Ghazi Barotha Hydropower Project (Loan 1424-PAK) in Pakistan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Islamic Republic of Pakistan Tarbela 5 Hydropower Extension Project

Report Number 0005-PAK Date: December 9, 2016 PROJECT DOCUMENT OF THE ASIAN INFRASTRUCTURE INVESTMENT BANK Islamic Republic of Pakistan Tarbela 5 Hydropower Extension Project CURRENCY EQUIVALENTS (Exchange Rate Effective December 21, 2015) Currency Unit = Pakistan Rupees (PKR) PKR 105.00 = US$1 US$ = SDR 1 FISCAL YEAR July 1 – June 30 ABBRREVIATIONS AND ACRONYMS AF Additional Financing kV Kilovolt AIIB Asian Infrastructure Investment kWh Kilowatt hour Bank M&E Monitoring & Evaluation BP Bank Procedure (WB) MW Megawatt CSCs Construction Supervision NTDC National Transmission and Consultants Dispatch Company, Ltd. ESA Environmental and Social OP Operational Policy (WB) Assessment PM&ECs Project Management Support ESP Environmental and Social and Monitoring & Evaluation Policy Consultants ESMP Environmental and Social PMU Project Management Unit Management Plan RAP Resettlement Action Plan ESS Environmental and Social SAP Social Action Plan Standards T4HP Tarbela Fourth Extension FDI Foreign Direct Investment Hydropower Project FY Fiscal Year WAPDA Water and Power Development GAAP Governance and Accountability Authority Action Plan WB World Bank (International Bank GDP Gross Domestic Product for Reconstruction and GoP Government of Pakistan Development) GWh Gigawatt hour ii Table of Contents ABBRREVIATIONS AND ACRONYMS II I. PROJECT SUMMARY SHEET III II. STRATEGIC CONTEXT 1 A. Country Context 1 B. Sectoral Context 1 III. THE PROJECT 1 A. Rationale 1 B. Project Objectives 2 C. Project Description and Components 2 D. Cost and Financing 3 E. Implementation Arrangements 4 IV. PROJECT ASSESSMENT 7 A. Technical 7 B. Economic and Financial Analysis 7 C. Fiduciary and Governance 7 D. Environmental and Social 8 E. Risks and Mitigation Measures 12 ANNEXES 14 Annex 1: Results Framework and Monitoring 14 Annex 2: Sovereign Credit Fact Sheet – Pakistan 16 Annex 3: Coordination with World Bank 17 Annex 4: Summary of ‘Indus Waters Treaty of 1960’ 18 ii I. -

Dasu Hydropower Project

Public Disclosure Authorized PAKISTAN WATER AND POWER DEVELOPMENT AUTHORITY (WAPDA) Public Disclosure Authorized Dasu Hydropower Project ENVIRONMENTAL AND SOCIAL ASSESSMENT Public Disclosure Authorized EXECUTIVE SUMMARY Report by Independent Environment and Social Consultants Public Disclosure Authorized April 2014 Contents List of Acronyms .................................................................................................................iv 1. Introduction ...................................................................................................................1 1.1. Background ............................................................................................................. 1 1.2. The Proposed Project ............................................................................................... 1 1.3. The Environmental and Social Assessment ............................................................... 3 1.4. Composition of Study Team..................................................................................... 3 2. Policy, Legal and Administrative Framework ...............................................................4 2.1. Applicable Legislation and Policies in Pakistan ........................................................ 4 2.2. Environmental Procedures ....................................................................................... 5 2.3. World Bank Safeguard Policies................................................................................ 6 2.4. Compliance Status with -

