Decoding the Enigma of Satoshi Nakamoto and the Birth of Bitcoin - Nytimes.Com

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is Bitcoin Really Untethered?

THE JOURNAL OF FINANCE • VOL. LXXV, NO. 4 • AUGUST 2020 Is Bitcoin Really Untethered? JOHN M. GRIFFIN and AMIN SHAMS∗ ABSTRACT This paper investigates whether Tether, a digital currency pegged to the U.S. dollar, influenced Bitcoin and other cryptocurrency prices during the 2017 boom. Using al- gorithms to analyze blockchain data, we find that purchases with Tether are timed following market downturns and result in sizable increases in Bitcoin prices. The flow is attributable to one entity, clusters below round prices, induces asymmetric auto- correlations in Bitcoin, and suggests insufficient Tether reserves before month-ends. Rather than demand from cash investors, these patterns are most consistent with the supply-based hypothesis of unbacked digital money inflating cryptocurrency prices. INNOVATION, EXCESSIVE SPECULATION, AND DUBIOUS behavior are often closely linked. Periods of extreme price increases followed by implosion, commonly known as “bubbles,” are often associated with legitimate inventions, technolo- gies, or opportunities. However, they can be carried to excess. In particu- lar, financial bubbles often coincide with the belief that a rapid gain can be ∗John M. Griffin is at the McCombs School of Business, University of Texas at Austin. Amin Shams is at the Fisher College of Business, Ohio State University. Helpful comments were received from Stefan Nagel (the editor); an associate editor; two anonymous referees; Cesare Fracassi; Sam Kruger; Shaun MaGruder; Gregor Matvos; Nikolai Roussanov; Clemens Sialm; and seminar and conference -

Cryptocurrency: the Economics of Money and Selected Policy Issues

Cryptocurrency: The Economics of Money and Selected Policy Issues Updated April 9, 2020 Congressional Research Service https://crsreports.congress.gov R45427 SUMMARY R45427 Cryptocurrency: The Economics of Money and April 9, 2020 Selected Policy Issues David W. Perkins Cryptocurrencies are digital money in electronic payment systems that generally do not require Specialist in government backing or the involvement of an intermediary, such as a bank. Instead, users of the Macroeconomic Policy system validate payments using certain protocols. Since the 2008 invention of the first cryptocurrency, Bitcoin, cryptocurrencies have proliferated. In recent years, they experienced a rapid increase and subsequent decrease in value. One estimate found that, as of March 2020, there were more than 5,100 different cryptocurrencies worth about $231 billion. Given this rapid growth and volatility, cryptocurrencies have drawn the attention of the public and policymakers. A particularly notable feature of cryptocurrencies is their potential to act as an alternative form of money. Historically, money has either had intrinsic value or derived value from government decree. Using money electronically generally has involved using the private ledgers and systems of at least one trusted intermediary. Cryptocurrencies, by contrast, generally employ user agreement, a network of users, and cryptographic protocols to achieve valid transfers of value. Cryptocurrency users typically use a pseudonymous address to identify each other and a passcode or private key to make changes to a public ledger in order to transfer value between accounts. Other computers in the network validate these transfers. Through this use of blockchain technology, cryptocurrency systems protect their public ledgers of accounts against manipulation, so that users can only send cryptocurrency to which they have access, thus allowing users to make valid transfers without a centralized, trusted intermediary. -

![Joseph Gao EAS 499: Senior Thesis Advisor: Brett Hemenway [DRAFT]](https://docslib.b-cdn.net/cover/8045/joseph-gao-eas-499-senior-thesis-advisor-brett-hemenway-draft-518045.webp)

Joseph Gao EAS 499: Senior Thesis Advisor: Brett Hemenway [DRAFT]

