Central Pattana Plc. Property Development and Investment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 AR CPN EN 2014 4C P1-72.Indd

AANNUALNNUAL RREPORTEPORT 22014014 TOGETHER WE ARE ONE CONTENTS 012 016 020 022 023 026 CONSOLIDATED MESSAGE FROM REPORT OF THE REPORT OF THE REPORT OF THE REPORT OF THE OPERATIONAL & THE BOARD AUDIT NOMINATION AND RISK POLICY CORPORATE FINANCIAL OF DIRECTORS COMMITTEE REMUNERATION COMMITTEE GOVERNANCE HIGHLIGHTS COMMITTEE AND SUSTAINABLE DEVELOPMENT COMMITTEE 054 062 064 065 068 073 FUTURE VISION & CORPORATE SUSTAINABILITY BUSINESS PERFORMANCES PROJECTS MISSIONS VALUES MANAGEMENT STRATEGIES ECONOMIC DIMENSION 114 132 135 138 148 149 CORPORATE NOMINATION OF REMUNERATION CONNECTED GROUP REVENUE GOVERNANCE DIRECTORS AND OF THE TRANSACTIONS STRUCTURE STRUCTURE OF MANAGEMENT DIRECTORS AND OF COMPANY COMPANY AND MANAGEMENT AND ITS ITS SUBSIDIARIES SUBSIDIARIES 263 268 269 272 273 276 GENERAL LIST OF EXISTING REFERENCE INFORMATION GRI INDEX INFORMATION OF COMMITTEE IN PROJECTS FIRMS FOR INVESTORS BUSINESS HELD SUBSIDIARIES MANAGED BY CPN BY CPN 10% UPWARD 028 030 034 040 043 047 BOARD OF 2014 YEAR IN AWARDS OF ECONOMIC NATURE OF ASSET UNDER DIRECTORS AND BRIEF GREAT PRIDE AND RETAIL BUSINESS CPN’S MANAGEMENT IN 2014 INDUSTRY MANAGEMENT TEAM OVERVIEW IN 2014 073 079 084 097 100 102 FINANCIAL ENVIRONMENTAL SOCIAL RISK FACTORS ORGANIZATION MANAGEMENT PERFORMANCE DIMENSION DIMENSION CHART STRUCTURE REVIEW 151 160 161 162 246 247 CAPITAL RESPONSIBILITY FINANCIAL INDEPENDENT AUDIT’S FEE MANAGEMENT STRUCTURE OF THE BOARD STATEMENTS & AUDITOR’S BIOGRAPHY OF DIRECTORS TO NOTES TO THE REPORT THE FINANCIAL FINANCIAL STATEMENTS STATEMENTS TOGETHER WE ARE ONE MOST ADMIRED DYNAMIC REGIONAL WORLD-CLASS TO BE THE MOST RETAIL RETAIL RETAIL REWARDING ADMIRED AND DEVELOPER DEVELOPER DEVELOPER EXPERIENCE DYNAMIC REGIONAL OF ALL RETAIL PROPERTY STAKEHOLDERS DEVELOPER WITH WORLD-CLASS REWARDING EXPERIENCE The word “ONE” conveys competency with immense power in itself. -

Central Pattana (CPN TB) Buy (Maintained)

Thailand Results Review 24 February 2020 Consumer Cyclical | Leisure & Entertainment Central Pattana (CPN TB) Buy (Maintained) Favourable 4Q19 Results; Keep BUY Target Price (Return): THB79.00 (32%) Price: THB60.00 Market Cap: USD8,516m Avg Daily Turnover (THB/USD) 379m/12.4m Keep BUY and DCF-based THB79.00 TP, 32% upside plus c.2% yield. Analyst We remain positive on Central Pattana’s positioning on mixed-use property development, which should secure its long-term outlook. 4Q/FY19 results Vatcharut Vacharawongsith were resilient – beat expectations – and we expect growth to continue this +662 2088 9736 year ie 6% for core profit and 20% for net profit from a big batch asset spin- [email protected] off to its REIT despite having no new malls. Strong 1Q20F bottomline may act as a near-term catalyst, while the stock looks undemanding (-1.5SD). 4Q19 results above expectations. 4Q19 net profit was THB3.61bn (+43% YoY, +28% QoQ). Excluding a THB203m one-time extra gain from the share sales of its subsidiary, core profit was THB3.4bn (+39%YoY, +21% QoQ). It was 15% higher than our forecast due to lower opex and tax expenses. Total revenue surge (20% YoY and 26% QoQ) was supported Share Performance (%) by rising occupancy rates at its key malls in Bangkok and strong residential YTD 1m 3m 6m 12m unit transfer – mainly the condominium project in the northern province of Absolute (3.6) (5.5) (5.9) (10.1) (22.6) Chiang Rai. The accounting re-classification of other income from related Relative 1.8 (0.4) 0.2 (1.4) (13.3) activities (ie marketing with its retail mall tenants) to its topline was applied, resulting in a GPM boost to 54%. -

