Semi-Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 12945-20 Date: February 10, 2020 To: All Participants Category: Dividends | International From: Global Tax Services Attention: Managing Partner/Officer, Cashier, Dividend Mgr., Tax Mgr. BNY Mellon | ADRs | Qualified Dividends for Tax Year 2019 Subject: Bank of New York Mellon Corporation (“BNYM”), as depositary for these issues listed below has reviewed and determined if they met the criteria for reduced U.S. tax rate as “qualified dividends” for tax year 2019. The Depository Trust Company received the attached correspondence containing Tax Information. If applicable, please consult your tax advisor to ensure proper treatment of these events. Non-Confidential DTCC Public (White) 2019 DIVIDEND CERTIFICATION CUSIP DR Name Country Exchange Qualified 000304105 AAC TECHNOLOGIES HLDGS INC CAYMAN ISLANDS OTC N 000380105 ABCAM PLC UNITED KINGDOM OTC Y 001201102 AGL ENERGY LTD AUSTRALIA OTC Y 001317205 AIA GROUP LTD HONG KONG OTC N 002482107 A2A SPA ITALY OTC Y 003381100 ABERTIS INFRAESTRUCTURAS S A SPAIN OTC Y 003725306 ABOITIZ EQUITY VENTURES INC PHILIPPINES OTC Y 003730108 ABOITIZ PWR CORP PHILIPPINES OTC Y 004563102 ACKERMANS & VAN HAAREN BELGIUM OTC Y 004845202 ACOM CO. JAPAN OTC Y 006754204 ADECCO GROUP AG SWITZERLAND OTC Y 007192107 ADMIRAL GROUP UNITED KINGDOM OTC Y 007627102 AEON CO LTD JAPAN OTC Y 008712200 AIDA ENGR LTD JAPAN OTC Y 009126202 AIR LIQUIDE FRANCE OTC Y 009279100 AIRBUS SE NETHERLANDS OTC Y 009707100 AJINOMOTO INC JAPAN OTC Y 015096209 ALEXANDRIA MINERAL - REG. S EGYPT None N 015393101 ALFA LAVAL AB SWEDEN SWEDEN OTC Y 021090204 ALPS ELEC LTD JAPAN OTC Y 021244207 ALSTOM FRANCE OTC Y 022205108 ALUMINA LTD AUSTRALIA OTC Y 022631204 AMADA HLDGS CO LTD JAPAN OTC Y 023511207 AMER GROUP HOLDING - REG. -

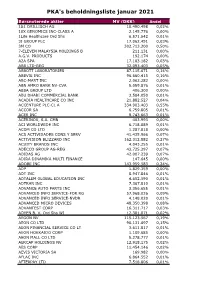

PKA's Beholdningsliste Januar 2021

PKA's beholdningsliste januar 2021 Børsnoterede aktier MV (DKK) Andel 1&1 DRILLISCH AG 10.490.498 0,02% 10X GENOMICS INC-CLASS A 2.145.776 0,00% 1Life Healthcare Ord Shs 6.571.542 0,01% 3I GROUP PLC 17.062.491 0,03% 3M CO 302.713.200 0,50% 7-ELEVEN MALAYSIA HOLDINGS B 211.131 0,00% A.G.V. PRODUCTS 192.174 0,00% A2A SPA 17.183.182 0,03% ABB LTD-REG 32.093.403 0,05% ABBOTT LABORATORIES 87.115.671 0,14% ABBVIE INC 96.660.415 0,16% ABC-MART INC 2.062.282 0,00% ABN AMRO BANK NV-CVA 5.059.876 0,01% ABSA GROUP LTD 406.300 0,00% ABU DHABI COMMERCIAL BANK 3.584.050 0,01% ACADIA HEALTHCARE CO INC 21.882.527 0,04% ACCENTURE PLC-CL A 334.903.403 0,55% ACCOR SA 6.759.805 0,01% ACER INC 8.743.663 0,01% ACERINOX, S.A. CMN 403.993 0,00% ACI WORLDWIDE INC 6.718.889 0,01% ACOM CO LTD 1.287.818 0,00% ACS ACTIVIDADES CONS Y SERV 41.435.966 0,07% ACTIVISION BLIZZARD INC 162.312.882 0,27% ACUITY BRANDS INC 4.043.255 0,01% ADECCO GROUP AG-REG 43.725.297 0,07% ADIDAS AG 42.007.239 0,07% ADIRA DINAMIKA MULTI FINANCE 147.645 0,00% ADOBE INC 143.959.583 0,24% ADP 1.829.359 0,00% ADT INC 8.947.846 0,01% ADTALEM GLOBAL EDUCATION INC 4.652.590 0,01% ADTRAN INC 7.367.810 0,01% ADVANCE AUTO PARTS INC 3.356.655 0,01% ADVANCED INFO SERVICE-FOR RG 57.968.026 0,09% ADVANCED INFO SERVICE-NVDR 4.148.020 0,01% ADVANCED MICRO DEVICES 48.350.398 0,08% ADVANTEST CORP 16.311.717 0,03% ADYEN B. -