Valid X-Ray License Holder 2018 Sr

Valid X-ray License Holder 2018 Sr. No Facility Attock 1 Abdullah Surgery, Kohat Road, Fateh Jang, Attock 2 Aero Hospital, Attock 3 Agha Hospital, B-84, Fateh Jhang Road, Attock 4 Alam Medical Centre, Near Peoples Colony, Kamra Road, Attock 5 Al-Madina Hospital, Pindi Gheb, Thana Road, Attock 6 Almas Medical Centrer, Pindi Road, Fath Jang, Attock 7 Al-Shifa Hospital, Jand, Attock 8 Amir Abdullah Memorial Hospital, Hazro, Attock 9 Atta Ullah Clinic, St # 14, Doctor's Lane Dar us Salam Colony, Attock 10 Attock Medical Center, Kamra Road, Attock 11 Attock Open MRI & Scan Centre, Opp. Attock Medical Centre, Kamra Road, Near DHQ, Near Asfandyar Bukhari Distt. Hospital, Attock 12 Awan X-ray, Thana Road, Zafar Chowk Pindigheb, Attock 13 Bilal Medical Centre, Near Shamir CNG Pindi Kohat Road, Jand, Attock 14 City Diagnostics, Pleader Lane, Attock 15 City X-Ray, Opp. THQ (civil) Hospital Hazara Road, Hassan Abdal, Attock 16 CMH, Attock Cantt., Attock 17 DHQ Hospital, Attock 18 Dr. Shakeel Ahmed Kiyani, 4- Civil Lines, Attock 19 Family Medical Complex, P/O Utman Abad, Hazara Road Jhari kass stop, Near Police Chowki Hassan Abdal, Attock 20 Faraz X-ray, Kohat Road, Near THQ Hospital Fateh Jang, Attock 21 Farooq Hospital, B-36, Lalazar Near Pleader Lane, Attock 22 Fauji Foundation Medical Center, Basal, Attock 23 Fauji Foundation Medical Center, Gohra Chowk, Attock 24 Hameed Memorial Hospital, Near Gate No. 2, GT Road Kamra Cantt, Attock 25 Hassan Medical Center, Tehsil Road, Jand, Attock 26 Hayat Memorial Hospital, 19-Pleader Lane, Attock 27 Hussain Hospital, Kamra Road, Attock 28 Iqbal Hospital, Kram Khan Road, Fateh Jang, Attock 29 Islamabad Diagnostic Centre, Hassan Abdal Branch, Hazara Road, Attock 30 Kamra Medical Complex, Shamsabad Mor, G.T Road, Kamra Cantt, Attock 31 Khalid Saeed Medical Center, Kamra Road, Attock 32 Khatak Day Health Centre, Tehsil Jand, Attock 33 Medicare Hospital, Kamra Road, Attock Attock Page No. -

Assessment of Spatial and Temporal Flow Variability of the Indus River

resources Article Assessment of Spatial and Temporal Flow Variability of the Indus River Muhammad Arfan 1,* , Jewell Lund 2, Daniyal Hassan 3 , Maaz Saleem 1 and Aftab Ahmad 1 1 USPCAS-W, MUET Sindh, Jamshoro 76090, Pakistan; [email protected] (M.S.); [email protected] (A.A.) 2 Department of Geography, University of Utah, Salt Lake City, UT 84112, USA; [email protected] 3 Department of Civil & Environmental Engineering, University of Utah, Salt Lake City, UT 84112, USA; [email protected] * Correspondence: [email protected]; Tel.: +92-346770908 or +1-801-815-1679 Received: 26 April 2019; Accepted: 29 May 2019; Published: 31 May 2019 Abstract: Considerable controversy exists among researchers over the behavior of glaciers in the Upper Indus Basin (UIB) with regard to climate change. Glacier monitoring studies using the Geographic Information System (GIS) and remote sensing techniques have given rise to contradictory results for various reasons. This uncertain situation deserves a thorough examination of the statistical trends of temperature and streamflow at several gauging stations, rather than relying solely on climate projections. Planning for equitable distribution of water among provinces in Pakistan requires accurate estimation of future water resources under changing flow regimes. Due to climate change, hydrological parameters are changing significantly; consequently the pattern of flows are changing. The present study assesses spatial and temporal flow variability and identifies drought and flood periods using flow data from the Indus River. Trends and variations in river flows were investigated by applying the Mann-Kendall test and Sen’s method. We divide the annual water cycle into two six-month and four three-month seasons based on the local water cycle pattern. -

