Form 990-PF Return of Private Foundation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Transit Agency Presentation 35Th Annual DBE Conference

ANN ARBOR AREA TRANSIT AUTHORITY 2700 S. Industrial Highway, Ann Arbor, MI 48104 Contact: Michelle Whitlow, email: [email protected] Phone:734-794-1813 Fax: 734-973-6338 www.theride.org Projected FY 2014‐2015 Contracting Opportunities: • Electrical services • Soil remediation • Specialized software • Painting • Tires DBE Goal: 1% • Janitorial supplies 0.75% Race • Oil analysis • Roof inspection & repairs Conscious (RC) • Oil & lubricants 0.25% Race • HVAC services • Uniforms Neutral (RN) • Asphalt reseal • Para transit service • Night ride services providers • Ypsilanti transit center renovations Interested in these jobs? Check The Ride’s website weekly! BATTLE CREEK TRANSIT 339 W. Michigan Ave., Battle Creek, MI 49037 Contact: Scott McKenzie, email: [email protected] Phone: 269-966-3558 Fax: 269-966-3421 www.battlecreekmi.gov/living Projected FY 2014‐2015 Contracting Opportunities: Building, grounds & facility maintenance to include: • Administrative offices, conference room, hallways & dispatch area DBE Goal: • Carpeting & painting 0.00153% RN • Driver’s break room & locker rooms: tile, paint, countertops & sinks • Reception area: tile & painting • Exterior: concrete step work & railing Interested in these jobs? Review the Battle Creek website periodically! BLUE WATER TRANSPORTATION COMMISSION 2021 Lapeer Ave., Port Huron, MI 48060 Contact: Lisa DeLong, email: [email protected] Phone: 810-966-4207 Fax: 734-973-6338 www.bwbus.com Projected FY 2014‐2015 Contracting Opportunities: • Supply maintenance equipment • Landscape -

Buhl Building, L.L.C. V. Commonwealth

IN THE SUPERIOR COURT OF THE STATE OF DELAWARE BUHL BUILDING, L.L.C., ) ) Plaintiff, ) v. ) ) COMMONWEALTH LAND TITLE ) INSURANCE COMPANY, and ) C.A. No.: N17C-03-093 EMD CCLD FIDELITY NATIONAL FINANCIAL, ) INC., ) ) Defendants. ) ) Submitted: May 28, 2019 Decided: August 19, 2019 Upon Defendants’ Motion to Establish Michigan as the Choice-of-Law and Partial Motion to Dismiss GRANTED Kenneth J. Nachbar, Esquire, Alexandra M. Cumings, Esquire, Morris, Nichols, Arsht & Tunnell LLP, Wilmington, Delaware, Bruce S. Sperling, Esquire, Robert D. Cheifetz, Sperling & Slater, P.C., Chicago, Illinois, Attorneys for Plaintiff Buhl Building, L.L.C.. Scott T. Earle, Esquire, Zarwin Baum DeVito Kaplan Schaer Toddy, P.C., Wilmington, Delaware, Attorneys for Defendants Commonwealth Land Title Insurance Company and Fidelity National Financial, Inc. DAVIS, J. I. INTRODUCTION This insurance coverage dispute is assigned to the Complex Commercial Litigation Division of the Court. Plaintiff Buhl Building, LLC (“Buhl”) brings this action against Defendants Commonwealth Land Title Insurance Company (“Commonwealth”) and Fidelity National Financial, Inc. (“FNF”) (collectively, the “Defendants”). Buhl purchased a title insurance policy (the “Contract”) from Commonwealth. FNF is Commonwealth’s parent corporation. The Court has reviewed the Contract and notes that FNF is not a signatory to that agreement. Buhl initiated this civil action by filing a complaint (the “Complaint”). In the Complaint, Buhl alleges that Commonwealth and FNF, working together, failed to provide clean title to a potential buyer of the Buhl’s building and failed to indemnify Buhl. As a result, Buhl contends that Commonwealth and FNF (i) breached the Contract,1 and (ii) acted in bad faith. -