Central Pattana (CPN TB) Buy (Maintained) Consumer Cyclical - Leisure & Entertainment Target Price: THB57.40 Market Cap: USD5,784M Price: THB43.30

Results Review, 21 May 2015 Central Pattana (CPN TB) Buy (Maintained) Consumer Cyclical - Leisure & Entertainment Target Price: THB57.40 Market Cap: USD5,784m Price: THB43.30 Macro Risks 2 Strong And Steady Wins The Race Growth . 2 0 Value . 03 0 . 03 0 1Q15 results are at 24% of our FY15 forecast, in line. Reiterate BUY . Central Pattana (CPN TB) 0 Price Close Relative to Stock Exchange of Thailand Index (RHS) with a DCF-derived TP of THB57.40 (33% upside). 1Q15 core PATMI 0 51 111 grew 22% YoY to THB2.0bn on 9% revenue growth and a 3.4ppts rise 0 in operating margin. We continue to expect 6% same-store rental 49 106 growth for FY15, partly driven by new initiatives to increase revenue from on-site media and maximise common area utilisation for 47 101 conventions and pop-up stores. 45 96 Total revenue up 9% YoY to THB5.8bn. The increase was led by 43 91 contribution from two new malls opened in 3Q14. Same-store rental also grew healthily at 6.5% YoY in the absence of discounts given to 41 86 CentralWorld (CTW) in 1Q14 as a result of a political protest that affected tenants’ sales. Occupancy rate dipped slightly to 94% due to 39 81 18 the current renovation works at CentralPlaza Pinklao. We expect 16 14 positive returns on this asset enhancement initiative which is slated to 12 10 be completed in 4Q15. 8 6 Good cost control results in higher-than expected margins. Gross 4 2 margin increased 1.9ppts to 50.3% while EBIT margins rose 3.4ppts to Volm 43.3%. -

Central Pattana Plc. Property Development and Investment

Central Pattana Plc. Property Development and Investment Manahakorn of Isan - The Largest Mixed-Use Project of Isan Corporate Presentation 3Q17 Performance Review Contents ► Our Company ► Growth ► Financing ► Looking ahead ► Appendices 2 Our company CPN at a Glance To be the most admired and dynamic regional retail property VISION developer with world-class rewarding experience Mixed-use Project Development Malls Other related business Property funds Residential Commercial Hotel CPNRF CPNCG 7 Office Buildings 2 Hotels 1 1 Residence • Lardprao CPNRF: Central City Residence • Pinklao Tower A RM2, RM3, PKO, CMA, 24 @ Bangna • Pinklao Tower B Pinklao Tower A&B 6 • Bangna • CentralWorld Tower 1 centralmarina • Chaengwattana CPNCG: • Rama9 The Offices @ CentralWorld st 32 1.7 mn sqm 1 Rank 21% Shopping Malls NLA Retail Developer Market Share in BKK 4 consecutive years As of November 2017 3 Our company Strategic Shareholders CPN is one of the flagship businesses of the Central Group (Chirathivat Family). As a strong and supportive shareholder, the Chirathivat family brings to CPN a wealth of retail-related expertise through the family‟s long record and successful leadership in Thailand‟s dynamic and competitive landscape of shopping mall developments and department store / specialty store operations. Chirathivat Family 27% Local funds 21% Free float Foreign 53% 47% funds 71% Individuals Central 8% Group 26% Source: TSD as of 30 September 2017 4 Our company Strategic Shareholder CPN‟s strong synergy with the Central Group helps CPN to attract -

