Worldwide Cruise Ship Activity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cruise Lines Or the Islands: Who Is Getting the Top Dollars out of World Travelers in the Caribbean?

Lynn University SPIRAL Student Theses, Dissertations, Portfolios and Projects Theses and Dissertations Collections 1996 Cruise Lines or the Islands: Who is Getting the Top Dollars Out of World Travelers in the Caribbean? Daniel Jerusalmi Lynn University Follow this and additional works at: https://spiral.lynn.edu/etds Part of the Hospitality Administration and Management Commons, and the Tourism and Travel Commons Recommended Citation Jerusalmi, Daniel, "Cruise Lines or the Islands: Who is Getting the Top Dollars Out of World Travelers in the Caribbean?" (1996). Student Theses, Dissertations, Portfolios and Projects. 109. https://spiral.lynn.edu/etds/109 This Thesis is brought to you for free and open access by the Theses and Dissertations Collections at SPIRAL. It has been accepted for inclusion in Student Theses, Dissertations, Portfolios and Projects by an authorized administrator of SPIRAL. For more information, please contact [email protected]. CRUISE LINES OR THE ISLANDS : WHO IS GETTING THE TOP DOLLARS OUT OF WORLD TRAVELERS IN THE CARIBBEAN? BY: DANIEL JERUSALMI TO: DR. SNYDER ABSTRACT This paper will discuss the current tourism situation in the Caribbean. The two main topics of analyses are the cruise lines and different islands in the Caribbean. The two areas will be presented separately and at the end they will be linked for analyses and conclusion with the help of graphs, charts and surveys. Puerto Rico, Curacao, Jamaica, and Barbados are the Caribbean islands chosen for this project. Within the cruise lines section, the paper will review the history of the industry, the reasons behind today's great success, and possible outlooks for the future. -

Gaming Customers Global Gaming Customers GAMING

GAMING Gaming Customers Global Gaming Customers GAMING Gaming Partners CORPORATE CORPORATE Bloomberry Resorts Corporation Ontario Lottery & Gaming Corporation (OLG) Jeju Sun Hotel & Casino Caesars Windsor Casino Solaire Resort & Casino Manila Penn National Gaming Boyd Gaming Corporation Argosy Casino Alton Belterra Park Argosy Casino Hotel & Spa - Riverside Kansas Star Casino Hollywood Casino & Hotel Lawrenceburg Caesars Entertainment Corporation Hollywood Casino & Hotel Tunica Harrah’s Las Vegas Hollywood Casino Aurora Harrah’s Northern California Hollywood Casino Columbus Indiana Grand Racing & Casino Hollywood Casino Hotel & Raceway Bangor Casino Cosmopol Hollywood Casino Toledo Casino Cosmopol Goteborg Hollywood Casino at Charles Town Races Casino Cosmopol Malmo Hollywood Casino at Kansas Speedway Casino Cosmopol Stockholm Hollywood Casino at Penn National Race Course - Grantville Casino Cosmopol Sundsvall Hollywood Gaming at Dayton Raceway Hollywood Gaming at Mahoning Valley Race Course Churchill Downs Incorporated L’Auberge Casino & Hotel Baton Rouge Presque Isle Downs & Casino Plainridge Park Casino Riverwalk Casino River City Casino & Hotel Cook Group Inc Zia Park Casino Hotel & Racetrack French Lick Casino Regency Entertainment SA Eldorado Resorts Regency Casino Mont Parnes Grand Victoria Elgin Regency Casino Thessaloniki Lumiere Place Casino & Hotel Regency Casino Tirana Gaming & Leisure Properties Inc Silver Heritage Group Hollywood Casino Baton Rouge Tiger Palace Resort Nepal Hollywood Casino Perryville The Cordish Companies -

