Operators' Approaches to Customer Data Monetisation in Europe And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EDI International Settlements Presentation by Eddy Patient September 2001 Contents

ITU SEMINAR (SLOVAKIA) EDI International Settlements Presentation by Eddy Patient September 2001 Contents • EDI & ETIS - Defined • Facts about the ETIS/EDI International Settlements Group • History of the EDI Group and D190 recommendation • EDI Group & Structure • EDI - Defined & how it works • EDI Global Members EDI Electronic Data Interchange EDI/ELECTRONIC COMMERCE IS ..... DATA EXCHANGED ELECTRONICALLY BETWEEN COMPUTERS OVER A NETWORK DATA EXCHANGE TODAY ? Why EDI ? Business BENEFITS uDemand from industry for E-Commerce uSpeed of transaction uAccuracy of data uEase of processing uCost reduction on many levels uSecurity ETIS ETIS e- and telecommunications information services is the platform for the interchange of information, experiences and professional networking at the heart of the Telecommunications industry. It is an industry led group, which brings together telecommunications operators, suppliers and content providers on key information and communication technology issues and facilitates co-operation among them. Facts about ETIS • ETIS is a global organization and has its origins in Europe • It’s members consist of Telecom Operators • ETIS is a non-profit making organization and relies on membership fees to cover costs • In addition to many other activities ETIS has several working groups which focus on specific topics • The International Settlements EDI forum is one such group • ETIS facilitates, supports, coordinate and provides the neutral presence for this group Facts about EDI Group • Members must be International Operators who are licensed to carry international traffic and enter into international agreements • EDI group is a non-profit making group • Relies on membership funding, members input and voluntary contribution from Operators • EDI Group is considered a non-competitive group due to the nature of the topic and its objective • Members are allowed to vote and influence decisions • EDI member Carriers are 40+ ; Approx. -

Case No COMP/M.6948 - TELENOR/ GLOBUL/ GERMANOS

EN Case No COMP/M.6948 - TELENOR/ GLOBUL/ GERMANOS Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 03/07/2013 In electronic form on the EUR-Lex website under document number 32013M6948 Office for Publications of the European Union L-2985 Luxembourg EUROPEAN COMMISSION Brussels, 3.7.2013 C(2013) 4282 final In the published version of this decision, some information has been omitted pursuant to Article PUBLIC VERSION 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible MERGER PROCEDURE the information omitted has been replaced by ranges of figures or a general description. To the notifying party Dear Sir/Madam, Subject: Case No COMP/M.6948 - Telenor/ Globul/ Germanos Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 (1) On 30 May 2013, the European Commission received the notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertaking Telenor ASA ("Telenor", Norway or the "Notifying Party") acquires within the meaning of Article 3(1)(b) of the Merger Regulation control of the whole of the undertakings Cosmo Bulgaria Mobile EAD (trading as "Globul", Bulgaria) and Germanos Telecom Bulgaria EAD ("Germanos", Bulgaria), by way of purchase of shares2. Globul and Germanos are together referred to as the "Target Companies". Telenor, Globul and Germanos are collectively referred to as the "Parties". 1 OJ L 24, 29.1.2004, p. -

Acquisition of Vodafone Sweden Completed

Acquisition of Vodafone Sweden completed Telenor has today paid EUR 994 million to Vodafone, thereby completing the acquisition of the mobile operator Vodafone Sweden. Including debt, the purchase price is EUR 1,035 million. Johan Lindgren will from today enter as CEO of the company. With the completion of the acquisition, Telenor's Scandinavian mobile customer base increases by 37 per cent, reaching a total of 5.6 million subscribers. The transaction secures Telenor a strong position in the Swedish mobile market. Vodafone Sweden is the third largest mobile operator in Sweden with 1.5 million subscribers and a market share of 16 per cent (22 per cent measured in revenues). The company is the second largest player in the Swedish business market with a 30 per cent market share in the corporate segment. Johan Lindgren will from today enter as CEO of the company. Johan Lindgren was previously CFO and Deputy CEO of Bredbandsbolaget, a company that was acquired by Telenor in May 2005. "We are very pleased that Johan Lindgren accepted the position as CEO of Vodafone Sweden. He has extensive experience from executive work, and possesses all the necessary commercial qualities required to take both the company and Telenor's position in the Swedish market further," said Morten Karlsen Sørby, Executive Vice President and Head of Telenor Nordic operations. "I approach this task with a considerable amount of humility. Vodafone Sweden is an operation with a solid position and many excellent services. At the same time we are seeing that the competition is getting tougher, and the company has started an important restructuring process which will also involve cost-reductions," says Johan Lindgren. -

