Harbison Center

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CBL & Associates Properties 2012 Annual Report

COVER PROPERTIES : Left to Right/Top to Bottom MALL DEL NORTE, LAREDO, TX CROSS CREEK MALL, FAYETTEVILLE, NC BURNSVILLE CENTER, BURNSVILLE, MN OAK PARK MALL, KANSAS CITY, KS CBL & Associates Properties, Inc. 2012 Annual When investors, business partners, retailers Report CBL & ASSOCIATES PROPERTIES, INC. and shoppers think of CBL they think of the leading owner of market-dominant malls in CORPORATE OFFICE BOSTON REGIONAL OFFICE DALLAS REGIONAL OFFICE ST. LOUIS REGIONAL OFFICE the U.S. In 2012, CBL once again demon- CBL CENTER WATERMILL CENTER ATRIUM AT OFFICE CENTER 1200 CHESTERFIELD MALL THINK SUITE 500 SUITE 395 SUITE 750 CHESTERFIELD, MO 63017-4841 strated why it is thought of among the best 2030 HAMILTON PLACE BLVD. 800 SOUTH STREET 1320 GREENWAY DRIVE (636) 536-0581 THINK 2012 Annual Report CHATTANOOGA, TN 37421-6000 WALTHAM, MA 02453-1457 IRVING, TX 75038-2503 CBLCBL & &Associates Associates Properties Properties, 2012 Inc. Annual Report companies in the shopping center industry. (423) 855-0001 (781) 398-7100 (214) 596-1195 CBLPROPERTIES.COM HAMILTON PLACE, CHATTANOOGA, TN: Our strategy of owning the The 2012 CBL & Associates Properties, Inc. Annual Report saved the following resources by printing on paper containing dominant mall in SFI-00616 10% postconsumer recycled content. its market helps attract in-demand new retailers. At trees waste water energy solid waste greenhouse gases waterborne waste Hamilton Place 5 1,930 3,217,760 214 420 13 Mall, Chattanooga fully grown gallons million BTUs pounds pounds pounds shoppers enjoy the market’s only Forever 21. COVER PROPERTIES : Left to Right/Top to Bottom MALL DEL NORTE, LAREDO, TX CROSS CREEK MALL, FAYETTEVILLE, NC BURNSVILLE CENTER, BURNSVILLE, MN OAK PARK MALL, KANSAS CITY, KS CBL & Associates Properties, Inc. -

2Q17 Columbia Retail Market Report

2Q17: Columbia Retail Market Report Grocers In, Big Box Retailers Out VACANCY The Columbia retail market stayed steady between the close of 2016 and the close of the second quarter, with vacancy 5.3% creeping from 5.1% to 5.3%. Net absorption this quarter Rates crept upwards from 5.1% in 4Q16 was negative 18,174 square feet (SF), compared to a positive 306,581 SF at the close of the fourth quarter 2016. NAI Avant Director of Retail Services Patrick Palmer, CCIM attributes the negative net absorption to big box retailers NET ABSORPTION closing their doors, making more vacant space available in the market. For example, this quarter, HH Gregg closed its doors -18,174 SF and moved out of ±30,396 SF at Village at Sandhill Forum 306,581 SF in 4Q16 Center, in addition to vacating the chain’s ±69,023 SF location on Bower Parkway. But the Columbia retail market remains steady and strong. Average rental rates rose from $11.06 SF at the close of 2016, AVERAGE RENTAL RATE to $11.42 SF at the close of the second quarter 2017. The Central Business District continues to own the highest rental $11.42 rate at $19.38 SF. Up from $11.06 in 4Q16 The highlights for the Columbia retail market in the second quarter of 2017 center around major grocery store openings and announcements. VACANCY: MALLS Impact of E-Commerce: Columbia is no exception to the nationwide 13.6% reality of big box retailers closing their doors. The only building type that saw Nearly every major department store, including decreased vacancy in 2Q17 Macy’s, Kohl’s, Walmart, and Sears, have closed hundreds of stores due to the rise of e-commerce. -

