The Best Place to Watch a Movie

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cinema City International NV Interim Management

Cinema City International N.V. Interim Management Report for the nine months ended 30 September 2009 Cinema City International N.V. Interim Management Report the nine months ended 30 September 2009 CONTENTS Page Directors' report 1 Condensed Consolidated Interim Financial Statements for the nine months ended 30 September 2009 Condensed Consolidated Statement of Financial Position 13 Condensed Consolidated Income Statement 14 Condensed Consolidated Statement of Changes in Equity 15 Condensed Consolidated Statement of Cash Flows 15 Notes to the Condensed Consolidated Interim Financial Statements 16 Cinema City International N.V. DIRECTORS’ REPORT General Introduction Cinema City International N.V. (the “Company”), incorporated in the Netherlands, is a control subsidiary of I.T. International Theatres Ltd. The Company (together with its subsidiaries, the "Group") is principally engaged in the operation of entertainment activities in various countries including: Poland, Romania, Hungary, Czech Republic, Bulgaria and Israel. The Company, through related entities, has been a family operated theatre business since 1929. The Company’s shares are traded on the Warsaw Stock Exchange. As of 16 November 2009 the market share price was PLN 22 (EUR 5.3), giving the Company a market capitalization of EUR 269 million. The Company's office is located in Rotterdam, the Netherlands. Highlights during the nine months ended 30 September 2009 The Company turned in a very solid performance for the nine months ended 30 September 2009, with revenues, EBITDA (Earnings Before Interest, Taxation, Depreciation and Amortisation) and net income all having increased in comparison to the first nine months of 2008. Consolidated EBITDA grew from EUR 30.7 million in the nine months ended 30 September 2008 to EUR 34.1 million for the nine months ended 30 September 2009. -

The Cinema Media Guide 2017

Second Edition THE CINEMA MEDIA GUIDE 2017 1 WELCOME TO OUR WORLD CONTENTS. Our vision 1 ABC1 Adults 41 Foreword 2 War for the Planet of the Apes 43 Fast facts 3 Dunkirk 44 The cinema audience 5 American Made 45 The WOW factor 6 Victoria and Abdul 46 Cinema’s role in the media mix 7 Goodbye Christopher Robin 47 Building Box Office Brands 8 Blade Runner 2049 48 The return on investment 9 The Snowman 49 How to buy 11 Murder on the Orient Express 50 Buying routes 12 Suburbicon 51 Optimise your campaign 16 16-34 Men 53 Sponsorship opportunities 17 Spider-Man: Homecoming 55 The production process 19 Atomic Blonde 56 Our cinemas 21 The Dark Tower 57 Our cinema gallery 22 Kingsman: The Golden Circle 58 Cineworld 23 Thor: Ragnarok 59 ODEON 24 Justice League 60 Vue 25 16-34 Women 61 Curzon Cinemas 26 The Beguiled 63 Everyman Cinemas 27 It 64 Picturehouse Cinemas 28 Flatliners 65 Independents 29 A Bad Mom’s Christmas 66 2017 films by audience Mother! 67 Coming soon to a cinema near you 31 Pitch Perfect 3 68 Adults 33 Main Shoppers with Children 69 Valerian and the City of Cars 3 71 a Thousand Planets 35 Captain Underpants: The First Epic Movie 72 Battle of the Sexes 36 The LEGO Ninjago Movie 73 Paddington 2 37 My Little Pony: The Movie 74 Daddy’s Home 2 38 Ferdinand 75 Star Wars: The Last Jedi 39 Coming in 2018 77 Jumanji: Welcome to the Jungle 40 OUR VISION. FOREWORD. -