American City: Detroit Architecture, 1845-2005

A Wayne State University Press Copyrighted Material m er i ca n Detroit Architecture 1845–2005 C Text by Robert Sharoff Photographs by William Zbaren i ty A Painted Turtle book Detroit, Michigan Wayne State University Press Copyrighted Material Contents Preface viii Guardian Building 56 Acknowledgments x David Stott Building 60 Introduction xiii Fisher Building 62 Horace H. Rackham Building 64 American City Coleman A. Young Municipal Center 68 Fort Wayne 2 Turkel House 70 Lighthouse Supply Depot 4 McGregor Memorial Conference Center 72 R. H. Traver Building 6 Lafayette Park 76 Wright-Kay Building 8 One Woodward 80 R. Hirt Jr. Co. Building 10 First Federal Bank Building 82 Chauncey Hurlbut Memorial Gate 12 Frank Murphy Hall of Justice 84 Detroit Cornice and Slate Company 14 Smith, Hinchman, and Grylls Building 86 Wayne County Building 16 Kresge-Ford Building 88 Savoyard Centre 18 SBC Building 90 Belle Isle Conservatory 20 Renaissance Center 92 Harmonie Centre 22 Horace E. Dodge and Son Dime Building 24 Memorial Fountain 96 L. B. King and Company Building 26 Detroit Receiving Hospital 98 Michigan Central Railroad Station 28 Coleman A. Young Community Center 100 R. H. Fyfe’s Shoe Store Building 30 Cobo Hall and Convention Center 102 Orchestra Hall 32 One Detroit Center 104 Detroit Public Library, Main Branch 34 John D. Dingell VA Hospital Cadillac Place 38 and Medical Center 106 Charles H. Wright Museum Women’s City Club 40 of African American History 108 Bankers Trust Company Building 42 Compuware Building 110 James Scott Fountain 44 Cass Technical High School 112 Buhl Building 46 Detroit Institute of Arts 48 Index of Buildings 116 Fox Theatre 50 Index of Architects, Architecture Firms, Penobscot Building 52 Designers, and Artists 118 Park Place Apartments 54 Bibliography 121. -

Broadcasting Emay 4 the News Magazine of the Fifth Estate Vol

The prrime time iinsups fort Vail ABC-TV in Los Angeles LWRT in Washington Broadcasting EMay 4 The News Magazine of the Fifth Estate Vol. 100 No. 18 50th Year 1981 m Katz. The best. The First Yea Of Broadcasting 1959 o PAGE 83 COPYRIGHT 0 1981 IA T COMMUNICATIONS CO Afready sok t RELUON PEOPLE... Abilene-Sweetwater . 65,000 Diary we elt Raleigh-Durham 246,000 Albany, Georgia 81,000 Rapid City 39,000 Albany-Schenectady- Reno 30,000 Troy 232,000 Richmond 206,000 Albuquerque 136,000 Roanoke-Lynchberg 236,000 Alexandria, LA 57,000 Detroit 642,000 Laredo 19,000 Rochester, NY 143,000 Alexandria, MN' 25,000 Dothan 62,000 Las Vegas 45,000 Rochester-Mason City- Alpena 11,000 Dubuque 18,000 Laurel-Hattiesburg 6,000 Austin 75,000 Amarillo 81,000 Duluth-Superior 107,000 Lexington 142,000 Rockford 109,000 Anchorage 27,000 El Centro-Yuma 13,000 Lima 21,000 Roswell 30,000 Anniston 27,000 El Paso 78,000 Lincoln-Hastings- Sacramento-Stockton 235,000 Ardmore-Ada 49,000 Elmira 32,000 Kearney 162,000 St. Joseph 30,000 Atlanta 605,000 Erie 71,000 Little Rock 197,000 St. Louis 409,000 Augusta 88,000 Eugene 34,000 Los Angeles 1 306,000 Salinas-Monterey 59,000 Austin, TX 84,000 Eureka 17,000 Louisville 277,000 Salisbury 30,000 Bakersfield 36,000 Evansville 117,000 Lubbock 78,000 Salt Lake City 188,000 Baltimore 299,000 Fargo 129,000 Macon 109,000 San Angelo 22,000 Bangor 68,000 Farmington 5,000 Madison 98,000 San Antonio 199,000 Baton Rouge 138,000 Flagstaff 11,000 Mankato 30,000 San Diego 252,000 Beaumont-Port Arthur 96,000 Flint-Saginaw-Bay City 201,000 Marquette 44,000 San Francisco 542,000 Bend 8,000 Florence, SC 89,000 McAllen-Brownsville Santa Barbara- (LRGV) 54,000 Billings 47,000 Ft. -

