S&P 500 Earnings Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Polen Capital and the Focus Growth Some of Our Faster-Growing Technology Strategy

Polen Focus Growth Portfolio Manager Commentary – September 2020 Summary • During the third quarter of 2020, the Polen Focus • Gambling-like behavior in the market should give Growth Composite Portfolio (the “Portfolio”) anyone pause in our view, and we are remaining returned 10.15% gross of fees versus 13.22% for the conservative in our estimates of future earnings Russell 1000 Growth Index (the Index”) and 8.93% for growth and the prices we are willing to pay. the S&P 500. Year to date, the Portfolio has returned 22.25% gross of fees versus 24.33% for the Russell • In the third quarter, we initiated new positions in 1000 Growth and 5.57% for the S&P 500. UnitedHealth Group and Intuitive Surgical and eliminated our position in ADP. We also trimmed our • The U.S. election is just around the corner, and while positions in MSCI, ServiceNow, PayPal, Align the outcome is uncertain, we believe the operating Technology, and Microsoft. environment for our businesses over the long run is unlikely to change materially. • Valuations in the U.S. equity market continued to climb in the third quarter. While we feel comfortable with the businesses we own and their valuations, we have seen some ebullient behavior in certain companies that gives us pause. Seeks Growth & Capital Preservation (Performance (%) as of 9-30-2020) 1 Yr 3 Yr 5 Yr Inception 40 30 20 10 0 Qtr YTD 1 Yr 3 Yr 5 Yr Inception Polen Focus Growth (Gross) 10.15 22.25 35.17 24.83 21.04 15.42 Polen Focus Growth (Net) 10.01 21.81 34.53 24.24 20.46 14.43 Russell 1000 Growth TR 13.22 24.33 37.54 21.68 20.11 11.24 S&P 500 TR 8.93 5.57 15.15 12.28 14.15 10.53 The performance data quoted represents past performance and does not guarantee future results. -

SUNAMERICA SERIES TRUST Form NPORT-P Filed 2019-12-27

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2019-12-27 | Period of Report: 2019-10-31 SEC Accession No. 0001752724-19-204507 (HTML Version on secdatabase.com) FILER SUNAMERICA SERIES TRUST Mailing Address Business Address HARBORSIDE 5 21650 OXNARD STREET, CIK:892538| IRS No.: 137002445 | State of Incorp.:MA | Fiscal Year End: 0131 185 HUDSON STREET, 10TH FLOOR Type: NPORT-P | Act: 40 | File No.: 811-07238 | Film No.: 191313138 SUITE 3300 WOODLAND HILLS CA 91367 JERSEY CITY NJ 07311 201-324-6378 Copyright © 2019 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document SunAmerica Series Trust SA AB Growth Portfolio PORTFOLIO OF INVESTMENTS October 31, 2019 (unaudited) Value Security Description Shares (Note 1) COMMON STOCKS 91.6% Applications Software 6.8% Microsoft Corp. 758,520 $108,749,012 Athletic Footwear 2.6% NIKE, Inc., Class B 461,910 41,364,041 Beverages-Non-alcoholic 3.4% Monster Beverage Corp. 981,694 55,102,484 Beverages-Wine/Spirits 0.5% Constellation Brands, Inc., Class A 44,620 8,492,525 Coatings/Paint 2.2% Sherwin-Williams Co. 60,890 34,848,565 Commercial Services-Finance 3.1% Euronet Worldwide, Inc. 2,997 419,790 PayPal Holdings, Inc. 400,430 41,684,763 S&P Global, Inc. 30,810 7,948,672 50,053,225 Computer Aided Design 0.1% ANSYS, Inc. 4,069 895,790 Computers 0.9% Apple, Inc. 60,940 15,159,434 Dental Supplies & Equipment 0.8% Align Technology, Inc. 49,480 12,483,309 Distribution/Wholesale 1.3% Copart, Inc. -