SC EV Market Study

SC EV Market Study 1 South Carolina Electric Vehicle Market Study Introduction 4 Current Assessment 5 Trends and Future Outlook 12 Implementation 17 Infrastructure Development 17 Educational Campaign: Plug in SC 22 1 Background Palmetto Clean Fuels (PCF) is an initiative of the South Carolina Office of Regulatory Staff - Energy Office (Energy Office). PCF is one of more than 100 U.S. Department of Energy (DOE) Clean Cities designees and represents the entire state of South Carolina. Clean Cities is a locally based, voluntary public/private partnership created to promote energy use in the transportation sector that is clean, safe, sustainable, and less dependent upon foreign energy sources. Clean Cities builds on local initiatives and partnerships as well as nationwide networks to achieve its goals. By combining local decision- making with voluntary action by partners, this grassroots community action group seeks to create effective programs that support a sustainable nationwide alternative fuels market. PCF works to increase the use of alternative fuels and advanced vehicle technologies and strives to help public and private entities— as well as individuals— lower fuel costs, improve air quality, and reduce petroleum consumption. PCF also promotes idle reduction, fuel economy measures, vehicle miles traveled reductions, and bicycle and pedestrian efforts. 1 2 Introduction This study focuses on one aspect of PCF work—electric vehicles (EV). It builds on several regional studies as well as the past efforts of the organization, Plug-In Carolina. Plug-In Carolina, a registered non-profit, was selected to manage a program to install Electric Vehicle Supply Equipment (EVSE) funded with the American Recovery and Reinvestment Act (ARRA) through the Energy Office. -

List of Creditors

Yatsen Group of Companies Inc. and Other Applicants Identified in the Initial Order (collectively, “YGC”) List of Creditors Please note the following: 1. This list of creditors has been prepared from information contained in the books and records of YGC. All balances are as at December 31, 2020. 2. The amounts included in this list of creditors do not take into consideration any un-invoiced amounts, nor have the amounts been adjusted for any amounts that may also be receivable from creditors. 3. This list of creditors has been prepared without admission as to the liability for, or quantum of, any of the amounts shown. 4. To date, a claims procedure has not been approved by the Court, and creditors are NOT required to file a statement of account or proof of claim at this point in time. If, at a later date, a claims procedure is approved by the Court, all known creditors will be notified and claim forms will be posted to the Monitor's website. It is through such a claims procedure that creditor claims will be reviewed and determined. Page 1 of 5 Yatsen Group of Companies Inc., et. al. (collectively, "YGC") List of Creditors Please note the following: 1. This list of creditors has been prepared from information contained in the books and records of YGC. All balances are as at December 31, 2020. 2. The amounts included in this list of creditors do not take into consideration any un-invoiced amounts, nor have the amounts been adjusted for any amounts that may also be receivable from creditors. -

Columbia Business Journal Call 771-8380 Or 1-800-888

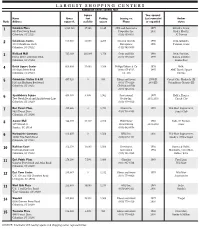

COLUMBIA BUSINESS JOURNAL LARGEST AREA SHOPPING CENTERS Ranked by gross leasable square feet Name Gross Square Address leasable feet Parking Leasing co. Year opened/ Anchor Rank Web site square ft. available (1) spaces Phone renovated tenants 1 Columbia Place 1,307,280 43,682 6,149 CBL and Associates Properties 1977 Dillard's, Sears, 7201 Two Notch Road (423) 553-8702 2002 Macy's, JC Penney Columbia, SC 29223 www.shopcolumbiamall.com 2 Columbiana Centre 926,441 5,000 4,200 General Growth Enterprises 1990 Belk, Dillard's, 100 Columbiana Circle (312) 960-5000 1996 Parisian, Sears Columbia, SC 29212 www.columbianacentre.com 3 Richland Mall 863,741 58,000 3,770 Faison 1988 Belk, Blacklion, Forest Drive at Beltline Blvd. (704) 972-2500 1999 Barnes & Noble, Parisian, Columbia, SC 29204 The Dept. Store www.shoprichlandmall.com 4 Dutch Square Center 600,000 25,000 3,100 Phillips Edison & Co. 1970 Belk, AMC cinema, 800 Bush River Road (513) 554-1110 1997 Burlington Coat Factory Columbia, SC 29210 www.dutchsquare.com 5 East Forest Shopping Center 381,810 7,000 1,790 Colliers Keenan 1995 Wal-Mart Supercenter, 5420 Forest Drive (803) 254-2300 Sam's Club, Hobby Lobby, Columbia, SC 29206 A.J. Wright 6 Sumter Mall 345,000 51,136 2,150 Hull/Storey Retail Group 1980 Belk, JC Penney, Sears 1057 Broad St. (800) 452-4094 2001-02 Sumter, SC 29150 www.shopsumtermall.com 7 Sparkleberry Square 320,971 3,770 1,962 Equity One 1997 Kohl's, Kroger, Circuit City Two Notch Road and Sparkleberry Lane (770) 818-1334 2002-03 Columbia, SC 29229 8 Northpointe Commons 313,607 -