PDF Success Story, Adventure of the Seas

ABB, Marine & Ports, Marine Services ABB’s modernization on Adventure of the Seas increases the lifetime of the vessel and secures the operational reliability. Increasing lifetime of the vessel, securing discussions about life cycle status and ABB’s solution presentations to improve the situation. The actual project was operational reliability, and enhancing the executed in eight months, which is exceptionally short for such maintainability of the vessel. an extensive project. All the works at dry dock were completed 1 day earlier than Success by collaboration scheduled and transfer trial from Grand Bahamas to Puerto Modernization scope Rico was possible to start earlier. That allowed ABB to test and The modernization project on Adventure of the Seas included tune the system to perfection without time pressure, even the upgrade of the existing PSR Cycloconverter Drive control though in normal case 48 hours of testing time is suitable. All platform to the AMC34 platform as well as the upgrade of the the sea trial tests and tuning of the new control systems were existing AC110 propulsion control platform to AC800M executed on transfer trial without need of additional sea trials. propulsion control platform. In addition to the material supply, the overall ABB scope of supply included installation work, commissioning phase and The vessel testing. Even with a tight schedule and shortened timeline ABB Adventure of the Seas was delivered in 2001 in Kvaerner Masa- was able to complete this pilot project successfully. The project Yards in Turku, Finland (today known as Meyer Turku Shipyard). team worked seamlessly together in Marine and Ports Finland, She is operated by Royal Caribbean International (RCI), and is getting support and assistance from the local ABB units in the the third vessel of the Voyager class. -

The Cruise Passengers' Rights & Remedies 2016

PANEL SIX ADMIRALTY LAW: THE CRUISE PASSENGERS’ RIGHTS & REMEDIES 2016 245 246 ADMIRALTY LAW THE CRUISE PASSENGERS’ RIGHTS & REMEDIES 2016 Submitted By: HON. THOMAS A. DICKERSON Appellate Division, Second Department Brooklyn, NY 247 248 ADMIRALTY LAW THE CRUISE PASSENGERS’ RIGHTS & REMEDIES 2016 By Thomas A. Dickerson1 Introduction Thank you for inviting me to present on the Cruise Passengers’ Rights And Remedies 2016. For the last 40 years I have been writing about the travel consumer’s rights and remedies against airlines, cruise lines, rental car companies, taxis and ride sharing companies, hotels and resorts, tour operators, travel agents, informal travel promoters, and destination ground operators providing tours and excursions. My treatise, Travel Law, now 2,000 pages and first published in 1981, has been revised and updated 65 times, now at the rate of every 6 months. I have written over 400 legal articles and my weekly article on Travel Law is available worldwide on www.eturbonews.com Litigator During this 40 years, I spent 18 years as a consumer advocate specializing in prosecuting individual and class action cases on behalf of injured and victimized 1 Thomas A. Dickerson is an Associate Justice of the Appellate Division, Second Department of the New York State Supreme Court. Justice Dickerson is the author of Travel Law, Law Journal Press, 2016; Class Actions: The Law of 50 States, Law Journal Press, 2016; Article 9 [New York State Class Actions] of Weinstein, Korn & Miller, New York Civil Practice CPLR, Lexis-Nexis (MB), 2016; Consumer Protection Chapter 111 in Commercial Litigation In New York State Courts: Fourth Edition (Robert L. -

