Chapter Iii State Excise Duties

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MAP:East Godavari(Andhra Pradesh)

81°0'0"E 81°10'0"E 81°20'0"E 81°30'0"E 81°40'0"E 81°50'0"E 82°0'0"E 82°10'0"E 82°20'0"E 82°30'0"E EAST GODAVARI DISTRICT GEOGRAPHICAL AREA (ANDHRA PRADESH) 47 MALKANGIRI SH Towards Sileru 18°0'0"N 18°0'0"N IR (EXCLUDING: AREA ALREADY AUTHORISED) ERVO I RES AY AR NK DO MALKANGIRI V IS H KEY MAP A K H A P A T N A M M Towards Polluru CA-02 A CA-01 M M ± A CA-07 H CA-35 CA-34 K V CA-60 I CA-03 CA-57 CA-58 S CA-33 CA-59 H CA-04 CA-57 CA-37 CA-36 AKH 17°50'0"N CA-32 CA-56 17°50'0"N CA-31 CA-55 CA-05 CA-38 CA-55 CA-39 AP CA-06 CA-30 CA-53 CA-54 CA-40 CA-39 A CA-07 CA-29 CA-41 CA-51 T CA-08 CA-41 T NAM CA-07 CA-28 CA-51 oward CA-42 CA-52 CA-27 CA-51 CA-09 CA-26 CA-44 CA-44 CA-25 s Tu T CA-10 CA-11 CA-43 CA-45 CA-46 o L lasipaka w W CA-24 A ar E CA-12 CA-23 S NG T CA-13 E d G CA-47 CA-22 B s O CA-48 D CA-21 F K A CA-14 CA-50 O V CA-20 o A R CA-49 Y. -

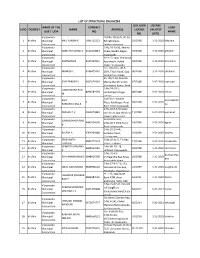

Unauthorised Layout Details

REGIONAL DEPUTY DIRECTOR OF TOWN AND COUNTRAY PLANNING, VISAKHAPATNAM DETAILS OF UNAUTHORIZED LAYOUTS IN URBAN LOCAL BODIES Details of unauthorised Layouts Name of Approx. Year Status of Layout development of Road subdivision Water Sl. No. Name of of ULB Sy.No. & formation Drains Electricity Width of % of Open space if Extent in Ac. Developer Owner of Supply No. of Plots Remakrs Village Gravel/W.B. (Y/N) (Y/N) Roads available land/unautho (Y/N) M/BT/ CC rised layout) 1 Srikakulam 2 Amadalavalasa Plot stones 104&105 1 5.00 S.Tagore - 7 Gravel No No No 168 30`0" - removed by Chintada Department 66&67 T.Bangaru 2 0.45 - 6 - NoNoNo 20 - - Do Akkivalasa Raju 158,159,171&1 3 72 2.50 - - 7 - NoNo No 90 - - Do Akkivalasa 67&68 K.Uma 4 0.50 maheswara - 7 - NoNoNo 14 - - Do Amadalavalas Rao a 2,4,26,27&31 5 1.00 B.Ramana - 6 - No No No 25 - - Do Amadalavalas a 11,12,13,16,21,2 2& 24, S.Seetaram & 6 1.30 - 8 - NoNoNo 30 - - Do Amadalavalas others a 3 Palasa-Kasibugga Bammidi Removal of 211 of 1 1.00 - Simhachalam & 2015 Gravel N N N - - - boundary stones Narsipuram Other and distrub road Removal of 149 of Sanapala 2 0.80 - 2014 Gravel N N N - - - boundary stones Chinabadam Padmalochalna and distrub road Removal of 158 of K Sankara Rao & 3 0.85 - 2014 Gravel N N N - - - boundary stones Chinabadam Others and distrub road Removal of 158 of 4 1.00 - Unknown Perosons 2012 Gravel N N N - - - boundary stones Chinabadam and distrub road Removal of 160 of B Nagaraju & 5 0.70 - 2013 Gravel N N N - - - boundary stones Chinabadam Others and distrub road Removal -

