Interactive Games and Entertainment Association

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GAMING GLOBAL a Report for British Council Nick Webber and Paul Long with Assistance from Oliver Williams and Jerome Turner

GAMING GLOBAL A report for British Council Nick Webber and Paul Long with assistance from Oliver Williams and Jerome Turner I Executive Summary The Gaming Global report explores the games environment in: five EU countries, • Finland • France • Germany • Poland • UK three non-EU countries, • Brazil • Russia • Republic of Korea and one non-European region. • East Asia It takes a culturally-focused approach, offers examples of innovative work, and makes the case for British Council’s engagement with the games sector, both as an entertainment and leisure sector, and as a culturally-productive contributor to the arts. What does the international landscape for gaming look like? In economic terms, the international video games market was worth approximately $75.5 billion in 2013, and will grow to almost $103 billion by 2017. In the UK video games are the most valuable purchased entertainment market, outstripping cinema, recorded music and DVDs. UK developers make a significant contribution in many formats and spaces, as do developers across the EU. Beyond the EU, there are established industries in a number of countries (notably Japan, Korea, Australia, New Zealand) who access international markets, with new entrants such as China and Brazil moving in that direction. Video games are almost always categorised as part of the creative economy, situating them within the scope of investment and promotion by a number of governments. Many countries draw on UK models of policy, although different countries take games either more or less seriously in terms of their cultural significance. The games industry tends to receive innovation funding, with money available through focused programmes. -

Game Developer Power 50 the Binding November 2012 of Isaac

THE LEADING GAME INDUSTRY MAGAZINE VOL19 NO 11 NOVEMBER 2012 INSIDE: GAME DEVELOPER POWER 50 THE BINDING NOVEMBER 2012 OF ISAAC www.unrealengine.com real Matinee extensively for Lost Planet 3. many inspirations from visionary directors Spark Unlimited Explores Sophos said these tools empower level de- such as Ridley Scott and John Carpenter. Lost Planet 3 with signers, artist, animators and sound design- Using UE3’s volumetric lighting capabilities ers to quickly prototype, iterate and polish of the engine, Spark was able to more effec- Unreal Engine 3 gameplay scenarios and cinematics. With tively create the moody atmosphere and light- multiple departments being comfortable with ing schemes to help create a sci-fi world that Capcom has enlisted Los Angeles developer Kismet and Matinee, engineers and design- shows as nicely as the reference it draws upon. Spark Unlimited to continue the adventures ers are no longer the bottleneck when it “Even though it takes place in the future, in the world of E.D.N. III. Lost Planet 3 is a comes to implementing assets, which fa- we defi nitely took a lot of inspiration from the prequel to the original game, offering fans of cilitates rapid development and leads to a Old West frontier,” said Sophos. “We also the franchise a very different experience in higher level of polish across the entire game. wanted a lived-in, retro-vibe, so high-tech the harsh, icy conditions of the unforgiving Sophos said the communication between hardware took a backseat to improvised planet. The game combines on-foot third-per- Spark and Epic has been great in its ongoing weapons and real-world fi rearms. -

GDAA Submission to the ECRC Inquiry Into the Future of The

Submission to Senate Environment and Communications References Committee Subject Inquiry into the Future of Australia's Video Game Development Industry Date 18 September 2015 Game Developers’ Association of Australia Submission to Inquiry into the Future of Australia's Video Game Development Industry INTRODUCTION The Game Developers’ Association of Australia (GDAA) welcomes the opportunity to respond to the Senate Environment and Communications References Committee’s (SECR) inquiry into The Future of Australia’s Video Game Development Industry. This submission addresses the Terms of Reference as provided by the SECR: a. How Australia can best set regulatory and taxation frameworks that will allow the local video game development industry to grow and fully meet its potential as a substantial employer b. How Australia can attract video game companies to set up development operations in Australia and employ local staff c. How export opportunities from Australia's local video game industry can be maximised d. Any other related matters. In this submission we have provided: • A brief description of the GDAA • An insight into the local and global digital games industry • An overview of the state of the interactive game development sector in Australia • A synopsis of the challenges and opportunities faced by the interactive game development sector in Australia For the purposes of clarity, the use of the term ‘games’ or ‘gaming’ in this submission does not refer to the gambling sector in any form, but rather the products, and the development of those products, in the digital games industry. Additionally, the terms ‘interactive games’, ‘video games’ and ‘digital games’ are interchangeable and refer to games that are created for and/or played on digital devices, including but not limited to, mobile and tablet devices, personal computers and home consoles. -