Detroit Media Guide Contents

DETROIT MEDIA GUIDE CONTENTS EXPERIENCE THE D 1 Welcome ..................................................................... 2 Detroit Basics ............................................................. 3 New Developments in The D ................................. 4 Destination Detroit ................................................... 9 Made in The D ...........................................................11 Fast Facts ................................................................... 12 Famous Detroiters .................................................. 14 EXPLORE DETROIT 15 The Detroit Experience...........................................17 Dearborn/Wayne ....................................................20 Downtown Detroit ..................................................22 Greater Novi .............................................................26 Macomb ....................................................................28 Oakland .....................................................................30 Itineraries .................................................................. 32 Annual Events ..........................................................34 STAYING WITH US 35 Accommodations (by District) ............................. 35 NAVIGATING THE D 39 Metro Detroit Map ..................................................40 Driving Distances ....................................................42 District Maps ............................................................43 Transportation .........................................................48 -

United States Bankruptcy Court Eastern District of Michigan Southern Division

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: Chapter 9 City of Detroit, Michigan, Case No. 13-53846 Debtor. Hon. Steve W. Rhodes _____________________________________/ SUPPLEMENTAL CERTIFICATE OF SERVICE I, Lydia Pastor Nino, certify and say that I am employed by Kurtzman Carson Consultants LLC (KCC), the claims and noticing agent for the Debtor in the above-captioned case. On March 4, 2014, at my direction and under my supervision, employees of KCC caused to be served the following documents via First Class mail to the parties on the service list attached hereto Exhibit A: • Notice of Hearing to Consider Approval of Disclosure Statement with Respect to Plan for Adjustment of Debts of the City of Detroit [attached hereto as Exhibit B] • First Amended Order Establishing Procedures, Deadlines and Hearing Dates Relating to the Debtor's Plan of Adjustment [Docket No. 2755] Dated: March 6, 2014 /s/ Lydia Pastor Nino Lydia Pastor Nino KCC 2335 Alaska Ave El Segundo, CA 90245 Tel 310.776.7386 13-53846-swr Doc 2948 Filed 03/07/14 Entered 03/07/14 20:57:06 Page 1 of 23 EXHIBIT A 13-53846-swr Doc 2948 Filed 03/07/14 Entered 03/07/14 20:57:06 Page 2 of 23 Exhibit A CreditorName CreditorNoticeName Address1 Address2 Address3 City State Zip 3308 Bargaining Unit c o Robert Davis AFSCME Local 3308 600 W Lafayette Ste 500 Detroit MI 48226 415 East Congress, LLC Shafer & Associates, P.C. 3800 Capital City Blvd Suite 2 Lansing MI 48906 5801 Southfield Service Drive Corp., a Delaware Corporation and Wholly Owned Subs.. -

