Reformulation of Current Business Cycle Theories As Refutable Hypotheses

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

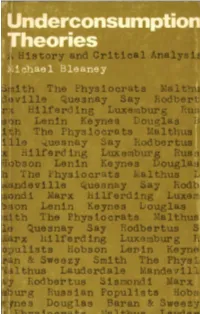

Underconsumption Theories

UNDER- CONSUMPTION THEORIES A History and Critical Analysis by M.F. Bleaney 1976 INTERNATIONAL PUBLISHERS New York Library of Congress Cataloging in Publication Data Bleaney, Michael Francis Underconsumption theories. Bibliography. Includes index. 1. Business cycles. 2. Consumption (Economics) 3. Economics—History. I. Title. HB3721.B55 330.1 76-26935 ISBN 0-7178-0476-3 © M. F. Bleaney Produced by computer-controlled phototypesetting, using OCR input techniques, and printed offset by UNWIN BROTHERS LIMITED The Gresham Press, Old Woking, Surrey PREFACE AND ACKNOWLEDGEMENTS This book is intended as a Marxist analysis of underconsump- tion theories. It is at once a history and a critique — for underconsumption theories are by no means dead. Their influence may still be discerned in the economic programmes put forward by political parties and trade unions, and in articles and books on the general tendencies of capitalism. No final conclusion as to the correctness of underconsumption theories is reached, for too little theoretical work of the necessary quality has been carried out to justify such a conclusion. But the weight of the theoretical evidence would seem to be against them. Much of their attractiveness in the end stems from the links which they maintain with the dominant ideology of capitalist society and the restricted extent of the theoretical break required to arrive at an underconsumptionist position. This, in conjunction with certain obviously appealing conclusions which emerge from them, has sufficed to ensure their continuing reproduction in the working-class movement. Not all of the authors discussed here are in fact underconsumptionist — Karl Marx and Rosa Luxemburg, in particular, are not — but all of them have been accused of being so at one time or another. -

Moneyflows and Business Fluctuations

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: A Study of Moneyflows in the United States Volume Author/Editor: Morris A. Copeland Volume Publisher: NBER Volume ISBN: 0-87014-053-1 Volume URL: http://www.nber.org/books/cope52-1 Publication Date: 1952 Chapter Title: Moneyflows and Business Fluctuations Chapter Author: Morris A. Copeland Chapter URL: http://www.nber.org/chapters/c0838 Chapter pages in book: (p. 240 - 289) Chapter 12 MONEYFLOWS AND BUSINESS FLUCTUATIONS The tumbling of prices in the panic is in large part due to the fact that the holders either of money or of deposit credit will not buy with it. Physically the money is there —asquantity, as concrete thing; psychologically, s pur- chasing power, it has vanished. So, also, the deposit credits exist, but they have ceased to exist as demand for products. They are merely hoarded, post- poned purchasing power. As present circulating medium, as present demand for anything, they are not. H. J. Davenport, The Economics of Enterprise (Macmillan, 1913), p. 318. Loan funds must be recognized as intangible and incorporeal facts, a sheer matter of intricacy and complexity in business relations —meshesof obligation —amere scaffolding of promises —afolding back one upon another of successive layers of credit. And because not necessarily represen- tative of an increase of social capital or even of the liquidated total of private capital, it seems necessary to recOgnize the loan fund as a distinct economic category. H. J. Davenport, Value and Distribution (University of Chicago Press, 1908), p. -

The Influence of Jan Tinbergen on Dutch Economic Policy

De Economist https://doi.org/10.1007/s10645-019-09333-1 The Infuence of Jan Tinbergen on Dutch Economic Policy F. J. H. Don1 © The Author(s) 2019 Abstract From the mid-1920s to the early 1960s, Jan Tinbergen was actively engaged in discussions about Dutch economic policy. He was the frst director of the Central Planning Bureau, from 1945 to 1955. It took quite some time and efort to fnd an efective role for this Bureau vis-à-vis the political decision makers in the REA, a subgroup of the Council of Ministers. Partly as a result of that, Tinbergen’s direct infuence on Dutch (macro)economic policy appears to have been rather small until 1950. In that year two new advisory bodies were established, the Social and Eco- nomic Council (SER) and the Central Economic Committee. Tinbergen was an infuential member of both, which efectively raised his impact on economic pol- icy. In the early ffties he played an important role in shaping the Dutch consen- sus economy. In addition, his indirect infuence has been substantial, as the methods and tools that he developed gained widespread acceptance in the Netherlands and in many other countries. Keywords Consensus economy · Macroeconomic policy · Planning · Policy advice · Tinbergen JEL Classifcation E600 · E610 · N140 The author is a former director of the CPB (1994–2006). He is grateful to Peter van den Berg, André de Jong, Kees van Paridon, Jarig van Sinderen and Bas ter Weel for their comments on earlier drafts. André de Jong also kindly granted access to several documents from his private archive, largely stemming from CPB sources. -

