Money and Banking Money and Banking

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ASA ECONOMIC SOCIOLOGY SECTION NEWSLETTER ACCOUNTS Volume 9 Issue 1 Spring 2010

ASA ECONOMIC SOCIOLOGY SECTION NEWSLETTER ACCOUNTS Volume 9 Issue 1 Spring 2010 Section Chair’s Introduction 2009‐10 Editors Jiwook Jung T Kim Pernell Sameer Srivastava The events of the last year and a half, or two if you were watching things Harvard University closely, have led many to question whether the economy operates as most everyone understood it to operate. The Great Recession has undermined many shibboleths of economic theory and challenged the idea that free markets regulate themselves. The notion that investment bankers and titans of industry would never take risks that might put the economy in jeopardy, because they would pay the price for a collapse, now seems Inside this Issue quaint. They did take such risks, and few of them have paid any kind of price. The CEOs of the leading automakers were chided for using private Markets on Trial: Progress and jets to fly to Washington to testify before Congress, and felt obliged to Prognosis for Economic Sociology’s Response to the Financial Crisis— make their next trips in their own products, but the heads of the investment Report on a Fall 2009 Symposium banks that led us down the road to perdition received healthy bonuses this by Adam Goldstein, UC Berkeley year, as they did last year. The Dollar Standard and the Global ProductionI System: The In this issue of Accounts, the editors chose to highlight challenges to Institutional Origins of the Global conventional economic wisdom. First, we have a first-person account, Financial Crisis by Bai Gao, Duke from UC-Berkeley doctoral candidate Adam Goldstein, of a fall Kellogg Book Summary and Interview: School (Northwestern) symposium titled Markets on Trial: Sociology’s David Stark’s The Sense of Response to the Financial Crisis. -

Gold & Platinum Awards June// 6/1/17 - 6/30/17

GOLD & PLATINUM AWARDS JUNE// 6/1/17 - 6/30/17 MULTI PLATINUM SINGLE // 34 Cert Date// Title// Artist// Genre// Label// Plat Level// Rel. Date// We Own It R&B/ 6/27/2017 2 Chainz Def Jam 5/21/2013 (Fast & Furious) Hip Hop 6/27/2017 Scars To Your Beautiful Alessia Cara Pop Def Jam 11/13/2015 R&B/ 6/5/2017 Caroline Amine Republic Records 8/26/2016 Hip Hop 6/20/2017 I Will Not Bow Breaking Benjamin Rock Hollywood Records 8/11/2009 6/23/2017 Count On Me Bruno Mars Pop Atlantic Records 5/11/2010 Calvin Harris & 6/19/2017 How Deep Is Your Love Pop Columbia 7/17/2015 Disciples This Is What You Calvin Harris & 6/19/2017 Pop Columbia 4/29/2016 Came For Rihanna This Is What You Calvin Harris & 6/19/2017 Pop Columbia 4/29/2016 Came For Rihanna Calvin Harris Feat. 6/19/2017 Blame Dance/Elec Columbia 9/7/2014 John Newman R&B/ 6/19/2017 I’m The One Dj Khaled Epic 4/28/2017 Hip Hop 6/9/2017 Cool Kids Echosmith Pop Warner Bros. Records 7/2/2013 6/20/2017 Thinking Out Loud Ed Sheeran Pop Atlantic Records 9/24/2014 6/20/2017 Thinking Out Loud Ed Sheeran Pop Atlantic Records 9/24/2014 www.riaa.com // // GOLD & PLATINUM AWARDS JUNE// 6/1/17 - 6/30/17 6/20/2017 Starving Hailee Steinfeld Pop Republic Records 7/15/2016 6/22/2017 Roar Katy Perry Pop Capitol Records 8/12/2013 R&B/ 6/23/2017 Location Khalid RCA 5/27/2016 Hip Hop R&B/ 6/30/2017 Tunnel Vision Kodak Black Atlantic Records 2/17/2017 Hip Hop 6/6/2017 Ispy (Feat. -

The Future of Money: from Financial Crisis to Public Resource

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Mellor, Mary Book — Published Version The future of money: From financial crisis to public resource Provided in Cooperation with: Pluto Press Suggested Citation: Mellor, Mary (2010) : The future of money: From financial crisis to public resource, ISBN 978-1-84964-450-1, Pluto Press, London, http://library.oapen.org/handle/20.500.12657/30777 This Version is available at: http://hdl.handle.net/10419/182430 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further -