Telenor Seeking to Acquire Control of Digi in Malaysia

Telenor seeking to acquire control of DiGi in Malaysia Telenor, through its wholly-owned subsidiary Telenor Asia Pte. Ltd., today announced that it is seeking to increase its shareholdings in DiGi.Com Berhad ("DiGi"). Telenor presently holds 247 million ordinary shares in DiGi, or approximately 32.9 percent. Telenor has informed the Board of Directors of DiGi of its intention to make a Voluntary Partial Take-over Offer for up to a maximum of 210.5 million additional shares, increasing its total ownership in DiGi to 61 percent, the current maximum foreign ownership allowed by Malaysian authorities. The partial offer was approved by the Securities Commission of Malaysia on June 20, 2001. Under the terms of the offer, Telenor will offer to all holders of the remaining 503 million DiGi shares a cash consideration of RM 6.60 per share for up to 210.5 million shares. The partial tender offer is conditional on Telenor receiving tenders such that it will hold at least 375,000,001 DiGi shares, representing more than 50 percent, at the completion of the offer. If upon completion of the offer Telenor holds 50 percent plus one share or 61 percent, the investment amounts to approx. USD 222 million or USD 365 million respectively. Following the offer, Telenor intends to maintain the public listing status of DiGi on the Kuala Lumpur Stock Exchange (KLSE: DIGI). Telenor is seeking to increase its long-term interest in the Malaysian mobile market through the partial tender offer for DiGi shares. The company is a full-service mobile telecommunications operator in Malaysia, with more than one million mobile subscribers on its GSM1800 network by the end of March 2001. -

