boulders Wind Farm Client Savannah Environmental (Pty) Ltd Location Vredenburg, Western Cape Project Team Pieter Arangie Theodore Neels Reviewed by: Christoff Krogscheepers, Pr. Eng Project Number ITS 3997 Date November 2018 Report Status Revision 1 File Name: G:\3997 TIS Boulders Wind Energy Facility, Vredenburg\12 Report\Issued\3997 Boulders Wind Energy Facility_Vredenburg - TIA_Revision1_PA_2018-11-22.docx This transport impact study was prepared in accordance with the South African Traffic Impact and Site Traffic Assessment Manual (TMH 26, COTO, Aug 2012), by a suitably qualified and registered professional traffic engineer. Details of any of the calculations on which the results in this report are based will be made available on request. i Boulders Wind Farm ITS 3997 November 2018 (Rev1) Table of Contents 1.0 INTRODUCTION ............................................................................................................ 1 2.0 LOCALITY ..................................................................................................................... 1 3.0 PROPOSED DEVELOPMENT ...................................................................................... 1 4.0 TRAFFIC -

Flower Route Map 2014 LR

K o n k i e p en w R31 Lö Narubis Vredeshoop Gawachub R360 Grünau Karasburg Rosh Pinah R360 Ariamsvlei R32 e N14 ng Ora N10 Upington N10 IAi-IAis/Richtersveld Transfrontier Park Augrabies N14 e g Keimoes Kuboes n a Oranjemund r Flower Hotlines O H a ib R359 Holgat Kakamas Alexander Bay Nababeep N14 Nature Reserve R358 Groblershoop N8 N8 Or a For up-to-date information on where to see the Vioolsdrif nge H R27 VIEWING TIPS best owers, please call: Eksteenfontein a r t e b e e Namakwa +27 (0)79 294 7260 N7 i s Pella t Lekkersing t Brak u West Coast +27 (0)72 938 8186 o N10 Pofadder S R383 R383 Aggeneys Flower Hour i R382 Kenhardt To view the owers at their best, choose the hottest Steinkopf R363 Port Nolloth N14 Marydale time of the day, which is from 11h00 to 15h00. It’s the s in extended ower power hour. Respect the ower Tu McDougall’s Bay paradise: Walk with care and don’t trample plants R358 unnecessarily. Please don’t pick any buds, bulbs or N10 specimens, nor disturb any sensitive dune areas. Concordia R361 R355 Nababeep Okiep DISTANCE TABLE Prieska Goegap Nature Reserve Sun Run fels Molyneux Buf R355 Springbok R27 The owers always face the sun. Try and drive towards Nature Reserve Grootmis R355 the sun to enjoy nature’s dazzling display. When viewing Kleinzee Naries i R357 i owers on foot, stand with the sun behind your back. R361 Copperton Certain owers don’t open when it’s overcast. -

Coaxial Connectors Navigator the ABC’S of Ordering from Radiall A

Coaxial Connectors Navigator The ABC’s of Ordering From Radiall A. Series P/N Series Prefix Radiall and Radiall AEP Orientation Gender Connector Catalog P/N & Part Number Series 3 digits correspond to series Radiall AEP Part 4 digits correspond to series (SMA, BNC, SMB, etc; refer to (SMA, BNC, SMB, etc.; refer to Section Number Straight Male Prefix Radiall System Number System Interface finder guide for series) finder guide for series) Name R XXX XXX XXX 3 digits correspond to function 9000-XXXX-XXX 4 digits correspond to function (Plating, captivation, attachment (Interface, geometry, panel Body mounting, etc.) and materials) Right angle Female 3 digits correspond to variant 3 digits correspond to variant Size (Variation) (Dimension, finish, packaging, etc.) Attachment B. Style C. Electrical Options Coupling System Main Cable Types SMA, SMC, TNC, N, UMP, MMS, MMT, BMA, SMP QMA, QN, SMB "Fakra Ω UHF, DIN 7/16, etc. MC-Card, SMB, MCX "smooth bore" BNC, C and USCar,"SMZ type 43 IMP, UMP Performance: Performance: Performance: Performance: Performance: Performance: Excellent Average Excellent Average Average Average Connection time: Connection time: Connection time: Connection time: Lock Connection time: Connection time: Bayonet Snap-On Slide-On Long Very fast Very fast Fast Very fast Press-On Very fast Screw-On Minimum Frequency Needs space Space saving Space saving Needs space Space saving Space saving Mating Cycles Measured in GHz: current Perfect for Outer latching Secured mating Perfect for Durability range is DC-40 GHz (Max) miniaturization -