Structural Engineers List

LIST OF STRUCTURAL ENGINEERS ULB /UDA LICENSE NAME OF THE CONTACT USER S.NO DISTRICT NAME ADDRESS LICENSE VALIDITY ULB / UDA NO NAME NO. UPTO Vijayawada Flat No.105 (GF), Sri Sai 1 Krishna Municipal ANIL KUMAR K 7095712323 RatnaEnclave, 01/2008 3-31-2020 kakumar Corporation Seetharampuram Vijayawada D.No.26-20-30, Swamy 2 Krishna Municipal RAMESH KUMAR G 9440140843 Street,Gandhi Nagar. 03/2008 3-31-2020 grkumar Corporation Vijayawada Vijayawada 60-3-17, Opp: Chaitanya 3 Krishna Municipal RAVINDRA N 9440709915 Apartment, Ashok 04/2008 3-31-2020 nravindra Corporation Nagar, Vijayawada Vijayawada C/o. Desicons, 40-5- 4 Krishna Municipal MAHESH C 9246475767 19/9, Tikkle Road, Opp 06/2008 3-31-2020 cmahesh Corporation Siddhartha college, Vijayawada 43-106/1-58, Bharath 5 Krishna Municipal SIVA PRASAD S 9951074339 Matha Mandir Street, 07/2008 3-31-2020 ssprasad Corporation Nandamuri Nagar, Ajith Vijayawada D.No.74-10-1, LINGESWARA RAO 6 Krishna Municipal 8096281594 LakshmipathiNagar 08/2008 3-31-2020 mlrao M Corporation Colony, Vijayawada 2nd Floor, Kakarla SIVA asramakrish 7 Krishna Municipal 0 Plaza, KalaNagar, Near 09/2008 3-31-2020 RAMAKRISHNA A na Corporation Benz Circle,Vijayawada Vijayawada D.No.28-5-1/3,kuppa 8 Krishna Municipal PRASAD P.V 9966573883 vari street,opp.Hotel raj 11/2008 3-31-2020 pvprasad Corporation towers ,eluru road Vijayawada Sri Sai Planners, GANGADHARA RAO 9 Krishna Municipal 9440109695 D.No.40-5-19/4,Tickle 14/2008 3-31-2020 bgrao B Corporation Road, Vijayawada Vijayawada D.No.29-19-44, 10 Krishna Municipal RAJESH A 9703369888 Dornakal Road, 16/2008 3-31-2020 arajesh Corporation Suryaraopet, Vijayawada SREEKANTH D.No.39-11-5, T.K.Rao 11 Krishna 9885721574 17/2008 3-31-2020 lsreekanth Municipal LINGALA Street,Labbipet, Vijayawada VENKATA RAMANA D.No.40-1/1-18, 12 Krishna 9848111681 18/2008 3-31-2020 svramana Municipal S. -

East Godavari District Annual Report

OM SRI SAIRAM East Godavari District Annual Report st st from 1 April 2018 - 31 March 2019 Contents FOREWORD FROM THE DISTRICT PRESIDENT ............................................................... SRI SATHYA SAI SEVA ORGANISATIONS – AN INTRODUCTION ......................................... WINGS OF THE ORGANISATIONS .............................................................................................. ADMINISTRATION OF THE ORGANISATION ............................................................................... THE 9 POINT CODE OF CONDUCT AND 10 PRINCIPLES ...................................................................... SRI SATHYA SAI SEVA ORGANISATIONS, [EAST GODAWARI District] ................................. BRIEF HISTORY .................................................................................................................................... DIVINE VISIT .............................................................................................................................. OVERVIEW ................................................................................................................................ SAI CENTRES ....................................................................................................................................... ACTIVITIES ................................................................................................................................ OFFICE BEARERS ............................................................................................................................... -

Final Merit List of Backlog-31-07-2021 (Autosaved)

