Notes on the Accumulation and Utilization of Capital: Some Theoretical Issues

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cesifo Working Paper No. 3754 Category 7: Monetary Policy and International Finance March 2012

The Quantity Theory of Money and Friedmanian Monetary Policy: An Empirical Investigation Claude Hillinger Bernd Süssmuth Marco Sunder CESIFO WORKING PAPER NO. 3754 CATEGORY 7: MONETARY POLICY AND INTERNATIONAL FINANCE MARCH 2012 An electronic version of the paper may be downloaded • from the SSRN website: www.SSRN.com • from the RePEc website: www.RePEc.org • from the CESifo website: www.CESifoT -group.org/wp T CESifo Working Paper No. 3754 The Quantity Theory of Money and Friedmanian Monetary Policy: An Empirical Investigation Abstract We introduce an approach for the empirical study of the quantity theory of money (QTM) that is novel both with respect to the specific steps taken as well as the general methodology employed. Empirical studies of the QTM have focused directly on the relationship between the rate of change of the money stock and inflation. We believe that this is an inferior starting point for several reasons and focus instead on the Cambridge form of the QTM. We find that the coefficient k fluctuates strongly in the short run, but has a low and steady rate of change in the long run, which makes the QTM a useful instrument for the long-run control of inflation. An important finding that contradicts all of the previous literature is that the QTM holds for low inflation as well as for high inflation. We discuss how our findings relate to monetarism generally and propose an adaption of McCallum’s rule for a Friedmanian monetary policy. JEL-Code: E310, E410, E510, E590. Keywords: Cambridge equation, Friedman’s k rule, monetarism, quantity theory. -

Capacity Utilization, Inflation and Monetary Policy

Capacity Utilization, Inflation and Monetary Policy: Classicals, post-Keynesians and the New Keynesian Consensus Peter Kriesler and Marc Lavoie1 Abstract The paper looks at the adjustment process towards long run equilibrium within Marxian models, defined in terms of normal rates of capacity utilization. The model is reduced to three essential equations: an IS equation, a Phillips curve equation and an central bank reaction function. It is shown that long run convergence depends on the specific inflation (Phillips curve) equation, and on the central bank setting a zero inflationary target. When these conditions are relaxed, the results are shown to accord more closely with post-Keynesian results. The Marxian model is then contrasted with New Consensus models, which only varies in its inflation/Phillips curve equation. Post-Keynesian criticisms of both the IS and the Phillips curve equation are considered, and suggestions for a post-Keynesian alternative are made. Keywords: monetary policy, central bank, inflation, capacity utilization, post-Keynesian, New- Keynesian JEL classification: E12, E40, E52, E58 In an extremely interesting paper, Duménil and Lévy (Duménil and Lévy 1999) explore the adjustment mechanism of an economy towards a long run equilibrium with capacity utilization at normal levels − a fully adjusted position as the Sraffians would call it, or a classical long-term equilibrium as Duménil and Lévy have it. Short run equilibrium within their model is of the Keynes/Kalecki type, with variability in levels of capacity utilization. One distinctive feature of their model is that it is not the forces of competition which push the economy to a fully adjusted position, but rather aspects of the macro economy coupled with the behaviour of the central bank. -

The Demand for Money

BSc Economics programme ECN 326: Monetary Economics Module 5 THE DEMAND FOR MONEY In Lecture 3, on the nature of money, we saw why there was a need for money: • to solve the double coincidence of wants problem associated with barter • to obviate the lack of trust between the payer and the payee in a transaction. However, what determines the quantity of money that individuals and economies demand is a separate question. It is the aim of this lecture to explain what determines the quantity of money we demand and also to present a number of models (or theories) of the demand for money. The lecture is majorly split into two main sections. The first part considers the demand for money from individuals or institutions/firms perspective, i.e., the microeconomic determinants of money demand. The second part examines the demand for money at the macroeconomic level, gives a brief history of money demand, focusing on the breakdown of the macroeconomic demand for money function. The ultimate aim of the lecture is to study the money demand as one of the building blocks of the money market equilibrium. The study of the demand for money function has long dominated empirical research in monetary economics. One is therefore tempted o inquire into the nature of this function that qualifies it for a special study. This is of particular importance as traditional microeconomics theory presents us with a generalized framework in which the demand for any good may be analyzed. Traditional theory approaches demand analysis by postulating that an individual derives satisfaction from the consumption of goods and services. -

