Table of Contents Page 1 TABLE of CONTENTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Law 111–80 111Th Congress an Act Making Appropriations for Agriculture, Rural Development, Food and Drug Adminis- Oct

123 STAT. 2090 PUBLIC LAW 111–80—OCT. 21, 2009 Public Law 111–80 111th Congress An Act Making appropriations for Agriculture, Rural Development, Food and Drug Adminis- Oct. 21, 2009 tration, and Related Agencies programs for the fiscal year ending September [H.R. 2997] 30, 2010, and for other purposes. Be it enacted by the Senate and House of Representatives of Agriculture, the United States of America in Congress assembled, That the Rural following sums are appropriated, out of any money in the Treasury Development, Food and Drug not otherwise appropriated, for Agriculture, Rural Development, Administration, Food and Drug Administration, and Related Agencies programs and Related for the fiscal year ending September 30, 2010, and for other pur- Agencies poses, namely: Appropriations Act, 2010. TITLE I AGRICULTURAL PROGRAMS PRODUCTION, PROCESSING AND MARKETING OFFICE OF THE SECRETARY For necessary expenses of the Office of the Secretary of Agri- culture, $5,285,000: Provided, That not to exceed $11,000 of this amount shall be available for official reception and representation expenses, not otherwise provided for, as determined by the Sec- retary. OFFICE OF TRIBAL RELATIONS For necessary expenses of the Office of Tribal Relations, $1,000,000, to support communication and consultation activities with Federally Recognized Tribes, as well as other requirements established by law. EXECUTIVE OPERATIONS OFFICE OF THE CHIEF ECONOMIST For necessary expenses of the Office of the Chief Economist, $13,032,000. NATIONAL APPEALS DIVISION For necessary expenses of the National Appeals Division, $15,254,000. VerDate Nov 24 2008 08:02 Sep 19, 2011 Jkt 079194 PO 00000 Frm 00634 Fmt 6580 Sfmt 6581 G:\GSDD\STATUTES\2009\79194PT2.001 MCNODE jbender on DSKFWWRZC1 with $$_JOB PUBLIC LAW 111–80—OCT. -

Down Payment and Closing Cost Assistance

STATE HOUSING FINANCE AGENCIES Down Payment and Closing Cost Assistance OVERVIEW STRUCTURE For many low- and moderate-income people, the The structure of down payment assistance programs most significant barrier to homeownership is the down varies by state with some programs offering fully payment and closing costs associated with getting a amortizing, repayable second mortgages, while other mortgage loan. For that reason, most HFAs offer some programs offer deferred payment and/or forgivable form of down payment and closing cost assistance second mortgages, and still other programs offer grant (DPA) to eligible low- and moderate-income home- funds with no repayment requirement. buyers in their states. The vast majority of HFA down payment assistance programs must be used in combi DPA SECOND MORTGAGES (AMORTIZING) nation with a first-lien mortgage product offered by the A second mortgage loan is subordinate to the first HFA. A few states offer stand-alone down payment and mortgage and is used to cover down payment and closing cost assistance that borrowers can combine closing costs. It is repayable over a given term. The with any non-HFA eligible mortgage product. Some interest rates and terms of the loans vary by state. DPA programs are targeted toward specific popula In some programs, the interest rate on the second tions, such as first-time homebuyers, active military mortgage matches that of the first mortgage. Other personnel and veterans, or teachers. Others offer programs offer more deeply subsidized rates on their assistance for any homebuyer who meets the income second mortgage down payment assistance. Some and purchase price limitations of their programs. -