ZEEBRIEF#173 12 December 2020

ZEEBRIEF#173 12 december 2020 Fijne Kerstdagen Een Goed & Gezond 2021 NIEUWSBRIEF 275 ALEXIA, IMO 9369083 (NB-216), Damen Combi Freighter 11000, 23-8-2005 contract, 13-1-2007 kiel gelegd bij Yichang Damen Shipyards Co. Ltd. (567303), 8-10-2007 te water, 3-1-2008 opgeleverd als ALEXIA door Damen Shipyards B.V. (567303) aan M.S. “Jolina” Schiffahrts G.m.b.H. & Co. Reederei K.G., Antigua & Barbuda, roepsein V2DE5, in beheer bij Intersee Schiffahrts G.m.b.H. & Co., Haren/Ems en Damen Shipyards B.V. 14-4-2008 (e) onder de vlag van de Ned. Antillen gebracht, thuishaven: Willemstad- N.A., roepsein PJSX, in beheer bij Transship B.V., Emmen voor Intersee Schiffahrts G.m.b.H. & Co., Haren/Ems. 7.878 GT. 10-10-2010 vlag: Curaçao. 10-5-2015 ETA vanaf Reydarfjordur voor Steinweg in de Frisohaven te Rotterdam. 12-5-2015 verkocht aan Marmactan Schiffahrts G.m.b.H. & Co. K.G, 5-2015 onder de vlag van Antigua & Barbuda gebracht, thuishaven: St. John's, roepsein V2GS5, in beheer bij MarConsult Schiffahrt (G.m.b.H. & Co.) K.G, Hamburg, 5-2015 herdoopt MARMACTAN. 12-5-2015 verhaald van de Frisohaven te Rotterdam naar de Hartelhaven in de Europoort onder de nieuwe naam. 13- 5-2015 van de Europoort naar Høgset, Noorwegen, 15-5-2015 ETA te Høgset. 12-11-2020 (GL) verkocht ARA Bergen Shipping B.V., Portugal (Madeira), roepsein CQEH2, in beheer bij ARA Ship Management B.V., herdoopt UNISTORM. (Foto: Henk Jungerius, 4-2-2020). ALSERBACH, IMO 9169732 (NB-213), 21-9-1997 te water gelaten bij Shipbuilding Yard Slip Joint Stock Co., Rybinsk (61604), 12-1997 opgeleverd door Peters-Werft Wewelsfleth G.m.b.H. -

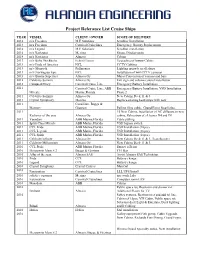

Project Referance List Cruise Ships

Project Referance List Cruise Ships YEAR VESSEL CLIENT / OWNER SCOPE OF DELIVERY 2014 m/s Freedom M.E Solutions Scrubber Installation 2014 m/s Freedom Carnival Cruiselines Emergency Battery Replacement 2014 m/s Legend M.E Solutions Scrubber installation 2014 m/s Navigator Merima Shops, Display units 2014 m/s Navigator Almaco Cabins 2013 m/s Birka Stockholm Eckerö Linjen Upgrading of luxury Cabins 2013 m/v Pride of America NCL CCTV Cabling 2013 m/v Monarch Pullmantur Lighting upgrade in all shops 2013 m/v Norwegian Epic NCL Installation of 660 CCTV cameras 2013 m/v Bimini Superfast Almaco Oy Major Conversion of casinos and bars 2012 Celebrity Summit Almaco Oy Exit sign and volume control installation 2012 Conquest/Glory Carnival Cruise Line Emergency Battery Installation 2011 Carnival Cruise Line, ABB Emergency Battery Installation, VSD Installation Mircale Marine,Florida Phase 2 2011 Celebrity Summit Almaco Oy New Cabins Deck 11 & 3 2011 Crystal Symphony. Merima Replace existing heat lamps with new 2011 Consilium, Bugge & Mercury Gjertsen Pulling fibre cable, Grand Foyer Step lights. 2011 15 New Cabins, Installation of AC diffusers in new Radiance of the seas. Almaco Oy cabins, Relocation of el. boxes D4 and D9 2011 Veendam ABB Marine,Florida Cable pulling 2011 Spirit Class Miracle ABB Marine,Florida VSD bypass switch 2011 CCL Pride ABB Marine,Florida VSD Installation (16pcs) 2011 CCL Legend ABB Marine,Florida VSD Installation (16pcs) 2011 CCL Spirit ABB Marine,Florida VSD Installation (16pcs) 2011 Celebrity Infinity Almaco Oy New Cabins Deck 11 & 3, Transformers 2011 Celebrity Millennium Almaco Oy New Cabins Deck 11 & 3 2010 CCL Pride ABB Marine Florida Energy efficent 2010 Mercury to Mein S 2 Bugge & Gjertsen TUI Bar 2010 Allur of the seas. -

