2019 Annual Report / 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The 16Th Congress

CongressWatch Report No. 176 Report No. 176 17 June 2013 The 16th Congress In the Senate The 16th Congress will open on 22 July, the same day that President Benigno Aquino III delivers his fourth State-of-the-Nation Address (SONA). The Senate will likely have a complete roster for the first time since the 12th Congress. It may be recalled that during the 2001 elections, 13 senators were elected, with the last placer serving the unfinished term of Sen. Teofisto Guingona who was then appointed as vice president. The chamber had a full roll of 24 senators for only a year, due to the appointment of Sen. Blas Ople as Foreign Affairs Secretary on 23 July 2002, and due to the passing of Sen. Renato Cayetano on 25 June 2003. The 11th, 13th, 14th, and 15th Congresses did not have full membership, primarily because a senator did not complete the six-year term due to being elected to another post.1 In the 2013 midterm elections last May, all of the six senators seeking re-election made it to the top 12, while two were members of the House of Representatives in the 15th Congress. The twelve senators-elect are: SENATOR PARTY PREVIOUS POSITION 1. ANGARA, Juan Edgardo M. LDP Representative (Aurora, lone) 2. AQUINO, Paolo Benigno IV A. LP Former chairperson, National Youth Commission 3. BINAY-ANGELES, Nancy S. UNA 4. CAYETANO, Alan Peter S. NP Outgoing senator 5. EJERCITO, Joseph Victor G. UNA Representative (San Juan City, lone) 6. ESCUDERO, Francis Joseph G. Independent Outgoing senator 7. -

UAP District A5 (Report 09.2020)

UNITED ARCHITECTS OF THE PHILIPPINES The Integrated and Accredited Professional Organization of Architects UAP National Headquarters, 53 Scout Rallos Street, Quezon City, Philippines MONTHLY DISTRICT ACCOMPLISHMENT & ACTIVITY REPORT Regional District A5 MONTH OF SEPTEMBER, 2020 District Director ROGER M. VICTORINO, UAP Contact Numbers 0927.313.2145 DATE OCTOBER 01, 2020 Email Address [email protected] SUBMITTED DISTRICT COUNCIL ACTIVITIES UNDERTAKEN DURING THE MONTH Indicate your district activities undertaken during the month such as District Council Meeting, Attendance, Professional Development Seminars, Corporate Social Responsibility Initiatives, etc. ACTIVITY NO. 36 PRESENTATION OF PROPOSED BILLETING Title of Activity FACILITY FOR FRONTLINERS CSR PROJECT Date SPETEMBER 07, 2020 TO AFP/V. LUNA HOSPITAL Total Attendees 6 Venue V. LUNA HOSPITAL Objective of the Activity To present the UAP Bayanihang Arkitektura CR Project to AFP/ V. Luna Hospital. Council Type of Activity Seminar X Socio-Civic Others: Meeting Activity in line with 4Ps X Profession X Professional X Professional Organization X Professional Product Activity in support of the Good X X Noble Leadership Member First UAP corporate thrust Governance After the recent meeting with project proponents and stakeholders last August 20, 2020, the said project has gone to some revisions on the plans and adjustment taking into account the materials to be used. The National President, Ar. Renato Heray, Bayanihang Arkitektura Chair Ar. Juanito Sy and A5 District Director Ar. Roger Victorino then proceeded to present the UAP Bayanihang Arkitektura Project the Temporary Billeting Facility for Front-liners to AFP V. Luna Hospital, September 7, 2020 (Monday), 10am-11:30am. MONTHLY DISTRICT REPORT | This report can be viewed at the UAP Corporate Website www.united-architects.org Page 1 of 26 NP Heray and Chair Sy introduce the proposed project to the attendees of the meeting including Capt. -

