EXLSERVICE HOLDINGS, INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

158877363.Pdf

Company Name NASSCOM Contact Salutation NASSCOM Contact First Name 3D PLM Software Solutions Ltd Mr. Sudarshan 3Five8 Technologies Pvt Ltd Ms. Sangeeta 3Forz Innovations Software Pvt Ltd Mr. Janakiram 3i Infotech Ltd Mr. Prathmesh 4C-Learning Solutions Pvt Ltd Mr. Vivek 4i Apps Solutions Pvt Ltd Mr. Kathiresh Kumar 7Seas Entertainment Ltd Mr. Maruti Sanker A G Technologies Pvt Ltd Mr. Anup A N Buildwell Pvt Ltd Mr. Rohit A T Kearney Ltd Ms. Shilpi A1 Future Technologies Mr. Srish Kumar Aabasoft Mr. Sujas AABSyS Information Technology Pvt Ltd Mr. Ravi Aaric Technologies Pvt Ltd Mr. Vipin Aarupadai Veedu Institute of Technology (VinayakaMr. Missions University) C Thara Abiba Systems Pvt Ltd Mr. Senthil ABM Knowledgeware Ltd Mr. Govind Abra Technologies Pvt Ltd Mr. Yogeshnath AbsolutData Research & Analytics SolutionsMr. Pvt Ltd Suhale Accel Frontline Ltd Mr. Ravi Sankar AccelTree Software Pvt Ltd Mr. Sasikumar Accelya Kale Solutions Ltd Mr. Mitul Accenture Services Pvt Ltd Mr. Rajesh Acclaris Business Solutions Pvt Ltd Mr. Subrata Accretive Health Pvt Ltd Mr. Shailendra Pratap Acidaes Solutions Pvt Ltd Mr. Rahul Ackcezione Technologies Pvt Ltd Mr. Kishore ACL Mobile Ltd Ms. Gunjan Acliv Technologies Pvt Ltd Mr. Achutha ACN Infotech (India) Pvt Ltd Mr. Chaman Acteva Solutions Management Pvt Ltd Ms. Sreeparna ActWitty Software Systems Pvt Ltd Mr. Samarth Adaptive Processes Consulting Pvt Ltd Ms. Ananya ADCC Infocad Pvt Ltd Mr. Amit Add Technologies (India) Ltd Mr. William Adhi Software Pvt Ltd Mr. K Aditya Birla Minacs Worldwide Ltd Ms. Pooja Adobe Systems India Pvt Ltd Mr. Naresh Chand ADP India Ltd Mr. S ADP Pvt Ltd Mr. -

Republic of the Philippines Department of Finance BUREAU of CUSTOMS 1099 MANILA

Republic of the Philippines Department of Finance BUREAU OF CUSTOMS 1099 MANILA I. Importers with incorrect phone numbers (711) 1590 ENERGY CORP. ASIAN SPORTS APPAREL PHILIPPINES 2ML EXCHANGE UNLIMITED CORP ASIANA AIRLINES 4 HERMANAS INTERNATIONAL MARKETING ASIA'S BEST INDUSTRIAL SALES CORP 7J&E SURPLUS & PARTS SUPPLY ASUKA TRADER INC. 888 TRADEALL INC. ASYA GLASS PHILIPPINES INC. A LIM DEVELOPMENT INC AUTO88 CORPORATION A.P. CARTON BOX INC. AUTOFIR ENTERPRISES AB MAURI PHILIPPINES INC. AVC PHILIPPINES INC. ABEL A. AVERGONZADO AVEN FASHION MANUFACTURING INC ABRAM MARKETING AVIATION ENTERPRISES INC ACG BUILDERS CENTRE INC B3R2 TRADING ACHING INDUSTRIAL SALES BALI OIL PALM PRODUCE CORPORATION ACQUIRE ASIA PACIFIC MANILA 2 INC BANANA LEAF ASIAN CAFE INC. ACQUIRE ASIA PACIFIC MANILA INC BANTUANON TRANSPORT CORPORATION ACTIONDO INTERNATIONAL ENT. BATING IRRIGATORS MULTI-PURPOSE ADLUCK TRADING BAYSHORE INTERNATIONAL ADVANCE PAPER CORPORATION BENEFIC CORPORATION AFFINAGE PHILIPPINES INC. BEST CHEMICALS AND PLASTICS INC. AGC AUTOMOTIVE PHILIPPINES INC BEST DEAL MARKETING CORP AGSPEC PHILIPPINES CORPORATION BHELLE-SOLAR PHILIPPINES CORPORATIO AGWAY CHEMICALS CORPORATION BIALOGVSKI GENERAL MERCHANDISE AIDA B. MINA BIBIANA FARMS & MILLS INCORPORATED AIDAN MARKETING BIOCLEAN ASIA PACIFIC INC. ALABASTER JAR EXPORTS & IMPORTS BIOSEED RESEARCH PHILIPPINES INC. ALBERO FRUITS PROCESSING CORP. BLISSFUL INDUSTRIAL CORPORATION ALDELGOY TRADING BLOOD RED INC. ALDWIN M. CAPAHI BLOOMING DALE INTERNATIONAL ALL FASHION GLOVES INC BONAMIS PHARMACY PHILIPPINES CORP ALL INDUSTRIAL ENTERPRISES BORACAY SEASCAPES RESORT INC. ALLIED PACIFIC PACKAGING SOLUTIONS BORLA ENTERPRISES ALMERAH BAGUINDA RASCAL BOUNTY SOURCE TRADING ALSTOM PHILIPPINES INC BRENT INTERNATIONAL SCHOOL MANILA AMBERVILLE INDUSTRIAL CORPORATION BRIGHT GOAL TRADING AMENITY TRADING BRIGHTMOVE CORPORATION ANGELES BEACH CLUB RESORTS CORP. BUEANA OCEAN FERRY SERVICES INC ANTONIO R. -

