Buy BJ's Wholesale Club

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Venditore 1500 W Chestnut St Washington, Pa 15301 1022

1 VENDITORE 1022 MARSHALL ENTERPRISES 10TH STREET MARKET 1500 W CHESTNUT ST INC 802 N 10TH ST WASHINGTON, PA 15301 1022-24 N MARSHALL ST ALLENTOWN, PA 18102 PHILADELPHIA, PA 19123 12TH STREET CANTINA 15TH STREET A-PLUS INC 1655 SUNNY I INC 913 OLD YORK RD 1501 MAUCH CHUNK RD 1655 S CHADWICK ST JENKINTOWN, PA 19046 ALLENTOWN, PA 18102 PHILADELPHIA, PA 19145 16781N'S MARKET 16TH STREET VARIETY 17 SQUARE THIRD ST PO BOX 155 1542 TASKER ST 17 ON THE SQUARE NU MINE, PA 16244 PHILADELPHIA, PA 19146 GETTYSBURG, PA 17325 1946 WEST DIAMOND INC 1ST ORIENTAL SUPERMARKET 2 B'S COUNTRY STORE 1946 W DIAMOND ST 1111 S 6TH ST 2746 S DARIEN ST PHILADELPHIA, PA 19121 PHILADELPHIA, PA 19147 PHILADELPHIA, PA 19148 20674NINE FARMS COUNTRY 220 PIT STOP 22ND STREET BROTHER'S STORE 4997 US HIGHWAY 220 GROCERY 1428 SEVEN VALLEYS RD HUGHESVILLE, PA 17737 755 S 22ND ST YORK, PA 17404 PHILADELPHIA, PA 19146 2345 RIDGE INC 25TH STREET MARKET 26TH STREET GROCERY 2345 RIDGE AVE 2300 N 25TH ST 2533 N 26TH ST PHILADELPHIA, PA 19121 PHILADELPHIA, PA 19132 PHILADELPHIA, PA 19132 2900-06 ENTERPRISES INC 3 T'S 307 MINI MART 2900-06 RIDGE AVE 3162 W ALLEGHENY AVE RTE 307 & 380 PHILADELPHIA, PA 19121 PHILADELPHIA, PA 19132 MOSCOW, PA 18444 40 STOP MINI MARKET 40TH STREET MARKET 414 FIRST & LAST STOP 4001 MARKET ST 1013 N 40TH ST RT 414 PHILADELPHIA, PA 19104 PHILADELPHIA, PA 19104 JERSEY MILL, PA 17739 42 FARM MARKET 46 MINI MARKET 4900 DISCOUNT ROUTE 42 4600 WOODLAND AVE 4810 SPRUCE ST UNITYVILLE, PA 17774 PHILADELPHIA, PA 19143 PHILADELPHIA, PA 19143 5 TWELVE FOOD MART 52ND -

Presence News

February 2020 Volume 17, Issue 02 East Presence News Earth Fare’s Closure Shocks Industry Inside this issue The news of another prominent East Coast natural foods retailer closing up shop shook the grocery East 1 industry in early February. In abrupt fashion, on February 3rd, Asheville, North Carolina-based Earth Fare announced it would halt business operations and close all 50 locations, joining two other once- Rocky Mountain 3 prominent and rising healthy foods chains shuttered in recent weeks. Colorado-based Lucky’s Market West 5 announced it would be closing the banner, excluding seven locations purchased by management, and Southwest 6 New York-based Fairway Market in January again filed for bankruptcy and is selling all stores. Northwest 8 In the days following both the Lucky’s and Fairway announcement many insiders eyed the Asheville- based organic, natural foods grocer as a potential benefactor, especially in the Florida market where Midwest 9 Lucky’s closed 20 of 21 stores, and Earth Fare had its own plans in the works for 50 locations alone in Distributor News 11 the state. However, the future now holds no new store openings, no further growth and uncertainty for Earth Fare’s reported 3,000 employees. The company began liquidation sales at all stores, which Earth Data Update 11 Fare has throughout 10 states, immediately after the news was announced. Oak Hill Capital Partners, a Food Policy 14 New York-based private equity firm, currently holds a majority stake in Earth Fare. Oak Hill had acquired the equity interest in 2012 from Monitor Clipper Partners, which had owned Earth Fare since Expo West 15 2006. -

What Is a Warehouse Club?

