B. Economic Development Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Rio Grande Valley/Deep S. Texas Hurricane Guide

The Official Rio Grande Valley/Deep South Texas HURRICANE GUIDE 2021 IT ONLY TAKES ONE STORM! weather.gov/rgv A Letter to Residents After more than a decade of near-misses, 2020 reminded the Rio Grande Valley and Deep South Texas that hurricanes are still a force to be reckoned with. Hurricane Hanna cut a swath from Padre Island National Seashore in Kenedy County through much of the Rio Grande Valley in late July, leaving nearly $1 billion in agricultural and property damage it its wake. While many may now think that we’ve paid our dues, that sentiment couldn’t be further from the truth! The combination of atmospheric and oceanic patterns favorable for a landfalling hurricane in the Rio Grande Valley/Deep South Texas region can occur in any season, including this one. Residents can use the experience of Hurricane Hanna in 2020 as a great reminder to be prepared in 2021. Hurricanes bring a multitude of hazards including flooding rain, damaging winds, deadly storm surge, and tornadoes. These destructive forces can displace you from your home for months or years, and there are many recent cases in the United States and territories where this has occurred. Hurricane Harvey (2017), Michael (2018, Florida Panhandle), and Laura (2020, southwest Louisiana) are just three such devastating events. This guide can help you and your family get prepared. Learn what to do before, during and after a storm. Your plan should include preparations for your home or business, gathering supplies, ensuring your insurance is up to date, and planning with your family for an evacuation. -

2011 Program

2 x Rio Grande Valley Sports Hall of Fame I welcome you to the 24th Annual Rio Grande Valley Sports Hall of Fame Induction Banquet. We are happy to have the banquet return to Brownsville, after having been in McAllen and Donna for the past four years. Brownsville hosted the two largest crowds of our banquet history in 2005 and 2006 with attendance of 360 guests. With the outstanding Class of 2011 being honored tonight, the attendance should surpass 300 again! I offer my congratulations to the 2011 class of seven inductees! As is usually the case, football again dominates the class that was selected by 85 voters from the group of past inductees and Hall of Fame board members, who took time to study the biographies and submit their votes last September. Six of the seven new inductees were outstanding football players representing their high schools. Two of them (Bob Brumley and Sammy Garza) went on to play professional football after highly successful collegiate careers. Another (Travis Sanders) still holds a 33-year old consecutive 100-yard rushing record for the Valley. All-State quarterback & safety (Donald Guillot) went on to NCAA baseball stardom at the University of Texas-PanAmerican, while the football coach of the class (Bruce Bush) has a stellar record of 41 successful seasons in South Texas. Another former quarterback from the state semi-finalist PSJA Bears (Carlos Vela) became a well-known trackand& field coach in the Valley. In addition, not to be outdone is the man (Ronnie Zamora) who helps players and coaches of several sports gain local, state and national recognition with his sports media writing, announcing and website work, always bringing recognition for others to the Valley. -

