Zee Entertainment Enterprises Limited Annual Report 2009-10

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annexure to Director's Report

ANNUAL REPORT 2017-18 EXPERIENCE THE EXTRAORDINARY ANNEXURE ‘A’ TO DIRECTORS’ REPORT DIRECTORS’ TO ‘A’ ANNEXURE 76 Statement containing salient features of the financial statement of subsidiaries/associates/joint ventures as per the Companies Act, 2013 for the year ended 31 March 2018 Part 1: Subsidiaries (` Millions) Name of the subsidiary Date of Reporting Share Reserves Total Total Investments Turnover Profit / Provision Profit / Proposed Mode and Acquisition Currency Capital & Surplus Assets Liabilities (Other than (Loss) for (loss) Dividend % of Subsidiary) before taxation after shareholding Taxation taxation Zee Turner Limited 31-Dec-01 INR 1 52 118 65 25 - 0 (5) 5 - 74% Essel Vision Productions Limited 10-Sep-10 INR 130 (262) 5,451 5,583 - 4,034 (506) 21 (527) - 100% ZEE Digital Convergence Limited 23-Sep-04 INR 300 (306) 81 87 - 21 (5) - (5) - 100% Zee Unimedia Limited 01-Apr-16 INR 100 (66) 53 19 - 17 9 1 8 - 100% Margo Networks Private Limited 17-Apr-17 INR 1 676 736 59 540 - (70) 1 (71) - 80% Fly by Wire International Private Limited ! 14-Jul-17 INR 20 62 539 457 5 342 92 40 53 - 100% India Webportal Private Limited ## 10-Dec-10 INR 1 3 19 15 - 166 (81) - (81) - 100% Idea Shopweb and Media Private Limited 01-Oct-15 INR 0 (5) 1 6 - 10 (4) - (4) - 51.04% (wef 22 July 2017) ## Zee Multimedia Worldwide (Mauritius) 10-Jun-11 USD 3,689 1,542 5,232 1 - - 112 3 109 - 100% Limited Zee TV USA Inc. $ 30-Sep-99 USD 65 (65) - - - - - - - - 100% Asia TV Limited & 30-Sep-99 GBP 1,495 (442) 2,341 1,288 - 1,846 105 25 80 - 100% OOO Zee CIS Holding LLC ** 06-Feb-09 RUB - - - - - - - - - - 100% OOO Zee CIS LLC ** 26-Feb-09 RUB 0 18 35 17 - 26 (13) - (13) - 100% Asia Multimedia Distribution Inc. -

ZEEMEDIA [email protected]

ZEEMEDIA [email protected] Collaborative Strategies C o h e s i v e G r o w t h ZEEMEDIA ZEE MEDIA CORPORATION LIMITED REGISTERED OFFICE 14th Floor, A Wing, Marathon Futurex, NM Joshi Marg, Lower Parel, Mumbai - 400013 Maharashtra Tel.: +91 22 7106 1234 Fax: +91 22 2300 2107 Website: www.zeenews.india.com Annual Report 2017-18 OUR ZEEMEDIA PRESENCE INSIDE THIS REPORT Corporate Overview Collaborative Strategies Cohesive Growth 01 Growing Together with Viewer Engagement 02 Growing Together with Advertisers' Reach 03 Growing Together with Society and Government 04 Growing Together with Our Employees - Our Trusted Aides 05 Srinagar Steadfast Progress, Nurturing New Ventures 06 Jammu Raising the Bar with Innovations 08 Message to Shareholders 10 Growth Firmly Embedded in Value System 12 Chandigarh Dehradun Our Channels and Digital Platforms 13 Corporate Information 16 Noida STATUTORY REPORTS Lucknow Varanasi Notice 17 Jaipur Ajmer Directors' Report 26 Patna Corporate Governance Report 43 Kota Management Discussion and Analysis 56 Ranchi Kolkata Ahmedabad Bhopal Indore Vadodara FINANCIAL STATEMENTS Rajkot Raipur Surat Standalone Financial Statements 67 Nagpur Consolidated Financial Statements 121 Bhubaneswar Nasik Aurangabad Thane Mumbai BSE, Mumbai Pune Kohlapur Hyderabad FORWARD LOOKING STATEMENTS Bengaluru Certain statements in this annual report concerning our future growth prospects are forward-looking statements, which involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. We have tried wherever possible to identify such statements by using words such as 'anticipate', 'estimate', 'expect', 'project', 'intend', 'plan', 'believe' and words of similar substance in connection with any discussion of future performance. -