Issue No. 3815 GUEST of HONOR and SPEAKER November 14

28 PROGRAM Official Newsletter of Rotary Club of Manila RCM’s 18th for Rotary Year 2019-2020 Thursday, November 14, 2019, 12:00 pm, Manila Polo Club, McKinley Room Officer-In-Charge/ Program Moderator : PP Benny Laguesma P R O G R A M T I M E T A B L E 11:00 AM Registration 12:15 PM Bell to be Rung: Members and Guests are requested to be seated Issuebalita No. 3815 November 14, 2019 12:20 PM Program Proper PP Benny Laguesma OIC/Moderator AVIATION INDUSTRY MAKES BIG IMPACT Call to Order Pres. Jackie Rodriguez ON PHILIPPINE ECONOMY Singing of the Philippine National Anthem RCM WF Music Chorale Invocator PP Jimmie Policarpio RCM Hymn/ Rotary Hymn RCM WF Music Chorale The Four (4) Way Test Credo All Rotarians 12:30 PM Introduction of Guests/Visiting Rotarians and Personalities STAR Rtn. Peri Resabal seated at the Presidential Table Welcome Song RCM WF Music Chorale 12:35 PM Maligayang Bati (RCM Birthday Celebrants) Nov. 19…PDG Vince Carlos Nov. 20…Rtn. Mon Ko Happy Birthday Song RCM WF Music Chorale GUEST OF HONOR AND SPEAKER 12:40 PM Induction of a New Member to the Rotary Club of Manila a) Brief Introduction of the Inductee SDG/Club Sec./DE/ Dir. Albert Alday Proposer Mr. Michael T. Macapagal (Filipino) Partner, Quisumbing Torres Classification: Law Practice-Construction Law Proposer: SDG/Club Secretary/DE/Dir. Albert Alday b) Charging of New Member PP Benny Laguesma Charging Officer c) Formal Induction Ceremony Pres. Jackie Rodriguez Inducting Officer Welcome Baby Rotarian Song RCM WF Music Chorale Hon. -

World Report 2019 Adventist Education Around the World

World Report 2019 Adventist Education Around the World General Conference of Seventh-day Adventists Department of Education December 31, 2019 Table of Contents World Reports ..................................................................................................................................................................................................................... 5 List of Acronyms and Abbreviations ....................................................................................................................................................................... 6 List of Basic School Type Definitions ...................................................................................................................................................................... 7 World Summary of Schools, Teachers, and Students ............................................................................................................................................. 8 World Summary of School Statistics....................................................................................................................................................................... 9 Division Reports ................................................................................................................................................................................................................. 10 East-Central Africa Division (ECD) ....................................................................................................................................................................... -

Servant Leadership, Sacrificial Service

INTERNATIONAL CONFERENCE FOR COLLEGE & UNIVERSITY PRESIDENTS Servant Leadership, Sacrificial Service March 24-27, 2014 Washington DC General Conference Department of Education AEO-PresidentsConferenceProgram.indd 1 3/19/14 2:24 PM Monday March 24, 2014 Time Presentation/Activity Presenter/Responsible Venue 16:30-18:00 Arrival, Registration Education Department GC Lobby 18:00-19:00 Welcome Reception Education Department GC Atrium 19:00-20:00 Showcase Divisions Auditorium Those requiring translation to Spanish, Portuguese or Russian may check out a radio at registration. Tuesday March 25, 2014 Time Presentation/Activity Presenter/Responsible Venue Dick Barron 08:00 – 09:00 Week of Prayer Auditorium Prayer: Stephen Currow 09:00 – 09:30 Welcome and Introductions Lisa Beardsley-Hardy Auditorium George R. Knight 09:30 – 10:30 Philosophy of Adventist Education Auditorium Coordinator: Lisa Beardsley-Hardy 10:30 – 10:45 Break Auditorium Ted Wilson 10:45 – 11:45 Role of Education in Church Mission Auditorium Coordinator: Ella Simmons 11:45 – 13:00 Lunch All GC Cafeteria Humberto Rasi 13:00 – 14:00 Trends in Adventist Education Auditorium Coordinator: John Fowler Gordon Bietz 14:00 – 15:15 Biblical Foundations of Servant Leadership Auditorium Coordinator: John Wesley Taylor V Panel: Susana Schulz, Norman Knight *14:00 – 15:15 Role of President’s Spouse 2 I-18 Demetra Andreasen, & Yetunde Makinde 15:15 – 15:30 Break Auditorium Panel, Discussion: Niels-Erik Andreasen, 15:30 – 16:30 Experiences and Expectations Juan Choque, Sang Lae Kim, Stephen Guptill, -

MANILA Licensure Examination for CERTIFIED PUBLIC ACCOUNTANT May 13, 20 & 21, 2018