Joseph Gao EAS 499: Senior Thesis Advisor: Brett Hemenway [DRAFT] Introduction to Cryptocurrencies for Retail Investors 1. ABSTRACT In the year 1998, roughly seven years before the smartphone revolution, (2007 marked the release of the iPhone, which arguably kicked off the ‘always online’ era that we live in today), Wei Dai published a proposal for an “anonymous, distributed electronic cash system”.(http://www.weidai.com/bmoney.txt). In the paper, Dai introduced two protocols to achieve his proposal - the first using a proof of work function as a means of creating money, and the second defining a set of servers responsible for keeping accounts, which must be regularly published, and verify balances for the other participants in the decentralized system. While B-money never took off, in part due to the impractical requirement of the first protocol that asks for a broadcast channel that is synchronous and unjammable, Wei Dai’s proposal planted the seeds of an idea that would later inspire Satoshi Nakamoto to publish the Bitcoin: A Peer-to-Peer Electronic Cash System white paper. This publication sparked a renewed wave of interest in distributed payment systems and resulted in thousands and thousands of new proposals and protocols to be developed in the next ten years. 2. INTRODUCTION The year of 2017 showed immense mainstream adoption in a number of cryptocurrencies. However, while mainstream chatter of these various cryptocurrencies has become nearly impossible to avoid, many retail investors are unfamiliar with the underlying technology powering each coin, according to studies performed by CoinDesk, Blockchain Capital, and The 1 University of Cambridge . -

What Is the Upper Limit of Value?

WHAT IS THE UPPER LIMIT OF VALUE? Anders Sandberg∗ David Manheim∗ Future of Humanity Institute 1DaySooner University of Oxford Delaware, United States, Suite 1, Littlegate House [email protected] 16/17 St. Ebbe’s Street, Oxford OX1 1PT [email protected] January 27, 2021 ABSTRACT How much value can our decisions create? We argue that unless our current understanding of physics is wrong in fairly fundamental ways, there exists an upper limit of value relevant to our decisions. First, due to the speed of light and the definition and conception of economic growth, the limit to economic growth is a restrictive one. Additionally, a related far larger but still finite limit exists for value in a much broader sense due to the physics of information and the ability of physical beings to place value on outcomes. We discuss how this argument can handle lexicographic preferences, probabilities, and the implications for infinite ethics and ethical uncertainty. Keywords Value · Physics of Information · Ethics Acknowledgements: We are grateful to the Global Priorities Institute for highlighting these issues and hosting the conference where this paper was conceived, and to Will MacAskill for the presentation that prompted the paper. Thanks to Hilary Greaves, Toby Ord, and Anthony DiGiovanni, as well as to Adam Brown, Evan Ryan Gunter, and Scott Aaronson, for feedback on the philosophy and the physics, respectively. David Manheim also thanks the late George Koleszarik for initially pointing out Wei Dai’s related work in 2015, and an early discussion of related issues with Scott Garrabrant and others on asymptotic logical uncertainty, both of which informed much of his thinking in conceiving the paper. -

Cryptocurrency and the Blockchain: Technical Overview and Potential Impact on Commercial Child Sexual Exploitation

Cryptocurrency and the BlockChain: Technical Overview and Potential Impact on Commercial Child Sexual Exploitation Prepared for the Financial Coalition Against Child Pornography (FCACP) and the International Centre for Missing & Exploited Children (ICMEC) by Eric Olson and Jonathan Tomek, May 2017 Foreword The International Centre for Missing & Exploited Children (ICMEC) advocates, trains and collaborates to eradicate child abduction, sexual abuse and exploitation around the globe. Collaboration – one of the pillars of our work – is uniquely demonstrated by the Financial Coalition Against Child Pornography (FCACP), which was launched in 2006 by ICMEC and the National Center for Missing & Exploited Children. The FCACP was created when it became evident that people were using their credit cards to buy images of children being sexually abused online. Working alongside law enforcement, the FCACP followed the money to disrupt the economics of the child pornography business, resulting in the virtual elimination of the use of credit cards in the United States for the purchase of child sexual abuse content online. And while that is a stunning accomplishment, ICMEC and the FCACP are mindful of the need to stay vigilant and continue to fight those who seek to profit from the sexual exploitation of children. It is with this in mind that we sought to research cryptocurrencies and the role they play in commercial sexual exploitation of children. This paper examines several cryptocurrencies, including Bitcoin, and the Blockchain architecture that supports them. It provides a summary of the underground and illicit uses of the currencies, as well as the ramifications for law enforcement and industry. ICMEC is extremely grateful to the authors of this paper – Eric Olson and Jonathan Tomek of LookingGlass Cyber Solutions. -