Putnam Panagora Market Neutral Fund Q3 Portfolio Holdings

Putnam PanAgora Market Neutral Fund The fund's portfolio 5/31/20 (Unaudited) INVESTMENT COMPANIES (46.1%)(a) Shares Value Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. 640 $3,635 State Street Institutional U.S. Government Money Market Fund 3,939,067 3,939,067 Total investment companies (cost $3,943,561) $3,942,702 UNITS (11.0%)(a) Units Value Acamar Partners Acquisition Corp.(NON) 419 $4,291 Alussa Energy Acquisition Corp. (Cayman Islands)(NON) 856 8,483 Amplitude Healthcare Acquisition Corp.(NON) 2,947 29,529 B. Riley Principal Merger Corp. II(NON) 2,620 26,174 CC Neuberger Principal Holdings I(NON) 2,652 27,024 Chardan Healthcare Acquisition 2 Corp.(NON) 2,652 26,493 CHP Merger Corp.(NON) 2,747 27,745 CIIG Merger Corp.(NON) 4,529 45,335 Collective Growth Corp.(NON) 2,803 27,890 DFP Healthcare Acquisitions Corp.(NON) 2,866 28,746 dMY Technology Group, Inc.(NON) 2,885 29,196 East Stone Acquisition Corp.(NON) 4,230 42,089 FinServ Acquisition Corp.(NON) 831 8,194 Foley Trasimene Acquisition Corp.(NON) 2,626 26,917 Fortress Value Acquisition Corp.(NON) 2,652 26,547 Galileo Acquisition Corp.(NON) 888 8,827 GigCapital3, Inc.(NON) 2,833 28,160 Gores Holdings IV, Inc.(NON) 1,306 13,844 Greenrose Acquisition Corp.(NON) 3,350 32,931 GX Acquisition Corp.(NON) 417 4,233 Healthcare Merger Corp.(NON) 2,705 28,105 InterPrivate Acquisition Corp.(NON) 2,918 29,180 Jaws Acquisition Corp.(NON) 2,620 27,038 Juniper Industrial Holdings, Inc.(NON) 841 8,418 Landcadia Holdings II, Inc.(NON) 1,165 12,174 LGL Systems Acquisition Corp.(NON) 2,568 25,629 Lifesci Acquisition Corp.(NON) 2,866 29,806 LIV Capital Acquisition Corp. -