2017 Investor Day 1-66 FINAL

Image window size is 10” x 4.82” Winning in the Digital World INVESTOR DAY, June 20, 2017 © ExlService Holdings, Inc. Safe harbor statement This presentation contains forward-looking statements. You should not place undue reliance on those statements because they are subject to numerous uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the Company's control. Forward-looking statements include information concerning the Company's possible or assumed future results of operations, including descriptions of its business strategy. These statements may include words such as "may," "will," "should," "believe," "expect," "anticipate," "intend," "plan," "estimate" or similar expressions. These statements are based on assumptions that we have made in light of management's experience in the industry as well as its perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. You should understand that these statements are not guarantees of performance or results. They involve known and unknown risks, uncertainties and assumptions. Although the Company believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect the Company's actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. These factors are discussed in more detail in the Company's filings with the Securities and Exchange Commission, including the Company’s Registration Statement on Form S-3 (containing a prospectus), the Company's Annual Report on Form 10-K for the year ended December 31, 2016 and the Company’s Quarterly Reports on Form 10-Q for the quarters ended June 30, 2016, September 30, 2016 and March 31, 2017. -

Securities and Exchange Commission Form S-1

Table of Contents As filed with the Securities and Exchange Commission on April 15, 2005 Registration No. 333-121001 SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 AMENDMENT No. 2 TO FORM S-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 ExlService Holdings, Inc. (Exact name of Registrant as specified in its charter) Delaware 541990 82-0572194 (State or other jurisdiction of (Primary Standard Industrial (IRS Employer Identification No.) incorporation or organization) Classification Code Number) 350 Park Avenue New York, New York 10022 (212) 277-7100 (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) Vikram Talwar Chief Executive Officer ExlService Holdings, Inc. 350 Park Avenue New York, New York 10022 (212) 277-7100 (Name, address, including zip code, and telephone number, including area code, of agent for service) Copies to: John C. Kennedy, Esq. Amit Shashank, Esq. Janet L. Fisher, Esq. Kenneth M. Schneider, Esq. General Counsel and Vice President Cleary Gottlieb Steen & Hamilton LLP Paul, Weiss, Rifkind, Wharton & Garrison LLP ExlService Holdings, Inc. One Liberty Plaza 1285 Avenue of the Americas 350 Park Avenue New York, New York 10006 New York, New York 10019-6064 New York, New York 10022 (212) 225-2000 (212) 373-3000 (212) 277-7100 Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. -

