FINAL Oregon Capital Scan 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Real Estate Crowdfunding – Modern Trend Or Restructured Investment Model?: Have the SEC’S Proposed Rules on Crowdfunding Created a Closed-Market System?

The Journal of Business, Entrepreneurship & the Law Volume 9 Issue 1 Article 2 4-1-2016 Real Estate Crowdfunding – Modern Trend or Restructured Investment Model?: Have the SEC’s Proposed Rules on Crowdfunding Created a Closed-market System? Cory Baker Follow this and additional works at: https://digitalcommons.pepperdine.edu/jbel Part of the Property Law and Real Estate Commons, and the Securities Law Commons Recommended Citation Cory Baker, Real Estate Crowdfunding – Modern Trend or Restructured Investment Model?: Have the SEC’s Proposed Rules on Crowdfunding Created a Closed-market System?, 9 J. Bus. Entrepreneurship & L. 21 (2016) Available at: https://digitalcommons.pepperdine.edu/jbel/vol9/iss1/2 This Comment is brought to you for free and open access by the Caruso School of Law at Pepperdine Digital Commons. It has been accepted for inclusion in The Journal of Business, Entrepreneurship & the Law by an authorized editor of Pepperdine Digital Commons. For more information, please contact [email protected], [email protected], [email protected]. REAL ESTATE CROWDFUNDING – MODERN TREND OR RESTRUCTURED INVESTMENT MODEL?: HAVE THE SEC’S PROPOSED RULES ON CROWDFUNDING CREATED A CLOSED- MARKET SYSTEM? 1 CORY BAKER Abstract ............................................................................................................. 22 I. Introduction ................................................................................................... 22 A. What is Crowdfunding? ...................................................................... -

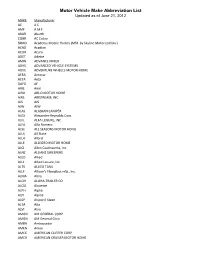

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

Equity Crowdfunding: a Market for Lemons? Darian M

College of William & Mary Law School William & Mary Law School Scholarship Repository Faculty Publications Faculty and Deans 2015 Equity Crowdfunding: A Market for Lemons? Darian M. Ibrahim William & Mary Law School, [email protected] Repository Citation Ibrahim, Darian M., "Equity Crowdfunding: A Market for Lemons?" (2015). Faculty Publications. 1792. https://scholarship.law.wm.edu/facpubs/1792 Copyright c 2015 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. https://scholarship.law.wm.edu/facpubs IBRAHIM_4fmt 1/3/2016 1:00 PM Article Equity Crowdfunding: A Market for Lemons? Darian M. Ibrahim† INTRODUCTION Everything is online now—the way we connect with others, the way we shop, even some forms of education. We keep up with friends on Facebook we cannot see in person, buy light bulbs from Amazon rather than making a trip to the hardware store,1 and obtain an MBA at night on our computers from the comfort of our own home after the kids have gone to bed.2 One area that has initially resisted the move to cyberspace, howev- er—eschewing the virtual world for the real one—is entrepre- neurial finance. Venture capitalists (VCs) and angel investors have long valued close networks and personal relationships when select- ing which entrepreneurs to fund, and they closely monitor their investments in person after they fund.3 These practices lead to intense locality in funding—i.e., investors funding entrepre- † Professor of Law, William & Mary Law School. My thanks to Brian Broughman, Joan Heminway, Don Langevoort, Alan Meese, Nate Oman, Ja- son Parsont, Gordon Smith, participants in a faculty workshop at Washington & Lee for helpful feedback on this Article. -

Chargedevs.Com Electric Vehicles Magazine

ELECTRIC VEHICLES MAGAZINE CHARGEDEVS.COM 2014 MEDIA KIT v1402 ISENTROPIC MEDIA ELECTRIC VEHICLES MAGAZINE EVs are here. Try to keep up. Industry activity and public interest in electric vehicles are at an all-time high, and we are dedicated to help bring EVs to prime time. Charged is a mirror for the EV industry, shining a light on the good ideas and innovators where we can find them, in our best effort to help connect the dots. Editorial Overview: Charged splits industry coverage into three categories: The Vehicles - In-depth features highlighting auto maker electrification strategies, fleet options, well-suited EV niches, racing, and other marketing efforts. The Tech - A closer look at pushing the limits of EVs through the beauty of well-engineered products - batteries, power electronics, and other EV-optimized automotive systems. The Infrastructure - Charging at home, at work, in public, and the implications for the utilities. Frequency: 6x Distribution: Charged is distributed to over 12,000 qualified subscribers. Hard copies are mailed direct to subscribers in North America and distributed at all of the leading industry events. International readers receive the popular digital edition, averaging over 78,000 views per issue. (All the digital issues, with current view counts, can be found at issuu.com/chargedevs/docs) Readership: Charged qualified subscribers are key decision makers throughout the electric vehicle industry, from small start-ups to the biggest automakers, independent design firms to Tier One suppliers, government officials -