How Bitcoin Functions As Property Law Eric D

College of William & Mary Law School William & Mary Law School Scholarship Repository Faculty Publications Faculty and Deans 2019 How Bitcoin Functions As Property Law Eric D. Chason William & Mary Law School, [email protected] Repository Citation Chason, Eric D., "How Bitcoin Functions As Property Law" (2019). Faculty Publications. 1896. https://scholarship.law.wm.edu/facpubs/1896 Copyright c 2019 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/facpubs How Bitcoin Functions As Property Law Eric D. Chason* Bitcoin replicates many of the formal aspects of real estate transactions. Bitcoin transactions have features that closely resemble grantor names, grantee names, legal descriptions, and signatures found in real property deeds. While these “Bitcoin deeds” may be interesting, they are not profound. Bitcoin goes beyond creating simple digital deeds, however, and replicates important institutional aspects of real estate transactions, in particular recordation and title assurance. Deeds to real property are recorded in a central repository (e.g., the public records office), which the parties (and the public) can search to determine title. When one grantor executes more than one deed covering the same property, recordation acts (race, notice, and race-notice) determine which grantee wins. The Bitcoin blockchain replicates the public records office, giving anyone with a computer the ability to see any Bitcoin transaction. Bitcoin mining replicates the recording of deeds, a process by which formally valid transactions between two parties become essentially a public record. When one grantor executes more than one transaction covering the same Bitcoin, a miner determines which grantee wins simply by moving one transaction to the blockchain before the others. -

A R E S E a R C H Agenda

Cooperation, Conflict, and Transformative Artificial Intelligence — A RESEARCH AGENDA Jesse Clifton — LONGTERMRISK.ORG March 2020 First draft: December 2019 Contents 1 Introduction 2 1.1 Cooperation failure: models and examples . .3 1.2 Outline of the agenda . .5 2 AI strategy and governance 8 2.1 Polarity and transition scenarios . .8 2.2 Commitment and transparency . .8 2.3 AI misalignment scenarios . 10 2.4 Other directions . 10 2.5 Potential downsides of research on cooperation failures . 11 3 Credibility 12 3.1 Commitment capabilities . 13 3.2 Open-source game theory . 13 4 Peaceful bargaining mechanisms 16 4.1 Rational crisis bargaining . 16 4.2 Surrogate goals . 18 5 Contemporary AI architectures 21 5.1 Learning to solve social dilemmas . 21 5.2 Multi-agent training . 24 5.3 Decision theory . 25 6 Humans in the loop 27 6.1 Behavioral game theory . 27 6.2 AI delegates . 28 7 Foundations of rational agency 30 7.1 Bounded decision theory . 30 7.2 Acausal reasoning . 31 8 Acknowledgements 35 1 1 Introduction Transformative artificial intelligence (TAI) may be a key factor in the long-run trajec- tory of civilization. A growing interdisciplinary community has begun to study how the development of TAI can be made safe and beneficial to sentient life (Bostrom, 2014; Russell et al., 2015; OpenAI, 2018; Ortega and Maini, 2018; Dafoe, 2018). We present a research agenda for advancing a critical component of this effort: preventing catastrophic failures of cooperation among TAI systems. By cooperation failures we refer to a broad class of potentially-catastrophic inefficiencies in interactions among TAI-enabled actors. -