S T a T E O F M I C H I G a N Before the Michigan Public

S T A T E O F M I C H I G A N BEFORE THE MICHIGAN PUBLIC SERVICE COMMISSION * * * * * In the matter of the application of ) THE DETROIT EDISON COMPANY ) Case No. U-13634 for approval of steam purchase agreements. ) ) At the December 6, 2002 meeting of the Michigan Public Service Commission in Lansing, Michigan. PRESENT: Hon. David A. Svanda, Commissioner Hon. Robert B. Nelson, Commissioner OPINION AND ORDER On November 21, 2002, The Detroit Edison Company (Detroit Edison) filed an application for approval of 89 fixed price steam purchase agreements and 6 variable price agreements between Detroit Edison and the customers listed on Attachment A. The fixed price associated with these agreements is $19.89 per 1,000 pounds of steam (Mlb). The variable price agreements are based on the previous month’s New York Mercantile Exchange natural gas closing price. Detroit Edison also filed an affidavit of Thomas J. LaVere showing Detroit Edison’s average cost of steam to be $22.92 per Mlb. The terms and conditions of the agreements filed by Detroit Edison are similar to those previously approved by the Commission. Eighty-eight of the agreements were executed without comment by both parties to the agreement. Accordingly, the Commission finds that those agreements are reasonable and in the public interest, and should be approved. The remaining seven agreements were also fully executed. However, in each case, the customer did so with some reservation, protest, or comment indicating dissatisfaction with the terms of the agreement. Those customers are identified on Attachment A by the words “signed with comment.” The Commission will review those agreements if the seven customers make an appropriate formal request for the Commission to do so. -

Page 1 DETROIT BOARD of POLICE COMMISSIONERS REGULAR

5/22/2014 Page 1 DETROIT BOARD OF POLICE COMMISSIONERS REGULAR MEETING THURSDAY, MAY 22, 2014 3:00 PM DETROIT PUBLIC SAFETY HEADQUARTERS 1301 THIRD AVENUE DETROIT, MICHIGAN 48226 5/22/2014 Page 2 1 COMMISSIONERS: 2 3 GEORGE ANTHONY, Secretary 4 JESSICA TAYLOR, Chairperson 5 DONNELL R. WHITE, Vice-Chairperson 6 RICHARD SHELBY, Commissioner (Dist. 1) 7 WENDELL L. BYRD, Commissioner (Dist. 2) 8 REGINALD CRAWFORD, Commissioner (Dist. 3) 9 WILLIE E. BELL, Commissioner (Dist. 4) 10 WILLIE E. BURTON, Commissioner (Dist. 5) 11 LISA CARTER, Commissioner (Dist. 6) 12 RICARDO R. MOORE, Commissioner (Dist. 7) 13 14 15 16 17 18 19 20 21 REPRESENTING THE CHIEF OF POLICE'S OFFICE: 22 23 DEPUTY CHIEF DAVID LeVALLEY 24 25 5/22/2014 Page 3 1 Detroit, Michigan 2 Thursday, June 20, 2013 3 About 3:02 p.m. 4 COMMISSIONER TAYLOR: Good afternoon. 5 Call the meeting to order at 3:02. 6 I think at this time I'm going to turn 7 this over to Commissioner White. I'm having some 8 throat issues, but anyway, I'm Commissioner 9 Taylor and I chair the Board. 10 COMMISSIONER WHITE: Thank you, Madam 11 Chair. Donnell White, Vice-Chair to the Board of 12 Police Commissioners. 13 At this time we will have roll call. 14 Mr. Secretary? 15 SECRETARY ANTHONY: Thank you, 16 Mr. Chair. For the record, George Anthony, 17 Secretary to the Board. Commissioner Richard 18 Shelby? 19 COMMISSIONER SHELBY: Here. 20 SECRETARY ANTHONY: Commissioner 21 Wendell L. Byrd? 22 COMMISSIONER BYRD: Here. 23 SECRETARY ANTHONY: Commissioner 24 Reginald Crawford? 25 COMMISSIONER CRAWFORD: Present. -