RATING RATIONALE 7 Aug 2020 Zee Entertainment Enterprises Limited

RATING RATIONALE 7 Aug 2020 Zee Entertainment Enterprises Limited Brickwork Ratings downgrades the ratings of 6% Cumulative Redeemable Non- Convertible Preference Shares (CRNPS) and issuer rating of Zee Entertainment Enterprises Limited. The rating continues to remain on Credit Watch with Negative Implications. Particulars. Previous Present Previous Present Instruments Amount Amount Rating Rating (Rs. Cr) (Rs. Cr) (December 2019) 6% Cumulative Redeemable BWR AA BWR AA- Non-convertible Credit Watch With Credit Watch With 1210.16 806.78 Preference Shares Negative Implications Negative Implications (CRNPS) BWR AA BWR AA- Issuer Rating NA NA Credit Watch With Credit Watch With Negative Implications Negative Implications INR Eight Hundred Six Crores and Seventy-Eight Total 1210.16 806.78 Lakhs Only. *Please refer to BWR website www.brickworkratings.com/ for definition of the ratings Rating Action: Brickwork Ratings (BWR) downgrades the ratings of CRNPS and issuer ratings of Zee Entertainment Enterprises Limited (ZEEL) from BWR AA (Credit Watch with Negative Implications) to BWR AA- (Credit Watch with Negative Implications). The downgrade in ratings factors in decline in profitability and margins for the year ended FY20, reported loss at the operating and net level for Q4FY20 and weakening credit profile. The ratings continue to factor in the established track record of ZEEL in the Indian television broadcasting industry and presence in the media and entertainment industry for more than two decades, a large array of offerings across general entertainment, regional and niche segments and the current low debt, high net worth and superior liquidity. www.brickworkratings.com Page 1 of 9 BWR also takes note of the audit qualification with respect to non-recognizing the liability against the put option agreement entered into by a wholly owned subsidiary with the related party. -

Decisions Taken by BCCC 16 April 2014 to 22 August 2015

ACTION BY BCCC ON COMPLAINTS RECEIVED FROM 16 APRIL 2014 TO 22 AUGUST 2015 S.NO Programme Channel Total Nature of Complaints Telecast Action By BCCC Number date of the of programme Compla reviwed by ints BCCC Receive d A : SPECIFIC CONTENT RELATED COMPLAINTS A-1 : Specific Content related complaints Disposed 1 2015 Movie Awards VH1 1 During the telecast, performers made some highly indecent 13.04.2015 Channel’s representatives appeared before BCCC. After detailed gestures. One of them grabs another man’s crotch and tries to deliberations, the channel was asked to run an Apology Scroll for three days. reach for his nipples saying, “I am gonna milk those nipples.” Also, Detailed Order is being issued. a suggestive term ‘girl power’ was used for referring to vagina and a female performer is heard telling the audience that her “vagina looks more like a neat burrito rather than a stand and stuff taco”. While the word vagina has been beeped/ muted, its description is denigrating to women. Acts performed on stage were highly indecent, sexually explicit, adult, vulgar and suggestive. Irrespective of the time, the content violates Licence Term and Programme Code of Cable TV Network Rules. 2 Dance India Dance Zee TV 2 Episode-1, 27/06/15: The dance performance of two girls was 27.06.2015 BCCC viewed the episode and did not find the dance to be vulgar or vulgar as it was exposing their bodies. Such acts spoil Indian 26.07.2015 obscene. The complaint was DISPOSED OF. culture. Episode-2, 26/07/15: The performance by contestant Pronita on the song ‘Kundi na khadkao raja’ was out-and-out vulgar. -