SC/ST BACKLOG RECRUITMENT-2018 NAME OF THE POST: SC COOK Total Unqualified Candidates - 1511 SC COOK UNQUALIFIED LIST OF CANDIDATES EXPERIE Reason for Un SNO APPLNO NAME MOBILE GENDER ADDRESS VILLAGE MANDAL DOB AGE QUALIFICATION CASTE NCE Qualification 3 162 PEDAPETA UDUMUDI P Telugu Reading 1 38637 BEERA SATYANARAYANA 9515665379 M GANNAVARAM Bellampudi P.Gannavaram 01-01-1968 49 0 and Writing SC No Experience 2-39-11 MADDILA VARI STREET, Telugu Reading 2 21732 TOLETI MADHAVI 9951451758F PEERARAJU PETA Kakinada (Municipal Town) Kakinada (U) 15-06-1969 48 0 and Writing SC No Experience Telugu Reading 3 39184 KUSUMA MOSHE 9866920345M 1-19 KRISHNUNIPALEM Gokavaram Gokavaram 01-08-1970 47 0 and Writing SC No Experience Telugu Reading 4 35128 KASIREDDY SRINIVASA RAO 9100642064 M H NO 6-95 ADAVIPETA Dontikurru Katrenikona 20-08-1970 46 0 and Writing SC No Experience D NO 10-26 MARUTHI STREET Telugu Reading 5 27898 CHINDADA SRINIVASA RAO 9848942359 M OPP MOUNT CARMEL SCHOOL Suryaraopeta (Part) (Municipal Town) Kakinada (R) 01-10-1970 46 0 and Writing SC No Experience 1-9-8/2 WARD-2 RAMALAYAM Telugu Reading 6 10051 LANKA APPARAO 9989569257M TEMPLE STREET TUNI Tuni (Municipal Town) Tuni 01-01-1971 46 0 and Writing SC No Experience Telugu Reading 43-8-5 CURCH PETA Rajahmundry (Municipal Corporation) Rajahmundry Urban No Experience 7 38692 E P RAVIKUMAR 8885497006M 3 13-01-1971 46 0 and Writing SC 43,karavakulanka,ramalayamdag Telugu Reading 8 6079 vakapalli sudarshan babu 9963340442 M gara Guthinadeevi I. Polavaram 15-02-1971 46 0 and Writing SC -

Andhra Pradesh Municipal Accounts Manual

Andhra Pradesh Municipal Accounts Manual Dr MCR HRD IAP Campus Road No. 25, Jubilee Hills Hyderabad 500033 November, 2007 Table of Contents Messages Preface GO Ms. No.233 MA dated 22-5-2002 GO Ms. No.619 MA dated 21-08-2007 Abbreviations 1. Introduction 1 to 16 Background 1 Definitions 2 Double Entry Accounting System 12 Accounting Rules 13 Accrual System of Accounting 14 Benefits of Accrual System of Accounting 14 Fund Based Accounting 15 2. Accounting Fundamentals 17 to 34 Accounting Concepts 17 Accounting Conventions 19 Significant Accounting Policies & Principles 20 3. Codification Structure 35 to 84 Chart of Accounts 35 Codification Logic and Procedure 37 Function 37 Account heads 38 Funds 40 Functionary 41 Field 41 ULB Codes 41 General Guidelines 41 Chart of Accounts – Code List 47 4. General Accounting Procedure 85 to 159 Books of Accounts 85 Procedure for Income Accounting 88 Procedure for Expenditure Accounting 99 Forms 119 5. Revenue Income 160 to 207 Accrual Basis of Accounting for Revenue Income 160 Tax Revenues 162 Assigned Revenues 173 Rental, Fees & Other Income 176 Grants 184 Income from Investments 193 6. Revenue Expenditure & Appropriations 208 to 253 Procedure for Expenditure Accounting 208 Establishment Expenses 212 Administrative Expenses 230 Operations & Maintenance 233 Interest & Finance Charges 235 Programme Expenses 239 Grants, Contributions & Subsidies 240 Provisions & Write Offs 240 Miscellaneous Expenses 241 Depreciation 241 Prior Period Items 242 Transfers to Reserve Funds 243 7. Liabilities (Capital Inflows) 254 to 286 Funds 254 Deposit Works 260 Deposits 261 Special Funds 268 Borrowings 274 8. Assets & Net Current Assets 287 to 380 Fixed Assets 287 Public Works 300 Capitalisation of Capital Work In Progress 301 Investments 304 Stores 317 Loans & Advances 337 Lease & Hire Purchase 343 Special Transactions 352 Addition to/Merger of Local Bodies 367 Inter Unit Transactions 370 9. -

