BAT INTERNATIONAL FINANCE Plc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2013--Annual-Report-Accounts.Pdf

Helping people make measurable progress in their lives through learning ANNUAL REPORT AND ACCOUNTS 2013 OUR TRANSFORMATION To find out more about how we are transforming our business go to page 09 EFFICACY To find out more about our focus on efficacy go to page 14 OUR PERFORMANCE For an in-depth analysis of our performance in 2013 go to page 19 Pearson is the world’s leading learning company, with 40,000 employees in more than 80 countries working to help people of all ages to make measurable progress in their lives through learning. We provide learning materials, technologies, assessments and services to teachers and students in order to help people everywhere aim higher and fulfil their true potential. We put the learner at the centre of everything we do. READ OUR REPORT ONLINE Learn more www.pearson.com/ar2013.html/ar2013.html To stay up to date wwithith PPearsonearson throughout the year,r, visit ouourr blog at blog.pearson.comn.com and follow us on Twitteritter – @pearsonplc 01 Heading one OVERVIEW Overview 02 Financial highlights A summary of who we are and what 04 Chairman’s introduction 1 we do, including performance highlights, 06 Our business models our business strategy and key areas of 09 Chief executive’s strategic overview investment and focus. 14 Pearson’s commitment to efficacy OUR PERFORMANCE OUR Our performance 19 Our performance An in-depth analysis of how we 20 Outlook 2014 2 performed in 2013, the outlook 23 Education: North America, International, Professional for 2014 and the principal risks and 32 Financial Times Group uncertainties affecting our businesses. -

Rb-Annual-Report-2012.Pdf

Reckitt Benckiser Group plc Reckitt Benckiser Group Healthier Happier Annual Report and Financial Statements 2012 Stronger Reckitt Benckiser Group plc Annual Report and Financial Statements 2012 Contents 1 Chairman’s Statement 2 Chief Executive’s Statement 10 Business Review 2012 18 Board of Directors and Executive Committee 19 Report of the Directors 22 Chairman’s Statement on Corporate Governance 24 Corporate Governance Report 30 Statement of Directors’ Responsibilities 31 Directors’ Remuneration Report 38 Independent Auditors’ Report to the members of Reckitt Benckiser Group plc 39 Group income statement 39 Group statement of comprehensive income 40 Group balance sheet 41 Group statement of changes in equity 42 Group cash flow statement 43 Notes to the financial statements 75 Five-year summary 76 Parent Company – Independent Auditors’ Report to the members of Reckitt Benckiser Group plc 77 Parent Company balance sheet 78 Notes to the Parent Company financial statements 84 Shareholder information Chairman’s Statement largest consumer health care category in The Board conducted its regular reviews the world with the acquisition of Schiff of the Company’s brands, geographic area Nutrition International, Inc. (Schiff) and and functional performance together with its leading US brands in the vitamins, detailed reviews of its human resources. minerals and supplements market. There The Board also completed its annual were also a few disposals of non core assessment of corporate governance assets. Net debt at the end of 2012, after including Board performance, corporate paying for dividends, net acquisitions and responsibility, and reputational and organisation restructuring, stood at business risk. £2,426m (2011: £1,795m). AGM Resolutions Your Board proposes an increase in the final The resolutions, which will be voted dividend of +11%, taking it to 78p per upon at our AGM of 2 May 2013 are share, and bringing the total dividend for fully explained in the Notice of Meeting. -