About Oliver Wyman Oliver Wyman Is a Global Leader in Management Consulting

About Oliver Wyman Oliver Wyman is a global leader in management consulting. With offices in 50+ cities across 26 countries, Oliver Wyman combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. Our 4700+ professionals help clients optimize their business, improve their operations and risk profile, and accelerate their organizational performance to seize the most attractive opportunities. Oliver Wyman’s thought leadership is evident in our agenda- setting books, white papers, research reports, and articles in the business press. Our clients are the CEOs and executive teams of the top Global 1000 companies. Visit our website for more details about Oliver Wyman: www.oliverwyman.com Job specification Job title: Research Associate or Research Analyst (Health & Life Sciences) Department: Knowledge Services - Research Office/region: Singapore Reports to: Head of Asia Pacific Research Job Overview: Candidates with more relevant research experience may join as Research Analyst. For the Research Associate role, they are expected to have developed requisite research skills and knowledge of tools to provide research independently to consulting teams. The Research Associate role is expected to perform more independently, having stronger research skills, a better understanding of management consulting business context and project environment. Role is focused on building content knowledge for the Health & Life Sciences specialization. The development focus will be to begin creating compelling synthesized end products which include basic analyses. Key Responsibilities: Conducting accurate and timely research to serve the Health & Life Sciences practice group in Asia. Providing both quick solutions and in-depth research for the Health & Life Sciences practice group in Asia. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Making Convenience Safe and Secure

Making Convenience Safe and Secure Zwipe Full Year Report 2020 25 February 2021 | André Løvestam, CEO and Lars Kristian Solheim, CFO Zwipe is a biometric fintech company pioneering the next generation contactless payment experience ISO contact plate module Fingerprint sensor with biometric SE Passive inlay* Zwipe has the most widely piloted solutions in the biometric payment marketplace * A passive inlay has no components mounted on it, it only contains an antenna to do the energy harvesting and 2 communication lines to handle the encrypted communication between the sensor and the secure element. Strong operational momentum in 2020 and YTD 2021: Customers • 9 new customers: card manufacturers with a total 200 million payment cards shipped annually • Go-to-Market partnerships with TietoEvry, areeba, Inkript and Veritech Partnerships • Engaged with Idex to collaborate on Zwipe Pay ONE, as well as 4 other eco-system partners Technology • The Zwipe Pay ONE project has passed its most critical milestones and major risk points • The first two Zwipe Pay ONE pilots announced in the Nordics, with OP Bank in Finland and Vopy in Commercial Sweden piloting Zwipe Pay ONE from Q3 2021 • Zwipe and partners conducted several insights studies from the Nordics, UK and the United States showing Consumer insights strong consumer interest for safer and more secure payments with high willingness to pay Organization • Significantly strengthened the organization to meet the demand for our solutions Investor relations • Listed on Nasdaq First North Growth Market -

Tax Program06

MARCH 9, 2007 RONALD REAGAN BUILDING AND INTERNATIONAL TRADE CENTER 1300 PENNSYLVANIA AVENUE NW WASHINGTON, D.C. THE 31ST TaxTax LawLaw A NNUAL ConferenceConference Conference Highlights 2 Update from Capitol Hill on Tax Legislation 2 Critical Developments in: Benefits and Employment Taxes PCAOB and Tax Policy Domestic Corporate Tax Enforcement Financial Products Tax Accounting International Tax Tax Legislative Update Partnerships and Pass-Throughs Tax Practice and Procedure E Ethics (2 hours of CLE credit) f CL rs o rs Hou hou 7 ng 2 ludi edit 2 Featured Speakers inc s Cr thic of E Donald L. Korb IRS Chief Counsel Eileen J. O’Connor Assistant Attorney General, Tax Division, Department of Justice 2 Luncheon Speaker Eric Solomon Assistant Secretary (Tax Policy), Department of the Treasury (Invited) PRESENTED BY THE SECTION OF TAXATION OF THE FEDERAL BAR ASSOCIATION Friday, March 9, 2007 • Program Overview 7:30 a.m. Registration Desk Opens 8–8:10 a.m. Welcome: Nicole M. Bielawski, Section of Taxation Chair, Mayer, Brown, Rowe & Maw LLP 8:10–9 a.m. Tax Legislative Update Co-Chairs Teresa Trissell, American Petroleum Institute Floyd L. Williams, IRS Office of Legislative Affairs (Moderator) Panelists Thomas Barthold, Acting Chief of Staff, Joint Committee on Taxation John Buckley, Democratic Chief Tax Counsel, House Committee on Ways and Means Chris Giosa, Republican Chief Economist, House Committee on Ways and Means Patrick Heck, Democratic Chief Tax Counsel, Senate Committee on Finance Mark Prater, Republican Chief Tax Counsel, Senate Committee on Finance 9–9:30 a.m. Distinguished Speaker: Donald L. Korb, IRS Chief Counsel Introduction: Thomas J. -