Page 1 Professional Regulation Commission MANILA Licensure Examination for CERTIFIED PUBLIC ACCOUNTANT May 13, 20 & 21, 2018 School : LA CONSOLACION COLLEGE Building : ADMINISTRATION Address : MENDIOLA ST., MANILA Floor : 1ST Room / Grp No. : 118 Seat School Attended NO. Last Name First Name Middle Name 1 ABACAN RYANDYL GUTIERREZ MANILA ADVENTIST COLLEGE (FOR MLA 2 ABACIAL NEIL FRANCIS GABRONINO N.C.B.A.-FAIRVIEW, QC 3 ABAD KIMBERLY YAP C.L.S.U. 4 ABAD RESHELLE PAULINE FARMA CAVITE S.U.-INDANG 5 ABAD REYMART MANGOBA NATIONAL UNIV-MANILA 6 ABADIA IVANH DINIELLE YBAÑEZ LA SALLE COLL.-ANTIPOLO 7 ABADIANO AIRA BANGUD P.U.P.-STA. MESA 8 ABADICIO CITADEL CALUPIG M.S.ENVERGA U-LUCENA 9 ABAIGAR JOSANNA CORDOVA ST.MARY'S COLL. OF CATBALOGAN 10 ABAJA MIRAJEAN ARGAMOSA P.U.P.-LOPEZ 11 ABALAYAN JULIUS ALONZO P.S.B.A.-Q.C. 12 ABALOS ANNA ROSE VILLAPANIA SYSTEMS P.C.F.-ANGELES CITY 13 ABALOS MA ANGELIQUE CALDERON LYCEUM OF APARRI 14 ABALOS MARIA CONSUELO VILLAFRANCA LYCEUM P.U.-MANILA 15 ABALUS DESHELIE TOMAS ST.MARY'S UNIV-BAYOMBONG 16 ABAN REGINALD DANIEL AGUIRRE P.L. MANILA 17 ABANDO CHRISTIAN MACARAEG COL DE DAGUPAN(for.COMPUTRONIX) 18 ABANGON SALMA GAMOR ABE ICBE-LAS PIÑAS 19 ABANILLA MARY ANN NADINE MAGDALUYO SAINT PAUL SCHOOL OF 20 ABANTE JANE ANGELA DILIM ST.LOUIS UNIV. 21 ABARA JESS ANTHONY SANTIAGO N.C.B.A.-CUBAO, QC REMARKS : USE SAME NAME IN ALL EXAMINATION FORMS. IF THERE IS AN ERROR IN SPELLING, DATE OF BIRTH, SCHOOL NAME, APPLIC NO. PLEASE REPORT TO THE APPLICATION DIV. -

Visual Foxpro

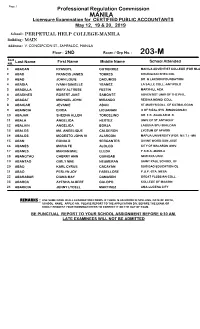

Page 1 Professional Regulation Commission MANILA Licensure Examination for CERTIFIED PUBLIC ACCOUNTANTS May 12, 19 & 20, 2019 School : PERPETUAL HELP COLLEGE-MANILA Building : MAIN Address : V. CONCEPCION ST., SAMPALOC, MANILA Floor : 2ND Room / Grp No. : 203-M Seat School Attended NO. Last Name First Name Middle Name 1 ABACAN RYANDYL GUTIERREZ MANILA ADVENTIST COLLEGE (FOR MLA 2 ABAD FRANCIS JAMES TORRES CHIANG KAI SHEK COL 3 ABAD JOHN LOUIE DACUMOS DR. G.LACSON FOUNDATION 4 ABADIA IVANH DINIELLE YBANEZ LA SALLE COLL.-ANTIPOLO 5 ABADILLA MARY ALTRESE FESTIN MARYHILL ACA. 6 ABADINES ROBERT JAKE SAMONTE ADVENTIST UNIV OF THE PHIL. 7 ABAGAT MICHAEL JOHN MIRANDO REGINA MONDI COLL. 8 ABAIGAR JEVANIE ABAN ST.MARY'S COLL. OF CATBALOGAN 9 ABAINCIA ERICA LICUANAN U OF RIZAL SYS.-BINANGONAN 10 ABAJAR SHEENA ALLEN TORCELINO DR. F.C. AGUILAR M. C. 11 ABALA ANGELICA HERTEZ UNIV.OF ST.ANTHONY 12 ABALAIN ANGELICA BORJA LAGUNA SPU-SINILOAN 13 ABALOS MA. ANGELIQUE CALDERON LYCEUM OF APARRI 14 ABALOS MODESTO JOHN III ALARCON MAPUA UNIVERSITY (FOR. M.I.T.) - MA 15 ABAN RONALD SERGANTES DIVINE WORD-SAN JOSE 16 ABANES MARIA FE ALOLOD CITY OF MALABON UNIV. 17 ABANES MARIAN MAE ELEDA P.S.B.A.-MANILA 18 ABANGTAO CHERRY ANN GUINGAB NEW ERA UNIV. 19 ABANTAO GIRLY MAE NEUMERAN SAINT PAUL SCHOOL OF 20 ABAO KARL CYRUS CACAYAN SURIGAO EDUCATION CE 21 ABAO PERLYN JOY FABELLORE P.U.P.-STA. MESA 22 ABARABAR DIANA MAY DAMASEN GREAT PLEBEIAN COLL. 23 ABARCA AYESHA ALBERT GALOPO COLLEGE OF MAASIN 24 ABARICIA JENNY LYCELL MARTINEZ AMA-LUCENA CITY REMARKS : USE SAME NAME IN ALL EXAMINATION FORMS. -