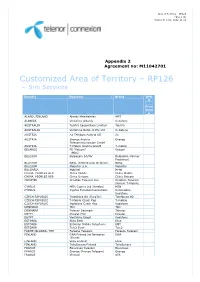

Customized Area of Territory – RP126 – Sim Services

Area of Territory – RP126 Page 1 (3) Version D rel01, 2012-11-21 Appendix 2 Agreement no: M11042701 Customized Area of Territory – RP126 – Sim Services Country Operator Brand GPR S Price Grou p ALAND, FINLAND Alands Mobiltelefon AMT ALBANIA Vodafone Albania Vodafone AUSTRALIA Telstra Corporation Limited Telstra AUSTRALIA Vodafone Network Pty Ltd Vodafone AUSTRIA A1 Telekom Austria AG A1 AUSTRIA Orange Austria Orange Telecommunication GmbH AUSTRIA T-Mobile Austria GmbH T-mobile BELARUS FE “Velcom” Velcom (MDC) BELGIUM Belgacom SA/NV Belgacom (former Proximus) BELGIUM BASE (KPN Orange Belgium) BASE BELGIUM Mobistar S.A. Mobistar BULGARIA Mobiltel M-tel CHINA, PEOPLES REP. China Mobile China Mobile CHINA, PEOPLES REP. China Unicom China Unicom CROATIA Croatian Telecom Inc. Croatian Telecom (former T-Mobile) CYPRUS MTN Cyprus Ltd (Areeba) MTN CYPRUS Cyprus Telecommunications Cytamobile- Vodafone CZECH REPUBLIC Telefónica O2 (EuroTel) Telefónica O2 CZECH REPUBLIC T-Mobile Czech Rep T-mobile CZECH REPUBLIC Vodafone Czech Rep Vodafone DENMARK TDC TDC DENMARK Telenor Denmark Telenor EGYPT Etisalat Misr Etisalat EGYPT Vodafone Egypt Vodafone ESTONIA Elisa Eesti Elisa ESTONIA Estonian Mobile Telephone EMT ESTONIA Tele2 Eesti Tele2 FAROE ISLANDS, THE Faroese Telecom Faroese Telecom FINLAND DNA Finland (fd Networks DNA (Finnet) FINLAND Elisa Finland Elisa FINLAND TeliaSonera Finland TeliaSonera FRANCE Bouygues Telecom Bouygues FRANCE Orange (France Telecom) Orange FRANCE Vivendi SFR Area of Territory – RP126 Page 2 (3) Version D rel01, 2012-11-21 GERMANY E-Plus Mobilfunk E-plus GERMANY Telefonica O2 Germany O2 GERMANY Telekom Deutschland GmbH Telekom (former T-mobile) Deutschland GERMANY Vodafone D2 Vodafone GREECE Vodafone Greece (Panafon) Vodafone GREECE Wind Hellas Wind Telecommunications HUNGARY Pannon GSM Távközlési Pannon HUNGARY Vodafone Hungary Ltd. -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

Telenor Announces Pricing of Its Offering of 70 Million VEON Common Shares and Adss

Telenor announces pricing of its offering of 70 million VEON common shares and ADSs Telenor ASA today announces that the underwriters have priced its offering of 70 million common shares in VEON Ltd. (formerly known as VimpelCom Ltd.) in the form of common shares and American Depositary Shares (ADSs) at a public offering price of USD 3.75 per ADS/share, resulting in net proceeds to Telenor of USD 259 million. The offering is expected to close on or about 12 April 2017. Today's transaction represents 4.0 per cent of VEON's total outstanding common shares, leaving Telenor with approximately 346.7 million VEON ADSs (19.7 per cent of VEON's total outstanding common shares), including the VEON ADSs that are underlying Telenor's USD 1 billion, 3-year exchangeable bond due 2019. Citigroup and Morgan Stanley have acted as joint global coordinators and joint bookrunners for the offering. Following the transaction, VEON will no longer be treated as an associated company in Telenor’s financial reporting and all of the previously recognised currency translation differences, amounting to an accounting loss of NOK 7.5 billion, including tax effects related to the hedging instruments, will be reclassified to the income statement. The effects of reclassification do not impact the total equity of Telenor. The effect will be recognised in the second quarter 2017. The net proceeds of USD 259 million (around NOK 2.2 billion) will be included in Telenor's cash flow statement for the second quarter 2017. The offering of common shares and ADSs is being made pursuant to VEON's shelf registration statement on Form F-3 initially filed with the Securities and Exchange Commission (SEC) on 23 May 2014, as amended and most recently declared effective on 20 April 2016 (the "Registration Statement"). -

KPN Integrated Annual Report 2020 Accelerating Digitalization of the Netherlands

KPN Integrated Annual Report 2020 Accelerating digitalization of the Netherlands Accelerating digitalization of the Netherlands In 2020, the Netherlands experienced a digital acceleration. In this Integrated Annual Report we display five case studies which emphasize the impact on healthcare, culture, public transport, safety and education sectors. KPN employees reflect on the effects of the developments for KPN’s business and internal organization. You can read the case studies on page 18-19, 31-32, 40-41, 49-50 and 64-65. Contents Safeguarding long-term value Financial Statements Appendices KPN at a glance Appendices CEO letter to stakeholders 6 Appendix 1: Alternative Performance Measures 180 Our purpose and the world around us 9 Appendix 2: Connectivity of non-financial information 182 Strategy, key performance and value creation model 12 Appendix 3: Transparency, materiality and 185 stakeholder engagement The value we create Appendix 4: List of top risks 198 Our value for stakeholders Appendix 5: Glossary 205 - Customer value 20 Appendix 6: Social figures 211 - Shareholder value 24 Appendix 7: Environmental figures 213 - Impact on society 28 Appendix 8: Supply chain 218 Appendix 9: Tax overview for continuing operations 220 Our performance per country - Network infrastructure 33 Appendix 10: GRI index 221 - Flexible, simple and converged products and services 36 - Focused innovation and digitalization 42 Notes: - Safeguarded privacy and security 46 The Board of Management Report consist of pages 6 - 82. - Sustainable employability 51 KPN's policy regarding board diversity is described on pages - Environmental performance and responsible 55 90 - 93. The detailed list of top risks can be found in Appendix 4. -