Apps on Breakaway's Ipads

1 Apps on Breakaway’s iPads Folder: Autism App Icon App Name App Description (Click the link for more info) Autism Apps is simply a comprehensive list of apps that are being used with and by people diagnosed with autism, Down syndrome and other special needs. It also Autism Apps includes links to any available information that can be found for each app. The Apps are also separated into over 30 categories, and the descriptions are all searchable, so any type of app is easy to find and download. In addition to an improved version of the original game, AutismXpress Pro features 2 AutismXpress Pro totally new games, which are both also designed to help sufferers of Autism identify and express their emotions through an easy to use and fun interface. Autism Stories is for all parents, teachers, guardians, family members, friends and associates of people living with autism. The goal is to provide a place for people to Autism Stories come together to share their experiences and show that autism can be understood and that those suffering from it are as capable as anyone else. Tap Metronome is a simple metronome for those who want quick access to a Tap Metronome reliable metronome. Folder: Board Games UNO Free The classic card game that can be played in single or multiplayer modes The fantastically fun game you know and love with stunning HD-quality graphics, Scrabble quick, easy play and incredible exclusive features. Like Solitaire? You'll love Real Solitaire Free HD. Designed exclusively for iPad, Real Solitaire Solitaire offers stunning visuals, sounds, landscape and portrait support, along with features you won't find anywhere else. -

Recreation, Sports, and Leisure

Recreation, Sports, and Leisure Name of App Platform Description Angry Birds 2 IOS Use the slingshot to fling birds at the piggies' towers and bring them crashing down to save the precious eggs. Choose which bird to fling when, play with friends, take on multi stage levels, and compete and collaborate with players around the globe. Clips iOS Clips is a free app for making fun videos to share with friends and family. With a few taps you can create and send a video message or tell a quick story with artistic filters, animated text, music, emoji, and fun stickers featuring characters from Star Wars, Disney•Pixar and more. Colorful - Calm Coloring Book IOS The only coloring book where you make relaxing music while you color. Plenty of FREE content to enjoy: free daily image and a free image in each category Disney Crossy Road iOS DISNEY CROSSY ROAD is an arcade game that will remind older gamers of the classic Frogger and put Disney's library of characters into a totally new world Disney Frozen Free Fall Game iOS Play 1,000+ exciting levels in Disney's amazing puzzle game, Frozen Free Fall! ... Join Anna, Elsa, Olaf and more of your favorite characters on a puzzle journey to slide and match-3 hundreds of icy puzzles Disney Junior Appisodes iOS The Disney Junior Appisodes app allows preschoolers to experience the magic of watching, playing and interacting directly with their favorite Disney Junior TV shows in a whole new way! ... Mickey Mouse Clubhouse Appisodes featuring "Quest for the Cyrstal Mickey" & "Mickey and Donald Have a Farm" episodes. -

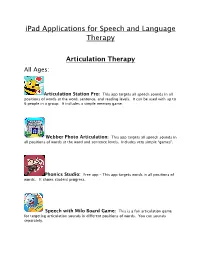

Ipad Applications for Speech and Language Therapy

iPad Applications for Speech and Language Therapy Articulation Therapy All Ages: Articulation Station Pro: This app targets all speech sounds in all positions of words at the word, sentence, and reading levels. It can be used with up to 6 people in a group. It includes a simple memory game. Webber Photo Articulation: This app targets all speech sounds in all positions of words at the word and sentence levels. Includes very simple “games”. Phonics Studio: Free app – This app targets words in all positions of words. It shows student progress. Speech with Milo Board Game: This is a fun articulation game for targeting articulation sounds in different positions of words. You can sounds separately. The Apraxia RainbowBee app: is a multi-step, multi-modality program with colorful graphic, photo, audio, and video targets and fun engaging games. The program is designed to help enhance motor planning for children with an apraxic component that impacts their speech production. Listen Close Articulation: is a unique speech therapy game that challenges players to memorize and repeat an ever-increasing string of articulation word sequences (Like the Simon game). It features a comprehensive collection of over 600 sound-specific articulation words designed for speech-language pathologists to use with individuals who exhibit difficulty producing the following speech sounds: S, Z, R, L, S/R/L Blends, SH, CH, and TH. ArtikPix: Full is an engaging articulation app with flashcard and matching activities for children with speech sound delays. Among the many features in ArtikPix - Full, group scoring is available for collecting scores in flashcards on up to 4 children at a time. -

