Earnings Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Service Bulletin TECHNICAL

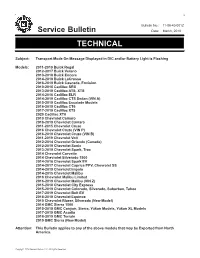

Bulletin No.: 11-08-49-001Z Service Bulletin Date: March, 2019 TECHNICAL Subject: Transport Mode On Message Displayed in DIC and/or Battery Light is Flashing Models: 2011-2019 Buick Regal 2012-2017 Buick Verano 2013-2018 Buick Encore 2014-2019 Buick LaCrosse 2016-2019 Buick Cascada, Envision 2010-2016 Cadillac SRX 2013-2019 Cadillac ATS, XTS 2014-2016 Cadillac ELR 2014-2019 Cadillac CTS Sedan (VIN A) 2015-2019 Cadillac Escalade Models 2016-2019 Cadillac CT6 2017-2019 Cadillac XT5 2020 Cadillac XT6 2010 Chevrolet Camaro 2016-2019 Chevrolet Camaro 2011-2015 Chevrolet Cruze 2016 Chevrolet Cruze (VIN P) 2016-2019 Chevrolet Cruze (VIN B) 2011-2019 Chevrolet Volt 2012-2014 Chevrolet Orlando (Canada) 2012-2019 Chevrolet Sonic 2013-2019 Chevrolet Spark, Trax 2014 Chevrolet Corvette 2014 Chevrolet Silverado 1500 2014-2016 Chevrolet Spark EV 2014-2017 Chevrolet Caprice PPV, Chevrolet SS 2014-2019 Chevrolet Impala 2014-2015 Chevrolet Malibu 2016 Chevrolet Malibu Limited 2016-2019 Chevrolet Malibu (VIN Z) 2015-2018 Chevrolet City Express 2015-2019 Chevrolet Colorado, Silverado, Suburban, Tahoe 2017-2019 Chevrolet Bolt EV 2018-2019 Chevrolet Equinox 2019 Chevrolet Blazer, Silverado (New Model) 2014 GMC Sierra 1500 2015-2019 GMC Canyon, Sierra, Yukon Models, Yukon XL Models 2017-2019 GMC Acadia 2018-2019 GMC Terrain 2019 GMC Sierra (New Model) Attention: This Bulletin applies to any of the above models that may be Exported from North America. Copyright 2019 General Motors LLC. All Rights Reserved. Page 2 March, 2019 Bulletin No.: 11-08-49-001Z This Bulletin has been revised to add the Model Year 2020 Cadillac XT6 and add the 2017-2019 Cadillac XT5 / 2017-2019 GMC Acadia and 2020 Cadillac XT6 to the Procedure Subsection titled: 2016-2019 Buick Envision / 2018-2019 Chevrolet Equinox, GMC Terrain. -

Condition/Concern

Bulletin No.: PIC6123B Date: Jan-2017 Subject: Adaptive Cruise Temporarily Unavailable Message Lane Keep Assist (LKA) Inoperative in High Ambient Temperatures Models: 2013 - 2017 Cadillac ATS 2014 - 2017 Cadillac CTS (VIN A) 2016 - 2017 Cadillac CT6 2013 - 2017 Cadillac XTS 2017 Cadillac XT5 2015 - 2017 Cadillac Escalade Models 2013 - 2016 Cadillac SRX This PI was updated to add models. Please discard PIC6123A. Condition/Concern Some customers may comment that an Adaptive Cruise Temporarily Unavailable message is displayed In the DIC when attempting to use Cruise Control after the vehicle has been parked in direct sunlight in high ambient temperatures. Furthermore it may be noticed that the Lane Keep Assist (LKA) will also be inoperable on startup and the LED indicator on the LKA switch will not be illuminated. If the LKA switch is pressed in this state, the DIC will display Lane Keep Assist Unavailable. If the Cameras internal ECU temperature exceeds 85 degrees C (185 deg. F) the image sensor will shut down. (The internal operating temperature range for the image sensor is -40 deg. C to 85 deg. C. (-40 deg. F to 185 deg. F.)) When this happens the image processor no longer functions and as a result Adaptive Cruise Control and Lane Keep Assist will be unavailable until the temperature falls within the operating range. There are two failure modes based on the ECU temperature, the data seen in GDS will be different depending on which failure mode is present. 1. First stage: • Adaptive Cruise Temporarily Unavailable Message • LKA does not function • Image Sensor in front View Camera Module (FVCM) stops functioning. -