What is a Warehouse Club? The principle operators in the warehouse club industry are BJ’s Wholesale, Cost-U-Less, Costco Wholesale, PriceSmart and Sam’s Club. These five companies follow the basic warehouse club principles developed by Sol and Robert Price, who founded the warehouse club industry when they opened the first Price Club in San Diego, California in 1976. However, the five warehouse club operators have adapted those basic concepts to today’s retail environment. This chapter provides an explanation of the key characteristics of a warehouse club in 2010. Overall Description A warehouse club offers its paid members low prices on a limited selection of nationally branded and private label merchandise within a wide range of product categories (see picture on the right of Mott’s sliced apples at BJ’s). Rapid inventory turnover, high sales volume and reduced operating costs enable warehouse clubs to operate at lower gross margins (8% to 14%) than discount chains, supermarkets and supercenters, which operate on gross margins of 20% to 40%. BJ’s – Mott’s Sliced Apples Overall Operating Philosophy When it comes to buying and merchandising, the warehouse clubs follow the same simple and straightforward six-point philosophy that was originated by Sol Price: 1. Purchase quality merchandise. 2. Purchase the right merchandise at the right time. 3. Sell products at the lowest possible retail price. 4. Merchandise items in a clean, undamaged condition. 5. Merchandise products in the right location. 6. Stock items with the correct amount of inventory, making sure that supply is not excessive. In 1983, Joseph Ellis, an analyst at Goldman Sachs, summarized the warehouse club operating philosophy in a meaningful and relevant way. -

2017 Warehouse Club Industry Guide

2017 Warehouse Club Industry Guide BJs.com Costco.com 7 1 0 2 , 2 2 SamsClub.com y a M — te a D CostULess.come PriceSmart.com s a le e R HHC Publishing, Inc.— Providing Club Industry Data, Information and Analysis since 1997 Online access and/or book delivery for the 2017 Warehouse Club Industry Guide Order Form will occur by May 22, 2017. These PRE PUBLICATION discounts expire May 15, 2017. ONE Version Option TWO Version Option Save Purchase either Save Purchase both Save up $200 the print or $300 the print and online version online versions to $300 and pay $599, a $200 and pay $699, a $300 discount off the everyday discount off the everyday price of $799. price of $999. ORDER ONE Version Order—Check One TWO Version Order—Check Box $599 Book Online $699 Book and Online DELIVERY AND PAYMENT Name To get your 2017 Warehouse Club Industry Guide, simply Title/Position complete this form and return it to: HHC Publishing, Inc. Company PO Box 9138 Foxboro, MA 02035-9138 Address 617-770-0102 City, State, Zip You can also fax the completed form to: Telephone, Email 617-479-4961 Invoice Me Check Enclosed UNCONDITIONAL MONEY BACK GUARANTEE American Express MasterCard Visa If you are not completely Credit Card Number satisfied with the 2017 Warehouse Club Industry Expiration Date & Guide, you are entitled to a full Signature refund. March 17, 2017 Volume 21, Issue 473 WAREHOUSE CLUB FOCUS Costco February Sales—5. Costco MVM Program—7. 1 For 21 years, your best source for information about the clubs. -

Membership Wholesale Clubs: a Low-Price Alternative

The Food Industry: Changing With the Times Membership Wholesale Clubs: A Low-Price Alternative Walter Epps and Judy Putnam (202) 786-1866 ffered the choice of paying $3.29 or posted wholesale prices, about 5 percent in O $2.79 for a 12-pack case of 12-ounce 1985. Pepsi's, obviously most buyers would Most wholesale clubs stock 4,000 to choose the lower price. This price appeal 6,000 items. This compares with up to goes a long way toward explaining the 25,000 items offered by conventional super meteoric ·rise of wholesale clubs-fully com markets and 30,000 to 50,000 items stocked puterized "no-frills" operations offering a by traditional discount stores. However, a limited selection of first quality, name-brand club's range of items is broad-from micro merchandise to smalJ businesses and select wave ovens to plastic trash bags. Within ed groups of consumers. any product category, clubs stock only a Today's clubs trace their lineage to the couple of fast-moving, welJ-known brands. cash-and-carry operations started more than Grocery items account for 40 to 60 percent 50 years ago by wholesale food distributors of clubs' sales, with general merchandise to serve their smalJ business customers who making up the remainder. couldn't buy in large quantities. As the Included in their food lines are canned name implies, customers pay cash at these peas, trout fillets, and frozen french fries. outlets and assume responsibility for receipt In short, there is the range of products, and delivery of their order, thus avoiding though not the variety of brands and sizes distributor service charges. -