Exlservice Holdings, Inc

Table of Contents Filed Pursuant to Rule 424(b)(4) Registration Statements 333-121001 and 333-138104 5,000,000 Shares ExlService Holdings, Inc. Common Stock This is an initial public offering of 5,000,000 shares of common stock of ExlService Holdings, Inc., all of which are being offered by us. Prior to this offering, there has been no public market for the common stock. Our common stock has been approved for listing on the Nasdaq Global Select Market under the symbol “EXLS.” Investing in our common stock involves risks. See “ Risk Factors” beginning on page 12 to read about factors you should consider before buying shares of our common stock. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. Per Share Total Initial public offering price $ 13.500 $ 67,500,000 Underwriting discount and commission $ 0.945 $ 4,725,000 Proceeds, before expenses $ 12.555 $ 62,775,000 To the extent that the underwriters sell more than 5,000,000 shares of our common stock, they have the option to purchase up to an additional 750,000 shares from us at the public offering price less the underwriting discount. Up to 5% of the shares offered hereby have been reserved for sale at the initial public offering price to specified persons under our directed share program. The underwriters expect to deliver the shares to purchasers against payment in New York, New York on October 25, 2006. -

Digital Literacy Exploring Africa Re-Engineering to Remain Relevant

NEWSLINE The Big News About Big Data VOL. 2 ISSUE 9 SEPTEMBER 2012 06 11 13 Indian BPO: Digital Literacy Exploring Africa Re-engineering to Remain Relevant http://www.nasscom.in/nasscom-newsletter/nasscom-newsline NASSCOM Research At a Glance NASSCOM has recently released segment-specific reports highlighting opportunities available in these areas. Some of the reports are highlighted below: Highlights the opportunity in offering services around Big Data implementation and analytics across industries. Covers the market size, emerging growth opportunities and competitive landscape, proposals for winning in the global Big Data: The Next Big Thing and local market. India’s IS Outsourcing Market: Adapting to Megatrends – Reinventing Business A comprehensive deep-dive analysis of the global retail industry from a demand Analyses the strategies firms (retailers) and supply side (IT-BPO need to adopt on this journey service providers) perspective. – build suitable offerings and differentiation, align with overall An Overview of strategy, financial impact, etc. the Retail Market: Analysing Opportunities Verticalisation: Industry Evolution for a Better Value Proposition Highlights the pivotal role of Marketing Analytics, and the opportunities, challenges and future trends associated with it. All reports are FREE for members. To get access Marketing Analytics to the industry trends and insights, become a member today. Join Now – Write to us at [email protected] To view the complete list, visit www.nasscom.in/research-reports What’s Inside Editorial Opportunities Galore We have for you a Newsline that covers much, presenting you with insights on a host of issues related to the Indian IT-BPO industry, especially emerging opportunities. -

P. 16-22 (Top Enterprise) 629-2.Qxd 6/29/07 1:45 PM Page 2

P. 16-22 (Top Enterprise) 629-2.qxd 6/29/07 1:45 PM Page 2 TOP ENTERPRISE PROVIDERS The Lucky By FAO Today Staff 13 Aided by a healthy market, the list of enterprise FAO service providers continues to grow. We look at a baker’s dozen of the leading global providers helping to make outsourcing a positive experience. Their numbers are growing, thanks to a FAO riches. And because so many of these ing a big bucket of services, from transac- very robust FAO market that some analysts BPO providers have a rich, established IT tion-heavy processes such as accounts say is expanding by 30 percent a year. heritage, they come well-backed by their payable and accounts receivable to more That’s why many providers are attracted to parent companies. strategic functions such as consolidation the segment—all hoping to sell their expert- In the end, we settled on some familiar and general ledger work. Another edge: ise to hungry buyers. names that almost always appear at the top strong leadership helping to guide their way So when we set out to choose this list of of buyers’ RFP list, as well as upstarts who in this still-maturing market. If they can top enterprise providers, it was apparent are showing they can close on deals. Most further elevate customer satisfaction, these that it would be a difficult task. After all, the likely, if you have been around the industry, companies will continue to stay on our list. market is still divided into traditional you’ll recognize the names on our baker’s In compiling our list, we’d like to thank Western Hemisphere-based providers such dozen of enterprise FAO providers. -