The Geographic, Geological and Oceanographic Setting of the Indus River

16 The Geographic, Geological and Oceanographic Setting of the Indus River Asif Inam1, Peter D. Clift2, Liviu Giosan3, Ali Rashid Tabrez1, Muhammad Tahir4, Muhammad Moazam Rabbani1 and Muhammad Danish1 1National Institute of Oceanography, ST. 47 Clifton Block 1, Karachi, Pakistan 2School of Geosciences, University of Aberdeen, Aberdeen AB24 3UE, UK 3Geology and Geophysics, Woods Hole Oceanographic Institution, Woods Hole, MA 02543, USA 4Fugro Geodetic Limited, 28-B, KDA Scheme #1, Karachi 75350, Pakistan 16.1 INTRODUCTION glaciers (Tarar, 1982). The Indus, Jhelum and Chenab Rivers are the major sources of water for the Indus Basin The 3000 km long Indus is one of the world’s larger rivers Irrigation System (IBIS). that has exerted a long lasting fascination on scholars Seasonal and annual river fl ows both are highly variable since Alexander the Great’s expedition in the region in (Ahmad, 1993; Asianics, 2000). Annual peak fl ow occurs 325 BC. The discovery of an early advanced civilization between June and late September, during the southwest in the Indus Valley (Meadows and Meadows, 1999 and monsoon. The high fl ows of the summer monsoon are references therein) further increased this interest in the augmented by snowmelt in the north that also conveys a history of the river. Its source lies in Tibet, close to sacred large volume of sediment from the mountains. Mount Kailas and part of its upper course runs through The 970 000 km2 drainage basin of the Indus ranks the India, but its channel and drainage basin are mostly in twelfth largest in the world. Its 30 000 km2 delta ranks Pakiistan. -

PREPARATORY SURVEY for MANGLA HYDRO POWER STATION REHABILITATION and ENHANCEMENT PROJECT in PAKISTAN Final Report

ISLAMIC REPUBLIC OF PAKISTAN Water and Power Development Authority (WAPDA) PREPARATORY SURVEY FOR MANGLA HYDRO POWER STATION REHABILITATION AND ENHANCEMENT PROJECT IN PAKISTAN Final Report January 2013 JAPAN INTERNATIONAL COOPERATION AGENCY (JICA) NIPPON KOEI CO., LTD. IC Net Limited. 4R JR(先) 13-004 ABBREVIATIONS AC Alternating Current GM General Manager ADB Asia Development Bank GOP Government of Pakistan AEDB Alternative Energy Development HESCO Hyderabad Electrical Supply Board Company AJK Azad Jammu Kashmir HR & A Human Resources and AVR Automatic Voltage Regulator Administration BCL Bamangwato Concessions Ltd. IEE Initial Environmental Examination BOD Biochemical Oxygen Demand I&P Dept. Irrigation and Power Development BOP Balance of Plant I&P Insurance & Pensions BPS Basic Pay Scales IESCO Islamabad Electrical Supply BS British Standard Company C&M Coordination & Monitoring IPB Isolated Phase Bus CDO Central Design Office IPC Interim Payment Certificate CDWP Central Development Working Party IPP Independent Power Producer CCC Central Contract Cell IRSA Indus River System Authority CDM Clean Development Mechanism JBIC Japan Bank for International CE Chief Engineer Cooperation CER Certified Emission Reductions JICA Japan International Cooperation CIF Cost, Freight and Insurance Agency CS Consultancy Services JPY Japanese Yen CM Carrier Management KESC Karachi Electric Supply Company CPPA Central Power Purchase Agency KFW Kreditanstalt für Wiederaufbau CRBC Chashma Right Bank Canal L/A Loan Agreement CRR Chief Resident Representative -