Cruise Ship Schedule 2017/2018

CRUISE SHIP SCHEDULE 2017/2018 October-17 Date Day Name of Vessel Agent Length Draft Berth Capacity Remarks 2 Monday Celebrity Equinox Platinum 1040 27 3 & 4 3145 2 Monday Astoria Platinum 525 25 P/S # 2 580 11 Wednesday Adventure of The Seas Platinum 1020 28 3 & 4 3400 18 Wednesday Logos Hope M&C 435 17 P/S # 2 442 19 Thursday Logos Hope M&C 435 17 P/S # 2 442 20 Friday Arcadia Cox & Co 935 28 3 & 4 2625 20 Friday Logos Hope M&C 435 17 P/S # 2 442 21 Saturday Logos Hope M&C 435 17 P/S # 2 442 22 Sunday Logos Hope M&C 435 17 P/S # 2 442 22 Sunday Viking Sea Platinum 745 21 3 & 4 930 23 Monday Celebrity Equinox Platinum 1040 27 3 & 4 3145 23 Monday Logos Hope M&C 435 17 P/S # 2 442 24 Tuesday Logos Hope M&C 435 17 P/S # 2 442 25 Wednesday Logos Hope M&C 435 17 P/S # 2 442 25 Wednesday Koningsdam Cox & Co 983 3 & 4 2650 26 Thursday Serenade of the Seas Platinum 963 28 3 & 4 2500 26 Thursday Logos Hope M&C 435 17 P/S # 2 442 27 Friday Astor Platinum 578 20 3 & 4 650 27 Friday Logos Hope M&C 435 17 P/S # 2 442 28 Saturday Logos Hope M&C 435 17 P/S # 2 442 29 Sunday Logos Hope M&C 435 17 P/S # 2 442 30 Monday Azura Cox & Co 952 28 3 & 4 3597 31 Tuesday Celebrity Summit Platinum 964 26 3 & 4 2450 31 Tuesday Viking Sea Platinum 749 21 P/S # 2 930 31 Tuesday Sea Dream1 Cox & co 353 13 Anch 110 R/Bay November-17 Date Day Name of Vessel Agent Length Draft Berth Capacity Remarks 1 Wednesday Adventure of The Seas Platinum 1020 28 3 & 4 3400 2 Thursday Zenith Platinum 682 26 P/S # 2 1828 2 Thursday Azura Cox & Co 952 28 3 & 4 3597 2 Thursday Adonia -

1 Msc Cruises Returns to Service in The

MSC CRUISES RETURNS TO SERVICE IN THE MEDITERRANEAN THANKS TO INDUSTRY-LEADING HEALTH AND SAFETY PROTOCOL COMPANY RELEASES HALF-YEAR 2020 RESULTS TOGETHER WITH OUTLOOK AND UPDATES ON MEASURES ADOPTED TO SAFEGUARD LIQUIDITY Geneva, Switzerland, 22 October 2020 – MSC Cruises returned into service with its flagship MSC Grandiosa and MSC Magnifica starting from 16 August and 19 October 2020 respectively, offering guests full cruise holidays with the opportunity to also discover different destinations in the Mediterranean, during seven- and ten-night cruises. The two MSC Cruises ships are the first to implement the Company’s new operating health and safety protocol. The protocol has been approved by the relevant national authorities from the countries that the ships are calling along their Eastern and Western Mediterranean itineraries: Italy, Greece and Malta. MSC Cruises’ health and safety protocol MSC Cruises’ new health and safety operating protocol has been designed to protect the health and safety of guests, crew as well as the local communities that the Company’s ships visit and has since been called a new standard for the overall industry. Its main pillars are: universal testing of all guests and crew prior to embarkation; “social bubble” for protected visits ashore at each destination; and an innovative onboard contact tracing mechanism. Moreover, the Seven Core Elements of a common health and safety protocol to support the resumption of the overall industry as put forward by CLIA, the Cruise Lines International Association, are inspired by the Nine Pillars on which MSC Cruises’ own protocol is based (see appendix for more details on MSC Cruises’ Nine Pillars). -