Rate Card Applicable for DTH Operators As Per The

Rate Card applicable for DTH Operators as per the Telecommunication (Broadcasting and Cable) Services (Fourth) (Addressable Systems) Tariff Order, 2010 dated 21st July 2010 (“Tariff Order”) A-La-Carte Rates: Sr. Rate to Operator per No Channels Subscriber per Month (Rs) 1 STAR Plus 7.87 2 STAR Gold 7.42 3 STAR Movies 7.42 4 STAR World 2.05 5 NGC 2.58 6 Fox Traveller 1.98 7 Channel V 0.45 8 Vijay TV 1.80 (Rs. 5.30 for TN) 9 ABP News FTA 10 Zee TV 5.83 11 Zee Cinema 5.83 12 Cartoon Network 5.62 13 Zee Marathi 3.60 14 Zee News 3.37 15 CNN 0.67 16 Zee Café 3.60 17 Zee Studio 3.15 18 Zee Trendz 0.45 19 Zee Punjab Haryana Himachal 0.67 20 Zee Bangla 3.64 21 Fox Crime 6.51 22 Nat Geo Wild 6.72 23 Life OK (Erstwhile STAR ONE) Effective from 18th December, 2011 9.21 24 MGM 2.70 25 HBO 7.01 26 Pogo 5.62 27 Zee Business 2.16 28 WB 2.77 29 FX 6.51 30 Baby TV 5.57 31 Nat Geo People 6.72 32 Nat Geo Music 3.11 33 Zee Salaam 6.30 34 Zee Uttar Pradesh Uttarakhand ( erstwhile FTA Zee News Uttar Pradesh) Effective from 11th June, 2013 35 ETC Punjabi 4.04 36 ETC 1.35 37 Zing 2.25 38 Zee Jagran 0.90 39 ABP Ananda 2.52 40 Star Jalsha 5.04 41 Zee 24 Ghante 2.70 42 Zee Talkies 6.96 43 Zee 24 Taas 3.82 44 NDTV India 3.37 45 NDTV 24*7 3.82 46 NDTV Profit 2.70 47 NDTV Good Times 4.04 48 Star Pravah 5.04 49 ABP Majha (FTA to Pay w.e.f. -

Zee Entertainment Enterprises Limited Quarter Three Financial Year 2010- Earnings Conference Call January 19 2010, 1300Hrs IST

3Q (October- December 2009) FY 2010 Teleconference January 19, 2010 Zee Entertainment Enterprises Limited Quarter Three Financial Year 2010- Earnings Conference Call January 19 2010, 1300hrs IST Moderator Ladies and gentlemen good afternoon and welcome to the Zee Entertainment Enterprises Ltd. Q3 FY2010 results conference call. Please note that this conference is being recorded. At this time I would like to hand the conference over to Mr. Harshdeep Chhabra from Zee Entertainment. Thank you and over to you sir. Harshdeep Chhabra Ladies and gentlemen, thank you for joining us today. This conference call has been organized to update our investors on the company’s performance in the third quarter of fiscal 2010 and to share with you the outlook of the management of Zee Entertainment Enterprises Limited. We do hope that you had a chance to go through copies of the earnings release and the results, both of which are uploaded on our website www.zeetelevision.com. To discuss the results and performance joining me today is Mr. Punit Goenka, Managing Director and CEO of ZEEL, along with members of the senior management team of the company including Mr. Hitesh Vakil, CFO & Mr. Atul Das, Head- Corporate Strategy & Business Development. We will start with a brief statement from Mr. Punit Goenka on the third quarter performance and will then open the discussion for question and answers. I would like to remind everybody that anything we say during this call that refers to our outlook for the future is a forward-looking statement that must be taken in the context of the risk that we face. -

Management Discussion and ANALYSIS

CORPORATE OVERVIEW OPERATIONAL OVERVIEW 72 BOARD AND MANAGEMENT REPORTS FINANCIAL STATEMENTS Management Discussion and ANALYSIS The figures have been stated in` /million in the MD&A for better readability. Investors are cautioned that this discussion contains forward-looking statements that involve risks and In FY2012, 10.5 million uncertainties including, but not limited to, risks inherent in the Company’s growth strategy, acquisition plans, dependence subscribers have adopted on certain businesses, dependence on availability of qualified and trained manpower and other factors. The satellite based television following discussion with the Company’s financial statements included herein and services via DTH, taking the notes thereto: OVERVIEW Zee Entertainment Enterprises Limited the gross DTH subscriber (ZEE) (BSE Code: 505537, NSE Code: ZEEL.EQ) is one of India’s largest vertically integrated media and entertainment base to 44.6 million company. The Company was formed in 1982. ZEE was the first company to launch a satellite channel in India and strong. from being a single channel for a single geography today operates multiple channels across multiple geographies in different languages and genres. The Company’s programming reaches out to over 650 million viewers across 168 countries. ZEE channel portfolio, across various genres in the Indian market, includes: i. Hindi Entertainment: Zee TV, Zee Smile, 9X ii. Hindi Movies: Zee Cinema, Zee Premier, Zee Action, Zee Classic iii. English Entertainment, Movies and Life style: Zee Studio, Zee Café, Zee Trendz ANNUAL REPORT 2011-12 Notice Directors’ Report Annexure to Directors’ Report Report on Corporate Governance Management Discussion & Analysis 73 The Indian Media and Entertainment Industry 11.7% witnessed steady growth in 2011. -