Get to Know Your 2021 Cadillac

21_CAD_XT5_COV_en_US_84581321B_2020NOV4.pdf 1 10/13/2020 1:09:52 PM C M Y CM MY CY CMY K Cadillac XT5 Owner Manual (GMNA-Localizing-U.S./Canada/Mexico- 14590481) - 2021 - CRC - 10/22/20 Introduction model variants, country specifications, Contents features/applications that may not be available in your region, or changes Introduction . 1 subsequent to the printing of this owner’s manual. Keys, Doors, and Windows . 6 Refer to the purchase documentation Seats and Restraints . 37 relating to your specific vehicle to Storage . 86 confirm the features. Instruments and Controls . 93 The names, logos, emblems, slogans, Keep this manual in the vehicle for vehicle model names, and vehicle quick reference. Lighting . 132 body designs appearing in this manual Infotainment System . 139 including, but not limited to, GM, the Canadian Vehicle Owners GM logo, CADILLAC, the CADILLAC Climate Controls . 201 A French language manual can be Emblem, and XT5 are trademarks and/ obtained from your dealer, at Driving and Operating . 209 or service marks of General Motors www.helminc.com, or from: LLC, its subsidiaries, affiliates, Vehicle Care . 292 or licensors. Propriétaires Canadiens Service and Maintenance . 373 For vehicles first sold in Canada, On peut obtenir un exemplaire de ce Technical Data . 387 substitute the name “General Motors guide en français auprès du ” Customer Information . 392 of Canada Company for Cadillac concessionnaire ou à l'adresse Motor Car Division wherever it suivante: Reporting Safety Defects . 402 appears in this manual. Helm, Incorporated OnStar . 405 This manual describes features that Attention: Customer Service Connected Services . 410 may or may not be on the vehicle 47911 Halyard Drive because of optional equipment that Plymouth, MI 48170 Index . -

2019-XT5-Brochure-Compressed.Pdf

XT5 2019 CADILLAC XT5 2019 Beauty can manifest itself in many different forms. It can delight and satisfy the eye. Move and comfort the body. Shape space and versatility. Beauty is not simply in the eye of the beholder. It is also to be held. Handled. Transformed. With effortless style, grace and elegance, beauty like this is a joy that can be felt forever. THE 2019 XT5 CADILLAC XT5 2019 BEAUTY SHAPED TO MOVE The 2019 XT5 intrinsically melds the look of high fashion with everyday needs. From a bold design aesthetic, to an ingenious cabin that is as spacious as it is versatile, to a striking stance, the Cadillac XT5 is ready to accommodate. When you step inside the XT5, you will see terrific design cues that feature a wide dash that hosts cutting-edge technologies with timeless craftsmanship. Wood, leather appointments and other materials have been chosen and fitted with a care reminiscent of fine tailoring. XT5 Premium Luxury in Dark Granite Metallic. Shown with available equipment. SIGNATURE LED HEADLAMPS & CRAFTED CABIN CADILLAC XT5 2019 Elegance abounds. With a hand-stitched steering wheel and dashboard, along with cut-and-sewn seating surfaces, each of the available interior combinations has been carefully curated. Leathers available in unique colours and custom stained exotic woods are paired for a rich yet understated feel. Wherever you are going, you’ll arrive in style. Lamps so artful, they’re signed. The Cadillac front and rear light systems offer available advanced LED technology with brilliant illumination. The headlamps and tail lamps are etched with the detail of the signature Cadillac Crest. -

Car Wars 2020-2023 the Rise (And Fall) of the Crossover?