Research & Forecast Report

Q4 2014 | RETAIL COLUMBIA, SOUTH CAROLINA RESEARCH & FORECAST REPORT On the Road to Becoming a Retail Destination KEY TAKEAWAYS > Overall market vacancy rate is trending downwards. Average asking rental rates for anchor and junior anchor space increased, but average asking rental rates for shop space declined slightly. > New development and redevelopments are gaining momentum along desirable retail corridors. MARKET INDICATORS > Growth continues for Downtown Columbia’s Congaree Vista. Q4 2014 Forecast > New retailers enter the market. VACANCY CURRENT CONDITIONS NET ABSORPTION Announcements of new retailers, restaurants, hotels, and residential developments in Columbia, SC flooded headlines throughout 2014. The significant year ended with an overall vacancy rate of RENTAL RATES 8.0% for the Columbia, SC retail market, down from the third quarter 2014 vacancy rate of 8.4% CONSTRUCTION and year-end 2013 rate of 8.8%. The vacancy rate is on a downward trend as a result of retailers expanding their footprints, and new retailers and fitness centers backfilling vacant big box space. Much of the absorbed space has been of higher quality retail space along prime retail corridors with high traffic counts and visibility. The resulting available shop space yielded an average asking rental rate of $12.81 NNN at year-end 2014, slightly lower than $13.01 NNN at the end of 1 DOWNTOWN RESIDENTIAL UPDATE the third quarter of 2014. Asking rental rates for shop space are expected to increase as on new developments complete construction and deliver new supply to the market. Average asking rental Downtown Columbia has the rates for anchor and junior anchor space were up to $7.45 NNN and $9.16 NNN, respectively, at potential to gain an additional year-end 2014 from the third quarter 2014 averages of $7.39 NNN and $7.53 NNN, respectively. -

2003 Book of Lists

LARGEST SHOPPING CENTERS RANKED BY GROSS SQUARE FEET Square Year opened/ Name Gross feet Parking Leasing co. Last renovated Anchor Rank Address square ft. available spaces Phone or expanded stores 1 Columbia Place 1,163,328 17,868 6,149 CBL and Associates 1977 Dillard’s, Sears, 650 Two Notch Road Properties Inc. 2002 Rich’s-Macy’s, Columbia, SC 29223 (423) 490-8644 JC Penney 2 Columbiana Centre 817,738 11,000 4,200 General Growth 1990 Belk, Dillard’s, 100 Columbiana Circle Enterprises 1996 Parisian, Sears Columbia, SC 29212 (312) 960-5000 3 Richland Mall 727,360 266,000 3,770 Grub and Ellis 1988 Belk, Parisian, Forest Drive at Beltline Blvd. (803) 779-8600 1999 Barnes & Noble Columbia, SC 29204 Booksellers 4 Dutch Square Center 600,000 17,000 3,100 Phillips Edison & Co. 1970 Belk, 800 Bush River Road (800) 875-6585, 1997 AMC Dutch Square Columbia, SC 29210 ext. 216 Cinema 5 Columbiana Station II & III 497,528 0 860 Edens and Avant 1999(II) Circuit City, Michael’s (II) I-26 and Harbison Boulevard (803) 779-4420 2000(III) Columbiana Grande (III) Columbia, SC 29212 CB Richard Ellis (803) 765-0884 6 Sparkleberry Square 433,389 8,000 1,962 Professional 1997 Kohl’s, Kroger, Two Notch Road and Sparkleberry Lane Realty Inc. 2002-2003 Circuit City Columbia, SC 29229 (803) 419-4020 7 East Forest Plaza 358,626 0 1,790 Hauck Co. 1995 Wal-Mart Supercenter, 5420 Forest Drive (513) 733-3300 Sam’s Club Columbia, SC 29206 8 Sumter Mall 344,839 17,317 2,150 Hull/Storey 1980 Belk, JC Penney, 1057 Broad St. -