Papal Visit Philippines 2014 and 2015 2014

This event is dedicated to the Filipino People on the occasion of the five- day pastoral and state visit of Pope Francis here in the Philippines on October 23 to 27, 2014 part of 22- day Asian and Oceanian tour from October 22 to November 13, 2014. Papal Visit Philippines 2014 and 2015 ―Mercy and Compassion‖ a Papal Visit Philippines 2014 and 2015 2014 Contents About the project ............................................................................................... 2 About the Theme of the Apostolic Visit: ‗Mercy and Compassion‘.................................. 4 History of Jesus is Lord Church Worldwide.............................................................................. 6 Executive Branch of the Philippines ....................................................................... 15 Presidents of the Republic of the Philippines ....................................................................... 15 Vice Presidents of the Republic of the Philippines .............................................................. 16 Speaker of the House of Representatives of the Philippines ............................................ 16 Presidents of the Senate of the Philippines .......................................................................... 17 Chief Justice of the Supreme Court of the Philippines ...................................................... 17 Leaders of the Roman Catholic Church ................................................................ 18 Pope (Roman Catholic Bishop of Rome and Worldwide Leader of Roman -

Private Higher Education Institutions Faculty-Student Ratio: AY 2017-18

Table 11. Private Higher Education Institutions Faculty-Student Ratio: AY 2017-18 Number of Number of Faculty/ Region Name of Private Higher Education Institution Students Faculty Student Ratio 01 - Ilocos Region The Adelphi College 434 27 1:16 Malasiqui Agno Valley College 565 29 1:19 Asbury College 401 21 1:19 Asiacareer College Foundation 116 16 1:7 Bacarra Medical Center School of Midwifery 24 10 1:2 CICOSAT Colleges 657 41 1:16 Colegio de Dagupan 4,037 72 1:56 Dagupan Colleges Foundation 72 20 1:4 Data Center College of the Philippines of Laoag City 1,280 47 1:27 Divine Word College of Laoag 1,567 91 1:17 Divine Word College of Urdaneta 40 11 1:4 Divine Word College of Vigan 415 49 1:8 The Great Plebeian College 450 42 1:11 Lorma Colleges 2,337 125 1:19 Luna Colleges 1,755 21 1:84 University of Luzon 4,938 180 1:27 Lyceum Northern Luzon 1,271 52 1:24 Mary Help of Christians College Seminary 45 18 1:3 Northern Christian College 541 59 1:9 Northern Luzon Adventist College 480 49 1:10 Northern Philippines College for Maritime, Science and Technology 1,610 47 1:34 Northwestern University 3,332 152 1:22 Osias Educational Foundation 383 15 1:26 Palaris College 271 27 1:10 Page 1 of 65 Number of Number of Faculty/ Region Name of Private Higher Education Institution Students Faculty Student Ratio Panpacific University North Philippines-Urdaneta City 1,842 56 1:33 Pangasinan Merchant Marine Academy 2,356 25 1:94 Perpetual Help College of Pangasinan 642 40 1:16 Polytechnic College of La union 1,101 46 1:24 Philippine College of Science and Technology 1,745 85 1:21 PIMSAT Colleges-Dagupan 1,511 40 1:38 Saint Columban's College 90 11 1:8 Saint Louis College-City of San Fernando 3,385 132 1:26 Saint Mary's College Sta. -