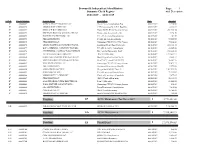

BR: Summary Check Register with Desc 06042015

Brownsville Independent School District Page: 1 Summary Check Register with Description 08/01/2019 - 08/31/2019 FUND Check Number Vendor Name Description Date Amount E7 00000069 MARCO ARIZPE ROOFING LLC. Sharp Elem.-Consolidation Proj 08/08/2019 1,350.00 E7 00000070 ARMKO INDUSTRIES INC. CTE Cummings-BLA H.S. Roof Re- 08/09/2019 4,886.82 E7 00000071 GERLACH BUILDERS LLC. Hanna ECHS HVAC System & Contr 08/09/2019 496,730.94 E7 00000072 GREEN-RUBIANO & ASSOCIATES INC Engineering Assessment of the 08/09/2019 5,194.50 E7 00000073 CARRIER ENTERPRISES LLC. Perez Elementary-Consolidation 08/12/2019 101.79 E7 00000074 PBK ARCHITECTS Facility Interior Assessments 08/12/2019 87,500.00 E7 00000075 CPM DESIGN LLC. Cummings CTE CV4 & CV3 Classro 08/16/2019 75,816.86 E7 00000076 ARGIO ROOFING & CONSTRUCTION L Southmost Elem. Roof Replaceme 08/16/2019 213,133.45 E7 00000077 BOUGAMBILIAS CONSTRUCTION LLC. Perez Elementary- Consolidatio 08/16/2019 23,965.00 E7 00000078 CENTENNIAL CONTRACTORS ENTERPR Del Castillo Elementary- Roof 08/16/2019 153,230.85 E7 00000079 E3 ENTEGRAL SOLUTIONS INC. -PACE ECHS (003) 08/16/2019 1,794,657.91 E7 00000080 GONZALEZ ENGINEERING & SURVEYI Board Approved Contract for Pr 08/16/2019 2,002.17 E7 00000081 MONTENEGRO'S PAVING & HAULING Item #7-6" Cement 3500 PSI wit 08/16/2019 56,807.55 E7 00000082 NM CONTRACTING LLC. Cummings CTE CV1 Canopy Improv 08/16/2019 98,475.71 E7 00000083 PBK ARCHITECTS Southmost Elementary - Roof Re 08/16/2019 1,375.00 E7 00000084 SCHNEIDER ELECTRIC Design Build HVAC Phase II 08/16/2019 1,502,593.80 E7 00000085 GONZALEZ GLASS Perez Elementary-Consolidation 08/16/2019 79,233.02 E7 00000086 MOORE SUPPLY COMPANY Canales Elementary - Consolida 08/16/2019 7,677.87 E7 00000087 CPM DESIGN LLC. -

March/April, 1990

t i MM—MM rl '"-^^^~zzz^~-^^ Coca-Cola signed as League's first corporate sponsor BY PETER CONTRERAS $461,450 last year for Public Information 361 academic scholar Director ships to students to The University attend Texas univer Intcrscholastic sities and colleges. League and Coca- "Other funds Cola have entered derived from this into ah agreement in agreement will go principle that makes toward improving the soft drink com theovcrall program," pany the first corpo Marshall continued. rate sponsor of UIL "Some of the funds activities. will be designated to Dr. Bailey upgraderegionaland Marshall, UIL director, and Ted Faubel of state meets and tournaments and to de Austin, a sales development account velop a greater range of instructional manager for Coca-Cola, made the an multi-media materials for teachers and nouncement during the boys' state bas students." ketball tournament in Austin in early Funds will also be used to increase March. the interest in and support of UIL pro 'The focus of all UIL activities is the grams at the local and state levels, Marshall student," Marshall said. "Academic, ath concluded. letic and fine arts contests are created, In return, Coca-Cola gets advertising "organized and administered with the in UIL publications and special recogni dominant intention of enriching the stu tion at UIL state events, but its name will dent's total educational experience. The not be included in the title of state cham UIL has entered the realm of corporate pionships events. sponsorship with the same philosophy." "If we were looking at it strictly as an Under the agreement, the UIL will advertising vehicle, we could have gotten receive 5125,000 in cash, $100,000 for its a lot more bang for our dollar by going scholarship foundation and more than with commercials," said Faubel. -

Institutes for Texas Teachers

Humanities Texas, the state af!liate of the National Endowment for the Humanities, conducts and supports public programs in history, literature, philosophy, and other humanities disciplines. These programs strengthen Texas communities and ultimately help sustain representative democracy by cultivating informed, educated citizens. www.humanitiestexas.org As the largest school at The University of Texas at Austin, the College of Liberal Arts forms the core of the university experience: a classic liberal arts education at a world-class research university. The college provides intellectual challenges, exposure to diversity, and learning opportunities that cross cultural boundaries and promote individual growth. Top-ranked programs set the standard for undergraduate excellence. www.utexas.edu/cola The University of Texas at San Antonio is dedicated to the advancement of knowledge through research and discovery, teaching and learning, community engagement and public service. As an institution of access and excellence, UTSA embraces multicultural traditions, serving as a center for intellectual and creative resources as well as a catalyst for socioeconomic development for Texas, the nation, and the world. www.utsa.edu The mission of the Lyndon Baines Johnson Library and Museum is to preserve and protect the historical materials in the collections institutes for texas teachers of the Johnson Library and make them readily accessible, to increase public awareness of the American experience through relevant exhibitions and educational programs, and to advance the Lyndon Baines Johnson Library and Museum’s standing as a center for intellectual activity and community leadership while meeting the challenges of a changing world. www.lbjlib.utexas.edu A We the People initiative of the National Endowment for the Humanities, with support from Houston Endowment, a philanthropy endowed by Mr. -