Restaurant Finance Monitor

RESTAURANT FINANCE MONITOR Volume 25, Number 11 • Restaurant Finance Monitor, 2808 Anthony Lane South, Minneapolis, MN 55418 • ISSN #1061-382X November 18, 2014 The Best Financing Ideas of 2014 Private Equity’s Interest in Emerging Concepts In 2014, PE groups showed significant interest in emerging By Dennis L. Monroe concepts. Buffalo Wild Wings stepped into this world again 2014 was an exciting year: Financing not only continued to be and acquired Rusty Taco. Sentinel Capital Partners bought available, but we saw several new and innovative approaches. Newk’s—both deals show PE’s interest in smaller, emerging Here are my thoughts on the best financing ideas of 2014: concepts. Private equity is creating its own deals by acquiring Effective Use of IPOs operating companies and serving as the primary operator. I We’ve seen a number of significant restaurant IPOs in 2014: see no end in sight for PE funding emerging concepts. Potbelly, Zoe’s Kitchen and Papa Murphy’s. Much was spurred EB-5 Funding Stepping up to Its Next Level by strong valuations and the market accepting smaller IPOs; EB-5 funding has evolved into the mainstream. This year private equity groups seeking to exit their investments; and LCR Capital Partners launched an EB-5 project dedicated certain changes in the securities laws that made smaller to the franchise sector. This looks much like a favorable loan IPOs more accessible, less complicated and requiring less program and seems to fit the needs of our industry. Individual filing. I think the trend of smaller IPOs will continue in EB-5 funding through various kinds of intermediaries also 2015. -

Commissioners Keith Heck, Cherryl Walker, and Simon G. Hare; Linda Mcelmurry, Recorder Chair Keith Heck Called the Meeting to Order at 2:00 P.M

APPROVED ON FEBRUARY25, 2015 BY THE BOARD OF COUNTY COMMISSIONERS AT THE WEEKLY BUSINESS SESSION General Discussion; February 12, 2015 2:00 p. m.— BCC Conference Room Commissioners Keith Heck, Cherryl Walker, and Simon G. Hare; Linda McElmurry, Recorder Chair Keith Heck called the meeting to order at 2:00 p.m. 1. Economic Development Recommendation/ Proposal Arthur O' Hare, Finance Director presented Exhibit A, Economic Development showing the updated figures for the Fund. He suggested the Board find ways to alleviate the pressure on the General Fund and consider using Economic Development funds to create a Community Development Director position when Dennis Lewis, Planning Director leaves so they can have someone to assist them. Commissioner Walker reviewed the information that she had provided to the Board, Exhibit B, Economic Development Recommendation. The packet outlined services and programs provided by SOREDI, IVCDO, and SBDC. She then reviewed her recommendations on spending Economic Development Funds. The Board agreed this was a great start. After some discussion, it was decided to bring it back on Tuesday during General Discussion. 2. Other( ORS 192.640( 1) ". notice shall include a list of the principal subjects anticipated to be considered at the meeting, but this requirement shall not limit the ability of a governing body to consider additional subjects.") The Board discussed the necessity of a Liaison for CASA, it was assigned to Commissioner Hare. The Board discussed the underground tanks at the Dimmick site, Commissioner Hare said Karen Homolac with Business Oregon is endeavoring to find funding for that project. Commissioner Heck let the Board know he has relayed their decision to Jack Swift regarding his request for a Resolution on the second amendment. -

Mv680491 Arizona Department of Transportation Mv579d Motor Vehicle Division 1801 West Jefferson Phoenix, Arizona 85001 December