BULLETIN Vol 50 No 1 January / February 2016

CINEMA THEATRE ASSOCIATION BULLETIN www.cta-uk.org Vol 50 No 1 January / February 2016 The Regent / Gaumont / Odeon Bournemouth, visited by the CTA last October – see report p8 An audience watching Nosferatu at the Abbeydale Sheffield – see Newsreel p28 – photo courtesy Scott Hukins FROM YOUR EDITOR CINEMA THEATRE ASSOCIATION (founded 1967) You will have noticed that the Bulletin has reached volume 50. How- promoting serious interest in all aspects of cinema buildings —————————— ever, this doesn’t mean that the CTA is 50 years old. We were found- Company limited by guarantee. Reg. No. 04428776. ed in 1967 so our 50th birthday will be next year. Special events are Registered address: 59 Harrowdene Gardens, Teddington, TW11 0DJ. planned to mark the occasion – watch this space! Registered Charity No. 1100702. Directors are marked ‡ in list below. A jigsaw we bought recently from a charity shop was entitled Road —————————— PATRONS: Carol Gibbons Glenda Jackson CBE Meets Rail. It wasn’t until I got it home that I realised it had the As- Sir Gerald Kaufman PC MP Lucinda Lambton toria/Odeon Southend in the background. Davis Simpson tells me —————————— that the dome actually belonged to Luker’s Brewery; the Odeon be- ANNUAL MEMBERSHIP SUBSCRIPTIONS ing built on part of the brewery site. There are two domes, marking Full Membership (UK) ................................................................ £29 the corners of the site and they are there to this day. The cinema Full Membership (UK under 25s) .............................................. £15 Overseas (Europe Standard & World Economy) ........................ £37 entrance was flanked by shops and then the two towers. Those Overseas (World Standard) ........................................................ £49 flanking shops are also still there: the Odeon was demolished about Associate Membership (UK & Worldwide) ................................ -

The Changing Meanings of the 1930S Cinema in Nottingham

FROM MODERNITY TO MEMORIAL: The Changing Meanings of the 1930s Cinema in Nottingham By Sarah Stubbings, BA, MA. Thesis submitted to the University of Nottingham for the degree of Doctor of Philosophy, August 2003 c1INGy G2ýPF 1sinr Uß CONTENTS Abstract Acknowledgements ii Introduction 1 PART ONE: CONTEMPORARY REPORTING OF THE 1930S CINEMA 1. Contested Space, Leisure and Consumption: The 1929 36 Reconstruction of the Market Place and its Impact on Cinema and the City 2. Luxury in Suburbia: The Modern, Feminised Cinemas of 73 the 1930s 3. Selling Cinema: How Advertisements and Promotional 108 Features Helped to Formulate the 1930s Cinema Discourse 4. Concerns Over Cinema: Perceptions of the Moral and 144 Physical Danger of Going to the Pictures PART TWO: RETROSPECTIVECOVERAGE OF THE 1930S CINEMA 5. The Post-war Fate of the 1930s Cinemas: Cinema Closures - 173 The 1950s and 1960s 6. Modernity and Modernisation: Cinema's Attempted 204 Transformation in the 1950s and 1960s 7. The Continued Presence of the Past: Popular Memory of 231 Cinema-going in the 'Golden Age' 8. Preserving the Past, Changing the Present? Cinema 260 Conservation: Its Context and Meanings Conclusion 292 Bibliography 298 ABSTRACT This work examines local press reporting of the 1930s cinema from 1930 up to the present day. By focusing on one particular city, Nottingham, I formulate an analysis of the place that cinema has occupied in the city's history. Utilising the local press as the primary source enables me to situate the discourses on the cinema building and the practice of cinema-going within the broader socio-cultural contexts and history of the city. -

Cineworld/City Screen Merger Inquiry

APPENDIX A Terms of reference and conduct of the inquiry Terms of reference 1. On 30 April 2013, the OFT sent the following reference to the CC: 1. In exercise of its duty under section 22(1) of the Enterprise Act 2002 (‘the Act’) to make a reference to the Competition Commission (‘the CC’) in relation to a completed merger the Office of Fair Trading (‘the OFT’) believes that it is or may be the case that – a. a relevant merger situation has been created in that: i. enterprises carried on by or under the control of Cineworld Group plc have ceased to be distinct from enterprises carried on by or under the control of City Screen Limited; and ii. the condition specified in section 23(4) of the Act is satisfied; and b. the creation of that situation has resulted, or may be expected to result in a substantial lessening of competition within any market or markets in the UK for goods or services, including the supply of film services. 2. Therefore, in exercise of its duty under section 22 of the Act, the OFT hereby refers to the CC, for investigation and report within a period ending on 14 October 2013, on the following questions in accordance with section 35 of the Act— a. whether a relevant merger situation has been created; and b. if so, whether the creation of that situation has resulted, or may be expected to result, in a substantial lessening of competition within any market or markets in the UK for goods and services. -