Walpole Public Library DVD List A

Walpole Public Library DVD List [Items purchased to present*] Last updated: 9/17/2021 INDEX Note: List does not reflect items lost or removed from collection A B C D E F G H I J K L M N O P Q R S T U V W X Y Z Nonfiction A A A place in the sun AAL Aaltra AAR Aardvark The best of Bud Abbot and Lou Costello : the Franchise Collection, ABB V.1 vol.1 The best of Bud Abbot and Lou Costello : the Franchise Collection, ABB V.2 vol.2 The best of Bud Abbot and Lou Costello : the Franchise Collection, ABB V.3 vol.3 The best of Bud Abbot and Lou Costello : the Franchise Collection, ABB V.4 vol.4 ABE Aberdeen ABO About a boy ABO About Elly ABO About Schmidt ABO About time ABO Above the rim ABR Abraham Lincoln vampire hunter ABS Absolutely anything ABS Absolutely fabulous : the movie ACC Acceptable risk ACC Accepted ACC Accountant, The ACC SER. Accused : series 1 & 2 1 & 2 ACE Ace in the hole ACE Ace Ventura pet detective ACR Across the universe ACT Act of valor ACT Acts of vengeance ADA Adam's apples ADA Adams chronicles, The ADA Adam ADA Adam’s Rib ADA Adaptation ADA Ad Astra ADJ Adjustment Bureau, The *does not reflect missing materials or those being mended Walpole Public Library DVD List [Items purchased to present*] ADM Admission ADO Adopt a highway ADR Adrift ADU Adult world ADV Adventure of Sherlock Holmes’ smarter brother, The ADV The adventures of Baron Munchausen ADV Adverse AEO Aeon Flux AFF SEAS.1 Affair, The : season 1 AFF SEAS.2 Affair, The : season 2 AFF SEAS.3 Affair, The : season 3 AFF SEAS.4 Affair, The : season 4 AFF SEAS.5 Affair, -

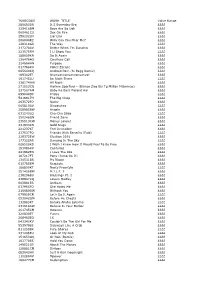

APRIL 22 ISSUE Orders Due March 24 MUSIC • FILM • MERCH Axis.Wmg.Com 4/22/17 RSD AUDIO & VIDEO RECAP

2017 NEW RELEASE SPECIAL APRIL 22 ISSUE Orders Due March 24 MUSIC • FILM • MERCH axis.wmg.com 4/22/17 RSD AUDIO & VIDEO RECAP ARTIST TITLE LBL CNF UPC SEL # SRP ORDERS DUE Le Soleil Est Pres de Moi (12" Single Air Splatter Vinyl)(Record Store Day PRH A 190295857370 559589 14.98 3/24/17 Exclusive) Anni-Frid Frida (Vinyl)(Record Store Day Exclusive) PRL A 190295838744 60247-P 21.98 3/24/17 Wild Season (feat. Florence Banks & Steelz Welch)(Explicit)(Vinyl Single)(Record WB S 054391960221 558713 7.98 3/24/17 Store Day Exclusive) Cracked Actor (Live Los Angeles, Bowie, David PRH A 190295869373 559537 39.98 3/24/17 '74)(3LP)(Record Store Day Exclusive) BOWPROMO (GEM Promo LP)(1LP Vinyl Bowie, David PRH A 190295875329 559540 54.98 3/24/17 Box)(Record Store Day Exclusive) Live at the Agora, 1978. (2LP)(Record Cars, The ECG A 081227940867 559102 29.98 3/24/17 Store Day Exclusive) Live from Los Angeles (Vinyl)(Record Clark, Brandy WB A 093624913894 558896 14.98 3/24/17 Store Day Exclusive) Greatest Hits Acoustic (2LP Picture Cure, The ECG A 081227940812 559251 31.98 3/24/17 Disc)(Record Store Day Exclusive) Greatest Hits (2LP Picture Disc)(Record Cure, The ECG A 081227940805 559252 31.98 3/24/17 Store Day Exclusive) Groove Is In The Heart / What Is Love? Deee-Lite ECG A 081227940980 66622 14.98 3/24/17 (Pink Vinyl)(Record Store Day Exclusive) Coral Fang (Explicit)(Red Vinyl)(Record Distillers, The RRW A 081227941468 48420 21.98 3/24/17 Store Day Exclusive) Live At The Matrix '67 (Vinyl)(Record Doors, The ECG A 081227940881 559094 21.98 3/24/17 -