Jan Tinbergen

Jan Tinbergen NOBEL LAUREATE JAN TINBERGEN was born in 1903 in The Hague, the Netherlands. He received his doctorate in physics from the University of Leiden in 1929, and since then has been honored with twenty other degrees in economics and the social sciences. He received the Erasmus Prize of the European Cultural Foundation in 1967, and he shared the first Nobel Memorial Prize in Economic Science in 1969. He was Professor of Development Planning, Erasmus University, Rot- terdam (previously Netherlands School of Economics), part time in 1933- 55, and full time in 1955-73; Director of the Central Planning Bureau, The Hague, 1945-55; and Professor of International Economic Coopera- tion, University of Leiden, 1973-75. Utilizing his early contributions to econometrics, he laid the founda- tions for modern short-term economic policies and emphasized empirical macroeconomics while Director of the Central Planning Bureau. Since the mid-1950s, Tinbergen bas concentrated on the methods and practice of planning for long-term development. His early work on development was published as The Design of Development (Baltimore, Md.: Johns Hopkins University Press, 1958). Some of his other books, originally published or translated into English, include An Econometric Approach to Business Cycle Problems (Paris: Hermann, 1937); Statistical Testing of Business Cycle Theories, 2 vols. (Geneva: League of Nations, 1939); International Economic Cooperation (Amsterdam: Elsevier Economische Bibliotheek, 1945); Business Cycles in the United Kingdom, 1870-1914 (Amsterdam: North-Holland, 1951); On the Theory of Economic Policy (Amsterdam: North-Holland, 1952); Centralization and Decentralization in Economic Policy (Amsterdam: North-Holland, 1954); Economic Policy: Principles and Design (Amster- dam: North-Holland, 1956); Selected Papers, L. -

Macroeconomic Dynamics at the Cowles Commission from the 1930S to the 1950S

MACROECONOMIC DYNAMICS AT THE COWLES COMMISSION FROM THE 1930S TO THE 1950S By Robert W. Dimand May 2019 COWLES FOUNDATION DISCUSSION PAPER NO. 2195 COWLES FOUNDATION FOR RESEARCH IN ECONOMICS YALE UNIVERSITY Box 208281 New Haven, Connecticut 06520-8281 http://cowles.yale.edu/ Macroeconomic Dynamics at the Cowles Commission from the 1930s to the 1950s Robert W. Dimand Department of Economics Brock University 1812 Sir Isaac Brock Way St. Catharines, Ontario L2S 3A1 Canada Telephone: 1-905-688-5550 x. 3125 Fax: 1-905-688-6388 E-mail: [email protected] Keywords: macroeconomic dynamics, Cowles Commission, business cycles, Lawrence R. Klein, Tjalling C. Koopmans Abstract: This paper explores the development of dynamic modelling of macroeconomic fluctuations at the Cowles Commission from Roos, Dynamic Economics (Cowles Monograph No. 1, 1934) and Davis, Analysis of Economic Time Series (Cowles Monograph No. 6, 1941) to Koopmans, ed., Statistical Inference in Dynamic Economic Models (Cowles Monograph No. 10, 1950) and Klein’s Economic Fluctuations in the United States, 1921-1941 (Cowles Monograph No. 11, 1950), emphasizing the emergence of a distinctive Cowles Commission approach to structural modelling of macroeconomic fluctuations influenced by Cowles Commission work on structural estimation of simulation equations models, as advanced by Haavelmo (“A Probability Approach to Econometrics,” Cowles Commission Paper No. 4, 1944) and in Cowles Monographs Nos. 10 and 14. This paper is part of a larger project, a history of the Cowles Commission and Foundation commissioned by the Cowles Foundation for Research in Economics at Yale University. Presented at the Association Charles Gide workshop “Macroeconomics: Dynamic Histories. When Statics is no longer Enough,” Colmar, May 16-19, 2019. -