Corkage Charged at R45 Per Bottle WINE LIST BUBBLY Botanicum

WINE LIST BUBBLY 125ml BTL Botanicum Brut, MCC, Simonsberg-Stellenbosch NV R55 R275 Saltare Brut Nature, MCC, Western Cape NV R365 Le Lude MCC, Brut, Franschhoek NV R485 Le Lude MCC, Brut Rosé, Franschhoek NV R485 Le Mensil Blanc de Blancs, Éperney, Champagne NV R985 WHITE 175ml BTL Eenzaamheit ‘Vin Blanc’ Chenin Blend, Paarl 2017 R45 R175 Eikendal ‘Janina’ Unwooded Chardonnay, Western Cape 2018 R48 R185 Mason Road Chenin Blanc, Paarl 2019 R52 R195 The Search Grenache Blanc/Marsanne/Roussanne, Voor-Paardeberg 2017 R55 R210 Trizanne Signature Wines Sauvignon Blanc, Elim 2018 R56 R215 Fram Chardonnay, Robertson 2018 R255 Julien Schaal ‘Mountain Vineyards’ Chardonnay, Cape South Coast 2017 R275 Buitenverwachting ‘Hussey's Vlei' Sauvignon Blanc, Constantia 2018 R285 Saboteur ‘White’ Chenin/Viognier/Sauvignon Blanc, Cape South Coast 2018 R295 Craven 'Karibib' Chenin Blanc, Stellenbosch 2016 R345 Klein Constantia Riesling, Constantia 2015 R365 Savage ‘White’ Sauvignon Blanc/Semillon, Western Cape 2016 R385 Spioenkop Riesling, Elgin 2016 R395 Alheit Vineyards ‘Cartology’ Chenin/Semillon, Western Cape 2016 R425 Alheit Vineyards ‘Magnetic North’ Chenin Blanc, Olifantsrivier 2015 R995 ROSÉ 175ml BTL Spider Pig 'Bro/Zay’ Colombar/Cinsault, Western Cape 2018 R48 R185 Von Loggerenberg ‘Break a Leg’ Cinsault, 2019 R245 RED 175ml BTL Scali ‘Sirkel’ Pinotage, Voor-Paardeberg 2016 R45 R175 Buitenverwachting ‘Meifort’ Cabernet Sauvignon/Merlot, Constantia 2016 R48 R185 Joostenberg 'Family Blend' Syrah/Cinsault/Mourvedre, Paarl 2017 R52 R195 Copper Pot -

National Road N12 Section 6: Victoria West to Britstown

STAATSKOERANT, 15 OKTOBER 2010 NO.33630 3 GOVERNMENT NOTICE DEPARTMENT OF TRANSPORT No. 904 15 October 2010 THE SOUTH AFRICAN NATIONAL ROADS AGENCY LIMITED Registration No: 98109584106 DECLARATION AMENDMENT OF NATIONAL ROAD N12 SECTION 6 AMENDMENT OF DECLARATION No. 631 OF 2005 By virtue of section 40(1)(b) of the South African National Roads Agency Limited and the National Roads Act, 1998 (Act NO.7 of 1998), I hereby amend Declaration No. 631 of 2005, by substituting the descriptive section of the route from Victoria West up to Britstown, with the subjoined sheets 1 to 27 of Plan No. P727/08. (National Road N12 Section 6: Victoria West - Britstown) VI ~/ o8 ~I ~ ~ ... ... CD +' +' f->< >< >< lli.S..E..I VICTORIA WEST / Ul ~ '-l Ul ;Ii; o o -// m y 250 »JJ z _-i ERF 2614 U1 iii,..:.. "- \D o lL. C\J a Q:: lL. _<n lLJ ~ Q:: OJ olLJ lL. m ~ Q:: Q) lLJ JJ N12/5 lL. ~ fj- Q:: ~ I\J a DECLARATION VICTORIA lLJ ... ... .... PLAN No. P745/09 +' a REM 550 +' :£ >< y -/7 0 >< WEST >< 25 Vel von stel die podreserwe voor von 'n gedeelte Z Die Suid Afrikoonse Nosionole Podogentskop 8eperk Die figuur getoon Sheet 1 of 27 a represents the rood reserve of 0 portion ~:~:~:~: ~ :~: ~:~:~:~:~:~ The figure shown w The South African Notional Roods Agency Limited ........... von Nosionole Roete Seksie 6 Plan w :.:-:-:-:.:.:-:.:-:-:.: N12 OJ of Notional Route Section P727108 w a D.O.9.A • U1 01 o II') g 01' ICTORIA0' z " o o (i: WEST \V II> ..... REM ERF 9~5 II') w ... -