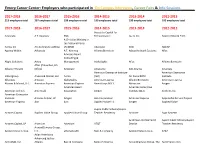

Employers Who Participated in on Campus Interviews, Career Fairs & Info Sessions

Emory Career Center: Employers who participated in On Campus Interviews, Career Fairs & Info Sessions 2017-2018 2016-2017 2015-2016 2014-2015 2013-2014 2012-2013 213 employers total 207 employers total 198 employers total 190 employers total 190 employers total 192 employers total 2017-2018 2016-2017 2015-2016 2014-2015 2013-2014 2012-2013 Access to Capital for Advocate A.T. Kearney 360i Entrepreneurs [x+1], Inc. Abercrombie & Fitch A Christian Ministry in the National Parks Aetna, Inc. Acuity Brands Lighting (ACMNP) Advocate 360i ADCAP Agency Within Advocate A.T. Kearney AllianceBernstein Adcap Network Systems Aflac Advisory Board Consulting & Alight Solutions Aetna Management AlphaSights Aflac AllianceBernstein Aflac (Columbus, GA Alliance Theatre Office) Advocate Altisource AGI Atlanta Allscripts American Enterprise Institute American Enterprise alliantgroup Alvarez & Marsal, LLC Aetna (AEI) Air Force ROTC Institute Allscripts Amazon AlphaSights American Express AllianceBernstein American Express Alvarez & Marsal, LLC American Express American Express AmeriCorps NCCC Altisource Amgen American Heart American Enterprise American Airlines Americold Association Amgen Institute (AEI) Anthem, Inc. American Enterprise Institute Antares Capital, LP Amgen Aon Corporation American Express Appalachia Service Project American Express Aon Aon Applied Value LLC Amgen Applied Value Aspire Public Schools/Aspire Antares Capital Applied Value Group Applied Value Group Teacher Residency Andover Argo Systems Andrews Entertainment Aspire Public Schools/Aspire Antares Capital, LP Arcesium Arcesium AT&T District Teacher Residency AroundCampus Group, Applied Value Group LLC athenahealth Bain & Company Applied Value Group AT&T Asian Americans Advancing Justice - ArchieMD, Inc. Atlanta Bain & Company Bank of America AroundCampus Group, The AutoTrader.com Atlanta Falcons - AMB AT&T Sports + Entertainment Bank of America BBVA Compass Aspire Public Schools Bain & Company Bard Globalization and Atlanta Network International Affairs Technologies, Inc. -

EXLSERVICE HOLDINGS, INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE YEAR ENDED DECEMBER 31, 2008 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO COMMISSION FILE NUMBER 001-33089 EXLSERVICE HOLDINGS, INC. (Exact name of registrant as specified in its charter) DELAWARE 82-0572194 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 350 PARK AVENUE, NEW YORK, NEW YORK 10022 (Address of principal executive offices) (Zip code) (212) 277-7100 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class: Name of Each Exchange on Which Registered: Common Stock, par value $0.001 per share NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Complainant Respondent Status NCR-01-00001-19 MICHAEL JOHN COLEGADO DE GRACIA LUCKBAY TRUCKING PENDING NCR-01-00002-19 JAIME BAYONAS PESCADERO, Et

Status of Cases 2nd Quarter 2019 Case No. Complainant Respondent Status NCR-01-00001-19 MICHAEL JOHN COLEGADO DE GRACIA LUCKBAY TRUCKING PENDING NCR-01-00002-19 JAIME BAYONAS PESCADERO, et. al. UNO TRANSPORT PENDING NCR-01-00004-19 ARTHUR BERNANTE TOLEDO, JR. S & I INTERNATIONAL MANAGEMENT INC. PENDING NCR-01-00006-19 MICHAEL LEONARDO LACTAO CITIGROUP BUSINESS PROCESS SOLUTIONS PENDING NCR-01-00007-19 RAYMUNDO ABUTIN PEREZ VARIANCE SECURITY AGENCY CORPORATION PENDING NCR-01-00011-19 RODOLFO RODRIGO ISANAN FINMAT INTERNATIONAL RESOURCES INC. DISPOSED NCR-01-00012-19 JORGE PURA LICOBEN BERROD DEVELOPMENT CORPORATION PENDING NCR-01-00013-19 ROMEO MONTOYA ASIS BUILDER 1927 PENDING NCR-01-00014-19 WILLIAM TINAMPAY PAGUIA SLC MACHINE SHOP PENDING NCR-01-00015-19 PAUL HIZON ESPIRITU III DELS APPAREL CORPORATION PENDING NCR-01-00017-19 LUZ DELA CRUZ RAYMUNDO, et. al. DELA SALLE UNIVERSITY - CENTER FOR LANGUAGE PENDING NCR-01-00018-19 PAMELA AVILA ESPIRITU PHILIPPINE RED CROSS DISPOSED NCR-01-00025-19 JOSE JOEL EWAYAN LAWAS ST. ANTHONY OF PADUA TRANSPORT PENDING NCR-01-00026-19 RICO PALAY MARCELLANA, et. al. COSMIC ENTERPRISES INC. PENDING 1.KENSONIC INC. / ONE ALPHA COMMUNICATION NCR-01-00028-19 NEIL PEREZ BALEÑA 2.AXELERATE MANPOWER AGENCY INC. DISPOSED NCR-01-00029-19 ROMMEL LINAJA MARABE JOVEN ESPIRITU ELECTRICAL SERVICES PENDING NCR-01-00033-19 RAYMOND FULO HERRERA COFFRAL FORMWORKS AND SCAFFOLDS INC. PENDING NCR-01-00036-19 CARMELO GALWAT MAGALIM MAYON SECURITY AGENCY DISPOSED NCR-01-00038-19 ERIC JOSEPH YOUNG MANANQUIL LEISURE & RESORT WORLD CORPORATION DISPOSED NCR-01-00043-18 ROSANNA ALBORQUE ARGANTE LUFTHANSA TECHNIK PHILIPPINES (LTP) DISPOSED NCR-01-00043-19 JIMMUEL ROMAY TAYING, et. -