Unit 11: Demand for Money: Classical Approaches

Demand for Money: ClassicalApproaches Unit-11 UNIT 11: DEMAND FOR MONEY: CLASSICAL APPROACHES UNIT STRUCTURE 11.1 Learning Objectives 11.2 Introduction 11.3 The Quantity Theory of Money: Basic Concepts 11.3.1 A Brief History 11.3.2 Definition 11.3.3 Assumptions 11.4 The Transactions Form of the Quantity Theory 11.4.1 Modified Version of Fisher's Equation 11.4.2 Criticisms 11.5 Cambridge Version: The Cash BalanceApproach 11.5.1 Superiority of the Cash BalanceApproach 11.5.2 Criticisms of the Cash Balance Approach 11.6 Let Us Sum Up 11.7 Answers to Check Your Progress 11.8 Further Reading 11.9 Model Questions 11.1 LEARNING OBJECTIVES After going through this unit, you will be able to- discuss the quantity theory of money and its different versions To explainhow a change in the supply of money influence the price level. 11.2 INTRODUCTION In the previous chapter we have discussed the theory of employment, Say's law of market and related thought of the classical economics. The classical school tried to examine and explain the interaction between various economics variables and to examine how closely they are inter-related. Macro Economics - I 201 Unit-11 Demand for Money: Classical Approaches Since money existed in its various forms and the economic activities are believed to be closely associated with money, the classical thinkers also tried to find out the relation between money and the working of economic variables such as price, demand, supply etc. In this unit, we shall discuss the approach of classical economics with respect to the relationship between the supply of money and the general price level in the economy. -

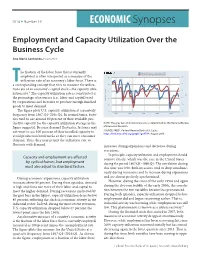

Employment and Capacity Utilization Over the Business Cycle

2016 n Number 19 ECONOMIC Synopses Employment and Capacity Utilization Over the Business Cycle Ana Maria Santacreu, Economist he fraction of the labor force that is currently Capacity Utilization: Total Industry (left) 100-Civilian Unemployment Rate (right) 98 employed is often interpreted as a measure of the 90 utilization rate of an economy’s labor force. There is 96 T 85 a corresponding concept that tries to measure the utiliza- tion rate of an economy’s capital stock—the capacity utili- 94 80 zation rate.1 The capacity utilization rate is constructed as 100-% 92 the percentage of resources (i.e., labor and capital) used 75 Percent of Capacity by corporations and factories to produce enough finished 90 goods to meet demand. 70 88 The figure plots U.S. capacity utilization at a quarterly 65 frequency from 1967:Q1–2016:Q1. In normal times, facto- 1970 1980 1990 2000 2010 ries tend to use around 80 percent of their available pro- fred.stlouisfed.org myf.red/g/6ZXZ ductive capacity (as the capacity utilization average in the NOTE: The gray bars indicate recessions as determined by the National Bureau figure suggests). Because demand fluctuates, factories may of Economic Research. SOURCE: FRED®, Federal Reserve Bank of St. Louis; not want to use 100 percent of their installed capacity to https://fred.stlouisfed.org/graph/?g=6TA4; August 2016. avoid production bottlenecks so they can meet consumer demand. Thus, they may permit the utilization rate to fluctuate with demand. increases during expansions and decreases during recessions. In principle, capacity utilization and employment should Capacity and employment are affected comove closely, which was the case in the United States by cyclical factors, but employment during the period 1967:Q1–1990:Q1. -

Imbalance Game 2.0: a Tale of Two Productivities

NEW THINKING Imbalance Game 2.0: A Tale of Two Productivities Michael Craig, CFA Vice President & Director Haining Zha, CFA Vice President September 2017 Almost nine years after the financial crisis, the global economy remains mired in low growth. Low productivity growth is certainly a key contributing factor, but our research shows that current productivity measures don’t tell the whole story. In this article, we propose a fundamental change to how people should examine productivity: we believe the supply and demand sides should be viewed separately to obtain more robust insights. Taking this approach allows us to differentiate supply-side progress from demand-side malaise and shows that the economy may be more promising than commonly thought. In addition, it highlights large supply-side divergences within and across different sectors of the economy, which are not reflected in the aggregate productivity measure – potentially leading to a distorted economic picture. Viewing productivity through this new lens, we believe that: • Nominal economic growth will remain low • Inflation will remain subdued • Interest rates will stay lower for longer • Technology-driven progress and persistent supply-side divergence will create investment risks and opportunities in equity markets In the investment world, economic growth is a big deal. We believe investment returns across asset classes can ultimately be traced back to one source: economic growth. Occasionally, asset prices can deviate from fundamentals, but over the long term, the relationship between returns and growth is very strong. That’s why it is critical to have a better understanding of the low growth phenomenon and key contributing factors, such as productivity. -