Spark Capital Technology Newsletter

INVESTMENT BANKING NEWSLETTER TECHNOLOGY APRIL 2018 FROM THE DIRECTOR’S DESK Dear Reader, Welcome to the eleventh edition of the monthly Technology Newsletter from Spark Capital. With this newsletter, we have tried to give you a flavour of various updates across the Software, Tech Services, Internet, and FinTech sectors. India’s consumer internet industry is undergoing tremendous innovations. Increasing internet penetration and digitization are changing the paradigm of consumer internet. Saavn’s sale to JioMusic could be a key step in the evolution of consumer internet industry in India. The deal proves that distribution, reach and large user bases aren’t the significant competitive moats (as they once were). JioMusic has levelled the playing field to such an extent that a new entrant has commanded twice the value of Saavn. The mobile user base is 15x larger than the PC world, hence the older competitive moats don’t work, the disruption cycles are so fast, that the competition in the consumer internet has never been fiercer. We are starting to see in some established categories with large numbers of entrants and few barriers to entry, where only price is the differentiator, that commodification is inexorable. If you are competing on price, at some point you will bottom out where you can no longer undercut. At that point, the business will begin to compete on service rather than customer acquisition, technology, category creation etc. Horizontal e-commerce has seen two clear leaders emerge which are Flipkart and Amazon respectively. We expect further consolidation among vertical players in grocery, food delivery, furniture. -

MAKING a DIFFERENCE in the MOMENTS THAT MATTER 2020 Annual Report Risk & Insurance Services Consulting

MAKING A DIFFERENCE IN THE MOMENTS THAT MATTER 2020 Annual Report Risk & Insurance Services Consulting Marsh Guy Carpenter Mercer Oliver Wyman Insurance Broking Reinsurance Health, Wealth Strategy, Economic & Risk Management & Capital Strategies & Career Consulting & Brand Consulting We are 76,000 colleagues in four global businesses united by a common purpose—to make a difference in the moments that matter. Three commitments unite us as we strive to live our purpose: SUCCEEDING TOGETHER. We are in business to expand what’s possible for our clients and each other. ACCELERATING IMPACT. We embrace change and create enduring client value. ADVANCING GOOD. We strive to serve the greater good. We work with our clients to enable enterprise around the world and secure better futures for all. TO OUR SHAREHOLDERS, COLLEAGUES AND CLIENTS, 2020 was a year when every moment mattered. Around the world, no organization was unaffected or unchanged as we all navigated the crisis of a global pandemic, a global economic crisis, another devastating year in a gathering climate crisis, and an overdue reckoning with race, equity and social justice. No one could plan for such a year, but looking back, our company was ready. 2 | Marsh McLennan 2020 Annual Report As we found smarter ways, every day, to accelerate impact for our clients, we did the same for our communities. From fundraising for medical workers, to mask-making, to one colleague who volunteered at night as an ambulance responder, we stood up for our communities when they needed it most. And we didn’t forget each other. Across our company, groups of supportive colleagues coalesced to help one another balance heightened professional and personal demands, organizing everything from online yoga 2020 was a crucible that brought out the best in classes to children’s reading programs. -

Leading Successfully in Turbulent Times a Guide to Robust Business Continuity Planning

Leading successfully in turbulent times A guide to robust business continuity planning kpmg.com/cn Contents Introduction 3 Business continuity checklist 4 Develop a robust cash management strategy 6 Build an agile and resilient operating model 8 Getting smart about tax 10 Be vigilant about employment matters 12 Pay attention to contracts and other legal obligations 14 About KPMG China 16 Contact us 18 2 Leading successfully in turbulent times © 2020 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. © 2020 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Leading successfully in turbulent times 3 Introduction In turbulent times, how can boards, senior management and risk managers safeguard the business and discover opportunities amid a crisis? Many businesses have contingency plans that were The current environment will test most businesses’ ability to developed with an eye on disruptions to the micro- operate and manage in a crisis. An effective response by a environment, such as power outages, inability of staff to company requires transparency, accountability and above reach their workplace, and the unavailability of machinery. all, strong leadership. Businesses need to be clear about However, such plans might not be adequate for the who is making the decisions, keeping the board regularly type of macro-environmental disruption we are currently informed, and maintaining the board’s independence. -