How Do Non-Poaching Agreements Distort Competition? the Rise of The

Advancing economics in business April 2020 TheHow rise do non-poachingof the cryptoexchange giants: whatagreements next for distort trading competition? cryptocurrencies? The rise of the cryptoexchange giants: what next for trading cryptocurrencies? Contact How cryptocurrencies work Helen Ralston Partner Bitcoin and other cryptocurrencies are permissionless forms of blockchain technology that rely on a ‘proof of work’ concept to verify transactions. In such a system, transactions are verified by third parties (commonly referred to as ‘miners’) racing to be the first to solve a unique, complex mathematical problem that is specific to each transaction and the history of preceding transactions. The first miner to solve the problem records the answer in the decentralised blockchain along with Since the inception of Bitcoin over its private key, thereby lengthening the chain. If the network confirms that this is the a decade ago, trading in crypto- correct answer—by other miners also identifying the same solution—the first miner is currencies has exploded. There are rewarded with coins in the system. now thousands of cryptocurrencies and hundreds of cryptoexchanges to Three features of the system make it robust to fraud: first, transactions are verified on a consensus basis (i.e. the majority of the network must agree that the transaction is trade on, of which Binance is by far the correct). Second, the verification (mining) process is time- and energy-intensive and largest. What is the secret of the few intentionally difficult to solve. Third, all transactions are linked, such that if someone big cryptoexchanges, and is the high wanted to change an earlier transaction they would need to redo all the subsequent number of smaller cryptoexchanges mining and do so before the rest of the network approved the next block. -

United States District Court Southern District of Florida

Case 9:18-cv-80176-BB Document 277 Entered on FLSD Docket 08/27/2019 Page 1 of 29 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF FLORIDA CASE NO. 18-CIV-80176-Bloom/Reinhart IRA KLEIMAN, as personal representative of the estate of David Kleiman, and W&K INFO DEFENSE RESEARCH, LLC, Plaintiffs, v. CRAIG WRIGHT, Defendant. ___________________________________/ ORDER ON PLAINTIFFS’ MOTION TO COMPEL [DE 210]1 This matter is before the Court on the Plaintiffs’ Motion to Compel, DE 210, and the Court’s Order dated June 14, 2019. DE 217. The Court has considered the totality of the docketed filings, including all pleadings referenced herein and transcripts of all cited court proceedings. As the judicial officer who presided at the relevant proceedings, I retain a current and independent recollection of the events discussed below. I have reviewed all of the exhibits introduced into the record at the evidentiary hearing, including the deposition excerpts filed in the record. See DE 270. Finally, I have carefully considered the arguments of counsel. The Court is fully advised and this matter is ripe for decision. The Court announced its ruling from the bench on August 26, 1 Magistrate judges may issue an order on any “pretrial matter not dispositive of a party's claim or defense.” Fed. R. Civ. P. 72(a). “Thus, magistrate judges have jurisdiction to enter sanctions orders for discovery failures which do not strike claims, completely preclude defenses or generate litigation-ending consequences.” Wandner v. Am. Airlines, 79 F. Supp. 3d 1285, 1295 (S.D. Fla. 2015) (J. -

How Did Dread Pirate Roberts Acquire and Protect His Bitcoin Wealth?

How Did Dread Pirate Roberts Acquire and Protect His Bitcoin Wealth? Dorit Ron and Adi Shamir Department of Computer Science and Applied Mathematics, The Weizmann Institute of Science, Israel {dorit.ron,adi.shamir}@weizmann.ac.il Abstract. The Bitcoin scheme is one of the most popular and talked about alternative payment schemes. It was conceived in 2008 by the mysterious Satoshi Nakamoto, whose real identity remains unknown even though his bitcoin holdings are believed to be worth several hundred million dollars. One of the most active parts of the Bitcoin ecosystem was the Silk Road marketplace, in which highly illegal substances and services were traded. It was run by another mysterious person who called himself Dread Pirate Roberts (DPR), whose bitcoin holdings are also estimated to be worth hundreds of millions of dollars at today's exchange rate. On October 1-st 2013, the FBI arrested a 29 year old person named Ross William Ulbricht, claiming that he is DPR, and seizing a small fraction of his bitcoin wealth. In this paper we use the publicly available record to trace the evolution of his holdings in order to find how he acquired and how he tried to hide them from the authorities. For example, we show that all his income from the months of May, June and September 2013, along with numerous other amounts, were not seized by the FBI. One of the most surprising discoveries we made during our analysis was the existence of a recent substantial transfer (which was worth more than 60,000 dollars when made on March 20-th 2013, and close to a million dollars at today's exchange rate) which may link these two mysterious figures. -