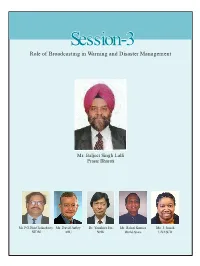

Session-3 Role of Broadcasting in Warning and Disaster Management

Session-3 Role of Broadcasting in Warning and Disaster Management Mr. Baljeet Singh Lalli Prasar Bharati Mr. P.G.DharChakraborty Mr. David Astley Dr. Yasuhiro Ito Mr. Rahul Kumar Ms. J. Josiah NIDM ABU NHK World Space UNESCO Broadcasters' preparedness for disaster Mr. Baljeet Singh Lalli Prasar Bharati Baljit Singh Lalli has taken over as the new CEO of Prasar Bharati. A 1971 batch IAS Officer of UP Cadre, Shri Lalli comes to head India's national broadcasting organization, comprising All India Radio and Doordarshan, with a vast administrative and managerial experience spanning over three decades. Shri Lalli was Secretary, Border Management in the Ministry of Home Affairs, Govt of India, prior to taking over as CEO, Prasar Bharati. A Post Graduate in English literature, Shri Baljit Singh Lalli has also worked as Secretary, Ministry of Panchayati Raj. Earlier, he worked as Additional Secretary, Ministry of Urban Development and Ministry of Agriculture. He was Member Secretary of the National Capital Region Planning Board and contributed towards the formulation of the Regional NCR Plan 2021. Shri Lalli has also been Part-time Chairperson of the Delhi Urban Art Commission (DUAC). Mr. P.G.DharChakraborty National Institute of Disaster Management, India Abstract The increasing incidents of disasters throughout the world, due to various factors ranging from global warming and climate change to unplanned settlement of vulnerable communities in hazards prone areas and the consequential mounting graph of loss of life and property, have brought the issue of disaster risk reduction and management at the core of development planning, particularly in developing countries. -

Extraordinary Together

Experience the Extraordinary ANNUAL REPORT 2017-18 ZEE ENTERTAINMENT ENTERPRISES LIMITED WELCOME TO THE EXTRAORDINARY WORLD OF ZEE! The journey of a thousand miles begins with one step. We took our first Our new brand ideology – ‘Extraordinary Together’, celebrates our step 25 years back with a simple idea - create stories that entertain, belief in the power of working together, that we’re greater than the inspire, and touch hearts. We started small but success fuelled our sum of our parts and from collaboration comes the strength to deliver desires, dreams and ambitions. As we moved ahead, the goals became the exceptional. Our mission to create extraordinary entertainment more audacious and we challenged ourselves to do more. We achieved experiences for our audience could not have been achieved without milestones which were not visible at the beginning and looked the support of our employees, partners and peers, who had the faith impossible even as we progressed. True to the saying, ‘A dream you in our vision and walked alongside us. At the cusp of our dream alone is only a dream, a dream you dream together is reality’, 25th anniversary, we reaffirm our commitment to work tirelessly with our vision materialised only because it was shared by our partners and each of them, to create new benchmarks and deliver the extraordinary. peers. Today, our 1.3 billion strong audience in 170+ countries is a result Mosaic, an art-form made of innumerable elements, each of which is of not only our relentless efforts but also of the countless others who vital to the picture that emerges when they all come together, is thus supported us on the way. -

KPMG FICCI 2013, 2014 and 2015 – TV 16

#shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 kpmg.com/in ficci-frames.com We would like to thank all those who have contributed and shared their valuable domain insights in helping us put this report together. Images Courtesy: 9X Media Pvt.Ltd. Phoebus Media Accel Animation Studios Prime Focus Ltd. Adlabs Imagica Redchillies VFX Anibrain Reliance Mediaworks Ltd. Baweja Movies Shemaroo Bhasinsoft Shobiz Experential Communications Pvt.Ltd. Disney India Showcraft Productions DQ Limited Star India Pvt. Ltd. Eros International Plc. Teamwork-Arts Fox Star Studios Technicolour India Graphiti Multimedia Pvt.Ltd. Turner International India Ltd. Greengold Animation Pvt.Ltd UTV Motion Pictures KidZania Viacom 18 Media Pvt.Ltd. Madmax Wonderla Holidays Maya Digital Studios Yash Raj Films Multiscreen Media Pvt.Ltd. Zee Entertainmnet Enterprises Ltd. National Film Development Corporation of India with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars FICCI-KPMG Indian Media and Entertainment Industry Report 2015 with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. entity. (“KPMG International”), a Swiss with KPMG International Cooperative © 2015 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated and a member firm of the KPMG network of independent member firms Partnership KPMG, an Indian Registered © 2015 #shootingforthestars: FICCI-KPMG Indian Media and Entertainment Industry Report 2015 Foreword Making India the global entertainment superpower 2014 has been a turning point for the media and entertainment industry in India in many ways. -