15 October 1998 PKESS CONFERENCE by NOBEL LAUREATE

15 October 1998 PKESS CONFERENCE BY NOBEL LAUREATE PROFESSOR AMARTYA SEN Professor Amartya Sen, the Indian philosopher and economist who was awarded the Nobel Prize for Economics, yesterday (14 October), said at a Headquarters press conference yesterday afternoon that globalization could be a major force for prosperity if adequately backed by good national policy. The main difficulty with globalization arose from failures in domestic policy, he said. Countries particularly threatened were those where human development had often been very poor. On balance, he said, major gains could be made by globalization. Even with the best scenario, there would be unexpected change, whether it arose from financial mismanagement or sudden changes in the world economy, and some people would suffer. A system of social safety nets would be needed, he said, adding that attention had to paid to that. Lack of social opportunities, such as literacy, good health care and macro-credit should be remedied. Globalization should be placed in a broader context and should be seen in terms of social and economic policies taken together. Professor Sen, who teaches at Trinity College in Cambridge, United Kingdom, was awarded the prize for his work on the causes of famine, on inequality and on measurement of poverty. He learned of the award in New York early Wednesday morning. He had arrived for a memorial lecture he would deliver at the United Nations on Thursday in honour of Mahbub ul Haq, a leading development thinker and creator of the widely acclaimed United Nations development programme Human Development Report. The memorial will be held in the Economic and Social Council chamber at 10:45 a.m. -

ΒΙΒΛΙΟΓ ΡΑΦΙΑ Bibliography

Τεύχος 53, Οκτώβριος-Δεκέμβριος 2019 | Issue 53, October-December 2019 ΒΙΒΛΙΟΓ ΡΑΦΙΑ Bibliography Βραβείο Νόμπελ στην Οικονομική Επιστήμη Nobel Prize in Economics Τα τεύχη δημοσιεύονται στον ιστοχώρο της All issues are published online at the Bank’s website Τράπεζας: address: https://www.bankofgreece.gr/trapeza/kepoe https://www.bankofgreece.gr/en/the- t/h-vivliothhkh-ths-tte/e-ekdoseis-kai- bank/culture/library/e-publications-and- anakoinwseis announcements Τράπεζα της Ελλάδος. Κέντρο Πολιτισμού, Bank of Greece. Centre for Culture, Research and Έρευνας και Τεκμηρίωσης, Τμήμα Documentation, Library Section Βιβλιοθήκης Ελ. Βενιζέλου 21, 102 50 Αθήνα, 21 El. Venizelos Ave., 102 50 Athens, [email protected] Τηλ. 210-3202446, [email protected], Tel. +30-210-3202446, 3202396, 3203129 3202396, 3203129 Βιβλιογραφία, τεύχος 53, Οκτ.-Δεκ. 2019, Bibliography, issue 53, Oct.-Dec. 2019, Nobel Prize Βραβείο Νόμπελ στην Οικονομική Επιστήμη in Economics Συντελεστές: Α. Ναδάλη, Ε. Σεμερτζάκη, Γ. Contributors: A. Nadali, E. Semertzaki, G. Tsouri Τσούρη Βιβλιογραφία, αρ.53 (Οκτ.-Δεκ. 2019), Βραβείο Nobel στην Οικονομική Επιστήμη 1 Bibliography, no. 53, (Oct.-Dec. 2019), Nobel Prize in Economics Πίνακας περιεχομένων Εισαγωγή / Introduction 6 2019: Abhijit Banerjee, Esther Duflo and Michael Kremer 7 Μονογραφίες / Monographs ................................................................................................... 7 Δοκίμια Εργασίας / Working papers ...................................................................................... -