District Census Handbook, East Godavari, Part X

CENSUS 1971 SERIES 2 ANDHRA PRADESH DISTRICT CENSUS HANDBOOK EAST GODA V ARt PART X-A VILLAGE & TOWN DIRECTORY PART X-B VILLAGE & TOWN PRIMARY CENSUS ABSTRACT T. VEDANTAM Of THE INDIAN ADMINISTRATIVE SERVICE DIRECTOR OF CENSUS OPERATIONS ANDHRA PRADESH PUBLISHED BY THE GOVERNMENT OF ANDHRA PRADESH 1973 Rajahmundry had been in the 'News' e,ven btrl'iJl-c this saw mill unit started producing the "Gossip Bench". 3. There is g~od d~mand tor the wooden furniture pre jJared at thiS umt. The Indian Navy the P 'J T V' I ' 01 ru,~ts at lsak tapatnam and Madras, the Housing BOa1ds of Andhra Pradesh and Tamil Nadu th H O 1 lh Si 0 b 01 ' C In l us .an, up Ul ding yard at Visakhapatnam, Central and State Warehousing Corporations, Post and Tele graph; and Defence Departments figure prominently among the major consumers of the mill's products. 40 The volume of business transacted between the yea) 196-1·65 and 1970-71 indicates the stupendous gTOwth made by this unique concern during a short span of about 6 years. The turnover in the three main divisions of th~ unit viz., Sawing, Pmcessing and Treatment whzch stood in the order of 13 ,600 c.tt., 600 c.ft. and 3iOO c.ft.} valued totally at Rs. 2.6 lakhs in 1964-65 increased to 2,65,000c.ft., 14}OO c.ft. and THE INTEGRATED SAW MILL UNIT, 68,~QO c.~t. valued at over Rs. 21 lakhs in 1970-71. RAJAHMUNDRY Thz~ umt. with countrywide fame is looked upon as a pwneerznfj p~oject in the field of country wood The motif on the, cover page depicts a fully manufactunng zndustry. -

Territorial Jurisdiction of Police Stations.Pdf

S. No. Station Mandal/Tahsil Jurisdiction Police Stations 1 Rajamahendravaram S. N. Mandals S. No Name of the Police Station i Rajamahendravaram Urban 1 I Town, PS, Rajamahendravaram ii Rajamahendravaram Rural 2 II Town, PS, Rajamahendravaram iii Seethanagaram 3 III Town, PS, Rajamahendravaram iv Korukonda 4 I Town CCS, PS, Rajamahendravaram v Gokavaram 5 IITown CCS, PS, Rajamahendravaram vi Kadiyam 6 III Town CCS, PS, Rajamahendravaram 7 Mahila PS, Rajamahendravaram 8 Prakash Nagar, PS, Rajamahendravaram 9 Rajanagaram Police Station 10 Seethanagaram Police Station 11 Korukonda Police Station 12 Dowleswaram Police Station 13 Kadiyam Police Station 14 Bommuru Police Station 15 Central Crime Station, Rajamahendravaram 16 Traffic Police Station 17 Rajamahendravaram I Excise Police Station 18 Rajamahendravaram II Excise Police Station 19 Korukonda Excise Police Station 2 Kakinada i Kakinada Urban 1 I Town Police Station, Kakinada ii Kakinada Rural 2 II Town Police Station, Kakinada iii Samalakot 3 Mahila Police Station, Kakinada iv Pedapudi 4 Indrapalem Police Station v Karapa 5 Port Police Station, Kakinada vi Kajuluru 6 Sarpavaram Police Station vii Thallarevu 7 Samalakot Police Station 8 Pedapudi Police Station 9 Thallarevu Police Station 10 Karapa Police Station 11 Excise Police Station 12 Korangi Police Station 13 Gollapalem Police Station 14 Thimmapuram Police Station 15 Traffice Police Station 16 Kakinada proh & Excise Police Station I 17 Kakinada proh & Excise Police Station II 18 Thallarevu Proh & Excise Police Station 19 Marine Police -