Acquisition by Terra Firma Investments (GP) 2 Ltd of United Cinemas International (UK) Limited and Cinema International Corporation (UK) Limited

Acquisition by Terra Firma Investments (GP) 2 Ltd of United Cinemas International (UK) Limited and Cinema International Corporation (UK) Limited The OFT's decision on reference under section 22 given on 7 January 2005 PARTIES 1. Terra Firma Investments (GP) 2 Ltd (Terra Firma) manages a number of private equity funds. On 2 September 2004, Terra Firma acquired Odeon Equity Co. Limited (Odeon), the largest cinema exhibitor in the UK, with 95 cinemas. 2. United Cinemas International (UK) Limited and Cinema International Corporation (UK) Limited (collectively UCI) operate multiplex cinemas in the UK. Prior to the merger, UCI was the fourth largest cinema exhibitor in the UK, with 32 cinemas nation-wide. Its UK turnover in the year to 31 December 2003 amounted to £123 million. TRANSACTION 3. On 28 October 2004, Terra Firma acquired sole control of UCI through its wholly-owned subsidiaries. The transaction completed on 28 October 2004. The administrative deadline expires on 7 January 2005. JURISDICTION 4. As a result of this transaction, Terra Firma and UCI have ceased to be distinct. The UK turnover of UCI exceeds £70 million, so that the turnover test in section 23(1)(b) of the Enterprise Act 2002 (the Act) is satisfied. The OFT therefore believes that it is, or may be the case, that a relevant merger situation has been created. RELEVANT MARKET 1 Product market 5. The parties overlap in the supply of cinema exhibition services in the UK, in the acquisition of film exhibition rights from film distributors, and in the provision of facilities for film premieres. -

Anticipated Acquisition by Odeon Cinemas Limited and Cineworld Cinemas Limited of Carlton Screen Advertising Limited

Anticipated acquisition by Odeon Cinemas Limited and Cineworld Cinemas Limited of Carlton Screen Advertising Limited ME/3632/08 The OFT's decision on reference under section 33(1) given on 1 July 2008. Full text of decision published on 17 July 2008. Please note that square brackets indicate figures or text which have been deleted or replaced at the request of the parties for reasons of commercial confidentiality. PARTIES 1. Odeon Cinemas Limited (Odeon) is the UK's largest cinema operator with 108 cinemas (831 screens). Odeon is a subsidiary of Corleone Capital Limited (Corleone) and its ultimate parent company is TFCP Holdings Limited (formerly Terra Firma Capital Partners Holdings Limited), the private equity fund manager. 2. Cineworld Cinemas Limited (Cineworld) is the UK's second largest cinema operator with 72 cinemas (741 screens). It is a subsidiary of Cineworld Group plc whose main shareholder (with 46.8 per cent)1 is Blackstone Capital Partners (Cayman) IV LP. 3. Carlton Screen Advertising Limited (CSA) is a provider of cinema advertising services in the UK. It is a wholly owned subsidiary of ITV plc (ITV), a television broadcaster. 1 As of 5 February 2008. 51.2 per cent of its shares are publicly traded on the London Stock Exchange and two per cent are Management owned. 1 TRANSACTION 4. The proposed transaction will proceed by way of two separate steps. The first is the formation of a 50:50 joint venture (JV) between Odeon and Cineworld.2 The JV will be incorporated as Digital Cinema Media Limited (DCM). 5. The second step is that DCM will acquire CSA from ITV plc for £500,000. -