British American Tobacco's Submission to the WHO's

British American Tobacco’s submission to the WHO’s Framework Convention on Tobacco Control This is the submission of the British American Tobacco group of companies commenting on the WHO’s Framework Convention on Tobacco Control. We are the world’s most international tobacco group with an active presence in 180 countries. Our companies sell some of the world’s best known brands including Dunhill, Kent, State Express 555, Lucky Strike, Benson & Hedges, Rothmans and Pall Mall. Executive summary • The WHO’s proposed ‘Framework Convention on Tobacco Control’ is fundamentally flawed and will not achieve its objectives. • The tobacco industry, along with other industries involved in the manufacture and distribution of legal but risky products, is the subject of considerable public attention. It is important that the debate about tobacco remains open, objective, constructive and free from opportunistic criticism if we are effectively to address the real issues associated with tobacco. • British American Tobacco is responsible tobacco. We seek to operate in partnership with governments, who are significant stakeholders in our business, and other interested parties, based on our open acknowledgement that we make a risky product and therefore support sensible regulation. • British American Tobacco shares the World Health Organisation’s desire to reduce the health impact of tobacco use. This paper outlines British American Tobacco’s proposal for the sensible regulation of tobacco. • Our proposal will relieve the WHO of the cost and bureaucracy involved in its wish to become a single global tobacco regulator, leaving it free to do what it should be doing – policy orientation. Some facts about tobacco • Today over one billion adults, about one third of the world’s adult population, choose to smoke. -

FY 2020 Announcement.Pdf

17 February 2021 –PRELIMINARY RESULTS BRITISH AMERICAN TOBACCO p.l.c. YEAR ENDED 31 DECEMBER 2020 ‘ACCELERATING TRANSFORMATION’ GROWTH IN NEW CATEGORIES AND GROUP EARNINGS DESPITE COVID-19 PERFORMANCE HIGHLIGHTS REPORTED ADJUSTED Current Vs 2019 Current Vs 2019 rates Rates (constant) Cigarette and THP volume share +30 bps Cigarette and THP value share +20 bps Non-Combustibles consumers1 13.5m +3.0m Revenue (£m) £25,776m -0.4% £25,776m +3.3% Profit from operations (£m) £9,962m +10.5% £11,365m +4.8% Operating margin (%) +38.6% +380 bps +44.1% +100 bps2 Diluted EPS (pence) 278.9p +12.0% 331.7p +5.5% Net cash generated from operating activities (£m) £9,786m +8.8% Free cash flow after dividends (£m) £2,550m +32.7% Cash conversion (%)2 98.2% -160 bps 103.0% +650 bps Borrowings3 (£m) £43,968m -3.1% Adjusted Net Debt (£m) £39,451m -5.3% Dividend per share (pence) 215.6p +2.5% The use of non-GAAP measures, including adjusting items and constant currencies, are further discussed on pages 48 to 53, with reconciliations from the most comparable IFRS measure provided. Note – 1. Internal estimate. 2. Movement in adjusted operating margin and operating cash conversion are provided at current rates. 3. Borrowings includes lease liabilities. Delivering today Building A Better TomorrowTM • Revenue, profit from operations and earnings • 1 growth* absorbing estimated 2.5% COVID-19 revenue 13.5m consumers of our non-combustible products , headwind adding 3m in 2020. On track to 50m by 2030 • New Categories revenue up 15%*, accelerating • Combustible revenue -

Betterbusiness Betterfinancials How We Drive Growth and Outperformance

Reckitt Benckiser Group plc Annual Report and Financial2015 Statements betterbusiness 2015 Reckitt Benckiser Group plc (RB) Annual Report and Financial Statements We make a difference to people’s lives through a trusted portfolio of brands, across consumer health, hygiene and home. Our vision Our purpose A world where people are To make a difference, by healthier and live better. giving people innovative solutions for healthier lives and happier homes. Our strategy betterbusiness betterfinancials How we drive growth and outperformance Chief Executive’s Review on pages 8–9 bettersociety betterenvironment How we support How we reduce our communities and our environmental develop our people impact Strategic framework on pages 12–13 Contents Strategic Report bettersociety Governance Report 1 Highlights 24 – Workplace 46 Board of Directors 2 At a glance 26 – Communities 50 Executive Committee 4 Chairman’s Statement 26 – Products 52 Chairman’s Statement on 7 Reasons why RB delivers betterenvironment Corporate Governance 8 Chief Executive’s Review 27 – Greenhouse gas emissions 54 Corporate Governance Statement 10 Our unique culture 28 – Water 60 Nomination Committee Report 12 Strategic framework 28 – Waste 61 Audit Committee Report 14 Our market and resources 29 – Sourcing 66 Directors’ Remuneration Report betterfinancials 30 Our operating model 68 Our remuneration at a glance 16 – Our strategy to deliver 32 Our operating model in action 70 Annual Report on Remuneration 17 – Organisation 34 Creating stakeholder value 79 Directors’ Remuneration Policy 19 – Powermarkets 36 Financial Review 85 Report of the Directors 20 – Powerbrands 40 Strategic Risks 88 Directors’ Statement of Responsibilities 22 – Virtuous earnings model Financial Statements 89 Financial Statements Any information contained in the 2015 Annual Report and Financial Statements on the price at which shares or other securities in Reckitt Benckiser Group plc have been bought or sold in the past, or on the yield on such shares or other securities, should not be relied upon as a guide to future performance. -