The Willaston Bar

THE WILLASTON BAR - BAR FOOD - SERVED FROM 12PM Biltong | Salted Mixed Nuts | Crisps R75 Bread Board w. hummus | tapenade | olives R70 Sweet Potato Fries w. truffle aioli | chermoula | homemade ketchup R70 Charcuterie w. preserves | pickles R125 Cheese Board w. preserves | fruit | nuts R125 Arancini w. basil pesto R100 - SANDWICHES - SERVED FROM 12PM Rare Roast Beef Sandwich w. pickles | Dijon mustard | parmesan R100 Fish Sandwich w. tartar | pea pesto R100 Green Sandwich w. avocado | English spinach | chévre R70 The Silo Burger w. Healey’s cheddar | french fries | onion rings | coleslaw R145 Classic Club Sandwich R135 - WINE - BUBBLY Le Lude Brut Franschhoek, South Africa, NV R85 | R405 Morena Cuvée Catherine, Brut Rose Franschhoek, South Africa, NV R85 | R405 Silverthorn “The Jewel Box” Robertson, South Africa 2012 R555 Klein Constantia Brut MCC Constantia, South Africa, 2012 R105 | R505 Barons de Rothschild Blanc de Blancs Reims, France NV R1605 Dom Perignon Rose Epernay, France 2004 R4505 Ruinart Dom Ruinart Blanc Reims, France, 2004 R3505 Laurent Perrier Brut Reims, France, NV R185 | R905 Tattinger Brut Reserve Reims, France, NV R205 | R1005 Le Mesnil Blanc de Blancs Mesnil-Sur-Oger, France, NV R955 Perrier Jouet Belle Epoque Brut Epernay, France, NV R3255 Tenuta Col Sandago, Prosecco Superiore Veneto, Italy NV R105 | R505 WHITE WINE - SAUVIGNON BLANC - Iona, Sauvignon Blanc Elgin, South Africa 2016 R75 | R325 Cape Point Vineyards, Sauvignon Blanc Cape Point, South Africa, 2016 R80 | R355 Louis Nel, Buckleberry Sauvignon Blanc Stellenbosch, -