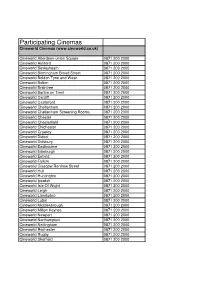

Participating Cinemas 2013 Excel

Participating Cinemas Cineworld Cinemas (www.cineworld.co.uk) Cineworld Aberdeen-union Square 0871 200 2000 Cineworld Ashford 0871 200 2000 Cineworld Bexleyheath 0871 200 2000 Cineworld Birmingham Broad Street 0871 200 2000 Cineworld Boldon Tyne and Wear 0871 200 2000 Cineworld Bolton 0871 200 2000 Cineworld Braintree 0871 200 2000 Cineworld Burton on Trent 0871 200 2000 Cineworld Cardiff 0871 200 2000 Cineworld Castleford 0871 200 2000 Cineworld Cheltenham 0871 200 2000 Cineworld Cheltenham Screening Rooms 0871 200 2000 Cineworld Chester 0871 200 2000 Cineworld Chesterfield 0871 200 2000 Cineworld Chichester 0871 200 2000 Cineworld Crawley 0871 200 2000 Cineworld Didcot 0871 200 2000 Cineworld Didsbury 0871 200 2000 Cineworld Eastbourne 0871 200 2000 Cineworld Edinburgh 0871 200 2000 Cineworld Enfield 0871 200 2000 Cineworld Falkirk 0871 200 2000 Cineworld Glasgow Renfrew Street 0871 200 2000 Cineworld Hull 0871 200 2000 Cineworld Huntington 0871 200 2000 Cineworld Ipswich 0871 200 2000 Cineworld Isle Of Wight 0871 200 2000 Cineworld Leigh 0871 200 2000 Cineworld Llandudno 0871 200 2000 Cineworld Luton 0871 200 2000 Cineworld Middlesbrough 0871 200 2000 Cineworld Milton Keynes 0871 200 2000 Cineworld Newport 0871 200 2000 Cineworld Northampton 0871 200 2000 Cineworld Nottingham 0871 200 2000 Cineworld Rochester 0871 200 2000 Cineworld Rugby 0871 200 2000 Cineworld Sheffield 0871 200 2000 Cineworld Shrewbury 0871 200 2000 Cineworld Solihull 0871 200 2000 Cineworld St Helens 0871 200 2000 Cineworld Stevenage 0871 200 2000 Cineworld Wakefield -

Exhibition, Authenticity, and Film Audiences at the Prince Charles Cinema

. Volume 13, Issue 1 May 2016 ‘Watch like a grown up … enjoy like a child’: Exhibition, authenticity, and film audiences at the Prince Charles Cinema Richard McCulloch, University of Huddersfield, UK Virginia Crisp, Coventry University, UK Abstract: It is tempting to view the rise of event-led cinema as a symptom of shifting audience preferences – the inevitable result of cinemagoers increasingly seeking out ‘immersive’, ‘participatory’ and ‘experiential’ film screenings. The research presented within this particular article aimed to explore the appeal of such screenings by focusing on audiences at the Prince Charles Cinema (PCC) in London – a venue that is widely known for hosting sing- alongs, quote-alongs, and other participatory events. Our results, however, were surprising. Respondents to our questionnaire readily subscribed to a form of cinephilia that embraces a wide variety of tastes, but largely rejects participatory aspects of event-led cinema in favour of what they deemed to be a more authentic cinematic experience. Audiences repeatedly emphasised the superiority of the silent, reverential film screening, and many felt that the PCC’s greatest quality was the way in which it reminded them of how cinemas used to be, not what they might one day become. Ultimately, the article demonstrates that cinematic events are by no means the only option available to audiences who crave alternatives to ‘mainstream’ cinemas. We call for a reconsideration of the immersive and experiential dimensions of traditional cinemagoing, and a greater emphasis on the viewing conditions that facilitate an affective bond between audience and film. To us, the search for alternative cinema experiences seems to be more about the desire for cinema to get better at what it already does, not for it to change into something entirely different. -

