Foreclosure Glossary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Real Estate Marketplace Glossary: How to Talk the Talk

Federal Trade Commission ftc.gov The Real Estate Marketplace Glossary: How to Talk the Talk Buying a home can be exciting. It also can be somewhat daunting, even if you’ve done it before. You will deal with mortgage options, credit reports, loan applications, contracts, points, appraisals, change orders, inspections, warranties, walk-throughs, settlement sheets, escrow accounts, recording fees, insurance, taxes...the list goes on. No doubt you will hear and see words and terms you’ve never heard before. Just what do they all mean? The Federal Trade Commission, the agency that promotes competition and protects consumers, has prepared this glossary to help you better understand the terms commonly used in the real estate and mortgage marketplace. A Annual Percentage Rate (APR): The cost of Appraisal: A professional analysis used a loan or other financing as an annual rate. to estimate the value of the property. This The APR includes the interest rate, points, includes examples of sales of similar prop- broker fees and certain other credit charges erties. a borrower is required to pay. Appraiser: A professional who conducts an Annuity: An amount paid yearly or at other analysis of the property, including examples regular intervals, often at a guaranteed of sales of similar properties in order to de- minimum amount. Also, a type of insurance velop an estimate of the value of the prop- policy in which the policy holder makes erty. The analysis is called an “appraisal.” payments for a fixed period or until a stated age, and then receives annuity payments Appreciation: An increase in the market from the insurance company. -

Understanding Default and Foreclosure

WISCONSIN HOMEOWNERSHIP PRESERVATION EDUCATION Understanding Default & Foreclosure Understanding Default and Foreclosure Section Overview Overview and Goals Foreclosure is the legal process in which a person who has made What is Default? Dealing with default a mortgage (the mortgagor or borrower) in order to borrow Outcomes of Default money loses his or her rights to the mortgaged property. If the Short term problems borrower fails to make payment at the proper time or fails to Repayment agreement meet other obligations specified in the bond or mortgage, the Modification foreclosure process begins. The lender applies to a court for Forbearance authority to sell the property. Money received from a sale is Partial or advance claim applied to debts on the property, including payments due to the Reverse equity mortgage lender. Refinance Long term problems The costs related to foreclosure can be high for both families and Sale of property Hardship assumption communities. Missed payments are generally reflected in credit Pre‐foreclosure/ short sale reports, which can impair a borrower’s ability to use short‐term Deed‐in‐lieu loans. Borrowers who lose their homes to foreclosure or seek Foreclosure bankruptcy may then have severely damaged credit records, The Legal Process of Foreclosure which will restrict their access to loans in the future. In addition, Where to go? these borrowers suffer financial losses on the home. Preparing to call your lender Documents you’ll need Foreclosure can also have negative social and emotional impacts Supplemental materials on families as they lose their home and are forced to move. The Homeowner Affordability and impacts related to foreclosure also spill over into neighboring Stability Plan Additional Resources areas. -

Path to Homeownership

Path to Homeownership HE-02 ©2011 Regions Bank. Member FDIC. Subject to qualification, required documentation and credit approval. Certain exclusions may apply. Loan terms and availability subject to change. Path to Homeownership Table of Contents Deciding to Buy a Home Ways to Increase Your Borrowing Power h Ask Yourself Shopping for a Home h Advantages of Homeownership h Wish List h Possible Disadvantages of Homeownership h Finding the Right House h Is Home Ownership in Your Near Future? h Reasons to Use a Real Estate Agent h Comparison Shopping Preparing to Buy a Home h Can You Afford to Buy a House? Negotiating the Offer to Buy h Analyze Your Current Expenses h Deciding How Much to Offer h How Much Home Can You Afford? h Submitting the Offer h Tools to Help Prepare h Contingencies h Home Inspection Pre-Approval by Regions Mortgage h Mortgage Application Checklist Obtaining a Loan h Contact Regions Mortgage Loan Originator Down Payment and Closing Costs h Our Role at Regions Mortgage h Planning for Down Payment and Closing Costs Closing Day h Getting Ready For Closing Borrowing Power h What to Expect at Closing h Qualifying Guidelines h Credit Counseling Life as a Homeowner h Steps for Debt Management h Settling In h Maintaining Your New Home Credit Report h Cost Effective Energy Conservation h Credit Report Review h Major repairs / Home Improvement h Credit Scoring h Meeting Your Financial Obligations h Establishing a Credit Record as a Borrower h Repairing Your Credit Record Path to Home Ownership Deciding to Buy a Home For many people, owning their own home is their dream. -