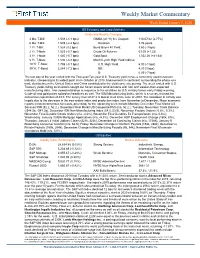

Weekly Market Commentary

Weekly Market Commentary Week Ended January 3, 2020 US Economy and Credit Markets Yields and Weekly Changes: 3 Mo. T-Bill: 1.508 (-4.4 bps) GNMA (30 Yr) 6% Coupon: 110-07/32 (2.77%) 6 Mo. T-Bill: 1.529 (-4.4 bps) Duration: 3.76 years 1 Yr. T-Bill: 1.524 (3.2 bps) Bond Buyer 40 Yield: 3.60 (-3 bps) 2 Yr. T-Note: 1.525 (-5.7 bps) Crude Oil Futures: 63.05 (+1.33) 3 Yr. T-Note: 1.540 (-5.7 bps) Gold Spot: 1,552.20 (+41.64) 5 Yr. T-Note: 1.590 (-8.8 bps) Merrill Lynch High Yield Indices: 10 Yr. T-Note: 1.788 (-8.7 bps) U.S. High Yield: 6.00 (-1 bps) 30 Yr. T-Bond: 2.244 (-7.2 bps) BB: 4.39 (1 bps) B: 6.09 (-7 bps) The last day of the year ended with the Two-year/Ten-year U.S. Treasury yield curve, a commonly used recession indicator, steepening to its widest point since October of 2018. Improvement in sentiment surrounding the phase-one trade deal between the United States and China contributed to the yield curve steepening. The week ended with U.S. Treasury yields falling as investors sought out haven assets amid tensions with Iran and weaker-than-expected manufacturing data. Iran vowed retaliation in response to the airstrikes by U.S. military forces early Friday morning. Crude oil and gold prices spiked on headlines as well. The ISM Manufacturing Index, which is a survey, missed the consensus expectation of 49.0. -

Fidelity® Contrafund®

Fidelity® Contrafund® Annual Report December 31, 2020 Contents Note to Shareholders 4 Performance 5 Management’s Discussion 6 of Fund Performance Investment Summary 7 Schedule of Investments 8 Financial Statements 28 Notes to Financial 33 Statements Report of Independent 45 Registered Public Accounting Firm Trustees and Officers 46 Shareholder Expense 56 Example Distributions 58 Proxy Voting Results 59 To view a fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines. Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation. Other third-party marks appearing herein are the property of their respective owners. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved. Annual Report This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus. -

Usaa Fund Holdings Usaa Nasdaq-100 Index Fund

USAA FUND HOLDINGS As of June 30, 2021 USAA NASDAQ-100 INDEX FUND CUSIP TICKER SECURITY NAME SHARES/PAR/CONTRACTS MARKET VALUE 00507V109 ATVI ACTIVISION BLIZZARD INC 229,531.00 21,906,438.64 00724F101 ADBE ADOBE INC 141,201.00 82,692,953.64 007903107 AMD ADVANCED MICRO DEVICES 358,915.00 33,712,885.95 015351109 ALXN ALEXION PHARMACEUTICALS 65,289.00 11,994,242.19 016255101 ALGN ALIGN TECHNOLOGY INC 23,377.00 14,283,347.00 02079K107 GOOG ALPHABET INC - CLASS C 62,814.00 157,431,984.48 02079K305 GOOGL ALPHABET INC - CLASS A 58,382.00 142,556,583.78 023135106 AMZN AMAZON.COM, INC. 97,900.00 336,791,664.00 025537101 AEP AEP CO., INC. 147,626.00 12,487,683.34 031162100 AMGN AMGEN, INC. 169,722.00 41,369,737.50 032654105 ADI ANALOG DEVICES, INC. 108,951.00 18,757,004.16 03662Q105 ANSS ANSYS INC 25,745.00 8,935,059.70 037833100 AAPL APPLE, INC. 3,239,420.00 443,670,963.20 038222105 AMAT APPLIED MATERIALS, INC. 269,988.00 38,446,291.20 052769106 ADSK AUTODESK, INC. 65,007.00 18,975,543.30 053015103 ADP AUTOMATIC DATA PROCESSING 125,698.00 24,966,136.76 056752108 BIDU BAIDU INC 76,539.00 15,606,302.10 09062X103 BIIB BIOGEN INC 44,474.00 15,400,011.98 09857L108 BKNG BOOKING HOLDINGS INC 12,127.00 26,534,967.43 11135F101 AVGO BROADCOM INC 120,612.00 57,512,626.08 12514G108 CDW CDW CORP OF DELAWARE 41,416.00 7,233,304.40 126408103 CSX CSX CORP. -