4Q17 Columbia Retail Market Report

4Q17: Columbia Retail Market Report Exciting Growth in Downtown VACANCY Columbia and Lexington Surges to Close Out the Year 5.4% Nationally, holiday sales rose a better than expected 5.5%, the Rates decreased for the first time in four strongest gain since the Great Recession. A booming stock market, quarters rising home values, tight job market with steady pay increases, and a year-end tax cut all bodes well for consumer confidence driving retail spending. NET ABSORPTION Locally, the Downtown Columbia area is on a roll with exciting projects taking shape across the skyline: final phase of Canalside, the Empire apartments rising near the State House, historic 250,526 SF renovation of the old Columbia fire station, and just across the river -128,359 SF in 3Q17 the Brookland mixed use development is well underway. Columbia will finally be getting a coveted rooftop dining option with the Black Rooster restaurant at Brookland overlooking the river, and the old fire station renovation will include an outdoor patio deck as part of its event venue. Millennials and students are shaking up retail with AVERAGE RENTAL RATE a strong appetite for a walkable, vibrant urban experience. The Columbia retail market improved slightly in all areas in the $11.66 fourth quarter of 2017 with a vacancy rate decrease, strong net Up from $11.20 in 3Q17 absorption, and rental rate increase. Vacancy hovered a little over 5% throughout all 4 quarters in 2017 and ended the year at a low vacancy of 5.4%. VACANCY: MALLS Net absorption this quarter was strong, a positive 250,526 square feet (SF). -

Richland County Business Service Center Open Businesses with Issued 2018 Richland County Business Licenses As of December 27, 2018 S.C

BSC Open Businesses with Issued 2018 Richland County Business LIcenses 12/27/2018 Richland County Business Service Center Open Businesses with Issued 2018 Richland County Business Licenses As of December 27, 2018 S.C. law provides that it is a crime to knowingly obtain or use personal information from a public body for commercial solicitation. Business Name Doing Business As Business Description (with NAICS code) Physical Location "A" Game Sports and Fitness 611620 -Sports and Recreation Instruction 508 Cartgate Cir Blythewood "Bundles" of Joy 448150 -Clothing Accessories Stores 1971 Lake Carolina Dr Columbia "Lady G" Creations, LLC 314999 -All Other Miscellaneous Textile Product Mills 1061 Sparkleberry Ln Ext Columbia "So" Fresh "So" Clean Janitorial Service 561720 -Janitorial Services 600 Crane Church Rd Columbia "The Barbershop" 812111 -Barber Shops 9400 Two Notch Rd Columbia "The Handy Duck", LLC 236118-B -Residential Remodelers 9519 Farrow Rd Columbia #1 A LifeSafer of South Carolina, Inc LifeSafer 811198 -All Other Automotive Repair and Maintenance 136 McLeod Rd Columbia #1 Lawn Care Service 561730 -Landscaping Services 966 Farnsworth Dr Hopkins #MrGrindOut LLC 624110 -Child and Youth Services 536 Wilkinson Ln Columbia 1 800 Got Junk 562111 -Solid Waste Collection 3405 Margrave Rd Columbia 1 Man Outfit & Helpers 236118-B -Residential Remodelers 324 Cooper Rd Blythewood 100 Gateway SC 531120 -Lessors of Nonresidential Buildings (except Miniwarehouses)100 Gateway Corporate Blvd Columbia 1009 Pine, LLC Sun Massage Therapy 621399 -Offices -

“The Most Military Friendly Community in America”

