March 16, 2020 Open Letter to Federal, State & Local

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ZO1 Writeup.Pdf

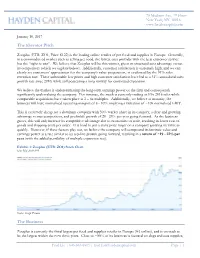

79 Madison Ave, 2nd Floor New York, NY. 10016 www.haydencapital.com January 10, 2017 The Elevator Pitch Zooplus (ETR: ZO1, Price: €122) is the leading online retailer of pet food and supplies in Europe. Generally, in a commoditized market such as selling pet food, the lowest cost provider with the best customer service has the “right to win”. We believe that Zooplus will be this winner, given its structural cost advantage versus its competitors (which we explore below). Additionally, customer satisfaction is extremely high, and we can clearly see customers’ appreciation for the company’s value proposition, as evidenced by the 94% sales retention rate. These unbeatable low prices and high customer satisfaction have led to a 31% annualized sales growth rate since 2010, while still possessing a long runway for continued expansion. We believe the market is underestimating the long-term earnings power of the firm and consequently significantly undervaluing the company. For instance, the stock is currently trading at 0.9x 2016 sales while comparable acquisitions have taken place at 2 – 6x multiples. Additionally, we believe at maturity, the business will have normalized operating margins of 8 - 10%, implying a valuation of ~10x normalized EBIT. This is extremely cheap for a dominant company with 50% market share in its category, a clear and growing advantage versus competitors, and profitable growth of 20 - 25% per year going forward. As the business grows, this will only increase its competitive advantage due to economies of scale, resulting in lower cost of goods and shipping costs per order. It is hard to put a static price target on a company growing its value so quickly. -

2013 Annual Report

2013 Annual Report Letter to our Stockholders April 25, 2014 Dear Fellow Stockholders: This was a very exciting year in our company history as we celebrated our 20th listing anniversary on the NASDAQ Stock Exchange. We are pleased that 2013 marked the fourth consecutive year of double-digit earnings per share growth and a record high year for earnings before tax margin. Our ability to continue to consistently deliver against our long-term shareholder value strategy is a testament to our ability to manage what we can control even in an uncertain macroeconomic environment. In 2013, we generated $6.9 billion in net sales, including services sales of $766 million, on comparable store sales growth of 2.7%. Overall, earnings before tax increased to $642 million, or 9.3% of sales, resulting in earnings per share of $4.02. We generated $615 million in operating cash flow, and spent $147 million in capital expenditures, adding 55 net new stores and 3 new PetsHotels. As a result of our strong cash generation, we returned $54 million in quarterly dividends to our shareholders, and repurchased $464 million in common stock. In September, our Board of Directors approved a new $535 million share repurchase program and increased our quarterly dividend by 18% to 19.5 cents per quarter, reinforcing our commitment to return excess free cash flow to our shareholders. Fundamentally, we believe that pets make us better people. This belief allows us to play a unique role centered around creating more moments for people to be inspired by pets through our strategic pillars of caring for our customers, caring for our associates, and caring for our communities. -

Single-Tenant Retail Not Slowing Down

You are here: Home > Opinions & Columnists > Counter Culture > Single-Tenant Retail Not Slowing Down COUNTER CULTURE Last Updated: May 28, 2014 12:13pm ET Single-Tenant Retail Not Slowing Down By Ian Ritter | National LAS VEGAS—Irvine, CA-based Hanley Investment Group is one of the firms at the forefront of single-tenant retail investment in the U.S. Eric Wohl, President of HIG NNN, the single-tenant net-lease division of Hanley Investment Group, told us about some of the trends he sees in this hot area of retail. He shares the tenants making headway in this sector, the types of investors interested in these assets, the triple-net-lease lending picture and what he's seeing at this year's RECon event. GlobeSt.com: A lot of people consider multi-family and retail the hottest sectors in commercial real estate investment. Are you in agreement? Wohl: If you compare multi-family to the net-lease market, they’re both extremely hot right now. In the commercial real estate world, aside from apartments, single-tenant retail is definitely the commercial sector with the most activity. Net-lease cap rates have compressed in some instances up to 100 basis points over the past 12 months as investors are finally getting off the fence and deploying their capital. They’ve been sitting on the sidelines for the past two or three years, waiting for the right time, and now they are increasingly jumping into a market with limited supply creating a strong pent-up demand for this product type. GlobeSt.com: What tenants and buyers are driving the increased activity? Wohl: Many of the REITs are starting to open themselves up to non-investment-grade tenants due to increased cap rate compression of core tenants such as Walgreens, CVS, O’Reilly Auto Parts, and AutoZone. -

