IR Conference

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

Paris, Le 19 Juillet 2021 POLITIQUE DE REMUNERATION APPLICABLE

Paris, le 19 juillet 2021 POLITIQUE DE REMUNERATION APPLICABLE AU DIRECTEUR GENERAL D’IP S OS REMPLACE LA SECTION 13.1.4 DU DOCUMENT D’ENREGISTREMENT UNIVERSEL 2020 La nomination prochaine de Nathalie Roos en qualité de Directrice Générale d’Ipsos SA a fait l'objet d'un communiqué de presse ce jour. Cette évolution de la gouvernance d’Ipsos SA s’inscrit dans le cadre de la dissociation, précédemment annoncée, des fonctions de Président et de Directeur général, à l’issue de laquelle Monsieur Didier Truchot, fondateur du groupe, prendra les fonctions de Président du Conseil d’administration d’Ipsos SA, tandis que Nathalie Roos en assurera la Direction générale. Le Conseil d'administration nommera formellement Mme Roos en qualité de Directrice générale, pour une durée de cinq ans avec effet au 28 septembre 2021, lors d'une réunion qui se tiendra à l'issue de l'Assemblée Générale des actionnaires qui sera convoquée pour le 21 septembre 2021 pour approuver la nouvelle politique de rémunération applicable au Directeur Général d’Ipsos, et sous réserve de cette approbation préalable. Le Conseil d’Administration d’Ipsos SA, lors de sa réunion du 2 juillet 2021, a ainsi fixé, sur proposition du Comité des Nominations et des Rémunérations, la politique de rémunération de la prochaine Directrice Générale à effet au 28 septembre 2021 qui complète et amende, uniquement en ce qu’elle concerne la politique de rémunération applicable au Directeur Général, la politique de rémunération des mandataires sociaux pour 2021 approuvée le 27 mai dernier par l’Assemblée Générale, décrite dans la rubrique correspondante du document d'enregistrement universel 2020 de la société. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

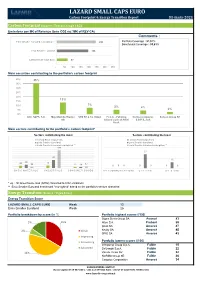

Carbon Footprint & Energy Transition Report

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

2019 Annual Report Annual 2019

a force for good. 2019 ANNUAL REPORT ANNUAL 2019 1, cours Ferdinand de Lesseps 92851 Rueil Malmaison Cedex – France Tel.: +33 1 47 16 35 00 Fax: +33 1 47 51 91 02 www.vinci.com VINCI.Group 2019 ANNUAL REPORT VINCI @VINCI CONTENTS 1 P r o l e 2 Album 10 Interview with the Chairman and CEO 12 Corporate governance 14 Direction and strategy 18 Stock market and shareholder base 22 Sustainable development 32 CONCESSIONS 34 VINCI Autoroutes 48 VINCI Airports 62 Other concessions 64 – VINCI Highways 68 – VINCI Railways 70 – VINCI Stadium 72 CONTRACTING 74 VINCI Energies 88 Eurovia 102 VINCI Construction 118 VINCI Immobilier 121 GENERAL & FINANCIAL ELEMENTS 122 Report of the Board of Directors 270 Report of the Lead Director and the Vice-Chairman of the Board of Directors 272 Consolidated nancial statements This universal registration document was filed on 2 March 2020 with the Autorité des Marchés Financiers (AMF, the French securities regulator), as competent authority 349 Parent company nancial statements under Regulation (EU) 2017/1129, without prior approval pursuant to Article 9 of the 367 Special report of the Statutory Auditors on said regulation. The universal registration document may be used for the purposes of an offer to the regulated agreements public of securities or the admission of securities to trading on a regulated market if accompanied by a prospectus or securities note as well as a summary of all 368 Persons responsible for the universal registration document amendments, if any, made to the universal registration document. The set of documents thus formed is approved by the AMF in accordance with Regulation (EU) 2017/1129. -

Further Growth at Eutelsat 7/8° West Video Neighbourhood: Now Reaching Into Over 56 Million TV Homes in Middle East and North Africa