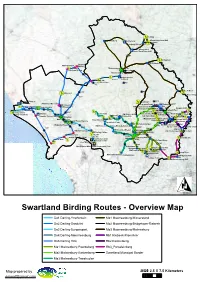

Swartland Birding Routes - Overview Map

!FDe Brug &RM Koringberg .!Koringberg Misverstand Dam Wall !F &RM Misverstand Koringberg Hiking Trails !F &RM N7 Misverstand :I Desert Rose Farm Stall K$ N7 !FBridgetown &RM Bridgetown Sandvlei RM Sandvlei N&!F&RM R45 &!FSout River Moorreesburg N7 Ganskraal Siding .!MKoo$rreesburg MoorreesburgTM Moorreesburg K$ R45 & !F !FRM R307-Main Stre Wetland Neulfontein &RM Da!Frling SW RK$45 and R307BS De Panne K$ N7 R45 &RM Riebeek West $ R 307 K$ R311 Kikoesvlei K !F !F K$ Berg River Bridge R3071 Blombos Hiking Tr Radyn Dam K$ R311 I BS Blombos !F !F: Hildebrand Monument RM Riebeek Rd-R311 &&RM Kikoesvlei 2 Ongegund/Smuts House Salt Pan Lime Kiln 1 \! Voorsp&oed Dam !F Tienie Versfeld RM Kikoesvlei 1 RM Riebeecksrivier Rd& \! & K$&R315 ! Voorspoed DamRM Riebee&k Rd R311 Zanquas Drift & \! R 27± K$ R K$315a !F Riebeek West RM BlombosRM Saltpan RM P!FPCK $Rd !F K$ R315 !F Horus Swift !F!FSchaap Island K$ R307 !FRi$ebeeksrivi.!er Dam1 RM DeliCo RIM Khwattu RM R315 Seasonal Pond RM Riebeeck Rd Riebeeksrivier RdK Small Vlei !FVis River Schaap Island Tra : K$ $ Seasonal Pan Oak Valley Dam !F& & Khwattu Cultural AreaK& & &RM Rd to R45 & Oak Valley Dam!F !F R.!307TM Darling !F :I& Riebee!Fk-Kasteel!F & !F !F RM Vyevlei Middelpos Dam Kloovenburg &&!F Darling$T$M Darling Vyevlei Dam !F .!&&R&M;I R311-R46Farm Dam KK Small Stream :I Pieter C!Fruythoff & R!3&07Oude$post Flower Reserve K$ K$;I&R 46!FEbenhaeser Dam& ± !K Spekulasie Farm $&R46 R46 ± R 307 R45 &FRM N7-Rheboksfontein K !F Waylands Flower Res & ! RM Riebeeksrivier-RK46$ R46 K$ RM Rondevlei-SpekulasieRheboksfontein Dam& $ R46. -

Getting Beyond the E-Toll Impasse

GETTING BEYOND THE E-TOLL IMPASSE August 2019 Initially compiled in September 2014 and titled “Beyond the Impasse” by Wayne Duvenage (OUTA Chairperson) and John Clarke (Consultant Social Worker), for presentation to Premier David Makhura’s Gauteng Advisory Panel on Socio-economic Impact of e-tolls. This position paper has now been updated and revised in August 2019 under an amended title: “Getting Beyond the e-toll Impasse” updated by Wayne Duvenage & Rudie Heyneke 1 Table of Contents 1. EXECUTIVE SUMMARY Page 3 2. INTRODUCTION & SETTING THE SCENE Page 5 3. DEFINITIONS, EXPLANATIONS & CLARIFICATIONS Page 7 • The South African Roads Agency Page 7 • Types of Tolls in SA Page 8 • E-tolls and Intelligent Transport Systems (I.T.S.) Page 9 • The User-Pays Principle. Page 10 4. HISTORY OF THE E-TOLL SAGA Page 11 5. GAUTENG’s E-TOLL CHALLENGES Page 26 • Grounds for opposition to e-tolling of GFIP Page 28 6. FACTORS FOR SUCCESSFUL ‘USER PAY’ I.T.S. Page 37 7. INTERNATIONAL EXAMPLES & CASE STUDIES Page 43 8. GOVERNMENT IN A CRISIS OF LEGITIMACY ON E-TOLLS Page 48 9. THE WAY FORWARD Page 50 • OUTA’s Proposals Page 51 10. CONCLUSION Page 54 11. GLOSSARY & ABBREVIATIONS Page 55 12. BIBLIOGRAPHY Page 56 ANNEXURES: A: ETC Contract Value for e-toll Operations Services. Page 57 B: ETC-JV Tender value. Page 58 C: List of types of e-toll billing Errors. Page 59 D: FUEL LEVY Revenue and Fuel Volumes sold. Page 60 E: Department of Transport Memo to Cabinet – Page 61 Gauteng’s Economic Value to SA. -