Minutes 2016 Annual General Meeting of Shareholders Central Pattana Public Company Limited

- Translation - Minutes 2016 Annual General Meeting of Shareholders Central Pattana Public Company Limited *************************************** The Annual General Meeting of Shareholders (AGM) took place at 2.00 p.m. on Thursday, April 21, 2016, at World Ballroom, 23rd floor, at Centara Grand & Bangkok Convention Center at CentralWorld, 999/99 Rama 1 Road, Patumwan, Bangkok. The meeting was registered with a barcode system and recorded for publicity at the www.cpn.co.th website. Before the meeting began, the master of ceremony introduced the Board of Directors, executives, the external auditor, and observer assigned to verify ballot counts as follows: Directors present at the Meeting: 1. Mr. Suthichai Chirathivat (Chairman) 2. Mr. Paitoon Taveebhol (Independent Director, Chairman of the Audit Committee, and Chairman of the Risk Policy Committee) 3. Mr. Karun Kittisataporn (Independent Director, Chairman of the Nomination and Remuneration Committee, and Member of the Audit Committee) 4. Mrs. Jotika Savanananda (Independent Director, Member of the Audit Committee, and Member of the Nomination and Remuneration Committee) 5. Mr. Suthikiati Chirathivat (Director) 6. Mr. Sudhisak Chirathivat (Director and Adviser of the Nomination and Remuneration Committee) 7. Mr. Kobchai Chirathivat (Director and Member of the Risk Policy Committee) 8. Mr. Preecha Ekkunagul (Director, Member of the Risk Policy Committee, President and Chief Executive Officer) Directors absent at the Meeting: 1. Mrs. Sunandha Tulayadhan (Independent Director, Member of the Audit Committee, and Member of the Nomination and Remuneration Committee) 2. Mr. Suthichart Chirathivat (Director) 3. Mr. Sudhitham Chirathivat (Director and Adviser of the Nomination and Remuneration Committee) 4. Mr. Prin Chirathivat (Director, Member of the Risk Policy Committee, and Adviser of the Nomination and Remuneration Committee) 1 - Translation - Executives present at the Meeting: 1. -

Central Pattana Public Company Limited Major Events

Document Quick Link Central Pattana Public Company Limited Major Events Management’s Discussion and Analysis (MD&A) Performance Consolidated Financial Results: 1Q18 Business Plan Executive Summary In 1Q18, the Thai economy continues to expand, primarily driven by a number of supporting factors, namely 1) growth in exports with a record high in March 2018. 2) Growth in the tourism sector characterized by an increase in foreign inbound tourists, especially from China due to more available direct flights to Thailand and Europe due to the Easter holidays at the end of the period. 3) Gradual expansion of private consumption as consumer confidence continues to improve and 4) Other supporting factors, namely public and private investments and proposed stimulus schemes, such as increase in minimum wages, local SME projects and agricultural business reform, to support the low-income group. Overall, the Thai economy is on course for a steady year of growth, according to the Bank of Thailand, with its GDP growth in 2018 at 4.1%, a slight increment from that of 2017 at 3.9%. Growth in both revenue The performance of Central Pattana Public Company Limited (“The Company” or and net profit “CPN”) in 1Q18 shows a net profit of THB 2,822 mn, an increase of 1.7% from the demonstrates the same period in the previous year (YoY), whilst total revenues stood at THB 8,223 effectiveness of retail mn, an increase of 6.5% YoY. The result demonstrates the growth resiliency of properties and cost CPN’s operating results despite the impact on its revenue from rent and services management from the major renovation at CentralWorld, the transfer of CentralFestival Pattaya Beach to CPN Retail Growth Leasehold REIT (“CPNREIT”) in December 2017, and the increase in utility cost due to the increase in electricity Ft rate since May 2017. -