The US Automotive Product Pipeline Car Wars 2020-2023 The Rise (and Fall) of the Crossover? Equity | 10 May 2019 Car Wars thesis and investment relevance Car Wars is an annual proprietary study that assesses the relative strength of each automaker’s product pipeline in the US. The purpose is to quantify industry product trends, and then relate our findings to investment decisions. Our thesis is fairly straightforward: we believe replacement rate drives showroom age, which drives market United States Autos/Car Manufacturers share, which drives profits and stock prices. OEMs with the highest replacement rate and youngest showroom age have generally gained share from model years 2004-19. John Murphy, CFA Research Analyst Ten key findings of our study MLPF&S +1 646 855 2025 1. Product activity remains reasonably robust across the industry, but the ramp into a [email protected] softening market will likely drive overcrowding and profit pressure. Aileen Smith Research Analyst 2. New vehicle introductions are 70% CUVs and Light Trucks, and just 24% Small and MLPF&S Mid/Large Cars. The material CUV overweight (45%) will likely pressure the +1 646 743 2007 [email protected] segment’s profitability to the low of passenger cars, and/or will leave dealers with a Yarden Amsalem dearth of entry level product to offer, further increasing an emphasis on used cars. Research Analyst MLPF&S 3. Product cadence overall continues to converge, making the market increasingly [email protected] competitive, which should drive incremental profit pressure across the value chain. Gwen Yucong Shi 4. -

2018-Cadillac-XT5-Product-Guide

VEHICLE HIGHLIGHTS . Lightweight construction elevates efficiency and driving performance . Design and structure engineered to increase interior space without adding bulk . V6 engine and advanced all-wheel drive . Convenience features like rear camera mirror, Apple CarPlay & Android Auto compatibility, Cadillac user experience system, hands-free liftgate, WiFi hotspot and charging USB ports PRODUCT INFORMATION Cadillac’s lightweight, sophisticated, and tech-outfitted XT5 paves way for brand’s luxury crossovers The 2018 Cadillac XT5 crossover combines spacious luxury and high-tech convenience features to create the perfect Crossover Touring 5 vehicle. Features include the rear camera mirror, Apple CarPlay & Android Auto compatibilities, auto-heated steering wheel and front- and rear-seat USB capabilities. The XT5 luxury crossover launched in mid-2016 and has quickly become one of the U.S. market’s best-selling luxury models. A promising start to the first of four promised Cadillac luxury crossovers in production. The XT5 is lightweight with a design structure specifically created to improve fuel economy, driving dynamics and interior space. It’s powered by the same 3.6-liter V6 engine that debuted in the 2017 ATS and CTS sport sedans, and is currently used in the CT6. The XT5’s reputation for connectivity is further bolstered by additional USB ports, which will be available in the 2018 model. The XT5’s mobile friendliness is evident with storage for both phones and tablets in the center console, WiFi capabilities and charging ports conveniently accessible in the front and rear seats. CHASSIS -- Lightweight, efficient package enables more space The Cadillac XT5 relies on the unique lightweight design of its chassis for increased fuel economy and the ultimate driving experience. -

2017 Cadillac CT6

2017 CT6 XT5 ATS CTS ESCALADE XTS A portfolio of vehicles as spirited, technologically FOR THOSE MOVED BY advanced and sophisticated as the people who drive them. Prestige Coupe, Sedan or SUV, each is perfect PERFORMANCE, INNOVATION for a journey toward the very best. A relentless journey that’s always filled with passion and never emptied AND CRAFTSMANSHIP with inactivity. Cadillac 2017. Technology that shines brilliantly, born of minds that work tirelessly. Every millimetre is a chiseled vision of modern craftsmanship. Power and poise are a truer definition of performance. Spacious enough to hold a precise attention to detail. CT6 An exclamation on reinvention Reimagined. Reinvigorated. Refined. The CT6 is the prestige sedan reinvented. Performance, innovation and craftsmanship have been pushed to their furthest, with a passion that need not shout what greatness it has accomplished. But, instead, simply and confidently enjoys it. The 2017 Cadillac CT6. OFFERED FEATURES: FUSION FRAME • ACTIVE CHASSIS PACKAGE • REAR SEAT INFOTAINMENT AND CLIMATE PACKAGE • BOSE® PANARAY® SOUND SYSTEM • EXTENDED COMFORT SEATS • REAR CAMERA MIRROR CT6 Absolutely agile A brilliant look back Entertained and comfortable regardless of where you’re sitting An incredibly rigid, yet lightweight frame, utilizing An available Rear Camera Mirror streams HD innovative fusion technologies, high-pressure video through the rearview mirror. This less The available Rear Seat Infotainment and Climate aluminium casting and high-strength steel, is at the obstructed view offers significantly more Package features articulating 25.4 cm diagonal HD heart of this sedan. Coupled with the available vision than ordinary technology, and reverts screens with Blu-ray™ playback and connectivity Active Chassis System with 4-wheel steering, along to a traditional mirror with just a touch. -