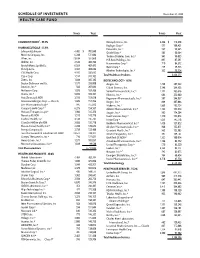

Schedule of Investments Health Care Fund

SCHEDULE OF INVESTMENTS December 31, 2020 HEALTH CARE FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 99.5% Dentsply Sirona, Inc. 2,228 $ 116,658 Repligen Corp.* 571 109,421 PHARMACEUTICALS - 31.9% Penumbra, Inc.* 527 92,225 Johnson & Johnson 4,485 $ 705,849 Quidel Corp.* 503 90,364 Merck & Company, Inc. 6,248 511,086 Tandem Diabetes Care, Inc.* 941 90,035 Pfizer, Inc. 13,634 501,868 Hill-Rom Holdings, Inc. 891 87,291 AbbVie, Inc. 4,543 486,782 Haemonetics Corp.* 710 84,312 Bristol-Myers Squibb Co. 6,569 407,475 Nevro Corp.* 459 79,453 Eli Lilly & Co. 2,391 403,696 iRhythm Technologies, Inc.* 332 78,754 CVS Health Corp. 4,915 335,695 Cigna Corp. 1,514 315,185 Total Healthcare-Products 6,434,517 Zoetis, Inc. 1,844 305,182 BIOTECHNOLOGY - 16.9% Becton Dickinson and Co. 1,171 293,008 Amgen, Inc. 1,729 397,532 DexCom, Inc.* 560 207,043 Gilead Sciences, Inc. 5,148 299,923 McKesson Corp. 1,078 187,486 Vertex Pharmaceuticals, Inc.* 1,124 265,646 Viatris, Inc.* 9,039 169,391 Illumina, Inc.* 684 253,080 AstraZeneca plc ADR 3,193 159,618 Regeneron Pharmaceuticals, Inc.* 507 244,937 AmerisourceBergen Corp. — Class A 1,609 157,296 Biogen, Inc.* 849 207,886 Jazz Pharmaceuticals plc* 945 155,972 Moderna, Inc.* 1,869 195,254 ,1 Canopy Growth Corp.* 6,273 154,567 Alexion Pharmaceuticals, Inc.* 1,124 175,614 Horizon Therapeutics plc* 1,986 145,276 Seagen, Inc.* 995 174,264 Novartis AG ADR 1,512 142,778 Exact Sciences Corp.* 1,170 155,013 Cardinal Health, Inc. -

Schedule of Investments Health Care Fund

SCHEDULE OF INVESTMENTS December 31, 2019 HEALTH CARE FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 99.6% Insulet Corp.* 657 $ 112,478 Henry Schein, Inc.* 1,575 105,084 PHARMACEUTICALS - 34.7% Masimo Corp.* 636 100,526 Johnson & Johnson 4,586 $ 668,960 Abiomed, Inc.* 572 97,577 Merck & Company, Inc. 5,761 523,963 Repligen Corp.* 819 75,758 Pfizer, Inc. 12,923 506,323 NuVasive, Inc.* 897 69,374 Bristol-Myers Squibb Co. 6,640 426,222 Tandem Diabetes Care, Inc.* 1,101 65,631 AbbVie, Inc. 4,443 393,383 Eli Lilly & Co. 2,925 384,433 Total Healthcare-Products 5,147,377 CVS Health Corp. 4,523 336,014 BIOTECHNOLOGY - 19.5% Cigna Corp. 1,486 303,872 Amgen, Inc. 1,701 410,060 Becton Dickinson and Co. 1,090 296,447 Gilead Sciences, Inc. 4,793 311,449 Zoetis, Inc. 2,074 274,494 Vertex Pharmaceuticals, Inc.* 1,184 259,237 Allergan plc 1,431 273,564 Biogen, Inc.* 844 250,440 McKesson Corp. 1,258 174,007 Illumina, Inc.* 729 241,838 DexCom, Inc.* 710 155,305 Regeneron Pharmaceuticals, Inc.* 589 221,158 AmerisourceBergen Corp. — Class A 1,699 144,449 Alexion Pharmaceuticals, Inc.* 1,516 163,955 Cardinal Health, Inc. 2,621 132,570 Seattle Genetics, Inc.* 1,314 150,138 AstraZeneca plc ADR 2,516 125,448 Incyte Corp.* 1,669 145,737 Jazz Pharmaceuticals plc* 818 122,111 BioMarin Pharmaceutical, Inc.* 1,575 133,166 Novartis AG ADR 1,243 117,700 Amarin Corporation plc ADR*,1 5,809 124,545 ,1 Canopy Growth Corp.* 5,456 115,067 Exact Sciences Corp.* 1,307 120,871 Elanco Animal Health, Inc.* 3,845 113,235 Alnylam Pharmaceuticals, Inc.* 1,044 120,238 GlaxoSmithKline -