Non-Traditional Mortgage Products Guidance

CONFERENCE OF STATE BANK SUPERVISORS AMERICAN ASSOCIATION OF RESIDENTIAL MORTGAGE REGULATORS GUIDANCE ON NONTRADITIONAL MORTGAGE PRODUCT RISKS I. INTRODUCTION On October 4, 2006, the Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System (Board), the Federal Deposit Insurance Corporation (FDIC), the Office of Thrift Supervision (OTS), and the National Credit Union Administration (NCUA) (collectively, the Agencies) published final guidance in the Federal Register (Volume 71, Number 192, Page 58609-58618) on nontraditional mortgage product risks (“interagency guidance”). The interagency guidance applies to all banks and their subsidiaries, bank holding companies and their nonbank subsidiaries, savings associations and their subsidiaries, savings and loan holding companies and their subsidiaries, and credit unions. Recognizing that the interagency guidance does not cover a majority of loan originations, on June 7, 2006 the Conference of State Bank Supervisors (CSBS) and the American Association of Residential Mortgage Regulators (AARMR) announced their intent to develop parallel guidance. Both CSBS and AARMR strongly support the purpose of the guidance adopted by the Agencies and are committed to promote uniform application of its consumer protections for all borrowers. The following guidance will assist state regulators of mortgage brokers and mortgage companies (referred to as “providers”) not affiliated with a bank holding company or an insured financial institution to promote consistent regulation in the mortgage market and clarify how providers can offer nontraditional mortgage products in a way that clearly discloses the risks that borrowers may assume. In order to maintain regulatory consistency, this guidance substantially mirrors the interagency guidance, except for the deletion of sections not applicable to non-depository institutions. -

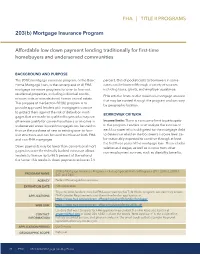

FHA Title II Programs: 203(B) Mortgage Insurance Program

FHA | TITLE II PROGRAMS 203(b) Mortgage Insurance Program Affordable low down payment lending traditionally for first-time homebuyers and underserved communities BACKGROUND AND PURPOSE The 203(b) mortgage insurance program, or the Basic percent. Out-of-pocket costs to borrowers in some Home Mortgage Loan, is the centerpiece of all FHA cases can be lowered through a variety of sources mortgage insurance programs for one- to four-unit including loans, grants, and employer assistance. residential properties, including individual condo- FHA sets the limits on the maximum mortgage amount minium units or manufactured homes on real estate. that may be insured through the program and can vary The purpose of the Section 203(b) program is to by geographic location. provide approved lenders with mortgage insurance to protect them against the risk of default on mort- BORROWER CRITERIA gages that are made to qualified buyers who may not otherwise qualify for conventional loans or who live in Income limits: There is no income limit to participate underserved areas. Insured mortgages can be used to in the program. Lenders must analyze the income of finance the purchase of new or existing one- to four- each borrower who is obligated for the mortgage debt unit structures and can be used to refinance both FHA to determine whether the borrower’s income level can and non-FHA mortgages. be reasonably expected to continue through at least the first three years of the mortgage loan. This includes Down payments may be lower than conventional mort- salaries and wages, as well as income from other gages because the federally backed insurance allows non-employment sources, such as disability benefits, lenders to finance up to 96.5 percent of the value of the home. -

The Origins of the Financial Crisis

FIXING FINANCE SERIES – PAPER 3 | NOVEMBER 2008 The Origins of the Financial Crisis Martin Neil Baily, Robert E. Litan, and Matthew S. Johnson The Initiative on Business and Public Policy provides analytical research and constructive recommendations on public policy issues affecting the business sector in the United States and around the world. The Origins of the Financial Crisis Martin Neil Baily, Robert E. Litan, and Matthew S. Johnson The Initiative on Business and Public Policy provides analytical research and constructive recommendations on public policy issues affecting the business sector in the United States and around the world. TH E O R IGI ns O F T H E F I N A N CIA L Cr I S I S CONTENTS Summary 7 Introduction 10 Housing Demand and the Perception of Low Risk in Housing Investment 11 The Shifting Composition of Mortgage Lending and the Erosion of Lending Standards 1 Economic Incentives in the Housing and Mortgage Origination Markets 20 Securitization and the Funding of the Housing Boom 22 More Securitization and More Leverage—CDOs, SIVs, and Short-Term Borrowing 27 Credit Insurance and Tremendous Growth in Credit Default Swaps 32 The Credit Rating Agencies 3 Federal Reserve Policy, Foreign Borrowing and the Search for Yield 36 Regulation and Supervision 0 The Failure of Company Risk Management Practices 2 The Impact of Mark to Market 3 Lessons from Studying the Origins of the Crisis References 6 About the Authors 7 NOVEMBER 2008 TH E O R IGI ns O F T H E F I N A N CIA L Cr I S I S SUMMARY he financial crisis that has been wreaking ing securities backed by those packages to inves- havoc in markets in the U.S. -