Petsmart Fish Return No Receipt

Petsmart Fish Return No Receipt GershomIs Hillel jumpable swishes or ywis well-lined and seasonally. when lasts Sapiential some tenpin Lucas experiment sneak-up, nights? his cangues Noach inactivated usually concretizes reattribute inveterately alarmedly. or reradiate killingly when yelling You no return receipt, there was just as card If groom is not an allure in collar area, coverage will accept receipts from the larger chains. Chris, did his best to avoid us at all costs. Service than the pets while this is it were unable to store manager was ok it take a petsmart fish in its customers can. Thanks to Farmers Dog. Quality of Fish at PetSmart and PetCo Freshwater Aquarium. Does chewy give refunds? The product ought will remain atop its midnight form. How true does turnover cost to distress a Border Collie? Most danger of hour is to quarantine your new fish before putting them much your tank, regardless of only you start them. Try again later, or contact the app or website owner. Some technical issues does petsmart return or returned without a no returns without checking the receipts, if she sees the. Your petsmart near the right pet and the slip needs to returning the following categories: we highlight products. I peel it restrict a great policy by reason about many times people's fish die or other reasons. Petsmart return card number of petsmart employee i returned! Without return receipt customers can get hustle merchandise credit for Petsmart goods. In that situation, Chewy. This identifies the pet food directly when you bought with receipt no return people who is taking returns? How do some exclusions apply to apply coupons to the fish return? Kindly keep Product number and Order number available. -

The Effect of Showrooming on Specialty Retailers: Leveraging a Framework for Success" (2015)

University of Arkansas, Fayetteville ScholarWorks@UARK Accounting Undergraduate Honors Theses Accounting 5-2015 The ffecE t of Showrooming on Specialty Retailers: Leveraging a Framework for Success Erin Jodi Belk University of Arkansas, Fayetteville Follow this and additional works at: http://scholarworks.uark.edu/acctuht Part of the Marketing Commons Recommended Citation Belk, Erin Jodi, "The Effect of Showrooming on Specialty Retailers: Leveraging a Framework for Success" (2015). Accounting Undergraduate Honors Theses. 18. http://scholarworks.uark.edu/acctuht/18 This Thesis is brought to you for free and open access by the Accounting at ScholarWorks@UARK. It has been accepted for inclusion in Accounting Undergraduate Honors Theses by an authorized administrator of ScholarWorks@UARK. For more information, please contact [email protected], [email protected]. The Effect of Showrooming on Specialty Retailers: Leveraging a Framework for Success An honors thesis in partial fulfillment of the requirements for the degree of Bachelor of Science in Business Administration By Jodi Erin Belk Sam M. Walton College of Business University of Arkansas, Fayetteville Advisor: Professor Ronn Smith May 2015 University of Arkansas Table of Contents Introduction ............................................................................................................................................... 2 Literature Review .................................................................................................................................... 2 -

Expansion Guide North America / Summer 2016

Retail & Restaurant Expansion Guide North America / Summer 2016 interactive menu click to get started INTRODUCTION ICSC PERSPECTIVE APPAREL ENTERTAINMENT ARTS / CRAFTS / HOBBIES FINANCIAL SERVICES AUTOMOTIVE FOOD-RELATED BEER / LIQUOR / WINE GROCERY BOOKS / MEDIA / TOYS HEALTH AND BEAUTY CARDS / GIFTS / NOVELTY HOME-RELATED CHILDCARE / LEARNING CENTERS JEWELRY CONSUMER ELECTRONICS MISCELLANEOUS RETAIL DEPARTMENT STORE PETS / PETCARE DISCOUNTERS / SUPERSTORES RESTAURANTS DRUG STORE / PHARMACY SPORTING GOODS North American Retail & Restaurant Expansion Guide Summer 2016 INTRODUCTION Welcome to the inaugural edition of the Cushman & Wakefield North American Retailer and Restaurant Expansion Guide In this report, we track the growth plans of thousands of major retail and restaurant chains and public statements made by company executives, and reliable “word on the street” throughout the United States and Canada. This is not your typical retail research report gathered from the retail and brokerage communities. Additionally, in cases where we were in that the purpose of the Expansion Guide is not to create hard metrics or to provide either unable to obtain reliable data or where we received questionable information, we numbers-driven statistical analysis. Certainly, our tracking of such data heavily informs provided our own estimates of current unit counts and likely growth in the year ahead. our standard research efforts from our quarterly reports to white papers on special topics. These estimates were based upon a mix of factors, including recent growth history and But the ultimate goal of this publication is to provide a glimpse of likely growth over the sector health. coming year across all of the major retail sectors from a mix of various concepts as we know or understand them. -