MV680491 ARIZONA DEPARTMENT OF TRANSPORTATION MV579D MOTOR VEHICLE DIVISION 1801 WEST JEFFERSON PHOENIX, ARIZONA 85001 DECEMBER 2012 2012 LICENSED AUTOMOTIVE RECYCLER -- AR BROKER -- B DISTRIBUTOR -- DS MOBILE HOME DEALER FOR PLATES ONLY -- M MANUFACTURER -- MF NEW MOTOR VEHICLE DEALER -- N PUBLIC CONSIGNMENT -- PC TITLE SERVICE COMPANY -- TS USED MOTOR VEHICLE DEALER -- U WHOLESALE AUCTION DEALER -- WA - 1- LICENSE DEALERSHIP NAME AND ADDRESS PHONE NO EXP DATE PRODUCTS AUTHORIZED TO SELL _______ ___________________________ ________ __________ ___________________________ ------ AR ------ L00000021 A A A 20TH STREET AUTO WRECKING INC 6022582020 12/31/2013 (AR112) 3244 S 40TH ST PHOENIX AZ 850401623 L00000057 A A NATIONAL TOWING AUTO PARTS 6022725331 12/31/2012 (AR165) 3410 W WASHINGTON ST PHOENIX AZ 850094705 P O BOX 42321 PHOENIX AZ 85080 L00000175 A AND S AUTO WRECKING 6022439119 12/31/2012 (AR458) 2449 W BROADWAY RD PHOENIX AZ 850412003 L00000125 A C S AUTO WRECKING ** DBA: MUNCHINO INVESTMENT INC L00000302 A TO Z AUTO RECYCLER 6022721680 12/31/2012 (AR595) 2724 W BUCKEYE RD PHOENIX AZ 850095742 L00011804 A-ONE AUTO PARTS & RECYCLER ** DBA: A-ONE AUTO WRECKING LLC L00011804 A-ONE AUTO WRECKING LLC 4803322266 03/31/2013 3419 W WASHINGTON ST PHOENIX AZ 850094704 10221 N 60TH LN GLENDALE AZ 853021257 DBA: A-ONE AUTO PARTS & RECYCLER - 2- LICENSE DEALERSHIP NAME AND ADDRESS PHONE NO EXP DATE PRODUCTS AUTHORIZED TO SELL _______ ___________________________ ________ __________ ___________________________ ------ AR ------ L00010226 A-Z QUALITY -

Emerging Technologies and the Democratisation of Financial Services: a Metatriangulation of Crowdfunding Research

Information and Organization 26 (2016) 101–115 Contents lists available at ScienceDirect Information and Organization journal homepage: www.elsevier.com/locate/infoandorg Emerging technologies and the democratisation of financial services: A metatriangulation of crowdfunding research Rob Gleasure ⁎, Joseph Feller Cork University Business School, University College Cork, Ireland article info abstract Article history: Crowdfunding has grown quickly and attracted significant scholarly attention. However, the di- Received 28 January 2016 verse approaches to crowdfunding that have emerged, as well as the uncertain relationship of Received in revised form 7 September 2016 these approaches to the umbrella concept of crowdsourcing, means it is not clear to what ex- Accepted 7 September 2016 tent crowdfunding presents theoretically novel behaviours, nor what those behaviours may be. Available online xxxx This study addresses this lack of clarity through a metatriangulation of 120 peer-reviewed studies on crowdfunding. These studies are distributed across the four dominant categories Keywords: of crowdfunding, namely crowd lending, crowd equity, crowd patronage, and crowd charity. Crowdfunding Research for each category is analysed separately to determine the topics of interest, the dom- Crowdsourcing inant theoretical perspectives, the methods employed, and the typical focus of analysis. We Metatriangulation Financial services bridge these categories to identify three common variables relating to funding behaviours and three relating to impact. Of these, we argue that two are fundamentally novel and under-researched, namely the ‘erosion of organisations' financial boundaries’ and ‘paying to participate’. The implications of these findings are discussed for crowdfunding and crowdsourcing. © 2016 Elsevier Ltd. All rights reserved. 1. Introduction The nature of work, creativity, and innovation has been challenged in recent years with the arrival of the related concepts of peer production (cf. -

PLUG-IN ELECTRIC VEHICLE DEPLOYMENT in the NORTHEAST a Market Overview and Literature Review

PLUG-IN ELECTRIC VEHICLE DEPLOYMENT IN THE NORTHEAST A Market Overview and Literature Review By Charles Zhu and Nick Nigro Center for Climate and Energy Solutions (C2ES) Prepared for the Transportation and Climate Initiative, Georgetown Climate Center, and New York State Energy Research and Development Authority Funded by the U.S. Department of Energy September 2012 NOTICE This material is based upon work supported by the Department of Energy under Award Number #DE-‐EE0005586. This report was prepared as an account of work sponsored by an agency of the United States Government, the New York State Energy Research and Development Authority, and the State of New York. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States Government or any agency thereof. The views and opinions of authors expressed herein do notessarily nec state or reflect those of the United States Government or any agency thereof. Information and documents published under the name of the Transportation and Climate Initiative (TCI) represent work produced in support of the TCI or its projects. TCI materials do not necessarily reflect the positions of individual jurisdictions or agencies unless explicitly stated. -