Australian and North American Game Industries Report 2013

CCI Report on Australian and North American Game Industries1 Key points 1. Industry background Australia Canada US 2. Consumer base Australia Canada US 3. Cultural policy and regulation Policy background Tax incentives Free Speech vs. Classification – US & Australia Intellectual property and piracy Virtual world governance and taxation 4. Labour strategies 5. Social impact of games Australia US Canada 6 Business strategies Cross-platform development Shift in focus towards mobile Monetization strategies Distribution and marketing 7. Creative clusters 8. Interest in Asia/China 1 The research is commissioned by The Research Grant Council Hong Kong Special Administration Region. The project code is 4001-SPPR-09 1 Product distribution and localization Conduits to China Overview The document provides background contextual material on the games industry in Australia and identifies key challenges and opportunities confronting Australian developers. Comparisons with the United States and Canada will also be provided. This report focuses on companies (games developers), the policy environments in which they operate and markets for their products. Australian information comes from a 2009 report on the video game industry as well as a 2012 report focusing on consumers; US and Canadian information is extracted from ESA reports dating from 2011. The first part of the paper provides comparative data; the second part examines key issues. Key points: Australia is primarily an importer of video games and associated technology; export revenue is primarily game and accessory developer income derived from intellectual property; While Australian developers’ share of the US market is minimal, the impact of US business on the viability of the Australian industry is critical; Traditionally Australian game companies adhered to the fee-for-service model of working for overseas companies, mainly U.S. -

2D Game Design

2D Game Design Dr. John F. Santore Computer Science Bridgewater State University Admin ● Lets go over the syllabus – after previous semesters have to be a hard- case ● and find out whose here. Welcome ● To 2d game design – Somewhat new course since I’m changing everything since last time. – Still a bit experimental ● I have agenda, ● If you have anything you are dying to do I'll try to squeeze it in – if you let me know now. Why 2D ● 3D games get big press so why 2D – 2d simpler technically to implement ● can focus on gameplay aspects ● not – lighting – physics – 3d math. – Most game design lessons are similar from 2d->3d – A few big 2d successes in last few years ● Plants vs. zombies series ● Angry birds series ● Clash of clans (pre-rendered to 2d sprites) – Still a lot of money in 2D games. Why Games? ● Why should we study game design? – US game software sales in 1995: $3.2 billion – US game software sales in 2008: $9.5 billion (ESA) – US game Software sales in 2013:$15.4 billion (NPD) – US game Software sales in 2015: $23.5 billion(ESA) ● 2008 and before don't include digital download sales – Of course digital downloads didn't account for as much then ● In 2013 $6.34B in new physical sales, used: $1.83B digital downloads: $7.22 B ● US movie box office total 2015: $11 billion (per boxofficemojo.com) ● Game software clearly ahead of movies for last 3 years. Digital download ● Back in August 2011 – Digital downloads accounted for 37% of game software revenue – Today it is well over half ● These numbers Don't seem to be counting the largest -

Software Quality Characteristics Tested for Mobile Application Development

Thesis no: MGSE-2015-02 Software Quality Characteristics Tested For Mobile Application Development Literature Review and Empirical Survey WALEED ANWAR Faculty of Computing Blekinge Institute of Technology SE-371 79 Karlskrona Sweden This thesis is submitted to the Faculty of Computing at Blekinge Institute of Technology in partial fulfillment of the requirements for the degree of Master of Science in Software Engineering. The thesis is equivalent to 10 weeks of full time studies. Contact Information: Author(s): WALEED ANWAR E-mail: [email protected] University advisor: Dr. Simon Poulding Department of Software Engineering Faculty of Computing Internet : www.bth.se Blekinge Institute of Technology Phone : +46 455 38 50 00 SE-371 79 Karlskrona, Sweden Fax : +46 455 38 50 57 ABSTRACT Context. Smart phones use is increasing day by day as there is large number of app users. Due to more use of apps, the testing of mobile application should be done correctly and flawlessly to ensure the effectiveness of mobile applications. Objectives. The objective of this research is to find out the important mobile application quality characteristics from developer’s perspective and how developers actually test for them. Apart from that how the developers test their mobile applications are also addressed. Methods. Two methodologies were used: the literature survey and the empirical survey. The literature survey was used to get familiar with the most commonly known mobile application quality characteristics for which mobile applications are tested for. The empirical survey was used to get data from developers by sending an online questionnaire link to the Google Play store developers and their response was recorded and further evaluated to present results. -