Video Resources Feature Films Boiler Room

Video Resources Feature Films Boiler Room. New Line Cinema, 2000.A college dropout, attempting to win back his father's high standards he gets a job as a broker for a suburban investment firm, which puts him on the fast track to success, but the job might not be as legitimate as it once appeared to be. Margin Call. Before the Door Pictures, 2011. Follows the key people at an investment bank, over a 24- hour period, during the early stages of the 2008 financial crisis. The Wolf of Wall Street. Universal Pictures, 2013. Based on the true story of Jordan Belfort, from his rise to a wealthy stock-broker living the high life to his fall involving crime, corruption and the federal government. The Big Short. Paramount Pictures,2015. In 2006-7 a group of investors bet against the US mortgage market. In their research they discover how flawed and corrupt the market is. The Last Days of Lehman Brothers. British Broadcasting Corporation, 2009. After six months' turmoil in the world's financial markets, Lehman Brothers was on life support and the government was about to pull the plug. Documentaries Enron: The Smartest Guys in the Room. Jigsaw Productions, 2005. A documentary about the Enron Corporation, its faulty and corrupt business practices, and how they led to its fall. Inside Job. Sony Pictures Classics, 2010. Takes a closer look at what brought about the 2008 financial meltdown. Too Big to Fail. HBO Films, 2011. Chronicles the financial meltdown of 2008 and centers on Treasury Secretary Henry Paulson. Money for Nothing: Inside the Federal Reserve. -

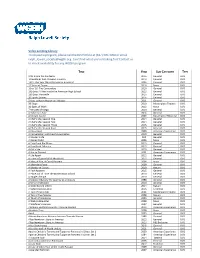

TUNECODE WORK TITLE Value Range 289693DR

TUNECODE WORK_TITLE Value Range 289693DR It S Everyday Bro ££££ 329418BM Boys Are So Ugh ££££ 060461CU Sex On Fire ££££ 258202LN Liar Liar ££££ 2680048Z Willy Can You Hear Me? ££££ 128318GR The Way ££££ 217278AV Better When I'm Dancing ££££ 223575FM I Ll Show You ££££ 188659KN Do It Again ££££ 136476HS Courtesy Call ££££ 224684HN Purpose ££££ 017788KU Police Escape ££££ 065640KQ Android Porn (Si Begg Remix) ££££ 189362ET Nyanyanyanyanyanyanya! ££££ 191745LU Be Right There ££££ 236174HW All Night ££££ 271523CQ Harlem Spartans - (Blanco Zico Bis Tg Millian Mizormac) ££££ 237567AM Baby Ko Bass Pasand Hai ££££ 099044DP Friday ££££ 5416917H The Big Chop ££££ 263572FQ Nasty ££££ 065810AV Dispatches ££££ 258985BW Angels ££££ 031243LQ Cha-Cha Slide ££££ 250248GN Friend Zone ££££ 235513CW Money Longer ££££ 231933KN Gold Slugs ££££ 221237KT Feel Invincible ££££ 237537FQ Friends With Benefits (Fwb) ££££ 228372EW Election 2016 ££££ 177322AR Dancing In The Sky ££££ 006520KS I Wish I Knew How It Would Feel To Be Free ££££ 153086KV Centuries ££££ 241982EN I Love The 90s ££££ 187217FT Pony (Jump On It) ££££ 134531BS My Nigga ££££ 015785EM Regulate ££££ 186800KT Nasty Freestyle ££££ 251426BW M.I.L.F. $ ££££ 238296BU Blessings Pt. 1 ££££ 238847KQ Lovers Medley ££££ 003981ER Anthem ££££ 037965FQ She Hates Me ££££ 216680GW Without You ££££ 079929CR Let's Do It Again ££££ 052042GM Before He Cheats ££££ 132883KT Baraka Allahu Lakuma ££££ 231618AW Believe In Your Barber ££££ 261745CM Ooouuu ££££ 220830ET Funny ££££ 268463EQ 16 ££££ 043343KV Couldn't Be The Girl -