Pacific Cruise Industry: Security Risk Context Statement

Pacific Cruise Industry: Security Risk Context Statement JANUARY 2008 SECURITY-IN-CONFIDENCE SECURITY-IN-CONFIDENCE This document was compiled by the Department of Infrastructure, Transport, Regional Development and Local Government, in cooperation with the Secretariat of the Pacific Community, Regional Maritime Programme, with funding provided through the AusAID Pacific Governance Support Programme. © Copyright Secretariat of the Pacific Community (SPC), 2008 All rights for commercial / for profit reproduction or translation, in any form, reserved. Permission to reproduce the document and/or translate in whole, in any form, whether for commercial / for profit or non-profit purposes, must be requested in writing. Original SPC artwork may not be altered or separately published without permission. i SECURITY-IN-CONFIDENCE Table of Contents 1. Introduction 1 2. Purpose 1 3. Executive Summary 1 4. Operating environment 2 International Cruise Industry 2 Pacific Cruise Industry 3 Standard Cruise Liners 1500 + 5 Development of Super/Mega Liners 5 Boutique Cruise Shipping 6 Booze cruises 7 Fly/ Cruise 7 Ports 7 Exotic Locations and on-shore excursions 7 Cruise Industry Support Services 8 Crew 8 World Cruises 10 5. International Preventive Security Regime 11 International Legislation 11 Essential Requirements 11 ISPS Implementation in the Pacific 12 Bilateral and multilateral engagement in the Pacific 12 6. Risk Management Context 12 Strategic Security Environment 12 Security Threats in the Global Maritime Environment 14 Pacific Security Environment 15 Security Threats to the Pacific Cruise Industry 16 Improvised Explosive Devices 16 Stand-off attacks 17 Biological or chemical attacks 17 Hijack 17 Landside 18 Criminal threats 18 7. Mitigation of Security Vulnerabilities 19 Physical Security 19 Access controls 19 Screening 21 Development of new port infrastructure 22 Human Security 22 Trusted insiders 22 Security culture 24 Coordination and information sharing 24 Security Planning 26 8. -

Cruise Segment Sub-Report Final

CRUISE SEGMENT SUB-REPORT WESTERN CAPE TOURISM MASTERPLAN DEVELOPMENT STRICTLY CONFIDENTIAL PREPARED FOR: The Department of Economic Development and Tourism (DEDAT) of the Provincial Government of the Western Cape, South Africa PROJECT NUMBER: EDT 004-19 FOCUS: UK, Europe & Americas LEADERS: Rashid Toefy, Deputy Director-General Ilse van Schalkwyk, Chief Director Economic Sector Support SUBMITTED BY: ANITA MENDIRATTA, Founder and President - AM&A DATE: February 11th 2020 FINAL 1. INTRODUCTION In Q3 2019 ANITA MENDIRATTA & Associates is honoured to have been invited by DEDAT to participate in a process around establishment of, as expressed by DEDAT: “a 15- year tourism master plan for the Western Cape (WCTMP). The Master Plan will set the foundation to start shaping the development needed to maintain and develop a sustainable and thriving tourist destination.” Central to WCTMP development is conducting comprehensive research around the potential of the Western Cape for travellers from two priority global regions, namely: 1) The Americas: representing 16.64% of current overseas travellers to South Africa with 57.2% of those visitors going to the Western Cape (WESGRO) 2) Europe: representing 60.57% of current overseas travellers to South Africa with 62.0% of those visitors going to the Western Cape (WESGRO) with emphasis on Megatrends and Destination Potential. This process is well underway, with Draft 2 of AM&A’s research underway with DEDAT. Within the report composed by AM&A, 15 Traveller Megatrends were identified as central to shaping the future of tourism growth globally. Within the 15, one of them, namely CRUISE TOURISM (no. 10), represents a significant, continuous- growth niche within global tourism. -