Welcome RECREATIONAL GUIDE TO FT. JACKSON & COLUMBIA, SOUTH CAROLINA “The Most Military Friendly Community in America” DINING l ENTERTAINMENT l AREA MAPS l RECREATION l LODGING Join us for a restful nights stay... Two Great Options near Ft. Jackson and The Village at Sandhill • 145 ULTRA MODERN ROO M S • 6.4 M ILES TO FORT JACKSON • FREE DEL U XE HOT BREAK F AST • ALL S M OKE -F REE ROO M S • FREE H IG H SPEED WIRED & WIRELESS INTERNET • MICROWAVE & FRIDGE IN EVERY ROO M • 32” LCD TVS WIT H 42 HD CH ANNELS • ON-SITE LA U NDRY • CO M PLI M ENTARY bu SINESS CENTER • CO M PLI M ENTARY F ITNESS CENTER 1.803.788.4901 1.803.419.3558 1011 & 1021 Clemaon Frontage Road Columbia, SC 292229 EDITOR CONTENTS Susan McPherson Katherine Yon Welcome to Columbia Welcome To Richland County, the City of Columbia PUBLICATION DESIGN ETUTS & Forest Acres About the Columbia Chamber ART DIRECTOR Kendall Davis Military Organizations History of Fort Jackson & Relationship to Columbia CONTRIBUTORS Fort Jackson National Cemetary Susan McPherson Family Morale Welfare & Recreation, Area Information Fort Jackson Local Accommodations Columbia Communities & Areas to Visit Culture, Entertainment, Shopping & Recreation Festivals & Events Performing Arts & Concerts Local & Outdoor Attractions Local Sports Arenas International Corridor Shopping Districts Columbia Area Maps Columbia Metropolitan Area City Center Greater Columbia Chamber of Commerce Welcome to Fort Jackson PO Box 1360 Victory Starts Here Columbia, SC 29202 Fort Jackson Map www.columbiachamber.com 803.733.1110 General Post Information Family & Morale, Welfare & Recreation (FMWR) Welcome is published biannually by the Greater Columbia Chamber of Commerce Child, Youth & School Services and is in no way connected with the U.S. -

WELCOME GAMECOCKS! the Out-Of- State Guide to Gamecock Country

WELCOME GAMECOCKS! The Out-of- State Guide to Gamecock Country Student Success Center University of South Carolina Dear Out-of-State Student, Welcome to South Carolina! We are so pleased to have you share your undergraduate experience here with us. Your time here will not only be a great experience, but you will find yourself being exposed to so many new and exciting things. Columbia, South Carolina and the University of South Carolina is a great place filled with limitless opportunities for you to explore our great university, but also our city and state! If you are from the northern, western or midwestern states, the southern experience is one you are sure to enjoy. The great weather, great food and the southern hospitality makes you feel right at home. It’s important to get involved! Take advantage of all the activities and opportunities available to you here. We have exciting programs and services available just for out-of-state students like you! The University of South Carolina is your new home away from home, so make your time here exciting and worthwhile. The purpose of this guide is to get you started on your journey and adjustment as well as provide you with the basic essentials you need to make a successful transition into USC. We wish you all the best and congratulate you on your decision to attend the University of South Carolina. Have a great semester. Go Gamecocks! Sincerely, Paul S. Millard Coordinator of Transfer & Special Student Population Services Student Success Center Thomas Cooper Library Twitter: 803-777-4163 @UofSCOutofState -

South Carolina Flood Assistance Information and Resources Available

South Carolina Flood Assistance Information and Resources Available At http://scemd.org, South Carolina Emergency Management Division (EMD) is continuously updating information on the state’s flood response. SCEMD.org also provides links to resources for those seeking assistance and those who want to help. EMD’s SC Severe Flood Line is 1-866-246-0133 Emergency Assistance Shelters currently open in Richland, Lexington and Orangeburg Counties: Shelter Location Address County Phone 7 Oaks Complex 200 Leisure Lane Lexington 571-271-2071 Irmo, SC Lexington Leisure Center 108 Park Rd. Lexington 571-205-3160 Lexington, SC Temple Baptist Church 806 Universal Drive Richland 803-776-3913 Columbia, SC 29209 St. Andrews Presbyterian Church 6952 St. Andrews Road Richland 803-732-2273 Columbia, SC 29212 BOTTLED WATER DISTRIBUTION Bottled water will be distributed at these sites from 8 a.m. – 6:30 p.m. until the drinking water emergency has ended. Distribution Location Address Dutch Square (former Belk parking lot) 421 Bush River Road Former Sam’s Club Parking Lot 1401 Sunset Drive Wal-Mart Parking Lot 5424 Forest Drive Lower Richland High School 2615 Lower Richland Boulevard Near Richland Mall 3700 Landmark Drive Midlands Shopping Center 2638 Two Notch Road Gadsden Community Center 1660 S. Goodwin Circle Eastover Park 1301 Main Street, Eastover, SC FOOD Community food pantries are providing food, water and baby supplies to residents affected by the flooding. • Harvest Hope Food Bank (HHFB) - (http://www.harvesthope.org or 803-254-4432) Located at 2220 Shop Road in Columbia and 1775 12th Street Ext in Cayce from 9 am to 3pm.