Commercial Mortgage Loans

STRATEGY INSIGHTS MAY 2014 Commercial Mortgage Loans: A Mature Asset Offering Yield Potential and IG Credit Quality by Jack Maher, Managing Director, Head of Private Real Estate Mark Hopkins, CFA, Vice President, Senior Research Analyst Commercial mortgage loans (CMLs) have emerged as a desirable option within a well-diversified fixed income portfolio for their ability to provide incremental yield while maintaining the portfolio’s credit quality. CMLs are privately negotiated debt instruments and do not carry risk ratings commonly associated with public bonds. However, our paper attempts to document that CMLs generally available to institutional investors have a credit profile similar to that of an A-rated corporate bond, while also historically providing an additional 100 bps in yield over A-rated industrials. CMLs differ from public securities such as corporate bonds in the types of protections they offer investors, most notably the mortgage itself, a benefit that affords lenders significant leverage in the relationship with borrowers. The mortgage is backed by a hard, tangible asset – a property – that helps lenders see very clearly the collateral behind their investment. The mortgage, along with other protections, has helped generate historical recovery from defaulted CMLs that is significantly higher than recovery from defaulted corporate bonds. The private CML market also provides greater flexibility for lenders and borrowers to structure mortgages that meet specific needs such as maturity, loan amount, interest terms and amortization. Real estate as an asset class has become more popular among institutional investors such as pension funds, insurance companies, open-end funds and foreign investors. These investors, along with public real estate investment trusts (REITs), generally invest in higher quality properties with lower leverage. -

Housing Choice Voucher Program

Housing Choice Voucher Program Owner Information Packet If you have any questions please contact the Housing Authority of Kansas City at: 920 Main, Suite 701, Kansas City, Missouri 64105 (816) 968- 4100 Table of Contents Welcome …………… …………………………………………………………… 3 Section 8 Program Overview ………………………………………………….. 4 How Tenants are Qualified for Section 8 ……………………………………... 4 Landlord Qualifications………………………………………………………….. 5 How the Process Begins ……………………………………………………….. 5 Selecting a Suitable Renter ……………………………………………………. 6 Miscellaneous Fees and Charges …………………………………………….. 6 Completion of Request for Tenancy Approval ……………………………….. 7 Proof of Ownership ……………………………………………………………… 8 Initial Inspection …………………………………………………………………. 8 Lead Base Paint …………………………………………………………………. 9 Lead Based Paint Procedures …………………………………………………. 9 What is Rent Reasonable.. ……………………………………………………... 10 Owner Provided Lease ………………………………………………………….. 10 Housing Assistance Payment (HAP) Contract Execution …………………… 11 Annual Inspection and Tenant Re-examination Process …………………… 11 Owner Request for Rent Increase …………………………………………….. 12 Other Types of Inspections …………………………………………………….. 13 Termination of Tenancy by Owner …………………………………………….. 14 Tenant Move-Out without Proper Notice ……………………………………… 14 Other Reasons a Family May be Required to Move ………………………… 15 Termination of Assistance by HAKC ………………………………………….. 14 Change of Ownership …………………………………………………………... 15 1099 ………………………. ……………………………………………………... 15 - 2-Revised 11/5/2009 Owner, Tenant, and HAKC Responsibilities …………………………………. -

H. R. Ll [Report No

H:\XML\AGRICULTURE 2020 SUBCOM.XML 753 [FULL COMMITTEE PRINT] Union Calendar No. ll 116TH CONGRESS 1ST SESSION H. R. ll [Report No. 116–ll] Making appropriations for Agriculture, Rural Development, Food and Drug Administration, and Related Agencies programs for the fiscal year ending September 30, 2020, and for other purposes. IN THE HOUSE OF REPRESENTATIVES MAY --, 2019 Mr. BISHOP of Georgia, from the Committee on Appropriations, reported the following bill; which was committed to the Committee of the Whole House on the State of the Union and ordered to be printed. A BILL Making appropriations for Agriculture, Rural Development, Food and Drug Administration, and Related Agencies programs for the fiscal year ending September 30, 2020, and for other purposes. L:\VA\052119\A052119.025.xml May 21, 2019 (6:45 p.m.) VerDate Nov 24 2008 18:45 May 21, 2019 Jkt 000000 PO 00000 Frm 00001 Fmt 6652 Sfmt 6652 C:\USERS\DJONES4\APPDATA\ROAMING\SOFTQUAD\XMETAL\7.0\GEN\C\AGRICULTUR H:\XML\AGRICULTURE 2020 SUBCOM.XML 753 2 1 Be it enacted by the Senate and House of Representa- 2 tives of the United States of America in Congress assembled, 3 That the following sums are appropriated, out of any 4 money in the Treasury not otherwise appropriated, for Ag- 5 riculture, Rural Development, Food and Drug Administra- 6 tion, and Related Agencies programs for fiscal year ending 7 September 30, 2020, and for other purposes, namely: 8 TITLE I 9 AGRICULTURAL PROGRAMS 10 PROCESSING, RESEARCH, AND MARKETING 11 OFFICE OF THE SECRETARY 12 (INCLUDING TRANSFERS OF FUNDS) 13 For necessary expenses of the Office of the Secretary, 14 $45,112,000, of which not to exceed $4,850,000 shall be 15 available for the Immediate Office of the Secretary; not 16 to exceed $1,448,000 shall be available for the Office of 17 Homeland Security; not to exceed $6,211,000 shall be 18 available for the Office of Partnerships and Public En- 19 gagement, of which $1,500,000 shall be for 7 U.S.C. -