An Analysis of Cruise Tourism in the Caribbean and Its Impact on Regional Destination Ports Adrian Hilaire World Maritime University

World Maritime University The Maritime Commons: Digital Repository of the World Maritime University World Maritime University Dissertations Dissertations 2007 An analysis of cruise tourism in the Caribbean and its impact on regional destination ports Adrian Hilaire World Maritime University Follow this and additional works at: http://commons.wmu.se/all_dissertations Part of the Regional Economics Commons Recommended Citation Hilaire, Adrian, "An analysis of cruise tourism in the Caribbean and its impact on regional destination ports" (2007). World Maritime University Dissertations. 349. http://commons.wmu.se/all_dissertations/349 This Dissertation is brought to you courtesy of Maritime Commons. Open Access items may be downloaded for non-commercial, fair use academic purposes. No items may be hosted on another server or web site without express written permission from the World Maritime University. For more information, please contact [email protected]. WORLD MARITIME UNIVERSITY Malmö, Sweden AN ANALYSIS OF CRUISE TOURISM IN THE CARIBBEAN AND ITS IMPACT ON REGIONAL DESTINATION PORTS By ADRIAN HILAIRE Saint Lucia A dissertation submitted to the World Maritime University in partial fulfillment of the requirements for the award of the degree of MASTER OF SCIENCE In MARITIME AFFAIRS (PORT MANAGEMENT) 2007 © Copyright Adrian Hilaire, 2007 Declaration I certify that all material in this dissertation that is not my own work has been identified, and that no material is included for which a degree has previously been conferred on me. The content of -

GENTING CRUISE LINES IS BACK in TOWN in MALAYSIA with STAR CRUISES’ SUPERSTAR GEMINI! Bigger Experience! Amazing Destinations! Fantastic Promotions!

PRESS RELEASE FOR IMMEDIATE RELEASE GENTING CRUISE LINES IS BACK IN TOWN IN MALAYSIA WITH STAR CRUISES’ SUPERSTAR GEMINI! Bigger Experience! Amazing Destinations! Fantastic Promotions! Kuala Lumpur – 25 September 2018 – Say a very big ‘hello’ to SuperStar Gemini, one of Star Cruises’ popular cruise ships, as she returns home to Malaysia from 5 November 2018 until 28 April 2019 as part of Genting Cruise Lines’ ongoing initiative to offer a variety of cruise products and best in class services for our guests in the region. For those eager to take the next cruise or wondering what a cruise vacation is like, the wait is over and your journey starts with Star Cruises – a perfect vacation option with your loved ones for the upcoming school holidays, year-end and New Year celebrations, as well as during those festive seasons. It’s going to be a bigger experience with more fun aboard the 13-storey SuperStar Gemini as our friendly crew welcomes you aboard from Port Klang, Penang and Langkawi in Malaysia, as well as Phuket in Thailand - all well-connected travel hubs with easy access and convenience for travellers across the region. Hop on and discover for yourselves all those amazing stories you hear about a cruise vacation, especially with Star Cruises. Forget about the hassle of conventional traveling, the packing and unpacking or the troublesome hotel and transportation arrangements for the different destinations. Discover a seamless, affordable and all-inclusive experience of a cruise vacation as SuperStar Gemini brings you from one amazing destination to the next in Malaysia and Thailand.