WNS (Holdings) Limited (Exact Name of Registrant As Specified in Its Charter)

Table of Contents SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 20-F o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2008 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to OR o SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number 001-32945 WNS (Holdings) Limited (Exact Name of Registrant as Specified in Its Charter) Not Applicable Jersey, Channel Islands (Translation of Registrant’s Name Into English) (Jurisdiction of Incorporation or Organization) Gate 4, Godrej & Boyce Complex Pirojshanagar, Vikhroli(W) Mumbai 400 079, India (91-22) 4095-2100 (Address and Telephone Number of Principal Executive Offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Name of Each Exchange Title of Each Class on Which Registered American Depositary Shares, each represented by The New York Stock Exchange one Ordinary Share, par value 10 pence per share Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

Annual Report 2018-19

Annual Report 2018-19 Catalysing IT-BPM Industry in India www.nasscom.in he National Association of Software around 2500. The member organizations & Service Companies (NASSCOM) is represent 95 per cent of industry revenues Tthe industry association for the IT- and have enabled the association to BPM sector in India. It was set up in 1988 spearhead initiatives and programmes to andregistered under the Indian Societies strengthen the sector in the country and Act,1860. A not-for-profit organisation globally. NASSCOM has also contributed funded by the industry, its objective is to to the development of two organisations build a growth-led, sustainable, technology - the Data Security Council of India, which and business services segment in the is focused on security and the NASSCOM country. NASSCOM’s membership has Foundation, which helps drive Corporate grown over the years and currently hovering Social Responsibility (CSR) initiatives. ASSCOM is headquartered in Noida, India, and has offices in ABOUT Neight other cities—Bengaluru, Chennai, Hyderabad, Kolkata, Mumbai, Pune, Thiruvananthapuram & Kochi. NASSCOM MESSAGE FROM THE CHAIRMAN 4 DESIGN4INDIA 74 MESSAGE FROM THE PRESIDENT 5 SECTOR SKILL COUNCIL NASSCOM 77 KEY ACTIVITIES REGIONAL OUTREACH GLOBAL TRADE DEVELOPMENT 10 TAMIL NADU 86 KERALA REGION 86 POLICY ADVOCACY 16 TELANGANA & ANDHRA PRADESH 86 EVENTS 22 KARNATAKA 87 RESEARCH REPORTS 28 EASTERN REGION 88 CENTER OF EXCELLENCE-IOT 40 MUMBAI, GUJARAT, MP & CHATTISGARH 89 SECTORAL COUNCIL PUNE 90 ENGINEERING R&D COUNCIL 48 NORTHERN REGION 90 BPM COUNCIL 52 AWARDS & RECOGNITION 92 GIC COUNCIL 56 IT SERVICES COUNCIL 58 SME COUNCIL 59 PRODUCT COUNCIL 62 DIVERSITY & INCLUSION FORUM 66 10000 STARTUPS - TORCHBEARERS 68 OF A YOUNG & CONFIDENT NEW INDIA CHAIRMAN’S Message Rishad Premji CHAIRMAN NASSCOM It’s been an honour for me to lead NASSCOM as its Chairman for the year 2018-19.