First Timers Guide to South Padre Island

so memorable. special souvenirs so padre Save room in your suitcase! South Padre Island has a variety of hidden gems to please the pickiest of shopaholics. For home décor, check out Sisters Interiors for coastal living pieces and upscale ac- cents. For jewelry and art connoisseurs, be sure to visit Seas the Day, a local shop that boasts jew- first-timers guide to south padre island. elry made by resident jewelers on-site and unique offerings in art, pottery and sculptures. And, for women’s fashion on trend, be sure to visit Cactus Flower, Barbara’s and Annabelle’s to secure your spot on the Island’s best-dressed list. check in to south padre island What’s your vacation style? Choose from a wide selection of beach and bayside hotels and vacation rentals, all perfectly situated to help you explore the Island’s activities and attractions. for the family for the romantics Located right next to the beach with its own Nestled between the warm waters of the Gulf of inland surfing attraction, uphill water coasters, Mexico and the tranquil Laguna Madre, you’ll and more fun than should be allowed, families find a peaceful yet vibrant seaside resort com- can make a splash on one of South Padre munity know as The Shores. This exclusive Island’s biggest attractions, Schlitterbahn enclave offers residents and guests an unhur- Beach Resort & Waterpark. The outdoor water ried lifestyle of tranquility and privacy, while park includes a resort and indoor water park for providing ample opportunities for more active year-round fun. -

Hidalgo County Historical Museum Archives

Museum of South Texas History Archives Photo Collection Subject Index Inventory Headings List Revision: January 2016 Consult archivist for finding aids relating to photo collections, negatives, slides, stereographs, or exhibit images. HEADING KEY I. Places II. People III. Activity IV. Things The HEADING lists are normally referred to only by their Roman numeral. For example, II includes groups and organizations, and III includes events and occupations. Each of the four HEADING lists is in upper case arranged alphabetically. Occasionally, subheadings appear as italics or with underlining, such as I GOVT BUILDINGS Federal Linn Post Office. Infrequently sub- subheading may appear, indicated by another right margin shift. Beneath each HEADING, Subheading, or Sub-subheading are folder titles. KEY HEADINGS = All Caps Subheadings= Underlined Folder Title = Regular Capitalization A I. AERIAL Brownsville/Matamoros Edinburg/Pan American/HCHM Elsa/Edcouch Hidalgo La Blanca Linn McAllen Madero McAllen Mission/Sharyland Mexico Padre Island, South/Port Isabel Pharr Rio Grande City/Fort Ringgold San Antonio Weslaco I. AGRICULTURE/SUPPLIES/BUSINESSES/AGENCIES/SEED and FEED I. AIRBASES/AIRFIELDS/AIRPORTS Brownsville Harlingen McAllen (Miller) Mercedes Moore World War II Korea Screwworm/Agriculture/Medical Science Projects Reynosa San Benito I. ARCHEOLOGY SITES Boca Chica Shipwreck Mexico I. AUCTION HOUSES B I. BACKYARDS I. BAKERIES/ PANADERIAS I. BANDSTANDS/QIOSCOS/KIOSKS/PAVILIONS Edinburg Mexico Rio Grande City 2 I. BANKS/SAVINGS AND LOANS/CREDIT UNIONS/INSURANCE AGENCIES/ LOAN COMPANY Brownsville Edinburg Chapin Edinburg State First National First State (NBC) Groundbreaking Construction/Expansion Completion Openings Exterior Interior Elsa Harlingen Hidalgo City La Feria McAllen First National Bank First State McAllen State Texas Commerce Mercedes Mission Monterrey San Antonio San Benito San Juan I. -