Central Pattana Plc. Property Development and Investment

Central Pattana Plc. Property Development and Investment CentralPlaza Marina Pattaya Re-launch on 19 December 2016 Corporate Presentation: 3Q16 Performance Review Contents ► Our Company ► Growth ► Financing ► Looking ahead ► Appendices 2 Our company CPN at a Glance To be the most admired and dynamic regional retail property VISION developer with world-class rewarding experience Mixed-use Project Development Malls Other related business Property funds Residential Commercial Hotel CPNRF CPNCG 7 Office Buildings 2 Hotels 1 1 Residence • Lardprao CPNRF: Central City Residence • Pinklao Tower A RM2, RM3, PKO, CMA, 23 @ Bangna • Pinklao Tower B Pinklao Tower A&B 6 • Bangna • CentralWorld Tower • Chaengwattana CPNCG: • Rama9 The Offices @ CentralWorld st 30 1.6 mn sqm 93% 1 Rank 16% Shopping Malls NLA Occ. Rate Retail Developer 9M16 Rev. Growth 3 Our company Strategic Shareholders CPN is one of the flagship businesses of the Central Group (Chirathivat Family). As a strong and supportive shareholder, the Chirathivat family brings to CPN a wealth of retail-related expertise through the family‟s long record and successful leadership in Thailand‟s dynamic and competitive landscape of shopping mall developments and department store / specialty store operations. Chirathivat Family 26% Local funds 19% Free float Foreign 53% 47% funds 73% Individuals Central 8% Group 27% Source: TSD as of 30 September 2016. 4 Our company Strategic Shareholder CPN‟s strong synergy with the Central Group helps CPN to attract dynamic tenants, increase people traffic and -

Central Pattana Plc Thai Airways International

CENTRAL PATTANA PLC No. 75/2015 9 December 2015 Company Rating: THAI AIRWAYS AA- Rating Rationale INTERNATIONAL PLC TRIS Rating affirms the company rating and the existing senior unsecured Issue Ratings: debenture ratings of Central Pattana PLC (CPN) at “AA-”. At the same time, SeniorAnnouncement unsecured no. 111 AA - 12 November 2011 TRIS Rating assigns the rating of “AA-” to CPN’s proposed issue of up to Bt2,200 Outlook: Stable million in senior unsecured debentures. The proceeds from the new debentures will be used for business expansion. The “AA-” ratings reflect the company’s Company Rating History: leading position in the retail property development industry in Thailand, proven Date Rating Outlook/Alert record of managing high-quality shopping centers, reliable cash flows from 12/05/14 AA- Stable contract-based rental and service income, and conservative financial policy. The 05/02/13 A+ Positive 23/05/07 A+ Stable ratings also take into consideration the large amount of capital expenditures 22/02/05 A Stable needed for business expansion during 2015-2018. 12/07/04 A- Positive CPN is the largest retail property developer in Thailand. Its major 04/10/02 A- shareholders are the Chirathivat family (29%) and Central Holding Co., Ltd. (26%). 17/05/01 BBB+ The ownership link with the Central Group is a benefit for CPN since many anchor stores under the group have been strong magnets for shopping centers owned by CPN. As of September 2015, CPN managed 28 shopping centers, with a total retail space of 1.54 million square meters (sq.m.). -

Central Pattana Plc. Property Development and Investment

Central Pattana Plc. Property Development and Investment CentralPlaza Nakhon Si Thammarat Corporate Presentation: 1Q16 Performance Review Contents ► Our Company ► Growth ► Financing ► Looking ahead ► Appendices 2 Our company CPN at a Glance Flagship business of the Central Group (Chirathivat Family) 29 1.6 mn sqm 93% 21% 15% Shopping Malls NLA Occ. Rate Market Share 5-yr top line growth Malls Other related business Residential Commercial Hotel 15 New Projects (2016-2020): 12 domestic malls and 3 overseas malls (i-City and 2 new malls) 1 Residence 7 Office Buildings 2 Hotels 1 Central City Residence @ Bangna • Lardprao Renovation projects: 21 • Pinklao Tower A 2016: Project 2016-2020 • Pinklao Tower B 6 BNA, RM3, PTC, and PKT • Bangna • CentralWorld Tower centralcenter 2017-2020: 1 • Chaengwattana CMA, CTW, CWN, and RM2 Announced: 3 Condominiums • Rama9 New Retail format and paid attraction Target: 3 Condominiums/Yr 3 Growth 5-yr target: revenue growth of 15%CAGR Overall NLA to increase by 20% between 2015 and 2018F Retail NLA and occupancy rates SQMmn % 97 98 96 96 97 2.0 95 96 96 94 94 94 94 100 1.8 90 1.6 80 36 1.4 70 33 1.2 60 30 1.0 29 50 0.8 25 40 23 0.6 20 30 18 15 0.4 15 20 10 11 0.2 projects 10 - - Existing New Unannounced RS: Occupancy rate Source: Company estimate as at 31 March 2016. Retail space: Includes leasable area of CentralPlaza Rama 2, CentralPlaza Rama 3, CentralPlaza Pinklao, and CentralPlaza Chiangmai Airport, which were 4 partially transferred to CPNRF, but still under CPN’s management. -

