Idbi a PROJECT REPORT ON

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Connection Issue 70.Pdf

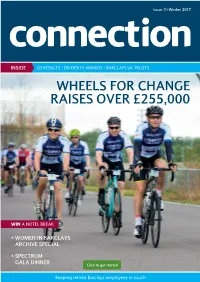

Issue 70 Winter 2017 connection INSIDE Q3 RESULTS • DIVERSITY AWARDS • BARCLAYS UK TRUSTS WHEELS FOR CHANGE RAISES OVER £255,000 WIN A HOTEL BREAK + WOMEN IN BARCLAYS ARCHIVE SPECIAL + SPECTRUM GALA DINNER Click to get started Keeping retired Barclays employees in touch Inside this issue... EDITOR’S WORD FEATURES REGULARS 5 10 Page 6 Page 4 Barclays news Barclays news Q3 2016 Results, The new £5 note, Barclays Diversity Wheels for Change, Spectrum’s Gala Business Awards 2016 Dinner and Pension Fund newsletter Page 8 Pensioners’ clubs & contacts Happy New Year to you all and welcome Page 12 Bournemouth and District Pensioners’ to the first edition of connection for Archive article 2017. We hope you’ve enjoyed the festive Club, Cornwall Pensioners’ Club, Women in Barclays season and are ready to embrace the Liverpool Retired Staff Club, East New Year. Midlands Pensioners’ Club and Many of you will be reading connection Ipswich District Pensioners’ Club on your computer or tablet screens for the Page 14 first time. To help you move through the Page 16 magazine more easily, we’ve added arrows Life beyond Your letters Barclays to the bottom of the pdf, and we’ve also Page 20 made the clickable links bold to make it The end of an era clear when you can click through to Retirements & obituaries other websites. Please let the Barclays Page 26 Team at Willis Towers Watson know if you Useful contacts no longer wish to receive a printed copy. If you’re thinking of embarking on a new Page 28 adventure this year, turn to pages 14 Competition & crossword and 15 for some Life beyond Barclays inspiration. -

Barclays Cover

Corporate governance Corporate governance report Chairman’s Introduction Statement from Barclays PLC Board of Directors I am pleased to present my first Corporate Governance report as For the year ended 31st December 2006, we have complied with the Chairman of Barclays. We report to you below, as we are required to do, provisions set out in section 1 of the UK Combined Code on Corporate on how we have complied with the UK Combined Code on Corporate Governance (the Code) and applied the principles of the Code as Governance in 2006. Good corporate governance is, however, more described below. The Code was revised with effect from 1st November than a mere statement of compliance. It should aim to set the highest 2006 and the revised Code applies to Barclays with effect from standards which should permeate the entire organisation and 1st January 2007. everything it does. Barclays has a strong ethos of corporate governance, Board Structure and Composition endorsed and upheld by the Board. I see it as a key part of my role as At the date of this report, the Board is comprised of the Chairman, five Chairman to maintain the highest standards of corporate governance executive Directors and nine non-executive Directors. The roles of and to ensure that we seek compliance with best practice provisions Chairman and Chief Executive are separate and each has clearly defined wherever possible. I am indebted to my predecessor as Chairman, responsibilities. The Chairman’s main role is to lead and manage the Matthew Barrett, for the strong legacy I have inherited. -

BARCLAYS COVERS:Layout 1 6/3/09 02:20 Page 1

BARCLAYS COVERS:Layout 1 6/3/09 02:20 Page 1 barclays.com/annualreport08 Annual Report 2008 Report Cover: Produced using 50% recycled fibre and pulp bleached using Elemental Chlorine Free (ECF) process. Report Text: Produced from 100% post consumer waste. Both mills are certified to the ISO14001 environmental management standard. Barclays PLC Annual Report 2008 We thank our customers and clients for the business they directed to Barclays in 2008. High levels of activity on their behalf have enabled us to report substantial profit generation in difficult conditions. “Our priorities in 2008 were (and remain): to stay close to customers and clients; to manage our risks; and to progress strategy. John Varley ”Group Chief Executive © Barclays Bank PLC 2009 www.barclays.com/annualreport08 Registered office: 1 Churchill Place, London E14 5HP 51° 30' 36"N Registered in England. Registered No: 48839 London, UK 12pm GMT 9910115 BARCLAYS COVERS:Layout 1 6/3/09 02:20 Page 2 Contents Forward-looking statements Business review 3 This document contains certain forward-looking statements Barclays today 4 within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and Section 27A of the US Securities Key performance indicators 6 Act of 1933, as amended, with respect to certain of the Group’s plans and its current goals and expectations relating to its future Group Chairman’s statement 10 financial condition and performance. Barclays cautions readers that no forward-looking statement is a guarantee of future Group Chief Executive’s review 12 performance and that actual results could differ materially from those contained in the forward-looking statements. -