Candidate Committee Cover Page

MICHIGAN DEPARTMENT OF STATE 1. Committee I.D. Number 82-155706 BUREAU OF ELECTIONS 2. Committee Name Michael Duggan for Mayor Committee CANDIDATE COMMITTEE COVER PAGE Report must be legible, typed or printed in ink and signed by the treasurer(or designated record keeper)and candidate. 3. This Statement covers from: 08/27/2013 to 10/20/2013 1. Committee I.D. Number 4. Candidate Last Name First Name M.I. 82-155706 Duggan Michael E. 2. Committee Name 4a. Office Sought Including District # or Community Served (If applicable) Michael Duggan for Mayor Committee City , Detroit - At Large , City Mayor 5. Committee's Mailing Address 6. Treasurer's Name & Residential Address 2751 E. Jefferson Ave, 5th Floor, Detroit, MI 48207 Williams, Dr. Rebecca , 675 Pallister St., Detroit, MI 48202 Area Code and Phone: (313) 324-8901 If the address in this box is different from the committee Area Code and Phone: (313) 324-8901 mailing address on the Statement of Organization, mail may be sent to this address by the filing official 7. Designated Record keeper's Name and Mailing Address (If the committee has a Designated Record keeper) Area Code and Phone: 8. TYPE OF STATEMENT Effective Date of Dissolution 10/20/2013 Pre General By checking this item, I/we certify that the committee has no assets or outstanding debts, including late filing fees. Further, I/We request that if the dissolution cannot be granted, Date of Election, Convention or Caucus that this be considered a request for the Reporting Waiver. Note: The disposition of residual funds must be reported on Schedule 1B and the 11/05/2013 Summary Page. -

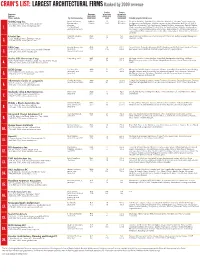

LARGEST ARCHITECTURAL Firmsranked by 2009 Revenue

CRAIN'S LIST: LARGEST ARCHITECTURAL FIRMS Ranked by 2009 revenue $ value $ value Company Revenue of projects of projects Address ($000,000) ($000,000) ($000,000) Rank Phone; website Top local executive 2009/2008 2009 2009/2008 Notable projects Detroit area SmithGroup Inc. Jeffrey Hausman, $166.3 29 $2,800.0 Guardian Building; Buhl Building; Penobscot Building; Wayne County corporate 500 Griswold, Suite 1700, Detroit 48226 Detroit office $166.0 162 $3,020.0 headquarters consolidation; Detroit Institute of Arts renovation; Boll Family YMCA; (313) 983-3600; www.smithgroup.com director; Ford Field; Comerica Park; McNamara Federal Building renovation; Detroit Athletic Carl Roehling, Club renovation and lighting; United Way for Southeastern Michigan headquarters 1. president and CEO renovation; Federal Reserve Bank of Chicago, Detroit branch; MGM Grand Detroit casino; Wade-Trim corporate office relocation, University of Detroit Mercy School of Dentistry Ghafari Inc. Yousif B. Ghafari, 75.0 11 NA GM press consolidation, LG Chem/Compact Power Inc. battery manufacturing and 17101 Michigan Ave., Dearborn 48126 chairman 130.0 27 NA assembly facility 2. (313) 441-3000; www.ghafari.com URS Corp. Ronald Henry, vice 45.6 10 632.1 Detroit Public Schools - Maybury (PK-8), Brightmoor (PK-8); Detroit Medical Center, 27777 Franklin Road, Suite 2000, Southfield 48034 president, 49.2 346 682.0 Karmanos Cancer Institute; Detroit Department of Transportation 3. (248) 204-5900; www.urscorp.com managing principal Harley Ellis Devereaux Corp. Gary Skog, CEO 39.5 29 550.0 Michigan Motion Picture Studios, GreenPath headquarters building, Oaklawn 26913 Northwestern Highway, Suite 200, Southfield 48033 65.2 54 851.0 Hospital surgery project, Port Huron Hospital master plan, city of Southfield nature 4. -