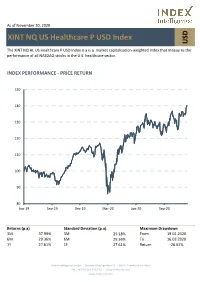

XINT NQ US Healthcare P USD Index USD

As of November 30, 2020 XINT NQ US Healthcare P USD Index USD The XINT NQ HL US Healthcare P USD Index is a is a market capitalization-weighted index that measures the performance of all NASDAQ stocks in the U.S. healthcare sector. INDEX PERFORMANCE - PRICE RETURN 150 140 130 120 110 100 90 80 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Returns (p.a) Standard Deviation (p.a) Maximum Drawdown 3M 37.99% 3M 25.18% From 19.02.2020 6M 29.36% 6M 29.36% To 16.03.2020 1Y 27.61% 1Y 27.61% Return -26.62% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com Top 10 Constituents FFMV (USDm) Weight % Industry Sector Amgen Inc 130,047 6.76 Health Care Intuitive Surgical Inc 84,670 4.40 Health Care Gilead Sciences Inc 76,063 3.96 Health Care Moderna Inc 60,269 3.13 Health Care Vertex Pharmaceuticals Inc 59,321 3.09 Health Care Regeneron Pharmaceuticals Inc 53,948 2.81 Health Care Illumina Inc 47,141 2.45 Health Care IDEXX Laboratories Inc 39,209 2.04 Health Care Biogen Inc 39,193 2.04 Health Care Align Technology Inc 37,919 1.97 Health Care Total 627,781 32.65 This information has been prepared by Index Intelligence GmbH (“IIG”). All information is provided "as is" and IIG makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included herein. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: December 31, 2010 Check here if Amendment [ ]; Amendment Number: ___ This Amendment (Check only one.):[ ] is a restatement. [ ] adds new holdings entries. Institutional Investment Manager Filing this Report: Name: ALLIANCEBERNSTEIN, L.P. Address: 1345 Avenue of the Americas NewYork, N.Y. 10105 Form 13F File Number: 28-10562 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Laurence Bertan Title: SVP and Head of Regulatory Reporting Phone: 212-969-1309 Signature, Place, and Date of Signing: /s/ Laurence Bertan New York, NY February 09, 2011 - -------------------------- -------------------- -------------------- [Signature] [City, State] [Date] All media outlets, please contact John Meyers at AllianceBernstein (212-969-2301) with any questions. All other questions can be directed to Michelle Pollitt at [email protected]. Report Type (Check only one.): [X] 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check here -

Federated Hermes Kaufmann Large Cap Fund

Federated Hermes Kaufmann Large Cap Fund Seeking growth through IPOs and innovation (KLCAX, KLCIX) Federated Hermes Kaufmann: Ticker Portfolio Date of Price Current An intensive, bottom-up focus on Holdings symbol weight (%) IPO of IPO price growth Communication Services Investors are drawn to growth funds for Activision Blizzard, Inc. ATVI 0.22 $92.38 many reasons. One primary reason is Alphabet Inc. GOOGL 3.10 $2,510.37 the pursuit of capital appreciation, the ability to grow assets over a long Facebook, Inc. FB 2.70 5/17/12 $38.00 $350.42 period. The true power of growth T-Mobile US, Inc. TMUS 3.28 $146.01 investing rests with the ability to The Walt Disney Company DIS 0.46 $177.04 compound earnings at an above-average rate. The challenge is Consumer Discretionary identifying those stocks capable of Airbnb, Inc. ABNB 0.48 12/10/20 $68.00 $149.64 doing so over at least a three to five-year time horizon. Alibaba Group Holding Limited - ADR BABA 0.72 9/18/14 $68.00 $205.94 This underscores the value of Amazon.com, Inc. AMZN 3.87 $3,719.34 Federated Hermes Kaufmann’s Chipotle Mexican Grill, Inc. CMG 0.57 $1,592.25 emphasis on pursuing exceptional, long-term growth opportunities at the Coupang LLC CPNG 0.36 3/11/21 $35.00 $42.13 best possible price—whether by Etsy, Inc. ETSY 1.01 $195.09 uncovering up-and-coming companies Floor & Decor Holdings, Inc. FND 0.55 $107.92 through intensive research, increasing positions in great companies when the Home Depot, Inc. -