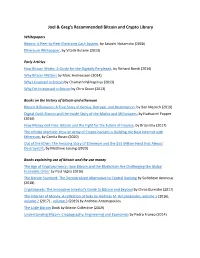

Joel & Greg's Recommended Bitcoin and Crypto Library

Joel & Greg’s Recommended Bitcoin and Crypto Library Whitepapers Bitcoin: A Peer‐to‐Peer Electronic Cash System, by Satoshi Nakamoto (2008) Ethereum Whitepaper, by Vitalik Buterin (2013) Early Articles How Bitcoin Works: A Guide for the Digitally Perplexed, by Richard Bondi (2014) Why Bitcoin Matters by Marc Andreessen (2014) Why I Invested in Bitcoin by Chamath Palihapitiya (2013) Why I’m Interested in Bitcoin by Chris Dixon (2013) Books on the history of bitcoin and ethereum Bitcoin Billionaires: A True Story of Genius, Betrayal, and Redemption, by Ben Mezrich (2019) Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires, by Nathaniel Popper (2016) How Money Got Free: Bitcoin and the Fight for the Future of Finance, by Brian Eha (2017) The Infinite Machine: How an Army of Crypto‐hackers is Building the Next Internet with Ethereum, by Camila Russo (2020) Out of the Ether: The Amazing Story of Ethereum and the $55 Million Heist that Almost Destroyed It, by Matthew Leising (2020) Books explaining use of bitcoin and the use money The Age of Cryptocurrency: How Bitcoin and the Blockchain Are Challenging the Global Economic Order by Paul Vigna (2016) The Bitcoin Standard: The Decentralized Alternative to Central Banking by Saifedean Ammous (2018) Cryptoassets: The Innovative Investor's Guide to Bitcoin and Beyond by Chros Burniske (2017) The Internet of Money: A collection of talks by Andreas M. Antonopoulos, volume 1 (2016), volume 2 (2017) , volume 3 (2019) by Andreas Antonopoulos The Little Bitcoin Book by Bitcoin Collective -

House Resolution (No.33)

ENROLLED 2021 Regular Session HOUSE RESOLUTION NO. 33 BY REPRESENTATIVE WRIGHT A RESOLUTION To commend Bitcoin for its success in becoming the first decentralized trillion dollar asset and to encourage the state and local governments to consider ways that could help them benefit from the increased use of this new technology. WHEREAS, Bitcoin, a well-known type of cryptocurrency, was first proposed in 2008 by the pseudonymous author Satoshi Nakamoto; and WHEREAS, Bitcoin, which could potentially replace gold as a monetary reserve, is limited and finite and there is a maximum capacity of only twenty-one million bitcoins allowed to be produced; and WHEREAS, Bitcoin is a completely decentralized digital asset, which means it utilizes a peer-to-peer, open source, automated digital asset trading platform where the parties deal directly with each other and without the need of a third party as opposed to a centralized exchange, which provides the parties with a trading platform and utilizes a third party; and WHEREAS, Bitcoin, following its introduction in 2009, began using a Proof of Work system, which allows for secure, decentralized consensus and allows Bitcoin and other cryptocurrencies to utilize peer-to-peer transactions in a secure manner without the need for a trusted third party; and WHEREAS, as the demand for cryptocurrencies such as Bitcoin increases, there is also an increased need for community currencies, which help facilitate local transactions or exchanges within groups with common needs; and WHEREAS, Community currencies, such as Moxey, which is a proprietary digital community currency invented in Louisiana, are beneficial to businesses that participate in these transactions or exchanges by providing access to new customers, better access to capital, and new tools for employee bonuses and compensation; and Page 1 of 2 HR NO.