American Rescue Plan Housing & Homelessness Programs and Their

American Rescue Plan Housing & Homelessness The American Rescue Plan (ARP) includes funds for programs to help renters and homeowners to alleviate pandemic-related housing issues. ARP includes a robust and comprehensive package of relief funding to boost housing stability, reduce homelessness, and support others facing housing-related hardships. Programs and Their Purposes Emergency Rental Assistance Program - $21.6 billion (U.S. Department of Treasury) The Emergency Rental Assistance Program provides emergency aid to low-income renters that have lost their income, are experiencing financial hardship and are at risk of losing housing. These funds, provided in the December emergency package, can be used for rent payments or arrearages to avoid/prevent eviction. The program includes $2.5 billion for low-income renter households paying more than 50 percent of income on rent or living in substandard or over- crowded conditions, rental market costs, and change in employment since February 2020 used as the factors for allocating funds. Eligible households include one person or more qualified for unemployment benefits; reduced income or significant costs during COVID-19 pandemic; risk of homelessness; household income below 80% area median income (AMI). Emergency Housing Vouchers - $5 billion (U.S. Department of Housing and Urban Development) The Emergency Housing Vouchers for Section 8 Housing provides vouchers for public housing agencies to individuals and families who are currently or recently homeless, and to those who are fleeing domestic violence, sexual assault, or human trafficking. Vouchers cannot be reissued after assistance to family ends. According to the Center for Budget and Policy Priorities, unlike cash assistance, vouchers offer longer-lasting support that can help renters remain stably housed as the recovery takes hold. -

Your Step-By-Step Mortgage Guide

Your Step-by-Step Mortgage Guide From Application to Closing Table of Contents In this Guide, you will learn about one of the most important steps in the homebuying process — obtaining a mortgage. The materials in this Guide will take you from application to closing and they’ll even address the first months of homeownership to show you the kinds of things you need to do to keep your home. Knowing what to expect will give you the confidence you need to make the best decisions about your home purchase. 1. Overview of the Mortgage Process ...................................................................Page 1 2. Understanding the People and Their Services ...................................................Page 3 3. What You Should Know About Your Mortgage Loan Application .......................Page 5 4. Understanding Your Costs Through Estimates, Disclosures and More ...............Page 8 5. What You Should Know About Your Closing .....................................................Page 11 6. Owning and Keeping Your Home ......................................................................Page 13 7. Glossary of Mortgage Terms .............................................................................Page 15 Your Step-by-Step Mortgage Guide your financial readiness. Or you can contact a Freddie Mac 1. Overview of the Borrower Help Center or Network which are trusted non- profit intermediaries with HUD-certified counselors on staff Mortgage Process that offer prepurchase homebuyer education as well as financial literacy using tools such as the Freddie Mac CreditSmart® curriculum to help achieve successful and Taking the Right Steps sustainable homeownership. Visit http://myhome.fred- diemac.com/resources/borrowerhelpcenters.html for a to Buy Your New Home directory and more information on their services. Next, Buying a home is an exciting experience, but it can be talk to a loan officer to review your income and expenses, one of the most challenging if you don’t understand which can be used to determine the type and amount of the mortgage process. -