Further growth at Eutelsat 7/8° West video neighbourhood: now reaching into over 56 million TV homes in Middle East and North Africa Eutelsat takes the pulse of TV trends in Middle East and North Africa with latest edition of its TV Observatory: Satellite surges 7% in one year to reach new milestone of 59 million homes, or 94% of total TV homes Eutelsat/Nilesat 7/8° West neighbourhood first choice for multi-channel viewing: offering broadcasters access to 56.2 million homes, up 6% in 12 months HD up 34% at 7/8° West with a penetration rate of 15%; 66% of homes watching channels from 7/8° West now HD-equipped Dubai, Paris, 14 November 2017 – Eutelsat Communications (Euronext Paris: ETL) today presented the results of its industry-benchmark survey on TV trends across the Middle East and North Africa at the ASBU BroadcastPro Selevision Summit in Dubai. Satellite: the preferred digital video infrastructure across Middle East and North Africa Satellite TV reception in the MENA region has continued to increase its market-share compared to terrestrial and IPTV, and now reaches into 59 million homes. This represents 94% of the 62.2 million TV homes in 14 Arab-speaking countries, up from 92% only 12 months ago. Eutelsat 7/8° West neighbourhood: first choice for multi-channel viewing Eutelsat’s 7/8° West neighbourhood has further reinforced its pole position, with reach into 56.2 million homes in 14 Arab countries, up 3.1 million homes in only one year. The attraction of 7/8° West for 95% of the satellite homes in the region is driven by an exceptional line-up of over 1,200 Arabic and international channels, with a high diversity of free-to-air content and exclusivity (55% of exclusive channels). -

Sondage D'intentions De Vote Pour Les Élections

SONDAGE D’INTENTIONS DE VOTE POUR LES ÉLECTIONS RÉGIONALES EN ÎLE-DE-FRANCE VOS CONTACTS IPSOS Brice Teinturier [email protected] Mathieu Gallard [email protected] FICHE TECHNIQUE ÉCHANTILLON DATE DE TERRAIN MÉTHODE 1 000 personnes inscrites sur les listes Du 26 au 27 avril 2021. Échantillon interrogé par Internet électorales d’Île-de-France, constituant via l’Access Panel Online d’Ipsos. un échantillon représentatif des habitants d’Île-de-France âgés de 18 ans Méthode des quotas : et plus. sexe, âge, profession de la personne interrogée, catégorie d’agglomération, département. Enquête réalisée pour Ce rapport a été élaboré dans le respect de la norme internationale ISO 20252 « Etudes de marché, études sociales et d’opinion ». Ce rapport a été relu par Mathieu Gallard, Directeur d’études (Ipsos Public Affairs). 2 ‒ ©Ipsos – Enquête électorale – France télévision / Radio France - Sopra Steria – Mai 2021 PRÉCISIONS SUR L’INTERVALLE DE CONFIANCE L’intervalle de confiance (appelé aussi marge d’erreur) est l’intervalle dans lequel se trouve la valeur recherchée avec une probabilité fixée (le niveau de confiance). L’amplitude de cet intervalle dépend du niveau de confiance, de la valeur observée et de la taille de l’échantillon. Le calcul n’est justifié que pour les sondages aléatoires. Il ne peut pas être déterminé dans le cas de sondages par quotas mais on considère qu’il est proche de celui des sondages aléatoires. INTERVALLE DE CONFIANCE Note de lecture : pour un échantillon de (avec un niveau de confiance de 95%) 500 personnes (intention de vote), si le SCORES OBTENUS (P) score mesuré est de 20%, il y a 95% de Taille 2 ou 5% ou 10% ou 15% ou 20% ou 25% ou 30% ou 35% ou 40% ou 45% ou chances que la valeur réelle se situe d'échantillon (N) 50% 98% 95% 90% 85% 80% 75% 70% 65% 60% 55% aujourd’hui entre 16,5% et 23,5% (plus ou 100 2,7 4,3 5,9 7,0 7,8 8,5 9,0 9,3 9,6 9,8 9,8 moins 3,5 points). -

