In the Court of Chancery of the State of Delaware

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

News Corporation (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 November 15, 2017 DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) NEWS CORPORATION (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) Delaware 001-35769 46-2950970 (STATE OR OTHER JURISDICTION (COMMISSION FILE NO.) (IRS EMPLOYER OF INCORPORATION) IDENTIFICATION NO.) 1211 Avenue of the Americas, New York, New York 10036 (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES, INCLUDING ZIP CODE) (212) 416-3400 (REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Form 10-K Filed by News Corp with SEC

ASX Announcement 11 August 2021 Form 10-K filed by News Corp with SEC On behalf of REA Group Ltd (ASX:REA) please find attached Form 10-K as filed by News Corp with the SEC for Q4 FY21 -ends- For further information, please contact: REA Group Ltd Investors: REA Group Ltd Media: Graham Curtin Prue Deniz General Manager Group Reporting Executive Manager Corporate Affairs P: +61 3 8456 4288 M: + 61 438 588 460 E: [email protected] E: [email protected] The release of this announcement was authorised by Tamara Kayser, Company Secretary. About REA Group Ltd: (www.rea-group.com): REA Group Ltd ACN 068 349 066 (ASX:REA) (“REA Group”) is a multinational digital advertising business specialising in property. REA Group operates Australia’s leading residential and commercial property websites – realestate.com.au and realcommercial.com.au – as well as the leading website dedicated to share property, Flatmates.com.au. REA Group owns Smartline Home Loans Pty Ltd and Mortgage Choice Ltd, Australian mortgage broking franchise groups, and PropTrack Pty Ltd, a leading provider of property data services. In Australia, REA Group holds strategic investments in Simpology Pty Ltd, a leading provider of mortgage application and e-lodgement solutions for the broking and lending industries; Realtair Pty Ltd, a digital platform providing end-to-end technology solutions for the real estate transaction process, Campaign Agent Pty Ltd, Australia’s leading provider of Buy Now Pay Later solutions for the Australian real estate market and Managed Platforms Pty Ltd, an emerging Property Management software platform. -

News Corporation 1 News Corporation

News Corporation 1 News Corporation News Corporation Type Public [1] [2] [3] [4] Traded as ASX: NWS ASX: NWSLV NASDAQ: NWS NASDAQ: NWSA Industry Media conglomerate [5] [6] Founded Adelaide, Australia (1979) Founder(s) Rupert Murdoch Headquarters 1211 Avenue of the Americas New York City, New York 10036 U.S Area served Worldwide Key people Rupert Murdoch (Chairman & CEO) Chase Carey (President & COO) Products Films, Television, Cable Programming, Satellite Television, Magazines, Newspapers, Books, Sporting Events, Websites [7] Revenue US$ 32.778 billion (2010) [7] Operating income US$ 3.703 billion (2010) [7] Net income US$ 2.539 billion (2010) [7] Total assets US$ 54.384 billion (2010) [7] Total equity US$ 25.113 billion (2010) [8] Employees 51,000 (2010) Subsidiaries List of acquisitions [9] Website www.newscorp.com News Corporation 2 News Corporation (NASDAQ: NWS [3], NASDAQ: NWSA [4], ASX: NWS [1], ASX: NWSLV [2]), often abbreviated to News Corp., is the world's third-largest media conglomerate (behind The Walt Disney Company and Time Warner) as of 2008, and the world's third largest in entertainment as of 2009.[10] [11] [12] [13] The company's Chairman & Chief Executive Officer is Rupert Murdoch. News Corporation is a publicly traded company listed on the NASDAQ, with secondary listings on the Australian Securities Exchange. Formerly incorporated in South Australia, the company was re-incorporated under Delaware General Corporation Law after a majority of shareholders approved the move on November 12, 2004. At present, News Corporation is headquartered at 1211 Avenue of the Americas (Sixth Ave.), in New York City, in the newer 1960s-1970s corridor of the Rockefeller Center complex. -