Sri Venkateswara Constructions-Tapeswaram.Pdf

Tapeswaram Branch, Main Road, Mandapeta Mandal, Tapeswaram, East Godavari Dist. Pin Code-533340. Ph: 08855-232129 Email id: [email protected] Date: 10.05.2019 E-AUCTION SALE NOTICE ------------------------------------------------------------------------------------------------- (Under Provision to Rule 8(6) / Rule 9(1) of Security Interest (Enforcement) Rules) E-Auction Sale Notice Of Immovable Assets Under The Securitization And Reconstruction Of Financial Assets And Enforcement Of Security Interest Act, 2002, Read With Proviso To Rule 8(6) Of The Security Interest (Enforcement) Rules Act, 2002. Notice is hereby given to the public in general and in particular to the Borrower(s) and Guarantor(s) that the below described immovable property mortgaged / charged to the secured creditor, the symbolic possession of which has been taken by the Authorized Officer of Indian Overseas Bank Secured Creditor, will be sold on ‘’ As is Where is’’, ‘’ As is what is’’ and ‘’Whatever there is’’ on 15.06.2019 for recovery of Rs.19,21,88,589/- on 10.05.2019 with further interests and costs due to the IOB Secured creditor from 1. M/s Sri Venkateswara Constructions Pvt Ltd (Borrower) 2. Sri. Satti Srinivasa Reddy (Managing Director/ Guarantor/ Mortgagor) 3. Sri. Keta Bhaskar Kumar Babu (Additional Director/Guarantor) 4. Sri. Satti Konda Reddy (Guarantor/ Mortgagor) 5. Sri. Chirla Ramakrishna Reddy, S/o Veera Raghava Reddy (Guarantor/ Mortgagor) 6. Smt. Satti Anuradha,W/o Satti Srinivasa Reddy (Guarantor/ Mortgagor) 7. Smt. Satti Lakshmi, W/o Satti Konda Reddy (Guarantor/ Mortgagor) 8. Sri. Dokala Babu Srinivasa Rao (Guarantor/ Mortgagor) 9. Smt. Ketha Nagmani W/o Venkata Satyanarayana Setty (Guarantor/ Mortgagor). -

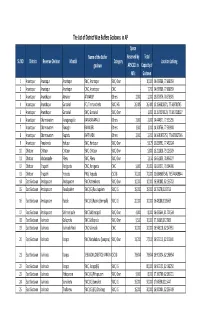

The List of District Wise Buffers Godowns in AP

The List of District Wise Buffers Godowns in AP Space Name of the Buffer Reserved by Total SL.NO District Revenue Division Mandal Category Location Latlong godown APSCSCL in Capacity of MTs Godown 1 Anantapur Anantapur Anantapur SWC, Anantapur SWC, Own ‐ 10,000 14.695586, 77.608059 2 Anantapur Anantapur Anantapur CWC, Anantapur CWC ‐ 7,700 14.695586, 77.608059 3 Anantapur Ananthapur Atmakur ATMAKUR Others 2,000 2,000 15.873576, 78.578505 4 Anantapur Ananthapur Guntakal FCI, Timmancherla SWC, HG 26,485 26,480 15.1593818971, 77.389781745 5 Anantapur Ananthapur Guntakal SWC, Guntakal SWC, Own ‐ 1,000 15.1575278129, 77.3857258627 6 Anantapur Dharmavaram Kanaganapalle KANAGANAPALLI Others 2,000 2,000 14.444371, 77.525255 7 Anantapur Dharmavaram Ramagiri RAMAGIRI Others 1,000 1,000 14.308766, 77.500908 8 Anantapur Dharmavaram Raptadu RAPTHADU Others 2,000 2,000 14.5681075753, 77.6472027346 9 Anantapur Penukonda Hidupur SWC, Hindupur SWC, Own ‐ 5,175 13.829591, 77.492024 10 Chittoor Chittoor Chittoor SWC, Chittoor SWC, Own ‐ 5,800 13.221828, 79.123509 11 Chittoor Madanapalle Pileru SWC, Pileru SWC, Own ‐ 2,150 13.651839, 78.936077 12 Chittoor Tirupathi Renigunta CWC, Renigunta CWC 5,000 20,000 13.631071, 79.504996 13 Chittoor Tirupathi Yerpedu PWS, Yerpedu CSC IG 70,000 70,000 13.6849607545, 79.5746439844 14 East Godavari Amalapuram Amalapuram SWC Katrenikona SWC, Own 10,000 10,000 16.580802, 82.153702 15 East Godavari Amalapuram Ravulapalem SWC (IG) Ravulapalem SWC, IG 15,000 15,000 16.75270,81.83716 16 East Godavari Amalapuram Razole SWC (IG) -