The Philippines Illustrated

The Philippines Illustrated A Visitors Guide & Fact Book By Graham Winter of www.philippineholiday.com Fig.1 & Fig 2. Apulit Island Beach, Palawan All photographs were taken by & are the property of the Author Images of Flower Island, Kubo Sa Dagat, Pandan Island & Fantasy Place supplied courtesy of the owners. CHAPTERS 1) History of The Philippines 2) Fast Facts: Politics & Political Parties Economy Trade & Business General Facts Tourist Information Social Statistics Population & People 3) Guide to the Regions 4) Cities Guide 5) Destinations Guide 6) Guide to The Best Tours 7) Hotels, accommodation & where to stay 8) Philippines Scuba Diving & Snorkelling. PADI Diving Courses 9) Art & Artists, Cultural Life & Museums 10) What to See, What to Do, Festival Calendar Shopping 11) Bars & Restaurants Guide. Filipino Cuisine Guide 12) Getting there & getting around 13) Guide to Girls 14) Scams, Cons & Rip-Offs 15) How to avoid petty crime 16) How to stay healthy. How to stay sane 17) Do’s & Don’ts 18) How to Get a Free Holiday 19) Essential items to bring with you. Advice to British Passport Holders 20) Volcanoes, Earthquakes, Disasters & The Dona Paz Incident 21) Residency, Retirement, Working & Doing Business, Property 22) Terrorism & Crime 23) Links 24) English-Tagalog, Language Guide. Native Languages & #s of speakers 25) Final Thoughts Appendices Listings: a) Govt.Departments. Who runs the country? b) 1630 hotels in the Philippines c) Universities d) Radio Stations e) Bus Companies f) Information on the Philippines Travel Tax g) Ferries information and schedules. Chapter 1) History of The Philippines The inhabitants are thought to have migrated to the Philippines from Borneo, Sumatra & Malaya 30,000 years ago. -

Urban-Scale Digital Twin for a Master Plan in the Area Adjacent to the International Airport of Cebu'- Philippines

POLITECNICO DI TORINO Master Degree - Civil Engineering Structures and Infrastructures Master’s degree Thesis URBAN-SCALE DIGITAL TWIN FOR A MASTER PLAN IN THE AREA ADJACENT TO THE INTERNATIONAL AIRPORT OF CEBU'- PHILIPPINES Supervisor: Prof.ssa Anna Osello Correlator: Prof.ssa Francesca Ugliotti Ing. Giuliano Pairone Candidate: Daniele Iunti Academical year: 2020-2021 JULY 2021 The present research is the result of a multidisciplinary study that brings together the skills derived from the civil engineering and automotive engineering courses of study. Within this specific thesis paper analyses, reasoning, and results are presented, mainly in the civil engineering field of investigation, with specific insights into the automotive sector. Despite the multifaceted nature of the research, the result the team achieved after one year of intense study is unique and derives from the collaboration and integration of competences from the abovementioned different backgrounds. This aspect represented the most challenging part of the study but at the same time the most enriching one, making it really interesting. As far as automotive engineering parts, engineer students in charge of these aspects are Ma Fanshu and Zhang Zheyuan. A special thank is a must because of their limitless availability and skills, methodological rigour and passion for the work done. “There is no logic that can be superimposed on the city; people make it, and it is to them, not buildings, that we must fit our plans.” ― Jane Jacobs (1958) Downtown is for people ABSTRACT La popolazione umana ha impiegato 200.000 anni per raggiungere 1 miliardo e solo 200 anni per raggiungere i 7 miliardi. -

Earth Day Marks Need for Collective Efforts on Solving Crises by Ma

UPPE PAGE BANNE EDITORI CARTOO 1 R AL N STORY STORY PAG LOWE Strategic Communication 1/1 25 April 2020 and Initiatives Service Page Date Earth Day marks need for collective efforts on solving crises By Ma. Cristina Arayata April 22, 2020, 7:18 pm https://www.pna.gov.ph/articles/1100699 Image grabbed from DENR's Facebook page MANILA – Every April 22, Earth Day is being observed to demonstrate support for environmental protection. But with the coronavirus disease 2019 (Covid-19) pandemic plaguing millions of people around the world, collective action among countries and stakeholders is of paramount importance. For the Department of Environment and Natural Resources (DENR) Secretary Roy Cimatu, comprehensive and concerted action is a must. In his Earth Day message shared on DENR's Facebook page, he said survival is at stake in both Covid-19 and climate change. "The urgency of the need for concerted and comprehensive action, without waiting for the problem to peak or to impact millions more of people, is the same," he added. With the Covid-19 pandemic, Cimatu said now is the perfect time for people to ponder the need for collective action. "The damage from Covid-19 and climate change bring about destruction and chaos to any nation. On the one hand, with Covid-19, we are faced with an immediate gripping fear of losing more lives; on the other hand, with climate change, we are faced with rising sea levels, saline intrusion into aquifers, droughts, floods, and the results will impact billions of people, as well as biodiversity.