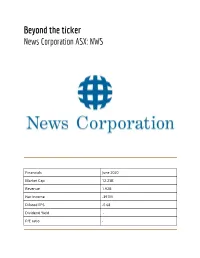

2.0 Financial Statement Breakdown

Beyond the ticker News Corporation ASX: NWS Financials June 2020 Market Cap 12.23B Revenue 1.92B Net Income -397M Diluted EPS -0.68 Dividend Yield - P/E ratio - Introduction 1.0 Focus Point - ALL News Corp has 3.95 B in goodwill on their balance sheet which accounts for 27.7% of their total assets. The balance sheet will come under pressure when it comes time to write down the goodwill. A positive focus point from New Corp is their streaming services, specifically Kayo. The streaming services provide a solid future stream of revenue. 2.0 Financial Statement Breakdown 2.1 Majority shareholders Name Number of shares Percentage of shares Rowe Price Associates, Inc. (Investment 65,749,732 16.9% Management) The Vanguard Group, Inc. 52,924,384 13.6% Independent Franchise Partners LLP 31,361,390 8.07% Yacktman Asset Management LP 21,058,734 5.42% Hotchkis & Wiley Capital Management LLC 20,559,584 5.29% SSgA Funds Management, Inc. 19,574,176 5.03% Southeastern Asset Management, Inc. 16,054,798 4.13% Dodge & Cox 13,740,109 3.53% Aristotle Capital Management LLC 11,050,110 2.84% Burgundy Asset Management Ltd. 10,598,948 2.73% 2.2 Directors and Executives - Andrew K. Rupert Murdoch - Executive Chairman Mr Rupert Murdoch is a well known Australian Media investor. He has a wealth of 17.6 billion from 21st Century Fox and News Corporation, he has been with and grown News Corp since it was a small single newspaper in Adelaide, Australia. Lachlan K. Murdoch - Co-Chairman Mr Lachlan Murdoch, as the name suggests is the son of Rupert, he is currently the CEO of Fox corporation and Co-Chairman of News Corporation. -

View Annual Report

Annual Report 2017 Find It Faster Critical Data Search is Connect to the always right at markets in real time your fi ngertips. with a redesigned data center. Save and Share Easily share stories or save them for o ine reading. What’s News A streamlined What’s News feed brings you the day’s top stories. The Wall Street Journal saw strong digital growth Easier to nearly 1.3 millionNavigation subscribers, representing A cleaner navigation bar gets you where 56% of total paidyou want subscribers.to go faster. Upwardly Mobile Introducing the new WSJ iPhone app for iOS. With an enhanced data center, easier navigation, save and share functionality and more, the new WSJ app keeps you moving. DOWNLOAD NOW HarperCollins celebrated its 200th anniversary. © 2017 Dow Jones & Co., Inc. All rights reserved. 6DJ5844 realtor.com®, the leading digital real estate site in engagement in the U.S., is the most important source of leads for real estate professionals. People visited realestate.com.au 2.5 times more than its nearest competitor. The Digital Real Estate Services segment contributed nearly 40% of News Corp’s profi tability. The Sun more than doubled its global monthly unique online visitors to a record 85 million. THE ELECTION 2017 EXIT POLL Friday,Sun June 9, 2017 FOR A GREATER BRITAIN 50p thesun.co.uk VERDICT lTories ‘fail LABOUR 266 on majority’ 34 lShe’s set to SNP 34 lose 17 seats 22 lCoalition LIB DEM At The Australian, readership grew to 14 of chaos fear 5 nearly half a million weekday readers. -

Annual Report 2016 More Than 50% of Dow Jones Revenues Came from Digital N N N N N N

Annual Report 2016 More than 50% of Dow Jones revenues came from digital n n n n n n WSJ+ GETAWAY Win a Three-Night Stay at Enchantment Resort in Arizona* Nestled among the towering red rocks of Sedona, Arizona, Enchantment Resort n n n n n n n n n n n n n n n n n n n n combines rugged grandeur with luxury and Native American culture. Enjoy stunning scenery and a wide array of activities, including golf at Seven Canyons. COMPETITION CLOSES AT MIDNIGHT ON OCTOBER 31, 2015 HarperCollins expanded ENTER NOW AT WSJPLUS.COM/SEDONA operations in Brazil, EXCLUSIVE TO SUBSCRIBERS France and Italy OFFERS / EXPERIENCES / GETAWAYS / TALKS *No purchase necessary. Void where prohibited. Open to subscribers as of October 2, 2015, 21 and over, who are legal residents of the 50 United States (or D.C.). For full offi cial rules visit wsjplus.com/offi cialrules. © 2015 Dow Jones & Co., Inc. All rights reserved. 6DJ2672 INT ROD UCING n n n n n n Mobile now accounts for ONLY THE EX CEPTIONAL more than 50% of realtor.com®’s overall traffic INT ROD UCING ONLY THE EX CEPTIONAL INT ROD UCING ONLY THE EX CEPTIONAL n n n n n n n n n n n n n n n n n n n n n n n The premier digital destination that connects your brand to the world’s most affluent property seekers featuring a unique selection of prestige properties, premium news, data and insights. mansionglobal.com For advertising opportunities, please contact [email protected] REA acquired iProperty, LAUNCH PARTNERS: Asia’s #1 onlineLAUNCH property PARTNERS: group LAUNCH PARTNERS: © 2015 Dow Jones & Co., Inc. -