Larry Morrison, Et Al. V. Barclays Bank Plc, Et Al. 09-CV-02326-Complaint

, tik. ;Iiti....:2 7 P:. :,ir Pi, r)§ fit i ev, 2 —ov Li S., t' r LAN 09 .323ILI JS 44C/SDNY CIVIL COVER SHEET REV. 1/2008 The JS-44 civil cover sheet and the information contained herein neither replace nor supplement the filing and service of pleadings orother papers as required by law, except as provided by local rules of court. This form, approved by the Judicial Conference of the United States in September 1974, is required for use of the Clerk of Court for the purpose of initiating the civil docket sheet. PLAINTIFFS DEFENDANTS Larry Morrison, on behalf of himself and all others similarly Barclays Bank PLC, et al. (see attached Schedule A for situated, additional defendants) ATTORNEYS (FIRM NAME, ADDRESS, AND TELEPHONE NUMBER) ATTORNEYS (IF KNOWN) Abraham Fruchter & Twersky, LLP, One Penn Plaza, Suuite 2805, NY, NY 10119, (212) 279-5050 CAUSE OF ACTION (CITE THE U.S. CIVIL STATUTE UNDER WHICH YOU ARE FILING AND WRITE A BRIEF STATEMENT OF CAUSE) (DO NOT CITE JURISDICTIONAL STATUTES UNLESS DIVERSITY) 15 USC Sections 77k, 771(a)(2) and 77o. Action for a false and misleading registration statement and prospectus Has this or a similar case been previously filed in SDNY at any time? No? 151 Yes? Ill Judge Previously Assigned If yes, was this case Vol.0 Invol. 0 Dismissed. No 0 Yes 0 If yes, give date & se No. (PLACE AN [x] IN ONE BOX ONLY) NATURE OF SUIT TORTS ACTIONS UNDER STATUTES CONTRACT PERSONAL INJURY PERSONAL INJURY FORFEITURE/PENALTY BANKRUPTCY OTHER STATUTES [ ] 110 INSURANCE [ [ 310 AIRPLANE [ ] 362 PERSONAL INJURY - [ ] 610 AGRICULTURE -

![Here Could Be a Recognition Only of What I Have Called External Goods […]](https://docslib.b-cdn.net/cover/5187/here-could-be-a-recognition-only-of-what-i-have-called-external-goods-1425187.webp)

Here Could Be a Recognition Only of What I Have Called External Goods […]

Competition and the London Clearing Banks, 1946-1979 Linda Arch © [email protected] The Court Room, The Bank of England https://www.flickr.com/photos/ba nkofengland/6220545302, accessed 3 May, 2015 1 Should Nation States Compete? 25-26 June 2015 Structure 1. Introduction 2. Context 3. Attitudes towards competition in clearing banking - ambivalence 4. Attitudes towards competition in clearing banking - embracing competition 5. Discussion and questions 2 Should Nation States Compete? 25-26 June 2015 1. INTRODUCTION 3 Should Nation States Compete? 25-26 June 2015 Alasdair MacIntyre Credit: Sean. https://www.flickr.com/p hotos/seanoconnor365/33 51618688 4 Should Nation States Compete? 25-26 June 2015 Introduction • “without the virtues there could be a recognition only of what I have called external goods […]. And in any society which recognised only external goods competitiveness would be the dominant and even exclusive feature.” • Alasdair MacIntyre, After Virtue: A Study in Moral Theory, Third Edition, (Notre Dame, IND: University of Notre Dame Press, 2007), 196. 5 Should Nation States Compete? 25-26 June 2015 Introduction External goods: • ‘goods of effectiveness’ • profit, money, share price, status, prestige … • property or possession of an individual Internal goods: • ‘goods of excellence’ • achieved in the context of ‘practices’ • benefit the whole community who take part in that practice • Eg. an internal good in clearing banking might be the good of ‘trustworthiness’ 6 Should Nation States Compete? 25-26 June 2015 Introduction -