Child Seats: Equipment: Safety Defect/Noncompliance Notices Received During May 2013

SAFETY DEFECT/NONCOMPLIANCE NOTICES RECEIVED DURING MAY 2013 Published June 11, 2013 CHILD SEATS: None during May 2013. EQUIPMENT: Koni North America (KONI) is recalling certain shock absorbers with model numbers 8245-1146L, 8245- 1146R, 8245-1201L, 8245-1201R, 8245-1203L, and 8245-1203R. These shock absorbers were manufactured January 2008 through April 2013. The affected absorbers were manufactured with an incorrectly welded bracket which may cause the shock absorber to bend and rest on the drive shaft. A bent shock absorber may compromise vehicle handling, increasing the risk of a crash. KONI will notify distributors and advise them to contact their customers of the recall. The shock absorbers will be replaced free of charge. The recall began on May 16, 2013. Customers may contact KONI at 1-800-209-3350. 13E-023 Dorman is recalling certain master cylinders, model number M630274-BX, manufactured by Bosch. The brake fluid level indicator (FLI) may not properly detect a low brake fluid level situation and warn the driver. If the brake system develops an external leak, it may result in a loss of brake fluid below the detection level of the fluid indicator switch. Without a warning, the driver may be unaware that the brake fluid level is low. A low brake fluid level may reduce the available braking force which could lengthen the required stopping distance and increase the risk of a crash. Dorman will notify owners and Bosch will replace the fluid level indicator switch free of charge. The recall is expected to begin during June 2013. Owners may contact Dorman Customer Service at 1-800-523-2492. -

Harley-Davidson, Inc. (Exact Name of Registrant As Specified in Its Charter) Wisconsin 39-1382325 (State of Organization) (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 27, 2020 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-9183 Harley-Davidson, Inc. (Exact name of registrant as specified in its charter) Wisconsin 39-1382325 (State of organization) (I.R.S. Employer Identification No.) 3700 West Juneau Avenue Milwaukee Wisconsin 53208 (Address of principal executive offices) (Zip code) Registrant's telephone number, including area code: (414) 342-4680 None (Former name, former address and former fiscal year, if changed since last report) Securities Registered Pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common Stock Par Value $.01 PER SHARE HOG New York Stock Exchange Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

View the Fund Wisdom Research Reports Produced Yearly And

Index About Highlights How Much is Getting Invested over Time Live Investment Options Top Deals Top Valuations Platforms Geographic Review Platforms Determining which Platform to List with Capital Type Industry 1 About Data: Mostly generally solicited offerings of startups raising their seed round 198 Offerings listed between 1/1/14 - 12/31/14 with $227MM invested of the 948 total offerings and $385,175,128 Raised to Date. Sources: AngelList, SeedInvest, WeFunder, Onevest, Fundable, EquityNet, Return On Change, CrowdFunder, and EarlyShares, AGfunder Conversations with founders of firms listing their offerings. Highlights AngelList, leading platform for online equity offerings and amount raised Companies are using equity funding platforms as a marketing channel while the majority of the money being invested is still happening offline. Online Equity Investing figures are a fraction of what is publicly disclosed due to lack of regulation on how to classify the round. The Infor mation Technology sector captured the most investment dollars. California had the most offerings, capturing the greatest investment amount. 53 offerings were fully funded A close split of firms offered equity vs. convertible debt. 2 How Much is Getting Invested over Time ? 2014 Investment Trends First spike: $50 million for Life360, of which only 1% was transacted through AngelList Second spike: $17 million Real estate fund, $0 transacted through EquityNet Note: Companies are using equity funding platforms as a marketing channel while the majority of the money being invested is still happening offline. Live Investment Options 239 total offerings available to invest in online as of Dec 31. 2014 3 Top Deals - Successful Companies Raising Money Top Funded Firms 2014 4 Top Valuations - Successful Entrepreneurs Top 6 Valuations from Firms Raising 2014 5 Platforms Platform Market Share by Share by Amount Funded 2014 Deals Funded 2014 Several companies have listed on multiple platforms.