Top Execs Settle Into Easy Living

CNYB 03-31-08 A 1.qxp 3/28/2008 8:48 PM Page 1 TOP STORIES BOARDS: THETOP Yahoo loses execs to smaller NYC media companies PAGE 3 ® 25 Page 19 Brit club owner aims for VOL. XXIV, NO. 13 WWW.CRAINSNEWYORK.COM MARCH 31-APRIL 6, 2008 PRICE: $3.00 enduring empire PAGE 2 Home Depot New surgery hard to stomach could drop for most patients PAGE 3 Harlem lease Cruise New bloomberg news York Harbor for PROJECT IN PERIL: Moynihan Station, seen here in an artist’s rendering, may not be built. to Franklin D. Roosevelt Drive. Frail economy drives “We are re-evaluating this site $50,000—really other chains to pull to determine if it still makes sense NEW YORK, NEW YORK, P. 6 for our business,” a Home Depot plug on growth plans, spokeswoman says. Why mega-projects too; some soldier on The home-improvement chain has been promising for 10 years to BUSINESS LIVES open a store at the former Wash- are falling apart BY ELISABETH BUTLER CORDOVA burn Wire Factory site,where Tar- get and Best Buy have also signed the home depot inc. may walk leases. Real estate sources say that Financing is crucial, approval. When even just one of away from long-standing plans to Home Depot would be responsible those legs is broken,the project can open a 100,000-square- for subleasing its space if but so is political, weaken and, in some cases, fail. foot store at East River RECESSION it decides not to open a community support That reality has become Plaza, a major new de- store there. -

Reconsidering Occupy Oakland and Its Horizons

Reconsidering Occupy Oakland and Its Horizons: Media Misframing, Decolonizing Fractures, and Enduring Resistance Hub Madison Marie Alvarado Research Supervisor: Frances Susan Hasso Reader: Jennifer Christine Nash This thesis is submitted in partial fulfillment of the requirements for Graduation with Distinction in the Program in Gender, Sexuality, and Feminist Studies Duke University Durham, North Carolina 2021 Abstract Reconsidering Occupy Oakland and Its Horizons is an archival study of the creation, reception, evolution, and remembrance of Occupy Oakland using a feminist lens. I investigate how Occupy Oakland’s radically democratic mobilization against economic violence, racism, and police violence was undermined by local and regional news coverage—namely in the San Francisco Chronicle and Oakland Tribune—through framing devices that demonized protesters and delegitimized the movement. I nevertheless found differences between local and regional coverage. Occupy Oakland challenged existing hegemonic boundaries regarding participatory democracy as its activists –seasoned and less experienced people from multiple generations – experimented with horizontal world-building through community structures, methods, and processes. This horizontal radical movement nevertheless struggled with the same divisions and inequalities that existed outside its camps: heteropatriarchy, white supremacy, and classism. The “stickiness” of embodied and structural inequalities persisted in Occupy Oakland camps despite efforts to create a radically egalitarian community. The nature of this stickiness can only be understood by taking seriously the local material and institutional conditions, obstacles, and histories that shaped the spaces of protest and its participants. Though news coverage often describes the movement as a failure, several new projects and coalitions formed during and after Occupy Oakland, illustrating its dynamic legacy and challenging social movement scholarship that reproduces temporal demise frameworks in its analysis. -