Historical Shoreline Change Through Texas Gulf

A Publication of the Gulf Coast Association of Geological Societies www.gcags.org HISTORICAL SHORELINE CHANGE THROUGH 2007, TEXAS GULF COAST: RATES, CONTRIBUTING CAUSES, AND HOLOCENE CONTEXT Jeffrey G. Paine, Sojan Mathew, and Tiffany Caudle Bureau of Economic Geology, Jackson School of Geosciences, University of Texas at Austin, University Station, Box X, Austin, Texas 78713, U.S.A. ABSTRACT Long-term historical rates of Gulf shoreline change along the Texas coast have been determined through 2007 (the latest imagery that predates Hurricane Ike) from a series of shoreline positions that includes those depicted on 1800s charts and mapped from aerial photographs, ground GPS surveys, and airborne lidar surveys. Net rates measured at 11,731 sites spaced at 164 ft (50 m) along the 332 mi (535 km) of Texas Gulf shoreline average 4.1 ft/yr (1.2 m/yr) of retreat, significantly lower than late Pleistocene to early-Holocene retreat rates of 8 to 181 ft/yr (2.4 to 55 m/yr) and similar to mid- to late Holocene rates estimated using past sea-level positions and shelf bathymetric contours as a shoreline proxy. Net shoreline retreat occurred along 84 percent of the Texas Gulf shoreline, resulting in an estimated land loss of 13,890 ac (5621 ha) since 1930 at an average rate of 180 ac/yr (73 ha/yr). Rates of change are more recessional on the upper Texas coast (-5.3 ft/yr [-1.6 m/yr] east of the Colorado River) than they are on the central and lower coast (-3.3 ft/yr [-1.0 m/yr] from the Colorado River to the Rio Grande). -

2015-16 TGCA Volleyball Academic All-State Selections

2015-16 TGCA Volleyball Academic All-State Selections Athlete First Athlete Last High School Coach First Coach Last Conf. 1A Sara English ASPERMONT HIGH SCHOOL Rebekah Bland 1A Jacy Sparks ASPERMONT HIGH SCHOOL Rebekah Bland 1A Macy Higgins BLUM HIGH SCHOOL Lauren McPherson 1A Rhealee Spies BURTON HIGH SCHOOL Katie Cloud 1A Cali Porter FORT DAVIS HIGH SCHOOL Gary Lamar 1A Kristina Mayo GARY HIGH SCHOOL Tamika Hubbard 1A Sydney Ritter GARY HIGH SCHOOL Tamika Hubbard 1A Cheyenne Camp KNOX CITY HIGH SCHOOL Brenna Hoegger 1A Cortlyn Barnes MEDINA HIGH SCHOOL Lovey Sockol 1A Hannah Garrison MEDINA HIGH SCHOOL Lovey Sockol 1A Chyna Phillips MEDINA HIGH SCHOOL Lovey Sockol 1A Whitley Whitewood MEDINA HIGH SCHOOL Lovey Sockol 1A Aurora Denise Araujo MUNDAY SECONDARY SCHOOL Jessica Toliver 1A Skylar Gomez MUNDAY SECONDARY SCHOOL Jessica Toliver 1A Kimberly Shahan MUNDAY SECONDARY SCHOOL Jessica Toliver 1A Ana Vega MUNDAY SECONDARY SCHOOL Jessica Toliver 1A Kiera Cosby NORTH ZULCH HIGH SCHOOL Gregory Horn 1A Jasmine D Willis OAKWOOD HIGH SCHOOL Mike Hill 1A Kendall Deaton PADUCAH HIGH SCHOOL Sandra Tribble 1A Leslie Mayo PADUCAH HIGH SCHOOL Sandra Tribble 1A Madison Heyman ROUND TOP‐CARMINE HIGH SCHOOL RaChelle Etzel 1A Adyson Lange ROUND TOP‐CARMINE HIGH SCHOOL RaChelle Etzel 1A Emma Leppard ROUND TOP‐CARMINE HIGH SCHOOL RaChelle Etzel 1A Cheyenne Janssen RUNGE HIGH SCHOOL Melissa Lopez 1A Brittany Rauch STERLING CITY HIGH SCHOOL Amelia Reeves 1A Verenise Aguirre TIOGA SCHOOL Mindy Patton 1A Samantha Holcomb TIOGA SCHOOL Mindy Patton 1A Heather -

Town of South Padre Island, Texas Comprehensive Plan 2008 April 2006 February 2008

