Market Study & Valuation Report Prepared

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Page 1 of 283 State Cong Code LEA Code LEA Name Estimated FY2018

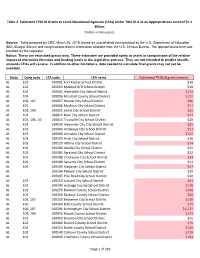

Table 2. Estimated FY2018 Grants to Local Educational Agencies (LEAs) Under Title IV-A at an Appropriations Level of $1.1 Billion Dollars in thousands Source: Table prepared by CRS, March 26, 2018, based on unpublished data provided by the U.S. Department of Education (ED), Budget Service and congressional district information available from the U.S. Census Bureau. The appropriations level was provided by the requester. Notice: These are estimated grants only. These estimates are provided solely to assist in comparisons of the relative impact of alternative formulas and funding levels in the legislative process. They are not intended to predict specific amounts LEAs will receive. In addition to other limitations, data needed to calculate final grants may not yet be available. State Cong code LEA code LEA name Estimated FY2018 grant amount AL 102 100001 Fort Rucker School District $10 AL 102 100003 Maxwell AFB School District $10 AL 104 100005 Albertville City School District $153 AL 104 100006 Marshall County School District $192 AL 106, 107 100007 Hoover City School District $86 AL 105 100008 Madison City School District $57 AL 103, 106 100011 Leeds City School District $32 AL 104 100012 Boaz City School District $41 AL 103, 106, 107 100013 Trussville City School District $20 AL 103 100030 Alexander City City School District $83 AL 102 100060 Andalusia City School District $51 AL 103 100090 Anniston City School District $122 AL 104 100100 Arab City School District $26 AL 105 100120 Athens City School District $54 AL 104 100180 Attalla -

Why Middle-Class Parents in New Jersey Should Be Concerned About Their Local Public Schools

Not As Good as You Think Why Middle-Class Parents in New Jersey Should be Concerned About Their Local Public Schools By Lance Izumi, J.D. with Alicia Chang Ph.D. 1 Not As Good as You Think Why Middle-Class Parents in New Jersey Should be Concerned About Their Local Public Schools By Lance Izumi, J.D. with Alicia Chang Ph.D. NOT AS GOOD AS YOU THINK Why Middle-Class Parents in New Jersey Should Be Concerned about Their Local Public Schools by Lance Izumi, J.D. with Alicia Chang, Ph.D. February 2016 ISBN: 978-1-934276-24-2 Pacific Research Institute 101 Montgomery Street, Suite 1300 San Francisco, CA 94104 Tel: 415-989-0833 Fax: 415-989-2411 www.pacificresearch.org Download copies of this study at www.pacificresearch.org. Nothing contained in this report is to be construed as necessarily reflecting the views of the Pacific Research Institute or as an attempt to thwart or aid the passage of any legislation. ©2016 Pacific Research Institute. All rights reserved. No part of this publi- cation may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopy, recording, or other- wise, without prior written consent of the publisher. Contents Acknowledgements ............................................................................................... 3 Executive Summary............................................................................................... 5 Introduction and Background on “Not As Good As You Think” Research ................ 8 Performance of New Jersey Students -