Telenor Group's Response to CDP 2020

Telenor Group’s response to CDP 2020 Climate Change (Investor CDP) for the reporting year 1 January-31 December 2019 Sector: Telecommunications Industry Group: Diversified Telecommunication Services Sub Industry: Integrated Telecommunication Services www.cdp.net www.telenor.com Sensitivity: Open Telenor Group - Climate Change 2020 C0. Introduction C0.1 (C0.1) Give a general description and introduction to your organization. Climate change is one of the greatest challenges facing people, businesses and governments. The mobile industry’s technology and smart services through Internet of Things (IoT) have the potential to cut global carbon emissions, reduce resource intensity, stimulate economic growth, and deliver substantial social benefits. Telenor has over the years followed up potential business initiatives and partnerships offering eco efficient solutions. Telenor Group is a leading telecommunications company across the Nordics and Asia with 186 million customers and annual sales of around USD 12 billion (2019). We hold #1 or #2 positions in most of our markets. We are committed to responsible business conduct and driven by the ambition of empowering societies. Connectivity has been Telenor's domain for more than 160 years, and our purpose is to connect our customers to what matters most. Telenor is listed at Oslo Stock Exchange under the ticker TEL. Telenor Group’s emissions of greenhouse gases in 2019 has been estimated to be a total of around 1.1 million tonnes of CO2 when using location-based electricity emission factors for the indirect scope 2 emissions, an increase of 9 per cent compared to recalculated data from 2018. The operations in Asia account for 96 per cent of the CO2 emissions, of which 80 per cent is related to grid electricity, while the remaining 16 per cent stems from diesel generators. -

Country List for Cellular Plans

Campbell Scientific, Inc. Cellular Data Service World-Wide Coverage Plans Campbell Scientific Cellular Data Service is offered in the countries listed below. The list identifies the data plan code, associated cellular network carrier, and available countries. Orders for cellular data service need to indicate the desired plan. Service in other countries may be available. Contact Campbell Scientific if service is needed in a country not shown on the list. The customer is responsible to verify the modem is supported by the carrier. Cellular data service is subject to the Campbell Scientific, Inc., Cellular Data Service Plan Terms and Conditions and Customer Agreement found at www.campbellsci.com/cell-terms. Plan Country Operator IT1A Albania Eagle Mobile IT1A Albania Vodafone - Albania IT1B Anguilla Cable and Wireless (Anguilla) Ltd IT1B Antigua and Barbuda Cable & Wireless Antigua & Barbuda Ltd IT1B Argentina Telefónica Móviles Argentina S.A. IT1A Armenia Armenia Telephone Company (Armentel) Joint Venture IT1B Armenia UCOM LLC IT1B Aruba New Millennium Telecom Services NV IT1A Australia SingTel Optus Pty Limited IT1B Australia Telstra Corporation Limited IT1A Australia Vodafone Hutchison Australia Pty Limited IT1A Austria A1 Telekom Austria AG IT1A Austria T-Mobile Austria GmbH IT1A Azerbaijan Azercell Telecom LLC IT1A Bangladesh Banglalink Digital Communications Ltd. IT1B Bangladesh Grameenphone Ltd IT1B Barbados Cable & Wireless (Barbados) Ltd IT1A Belarus JLLC Mobile TeleSystems IT1A Belarus Unitary enterprise velcom IT1A Belgium ORANGE Belgium nv/SA IT1A Belgium Proximus PLC IT1A Belgium Telenet Group BVBA/SPRL IT1B Belize Belize Telemedia Limited IT1B Benin Etisalat Benin SA IT1A Bolivia (Plurinational State of) TIGO - Telefonica Celular de Bolivia S.A. -