Awards 10X Diamond Album March // 3/1/17 - 3/31/17

RIAA GOLD & PLATINUM NICKELBACK//ALL THE RIGHT REASONS AWARDS 10X DIAMOND ALBUM MARCH // 3/1/17 - 3/31/17 KANYE WEST//THE LIFE OF PABLO PLATINUM ALBUM In March 2017, RIAA certified 119 Digital Single Awards and THE CHAINSMOKERS//COLLAGE EP 21 Album Awards. All RIAA Awards PLATINUM ALBUM dating back to 1958, plus top tallies for your favorite artists, are available ED SHEERAN//÷ at riaa.com/gold-platinum! GOLD ALBUM JOSH TURNER//HAYWIRE SONGS GOLD ALBUM www.riaa.com //// //// GOLD & PLATINUM AWARDS MARCH // 3/1/17 - 3/31/17 MULTI PLATINUM SINGLE // 12 Cert Date// Title// Artist// Genre// Label// Plat Level// Rel. Date// R&B/ 3/30/2017 Caroline Amine Republic Records 8/26/2016 Hip Hop Ariana Grande 3/9/2017 Side To Side Pop Republic Records 5/20/2016 Feat. Nicki Minaj 3/3/2017 24K Magic Bruno Mars Pop Atlantic Records 10/7/2016 3/2/2017 Shape Of You Ed Sheeran Pop Atlantic Records 1/6/2017 R&B/ 3/30/2017 All The Way Up Fat Joe & Remy Ma Rng/Empire 3/2/2016 Hip Hop I Hate U, I Love U 3/1/2017 Gnash Pop :): 8/7/2015 (Feat. Olivia O’brien) R&B/ 3/22/2017 Ride SoMo Republic Records 11/19/2013 Hip Hop 3/27/2017 Closer The Chainsmokers Pop Columbia 7/29/2016 3/27/2017 Closer The Chainsmokers Pop Columbia 7/29/2016 3/27/2017 Closer The Chainsmokers Pop Columbia 7/29/2016 R&B/ 3/9/2017 Starboy The Weeknd Republic Records/Xo Records 7/29/2016 Hip Hop R&B/ 3/9/2017 Starboy The Weeknd Republic Records/Xo Records 7/29/2016 Hip Hop www.riaa.com // // GOLD & PLATINUM AWARDS MARCH // 3/1/17 - 3/31/17 PLATINUM SINGLE // 16 Cert Date// Title// Artist// Genre// Label// Platinum// Rel. -

Super ACRONYM - Round 1

Super ACRONYM - Round 1 1. Description acceptable. This character grabs a woman and tells her, "Americans, you're all the same, always overdressing for the wrong occasions," then unveils an ominous apparatus that turns out to be a coat hanger. Ronald Lacey plays this character, who sustains an injury at a tavern called the Raven that prompts him to arrange (*) an excavation near Cairo to locate the Well of Souls. That injury is later seen in close-up when this character gives a Heil Hitler, showing one side of the headpiece of the Staff of Ra seared onto his palm. For 10 points, name this villain who dies in an absolutely amazing way in Raiders of the Lost Ark. ANSWER: The Nazi whose face is melted off (or Major Arnold Ernst Toht; accept any answer indicating the Nazi whose face is melted by the Ark of the Covenant; accept answers indicating the Nazi who wears glasses or similar; prompt on answers like "that one Nazi (from Raiders)") <Vopava> 2. In 1920, baseball owners briefly considered imposing an automatic balk as a penalty for taking this action. Chris Rose and Kevin Millar host an MLB Network talk show whose name parodies this action. In 2006, Todd Williams badly botched one of these actions against Miguel Cabrera. In a 1998 game, Buck Showalter had (*) Gregg Olson of the Diamondbacks do this with the bases loaded against Barry Bonds, who accumulated 120 of these actions in 2004. Beginning in 2017 at the Major League level, no actual throws were necessary to issue, for 10 points, what baseball action that deliberately lets a man on base? ANSWER: intentional walk (or intentional base on balls; prompt on "walk" or "base on balls" without the word "intentional") <Nelson> 3. -