Concept of Money,Qtm & Keynesian Theory of Money Nta UGC-NET Dec

Nta UGC-NET dec-2018 Online batch ,Lecture-21 Macro eco Topic- 6 Concept of money,qtm & Keynesian theory of money UGC-NET PAPER-2 (ECO) CONCEPT OF MONEY Intro- The supply of money means the total stock of money (paper notes, coins and demand deposits of bank) in circulation which is held by the public at any particular point of time. Briefly money supply is the stock of money in circulation on a specific day. Thus two components of money supply are (i) currency (Paper notes and coins) (ii) Demand deposits of commercial banks. In other words, money held by its users (and not supplier) in spendable form at a point of time is termed as money supply. The stock of money held by government and the banking system are not included because they are suppliers or producers of money and cash balances held by them are not in actual circulation. In short, money supply includes currency held by public and net demand deposits in banks. Sources of Money Supply: (i) Government (which Issues one-rupee notes and all other coins) (ii) RBI (which issues paper currency) (iii) commercial banks (which create credit on the basis of demand deposits). Money Multiplier. money multiplieris the amount of money that banks generate with each currency of reserves. Reserves is the amount of deposits that the banks requires to hold and not lend. Formula 1 Money Multiplier(m) = Required Reserve Ratio Mathematical relationship between the monetary base and money supply of an economy. It explains the increase in the amount of cash in circulation generated by the banks' ability to lend money out of their depositors' funds. -

Liquidity Preference

liquidity preference Carlo Panico From The New Palgrave Dictionary of Economics, Second Edition, 2008 Edited by Steven N. Durlauf and Lawrence E. Blume Abstract Macmillan. Keynes’s notion of liquidity preference stems from the fact that he made some specific sources of demand for monetary instruments depend upon the expected Palgrave variations of the interest rate, and consequently on the expected variations in the capital value of financial assets. This source of demand was considered to be the Licensee: cause of variations in the rate of interest. Economists close to Keynes realized that in the General Theory he had turned the analysis of liquidity preference into a new theory of the interest rate. Robertson defended the marginalist theory, while Hicks permission. ‘ ’ paved the way for the neoclassical synthesis . without Keywords distribute or Cambridge equation; central bank money; finance motive; Hicks, J. R.; IS–LM copy models; Keynes, J. M.; liquidity preference; loanable funds; marginalist theory of the not rate of interest; monetary instruments; natural rate and average rate of interest; may neoclassical synthesis; precautionary motive; reserves–loans ratio; Robertson, D.; You saving and investment; simultaneous equilibrium; speculation; speculative motive; subjective probability; temporary equilibrium; Tobin, J.; transaction motive; uncertainty; Walras’s Law JEL classifications E4 www.dictionaryofeconomics.com. Article Economics. of The notion of ‘liquidity preference’ has become generally used in the literature on monetary issues (particularly that concerned with the interest rate) following Dictionary Keynes’s contributions in the 1930s. It concerns the motives for demanding monetary instruments or other close substitutes. Earlier, the analysis of the demand Palgrave for monetary instruments was based on other motives and concepts and led to New different conclusions. -

The Great Depression As a Historical Problem

Upjohn Institute Press The Great Depression as a Historical Problem Michael A. Bernstein University of California, San Diego Chapter 3 (pp. 63-94) in: The Economics of the Great Depression Mark Wheeler, ed. Kalamazoo, MI: W.E. Upjohn Institute for Employment Research, 1998 DOI: 10.17848/9780585322049.ch3 Copyright ©1998. W.E. Upjohn Institute for Employment Research. All rights reserved. 3 The Great Depression as a Historical Problem Michael A. Bernstein University of California, San Diego It is now over a half-century since the Great Depression of the 1930s, the most severe and protracted economic crisis in American his tory. To this day, there exists no general agreement about its causes, although there tends to be a consensus about its consequences. Those who at the time argued that the Depression was symptomatic of a pro found weakness in the mechanisms of capitalism were only briefly heard. After World War II, their views appeared hysterical and exag gerated, as the industrialized nations (the United States most prominent among them) sustained dramatic rates of growth and as the economics profession became increasingly preoccupied with the development of Keynesian theory and the management of the mixed economy. As a consequence, the economic slump of the inter-war period came to be viewed as a policy problem rather than as an outgrowth of fundamental tendencies in capitalist development. Within that new context, a debate persisted for a few years, but it too eventually subsided. The presump tion was that the Great Depression could never be repeated owing to the increasing sophistication of economic analysis and policy formula tion. -