2021 CADILLACARABIA.COM /Cadillacarabia

XT5 XT5 /cadillacarabia CADILLACARABIA.COM 2021 CADILLAC XT5 2021 Fall in love with driving all over again with effortless style, grace and elegance. Built to embody purpose and perfection with a passion to stimulate your senses. The XT5 offers the agility of a sedan with the stability of an SUV in a unique versatile crossover designed to inspire, excite and exhilarate your everyday. THE UNDENIABLE 2021 XT5 CADILLAC XT5 2021 MAKE AN ENTRANCE Built to turn heads with sharp lines and sweeping curves, the new XT5 is a symbol of flawless design that never fails to attract attention. The signature grille, undisputable crest and jewel-like lighting makes this impressive crossover stand out from the rest. Get behind the wheel and start your journey in undeniable style made to move you. XT5 Sport in Satin Steel Metallic. Shown with available equipment. SIGNATURE LED HEADLAMPS & CRAFTED CABIN CADILLAC XT5 2021 Elegance that astounds. Every material in the XT5 is carefully selected to come together as one masterpiece. When your steering wheel and dashboard are hand- stitched and made of Semi-Aniline leather, uniquely colored leather seats are exquisitely cut-and-sewn with Chevron perforated inserts, and exotic wooden panels are custom stained to suit your style; you know it doesn’t get any better. Leads the way with extraordinary vision. Because no ordinary lamp would do the XT5 justice, it comes with the Cadillac front and rear light systems built with LED technology to give you brilliant illumination. Every headlamp and taillamp is carefully etched with the signature Cadillac crest, that not only adds style, but function too. -

About General Motors China 02 2018 GM China Corporate Social Responsibility Report 03

For years, we have said that the auto industry is experiencing more change today than in the past 50 years. That pace of change is only accelerating. With the right team, technology, resources and scale to achieve our vision of zero Contents crashes, zero emissions and zero congestion, I believe the only thing that can stop us is not acting quickly enough. Disruption creates uncertainty, but it also creates vast possibilities 02 Leadership Message that will lead to a better world. 04 2018 Highlights Mary Barra, General Motors Chairman and CEO 06 Sustainable Vision Creating a Future of Zero Crashes, Zero Emissions and Zero Congestion 08 Sustainable Growth Innovate Now: Seeing Things Not as They Are But as They Could Be Products, Technology and Experience Driving Industry Development 14 On the Spot Optimizing Our Facilities Committed to Safety in Everything We Do Addressing New Security Challenges 20 Special Focus Green Supply Chain 22 Working Together for a Sustainable Future GM and Our Customers GM and Our Employees GM and Our Community 32 Corporate Social Responsibility Management Corporate Social Responsibility Strategy Stakeholder Involvement Honors and Recognition 35 About General Motors China 02 2018 GM China Corporate Social Responsibility Report 03 Leadership Message Corporate Social Responsibility is Synonymous with Our Business Strategy in How do employee volunteers support GM China activities? China at General Motors Our employees have long been active What role does corporate social GM is on track to deliver 10 NEV models participants in many of GM China's CSR responsibility (CSR) play in GM China’s in China between 2016 and 2020, and activities. -

Magazine the Well-Driven Life Winter 2016

CADILLAC MAGAZINE THE WELL-DRIVEN LIFE WINTER 2016 KINGDOM OF AWE EXPLORING THE EXOTIC BEAUTY OF CAMBODIA JASON MRAZ PLANTS THE SEEDS OF KINDNESS FIRST-EVER CT6 TAKES A DOWNTOWN DRIVE THE SHARED WORKSPACE COMES OF AGE WELCOME THIS YEAR WE BEGIN to transform the Cadillac brand. We launched our new brand platform, Dare Greatly, as a signal of our ambition. We moved our marketing, leadership, and sales organization to New York, while keeping Cadillac’s great design and engineering functions in Detroit. And we’ve hosted some incredible events, including the reveals of the first-ever 2016 CT6 Sedan and 2017 XT5 Crossover. In addition, we’ve celebrated those who dare with our entrepreneurial brands like Public School to extend the Cadillac brand into the realms ONLY THOSE WHO of fashion and business. And with Cadillac Magazine we continue to DARE, DRIVE THE share stories of those who dare. WORLD FORWARD. It’s daring to nearly circle the globe to explore a country most remember only from headlines about a gruesome war. Today the Kingdom of Cambodia enchants with ancient temples and a culture refective of two faiths—Hindu and Buddhism over centuries (page 62). It’s daring to leave behind the comforts of the offce to strike out on your own. The latest wave of shared workspaces is making the transition easier for 21st century entrepreneurs (page 49). And it’s daring to eschew glamor and use your celebrity voice to spread kindness and change the human experience. That’s what singer Jason Mraz is doing (page 34). -