UC Riverside Electronic Theses and Dissertations

UC Riverside UC Riverside Electronic Theses and Dissertations Title Playing Along Infinite Rivers: Alternative Readings of a Malay State Permalink https://escholarship.org/uc/item/70c383r7 Author Syed Abu Bakar, Syed Husni Bin Publication Date 2015 Peer reviewed|Thesis/dissertation eScholarship.org Powered by the California Digital Library University of California UNIVERSITY OF CALIFORNIA RIVERSIDE Playing Along Infinite Rivers: Alternative Readings of a Malay State A Dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Comparative Literature by Syed Husni Bin Syed Abu Bakar August 2015 Dissertation Committee: Dr. Hendrik Maier, Chairperson Dr. Mariam Lam Dr. Tamara Ho Copyright by Syed Husni Bin Syed Abu Bakar 2015 The Dissertation of Syed Husni Bin Syed Abu Bakar is approved: ____________________________________________________ ____________________________________________________ ____________________________________________________ Committee Chairperson University of California, Riverside Acknowledgements There have been many kind souls along the way that helped, suggested, and recommended, taught and guided me along the way. I first embarked on my research on Malay literature, history and Southeast Asian studies not knowing what to focus on, given the enormous corpus of available literature on the region. Two years into my graduate studies, my graduate advisor, a dear friend and conversation partner, an expert on hikayats, Hendrik Maier brought Misa Melayu, one of the lesser read hikayat to my attention, suggesting that I read it, and write about it. If it was not for his recommendation, this dissertation would not have been written, and for that, and countless other reasons, I thank him kindly. I would like to thank the rest of my graduate committee, and fellow Southeast Asianists Mariam Lam and Tamara Ho, whose friendship, advice, support and guidance have been indispensable. -

Video Lending Library to Request a Program, Please Call the RLS Hotline at (617) 300-3900 Or Email Ralph Lowell [email protected]

Video Lending Library To request a program, please call the RLS Hotline at (617) 300-3900 or email [email protected]. Can't find what you're looking for? Contact us to check availability for any WGBH program. TITLE YEAR SUB-CATEGORY TYPE 9/11 Inside the Pentagon 2016 General DVD 10 Buildings that Changed America 2013 General DVD 1421: The Year China Discovered America? 2004 General DVD 15 Years of Terror 2016 Nova DVD 16 or ’16: The Contenders 2016 General DVD 180 Days: A Year inside the American High School 2013 General DVD 180 Days: Hartsville 2015 General DVD 20 Sports Stories 2016 General DVD 3 Keys to Heart Health Lori Moscas 2011 General DVD 39 Steps 2010 Masterpiece Theatre DVD 3D Spies of WWII 2012 Nova DVD 7 Minutes of Magic 2010 General DVD A Ballerina’s Tale 2015 General DVD A Certain Justice 2003 Masterpiece Mystery! DVD A Chef’s Life, Season One 2014 General DVD A Chef’s Life, Season Two 2014 General DVD A Chef’s Life, Season Three 2015 General DVD A Chef’s Life, Season Four 2016 General DVD A Class Apart 2009 American Experience DVD A Conversation with Henry Louis Gates 2010 General DVD A Danger's Life N/A General DVD A Daring Flight 2005 Nova DVD A Few Good Pie Places 2015 General DVD A Few Great Bakeries 2015 General DVD A Girl's Life 2010 General DVD A House Divided 2001 American Experience DVD A Life Apart 2012 General DVD A Lover's Quarrel With the World 2012 General DVD A Man, A Plan, A Canal, Panama 2004 Nova DVD A Moveable Feast 2009 General DVD A Murder of Crows 2010 Nature DVD A Path Appears 2015 General -

The Ascent of Money: a Financial History of the World Author: Niall Ferguson Publisher: Penguin Group Date of Publication: November 2008 ISBN: 9781594201929 No

The Ascent of Money: A Financial History of the World Author: Niall Ferguson Publisher: Penguin Group Date of Publication: November 2008 ISBN: 9781594201929 No. of Pages: 432 Buy This Book [Summary published by CapitolReader.com on April 23, 2009] Click here for more political and current events books from Penguin. About The Author: Niall Ferguson is one of Britain’s most renowned historians. He teaches history at both Harvard and Oxford. He is also the author of numerous bestsellers including The War of the World. In addition, Ferguson has brought economics and history to a wider audience through several highly-popular TV documentary series and also through his frequent newspaper and magazine articles. General Overview: Bread, cash, dough, loot: Call it what you like, it matters. To Christians, love of it is the root of all evil. To generals, it’s the sinews of war. To revolutionaries, it’s the chains of labor. But in The Ascent of Money, Niall Ferguson shows that finance is in fact the foundation of human progress. What’s more, he reveals financial history as the essential backstory behind all history. The evolution of credit and debt, in his view, was as important as any technological innovation in the rise of civilization. * Please Note: This CapitolReader.com summary does not offer judgment or opinion on the book’s content. The ideas, viewpoints and arguments are presented just as the book’s author has intended. - Page 1 Reprinted by arrangement with The Penguin Press, a member of Penguin Group (USA) Inc., from THE ASCENT OF MONEY by Niall Ferguson.