Capacity and Capacity Utilization in Fishing Industries

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by College of William & Mary: W&M Publish W&M ScholarWorks VIMS Books and Book Chapters Virginia Institute of Marine Science 2003 Capacity And Capacity Utilization In Fishing Industries James E. Kirkley Dale Squires Follow this and additional works at: https://scholarworks.wm.edu/vimsbooks Part of the Aquaculture and Fisheries Commons Extracted from : Pascoe, S.; Gréboval, D. (eds.) Measuring capacity in fisheries. FAO Fisheries Technical Paper. No. 445. Rome, FAO. 2003. 314p. http://www.fao.org/3/Y4849E/y4849e00.htm http://www.fao.org/3/Y4849E/y4849e04.htm#bm04 CAPACITY AND CAPACITY UTILIZATION IN FISHING INDUSTRIES – James E. Kirkley[24] and Dale Squires[25] Abstract: The definition and measurement of capacity in fishing and other natural resource industries possess unique problems because of the stock-flow production technology, in which inputs are applied to the natural resource stock to produce a flow of output. In addition, there are often multiple resource stocks, corresponding to different species, with a mobile stock of capital that can exploit one or more of these stocks. In turn, this leads to three unique issues: (1) multiple stocks of capital and the resource; (2) that of aggregation or how to define the industry and resource stocks to consider; and (3), that of latent capacity or how to include stocks of capital that are currently inactive or exploit the resource stock only at low levels of variable input utilization. This paper presents appropriate definitions of capacity and methods for measuring capacity in fishing industries taking into consideration these issues. -

Entry Dynamics, Capacity Utilisation and Productivity in a Dynamic Open Economy

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Aloi, Marta; Dixon, Huw D. Working Paper Entry Dynamics, Capacity Utilisation and Productivity in a Dynamic Open Economy CESifo Working Paper, No. 716 Provided in Cooperation with: Ifo Institute – Leibniz Institute for Economic Research at the University of Munich Suggested Citation: Aloi, Marta; Dixon, Huw D. (2002) : Entry Dynamics, Capacity Utilisation and Productivity in a Dynamic Open Economy, CESifo Working Paper, No. 716, Center for Economic Studies and ifo Institute (CESifo), Munich This Version is available at: http://hdl.handle.net/10419/75945 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu A joint Initiative of Ludwig-Maximilians-Universität and Ifo Institute for Economic Research Working Papers ENTRY DYNAMICS, CAPACITY UTILISATION AND PRODUCTIVITY IN A DYNAMIC OPEN ECONOMY* Marta Aloi Huw Dixon CESifo Working Paper No. -

Different Variants of Cash Balance Equation (Note-Compiled from Internet for Teaching Purpose )

Different Variants of Cash Balance Equation (Note-Compiled from internet for teaching purpose ) There are various forms of cash balance equation. Important ones are described as follows: Marshall’s Equation: Dr. Marshall has explained the value of money through the M = kY below mentioned equation: (Here, M : quantity of money, Y: monetary income, K: that part of the income which people want to keep as cash) Because monetary income (Y) is the product of gross production (O) and price level (P), i.e., Y = PXO. Hence, the above equation may be written as follows: M = POk or P =M/Ok Pigou’s Equation: Pigou’s equation is as follows: P = kR M (Here, M: total quantity of money, R: gross actual income, k: That part of actual income which people want to keep as cash.) Value of money is inverse of the general price level. In Fig. 12.2, demand and supply of money is shown on axis OX and value of money is shown on axis OY. DD is the demand curve of money. Q1M1; Q2M2; Q3M3 are supply curves of money. At a specified point oftime, supply of money is constant; hence it is represented through a straight line. When supply of money increases from OM1 to OM2, then, value of money decreases from OP1 to OP2. Reduction in value of money is in proportion to increase in supply of money. In the same way, when supply of money increases from OM2 to OM3, value of money decreases from OP2 to OP3. Still in reference to change in value of money, Pigou has given more importance to K as compared to M.