District ATTOCK CRITERIA for RESULT of GRADE 5

District ATTOCK CRITERIA FOR RESULT OF GRADE 5 Criteria ATTOCK Punjab Status Minimum 33% marks in all subjects 88.47% 88.32% PASS Pass + Minimum 33% marks in four subjects and 28 to 32 marks Pass + Pass with 88.88% 89.91% in one subject Grace Marks Pass + Pass with Pass + Pass with grace marks + Minimum 33% marks in four Grace Marks + 96.33% 96.72% subjects and 10 to 27 marks in one subject Promoted to Next Class Candidate scoring minimum 33% marks in all subjects will be considered "Pass" One star (*) on total marks indicates that the candidate has passed with grace marks. Two stars (**) on total marks indicate that the candidate is promoted to next class. PUNJAB EXAMINATION COMMISSION, RESULT INFORMATION GRADE 5 EXAMINATION, 2019 DISTRICT: ATTOCK Students Students Students Pass % with Pass + Promoted Pass + Gender Registered Appeared Pass 33% marks Students Promoted % Male 10474 10364 8866 85.55 9821 94.76 Public School Female 11053 10988 10172 92.57 10772 98.03 Male 4579 4506 3882 86.15 4313 95.72 Private School Female 3398 3370 3074 91.22 3298 97.86 Male 626 600 426 71.00 533 88.83 Private Candidate Female 384 369 295 79.95 351 95.12 30514 30197 26715 PUNJAB EXAMINATION COMMISSION, GRADE 5 EXAMINATION, 2019 DISTRICT: ATTOCK Overall Position Holders Roll NO Name Marks Position 11-138-126 Hadeesa Noor Ul Ain 482 1st 11-153-207 Shams Ul Ain 482 1st 11-138-221 Ia Eman 478 2nd 11-138-290 Manahil Khalid 477 3rd PUNJAB EXAMINATION COMMISSION, GRADE 5 EXAMINATION, 2019 DISTRICT: ATTOCK Male Position Holders Roll NO Name Marks Position 11-162-219 Muhammad Hasan Ali 476 1st 11-262-182 Raja Mohammad Bilal 475 2nd 11-135-111 Hammad Hassan 473 3rd PUNJAB EXAMINATION COMMISSION, GRADE 5 EXAMINATION, 2019 DISTRICT: ATTOCK FEMALE Position Holders Roll NO Name Marks Position 11-138-126 Hadeesa Noor Ul Ain 482 1st 11-153-207 Shams Ul Ain 482 1st 11-138-221 Ia Eman 478 2nd 11-138-290 Manahil Khalid 477 3rd j b i i i i Punjab Examination Commission Grade 5 Examination 2019 School wise Results Summary Sr. -