Town of South Padre Island, Texas Comprehensive Plan 2008 April 2006 February 2008 DedicationDedication Comprehensive Plan Advisory Committee A process that started in April of 2006 and was completed February 2008 Wendy Hauschildt Steve O’Neal Nancy Marsden Lucinda Wierenga Leah Thrash Clayton Brashear David Horton John Gieseking Lori Wells Troy Giles Sally Robey Mary Helen Flores Glenn McKinlay Liz Money Patricia Hernandez‐Edelstein Aldermen May 2007 – May 2008 Robert N. Pinkerton, Jr. – Mayor Kirk Mills, Mayor Pro‐Tem Phillip Money Jo Ann Evans Courtney Hayden Tara Rios‐Ybarra Aldermen May 2006 – May 2007 Robert N. Pinkerton, Jr. – Mayor Richard Ridolfi, Mayor Pro‐Tem Phillip Money Jo Ann Evans Jim Hoff Tara Rios‐Ybarra Aldermen May 2005 – May 2006 Robert N. Pinkerton, Jr. – Mayor Richard Ridolfi, Mayor Pro‐Tem Fred Mallett Kirk Mills Jim Hoff Tara Rios‐Ybarra City Staff City Manager Dewey Cashwell City Planner Cate Ball Public Information Officer Jason Moody April 2006 February 2008 TableTable ofof ContentsContents Chapter 1 – Planning Framework Page Purpose.........................................................................................................1 Plan Development.......................................................................................2 Mission Statement.......................................................................................3 Public Involvement.....................................................................................4 Use of Plan ...................................................................................................4 -

Laguna Madre and Baffin Bay Areas

Shoreline Types of the South Texas Coast: Laguna Madre and Baffin Bay Areas Final Report Prepared for the Texas General Land Office under GLO Contract No. 00-126R William A. White, Thomas A. Tremblay, and Robert A. Morton* * Curremly with {he Center for Coastal Geology, U.s. Geological Survey Bureau of Economic Geology Scott W. Tinker, Director The University of Texas at Austin Austin, Texas 78713-8924 July 2000 CONTENTS EXECUTIVE SUMMARY ............................................................................................................ 1 INTRODUCTION ............................................ ............... .. ................................................... .......... 2 RATIONALE FOR UPDATING SHORELINE INVENTORIES AND ESI MAPS ...... .. .... ...... .. 5 PREVIOUS RELATED WORK ............................................ ........ ................................................. 6 METHODS OF MAPPING AND APPLYING ESI RANKINGS ...... .. ......................................... 8 Mapping Procedures ................................................................................................................. 8 Application of ESI Rankings to Complex Shorelines .............................................................. 9 Field Verification and Modifications ...................................................................................... 12 Quality Control .............................................................................. ......................................... 13 SHORELINE TYPES OF THE SOUTH TEXAS COAST -

The Collegian (2008-08-25)

University of Texas Rio Grande Valley ScholarWorks @ UTRGV The Collegian Special Collections and Archives 8-25-2008 The Collegian (2008-08-25) Isis Lopez The University of Texas Rio Grande Valley Follow this and additional works at: https://scholarworks.utrgv.edu/collegian Recommended Citation The Collegian (BLIBR-0075). UTRGV Digital Library, The University of Texas – Rio Grande Valley This Book is brought to you for free and open access by the Special Collections and Archives at ScholarWorks @ UTRGV. It has been accepted for inclusion in The Collegian by an authorized administrator of ScholarWorks @ UTRGV. For more information, please contact [email protected], [email protected]. THE STUDENT VOICE OF THE UNIVERSITY OF TEXAS AT BROWNSVILLE AND TEXAS SOUTHMOST COLLEGE THE Volume 61 Monday OLLEGIANwww.collegian.utb.edu CIssue 2 August 25, 2008 TSC tax rate hearing Thursday Enrollment By Julianna Sosa operating budget of the district --Property acquisition, raise the same amount of dollars up slightly Staff Writer is funded by tax revenues, which $1,250,000 as the 2007 rate; and the rollback provide funding for scholarships, --Insurance, $1,177,683 rate, which is 16.51 cents and By Julianna Sosa The first of two public hearings capital improvements, deferred --Institutional Advancement would generate 8 percent more in Staff Writer on the proposed 2008 Texas maintenance, insurance and (partnership budget/grant writers), revenue than the 2007 rate. Southmost College District tax administration. $530,169 Sanchez gave two examples A total of 11,581 students were rate is set for 5 p.m. Thursday in Melba Sanchez, assistant vice --Library (partnership budget), showing the effect of the tax rates registered for classes at UTB/TSC the Gorgas Hall boardroom.