Participating Chain Pharmacies

PARTICIPATING CHAIN PHARMACIES A & P Pharmacy Discount Drug Mart Hy-Vee, Drug Town Network Pharmacy Shoppers Pharmacy ABCO Pharmacy Doc's Drugs Ingles Pharmacy Oncology Pharmacy Services Shoprite Pharmacy Acme Pharmacy Drug Emporium Integrity Healthcare Services P&C Food Market Shurfine Pharmacy Acme, Lucky, Osco, Sav-on Drug Fair Kare Pharmacy Pacmed Clinic Pharmacy Smith's Food & Drug Center Albertson's Pharmacy Duane Reade Kash N' Karry Pharmacy Pamida Pharmacy Snyder Drug Stores Allcare Pharmacy Eagle Pharmacy Kelsey Seybold Clinic Pharmacy Park Nicollet Pharmacy Southern Family Markets Ambulatory Pharmaceutical Services Edgehill Drugs Kerr Drug Pathmark Stadtlander Pharmacy Anchor Pharmacy Express, Thrift, Treasury Keystone Medicine Chest Payless Pharmacy Standard Drug Company Appletree Pharmacy Fagen Pharmacy King Kullen Pharmacy Pediatric Services of America Star Pharmacy Arrow Pharmacy Fairview Pharmacy Kinney Drug's Pharma-Card Statscript Pharmacy Aurora Pharmacy Family Care Pharmacy Kleins Supermarket Pharmacy Pharmacy Plus Steele's Pharmacy B J's Pharmacy Family Drug Klinck, Drug Barn Presbyterian Retail Pharmacy Stop & Shop Pharmacy Bakers Pharmacy Family Fare Klingensmith's Drug Price Chopper Pharmacy Super D Bartell Drugs Family Pharmacy Kmart Pharmacy Price Less Drug Super Food Mart Basha's United Drug Fedco Drug Knight Drugs Price Wise, Piggly Wiggly Super Fresh Pharmacy Bel Air Pharmacy Finast Pharmacy Kohlls Pharmacy Prime Med Pharmacy Super RX Pharmacy Big Bear Pharmacy Food 4 Less Pharmacy Kopp Drug Publix Pharmacy -

United Natural Foods (UNFI)

United Natural Foods Annual Report 2019 Form 10-K (NYSE:UNFI) Published: October 1st, 2019 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended August 3, 2019 or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _______ to _______ Commission File Number: 001-15723 UNITED NATURAL FOODS, INC. (Exact name of registrant as specified in its charter) Delaware 05-0376157 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 313 Iron Horse Way, Providence, RI 02908 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (401) 528-8634 Securities registered pursuant to Section 12(b) of the Act: Name of each exchange on which Title of each class Trading Symbol registered Common Stock, par value $0.01 per share UNFI New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Freson Bros. Stony Plain AB Bobs' IGA Wrangell AK City Market, Inc

NGA Retail Membership List by State – Summer 2018 Company City State Freson Bros. Stony Plain AB Bobs' IGA Wrangell AK City Market, Inc. Wrangell AK Copper Valley IGA Glennallen AK Country Foods IGA Kenai AK Cubby's Marketplace IGA Talkeetna AK Fairway Market, IGA Skagway AK Hames Corporation dba Sea Mart Quality Foods Sitka AK Howsers Supermarket IGA Haines AK IGA Food Cache Delta Junction AK Tatsuda's IGA Ketchikan AK Trading Union IGA Petersburg AK A & R Supermarkets, Inc. dba Sav Mor Calera AL Autry Greer & Sons, Inc. Mobile AL Baker Foods, Inc. dba Piggly Wiggly Pell City AL Big Bear of Luverne, Inc. dba Super Foods Supermarkets Luverne AL Farmers IGA Foodliner Opp AL Forster & Howell, Inc. dba Grocery Outlets Dothan AL Fourth Avenue Supermarket Inc. dba Four Winds Fine Foods Bessemer AL Freeman Foods Inc. dba Freeman's Shur-Valu Foods Dothan AL Gregerson's Foods, Inc. dba Gregerson's Foods Gadsden AL Hackleburg Market Hackleburg AL Holley Oil Company Wetumpka AL Hopper Family Market Cullman AL Johnson's Giant Food, Inc. Altalla AL Langley Inc. Hayneville AL M&B Enterprises dba Fuller's Supermarket Greensboro AL Piggly Wiggly - Warrior, AL Russell Supermarket, Inc. Warrior AL Pinnacle Foods Mobile AL Ragland Bros. Retail Co. Inc. Huntsville AL Shan Bruce Enterprises, Inc. dba Foodland Fort Payne AL Tallassee Super Foods Tallassee AL Western Supermarkets, Inc. Birmingham AL Williams-McGue Inc. dba WM Grocery Wedowee AL Wrights Markets Opelika AL Bill's Fresh Market Jonesboro AR Cash Saver Russellville AR Cranford's Fresh World White Hall White Hall AR Dale Newman Management Co. -