W. Stark, J.M. Keynes and the Mercantilists 30/09/2019

W. Stark, J.M. Keynes and the Mercantilists 30/09/2019 Constantinos Repapis1 Abstract In this paper we investigate Werner Stark’s sociology of knowledge approach in the history of economic thought. This paper explores: 1) The strengths and weaknesses of Stark’s approach to historiography, 2) seeing how this can frame an understanding of mercantilist writings and, 3) develop a link between a pluralist understanding of economics, and the sociology of knowledge approach. The reason for developing this link is to extend the sociology of knowledge approach to encompass a pluralist understanding of economic theorising and, at the same time, clarify the link between context and economic theory. John Maynard Keynes’ practice of building narratives of intellectual traditions as evidenced in The General Theory is used to develop a position between an understanding of history of economic thought as the evolution of abstract and de-contextualized economic theorising and, the view of economic theory as only relevant within the social conditions from which it arose. Keywords: Werner Stark, Mercantilism, sociology of knowledge 1 Correspondence may be addressed to: C. Repapis, Institute of Management Studies, Goldsmiths, University of London. Email: [email protected]. I would like to thank Geoff Harcourt, Sheila Dow, Ragupathy Venkatachalam, Kumaraswamy (Vela) Velupillai, Maxime Desmarais-Tremblay, Harro Maas, two anonymous referees for valuable feedback, and the participants of the 2019 ESHET session in Lille and the THETS session in Goldsmiths, for helpful comments and discussions. Finally, I would like to thank Dr. Daniele Besomi for clarifications on the Harrod-Keynes correspondence. 1 JEL Codes: B11, B31, B40 2 I. -

![Tjalling C. Koopmans [Ideological Profiles of the Economics Laureates] Daniel B](https://docslib.b-cdn.net/cover/6752/tjalling-c-koopmans-ideological-profiles-of-the-economics-laureates-daniel-b-1096752.webp)

Tjalling C. Koopmans [Ideological Profiles of the Economics Laureates] Daniel B

Tjalling C. Koopmans [Ideological Profiles of the Economics Laureates] Daniel B. Klein, Ryan Daza, and Hannah Mead Econ Journal Watch 10(3), September 2013: 396-399 Abstract Tjalling C. Koopmans is among the 71 individuals who were awarded the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel between 1969 and 2012. This ideological profile is part of the project called “The Ideological Migration of the Economics Laureates,” which fills the September 2013 issue of Econ Journal Watch. Keywords Classical liberalism, economists, Nobel Prize in economics, ideology, ideological migration, intellectual biography. JEL classification A11, A13, B2, B3 Link to this document http://econjwatch.org/file_download/736/KoopmansIPEL.pdf ECON JOURNAL WATCH Klein, Lawrence R. 1987. The ET Interview: Professor L. R. Klein [interview by Roberto S. Mariano]. Econometric Theory 3(3): 409-460. Klein, Lawrence R. 1992a [1981]. Autobiography. In Nobel Lectures: Economic Sciences, 1969–1980, ed. Assar Lindbeck. Singapore: World Scientific Publishing Co. Link Klein, Lawrence R. 1992b [1981]. Some Economic Scenarios for the 1980s. In Nobel Lectures: Economic Sciences, 1969–1980, ed. Assar Lindbeck, 421-442. Singapore: World Scientific Publishing Co. Link Klein, Lawrence R. 1992c. My Professional Life Philosophy. In Eminent Economists: Their Life Philosophies, ed. Michael Szenberg, 180-189. Cambridge, UK: Cambridge University Press. Klein, Lawrence R. 2004. Transcript: Lawrence R. Klein [interview]. Wall Street Journal, September 3. Link Klein, Lawrence R. 2006. Interview. Estudios de Economíca Aplicada 24(1): 31-42. Klein, Lawrence R. 2009. Autobiographical chapter in Lives of the Laureates: Twenty- three Nobel Economists, 5th ed., eds. William Breit and Barry Hirsch, 17-34. -

Economic Development and Planning

Economic Development and Planning Publisher's Note Two further volumes of ESSAYS IN HONOUR OF JAN TINBERGEN, also edited by Willy Sellekaerts, are published simultaneously: INTERNATIONAL TRADE AND FINANCE and ECONOMETRICS AND ECONOMIC THEORY. Jan Tinbergen Economic Development and Planning Essays in Honour of Jan Tinbergen Edited by Willy Sellekaerts Palgrave Macmillan Editorial matter and selection © Willy Sellekaerts 1974 Chapter 1 © Irma Adelman and Cynthia Taft Morris 1974 Chapter 2@ Bela Balassa 1974 Chapter 3 © V. S. Dadajan 1974 Chapter 4 @ John C. H. Fei and Gustav Ranis 1974 Chapter 5 @ Karl A. Fox 1974 Chapter 6@ Arnold C. Harberger 1974 Chapter 7 @Harry G. Johnson 1974 Chapter 8 @ H. Leibenstein 1974 Chapter 9@ John Letiche 1974 Chapter 10 @ Hans W. Singer 1974 Softcover reprint of the hardcover 1st edition 1974 978-0-333-14976-8 All rights reserved. No part of this publication may be reproduced or transmitted, in any form or by any means, without permission. First published 1974 by THE MACMILLAN PRESS LID London and Basingstoke Associated companies in New York Dublin Melbourne Johannesburg and Madras SBN 333 14976 9 ISBN 978-1-349-01935-9 ISBN 978-1-349-01933-5 (eBook) DOI 10.1007/978-1-349-01933-5 Contents Preface vii Introduction Bent Hansen ix 1 The Derivation of Cardinal Scales from Ordinal Data: An Application of Multidimensional Scal ing to Measure Levels of National Development Irma Adelman and Cynthia Taft Morris 1 2 Project Appraisal in Developing Countries Bela Balassa 41 3 A Long-Term Macroeconomic Forecasting Model of the Soviet Economy V. -