L'opinion Des Usagers Sur Le Dispositif Maprimerénov' », Mai 2021

L’OPINION DES USAGERS SUR LE DISPOSITIF MAPRIMERÉNOV’ VAGUE 2 MAI 2021 Fiche technique ÉCHANTILLON DATES DE TERRAIN MÉTHODOLOGIE 13 590 personnes issues d’un fichier de Enquête réalisée du Échantillon interrogé en ligne personnes ayant eu recours à 27 avril au 4 mai 2021. après envoi d’un courriel MaPrimeRénov’. d’invitation. Echantillon redressé selon la structure du fichier de contacts: région, nature des travaux réalisés et montant de la prime reçue. Ce rapport a été élaboré dans le respect de la norme internationale ISO 20252 « Etudes de marché, études sociales et d’opinion ». Ce rapport a été relu par Mathieu Gallard, Directeur d’études (Ipsos Public Affairs). 2 ©Ipsos – Enquête d’opinion sur le dispositif MaPrimeRénov’ – Mai 2021 Structure de l’échantillon (1/2) NOMBRE DE POURCENTAGE NOMBRE DE POURCENTAGE PERSONNES DANS PERSONNES DANS INTERROGÉS L’ÉCHANTILLON INTERROGÉS L’ÉCHANTILLON . LE TYPE DE TRAVAUX RÉALISÉS . AGE - Pompe à chaleur air / eau 2412 18 - Moins de 35 ans 1521 11 - Chaudière à gaz THPE 2585 19 - 35 à 49 ans 4258 31 - Poêle à granulés 3341 25 - 50 ans et plus 7746 57 - Isolation 2596 19 . LE REVENU MENSUEL DU FOYER - Autre chauffage ou 2549 19 - Moins de 1.200 € 1650 12 chauffe-eau - 1.200 à 1.999 € 4905 36 - Ventilation 64 1 - 2.000 à 3.000 € 4418 33 - Audit énergétique 43 <0,5 - Plus de 3.000 € 2167 16 . LA RÉGION . LE TYPE D’AIRE URBAINE - Ile-de-France 1277 9 - Grande métropole 396 3 - Nord Ouest 3787 28 - Métropole moyenne 632 5 - Nord Est 3192 23 - Banlieue 3193 23 - Sud Ouest 1693 13 - Périurbain 5420 40 - Sud Est 2598 19 3 ©Ipsos- –Rural Enquête d’opinion sur le dispositif MaPrimeRénov2734 ’ – Mai 2021 20 Structure de l’échantillon (2/2) NOMBRE DE POURCENTAGE NOMBRE DE POURCENTAGE PERSONNES DANS PERSONNES DANS INTERROGÉS L’ÉCHANTILLON INTERROGÉS L’ÉCHANTILLON . -

Sondage D'intentions De Vote Pour Les Élections Régionales En Hauts-De

SONDAGE D’INTENTIONS DE VOTE POUR LES ÉLECTIONS RÉGIONALES EN HAUTS-DE-FRANCE EMBARGO JUSQU’À MERCREDI 2 JUIN, 5H00 VOS CONTACTS IPSOS Brice Teinturier [email protected] Jean-François Doridot [email protected] Mathieu Gallard [email protected] FICHE TECHNIQUE ÉCHANTILLON DATE DE TERRAIN MÉTHODE 1 000 personnes inscrites sur les listes Du 27 au 29 mai 2021. Échantillon interrogé par Internet électorales d’Hauts-de-France, via l’Access Panel Online d’Ipsos. constituant un échantillon représentatif des habitants d’Hauts-de-France âgés de Méthode des quotas : 18 ans et plus. sexe, âge, profession de la personne interrogée, catégorie d’agglomération, département. Enquête réalisée pour Ce rapport a été élaboré dans le respect de la norme internationale ISO 20252 « Etudes de marché, études sociales et d’opinion ». Ce rapport a été relu par Jean-François Doridot, Directeur Ipsos Public Affairs. 2 ‒ ©Ipsos – Enquête électorale – France télévision / Radio France - Sopra Steria – Mai / Juin 2021 PRÉCISIONS SUR L’INTERVALLE DE CONFIANCE L’intervalle de confiance (appelé aussi marge d’erreur) est l’intervalle dans lequel se trouve la valeur recherchée avec une probabilité fixée (le niveau de confiance). L’amplitude de cet intervalle dépend du niveau de confiance, de la valeur observée et de la taille de l’échantillon. Le calcul n’est justifié que pour les sondages aléatoires. Il ne peut pas être déterminé dans le cas de sondages par quotas mais on considère qu’il est proche de celui des sondages aléatoires. INTERVALLE DE CONFIANCE Note de lecture : pour un échantillon de (avec un niveau de confiance de 95%) 450 personnes (intention de vote), si le SCORES OBTENUS (P) score mesuré est de 20%, il y a 95% de Taille 2 ou 5% ou 10% ou 15% ou 20% ou 25% ou 30% ou 35% ou 40% ou 45% ou chances que la valeur réelle se situe d'échantillon (N) 50% 98% 95% 90% 85% 80% 75% 70% 65% 60% 55% aujourd’hui entre 16,3% et 23,7% (plus ou 100 2,7 4,3 5,9 7,0 7,8 8,5 9,0 9,3 9,6 9,8 9,8 moins 3,6 points). -