1468-Q-171031 Pre-Feasibility Study Proposal.Docx

Tenterden Cinema Proposal to Tenterden Town Council for carrying out a Pre-feasibility Study and Site Options Appraisal by Ron Inglis of Craigmount Consulting Stefanie Fischer of Burrell Foley Fischer LLP Chris Goucher of Greenwood Projects 31 October 2017 1468-Q-171031 Pre-feasibility Study Proposal.docx 1 General Information 1.1 Introduction Cinema and arts consultant Ron Inglis (Craigmount Consulting), architect Stefanie Fischer (Burrell Foley Fischer LLP) and Quantity Surveyor, Chris Goucher of Greenwood Projects are pleased to submit proposals for the pre-feasibility study and site options appraisal for the Tenterden cinema. It is envisaged that Craigmount Consulting, Burrell Foley Fischer LLP and Greenwood Projects would can be directly appointed under separate contracts, but the proposals for services and fees are linked in terms of methodology. Together we bring a wealth of experience from many cinema, multi-arts and media venue developments as well as extensive expertise in the cinema and media sectors. Capital developments which we have worked on, or continue to work on, include: • Shetland cinema and music venue – 2 screen digital cinema and live performance venue with associated facilities. • * Scala Cinema & Arts Centre, Prestatyn, North Wales – opened February 2009. 2 screen digital cinema with live performance capabilities. • Kino, Hawkhurst – The first all-digital cinema in the UK. Single screen with café bar. • Harbour Lights, Southampton – 2 screen cinema. • Stratford East Picturehouse, London – 4 screen cinema and restaurant. • Ciné Lumière, Institut Français, London – redevelopment of specialist cinema. • * Limerick Film & Media Centre – Pre-feasibility and feasibility study for 3 screen specialist cinema and education facilities. • Broadway, Nottingham’s Media Centre. -

Global City Holdings Nv

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt about the contents of this document or as to the action you should take, you are recommended immediately to seek your own personal financial advice from your stockbroker, bank manager, lawyer, accountant or other independent financial adviser who specializes in advising on shares or other securities and who is authorized. Certain statements contained in this Circular are not historical facts but rather statements of future. These forward- looking statements are based on the Company's current plans, expectations and projections about future events. Any forward-looking statements speak only as of the date they are made and are subject to uncertainties, assumptions and risks that may cause the events to differ materially from those anticipated in any forward-looking statement. Such forward-looking statements include, without limitation, improvements in process and operations, new business opportunities, performance against Company's targets, new projects, future markets for the Company's products and other trend projections. For the avoidance of any doubts, this Circular does not contain any forecast about the Company's and its capital group's financial results. GLOBAL CITY HOLDINGS N.V. (incorporated in the Netherlands with registered number 33260971) Shareholder Update and Notice of General Meeting This document is sent to you as an existing shareholder Global City Holdings N.V. and has not been approved by any other person or any regulatory body. This document does not constitute an admission document relating to Global City Holdings N.V. and does not constitute, or form part of, any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any shares in Global City Holdings N.V. -

Cinema City International N.V

Niniejszy dokument jest tłumaczeniem prospektu sporządzonego przez spółkę Cinema City International N.V. i zatwierdzonego przez holenderski Urząd Nadzoru nad Rynkami Finansowymi (Autoriteit Financiële Markten, „AFM”) w angielskiej wersji językowej. W związku z ofertą publiczną w Polsce Emitent jest zobowiązany opublikować w Polsce angielską wersję językową Prospektu oraz podsumowanie Prospektu w języku polskim. Dla wygody inwestorów Emitent dodatkowo sporządził tłumaczenie całego Prospektu na język polski. Należy jednak zwrócić uwagę, że angielska wersja językowa jest jedyną wiążącą wersją Prospektu. Choć dołożono wszelkiej staranności, by zapewnić prawidłowość tłumaczenia Prospektu na język polski, Emitent, Wprowadzający oraz osoby działające w ich imieniu, ich doradcy i inne osoby, którymi się posługują, nie ponoszą odpowiedzialności za ewentualne błędy w tłumaczeniu Prospektu na język polski. Emitent odpowiada tylko za błędy w oryginalnej angielskojęzycznej wersji Prospektu oraz w tłumaczeniu podsumowania na język polski. Przy podejmowaniu decyzji inwestycyjnych należy kierować się wyłącznie oryginalną angielską wersją językową Prospektu oraz podsumowaniem Prospektu w języku polskim. Cinema City International N.V. (spółka akcyjna (naamloze vennootschap) utworzona zgodnie z przepisami prawa holenderskiego z siedzibą w Amsterdamie) Oferta 15 664 352 Akcji o wartości nominalnej 0,01 EUR na Akcję Na podstawie tego dokumentu („Prospekt”) oferuje się 15 664 352 akcje zwykłe („Akcje Podstawowe”) Cinema City International N.V. („Cinema City”,