Telenor Connexion Provides Advanced Iot Data Analytics to Its Clients

in collaboration with Internet of Things analytics can really drive value. ARTS provides our customers with a tool to understand “the IoT data at their disposal. It has the added benefit of reducing maintenance costs, generating savings and uncovering new revenue streams.” Anders Bresell Head of Technology Development Telenor Connexion Overview Telenor Connexion Provides Customer Name: Telenor Connexion Industry: Telecommunication/ Advanced IoT Data Analytics to Internet of Things HQ Location: Sweden Its Clients Client Challenges/Business Need: A lack of self-service troubleshooting capability for clients. Capgemini Enables the Leading IoT Solutions Solution-at-a-glance: A state-of- Provider to Jump Ahead of the Competition the-art self-service trouble-shooting system, the Advanced Real-time troubleshooting Tool Set (ARTS). Connecting the World In today’s world the term offline is no longer applicable, Telenor Connexion makes Results (Benefits): sure its clients are connected to the digital word, enabling them to make the most of • Lower time spent on the Internet of Things. The company connects people, places and things through troubleshooting over 400 mobile networks making up one global IoT system. • Reduced downtime for clients Lagging Legacy Systems • Improved analytics capability While Telenor Connexion provided its customers with high quality mobile connectivity on a global level, there was untapped potential in mining data from its global systems for the benefit of the company and its clients. At the time, Telenor Connexion had limited strategic insight into network performance and geographical device distribution, and the decision was made to improve on these systems. The adoption of advanced data analytics would also provide powerful self-service troubleshooting capabilities for clients who previously could not take action on connectivity issues. -

Analysys Mason Provides an Assessment of Cisco Prime For

Cisco: Network management systems Company Profile Cisco Prime for Service Providers: network management systems January 2013 Glen Ragoonanan and Anil Rao © Analysys Mason Limited 2013 Cisco: Network management systems 2 Company summary . Founded in 1984, Cisco is one of world’s leading suppliers of Figure 1: Cisco company facts [Source: Analysys Mason, 2013] IP-NGN network equipment, particularly in carrier-grade and enterprise routers and switches. It also supplies network Founded 1984 management, subscriber/CPE management and operations support systems providing lifecycle management for creating Offices San Jose (HQ), worldwide and operationalising services, primarily on its own equipment. Employees 72 360 . Cisco has transformed its OSS portfolio from an unstructured and disparate set of software components into a consolidated Regional focus Worldwide and highly modular product suite called Cisco Prime. Cisco Prime for Service Providers targets management of IP-NGN, NMS revenue USD363 million, 2011 cloud, mobile Internet and video infrastructure. Cisco Customers AT&T, Bell Mobility, China Telecom, Comcast, KPN, extended its Cisco Prime network management systems NTT Plala, Shaw Communications, Telenor, (NMS) portfolio into its strong enterprise business unit with TIM (Brazil) and Verizon Wireless Cisco Prime for IT. Selected key Enventis, Inmarsat, Integrated Broadband Services . Cisco Prime for Service Providers is the focus of this profile. customers1 (IBBS), Unitymedia It has been built partly ground up and partly through the acquisition of assets such as Axioss from Comptel in 2011, Partnerships N/a which supplemented Cisco’s core elements and network management capabilities with service fulfilment functionality. Company status Publicly owned Cisco can now offer a comprehensive end-to-end service lifecycle management solution to CSPs.