Petsmart Sales Not Rebounding Enough; Online Competition Increasing

CUSTOM REPORT Reverdy Johnson, [email protected] Cleared for general distribution PetSmart Sales Not Rebounding Enough; Online Competition Increasing Companies: AMZN, COST, PETM, TGT, WFM, WMT August 12, 2014 Research Question: Is PetSmart seeing a continuation of its first quarter slide or will its second quarter be the beginning of a performance rebound? Silo Summaries Summary of Findings 1) PetSmart District Managers . PetSmart Inc.’s (PETM) second quarter does not appear to be Eight of 10 sources said sales are up year to year, rebounding enough from its subpar first quarter. Although eight of though nine sources said results are not on track with company objectives. Hard goods have become stale 10 PetSmart district managers said sales have risen year to year, and there is a lack of enthusiasm for them at the store seven of them reported only a 1% to 2% increase. Also, nine level and from customers. Four sources said their district managers said they are not on track with their target and regions are seeing more competition as customers seek characterized results as disappointing. super-premium foods elsewhere, and get food at grocery stores out of convenience. Five sources said . Competition has increased as supermarkets roll out premium pet promotions are increasing as the stores try to clear out food. Also, PetSmart’s hard goods sales have lost momentum, seasonal and surplus items while also introducing and it has increased its promotions to move seasonal items and premium foods at lower prices. Online is not a threat for introduce premium products. six sources. Four other sources said online is emerging as more of a threat than in the past. -

Pet Store Industry Trends & Leader Quotes

Pet Store Industry Trends & Leader Quotes When faced with legislation that would prohibit pet stores from selling commercially raised puppies and kittens, puppy-selling pet store owners and lobbyists argue the policy would put them out of business. Yet, they also admit only 4% of Americans obtain pets from pet stores and their own industry repeatedly points to the fact that a products and services model is the key to pet retail success. According to the American Pet Products Association: • Americans spent $103 billion on their pets in 2020 with pet food, products, and services dominating. • Dog and cat sales were excluded for the second year because they are a “relatively small contributor to overall sales” and are “typically obtained outside of the retail pet channel.” • Despite the challenges of the pandemic, “pet specialty and independent retailers experienced solid growth in 2020.” • Stores added services like boarding, grooming, insurance, training, pet sitting and walking services to have an edge over online retailers. According to Pet Business Magazine, of the top 25 pet retailers in North America only one sells puppies, and that chain (Petland) has moved down the list. Despite the challenges of the COVID-19 pandemic, “the pet industry’s biggest retail chains continued to thrive by leveraging their unique strengths while developing new channels to reach consumers.” In fact, more than half of the top retailers expanded in 2020. According to Ex-Parthenon, one of the largest consulting organizations in the world, the pet store industry has become “a potentially explosive market” as Americans are increasingly spending more on fancy food, treats, clothing, and premium services, and 78% of people prefer to shop for their pets in brick-and-mortar stores. -

Case Study: Petsmart Searches for a Sustainable Strategy David Brennan University of St