The Role of Models and Probabilities in the Monetary Policy Process

1017-01 BPEA/Sims 12/30/02 14:48 Page 1 CHRISTOPHER A. SIMS Princeton University The Role of Models and Probabilities in the Monetary Policy Process This is a paper on the way data relate to decisionmaking in central banks. One component of the paper is based on a series of interviews with staff members and a few policy committee members of four central banks: the Swedish Riksbank, the European Central Bank (ECB), the Bank of England, and the U.S. Federal Reserve. These interviews focused on the policy process and sought to determine how forecasts were made, how uncertainty was characterized and handled, and what role formal economic models played in the process at each central bank. In each of the four central banks, “subjective” forecasting, based on data analysis by sectoral “experts,” plays an important role. At the Federal Reserve, a seventeen-year record of model-based forecasts can be com- pared with a longer record of subjective forecasts, and a second compo- nent of this paper is an analysis of these records. Two of the central banks—the Riksbank and the Bank of England— have explicit inflation-targeting policies that require them to set quantita- tive targets for inflation and to publish, several times a year, their forecasts of inflation. A third component of the paper discusses the effects of such a policy regime on the policy process and on the role of models within it. The large models in use in central banks today grew out of a first generation of large models that were thought to be founded on the statisti- cal theory of simultaneous-equations models. -

Macroeconomic Dynamics at the Cowles Commission from the 1930S to the 1950S

Yale University EliScholar – A Digital Platform for Scholarly Publishing at Yale Cowles Foundation Discussion Papers Cowles Foundation 9-1-2019 Macroeconomic Dynamics at the Cowles Commission from the 1930s to the 1950s Robert W. Dimand Follow this and additional works at: https://elischolar.library.yale.edu/cowles-discussion-paper-series Part of the Economics Commons Recommended Citation Dimand, Robert W., "Macroeconomic Dynamics at the Cowles Commission from the 1930s to the 1950s" (2019). Cowles Foundation Discussion Papers. 56. https://elischolar.library.yale.edu/cowles-discussion-paper-series/56 This Discussion Paper is brought to you for free and open access by the Cowles Foundation at EliScholar – A Digital Platform for Scholarly Publishing at Yale. It has been accepted for inclusion in Cowles Foundation Discussion Papers by an authorized administrator of EliScholar – A Digital Platform for Scholarly Publishing at Yale. For more information, please contact [email protected]. MACROECONOMIC DYNAMICS AT THE COWLES COMMISSION FROM THE 1930S TO THE 1950S By Robert W. Dimand May 2019 COWLES FOUNDATION DISCUSSION PAPER NO. 2195 COWLES FOUNDATION FOR RESEARCH IN ECONOMICS YALE UNIVERSITY Box 208281 New Haven, Connecticut 06520-8281 http://cowles.yale.edu/ Macroeconomic Dynamics at the Cowles Commission from the 1930s to the 1950s Robert W. Dimand Department of Economics Brock University 1812 Sir Isaac Brock Way St. Catharines, Ontario L2S 3A1 Canada Telephone: 1-905-688-5550 x. 3125 Fax: 1-905-688-6388 E-mail: [email protected] Keywords: macroeconomic dynamics, Cowles Commission, business cycles, Lawrence R. Klein, Tjalling C. Koopmans Abstract: This paper explores the development of dynamic modelling of macroeconomic fluctuations at the Cowles Commission from Roos, Dynamic Economics (Cowles Monograph No.