Accessing the ASEAN Consumer Market: Toys and Games (Distribution Channels)

3 June 2019 Accessing the ASEAN Consumer Market: Toys and Games (Distribution Channels) Across many ASEAN nations in recent years, the toys and game industry has continued to be affected by the increasing popularity of online shopping. This migration affects some toy categories more than others. E-commerce already dominates the baby and pre-school toys market as parents are the key decision makers in the purchase of these sorts of toys and are inclined to search for these products online to find the best deals. Despite the rise of e-commerce, bricks-and-mortar stores are still the preferred channel for some categories of toys, especially dolls, superhero action figures, board games, and science, technology, engineering and math (STEM) toys. Purchases of these sorts of toys and games are highly driven by children’s choice, and parents like to try them out with their kids before buying them. This kind of shopping activity can enhance the bond between parent and child. Going shopping together for toys is a favourite activity for many families, especially during holiday seasons. Hong Kong toymakers and suppliers eyeing the ASEAN market need to keep aware of developments in both online and offline channels in order not to miss opportunities. Toys and Games Specialist Stores Toys and games specialist stores are a one-stop shop for toys, games, parties and gifts. They remain a preferred option for many ASEAN families shopping for traditional toys for children over three years old – toys such as dolls, action figures, board games and STEM toys. However, older children and teens in ASEAN are becoming increasingly reliant on their smartphones and social media at an early age. -

Stock Comparison

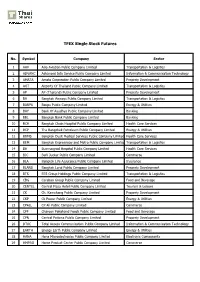

TFEX Single Stock Futures No. Symbol Company Sector 1 AAV Asia Aviation Public Company Limited Transportation & Logistics 2 ADVANC Advanced Info Service Public Company Limited Information & Communication Technology 3 AMATA Amata Corporation Public Company Limited Property Development 4 AOT Airports Of Thailand Public Company Limited Transportation & Logistics 5 AP AP (Thailand) Public Company Limited Property Development 6 BA Bangkok Airways Public Company Limited Transportation & Logistics 7 BANPU Banpu Public Company Limited Energy & Utilities 8 BAY Bank Of Ayudhya Public Company Limited Banking 9 BBL Bangkok Bank Public Company Limited Banking 10 BCH Bangkok Chain Hospital Public Company Limited Health Care Services 11 BCP The Bangchak Petroleum Public Company Limited Energy & Utilities 12 BDMS Bangkok Dusit Medical Services Public Company Limited Health Care Services 13 BEM Bangkok Expressway and Metro Public Company Limited Transportation & Logistics 14 BH Bumrungrad Hospital Public Company Limited Health Care Services 15 BJC Berli Jucker Public Company Limited Commerce 16 BLA Bangkok Life Assurance Public Company Limited Insurance 17 BLAND Bangkok Land Public Company Limited Property Development 18 BTS BTS Group Holdings Public Company Limited Transportation & Logistics 19 CBG Carabao Group Public Company Limited Food and Beverage 20 CENTEL Central Plaza Hotel Public Company Limited Tourism & Leisure 21 CK Ch. Karnchang Public Company Limited Property Development 22 CKP Ck Power Public Company Limited Energy & Utilities 23 CPALL CP All Public Company Limited Commerce 24 CPF Charoen Pokphand Foods Public Company Limited Food and Beverage 25 CPN Central Pattana Public Company Limited Property Development 26 DTAC Total Access Communication Public Company Limited Information & Communication Technology 27 EARTH Energy Earth Public Company Limited Energy & Utilities 28 HANA Hana Microelectronics Public Company Limited Electronic Components 29 HMPRO Home Product Center Public Company Limited Commerce TFEX Single Stock Futures No. -