2020 Cadillac XT5 Owner's Manual

20_CAD_XT5_COV_en_US_84290261A_2019JUN07.ai 1 4/18/2019 11:39:34 AM 2020 XT5 C M Y CM MY CY XT5 CMY K 84290261 A Cadillac XT5 Owner Manual (GMNA-Localizing-U.S./Canada/Mexico- 13527534) - 2020 - CRC - 5/29/19 Contents Introduction . 2 Keys, Doors, and Windows . 9 Seats and Restraints . 44 Storage . 95 Instruments and Controls . 102 Lighting . 143 Infotainment System . 150 Climate Controls . 151 Driving and Operating . 160 Vehicle Care . 250 Service and Maintenance . 335 Technical Data . 349 Customer Information . 353 Reporting Safety Defects . 363 OnStar . 367 Connected Services . 374 Index . 377 Cadillac XT5 Owner Manual (GMNA-Localizing-U.S./Canada/Mexico- 13527534) - 2020 - CRC - 5/29/19 2 INTRODUCTION Introduction This manual describes features that Helm, Incorporated may or may not be on the vehicle Attention: Customer Service because of optional equipment that 47911 Halyard Drive was not purchased on the vehicle, Plymouth, MI 48170 model variants, country specifications, USA features/applications that may not be available in your region, or changes Using this Manual subsequent to the printing of this owner’s manual. To quickly locate information about the vehicle, use the Index in the back The names, logos, emblems, slogans, Refer to the purchase documentation of the manual. It is an alphabetical vehicle model names, and vehicle relating to your specific vehicle to list of what is in the manual and the body designs appearing in this manual confirm the features. page number where it can be found. including, but not limited to, GM, the GM logo, CADILLAC, the CADILLAC Keep this manual in the vehicle for Emblem, and XT5 are trademarks and/ quick reference. -

Service Update 16029 Engine High Pressure Fuel Pump and Fuel Rail Low Torque

Service Update 16029 Engine High Pressure Fuel Pump and Fuel Rail Low Torque Reference Number: N16206438 Release Date: October 2016 Revision: 00 Attention: This service update includes vehicles in dealer inventory and customer vehicles that return to the dealership for any reason. This bulletin will expire at the end of the involved vehicle’s New Vehicle Limited Warranty period. Model Year Make Model From To RPO Description Cadillac ATS 2016 2016 LGX 3.6L V-6 Engine Cadillac CTS 2016 2016 LGX 3.6L V-6 Engine Cadillac XT5 2017 2017 LGX 3.6L V-6 Engine Chevrolet Camaro 2016 2016 LGX 3.6L V-6 Engine Involved vehicles are marked “open” on the Investigate Vehicle History screen in GM Global Warranty Management system. This site should always be checked to confirm vehicle involvement prior to beginning any required inspections and/or repairs. Condition The high pressure fuel pump or fuel rail fastener(s) may have been improperly tightened during manufacturing. Fuel could leak from the fuel pump or fuel rail causing the vehicle to go into reduced power mode. If this occurs DTC P228C, P228D or P00C6 will set, causing the Check Engine Light to be illuminated. Correction Using the VIN list provided below, tighten the appropriate fastener as outlined in the service procedure section and, if required, replace the fuel pump or fuel feed intermediate pipe. VIN Location of Low Torque Fastener 1GYKNCRS6HZ114294 Fuel Rail 1G6AX5SS5G0196008 Fuel Pump 1G1FB1RS5G0189956 Fuel Pump 1G1FD1RS1G0168709 Fuel Rail 1G1FB1RS5G0172767 Fuel Rail 1G1FD1RS1G0181590 Fuel Pump 1G1FB3DS8G0186374 Fuel Rail 1G6AE5SS2G0119649 Fuel Pump Parts Quantity Part Name Part No.