Deloitte Studie

Global Powers of Retailing 2018 Transformative change, reinvigorated commerce Contents Top 250 quick statistics 4 Retail trends: Transformative change, reinvigorated commerce 5 Retailing through the lens of young consumers 8 A retrospective: Then and now 10 Global economic outlook 12 Top 10 highlights 16 Global Powers of Retailing Top 250 18 Geographic analysis 26 Product sector analysis 30 New entrants 33 Fastest 50 34 Study methodology and data sources 39 Endnotes 43 Contacts 47 Global Powers of Retailing identifies the 250 largest retailers around the world based on publicly available data for FY2016 (fiscal years ended through June 2017), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook and looks at the 50 fastest-growing retailers and new entrants to the Top 250. This year’s report will focus on the theme of “Transformative change, reinvigorated commerce”, which looks at the latest retail trends and the future of retailing through the lens of young consumers. To mark this 21st edition, there will be a retrospective which looks at how the Top 250 has changed over the last 15 years. 3 Top 250 quick statistics, FY2016 5 year retail Composite revenue growth US$4.4 net profit margin (Compound annual growth rate CAGR trillion 3.2% from FY2011-2016) Aggregate retail revenue 4.8% of Top 250 Minimum retail Top 250 US$17.6 revenue required to be retailers with foreign billion among Top 250 operations Average size US$3.6 66.8% of Top 250 (retail revenue) billion Composite year-over-year retail 3.3% 22.5% 10 revenue growth Composite Share of Top 250 Average number return on assets aggregate retail revenue of countries with 4.1% from foreign retail operations operations per company Source: Deloitte Touche Tohmatsu Limited. -

Alabama Vendor List.Xlsx

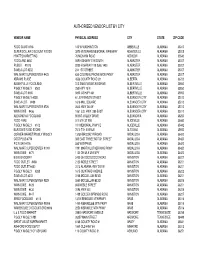

AUTHORIZED VENDOR LIST BY CITY VENDOR NAME PHYSICAL ADDRESS CITY STATE ZIP CODE FOOD GIANT #716 100 W WASHINGTON ABBEVILLE ALABAMA 36310 SUPER DOLLAR DISCOUNT FOODS 3970 VETERANS MEMORIAL PARKWAY ADAMSVILLE ALABAMA 35005 HYATT'S MARKET INC 70 MCHANN ROAD ADDISON ALABAMA 35540 FOODLAND #450 509 HIGHWAY 119 SOUTH ALABASTER ALABAMA 35007 PUBLIX #1073 9200 HIGHWAY 119 Suite 1400 ALABASTER ALABAMA 35007 SAVE-A-LOT #202 244 1ST STREET ALABASTER ALABAMA 35007 WAL MART SUPERCENTER #423 630 COLONIAL PROMENADE PKWY ALABASTER ALABAMA 35007 ABRAMS PLACE 4556 COUNTY ROAD 29 ALBERTA ALABAMA 36720 ALBERTVILLE FOODLAND 313 SAND MOUNTAIN DRIVE ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #500 250 HWY 75 N ALBERTVILLE ALABAMA 35950 SAVE-A-LOT #165 5850 US HWY 431 ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #238 61 JEFFERSON STREET ALEXANDER CITY ALABAMA 35010 SAVE-A-LOT #489 1616 MILL SQUARE ALEXANDER CITY ALABAMA 35010 WAL MART SUPERCENTER #726 2643 HWY 280 W ALEXANDER CITY ALABAMA 35010 WINN DIXIE #456 1061 U.S. HWY. 280 EAST ALEXANDER CITY ALABAMA 35010 ALEXANDRIA FOODLAND 85 BIG VALLEY DRIVE ALEXANDRIA ALABAMA 36250 FOOD FARE 517 5TH ST NW ALICEVILLE ALABAMA 35442 PIGGLY WIGGLY #102 101 MEMORIAL PKWY E ALICEVILLE ALABAMA 35442 BURTON'S FOOD STORE 7010 7TH AVENUE ALTOONA ALABAMA 35952 CORNER MARKET/PIGGLY WIGGLY 13759 BROOKLYN ROAD ANDALUSIA ALABAMA 36420 COST PLUS #774 305 EAST THREE NOTCH STREET ANDALUSIA ALABAMA 36420 PIC N SAV #776 550 W BYPASS ANDALUSIA ALABAMA 36420 WAL MART SUPERCENTER #1091 1991 MARTIN LUTHER KING PKWY ANDALUSIA ALABAMA 36420 WINN DIXIE -