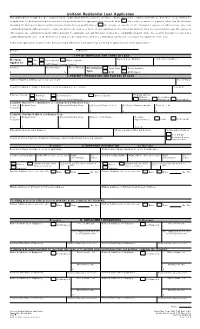

Sample Mortgage Application (PDF)

Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as "Borrower" or "Co-Borrower," as applicable. Co-Borrower information must also be provided (and the appropriate box checked) when the income or assets of a person other than the Borrower (including the Borrower's spouse) will be used as a basis for loan qualification or the income or assets of the Borrower's spouse or other person who has community property rights pursuant to state law will not be used as a basis for loan qualification, but his or her liabilities must be considered because the spouse or other person has community property rights pursuant to applicable law and Borrower resides in a community property state, the security property is located in a community property state, or the Borrower is relying on other property located in a community property state as a basis for repayment of the loan. If this is an application for joint credit, Borrower and Co-Borrower each agree that we intend to apply for joint credit (sign below): Borrower Co-Borrower I. TYPE OF MORTGAGE AND TERMS OF LOAN Agency Case Number Lender Case Number Mortgage VA Conventional Other (explain): Applied for: FHA USDA/Rural Housing Service Amount Interest Rate No. of Months Amortization Fixed Rate Other (explain): $%Type: GPM ARM (type): II. PROPERTY INFORMATION AND PURPOSE OF LOAN Subject Property Address (street, city, state & ZIP) No. of Units Legal Description of Subject Property (attach description if necessary) Year Built Purpose of Loan Purchase Construction Other (explain): Property will be: Primary Secondary Refinance Construction-Permanent Residence Residence Investment Complete this line if construction or construction-permanent loan. -

New Public Data Available on USDA Rural Housing Service's

Data Shop Data Shop, a department of Cityscape, presents short articles or notes on the uses of data in housing and urban research. Through this department, the Office of Policy Development and Research introduces readers to new and overlooked data sources and to improved techniques in using well-known data. The emphasis is on sources and methods that analysts can use in their own work. Researchers often run into knotty data problems involving data interpretation or manipulation that must be solved before a project can proceed, but they seldom get to focus in detail on the solutions to such problems. If you have an idea for an applied, data-centric note of no more than 3,000 words, please send a one-paragraph abstract to [email protected] for consideration. New Public Data Available on USDA Rural Housing Service’s Single-Family and Multifamily Programs Corianne Payton Scally Urban Institute David Lipsetz U.S. Department of Agriculture (former) Views and opinions expressed in this article are those of the authors and do not necessarily reflect the views and policies of the U.S. Department of Agriculture or the U.S. government. Abstract The Rural Housing Service (RHS) within the U.S. Department of Agriculture’s Rural Development agency has released a comprehensive set of public data on its direct and guaranteed loans across its single-family and multifamily housing program areas. These data are available for free download via a periodic release on data.gov and available to the public to map along with select public demographic, social, and eco- nomic variables compiled and maintained by PolicyMap. -

Group Coordinator Training Guide

Group Coordinator Training Guide GROUP COORDINATOR TRAINING GUIDE RURAL DEVELOPMENT SECTION 523 MUTUAL SELF-HELP HOUSING PROGRAM December 2002 Group Coordinator Training Guide A Guide for Grantees of the USDA Section 523 Self-Help Housing Program Developed jointly by the Self-Help Housing Technical and Management Assistance (T & MA) Contractors: Florida Non-Profit Housing, Inc. (FNPH) Little Dixie Community Action Agency, Inc. (LDCAA) National Council of Agricultural Life and Labor Research Fund, Inc. (NCALL) Rural Community Assistance Corporation (RCAC) Funded by: United States Department of Agriculture, Rural Development The work that provided the basis for this publication was supported by funding under an award with the U.S.D.A. Rural Development. The substance and findings of the work are dedicated to the public. The T & MA Contractors are solely responsible for the accuracy of the statements and interpretations contained in this publication. Such interpretations do not necessarily reflect the views of the Government. Published in 2002 by the T & MA Contractors this guide is designed to provide accurate and authoritative information in regard to the subject matter covered. It is distributed with the understanding that the authors are not engaged in rendering legal, accounting, or other professional services. If legal or other expert assistance is required, the services of a competent professional person should be sought. All rights reserved. The text of this publication, or any part thereof, may not be reproduced in any manner whatsoever without written permission from the T & MA Contractors. If you wish to make or distribute copies, please write a letter indicating the number of copies that you wish to make or distribute, the size and type of audience to whom you wish to distribute, and the type of organization or agency that you are. -