Download, View and Print the Second Part of the Report As a Pdf File

Universe of Public Elementary and Secondary Education Agencies - Fall 2002 MONTANA / Page 203 Total 2001-02 Name of Agency Mailing Address Telephone Name of County Metro Grade Student Reg HS Spec Ed Teachers Sch's Street or P.O. Box City ZIP Number Status Span Membership Grads IEP Regular School Districts ABSAROKEE ELEM 327 S WOODARD AVE ABSAROKEE 59001 406-328-4583 STILLWATER 3 PK-08 237 † 39 17 2 ABSAROKEE H S 327 S WOODARD AVE ABSAROKEE 59001 406-328-4583 STILLWATER 3 09-12 121 33 8 11 1 ALBERTON K-12 SCHOOLS PO BOX 330 ALBERTON 59820 406-722-4413 MINERAL 3 PK-12 210 20 33 18 3 ALBION ELEM (NON-OP) HC 50 BOX 3 ALZADA 59311 406-828-4598 CARTER 3 N -N † † † † -2 ALDER ELEM PO BOX 110 ALDER 59710 406-842-5285 MADISON 3 PK-06 13 † † 2 1 ALZADA ELEM BOX 8 ALZADA 59311 406-828-4554 CARTER 3 PK-08 10 † 4 1 1 AMSTERDAM ELEM 6360 CAMP CREEK ROAD MANHATTAN 59741 406-282-7216 GALLATIN 3 KG-06 75 † 14 6 1 ANACONDA ELEM PO BOX 1281 ANACONDA 59711 406-563-8277 DEER LODGE 3 PK-08 927 † 162 58 4 ANACONDA H S PO BOX 1281 ANACONDA 59711 406-563-8277 DEER LODGE 3 09-12 476 90 62 26 1 ANDERSON ELEM 10040 COTTONWOOD ROAD BOZEMAN 59718 406-587-1305 GALLATIN 3 PK-08 184 † 15 14 2 ARLEE ELEM PO BOX 37 ARLEE 59821 406-726-3216 LAKE 3 PK-08 324 † 46 28 2 ARLEE H S PO BOX 37 ARLEE 59821 406-726-3216 LAKE 3 09-12 147 21 14 12 1 ARROWHEAD ELEM PO BOX 37 PRAY 59065 406-333-4359 PARK 3 PK-08 121 † 17 11 2 ASHLAND ELEM BOX 17 ASHLAND 59003 406-784-2568 ROSEBUD 3 PK-08 53 † 19 7 2 AUCHARD CREEK ELEM 9605 HWY 287 WOLF CREEK 59648 406-562-3528 LEWIS AND CLARK 3 PK-08 -

ESEA Waiver - Annual Progress Targets

ESEA Waiver - Annual Progress Targets CDS CODE : 27-0450-888 DISTRICT : Boonton Town School District SCHOOL : DISTRICT LEVEL The tables represent the annual proficiency targets, established for this School under ESEA Waiver Schools and Subgroups could meet expectations either by meeting the statewide proficiency rate of 90 percent, or reaching their individually determined progress targets. The statewide proficiency rate will be increased to 95 percent in 2015. Performance Targets - Language Arts Literacy # of Valid Baseline Yearly Baseline 2011-2012 2012-2013 2013-2014 2014-2015 2015-2016 2016-2017 Subgroup Test Scores % Proficient Increment year Target (%P) Target (%P) Target (%P) Target (%P) Target (%P) Target (%P) Schoolwide 520 78.6 1.8 1011 80.4 82.2 84 85.8 87.6 89.4 White 299 84 1.4 1011 85.4 86.8 88.2 89.6 90 90 Black 45 60 3.3 1011 63.3 66.6 69.9 73.2 76.5 79.8 Hispanic 55 70.9 2.4 1011 73.3 75.7 78.1 80.5 82.9 85.3 American Indian - - - 1011 - - - - - - Asian 119 76.5 2 1011 78.5 80.5 82.5 84.5 86.5 88.5 Two or More Races - - - 1011 - - - - - - Students with Disabilities 118 44.9 4.6 1011 49.5 54.1 58.7 63.3 67.9 72.5 Limited English Proficiency - - - 1011 - - - - - - Economically Disadvantaged 136 69.1 2.6 1011 71.7 74.3 76.9 79.5 82.1 84.7 Performance Targets - Mathematics # of Valid Baseline Yearly Baseline 2011-2012 2012-2013 2013-2014 2014-2015 2015-2016 2016-2017 Subgroup Test Scores % Proficient Increment year Target (%P) Target (%P) Target (%P) Target (%P) Target (%P) Target (%P) Schoolwide 522 81.4 1.6 1011 83 84.6 -