BAT INTERNATIONAL FINANCE Plc

BASE PROSPECTUS B.A.T. INTERNATIONAL FINANCE p.l.c. (incorporated with limited liability in England and Wales) BRITISH AMERICAN TOBACCO HOLDINGS (THE NETHERLANDS) B.V. (incorporated with limited liability in The Netherlands) B.A.T. NETHERLANDS FINANCE B.V. (incorporated with limited liability in The Netherlands) B.A.T CAPITAL CORPORATION (incorporated with limited liability in the State of Delaware, United States of America) £25,000,000,000 Euro Medium Term Note Programme unconditionally and irrevocably guaranteed by BRITISH AMERICAN TOBACCO p.l.c. (incorporated with limited liability in England and Wales) and each of the Issuers (except where it is the relevant Issuer) On 6 July 1998, each of B.A.T. International Finance p.l.c. (“BATIF”), B.A.T Capital Corporation (“BATCAP”) and B.A.T Finance B.V. (“BATFIN”) entered into a Euro Medium Term Note Programme (the “Programme”) for the issue of Euro Medium Term Notes (the “Notes”). On 16 April 2003, British American Tobacco Holdings (The Netherlands) B.V. (“BATHTN”) acceded to the Programme as an issuer and, where relevant, a guarantor and BATFIN was removed as an issuer and a guarantor under the Programme. On 9 December 2011, BATCAP was removed as an issuer and a guarantor under the Programme. On 16 May 2014, B.A.T. Netherlands Finance B.V. (“BATNF”) acceded to the Programme as an issuer and, where relevant, a guarantor. On 31 May 2017, BATCAP acceded to the Programme as an issuer and, where relevant, a guarantor. BATIF, BATHTN, BATNF and BATCAP are each, in their capacities as issuers under the Programme, an “Issuer” and together referred to as the “Issuers”. -

Imperial-Ham-La:Layout 1

CMAJ Special report Destroyed documents: uncovering the science that Imperial Tobacco Canada sought to conceal David Hammond MSc PhD, Michael Chaiton MSc, Alex Lee BSc, Neil Collishaw MA Previously published at www.cmaj.ca Abstract provided a wealth of information about the conduct of the tobacco industry, the health effects of smoking and the role Background: In 1992, British American Tobacco had its of cigarette design in promoting addiction.2 Canadian affiliate, Imperial Tobacco Canada, destroy inter- A number of the most sensitive documents were concealed nal research documents that could expose the company to or destroyed before the trial as the threat of litigation grew.3,4 liability or embarrassment. Sixty of these destroyed docu- Based on advice from their lawyers, companies such as ments were subsequently uncovered in British American British American Tobacco instituted a policy of document Tobacco’s files. destruction.5 A.G. Thomas, the head of Group Security at Methods: Legal counsel for Imperial Tobacco Canada pro- British American Tobacco, explained the criteria for selecting vided a list of 60 destroyed documents to British American reports for destruction: “In determining whether a redundant Tobacco. Information in this list was used to search for document contains sensitive information, holders should copies of the documents in British American Tobacco files released through court disclosure. We reviewed and sum- apply the rule of thumb of whether the contents would harm marized this information. or embarrass the Company or an individual if they were to be made public.”6 Results: Imperial Tobacco destroyed documents that British American Tobacco’s destruction policy was most included evidence from scientific reviews prepared by rigorously pursued by its subsidiaries in the United States, British American Tobacco’s researchers, as well as 47 ori - gin al research studies, 35 of which examined the biological Canada and Australia, likely because of the imminent threat activity and carcinogenicity of tobacco smoke. -