KBC, India's Most Famous Game Show: an Analyis

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/348295598 KBC, India's most famous game show: An Analyis Article in ACADEMICIA An International Multidisciplinary Research Journal · December 2020 DOI: 10.5958/2249-7137.2020.01740.1 CITATIONS READS 0 27 1 author: Karunakar B. Narsee Monjee Institute of Management Studies 21 PUBLICATIONS 3 CITATIONS SEE PROFILE All content following this page was uploaded by Karunakar B. on 07 January 2021. The user has requested enhancement of the downloaded file. ACADEMICIA ISSN: 2249-7137 Vol. 10 Issue 12, December 2020 Impact Factor: SJIF 2020 = 7.13 ACADEMICIA An International Multidisciplinary R e s e a r c h J o u r n a l (Double Blind Refereed & Peer Reviewed Journal) DOI: 10.5958/2249-7137.2020.01740.1 KBC, INDIA’S MOST FAMOUS GAME SHOW: AN ANALYSIS Dr B Karunakar* *NMIMS Hyderabad, INDIA Email id: [email protected]; [email protected] ABSTRACT Today, there are more than a dozen reality shows on air across all kinds of channels, from general entertainment to youth channels to the regional, all on prime time. These reality shows offer a wide scope for brand visibility. In this context, Kaun Banega Crorepati as a reality show was studied for its impact and the economics involved. The attempt of this article is to provide insights on the working of the TV channels, production houses, marketers & advertisers that provide the sponsorship, the general comparison of reality shows with serials and the overall impact created. KEYWORDS: Sponsorship, Reality Shows INTRODUCTION Amid the COVID-19 lockdown, 'Kaun Banega Crorepati' (KBC) Season 12, hosted by India’s famous actor Amitabh Bachchan caught the attention of audiences as millions logged in to participate in the show during May 2020. -

Economy News Corporate News

SEPTEMBER 16, 2008 Economy News Equity 4 Call rates hardened yesterday to touch a high of 12.5% as liquidity in the % Chg money market came under strain due to outflows towards payment for 15 Sep 08 1 Day 1 Mth 3 Mths advance tax and debt auction. Call rates closed at 10.50-10.60%, off a high of 12.50%, the highest since April 17, 2006. It had ended at 9.80- Indian Indices BSE Sensex 13,531 (3.4) (8.1) (12.1) 10% on Saturday (BS) Nifty 4,073 (3.7) (8.1) (10.9) 4 The rupee hit a two-year low of Rs.46 / USD in early morning trade BSE Banking 6,792 (3.4) (1.6) (6.4) yesterday. Latest data shows that the Reserve Bank of India (RBI) had BSE IT 3,597 (5.5) (7.7) (18.5) pumped in $7 billion, on a net basis, in the forex markets during April- BSE Capital Goods 11,367 (4.0) (6.4) (6.1) July 2008 to stem the slide in the value of the rupee. (BS) BSE Oil & Gas 8,814 (3.3) (13.6) (12.0) NSE Midcap 5,313 (4.3) (8.5) (13.6) 4 Expressing optimism that the improved industrial growth in July would BSE Small-cap 6,380 (4.9) (10.3) (16.8) continue in the days ahead, former head of the PM's economic panel, C. World Indices Rangarajan, has said that, inflation may come down to 10% by Dow Jones 10,918 (4.4) (6.4) (11.0) December from over 12 per cent at present (BS) Nasdaq 2,180 (3.6) (11.1) (11.9) FTSE 5,204 (3.9) (4.6) (10.2) Corporate News Nikkei 12,215 0.9 (10.9) (17.0) Hangseng 19,353 (0.2) (14.1) (19.5) 4 Emami Ltd has more than doubled the open offer price for Zandu Pharmaceutical Works to Rs.15000 per share from Rs.7315 per share Value traded (Rs cr) earlier.