Risk Management and Public Perception of Hydropower

BY Engr. Munawar Iqbal Director (Hydropower) PPIB, Ministry of Water and Power, Kathmandu, Nepal Government of Pakistan 9-10 May 2016 C O N T E N T S Overview of Power Mix Hydropower Potential of Pakistan Evolution of hydro model in Pakistan Salient futures of Power Policy 2002 & 2015 Success Stories in Private Sector Concluding Remarks PAKISTAN POWER SECTOR - POWER MIX Power Mix is a blend of: • Hydel • Wind (50 MW) • Oil • Gas • Nuclear • Coal (150 MW) PAKISTAN POWER SECTOR - TOTAL INSTALLED CAPACITY MW % Wind Public Public Sector Private 50 MW Sector Hydel 7,013 28 Sector, Hydel, 11950, 7013, Thermal 5,458 22 47.4% 27.8% Nuclear 787 3 Total 13,258 53 Public Sector Private Sector Nuclear, Thermal, 787, 3.1% 5458, IPPs 9,528 42 21.6% K-E 2,422 10 Total Installed Capacity 25,208 MW Total 11,950 52 4 HYDROPOWER RESPONSIBILITY PUBLIC SECTOR • WAPDA • Provinces PRIVATE SECTOR • Private Power & Infrastructure Board (PPIB) • Alternate Energy Development Board (AEDB) • Provinces Tarbela Dam Capacity 3,478 MW Enhanced 4,888 MW Opening date 1976 Impounds 9.7 MAF Height 143.26 m Construction 1968-1976 Mangla Dam Coordinates 33.142083°N 73.645015°E Construction 1961-1967 Type of dam Embankment dam Impounds Jhelum River Height 147 m (482 ft) Total capacity 7.390 MAF Turbines 10 x 100 MW Capacity 1,000 MW Warsak Dam Capacity 243 MW Impounds 25,300 acre·ft Height 76.2 m Commission 1960 Ghazi Barotha Dam Capacity 1,450 MW Impounds 20,700 AF head 69 m Construction 1995-2004 HYDROPOWER IN OPERATION By WAPDA Installed S# Name of Project Province Capacity -

The Case of Diamerbhashadam in Pakistan

Sabir M., Torre A., 2017, Different proximities and conflicts related to the setting of big infrastructures. The case of Diamer Basha Dam in Pakistan, in Bandyopadhyay S., Torre A., Casaca P., Dentinho T. (eds.), 2017, Regional Cooperation in South Asia. Socio-economic, Spatial, Ecological and Institu- tional Aspects, Springer, 363 p. Different Proximities and Conflicts Related to the Setting of Big Infrastructures: The Case of DiamerBhashaDam in Pakistan Muazzam Sabir and André Torre UMR SAD-APT, INRA – Agroparistech, University Paris Saclay, France. E-mail: [email protected], [email protected] Abstract Land use conflicts are recognized as the result of mismanagement of infrastructural development projects. Several issues have been conferred related to infrastructural projects in Asia and South Asia, like corruption, mismanagement, cronyism and adverse socioeconomic impacts. The paper focuses particularly on land use conflicts related to Diamer-Bhasha dam project in northern Pakistan. Keeping in view this peculiar case, it goes into the concept of conflicts and proxim- ity, e.g. types of proximity and the role they play in conflict generation, conflict resolution and modes of conflict prevention. We provide the different types and expressions of conflicts due to Diamer-Bhasha dam project, their impact on local population and the territory, e.g. unfair land acquisition, improper displacement, compensation, resettlement and livelihood issues. Contiguity problems due to geo- graphical proximity as well as mechanisms of conflict resolution through organized proximity are also discussed. Finally, we conclude and recommend the strategies for better governance and the way ahead for upcoming studies on similar issues. 16.1 Introduction Land due to infrastructural projects has been subject to conflicts in several parts of the world and greatly influenced the socioeconomic position of different actors (Oppio et al. -