The Lawyers Club, 1947-1948 University of Michigan Law School

University of Michigan Law School University of Michigan Law School Scholarship Repository Miscellaneous Law School Publications Law School History and Publications 1948 The Lawyers Club, 1947-1948 University of Michigan Law School Follow this and additional works at: http://repository.law.umich.edu/miscellaneous Part of the Legal Education Commons Citation University of Michigan Law School, "The Lawyers Club, 1947-1948" (1948). Miscellaneous Law School Publications. http://repository.law.umich.edu/miscellaneous/41 This Book is brought to you for free and open access by the Law School History and Publications at University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in Miscellaneous Law School Publications by an authorized administrator of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. H LAWYERS LU NIVE SI ICHI Table of PAGE OFFICERS. 6 BOARD OF C:·OVERNORS CoMl\HTTEEs 8 STUDENT COUNCIL. 9 FORMER OFFICERS . 10 FORMER MEMBERS OF THE HOARD O:F GOVERNORS 11 FORMER PRESIDENTS OF THE STUDENT COUNCIL 13 CoNi>TITUTION AND BY-LAws 15 HONORARY MEMBERS 36 LAWYER MEMBERS 48 STUDENT MEMBERS 62 JN MEMORIAM MEMBERS 73 6 OFFICERS Officers ex officio HoN. LELAND W. CARR Chief Justice, Supreme Court of Michigan! HoN. GEORGE E. BusHNELL Chief Justice, Supreme Court of Michigan2 President Eow ARD S. RoGERS GROVER c. GRISMORE I During HJ47 2 During 1948 THE LAWYERS CLUB 7 Court of the State HoN. LELAND W. Chief 1!H7 HoN. GEORGE E. BUSHNELL, Chief 1948 HoN. WALTER H. NoRTH firom the Board HoN. J. HERBERT The P1esident of the ALEXANDER G. -

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT of MICHIGAN SOUTHERN DIVISION in Re CITY of DETROIT, MICHIGAN Debtor. Chapter 9

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re Chapter 9 CITY OF DETROIT, MICHIGAN Case No. 13-53846 Debtor. CERTIFICATE OF SERVICE I, William W. Kannel, do hereby certify that on the 2nd day of August 2013, I caused a copy of the Verified Statement of Mintz Levin Cohn Ferris Glovsky and Popeo, PC and Andrew J. Gerdes, P.L.C. Pursuant to Federal Rule of Bankruptcy Procedure 2019(a), to be served upon the parties at their respective addresses set forth on Exhibit A hereto through the Court’s ECF system, and that copies will be sent electronically to registered participants as identified on the Notice of Electronic Filing (NEF) and paper copies will be sent to those indicated as non- registered participants as of the date herein. Dated: August 2, 2013 /s/ William W. Kannel William W. Kannel, Esq. 1 13-53846-swr Doc 272-1 Filed 08/02/13 Entered 08/02/13 15:01:57 Page 1 of 9 Exhibit A AFSCME Council #25 AFSCME Council #25 Attn: Albert Garrett Attn: Ed McNeil 1034 N. Washington 600 W. Lafayette, Ste. 500 Lansing, MI 48906 Detroit, MI 48226 AFSCME Council #25 AFSCME Council #25 AFSCME Local # 6087 Attn: Catherine Phillips Attn: DeAngelo Malcolm Attn: Clarence Sanders 600 W. Lafayette, Ste. 500 600 W. Lafayette, Ste. 500 2633 Michigan Avenue Detroit, MI 48226 Detroit, MI 48226 Detroit, MI 48216 AFSCME Local #0023 AFSCME Local #0062 AFSCME Local #0207 Attn: Robert Stokes Attn: Lacydia Moore-Reese Attn: James Williams 600 W. Lafayette, Ste. 134 600 W.