Jerhigh Newsletter กันยายน 2557

www.jerhigh.com Vol.6 No.67 SEPTEMBER 2014 ISSN 19054424 It’s Gotta BE YOU, ONLY YOU. ณัชชานันท์ พีระณรงค์ Dog Guru เพียงเล็กน้อย กำรป้องกันไว้ก่อน เรื่องฟันก็ส�าคัญ ก็จ�ำเป็นจะต้องค�ำนึงถึงด้วย กำรดูแล กำรดูแลเอำใจใส่ที่ถูกต้องย่อม ฟันและช่องปำกของเจ้ำตูบด้วย ช่วยพิทักษ์และยืดอำยุกำรใช้งำน ตัวของคุณเองเมื่ออยู่ที่บ้ำน ก็ถือเป็น ของฟัน ให้นำนขึ้น ส่งผลให้เจ้ำตูบ สิ่งจ�ำเป็นอันดับต้นๆ ในกำรที่จะเลี้ยง มีควำมสุขสดใสตลอดอำยุขัย ฉะนั้น สุนัขสักตัว และบำงขั้นตอนก็สำมำรถ สิ่งที่เจ้ำของควรท�ำก็คือรีบจัดโปรแกรม ช่วยลดปัญหำกลิ่นปำกได้ไม่ยำกเลย ที่เหมำะสมให้เขำอย่ำงด่วน เพรำะ เมื่อคุณท�ำอยู่สม�่ำเสมอ และวิธีง่ำยๆ อำกำรบำดเจ็บของฟันนั้นไม่ได้ ก็คือ กำรแปรงฟัน แสดงออกมำให้เห็น แม้กิริยำอำกำร ส�ำหรับสุนัขแล้วกำรแปรงฟัน จะดูปกติ แต่ใครจะรู้ดีไปกว่ำเจ้ำตัว คงต้องมีตัวช่วยพิเศษสักหน่อย นั่น ว่ำมันปวดแค่ไหน ก็คือแปรงชนิดพิเศษที่ท�ำขึ้นมำส�ำหรับ เมื่อคุณทรำบควำมส�ำคัญของ สุนัขโดยเฉพำะ และยำสีฟันที่ผลิตขึ้น กำรบ�ำรุงรักษำฟันแล้ว ตำรำงนัด เพื่อสุนัขในปัจจุบันก็สำมำรถหำซื้อได้ คุณหมอที่เรำก�ำลังจะน�ำเสนอ ไม่ยำกนัก ซึ่งจะมีกลิ่นที่สุนัขชื่นชอบ ต่อไปนี้ ควรจ�ำให้แม่น อย่ำได้ลืม ต่ำงจำกยำสีฟันของคน ช่วยให้กำร เป็นอันขำด แปรงฟันเจ้ำตัวยุ่งง่ำยขึ้นมำก อีกวิธีที่สำมำรถปฏิบัติเองได้ที่บ้ำน ลูกสุนัข อายุ 0-12 เดือน BAD BREATH ก็คือ กำรให้อำหำร ซึ่งอำจปรึกษำกับ เมื่อครบก�ำหนดรับวัคซีนในช่วง สัตวแพทย์ผู้เชี่ยวชำญถึงอำหำรที่ 4 เดือน เวลำที่คุณพำเขำไปตำมนัด (CHRONIC) IN DOGS เหมำะกับสุนัขของเรา และสำมำรถช่วย อย่ำลืมกระซิบให้หมอตรวจฟันของ ณเคยสังเกตกันบ้างหรือไม่ ว่ากลิ่นลมหายใจของเจ้าตูบมีความ ลดกลิ่นปำกและหินปูนได้ในระดับหนึ่ง เขำควบคู่กันไปด้วย ผิดแปลกอย่างไร จริงอยู่ว่าสุนัขเกิดกลิ่นปากได้เป็นเรื่องธรรมดา