FICO Mortgage Credit Risk Managers Handbook

FICO Mortgage Credit Risk Manager’s Best Practices Handbook Craig Focardi Senior Research Director Consumer Lending, TowerGroup September 2009 Executive Summary The mortgage credit and liquidity crisis has triggered a downward spiral of job losses, declining home prices, and rising mortgage delinquencies and foreclosures. The residential mortgage lending industry faces intense pressures. Mortgage servicers must better manage the rising tide of defaults and return financial institutions to profitability while responding quickly to increased internal, regulatory, and investor reporting requirements. These circumstances have moved management of mortgage credit risk from backstage to center stage. The risk management function cuts across the loan origination, collections, and portfolio risk management departments and is now a focus in mortgage servicers’ strategic planning, financial management, and lending operations. The imperative for strategic focus on credit risk management as well as information technology (IT) resource allocation to this function may seem obvious today. However, as recently as June 2007, mortgage lenders continued to originate subprime and other risky mortgages while investing little in new mortgage collections and infrastructure, technology, and training for mortgage portfolio management. Moreover, survey results presented in this Handbook reveal that although many mortgage servicers have increased mortgage collections and loss mitigation staffing, few servicers have invested sufficiently in data management, predictive analytics, scoring and reporting technology to identify the borrowers most at risk, implement appropriate treatments for different customer segments, and reduce mortgage re-defaults and foreclosures. The content of this Handbook is based on a survey that FICO, a leader in decision management, analytics, and scoring, commissioned from TowerGroup, a leading research and advisory firm focusing on the strategic application of technology in financial services. -

Wic, Medicaid, and Snap: Teaming up to Improve the Health of Women and Children

WIC, MEDICAID, AND SNAP: TEAMING UP TO IMPROVE THE HEALTH OF WOMEN AND CHILDREN THE IMPORTANCE OF THE IMPORTANCE NWA’S MISSION MEDICAID FOR WIC OF SNAP FOR WIC PARTICIPANTS PARTICIPANTS The National The vast majority of WIC participants WIC benefits are not meant to cover WIC Association rely on Medicaid and/or the Children’s a full grocery basket of food each (NWA) provides its Health Insurance Program (CHIP)— month. Instead, targeted foods members with tools which provides coverage to uninsured address nutritional gaps in the diets of and leadership to children who are not eligible for pregnant women, new mothers, and expand and sustain Medicaid, but cannot afford private young children, For families lacking effective nutrition insurance—for healthcare coverage.3 resources to afford foods beyond the services for In addition to covering nearly half scope of WIC, SNAP plays a vital role. mothers and young of all births in the US, Medicaid A large body of research demonstrates children. provides a range of prenatal and that SNAP reduces the number of postpartum services that are key households facing food insecurity.7 8 to improving outcomes for WIC This is particularly true of households mothers and babies during these with children, with conservative vital periods.4 Most states’ Medicaid estimates attributing a reduction in OVERVIEW OF WIC programs cover access to prenatal childhood food insecurity of at least The Special Supplemental Nutrition vitamins, ultrasounds, amniocentesis, 8.1% to SNAP.9 Other studies assert Program for Women, Infants, and chorionic villus sampling (CVS) tests, that a mere six months of participation Children (WIC), the nation’s premier genetic counseling, breast pumps, in SNAP reduces the likelihood of public health nutrition program, has and postpartum home visiting.5 This food insecurity by one-third compared improved the health of women, infants, coverage plays a critical role in to similarly situated households.10 and children for 46 years.