School District of the Borough of Butler County of Morris, New Jersey

SCHOOL DISTRICT OF THE BOROUGH OF BUTLER COUNTY OF MORRIS, NEW JERSEY COMPREHENSIVE ANNUAL FINANCIAL REPORT FOR THE FISCAL YEAR ENDED JUNE 30, 2017 THIS PAGE INTENTIONALLY LEFT BLANK COMPREHENSIVE ANNUAL FINANCIAL REPORT of the Borough of Butler School District Board of Education Butler, New Jersey For the Fiscal Year Ended June 30, 2017 Prepared by Borough of Butler School District Board of Education Finance Office THIS PAGE INTENTIONALLY LEFT BLANK COMPREHENSIVE ANNUAL FINANCIAL REPORT OF THE BOROUGH OF BUTLER SCHOOL DISTRICT FOR THE FISCAL YEAR ENDED JUNE 30, 2017 TABLE OF CONTENTS INTRODUCTORY SECTION Page Letter of Transmittal 1 - 5 Organizational Chart 6 Roster of Officials 7 Consultants and Advisors 8 FINANCIAL SECTION Independent Auditor's Report 9 - 12 Required Supplementary Information - Part I Management's Discussion and Analysis 13 - 21 Basic Financial Statements A. District-wide Financial Statements: A-1 Statement of Net Position 22 A-2 Statement of Activities 23 B. Fund Financial Statements: Governmental Funds: B-1 Balance Sheet 24 B-2 Statement of Revenues, Expenditures, and Changes in Fund Balance 25 B-3 Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances of Governmental Funds to the Statement of Activities 26 Proprietary Funds: B-4 Statement of Net Position 27 B-5 Statement of Revenues, Expenses, and Changes in Fund Net Position 28 B-6 Statement of Cash Flows 29 Fiduciary Funds: B-7 Statement of Fiduciary Net Position 30 B-8 Statement of Changes in Fiduciary Net Position 31 Notes to the Basic Financial Statements 32 - 69 COMPREHENSIVE ANNUAL FINANCIAL REPORT OF THE BUTLER BOROUGH SCHOOL DISTRICT FOR THE FISCAL YEAR ENDED JUNE 30, 2017 TABLE OF CONTENTS (Continued) FINANCIAL SECTION (Continued) Page Required Supplementary Information - Part II C. -

Appendix B DEFENDANTS SCHOOL DISTRICTS in the UNITED STATES

Case 1:20-cv-05878-CM Document 1-1 Filed 07/28/20 Page 1 of 119 Appendix B DEFENDANTS SCHOOL DISTRICTS IN THE UNITED STATES (Abbreviations: S.D. = School District, I.S.D. = Independent School District, Unified School District = U.S.D., Consolidated School District = C.S.D., Elementary School District = E.S.D., School District = S.D.) Alabama Alabaster City Enterprise City Montgomery County Albertville City Escambia County Morgan County Alexander City Etowah County Mountain Brook City Andalusia City Eufaula City Muscle Shoals City Anniston City Fairfield City Oneonta City Arab City Fayette County Opelika City Attalla City Florence City Opp City Athens City Fort Payne City Oxford City Auburn City Fort Rucker Ozark City Autauga County Franklin County Pelham City Schools Baldwin County Gadsden City Pell City Barbour County Geneva City Perry County Bessemer City Geneva County Phenix City Bibb County Greene County Pickens County Birmingham City Guntersville City Piedmont City Blount County Hale County Pike County Boaz City Haleyville City Randolph County Brewton City Hartselle City Roanoke City Bullock County Henry County Russell County Butler County Homewood City Russellville City Calhoun County Hoover City Saint Clair County Chambers County Houston County Saraland Cherokee County Huntsville City Scottsboro City Chilton County Jackson County Selma City Choctaw County Jacksonville City Sheffield City Clarke County Jasper City Shelby County Clay County Jefferson County Sumter County Cleburne County Lamar County Sylacauga City Coffee County Lanett -