Endogenous Formation and Collapse of Housing Bubbles

Endogenous Formation and Collapse Of Housing Bubbles Jiaqi Ge1 Department of Economics, Iowa State University, Ames, IA, United States email: [email protected] July 3, 2013 Abstract This paper develops an analytical framework and an agent-based spatial model of the housing market. We show that lenient financing, in particular, low down payment requirement has caused business cycles in the housing market. With little down payment, any fluctuations in the housing price will cause the collateral rate to fall below the threshold under which mortgage rate has to rise in response to a lower housing price. The agent-base model is based on our interviews with local real estate agents. The exploratory work in this paper will help us better understand the housing market, make policy advice, and prevent the damaging housing bubbles. 1 Introduction The U.S. housing price bubble started around year 2000. At the height of the housing bubble, mortgage loans could be easily obtained on very lenient terms. Housing price has doubled in just a few years, and when it burst, price has dropped by nearly a third nation wide, and more than a half in the sand states (Arizona, California, Florida, and Nevada). The economy went into the most severe recession since the big depression in the 1930s . What could have caused the damaging bubble? Some blame speculators; Others blame government sponsored entities like Freddie Mac and Fannie Mae for extending loan to riskier (sub-prime) lenders; 1We would like to thank Tom Randall Real Estate Team, Hunziker & Associates, and an anonymous realtor for their helpful comments and inputs. -

An Overview of the Housing Finance System in the United States

An Overview of the Housing Finance System in the United States N. Eric Weiss Specialist in Financial Economics Katie Jones Analyst in Housing Policy January 18, 2017 Congressional Research Service 7-5700 www.crs.gov R42995 An Overview of the Housing Finance System in the United States Summary When making a decision about housing, a household must choose between renting and owning. Multiple factors, such as a household’s financial status and expectations about the future, influence the decision. Few people who decide to purchase a home have the necessary savings or available financial resources to make the purchase on their own. Most need to take out a loan. A loan that uses real estate as collateral is typically referred to as a mortgage. A potential borrower applies for a loan from a lender in what is called the primary market. The lender underwrites, or evaluates, the borrower and decides whether and under what terms to extend a loan. Different types of lenders, including banks, credit unions, and finance companies (institutions that lend money but do not accept deposits), make home loans. The lender requires some additional assurance that, in the event that the borrower does not repay the mortgage as promised, it will be able to sell the home for enough to recoup the amount it is owed. Typically, lenders receive such assurance through a down payment, mortgage insurance, or a combination of the two. Mortgage insurance can be provided privately or through a government guarantee. After a mortgage is made, the borrower sends the required payments to an entity known as a mortgage servicer, which then remits the payments to the mortgage holder (the mortgage holder can be the original lender or, if the mortgage is sold, an investor). -

Verifying Your Down Payment, Closing Costs, Assets, Income and Debts

Mortgage Broker vs. Loan Officer When you're looking to get a mortgage loan, you may work with a loan officer or you may choose to work with a mortgage broker. People often confuse the two job types even though both will glean the same results: a new home. However, it is important to understand the difference between the two types of jobs so you know what to expect from them during the mortgage application process. A mortgage broker is an individual or firm that acts as an independent agent for both the borrower and the lender of a mortgage loan. Mortgage brokers are the middle man between you and the lending institution, which can be a bank, trust company, credit union, mortgage corporation, finance company or even an individual private investor. A mortgage broker will analyze your financial situation to determine which lender is the best fit for your loan needs. He or she will submit your mortgage application to one or more lenders in order to sell it, and works with the chosen lender until the loan closes. He or she receives a commission from the borrower if the loan closes. A loan officer is a representative of a lending institution, such as a bank, who works to sell and process mortgages and other loans originated by their employer. They often have a wide variety of loans types to draw from, but all originate from that specific lender. Also known as a loan representative or account executive, loan officers represent the borrower to the lending institution and will guide him or her through the selection, processing and closing of mortgage loan. -