NFC Technology Brings New Life to Games

NFC Technology Brings New Life to Games Kids, toy makers and technology providers all benefit, as the line between physical and virtual play blends. By Jennifer Zaino Oct. 1, 2012—"Skylanders is my favorite video game," says my 9-year-old son, as he positions his Legendary Bash action figure atop the Portal of Power accessory and watches the figure come to life onscreen in his Wii gaming system. "It's cool," he says, though he's not referring to the Near-Field Communications (NFC) reader in the Portal of Power that reads the NFC tag in the action figure. "It's easy to switch characters during the game, and I can play at my friends' houses with my action figures and their system knows it's my guys." He's not the only one enthralled with Skylanders: Spyro's Adventure, released last fall by Activision Blizzard. The game is available for Nintendo, PlayStation and Xbox gaming consoles, as well as PC and Mac computers, in addition to the Wii. While reporting its second-quarter earnings, in August, Activision Blizzard said the game was one of the top three titles so far this year in North America and Europe, and Skylanders toys were the top-selling action figures in the United States in the first half of 2012. Image courtesy of Activision NFC—a short-range wireless technology that enables device-to-device data transfers—is ushering in a new age of gaming, opening up a world in which kids of all ages can bridge the divide between physical and virtual play. -

Adventures at the Interplay of Poetry and Computer Games

DUAL WIELD: ADVENTURES AT THE INTERPLAY OF POETRY AND COMPUTER GAMES JONATHAN STONE A thesis submitted in partial fulfilment of the requirements of the University of the West of England, Bristol for the degree of Doctor of Philosophy Faculty of Arts, Creative Industries and Education, University of the West of England, Bristol August 2019 1 Abstract In recent years, poets and digital game developers alike have begun to experiment with the possibilities of poem-game interplay and hybrid poetry games. The results of such experiments are intimately connected to poetry’s expansion into digital-interactive space, a process described by Loss Pequeño Glazier as extending “the physicality of reading”. This experiential augmentation runs both ways: the technologies associated with game development permit the reader’s cybernetic incorporation into the world of the poem, while poetry may be used to lend shape and meaning to the bodily sensations experienced by the player of computer games. Additionally, computer game culture, long underprivileged in arts discourse, represents a new frontier of emergent assimilable dialect for the poet. The components of the computer game – its rules, content, interface, hardware – may all be absorbed into the textuality of the poem, recruited as units of poetic meaning, not just verbally but ideogrammically, imagistically or calligrammically. This is, in short, an abundant new playground for poets, while on the other side of the equation, the organisational strategies of poetry make for an equally rich resource for game developers. This project takes the form of a hybrid of more conventional theoretical analysis and practice-based research, analysing the existing state of poem-game hybridity and testing ways that it might be advanced through the creation of various example artefacts. -

DIGITAL GAMES Cover Image Image Courtesy of League of Geeks

DIGITAL GAMES Cover image Image courtesy of League of Geeks This page Image courtesy of PAX Australia 2016 Facing page Image courtesy of League of Geeks DISCLAIMER Austrade does not endorse or guarantee the performance or suitability of any introduced party or accept liability for the accuracy or usefulness of any information contained in this Report. Please use commercial discretion to assess the suitability of any business introduction or goods and services offered when assessing your business needs. Austrade does not accept liability for any loss associated with the use of any information and any reliance is entirely at the user’s discretion. © Commonwealth of Australia 2017 This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission from the Commonwealth, available through the Australian Trade & Investment Commission. Requests and inquiries concerning reproduction and rights should be addressed to the Marketing Manager, Austrade, GPO Box 5301, Sydney NSW 2001 or by email to [email protected] Publication date: July 2017 2 DIGITAL GAMES TALENTED AND EXPERIENCED VIDEO GAME PROFESSIONALS DIGITAL GAMES 3 INTRODUCTION The Australian game development industry has a long INDUSTRY history of performing at a high level within a competitive OVERVIEW global industry. Australian-made games have topped sales charts, received major industry awards and INDUSTRY STRENGTHS enjoyed wide coverage in the international media. The video game sector is bolstered by This report provides an overview of the INDUSTRY strong capability in other complementary Australian video game industry’s key ORGANISATIONS industries, including animation and visual capabilities.