Food & Beverage Consumption Study (FIVE)

IPSOS SYNDICATED The Food and Beverage Group Syndicated Studies January 2020 © 2019 Ipsos. All rights reserved. Contains Ipsos' Confidential and Proprietary information and may not be disclosed or reproduced without the prior written consent of Ipsos. Daily tracking of individual consumers’ eating and drinking habits, attitudes and item choices both at home and away from home to address business issues like: • Trends • Targeting • Positioning • Daypart Evaluations • Drivers of Growth or Decline • Annual Planning Initiatives • Retailer Presentation Enhancements © Ipsos. FIVE | SYNDICATED Industry The Evolution of FIVE Leader for Consumption 2019 Behavior in Canada - Strategic 2015 Partnering -Food and - Category Deep Beverage Expertise Dives - 10 subscribing - Trended Data clients 2013 - 7 subscribing - Successful clients - 20 ad hoc clients launch - 3 founding clients - 9 ad hoc clients - 2 ad hoc clients © Ipsos. FIVE | SYNDICATED Ipsos FIVE: How we do it FIVE is an online diary consumption tracking study fielded daily. Launched January 2013, this syndicated study captures eating and drinking behaviour for the average Canadian’s day across all categories/brands, dayparts and venues. Sample Annual base sample of 20,000 Canadians ages 2yrs+ IN FIELD 7 DAYS A WEEK. Surveys sent out daily – English and French Data is weighted and released quarterly (5000 completes per quarter) 365 DAYS A YEAR. How is it Captured? Information capture is focused on yesterday’s behaviour targeting: Morning (Breakfast and all Morning Snacks) Afternoon (Lunch and all Afternoon Snacks) Dinner Evening Snack and Light Meals • Captures situational dynamics, attitudes, motivations, item preparation details, health statuses and general beliefs • Captures where items consumed were sourced and some purchase behaviour dynamics 4 Document classification: Internal Only Ipsos FIVE: What we capture who what where when why Standard Food & Beverages Where Consumed (In Occasion Functional Motivations Demographics (Age, Consumed (day Home vs. -

Communiqué De Presse

COMMUNIQUÉ DE PRESSE Les Canadiens sont plutôt pessimistes quant aux mois à venir, mais continuent d’appuyer les mesures mises en place pour combattre la pandémie Cependant, la moitié des Canadiens (50%) sont insatisfaits de la gestion fédérale de la campagne de vaccination contre la COVID-19 Montréal, QC, 1er mars 2021 — L’hiver n’est facile à traverser en mode pandémie. Cette période d’incertitude prolongée et l’évolution rapide du virus depuis le temps des fêtes ont eu un impact important sur l’état d’esprit des Canadiens en ce début d’année 2021. En fait, l’état d’esprit des Canadiens face à la pandémie ne s’est pas amélioré par rapport à l’automne dernier et ce, malgré l’arrivée des vaccins. Un tiers des Canadiens se disent plus pessimistes (34%), contre un peu moins d’optimistes (29%), alors que 37% nous disent que leur état d’esprit est le même qu’à l’automne. Qualité de vie en chute, consommation croissante Les Canadiens ont vécu une détérioration importante de plusieurs aspects de leur qualité de vie depuis le début de la pandémie, surtout au niveau de leur vie sociale (chute nette de 68 points de pourcentage) et leur santé mentale (-42 pts). Les plus jeunes sont particulièrement affectés mentalement, alors que les gens à revenu moins élevés se disent plus fortement affectés financièrement. Les résidents de l’Alberta sont aussi plus enclins à rapporter une détérioration dans différents aspects de leur vie. En lien avec ce pessimisme ambiant, ceux qui consomment de l’alcool, du tabac ou du cannabis ont tendance à en consommer davantage qu’avant la pandémie.