For Personal Use Only Use Personal For

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): November 6, 2018 NEWS CORPORATION (Exact name of registrant as specified in its charter) Delaware 001-35769 46-2950970 (State or other jurisdiction (Commission (IRS Employer of incorporation) File Number) Identification No.) 1211 Avenue of the Americas, New York, New York 10036 (Address of principal executive offices, including zip code) (212) 416-3400 (Registrant's telephone number, including area code) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Notice of Annual Meeting of Stockholders Date Andtime November 18, 2020, 3:00 P.M

Notice of Annual Meeting of Stockholders Date andTime November 18, 2020, 3:00 p.m. (Eastern Standard Time) YOUR VOTE IS IMPORTANT Even if you plan to participate in the Annual Meeting virtually, we encourage you to vote and submit your Virtual Meeting Location proxy in advance by: The 2020 Annual Meeting of News Corporation (the ‘‘Company’’) will be held exclusively via live webcast at visiting www.proxyvote.com (common www.virtualshareholdermeeting.com/NWS2020. stock) or www.investorvote.com.au (CDIs) returning your signed proxy card or voting Record Date instruction form September 21, 2020 calling 1-800-690-6903 toll-free from the United States, U.S. territories and Canada (common stock only) Advance voting deadlines are noted on page 66 of the proxy statement Items to be Voted ■ elect the nine Directors identified in the attached proxy statement to the Board of Directors (the ‘‘Board’’) of the Company; ■ ratify the selection of Ernst &Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2021; ■ consider an advisory vote to approve executive compensation; ■ consider an advisory vote on the frequency of future advisory votes to approve executive compensation; ■ consider the stockholder proposal described in the attached proxy statement, if properly presented at the Annual Meeting; and ■ consider any other business properly brought before the Annual Meeting and any adjournment or postponement thereof. Eligibility to Vote While all of the Company’s stockholders and all holders of CHESS Depositary Interests (‘‘CDIs’’) exchangeable for shares of the Company’s common stock are invited to attend and ask questions at the Annual Meeting, only stockholders of record of the Company’s Class B Common Stock and holders of CDIs exchangeable for shares of the Company’s Class B Common Stock at the close of business on September 21, 2020, the Record Date, are entitled to notice of, and to vote on the matters to be presented at, the Annual Meeting and any adjournment or postponement thereof. -

VOTE NO at NEWS CORPORATION the Comptroller's Office

VOTE NO AT NEWS CORPORATION The Comptroller’s Office recommends that the NYC Funds vote against 9 of 15 directors at News Corporation’s annual meeting scheduled for October 21, 2011. The directors include insiders David Devoe, James Murdoch, Lachlan Murdoch, Rupert Murdoch and Arthur Siskind, and outside directors Natalie Bancroft, Viet Dinh, Roderick Eddington and Andrew Knight. Because News Corp’s dual class share structure effectively insures all directors will be re- elected, the objective is to send a strong message regarding the need to reconstitute the board. We note that the five NYC Pension Funds collectively hold shares valued at $95 million, only a small portion of which – held by BERS, Fire and NYCERS –have voting rights. News Corp Holdings at 10/12/11 close Voting Non-Voting Total BERS $ 155,610 $ 1,906,889 $ 2,062,499 Fire $ 134,235 $ 5,934,008 $ 6,068,243 NYCERS $ 518,985 $ 33,220,307 $ 33,739,292 Police $ - $ 18,326,036 $ 1,071,698 TRS $ - $ 34,913,925 $ 2,041,750 Total $ 808,830 $ 94,301,165 $ 95,109,995 Summary The growing phone hacking scandal and resulting corporate crisis at News Corp. are ultimately the consequence of a weak board that failed to exercise independent oversight of management over an extended period. The board had ample red flags over the past five years regarding improper practices not unlike those in the current scandal, including multiple payouts totaling $655 million to settle litigation alleging hacking, corporate espionage and anticompetitive behavior at a US subsidiary (New York Times, 7/17/11). -

Proxy Statement Pursuant to Section 14(A) of the Securities Exchange Act of 1934 (Amendment No

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant ☒ Filed by a Party other than the Registrant □ Check the appropriate box: □ Preliminary Proxy Statement □ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement □ Definitive Additional Materials □ Soliciting Material under §240.14a-12 NEWS CORPORATION (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. □ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each Class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: □ Fee paid previously with preliminary materials. □ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. (1) Amount previously paid: For personal use only (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: Notice of Annual Meeting of Stockholders Date andTime November 6, 2018, 10:00 a.m.