The Grasshopper Pensioners' Club Just As We Have For

THE GRASSHOPPER PENSIONERS’ CLUB Website: www.martinsbank.co.uk © gut informiert! SECRETARY: David Baldwin, Lower Windle, Windle Royd Lane, Warley, HX2 7LY. 'Phone: 01422 832734. email: [email protected] CHAIRMAN: Bernard Lovewell TREASURER: Robert Bunn WELFARE OFFICER: Susan Sutcliffe New Year Edition 2021 JUST AS WE HAVE MORE MEMORIES On this occasion from 1951 when our two best- FOR BEEN 458 YEARS, represented Districts in our membership met in WE’RE STILL HERE WITH their annual match, where the following photograph and comments were cut from their magazine by Joan and Gordon Anthony: The annual match between Liverpool and London Districts took place on Monday 8th October on the ground of the Odyssey WE WILL REMEMBER THEM THE MARTINS BANK WAR MEMORIAL In our last edition we mentioned the rededication of our War Memorial in 54 Lombard Street we are now attempting to identify its current location. Club in Liverpool, the kick-off being taken by Mr. J.A. Banks, the Liverpool District Manager. Fog, which persisted all day, lifted just before the match began and the game took place in brilliant sunshine but with a rather strong breeze across the pitch. Liverpool pressed strongly from the beginning and after fifteen minutes they were rewarded with a goal by Smith, the left winger, from an opening made by Bass, who had headed across the goal mouth. Play was fairly even for the next twenty minutes and then London broke away and Anthony, the centre forward, scored for the visitors. Both goal-keepers had more to do in the second half and had it not been the good work of Ford, the keeper for London, who made two excellent saves, the visitors would probably have been defeated, whereas the match ended in a draw. -

Annual Report 2005 Barclays PLC Barclays PLC Annual Report 2005

The cover and pages 1-20 of this report are printed on coated paper containing 30% de-inked post-consumer recycled fibre and 70% virgin fibre, of which 30% comes from well-managed forests independently certified according to the rules of the Forest Stewardship Council (FSC). The remaining pages are printed on uncoated paper containing 25% de-inked post-consumer fibre, 50% pre-consumer fibre or mill broke and 25% FSC approved fibre. All pulps are Elemental Chlorine Free (ECF). The papers are produced at mills with ISO 9001, ISO 9002, ISO 14001, EMAS and FSC accreditation. 2005 Annual Report PLC Barclays Barclays PLC Annual Report 2005 Registered office: 1 Churchill Place, London E14 5HP Registered in England. Registered No: 48839 9904803 Forward-looking statements This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and Section 27A of the US Securities Act of 1933, as amended, with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition and performance. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as ‘aim’, ‘anticipate’, ‘target’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, or other words of similar meaning. Examples of forward-looking statements include, among others, statements regarding the Group’s future financial position, income growth, impairment charges, business strategy, projected levels of growth in the banking and financial markets, projected costs, estimates of capital expenditures, and plans and objectives for future operations. -

Analysing Risk Management in Banks: Evidence of Bank Efficiency

British Journal of Economics, Finance and Management Sciences 1 March 2017, Vol. 13 (2) The Nature and Extent of the Reciprocal Obligations Involved in the Banker/Customer Relationship Stanyo Dinov Abstract The current paper explores the banker/customer relationship and its historical development. Based on statuary and case law, it outlines the definitions of banker and customer, the duration of their relationship and their individual rights and obligations. Recent changes of the relationship and the differences, resulting from court decisions in England and Scotland regarding their obligations, are also presented. The article also trays to predict the possible changes to the banker/customer relationship in the near future. The most important conclusions, as well as possible further developments, are outlined at the end. Keywords: BEA, CCA, JCR, BPS, ATM systems I. Introduction The relationship between the banker and the customer has changed over time, so it is not easy to predict the nature of this relationship in the near future. Recent rapid technological development has raised many questions about customers‟ privacy and protection. Therefore, there is still a need to closely examine the legal aspects of this relationship from the past to the present, in order to find the best approach to its future context. II. Definition, nature and formation of reciprocal obligation 1. Definition The banker/customer relationship consists of two sides. A banker, according to the Bills of Exchange Act (BEA) 1882 s 2, „includes a body of persons whether -

Barclays PLC Rights Issue Prospectus

THIS PROSPECTUS AND ANY ACCOMPANYING DOCUMENTS ARE IMPORTANT AND REQUIRE YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you are recommended to seek immediately your own personal financial advice from your stockbroker, bank manager, solicitor, accountant, fund manager or other appropriate independent financial adviser, who is authorised under the Financial Services and Markets Act 2000 (the “FSMA”) if you are in the UK or, if not, from another appropriately authorised independent financial adviser. If you sell or have sold or otherwise transferred all of your Existing Ordinary Shares (other than ex-rights) held in certificated form before 18 September 2013 (the “Ex-Rights Date”) please send this Prospectus, together with any Provisional Allotment Letter, duly renounced, if and when received, at once to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee except that such documents should not be sent to any jurisdiction where to do so might constitute a violation of local securities laws or regulations. If you sell or have sold or otherwise transferred all or some of your Existing Ordinary Shares (other than ex-rights) held in uncertificated form before the Ex-Rights Date, a claim transaction will automatically be generated by Euroclear UK which, on settlement, will transfer the appropriate number of Nil Paid Rights to the purchaser or transferee. If you sell or have sold or otherwise transferred only part of your holding of Existing Ordinary Shares (other than ex-rights) held in certificated form before the Ex-Rights Date, you should refer to the instruction regarding split applications in Part II “Terms and Conditions of the Rights Issue” of this Prospectus and in the Provisional Allotment Letter, if and when received. -