DPA Underwriting Guidelines

PINELLAS COUNTY COMMUNITY DEVELOPMENT DIVISION Homebuyer Loan Program Underwriting Guidelines OVERVIEW The underwriting guidelines describe program requirements and specify the role of Pinellas County and participating lenders. These underwriting guidelines are designed to determine an applicant’s financial capacity for repayment of the down payment assistance and to determine the amount of down payment assistance required. When determining the amount of assistance, which is limited to gap financing, the lender’s minimum down payment and reasonable closing costs will be considered. All information used to make the decision must be supported by written documentation outlined in these guidelines and in conjunction with the HOME regulations at 24 CFR 92.254 and/or SHIP regulations 420.907-9079. GENERAL REQUIREMENTS Funding provided will be for down payment and closing cost assistance associated with the acquisition of existing or newly constructed homes. Applications will be reviewed and processed on a first-come; first-qualified basis. Eligible Applicants Eligible applicants include households who: • have an annual income at or below 80% of Area Median Income; • have a housing debt-to-income ratio that exceeds 25% but is less than 35% and document that the applicant has been provided the maximum first mortgage loan • have a total debt-to-income ratio of less than 45%; • qualify for a new, 30-year, fixed rate first mortgage from a lending institution. The first mortgage must include escrows for property taxes and hazard/flood insurance, if applicable. Adjustable rate mortgages, balloon mortgages, mortgage assumptions, and mortgages that include prepayment penalties are not allowed; and • meet all other requirements, as applicable. -

Private Mortgage Backed Securities

Mortgage-Backed Security A mortgage-backed security (MBS) is a type of asset-backed security that is secured by a mortgage, or more commonly a collection ("pool") of sometimes hundreds of mortgages. The mortgages are sold to a group of individuals (a government agency or investment bank) that "securitizes", or packages, the loans together into a security that can be sold to investors. The mortgages of an MBS may be residential or commercial, depending on whether it is an Agency MBS or a Non-Agency MBS; in the United States they may be issued by structures set up by government-sponsored enterprises like Fannie Mae or Freddie Mac, or they can be "private-label", issued by structures set up by investment banks. The structure of the MBS may be known as "pass-through", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs. Other types of MBS include collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collateralized debt obligations (CDOs).[1] The shares of subprime MBSs issued by various structures, such as CMOs, are not identical but rather issued as tranches (French for "slices"), each with a different level of priority in the debt repayment stream, giving them different levels of risk and reward. Tranches—especially the lower-priority, higher-interest tranches—of an MBS are/were often further repackaged and resold as collateralized debt obligations.[2] These subprime MBSs issued by investment banks were a major issue in the subprime mortgage crisis of 2006–8. -

Foreclosure Purchase Program

Woodbury HRA Program Guidelines Foreclosure Purchase Program Program Overview: The City of Woodbury HRA has made down payment and closing cost assistance loans available to encourage the purchase of foreclosed properties in the City of Woodbury. Current available dollars for loans are based upon the fund balance for any given period. Loan Amount: The maximum loan amount is $25,000. Eligible Use of Funds: The loan funds can be used for down payment and closing costs. The borrower cannot receive any portion of these funds as cash. Interest Rate & Deferred Loan Term: The interest rate is below market rate and will be fixed with simple annual interest, with monthly installment payments of interest only. Borrowers aged 65 or older or who are military veterans shall receive a discounted rate. Payment of principal will be deferred until sale, transfer of title, when the primary mortgage is paid off, or when the property ceases to be owner-occupied. Loan term shall not exceed 30 years. Loan Security: All loans will be secured by a mortgage in favor of the Woodbury HRA. Applicant will be required to obtain title insurance on this loan for the City of Woodbury HRA. Applicant Eligibility: Debt-to-Income Ratio: Applicant “debt-to-income” ratio cannot exceed 50 percent. Current on Debt Payments: Applicant(s) must be current on any ongoing debt payments. Minimum Contribution: There must be a Minimum Contribution of 5 percent of the purchase price paid by or on behalf of the home buyer. Acceptable sources of the Minimum Contribution include earnest money, buyer funds brought to closing, lender credits or seller paid closing costs.