LIST of FARMS REGISTERED in EAST GODAVARI DISTRICT * Valid for 5 Years from the Date of Issue

LIST OF FARMS REGISTERED IN EAST GODAVARI DISTRICT * Valid for 5 Years from the Date of Issue. Address Farm Address S.No. Registration No. Name Father's / Husband's name Survey Number Issue date * Village / P.O. Mandal District Mandal Revenue Village Karri Venkat C/o D Divakara Reddy, 116/3; 114/5,7,11; 1 AP-II-2007(01621) Krishna Reddy Shri Venkat Reddy Gollala Mamidada Pedapudi Mandal East Godavari District Pedapudi Pedapudi 110/1 26.11.2007 Medapati Sura C/o D Divakara Reddy, 120/1A, 122/3 to 5; 2 AP-II-2007(01622) Reddy Shri Rama Reddy Gollala Mamidada Pedapudi Mandal East Godavari District Pedapudi Pedapudi 111/1 26.11.2007 Katta Veera C/o D Divakara Reddy, 3 AP-II-2007(01623) Raghavalu Shri Venkanna Gollala Mamidada Pedapudi Mandal East Godavari District Pedapudi Pedapudi 122/2 26.11.2007 Boddupalli Appa C/o D Divakara Reddy, 4 AP-II-2007(01624) Rao Shri Appala Swamy Gollala Mamidada Pedapudi Mandal East Godavari District Pedapudi Pedapudi 112/1,4,5,6,2,8,10 26.11.2007 112/9, 111/4, 112/3, C/o D Divakara Reddy, 112/7, 111/2, 112/1, 5 AP-II-2007(01625) Bera Setha Ramulu Shri Suryanarayana Gollala Mamidada Pedapudi Mandal East Godavari District Pedapudi Pedapudi 120/B; 122/1 26.11.2007 Palepu Venkat C/o D Divakara Reddy, 111/3, 111/5, 111/6, 6 AP-II-2007(01626) Ramana Shri Chinna Appala Swamy Gollala Mamidada Pedapudi Mandal East Godavari District Pedapudi Pedapudi 111/7 26.11.2007 Dwarampudi C/o D Divakara Reddy, 7 AP-II-2007(01627) Divakara Reddy Shri Appa Reddy Gollala Mamidada Pedapudi Mandal East Godavari District Pedapudi Pedapudi -

Mandapeta Assembly Andhra Pradesh Factbook

Editor & Director Dr. R.K. Thukral Research Editor Dr. Shafeeq Rahman Compiled, Researched and Published by Datanet India Pvt. Ltd. D-100, 1st Floor, Okhla Industrial Area, Phase-I, New Delhi- 110020. Ph.: 91-11- 43580781, 26810964-65-66 Email : [email protected] Website : www.electionsinindia.com Online Book Store : www.datanetindia-ebooks.com Report No. : AFB/AP-048-0118 ISBN : 978-93-87415-60-7 First Edition : January, 2018 Third Updated Edition : June, 2019 Price : Rs. 11500/- US$ 310 © Datanet India Pvt. Ltd. All rights reserved. No part of this book may be reproduced, stored in a retrieval system or transmitted in any form or by any means, mechanical photocopying, photographing, scanning, recording or otherwise without the prior written permission of the publisher. Please refer to Disclaimer at page no. 132 for the use of this publication. Printed in India No. Particulars Page No. Introduction 1 Assembly Constituency at a Glance | Features of Assembly as per 1-2 Delimitation Commission of India (2008) Location and Political Maps 2 Location Map | Boundaries of Assembly Constituency in District | Boundaries 3-9 of Assembly Constituency under Parliamentary Constituency | Town & Village-wise Winner Parties- 2014-PE, 2014-AE, 2009-PE and 2009-AE Administrative Setup 3 District | Sub-district | Towns | Villages | Inhabited Villages | Uninhabited 10-12 Villages | Village Panchayat | Intermediate Panchayat Demographics 4 Population | Households | Rural/Urban Population | Towns and Villages by 13-14 Population Size | Sex Ratio