Tender Bulletin REPUBLICREPUBLIC of of SOUTH SOUTH AFRICAAFRICA

Government Tender Bulletin REPUBLICREPUBLIC OF OF SOUTH SOUTH AFRICAAFRICA Vol. 598 Pretoria, 17 April 2015 No. 2864 This document is also available on the Internet on the following web sites: 1. http://www.treasury.gov.za 2. http://www.info.gov.za/documents/tenders/index.htm 3. http://www.gpwonline.co.za N.B. The Government Printing Works will not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes AIDS HELPLINEHELPLINE: 08000800-123-22 123 22 PreventionPrevention is is the the curecure 501241— A 2864— 1 2 GOVERNMENT TENDER BULLETIN, 17 APRIL 2015 INDEX Page No. Instructions.................................................................................................................................. 8 A. BID INVITED FOR SUPPLIES, SERVICES AND DISPOSALS SUPPLIES: CLOTHING/TEXTILES .................................................................................. 10 ١ SUPPLIES: ELECTRICAL EQUIPMENT .......................................................................... 10 ١ SUPPLIES: GENERAL...................................................................................................... 11 ١ SUPPLIES: MEDICAL ....................................................................................................... 28 ١ SUPPLIES: PERISHABLE PROVISIONS......................................................................... 33 ١ SUPPLIES: STATIONERY/PRINTING .............................................................................. 35 ١ SERVICES: BUILDING .................................................................................................... -

Government Gazette Staatskoerant REPUBLIC of SOUTH AFRICA REPUBLIEK VAN SUID AFRIKA

Government Gazette Staatskoerant REPUBLIC OF SOUTH AFRICA REPUBLIEK VAN SUID AFRIKA Regulation Gazette No. 10177 Regulasiekoerant March Vol. 657 13 2020 No. 43086 Maart PART 1 OF 2 ISSN 1682-5843 N.B. The Government Printing Works will 43086 not be held responsible for the quality of “Hard Copies” or “Electronic Files” submitted for publication purposes 9 771682 584003 AIDS HELPLINE: 0800-0123-22 Prevention is the cure 2 No. 43086 GOVERNMENT GAZETTE, 13 MARCH 2020 IMPORTANT NOTICE OF OFFICE RELOCATION Private Bag X85, PRETORIA, 0001 149 Bosman Street, PRETORIA Tel: 012 748 6197, Website: www.gpwonline.co.za URGENT NOTICE TO OUR VALUED CUSTOMERS: PUBLICATIONS OFFICE’S RELOCATION HAS BEEN TEMPORARILY SUSPENDED. Please be advised that the GPW Publications office will no longer move to 88 Visagie Street as indicated in the previous notices. The move has been suspended due to the fact that the new building in 88 Visagie Street is not ready for occupation yet. We will later on issue another notice informing you of the new date of relocation. We are doing everything possible to ensure that our service to you is not disrupted. As things stand, we will continue providing you with our normal service from the current location at 196 Paul Kruger Street, Masada building. Customers who seek further information and or have any questions or concerns are free to contact us through telephone 012 748 6066 or email Ms Maureen Toka at [email protected] or cell phone at 082 859 4910. Please note that you will still be able to download gazettes free of charge from our website www.gpwonline.co.za. -

C . __ P Ar T 1 0 F 2 ...".)

March Vol. 669 12 2021 No. 44262 Maart C..... __ P_AR_T_1_0_F_2_...".) 2 No. 44262 GOVERNMENT GAZETTE, 12 MARCH 2021 Contents Page No. Transport, Department of / Vervoer, Departement van Cross Border Road Transport Agency: Applications for Permits Menlyn ............................................................................................................................... 3 Applications Concerning Operating Licences Goodwood ......................................................................................................................... 7 Goodwood ......................................................................................................................... 23 Goodwood ......................................................................................................................... 76 Johannesburg – GPGTSHW968 ....................................................................................... 119 STAATSKOERANT, 12 Maart 2021 No. 44262 3 CROSS-BORDER ROAD TRANSPORT AGENCY APPLICATIONS FOR PERMITS Particulars in respect of applications for permits as submitted to the Cross-Border Road Transport Agency, indicating, firstly, the reference number, and then- (i) the name of the applicant and the name of the applicant's representative, if applicable. (ii) the country of departure, destination and, where applicable, transit. (iii) the applicant's postal address or, in the case of a representative applying on behalf of the applicant, the representative's postal address. (iv) the number and type of vehicles,