Supermarkets & Grocery Stores in the US

US INDUSTRY (NAICS) REPORT 44511 Supermarkets & Grocery Stores in the US In the bag: Rising discretionary income is expected to support revenue growth Cecilia Fernandez | November 2020 IBISWorld.com +1-800-330-3772 [email protected] Supermarkets & Grocery Stores in the US 44511 November 2020 Contents About This Industry...........................................5 Competitive Landscape...................................26 Industry Definition..........................................................5 Market Share Concentration....................................... 26 Major Players................................................................. 5 Key Success Factors................................................... 26 Main Activities................................................................5 Cost Structure Benchmarks........................................27 Supply Chain...................................................................6 Basis of Competition...................................................31 Similar Industries........................................................... 6 Barriers to Entry........................................................... 32 Related International Industries....................................6 Industry Globalization..................................................33 Industry at a Glance.......................................... 7 Major Companies............................................34 Executive Summary....................................................... 9 Major Players.............................................................. -

2020 Fact Book Kroger at a Glance KROGER FACT BOOK 2020 2 Pick up and Delivery Available to 97% of Custom- Ers

2020 Fact Book Kroger At A Glance KROGER FACT BOOK 2020 2 Pick up and Delivery available to 97% of Custom- ers PICK UP AND DELIVERY 2,255 AVAILABLE TO PHARMACIES $132.5B AND ALMOST TOTAL 2020 SALES 271 MILLION 98% PRESCRIPTIONS FILLED HOUSEHOLDS 31 OF NEARLY WE COVER 45 500,000 640 ASSOCIATES MILLION DISTRIBUTION COMPANY-WIDE CENTERS MEALS 34 DONATED THROUGH 100 FEEDING AMERICA FOOD FOOD BANK PARTNERS PRODUCTION PLANTS ARE 35 STATES ACHIEVED 2,223 ZERO WASTE & THE DISTRICT PICK UP 81% 1,596 LOCATIONS WASTE OF COLUMBIA SUPERMARKET DIVERSION FUEL CENTERS FROM LANDFILLS COMPANY WIDE 90 MILLION POUNDS OF FOOD 2,742 RESCUED SUPERMARKETS & 2.3 MULTI-DEPARTMENT STORES BILLION kWh ONE OF AMERICA’S 9MCUSTOMERS $213M AVOIDED SINCE MOST RESPONSIBLE TO END HUNGER 2000 DAILY IN OUR COMMUNITIES COMPANIES OF 2021 AS RECOGNIZED BY NEWSWEEK KROGER FACT BOOK 2020 Table of Contents About 1 Overview 2 Letter to Shareholders 4 Restock Kroger and Our Priorities 10 Redefine Customer Expereince 11 Partner for Customer Value 26 Develop Talent 34 Live Our Purpose 39 Create Shareholder Value 42 Appendix 51 KROGER FACT BOOK 2020 ABOUT THE KROGER FACT BOOK This Fact Book provides certain financial and adjusted free cash flow goals may be affected changes in inflation or deflation in product and operating information about The Kroger Co. by: COVID-19 pandemic related factors, risks operating costs; stock repurchases; Kroger’s (Kroger®) and its consolidated subsidiaries. It is and challenges, including among others, the ability to retain pharmacy sales from third party intended to provide general information about length of time that the pandemic continues, payors; consolidation in the healthcare industry, Kroger and therefore does not include the new variants of the virus, the effect of the including pharmacy benefit managers; Kroger’s Company’s consolidated financial statements easing of restrictions, lack of access to vaccines ability to negotiate modifications to multi- and notes.