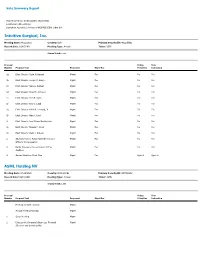

2021 Proxy Vote

Vote Summary Report Reporting Period: 07/01/2020 to 06/30/2021 Location(s): All Locations Institution Account(s): Horizons NASDAQ-100® Index ETF Intuitive Surgical, Inc. Meeting Date: 04/22/2021 Country: USA Primary Security ID: 46120E602 Record Date: 03/05/2021 Meeting Type: Annual Ticker: ISRG Shares Voted: 2,232 Proposal Voting Vote Number Proposal Text Proponent Mgmt Rec Policy Rec Instruction 1a Elect Director Craig H. Barratt Mgmt For For For 1b Elect Director Joseph C. Beery Mgmt For For For 1c Elect Director Gary S. Guthart Mgmt For For For 1d Elect Director Amal M. Johnson Mgmt For For For 1e Elect Director Don R. Kania Mgmt For For For 1f Elect Director Amy L. Ladd Mgmt For For For 1g Elect Director Keith R. Leonard, Jr. Mgmt For For For 1h Elect Director Alan J. Levy Mgmt For For For 1i Elect Director Jami Dover Nachtsheim Mgmt For For For 1j Elect Director Monica P. Reed Mgmt For For For 1k Elect Director Mark J. Rubash Mgmt For For For 2 Advisory Vote to Ratify Named Executive Mgmt For For For Officers' Compensation 3 Ratify PricewaterhouseCoopers LLP as Mgmt For For For Auditors 4 Amend Omnibus Stock Plan Mgmt For Against Against ASML Holding NV Meeting Date: 04/29/2021 Country: Netherlands Primary Security ID: N07059202 Record Date: 04/01/2021 Meeting Type: Annual Ticker: ASML Shares Voted: 1,593 Proposal Voting Vote Number Proposal Text Proponent Mgmt Rec Policy Rec Instruction Meeting for ADR Holders Mgmt Annual Meeting Agenda Mgmt 1 Open Meeting Mgmt 2 Discuss the Company's Business, Financial Mgmt Situation and Sustainability -

Securities at Value BT WALDEN EQUITY FUND 30-Apr-21

Securities At Value BT WALDEN EQUITY FUND 30-Apr-21 Ticker Description Shares/Par Market Value ADBE ADOBE SYSTEMS INC 4,000.0000 2,033,360.00 APD AIR PRODUCTS & CHEMICAL 8,000.0000 2,307,840.00 AKAM AKAMAI TECHNOLOGIES INC 22,000.0000 2,391,400.00 GOOG ALPHABET INC - CLASS C 4,700.0000 11,327,564.00 GOOGL ALPHABET INC - CLASS A 2,700.0000 6,354,450.00 AXP AMERICAN EXPRESS CO. 24,375.0000 3,737,906.25 AMGN AMGEN, INC. 7,000.0000 1,677,480.00 ADI ANALOG DEVICES 18,000.0000 2,756,880.00 AAPL APPLE INC. 145,000.0000 19,061,700.00 ATR APTARGROUP INC. 26,000.0000 3,921,060.00 ATO ATMOS ENERGY CORP 17,000.0000 1,761,030.00 ADP AUTOMATIC DATA PROCESS 25,850.0000 4,833,691.50 BDX BECTON DICKINSON & CO 16,500.0000 4,105,365.00 CHTR CHARTER COMMUNICATIONS 4,879.0000 3,285,762.55 CINF CINCINNATI FINANCIAL CORP 17,550.0000 1,977,534.00 CSCO CISCO SYSTEMS, INC. 77,000.0000 3,920,070.00 CL COLGATE PALMOLIVE CO. 20,000.0000 1,614,000.00 CMCSA COMCAST CORP-CLASS A 66,725.0000 3,746,608.75 COP CONOCOPHILLIPS 95,000.0000 4,858,300.00 COO COOPER COS 6,000.0000 2,465,340.00 COST COSTCO WHOLESALE CORP. 16,500.0000 6,139,485.00 CMI US CUMMINS INC 11,000.0000 2,772,440.00 DHR DANAHER CORP 11,000.0000 2,793,340.00 DE DEERE & COMPANY 13,300.0000 4,932,305.00 XRAY DENTSPLY SIRONA INC 15,000.0000 1,012,650.00 DIS WALT DISNEY CO.