Candidates for the 2016 Presidential Scholars Program

Candidates for the Presidential Scholars Program January 2016 [*] An asterisk indicates a Candidate for Presidential Scholar in the Arts. [**] A double asterisk indicates a Candidate for Presidential Scholar in Career and Technical Education. Candidates are grouped by their legal place of residence; the state abbreviation listed, if different, may indicate where the candidate attends school. Alabama AL - Auburn - Anna Greene, Auburn High School AL - Auburn - Megan Lange, Auburn High School AL - Banks - Madelyn E. Montgomery, Evangel Family Christian Academy AL - Birmingham - Joseph Bannerman, Ramsay High School AL - Birmingham - Alana Bennett, P. D. Jackson-Olin High School AL - Birmingham - Natalie E. Conboy, Vestavia Hills High School AL - Birmingham - Alexander Debruge, Mountain Brook High School AL - Birmingham - Robert Denniston, The Altamont School AL - Birmingham - Cameron Giordano, Oak Mountain High school AL - Birmingham - Wyatt V. Harrison, Homewood High School AL - Birmingham - Adam S. He, Alabama School of Fine Arts AL - Birmingham - Katherine M. Hunter, Spain Park High School AL - Birmingham - Elizabeth Hurley, Chelsea High School AL - Birmingham - Hugh K. Perkins, The Altamont School AL - Birmingham - Mary E. Richardson, Homewood High School AL - Birmingham - Maya D. Samuels-Fair, Alabama School of Fine Arts AL - Columbiana - Landon C. Bentley, Shelby County High School AL - Cullman - Wilson R. Raney, Cullman High School AL - Daphne - Stephen T. Mcmanus, Bayside Academy AL - Decatur - Andie N. Wall, Austin High School AL - Fairhope - Adam P. Schrubbe, Fairhope High School AL - Florence - Chase Halcombe, Florence High School AL - Fort Deposit - Rachael Jackson, Fort Dale Academy AL - Gadsden - Harry H. Hager, Gadsden City High School AL - Gadsden - Justin C. Kelley, Gadsden City High School AL - Gardendale - Garrett A. -

Appendix B DEFENDANTS SCHOOL DISTRICTS in the UNITED STATES

Appendix B DEFENDANTS SCHOOL DISTRICTS IN THE UNITED STATES (Abbreviations: S.D. = School District, I.S.D. = Independent School District, Unified School District = U.S.D., Consolidated School District = C.S.D., Elementary School District = E.S.D., School District = S.D.) Alabama Alabaster City Enterprise City Montgomery County Albertville City Escambia County Morgan County Alexander City Etowah County Mountain Brook City Andalusia City Eufaula City Muscle Shoals City Anniston City Fairfield City Oneonta City Arab City Fayette County Opelika City Attalla City Florence City Opp City Athens City Fort Payne City Oxford City Auburn City Fort Rucker Ozark City Autauga County Franklin County Pelham City Schools Baldwin County Gadsden City Pell City Barbour County Geneva City Perry County Bessemer City Geneva County Phenix City Bibb County Greene County Pickens County Birmingham City Guntersville City Piedmont City Blount County Hale County Pike County Boaz City Haleyville City Randolph County Brewton City Hartselle City Roanoke City Bullock County Henry County Russell County Butler County Homewood City Russellville City Calhoun County Hoover City Saint Clair County Chambers County Houston County Saraland Cherokee County Huntsville City Scottsboro City Chilton County Jackson County Selma City Choctaw County Jacksonville City Sheffield City Clarke County Jasper City Shelby County Clay County Jefferson County Sumter County Cleburne County Lamar County Sylacauga City Coffee County Lanett City Talladega City Colbert County Lauderdale County Talladega