Healthcare Trust of America, Inc. CRA International, Inc

Vote Summary Report Date range covered: 07/01/2020 to 09/30/2020 Location(s): State of Connecticut Retirement Plans and Trust Funds (3879) Institution Account(s): All Institution Accounts Healthcare Trust of America, Inc. Meeting Date: 07/07/2020 Primary Security ID: 42225P501 Record Date: 04/15/2020 Meeting Type: Annual Shares Voted: 15,700 Vote Proposal Text Proponent Instruction Elect Director Scott D. Peters Mgmt Against Elect Director W. Bradley Blair, II Mgmt Against Elect Director Vicki U. Booth Mgmt Against Elect Director H. Lee Cooper Mgmt For Elect Director Warren D. Fix Mgmt For Elect Director Peter N. Foss Mgmt Against Elect Director Jay P. Leupp Mgmt For Elect Director Gary T. Wescombe Mgmt For Advisory Vote to Ratify Named Executive Mgmt For Officers' Compensation Ratify Deloitte & Touche LLP as Auditors Mgmt For CRA International, Inc. Meeting Date: 07/08/2020 Primary Security ID: 12618T105 Record Date: 05/14/2020 Meeting Type: Annual Shares Voted: 6,534 Vote Proposal Text Proponent Instruction Elect Director Richard D. Booth Mgmt For Elect Director William F. Concannon Mgmt Withhold Elect Director Christine R. Detrick Mgmt For Advisory Vote to Ratify Named Executive Mgmt For Officers' Compensation Ratify Grant Thornton LLP as Auditors Mgmt For Vote Summary Report Date range covered: 07/01/2020 to 09/30/2020 Location(s): State of Connecticut Retirement Plans and Trust Funds (3879) Institution Account(s): All Institution Accounts BioLife Solutions, Inc. Meeting Date: 07/09/2020 Primary Security ID: 09062W204 Record Date: 05/12/2020 Meeting Type: Annual Shares Voted: 7,100 Vote Proposal Text Proponent Instruction Elect Director Michael Rice Mgmt Withhold Elect Director Raymond W. -

Business Servicesservices

Q U A R T E RL Y DIALOGUE THIRD Q UA R T ER 2010 BusinessBusiness ServicesServices QUARTERLY INDUSTRYQUARTERLY UPDATE INDUSTRY | FOURTH UPDATE | FOURTH QUARTER QUARTER 201 201 44 After underperforming for much of 2014, the SCA Business Services Index outperformed the broader markets in Q4 2014, increasing by over 11.2 % compared to an increase of 5.8% for the S&P 500. Virtually all subsectors of the SCA Business Services Index outperformed the broader market as a result of consensus predictions of enhanced economic growth in the U.S. during 2015. In particular, the SCA Marketing Services sector (+29.6%), the SCA IT Consulting sector (+16.9%), and the SCA Professional Staffing sector (+11.6%) recorded significant growth. While the stock market was thriving, M&A activity slowed in the Business Services sector during Q4 2014 posting the fewest closed transactions of any quarter this year. However, the beginning of 2015 has already seen a number of high profile Business Services transactions announced, and we expect M&A activity in the sector to continue to accelerate throughout the year among both strategic and financial acquirers. Notable merger and acquisition transactions during the quarter include: AMN Healthcare Services Inc. (NYSE: AHS), the largest U.S. healthcare staffing firm, agreed to acquire Onward Healthcare, a leading provider pf Contents physician and nurse staffing, from Welsh Carson Anderson & Stowe for Market Overview 2 $82.5 million. Stock Performance 3 PT&C Forensic Consulting Services, P.A. acquired LWG Consulting, Inc. LWG Consulting, Inc. provides forensic engineering and recovery Industry Developments 4 solutions for the insurance, legal, and risk management industries in the Selected M&A Transactions 5 U.S.