World Bank Document

f Public Disclosure Authorized REPORT ON GHAZI-GARIALA HYDROPOWER PROJECT ARCHAEOLOGICAL STUDIES Public Disclosure Authorized BY M.A.HALIM AND GULZARM. KHAN Public Disclosure Authorized DEPARTMENT OF ARCHAEOLOGY AND MUSEUMS GOVERNMENT OF PAKISTAN Public Disclosure Authorized REPORT ON GHAZI-GARIALA HYDROPOWER PROJECT ARCHAEOLOGICAL STUDIES BY M.A. HALIM AND GULZAR M. KHAN DEPARTMENT OF ARCHAEOLOGY AND MUSEUMS GOVERNMENT OF PAKISTAN GRAZI-GARIALA HYDROPOWER PROJECT ARCHAEOLOGICAL STUDIES TABLE OF CONTENTS Page 1. INTRODUCTION 1 2. LOCATION OF THE PROJECT AREA 2 3. PHYSICAL FEATURES AND ENVIRONMENTS 2 4. HISTORICAL PERSPECTIVE 3 5. KNOWN SITES IN THE PROJECT AREA 3 5.1 General 3 5.2 Palaeolithic Tool Sites 4 5.3 Petroglyphs 4 5.4 Buddhist Sites 4 5.5 Muslim Monuments 5 6. NEW DISCOVERIES 5 6.1 General 5 6.2 Palaeolithic Artefact (Cleaver) 5 6.3 Petroglyphs 6 6.4 Hasanpur 6 6.5 Musa II 7 6.6 Pindanwala Tibba 7 6.7 Musa I 8 6.8 Musa III 8 6.9 Patri near Dakhner 9 7. CONCLUSIONS AND RECOMMENDATIONS 9 7.1 Conclusions 9 7.2 Recommendations 9 REFERENCES (i) LIST OF ILLUSTRATIONS Plates Description I Pool Area on River Indus II A Confluence of Indus and Haro Rivers II B Rock Outcrops at Kamra III Rock Outcrops at Dakhner IV Arid Area between Rumian and Dakhner V Fertile Plain of Chhachh VI Soft Sandy Area west of Kamra Village VII Palaeolithic Quartzite Tool VIII Erratic Boulders at Barotha IX A Erratic Boulder at Gariala IX B Erratic Boulder in the Bed near Indus-Haro Confluence X Erratic Boulder with Petroglyph at Gariala XI Details of Petroglyphic Figures on the Boulder at Gariala XII Work of Idle Grazers on Rocks near Khadi Baba XIII A Hasanpur. -

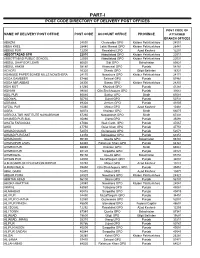

Part-I: Post Code Directory of Delivery Post Offices

PART-I POST CODE DIRECTORY OF DELIVERY POST OFFICES POST CODE OF NAME OF DELIVERY POST OFFICE POST CODE ACCOUNT OFFICE PROVINCE ATTACHED BRANCH OFFICES ABAZAI 24550 Charsadda GPO Khyber Pakhtunkhwa 24551 ABBA KHEL 28440 Lakki Marwat GPO Khyber Pakhtunkhwa 28441 ABBAS PUR 12200 Rawalakot GPO Azad Kashmir 12201 ABBOTTABAD GPO 22010 Abbottabad GPO Khyber Pakhtunkhwa 22011 ABBOTTABAD PUBLIC SCHOOL 22030 Abbottabad GPO Khyber Pakhtunkhwa 22031 ABDUL GHAFOOR LEHRI 80820 Sibi GPO Balochistan 80821 ABDUL HAKIM 58180 Khanewal GPO Punjab 58181 ACHORI 16320 Skardu GPO Gilgit Baltistan 16321 ADAMJEE PAPER BOARD MILLS NOWSHERA 24170 Nowshera GPO Khyber Pakhtunkhwa 24171 ADDA GAMBEER 57460 Sahiwal GPO Punjab 57461 ADDA MIR ABBAS 28300 Bannu GPO Khyber Pakhtunkhwa 28301 ADHI KOT 41260 Khushab GPO Punjab 41261 ADHIAN 39060 Qila Sheikhupura GPO Punjab 39061 ADIL PUR 65080 Sukkur GPO Sindh 65081 ADOWAL 50730 Gujrat GPO Punjab 50731 ADRANA 49304 Jhelum GPO Punjab 49305 AFZAL PUR 10360 Mirpur GPO Azad Kashmir 10361 AGRA 66074 Khairpur GPO Sindh 66075 AGRICULTUR INSTITUTE NAWABSHAH 67230 Nawabshah GPO Sindh 67231 AHAMED PUR SIAL 35090 Jhang GPO Punjab 35091 AHATA FAROOQIA 47066 Wah Cantt. GPO Punjab 47067 AHDI 47750 Gujar Khan GPO Punjab 47751 AHMAD NAGAR 52070 Gujranwala GPO Punjab 52071 AHMAD PUR EAST 63350 Bahawalpur GPO Punjab 63351 AHMADOON 96100 Quetta GPO Balochistan 96101 AHMADPUR LAMA 64380 Rahimyar Khan GPO Punjab 64381 AHMED PUR 66040 Khairpur GPO Sindh 66041 AHMED PUR 40120 Sargodha GPO Punjab 40121 AHMEDWAL 95150 Quetta GPO Balochistan 95151 -