2008 Barclays PLC Annual Review

barclays.com/annualreport08 Annual Review 2008 John Varley Group Chief Executive Our 4 strategic Performance Corporate governance Highlights of the year 3 Barclays today 4 priorities We have managed Barclays carefully The Board is responsible for Group Chairman’s statement 6 Group Chief Executive’s review 7 1. Build the best bank in the UK through this period. managing the Company on behalf of its shareholders and must Business review 9 2. Accelerate growth of global While performances across the ensure that an appropriate balance Summary Financial Statement 14 businesses Group varied, every one of our between promoting long-term Corporate sustainability 16 3. Develop retail and commercial businesses was profitable in 2008. growth and delivering short-term Summary corporate governance report 18 banking activities in selected This is a good achievement, given objectives is achieved. Board of Directors and countries outside the UK the environment. Executive Committee 20 4. Enhance operational excellence Risk management 22 Summary remuneration report 24 see page 2 see page 9 see page 18 Shareholder support 26 2 Barclays PLC Annual Review 2008 | www.barclays.com/annualreport08 In a very difficult economic environment in 2008, Barclays has steered a course that has enabled us “to be solidly profitable despite strong headwinds. We are well positioned to maintain Barclays competitive strengths through the undoubted challenges that will come in 2009 and beyond. Marcus Agius ”Group Chairman Our strategy Our strategy is to achieve good growth through -

2006 Barclays PLC Annual Report

Contents This Report is printed on Revive 100 Offset made from 100% FSC certified recycled fibre sourced from de-inked post-consumer waste. The printer and manufacturing mill are both credited with ISO 14001 Environmental Management Systems Standard and both are FSC certified. page Section 1 Operating review Financial highlights and performance indicators 2 Executive management structure 5 Chairman’s statement 7 Group Chief Executive’s review 8 Income statement and balance sheet summary 10 Financial review 15 Barclays PLC Annual Report 2006 Annual Report PLC Barclays Barclays PLC Risk factors 67 Risk management 71 Annual Report 2006 Critical accounting estimates 118 Earn, invest and grow Section 2 Governance Board and Executive Committee 122 Directors’ report 124 Corporate governance report 127 Remuneration report 135 Accountability and audit 151 Corporate responsibility 153 Section 3 Financial statements Presentation of information 158 Independent Auditors’ report/Independent Registered Public Accounting Firm’s report 159 Consolidated accounts Barclays PLC 161 Section 4 Shareholder information 305 Forward-looking statements This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and Section 27A of the US Securities Act of 1933, as amended, with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition and performance. These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as ‘aim’, ‘anticipate’, ‘target’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, or other words of similar meaning. -

Salz Review. Barclays Will Consider and Decide for Itself Whether, and If So How, to Act on the Views, Findings and Recommendations Contained in This Report

0 Salz Review An Independent Review of Barclays’ Business Practices April 2013 Salz Review An Independent Review of Barclays’ Business Practices April 2013 Salz Review An Independent Review of Barclays’ Business Practices Disclaimer This Report has been prepared by Anthony Salz with Russell Collins acting as Deputy Reviewer (the Salz Review). The Review was set up by Barclays as an independent review reporting to a non-executive committee of Barclays. The views, findings and recommendations included in this Report are entirely those of the Salz Review. Barclays will consider and decide for itself whether, and if so how, to act on the views, findings and recommendations contained in this Report. The Review's Terms of Reference and the approach to the Review are described in Appendix A. The views, findings and recommendations are based on the Salz Review's assessment of the documents provided by Barclays or others in response to requests and information gained from interviews. The Salz Review has not conducted a forensic investigation or an audit of the information made available to it. In some cases restrictions were placed on the Salz Review's access to documents or documents were redacted by Barclays, in each case for legal reasons. The Salz Review has generally assumed the veracity of information provided. Other individuals considering the same information could form a different assessment of it. Similarly, the Salz Review might have formed a different assessment had it considered other information. Accordingly, the findings of the Salz Review should not be treated as determinative of any fact, nor of the performance of, or compliance with, any legal or regulatory obligation.