Securities and Exchange Commission on February 20, 2018

As filed with the Securities and Exchange Commission on February 20, 2018. SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 Or ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 Or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Or SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report ____________ For the transition period from N/A to N/A Commission file number: 001-14930 HSBC Holdings plc (Exact name of Registrant as specified in its charter) N/A United Kingdom (Translation of Registrant’s name into English) (Jurisdiction of incorporation or organisation) 8 Canada Square London E14 5HQ United Kingdom (Address of principal executive offices) Gavin A Francis 8 Canada Square London E14 5HQ United Kingdom Tel +44 (0) 20 7991 8888 Fax +44 (0) 20 7992 4880 (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: Title of each class Name of each exchange on which registered Ordinary Shares, nominal value US$0.50 each. London Stock Exchange Hong Kong Stock Exchange Euronext Paris Bermuda Stock Exchange New York Stock Exchange* American Depository Shares, each representing 5 New York Stock Exchange Ordinary Shares of nominal value US$0.50 each. -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

On Appeal from the Court of Appeal for British Columbia

Court File No. 33563 IN THE SUPREME COURT OF CANADA (ON APPEAL FROM THE COURT OF APPEAL FOR BRITISH COLUMBIA) BETWEEN: THE ATTORNEY GENERAL OF CANADA APPELLANT/RESPONDENT BY CROSS-APPEAL (THIRD PARTY) – and – IMPERIAL TOBACCO CANADA LIMITED, ROTHMANS, BENSON & HEDGES INC., ROTHMANS INC., JTI-MACDONALD CORP., B.A.T INDUSTRIES P.L.C., BRITISH AMERICAN TOBACCO (INVESTMENTS) LIMITED, CARRERAS ROTHMANS LIMITED, PHILIP MORRIS USA INC., PHILIP MORRIS INTERNATIONAL INC., R.J. REYNOLDS TOBACCO COMPANY and R.J. REYNOLDS TOBACCO INTERNATIONAL, INC. RESPONDENTS/APPELLANTS BY CROSS-APPEAL (APPELLANTS) – and – HER MAJESTY THE QUEEN IN RIGHT OF BRITISH COLUMBIA RESPONDENT (RESPONDENT) – and – ATTORNEY GENERAL OF BRITISH COLUMBIA and ATTORNEY GENERAL OF NEW BRUNSWICK INTERVENERS CONSOLIDATED FACTUM OF RESPONDENTS ON APPEAL AND CONSOLIDATED FACTUM OF APPELLANTS ON CROSS-APPEAL OF ROTHMANS, BENSON & HEDGES INC., ROTHMANS INC., PHILIP MORRIS USA INC. AND PHILIP MORRIS INTERNATIONAL INC. (pursuant to Rules 42 and 43 of the Rules of the Supreme Court of Canada) COUNSEL FOR ROTHMANS, BENSON & OTTAWA AGENT FOR ROTHMANS, HEDGES INC. AND ROTHMANS INC. BENSON & HEDGES INC. AND MACAULAY McCOLL LLP ROTHMANS INC. 1575 – 650 West Georgia Street GOWLING LAFLEUR HENDERSON LLP Vancouver, British Columbia V6B 4N9 2600 – 160 Elgin Street Telephone: 604-687-9811 Ottawa, Ontario K1P 1C3 Facsimile: 604-687-8716 Telephone: 613-233-1781 KENNETH N. AFFLECK, Q.C. Facsimile: 613-563-9869 HENRY S. BROWN, Q.C. COUNSEL FOR PHILIP MORRIS USA OTTAWA AGENT FOR PHILIP MORRIS INC. USA INC. DAVIS & COMPANY LLP GOWLING LAFLEUR HENDERSON LLP 2800 – 666 Burrard Street 2600 – 160 Elgin Street Vancouver, British Columbia V7Y 1K2 Ottawa, Ontario K1P 1C3 Telephone: 604-687-9444 Telephone: 613-233-1781 Facsimile: 604-687-1612 Facsimile: 613-563-9869 D. -