Appendix - II Pakistani Banks and Their Branches (December 31, 2008)

Appendix - II Pakistani Banks and their Branches (December 31, 2008) Allied Bank Ltd. Bhalwal (2) Chishtian (2) -Grain Market -Grain Market (743) -Noor Hayat Colony -Mohar Sharif Road Abbaspur 251 RB Bandla Bheli Bhattar (A.K.) Chitral Chungpur (A.K.) Abbottabad (4) Burewala (2) Dadu -Bara Towers, Jinnahabad -Grain Market -Pineview Road -Housing Scheme Dadyal (A.K) (2) -Supply Bazar -College Road -The Mall Chak Jhumra -Samahni Ratta Cross Chak Naurang Adda Johal Chak No. 111 P Daharki Adda Nandipur Rasoolpur Chak No. 122/JB Nurpur Danna (A.K.) Bhal Chak No. 142/P Bangla Danyor Adda Pansra Manthar Darband Adda Sarai Mochiwal Chak No. 220 RB Dargai Adda Thikriwala Chak No. 272 HR Fortabbas Darhal Gaggan Ahmed Pur East Chak No. 280/JB (Dawakhri) Daroo Jabagai Kombar Akalgarh (A.K) Chak No. 34/TDA Daska Arifwala Chak No. 354 Daurandi (A.K.) Attock (Campbellpur) Chak No. 44/N.B. Deenpur Bagh (A.K) Chak No. 509 GB Deh Uddhi Bahawalnagar Chak No. 76 RB Dinga Chak No. 80 SB Bahawalpur (5) Chak No. 88/10 R Dera Ghazi Khan (2) Chak No. 89/6-R -Com. Area Sattelite Town -Azmat Road -Dubai Chowk -Model Town -Farid Gate Chakwal (2) -Ghalla Mandi -Mohra Chinna Dera Ismail Khan (3) -Settelite Town -Talagang Road -Circular Road -Commissionery Bazar Bakhar Jamali Mori Talu Chaman -Faqirani Gate (Muryali) Balagarhi Chaprar Balakot Charsadda Dhamke (Faisalabad) Baldher Chaskswari (A.K) Dhamke (Sheikhupura) Bucheke Chattar (A.K) Dhangar Bala (A.K) Chhatro (A.K.) Dheed Wal Bannu (2) Dina -Chai Bazar (Ghalla Mandi) Chichawatni (2) Dipalpur -Preedy Gate -College Road Dir Barja Jandala (A.K) -Railway Road Dunyapur Batkhela Ellahabad Behari Agla Mohra (A.K.) Chilas Eminabad More Bewal Bhagowal Faisalabad (20) Bhakkar Chiniot (2) -Akbarabad Bhaleki (Phularwan Chowk) -Muslim Bazar (Main) -Sargodha Road -Chibban Road 415 ABL -Factory Area -Zia Plaza Gt Road Islamabad (23) -Ghulam Muhammad Abad Colony Gujrat (3) -I-9 Industrial Area -Gole Cloth Market -Grand Trunk Road -Aabpara -Gole Kiryana Bazar -Rehman Saheed Road -Blue Area ABL -Gulburg Colony -Shah Daula Road.