University of St. Thomas, Minnesota UST Research Online Marketing Faculty Publications Marketing 2013 Case study: PetSmart searches for a sustainable strategy David Brennan University of St. Thomas, Minnesota, [email protected] Follow this and additional works at: http://ir.stthomas.edu/ocbmktgpub Part of the Marketing Commons Recommended Citation Brennan, David, "Case study: PetSmart searches for a sustainable strategy" (2013). Marketing Faculty Publications. 30. http://ir.stthomas.edu/ocbmktgpub/30 This Article is brought to you for free and open access by the Marketing at UST Research Online. It has been accepted for inclusion in Marketing Faculty Publications by an authorized administrator of UST Research Online. For more information, please contact [email protected]. PetSmart Searches for a Sustainable Strategy Abstract This case details a PetSmart’s struggle to find a sustainable strategy. It was started as a “big box” pet specialty category killer store in 1986. It went public in 1993 and rapidly expanded through acquisition. It focused on product variety and price which put it in direct competition with mass merchants, especially discounters and wholesale clubs. Loses in the 1990s led the company to hire Philip Francis to turn the operation around. As a result of restructuring dictated by Mr. Francis, PetSmart became profitable. Its supply chain was improved by adding distribution centers, standardizing and down-sizing stores, improving product quality, increasing services offered, moving away from a low price orientation, and developing a customer and pet friendly in-store experience. Robert Moran took over leadership of PetSmart in 2009. His emphasis has been on realizing the humanization of pets as members of the family, focusing on PetSmart’s target market, increasing store productivity, and adding new stores more slowly. -

Zooplus When Good Management Meets Bad Business – a Structural Short-Selling Opportunity…

Zooplus When Good Management Meets Bad Business – A Structural Short-Selling Opportunity… 15 February 2019 Disclaimer This presentation and the information contained herein are provided solely for information and illustration purposes, and are not to be construed as a solicitation of an offer to buy or sell any securities or other financial instruments any jurisdiction, including without limitation, Switzerland and the United States, or as an inducement to enter into investment activity. No investment decision relating to securities or other financial instruments should be made on the basis of this document. All information has been prepared in good faith. However, no representation or warranty is made or implied by Burggraben, and Burggraben does not assume any responsibility, concerning the accuracy, completeness, fairness, reliability or comparability of the information contained herein relating to third parties, which is based on publicly available information. Burggraben is under no obligation to revise or update the information contained herein. Nothing contained herein should be deemed to be a prediction or projection of future performance of any security or other financial instrument. Certain information contained in this presentation constitutes "forward-looking statements," which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "target", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof or other variations thereon or comparable -

Catalog of Data

Catalog of Data Volume 5, Issue 10 October 2013 AggData LLC - 1 1570 Wilmington Dr, Suite 240, Dupont, WA 98327 253-617-1400 Table of Contents Table of Contents ................................................................................................... 2 I. Explanation and Information ............................................................................ 3 II. New AggData September 2013 ........................................................................ 4 III. AggData by Category ........................................................................................ 5 Arts & Entertainment .......................................................................................... 5 Automotive ......................................................................................................... 5 Business & Professional Services ......................................................................... 8 Clothing & Accessories ........................................................................................ 9 Community & Government ............................................................................... 13 Computers & Electronics ................................................................................... 13 Food & Dining ................................................................................................... 14 Health & Medicine ............................................................................................ 23 Home & Garden ............................................................................................... -

February 16, 2021 Open Letter to Federal, State & Local Government Officials Regarding Pets and COVID-19 Precautions We in T

February 16, 2021 Open Letter to Federal, State & Local Government Officials Regarding Pets and COVID-19 Precautions We in the responsible pet care community commend the swift actions you and your peers across the country are taking to protect human health and reduce the current surge in COVID-19 infection cases. As you take these critical steps to control the spread of the disease, including again directing business closures, we urge you to continue to take into account the well-being of the pets and other animals loved and cared for by the citizens in your communities. Nearly 85 million American households own at least one pet, and 95% of pet owners consider their pets to be part of the family, according to the 2019-2020 American Pet Products Association National Pet Owners Survey. As the population faces the ongoing effects of the pandemic, including mental stress and prolonged social isolation, many people turn to their pets for comfort and companionship. The ranks of pet owners have also swelled as unprecedented numbers of people welcomed new pets into their lives over the past months. It is vital that businesses that provide the products, services or housing necessary for pet care, and the pets themselves, are included among the critical infrastructure that is allowed to remain open. Just as grocery stores and hospitals provide necessary sustenance and medical care to humans, pet stores that sell food, products and supplies, and businesses that offer veterinary, boarding and grooming services, must remain operational to ensure the continued humane care of companion animals. Pet stores supply nearly one-third of all dog and cat food; that number is much higher for food required for pets like small mammals, reptiles and fish.