Imperial Tobacco Canada Limited and Imperial Tobacco Company Limited

Court File No. CV-19-616077-00CL Imperial Tobacco Canada Limited and Imperial Tobacco Company Limited PRE-FILING REPORT OF THE PROPOSED MONITOR March 12, 2019 TABLE OF CONTENTS GENERAL .....................................................................................................................................1 INTRODUCTION ............................................................................................................................1 BACKGROUND ..............................................................................................................................6 FORUM .........................................................................................................................................14 ACCOMMODATION AGREEMENT ................................................................................................15 THE TOBACCO CLAIMANT REPRESENTATIVE .............................................................................17 IMPERIAL’S CASH FLOW FORECAST ..........................................................................................18 COURT-ORDERED CHARGES .......................................................................................................20 CHAPTER 15 PROCEEDINGS ........................................................................................................23 RELIEF SOUGHT ...........................................................................................................................24 CONCLUSION ...............................................................................................................................25 -

Cigarette Minimum Retail Price List

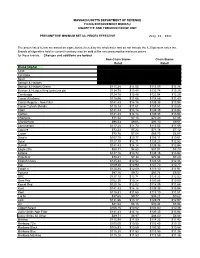

MASSACHUSETTS DEPARTMENT OF REVENUE FILING ENFORCEMENT BUREAU CIGARETTE AND TOBACCO EXCISE UNIT PRESUMPTIVE MINIMUM RETAIL PRICES EFFECTIVE July 26, 2021 The prices listed below are based on cigarettes delivered by the wholesaler and do not include the 6.25 percent sales tax. Brands of cigarettes held in current inventory may be sold at the new presumptive minimum prices for those brands. Changes and additions are bolded. Non-Chain Stores Chain Stores Retail Retail Brand (Alpha) Carton Pack Carton Pack 1839 $86.64 $8.66 $85.38 $8.54 1st Class $71.49 $7.15 $70.44 $7.04 Basic $122.21 $12.22 $120.41 $12.04 Benson & Hedges $136.55 $13.66 $134.54 $13.45 Benson & Hedges Green $115.28 $11.53 $113.59 $11.36 Benson & Hedges King (princess pk) $134.75 $13.48 $132.78 $13.28 Cambridge $124.78 $12.48 $122.94 $12.29 Camel All others $116.56 $11.66 $114.85 $11.49 Camel Regular - Non Filter $141.43 $14.14 $139.35 $13.94 Camel Turkish Blends $110.14 $11.01 $108.51 $10.85 Capri $141.43 $14.14 $139.35 $13.94 Carlton $141.43 $14.14 $139.35 $13.94 Checkers $71.54 $7.15 $70.49 $7.05 Chesterfield $96.53 $9.65 $95.10 $9.51 Commander $117.28 $11.73 $115.55 $11.56 Couture $72.23 $7.22 $71.16 $7.12 Crown $70.76 $7.08 $69.73 $6.97 Dave's $107.70 $10.77 $106.11 $10.61 Doral $127.10 $12.71 $125.23 $12.52 Dunhill $141.43 $14.14 $139.35 $13.94 Eagle 20's $88.31 $8.83 $87.01 $8.70 Eclipse $137.16 $13.72 $135.15 $13.52 Edgefield $73.41 $7.34 $72.34 $7.23 English Ovals $125.44 $12.54 $123.59 $12.36 Eve $109.30 $10.93 $107.70 $10.77 Export A $120.88 $12.09 $119.10 $11.91